Underpaid hurricane damage insurance claim issues are frustrating many policyholders. When your insurance settlement fails to cover your actual losses, it can feel overwhelming trying to steer the system. Here’s a quick overview to help you understand your options:

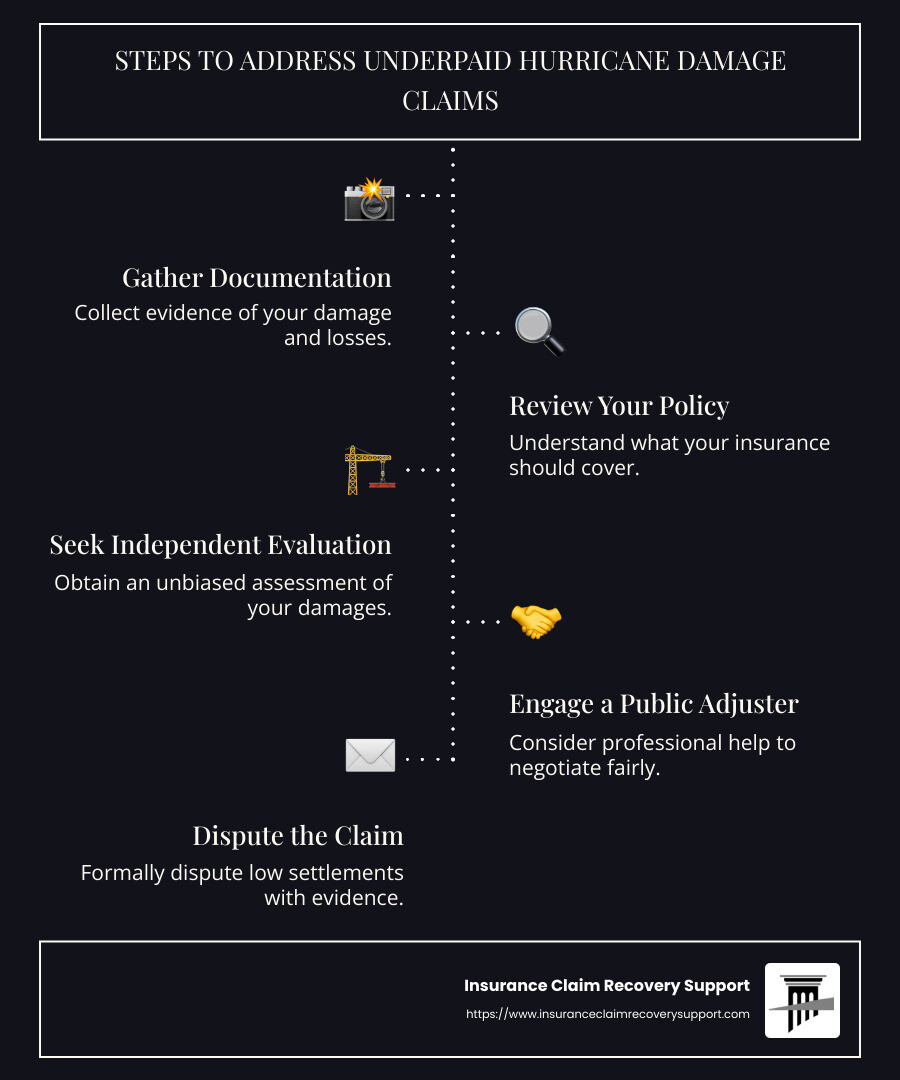

- Gather documentation: Collect evidence of your damage and losses.

- Review your policy: Know what your insurance should cover.

- Seek an independent evaluation: Get an unbiased assessment of your damages.

- Engage a public adjuster: Consider professional help to negotiate fairly.

When hurricanes strike, the aftermath can leave property owners facing not just physical destruction but financial distress, especially when insurance claims are not settled adequately. At Insurance Claim Recovery Support, we understand the urgency and complexities involved in rectifying an underpaid hurricane damage insurance claim. Our mission is to ensure policyholders receive a fair settlement.

As Scott Friedson, I bring experience from having settled hundreds of millions in property claims, changing underpaid hurricane damage insurance claim cases into successful recoveries. With expertise in overcoming lowball settlements, I’m here to guide you through effectively managing your claim. Now, let’s dig into understanding what causes these underpayments and how you can address them.

Basic underpaid hurricane damage insurance claim terms:

- commercial hurricane damage insurance claim

- denied hurricane damage insurance claim

- how to file a hurricane damage insurance claim

Understanding Underpaid Hurricane Damage Insurance Claims

Common Reasons for Underpaid Claims

Underpaid hurricane damage insurance claims are a major headache for policyholders. When your insurance payout doesn’t match the actual cost of repairs, it’s crucial to understand why this happens. Let’s break down the common reasons behind these underpayments.

