Your Business Suffered Property Damage. Your Insurer Isn’t Paying. Now What?

Can I sue my insurance company for property damage? Yes, business owners can sue their insurance company for property damage claims, but understanding when and how is crucial for protecting your commercial interests.

Quick Answer for Business Owners:

- Yes, you can sue your insurance company for wrongful claim denial, bad faith practices, or breach of contract.

- Common grounds include: unreasonable claim denials, significant underpayments, failure to investigate properly, or unjustified delays.

- Before suing consider: hiring a public adjuster, filing complaints with state regulators, or attempting mediation.

- Timeline warning: Lawsuits can take over a year for mediation and over three years for jury trials.

- Statute of limitations: Typically 2-4 years in Texas, depending on your claim type.

- Better alternative: Public adjusters often resolve disputes in weeks or months without litigation costs.

When your commercial property suffers damage from a fire, hurricane, or other covered peril, you expect your insurer to honor their contract. Unfortunately, policyholders file thousands of lawsuits against insurers each year for claim denials, underpayments, or bad faith practices. For owners of commercial buildings or multifamily complexes, a disputed claim can threaten your entire operation.

This guide examines your legal options, including the critical decision between pursuing litigation or working with a public adjuster to resolve your claim efficiently.

I’m Scott Friedson, a multi-state licensed public adjuster and CEO of ICRS LLC. By settling over 500 large loss claims valued at more than $250 million, I’ve helped business owners steer complex insurance disputes, often avoiding unnecessary litigation while securing fair settlements for commercial property damage claims.

Can a Business Sue Its Insurance Company? Understanding Your Legal Rights

When your commercial building or apartment complex suffers significant damage, and your insurer denies the claim or offers an insulting settlement, it’s natural to wonder: can I sue my insurance company for property damage? The answer is absolutely yes. Your insurance policy is a legally binding contract, and when your insurer fails to honor it, you have legal recourse.

Most insurance disputes center on two legal principles: breach of contract and insurance bad faith. These apply whether your property suffered fire, hurricane, or freeze damage. However, litigation is a long and costly process. Many property owners find faster, more cost-effective resolution through a public adjuster, who can often resolve disputes in months, not years. Understanding your rights is the first step to getting the compensation you need to rebuild. For more details, see our guide on Disputing Damage Claims in a Lawsuit.

Common Reasons to Sue Your Insurer for a Commercial Property Damage Claim

The decision to sue your insurer typically follows a pattern of unreasonable behavior. Here are the most common reasons business owners take legal action:

- Unreasonable Claim Denial: Your insurer denies a legitimate, documented claim without a valid, policy-based reason, often blaming wear and tear or pre-existing conditions against the evidence.

- Significant Underpayment: The insurer acknowledges the damage but offers a settlement that covers only a fraction of your actual repair costs, threatening your business operations. This is a key reason property owners seek help for an Underpaid, Delayed Insurance Claim.

- Failure to Investigate Properly: Your insurer rushes the inspection, ignores crucial evidence you provide, uses biased experts, or fails to look for hidden damage.

- Misrepresenting Policy Terms: The insurer deliberately misinterprets complex policy language to reduce or deny your claim, exploiting the complexity of the contract.

- Unjustified Delays: Your insurer drags out the claims process, ignores communications, or delays payment without reason, violating their duty to handle claims promptly. In Texas, the Prompt Payment of Claims Act sets legal deadlines for payment.

Legal Grounds for a Lawsuit: Breach of Contract vs. Insurance Bad Faith

Understanding the difference between breach of contract and insurance bad faith is crucial. Because insurers write the policies, the law imposes a duty of good faith and fair dealing on them, requiring them to act honestly and fairly.

-

Breach of Contract: This occurs when your insurer directly violates a specific term in your policy. For example, if your policy covers tornado damage but they refuse to pay for valid repairs, they have breached the contract. A lawsuit aims to enforce the policy and recover the benefits you are owed.

-

Insurance Bad Faith: This is a more serious accusation, suggesting your insurer acted with dishonesty or gross negligence. It goes beyond a simple disagreement and implies intentional misconduct, such as fabricating denial reasons or coercing you into accepting a low offer after a major event like a Business Fire Damage Claim. Successful bad faith claims can recover not only your policy benefits but also additional punitive damages.

While you can sue, litigation should be a last resort. Many disputes are resolved more efficiently by a skilled public adjuster, avoiding the time and stress of court.

What Is Insurance ‘Bad Faith’ and How Do You Prove It?

Insurance bad faith is more than an honest mistake—it’s when an insurer deliberately puts its profits ahead of its contractual promises to you. When business owners ask, “can I sue my insurance company for property damage,” they are often experiencing bad faith practices without realizing it.