Discrepancies in Damage Assessment

Insurance adjusters sometimes undervalue the extent of damage. This can happen because of oversight or because the adjuster is unfamiliar with specific types of hurricane damage, like hidden structural issues or water infiltration that isn’t immediately visible.

Policy Interpretation

Insurance policies can be complex, and interpretations can vary. Sometimes, insurance companies interpret policy terms in a way that minimizes payouts. Disputes can arise over what counts as a covered peril or how policy limits are applied. This can lead to a lower-than-expected payout.

Missing Information

A lack of documentation can also lead to underpaid claims. If you don’t provide enough evidence or proof of loss, the insurance company might not fully recognize the extent of your claim. Always keep detailed records and photographs of the damage.

Depreciation Calculation

How depreciation is calculated can significantly affect your payout. Insurers may apply depreciation in a way that reduces the claim amount. Understanding how your policy handles depreciation is key to ensuring you aren’t shortchanged.

Code Upgrade Requirements

Building codes change, and some insurance policies don’t cover the additional costs associated with meeting new regulations. If your policy excludes code upgrades, you might end up paying out of pocket to bring repairs up to the latest standards.

Understanding these factors can empower you to effectively address an underpaid hurricane damage insurance claim. By knowing what to look for, you can take steps to ensure your claim is settled fairly.

Steps to Address an Underpaid Hurricane Damage Insurance Claim

Facing an underpaid hurricane damage insurance claim can be frustrating, but there are clear steps you can take to address the issue. Here’s a guide to help you steer the process and work towards a fair settlement.

Reviewing Your Insurance Policy

Start by thoroughly reviewing your insurance policy. Understand the terms and conditions, coverage limits, and any exclusions that may apply. This knowledge is crucial, as it forms the basis of your claim. If your claim payout doesn’t align with what your policy covers, you’ll need to address this discrepancy.

Getting an Independent Estimate

Next, seek an independent estimate from a trusted contractor. This provides an unbiased assessment of the repair costs. Having multiple estimates can help you compare against the insurance company’s valuation and identify any significant differences. This step is essential to ensure that the damage is accurately assessed and valued.

Documenting Everything

Documentation is key. Keep detailed communication records with your insurance company. Take clear photographs of the damage from various angles before any repairs begin. Collect repair estimates, invoices, and any other relevant documents. This evidence will support your case if you need to dispute the claim.

Formally Disputing the Claim

If you believe your claim was underpaid, you can submit a formal dispute. Write a dispute letter to your insurance company, clearly stating the reasons for your disagreement. Include all supporting evidence and documentation to back up your claim. Be precise about why you believe the payout is insufficient.

Hiring a Public Adjuster or Attorney

If the dispute doesn’t resolve the issue, consider hiring a public adjuster or an attorney. Public adjusters are experts in negotiation and can help maximize your claim. An attorney can provide legal advice and represent you if the dispute escalates. Their expertise can be invaluable in navigating complex claims processes.

By following these steps, you can effectively address an underpaid hurricane damage insurance claim and work towards getting the settlement you deserve.

Role of Public Adjusters in Underpaid Hurricane Damage Insurance Claims

When dealing with an underpaid hurricane damage insurance claim, a public adjuster can be your best ally. These professionals specialize in representing policyholders, not insurance companies, ensuring you get the settlement you deserve.

Benefits of Hiring a Public Adjuster

Expertise and Accurate Damage Assessment

Public adjusters have a deep understanding of insurance policies and the claims process. They are adept at deciphering complicated policy language, which helps in identifying all areas of coverage you’re entitled to. Their expertise in conducting thorough evaluations ensures that no damage is overlooked. This accurate damage assessment is crucial for a fair claim.

Maximizing Your Claim

The primary goal of a public adjuster is to maximize your insurance payout. By carefully reviewing your policy and the damage, they ensure that every aspect is included in your claim. This comprehensive approach often results in a higher settlement than you might achieve on your own.

Negotiating Power

Public adjusters are skilled negotiators. They communicate directly with the insurance company on your behalf, advocating for a fair settlement. Their experience and knowledge of the industry level the playing field, giving you a stronger position in negotiations.

Saving Time and Reducing Stress

Handling an underpaid claim can be time-consuming and stressful. Public adjusters manage the entire process, from documentation to negotiation, allowing you to focus on recovery and restoration. This not only saves you time but also reduces the emotional burden of dealing with insurance companies.

Contingency Fees

Most public adjusters work on a contingency fee basis. This means they only get paid if they successfully increase your settlement. This arrangement ensures they are motivated to secure the best possible outcome for you, without any upfront costs.

Incorporating a public adjuster into your claims process can make a significant difference in achieving a fair settlement for your underpaid hurricane damage insurance claim. Their expertise, negotiation skills, and focus on maximizing your claim are invaluable assets in navigating the complexities of insurance disputes.

What to Do If Your Hurricane Damage Insurance Claim is Denied

When a hurricane damage insurance claim is denied, it can feel overwhelming. But don’t lose hope—there are steps you can take to challenge the denial and potentially secure the settlement you deserve.

Requesting an Insurance Claim Review

Start by examining the denial letter you received from your insurance company. This document should detail the reasons for the denial. Understanding these reasons is crucial for your next steps.

Gather additional evidence to support your claim. This might include photographs, repair estimates, or other documentation that contradicts the insurer’s decision.

Request a formal review of your claim. Contact your insurance company and ask them to reassess their decision. Provide your additional evidence to strengthen your case. This step can sometimes lead to a favorable outcome without further escalation.

Filing a Complaint with the Florida Office of Insurance Regulation

If the formal review doesn’t resolve the issue, consider filing a complaint with the Florida Office of Insurance Regulation (OIR). This regulatory body oversees insurance practices in the state and can intervene in disputes.

To file a complaint, gather all your documentation, including the denial letter and evidence supporting your claim. Contact the OIR at (877) 693-5236 to start the resolution process. They will review your case and may mediate between you and the insurance company.

Contacting an Insurance Claims Attorney

If your efforts with the insurance company and the OIR don’t lead to a resolution, it might be time to seek legal advice. An attorney specializing in insurance claims can provide guidance on your situation.

A lawyer can help determine if your insurance company is in breach of contract. If so, they might recommend filing a lawsuit. This legal action can lead to a summary judgment in your favor, resulting in the payout you are entitled to.

Navigating a denied hurricane damage insurance claim can be challenging, but by taking these steps, you can improve your chances of a successful outcome. Moving forward, we’ll explore frequently asked questions about underpaid hurricane damage insurance claims.

Frequently Asked Questions about Underpaid Hurricane Damage Insurance Claims

When dealing with underpaid hurricane damage insurance claims, many policyholders have questions about timelines, deductibles, and potential impacts on their insurance rates. Let’s address some of the most common queries.

How long does an insurance company have to settle a hurricane claim in Florida?

In Florida, insurance companies are required to respond to a claim within 14 days of receiving it. This initial response should confirm receipt and outline the next steps. However, the full settlement of a claim can take up to 90 days from the date the insurer receives notice of the claim. This timeframe allows the company to assess the damage, review the policy, and determine the appropriate payout.

What is the deductible for hurricane damage?

The deductible for hurricane damage can vary depending on your specific insurance policy. Typically, it ranges from 1% to 10% of the insured value of your home. For example, if your home is insured for $300,000, a 2% deductible would mean you’re responsible for the first $6,000 of damage before your insurance kicks in.

Does insurance go up after a hurricane claim?

Filing a hurricane damage claim can potentially lead to an increase in your insurance premiums. Insurance companies often assess the frequency of claims when determining rates. If you file multiple claims over a short period, or if a major hurricane affects a large area, insurers may adjust rates to offset their increased risk. However, these changes are not immediate and typically occur upon policy renewal.

Understanding these aspects of hurricane damage insurance claims can help policyholders steer the claims process more effectively. By being informed, you can better manage your expectations and plan accordingly.

Conclusion

Dealing with underpaid hurricane damage insurance claims can be a challenging and frustrating experience. However, with the right support and guidance, policyholders can steer this process more effectively. At Insurance Claim Recovery Support, we are committed to advocating for policyholders and ensuring they receive the maximum settlement they deserve.

Our expertise as public adjusters allows us to serve clients across Texas, including Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway. We understand the unique challenges that come with hurricane damage and are here to help you every step of the way.

Why Choose Us?

Expert Advocacy: We specialize in representing policyholders, not insurance companies. Our goal is to challenge underpayments and denials to ensure you receive the settlement you’re entitled to.

Maximizing Settlements: Our team is skilled in assessing damage, interpreting policy details, and negotiating with insurers to maximize your claim. We work diligently to ensure nothing is overlooked.

Local Expertise: With a strong presence in Texas, we are well-versed in the local insurance landscape and the specific challenges posed by hurricanes in the region.

By choosing Insurance Claim Recovery Support, you gain a partner who is dedicated to your recovery and financial well-being. We stand by your side, from the initial damage assessment to the final settlement, ensuring a smooth and stress-free process.

Don’t steer this journey alone. Contact us today for expert assistance and let us help you rebuild and restore your property with the financial settlement you deserve.