Bad faith occurs when your insurer knowingly fails in its legal duty to act honestly and fairly. These actions are often disguised as normal claim handling, such as providing vague denial explanations or using endless document requests to delay your claim. These are some of the 8 Sneaky Tricks Insurance Companies Use to Underpay and Delay Your Claim.

Proving bad faith requires showing a pattern of unreasonable behavior, not just dissatisfaction with a settlement offer. Thorough documentation is your best weapon against these unfair claim settlement practices. A successful bad faith claim can result in punitive damages, which punish the insurer for their misconduct, in addition to your policy benefits.

Recognizing Bad Faith Tactics in Your Property Damage Claim

Spotting bad faith can be difficult when you’re stressed about damage to your commercial property. Watch for these red flags:

- Poor Communication: Your adjuster becomes impossible to reach, and calls or emails go unanswered for long periods.

- Unreasonable Lowball Offers: Your insurer offers a settlement far below your independent repair estimates without a clear explanation.

- Inadequate Investigations: The company’s adjuster spends minimal time at your property, ignores your evidence, or declares most damage “pre-existing.”

- Use of Biased Experts: The insurer’s chosen engineer or expert consistently finds ways to minimize the damage or blame it on causes your policy doesn’t cover.

- Payment Delays: An agreement is reached, but the insurer fails to send payment within a reasonable timeframe, potentially violating Texas’s Prompt Payment of Claims Act.

- Intimidation: The insurer suggests that hiring a public adjuster or attorney will harm your claim or lead to non-renewal.

Building Your Case: Evidence Needed to Sue an Insurer for Property Damage

A strong case against your insurer begins the moment damage occurs. Every piece of documentation is potential evidence. Here is what you need:

- Your Insurance Policy: A complete, certified copy, including all endorsements.

- Damage Documentation: Extensive, date-stamped photos and videos of the damage before any cleanup.

- Correspondence Log: A detailed record of every interaction with your insurer, including dates, names, and conversation summaries. Save all emails and letters.

- Independent Repair Estimates: Multiple quotes from qualified, licensed commercial contractors.

- Claim Submission Records: Copies of all forms and documents you sent to the insurer.

- Denial Letters and Offers: All written communications from the insurer explaining their decisions.

- Expert Reports: Objective assessments from independent adjusters, engineers, or other experts. Understanding What Does a Commercial Claims Adjuster Do can highlight the value of an independent assessment.

Strong evidence is key to succeeding in court or, ideally, avoiding it by empowering a public adjuster to negotiate a fair settlement on your behalf.

A Guide for Business Owners Searching if They Can “Sue My Insurance Company” After Suffering Property Damage

When your commercial property is damaged and your insurer won’t cooperate, you’re likely asking: “Can I sue my insurance company for property damage?” While the answer is yes, rushing into litigation may not be your best move. There is a path that can save you years of stress and significant legal fees.

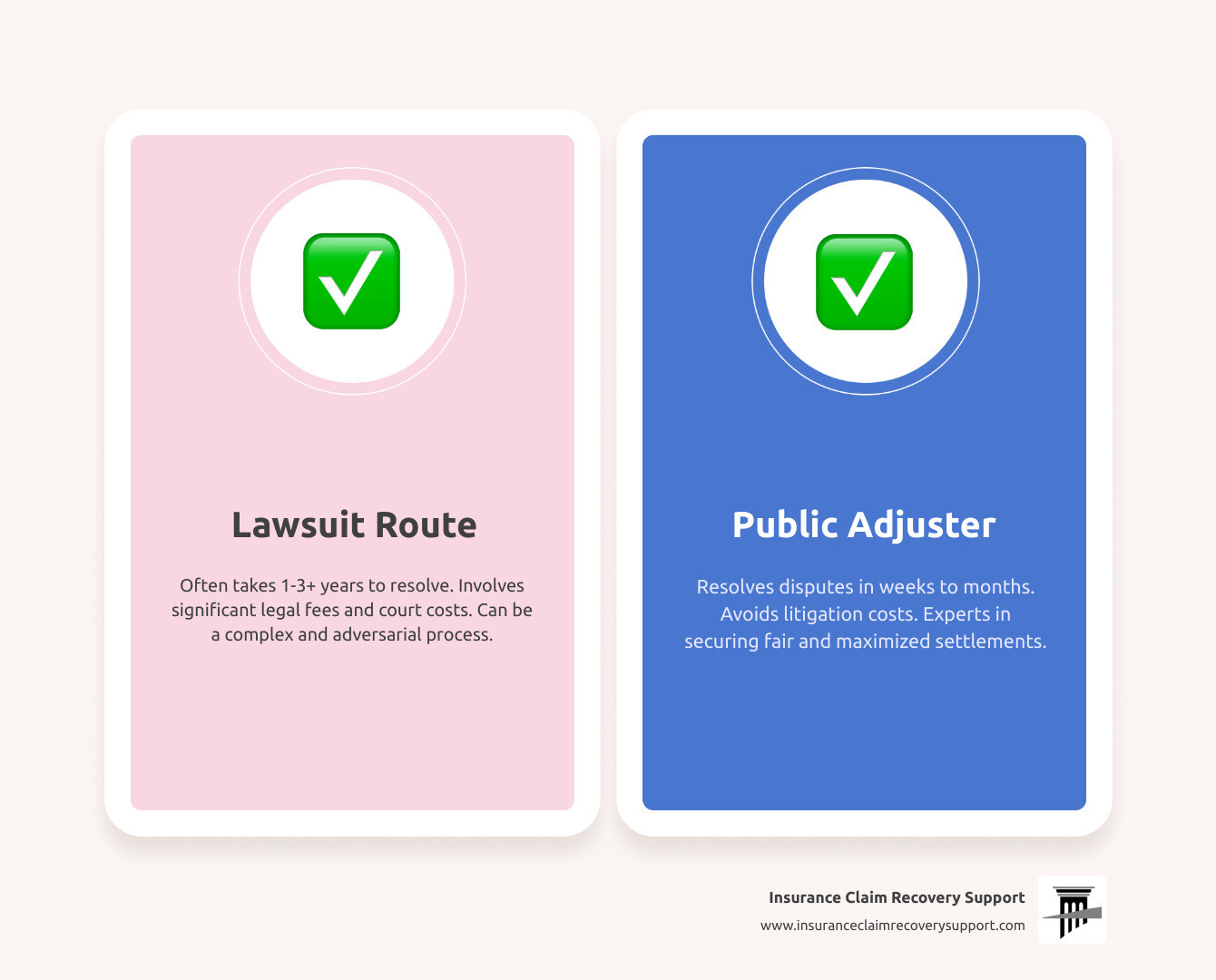

Think of it this way: suing your insurer is like declaring war, while hiring a public adjuster is like skilled diplomacy. A lawsuit involves attorneys, court costs, and a trial that could take over three years. Meanwhile, your property remains damaged. In contrast, working with Commercial Property Public Insurance Adjusters often resolves disputes in just weeks or months.

At Insurance Claim Recovery Support, we specialize in helping owners of commercial buildings, apartment complexes, and religious institutions in Texas and nationwide. Our approach uses thorough documentation and expert negotiation to achieve fair settlements without going to court.

Key Steps to Take Before You File a Lawsuit

Before calling an attorney, take these steps. They can often resolve the dispute or, at a minimum, strengthen your case if litigation becomes necessary.

- Review Your Insurance Policy: Get a complete copy and read your coverages, limits, and the required claims process. Understand what your policy actually promises.

- Send a Formal Demand Letter: Write a professional letter stating your position, referencing your policy, presenting your evidence, and demanding a specific settlement amount with a reasonable deadline.

- File a State Complaint: File a complaint with your state’s insurance department (e.g., the Texas Department of Insurance). This creates an official record and may trigger an investigation.

- Consider Mediation or Arbitration: These alternative dispute resolution methods are less adversarial and more cost-effective than a lawsuit. Your policy may even require them.

- Exhaust Administrative Remedies: Some policies require you to complete an internal appeals process before you can file a lawsuit. Skipping this step could get your case dismissed.

Why Business Owners Should Consider a Public Adjuster Before Suing Their Insurance Company

Hiring a public adjuster often eliminates the need to sue your insurance company. Public adjusters are experts in the claims process itself—we speak the insurer’s language and know how to present a claim to maximize your settlement.

- Timeline: Lawsuits can take over three years to go to trial. A public adjuster can often resolve a dispute in a matter of months.

- Cost: Both professionals often work on contingency, but attorney fees for litigation are typically higher, and you’ll also face court costs and expert witness fees. A public adjuster focuses on an efficient resolution with lower overall costs.

- Expertise: Attorneys know the law, but public adjusters specialize in damage assessment, construction costs, and claims negotiation. For hail damage to an Austin office or hurricane damage to a Houston apartment complex, you need technical and policy expertise.

- Relationship: A lawsuit creates an adversarial relationship with your insurer. A public adjuster maintains a professional, collaborative approach that is viewed as a normal part of the claims process.

- Stress: Litigation is stressful. A public adjuster handles the negotiations, allowing you to focus on your business.

The involvement of a skilled public adjuster signals to the insurer that you are serious and have professional representation. This is often enough to bring them to the negotiating table and avoid court. To learn more, read about When Should a Policyholder Hire a Public Insurance Adjuster.

The Lawsuit Process: What to Expect When Taking Your Insurer to Court

When all other options fail, a lawsuit against your insurance company may be your final recourse. For business owners, understand the lengthy and demanding path ahead.

The process begins by filing a complaint, where your attorney outlines your case (breach of contract, bad faith, or both) and the damages you seek. This is followed by the findy phase, the most time-consuming part, where both sides exchange documents and conduct depositions under oath. This phase alone can last for months or even years.

Before a trial, courts encourage mediation and settlement negotiations. A neutral mediator helps both sides find common ground, and many cases are resolved at this stage. If no agreement is reached, your case proceeds to trial, where a judge or jury hears the evidence and decides the outcome. Even after a verdict, either side can appeal, potentially adding years to the process. Understanding the potential costs, including Attorneys Fees in Property Damages Texas, is crucial.

This is why so many business owners in Texas choose to work with a public adjuster first, often resolving disputes in months that would otherwise take years in court.

Navigating the Legal Timeline and Statute of Limitations in Texas

Time is critical when suing an insurer. The statute of limitations is a strict deadline for filing a lawsuit. If you miss it, you lose your right to sue.

- Breach of Contract: In Texas, you generally have four years from the date of the breach (e.g., when your claim was denied) to file a lawsuit.

- Bad Faith Claims: The timeline is much shorter, typically two years from when the bad faith conduct occurred.

The reality of lawsuit timelines can be shocking. Reaching mediation often takes over a year, while a jury trial can easily exceed three years. This is why we recommend exploring alternatives like a public adjuster before committing to litigation.

Potential Outcomes: What Damages Can You Recover in an Insurance Lawsuit?

If your lawsuit is successful, the damages awarded are intended to make your business whole and, in some cases, punish the insurer. Potential recoveries include:

- Compensatory Damages: The core of your award, covering the full cost to repair or replace your property, plus lost business income and other expenses incurred due to the delay.

- Consequential Damages: Losses that go beyond direct policy benefits, such as damage to your business’s reputation or additional financing costs.

- Punitive Damages: Available only in successful bad faith cases, these are intended to punish the insurer for egregious conduct and deter future misconduct.

- Attorney’s Fees and Court Costs: Often recoverable in successful bad faith and some breach of contract cases in Texas.

- Interest on Delayed Payments: Compensation for the time value of money the insurer wrongfully withheld.

While these recoveries can be substantial, achieving them requires navigating years of uncertain litigation. This is why a public adjuster, focused on maximizing your settlement efficiently, is often the smarter first step.

Frequently Asked Questions about Suing Your Insurance Company

When your insurer isn’t cooperating after a commercial property loss, the question “can I sue my insurance company for property damage” is top of mind. Here are concise answers to the most common questions business owners have.

How long does it take to sue an insurance company for property damage?

A lawsuit is a slow process. Even if your case settles in mediation, it will likely take over a year. If it proceeds to a jury trial, you should expect the process to last three years or more. The complexity of your claim, the amount of money at stake, and the insurer’s willingness to negotiate all impact this timeline. In contrast, a public adjuster can often resolve a dispute in just a few months.

How much does it cost to sue an insurance company?

Most property damage attorneys work on a contingency fee, meaning they take a percentage (typically 33-40%) of your final recovery. You don’t pay fees upfront, but you are responsible for other expenses. These additional costs include court filing fees, deposition costs, and expensive expert witness fees (e.g., engineers, accountants), which can add up to thousands of dollars. A public adjuster also works on contingency, but their fees are typically lower, and they aim to settle your claim without incurring litigation expenses. Learn more about how they are retained here: What is a Public Insurance Adjuster Hire.

Can my insurance company drop my business policy if I sue them?

An insurer generally cannot cancel your policy mid-term in retaliation for a lawsuit, as this is illegal in most states, including Texas. However, they can choose not to renew your policy when it expires. While retaliation laws exist, proving that non-renewal was a direct result of the lawsuit can be difficult. For business owners in Texas cities like San Angelo or Waco, the need to recover from significant property damage often outweighs the risk of having to find a new insurer, especially when an insurer has acted in bad faith.

Conclusion: A Better Path to Resolving Your Commercial Claim Dispute

When your commercial building is damaged and your insurer refuses to pay fairly, asking “can I sue my insurance company for property damage” is a valid response. However, litigation should be your last resort, not your first step.

Lawsuits are expensive, stressful, and can take over three years to resolve. Meanwhile, your business suffers. There is a smarter approach. As public adjusters at Insurance Claim Recovery Support, we’ve settled over $250 million in large loss claims by using professional advocacy to resolve disputes efficiently.

We work exclusively for you, the policyholder. We know how to counter the insurance company’s tactics and present your claim to get results. Whether you’re dealing with freeze damage in Austin, hurricane destruction in Houston, or fire damage in Dallas-Fort Worth, our goal is to maximize your settlement without the need for a lengthy court battle.

For owners of commercial buildings, multifamily HOAs, apartment complexes, or religious institutions, you don’t have to choose between a lowball offer and a lawsuit. Professional advocacy provides a better path that protects your interests and gets your business back on track quickly.