Why License Verification is a Critical First Step for Property Owners

For owners and managers of commercial and multifamily properties in Texas, texas license verification is a crucial first step. When your property suffers damage from fire, hail, hurricane, tornado, freeze, lightning, or flood, you need to ensure any professional you hire is legitimate and qualified. This simple check can protect you from fraud, incompetent work, and unnecessary complications.

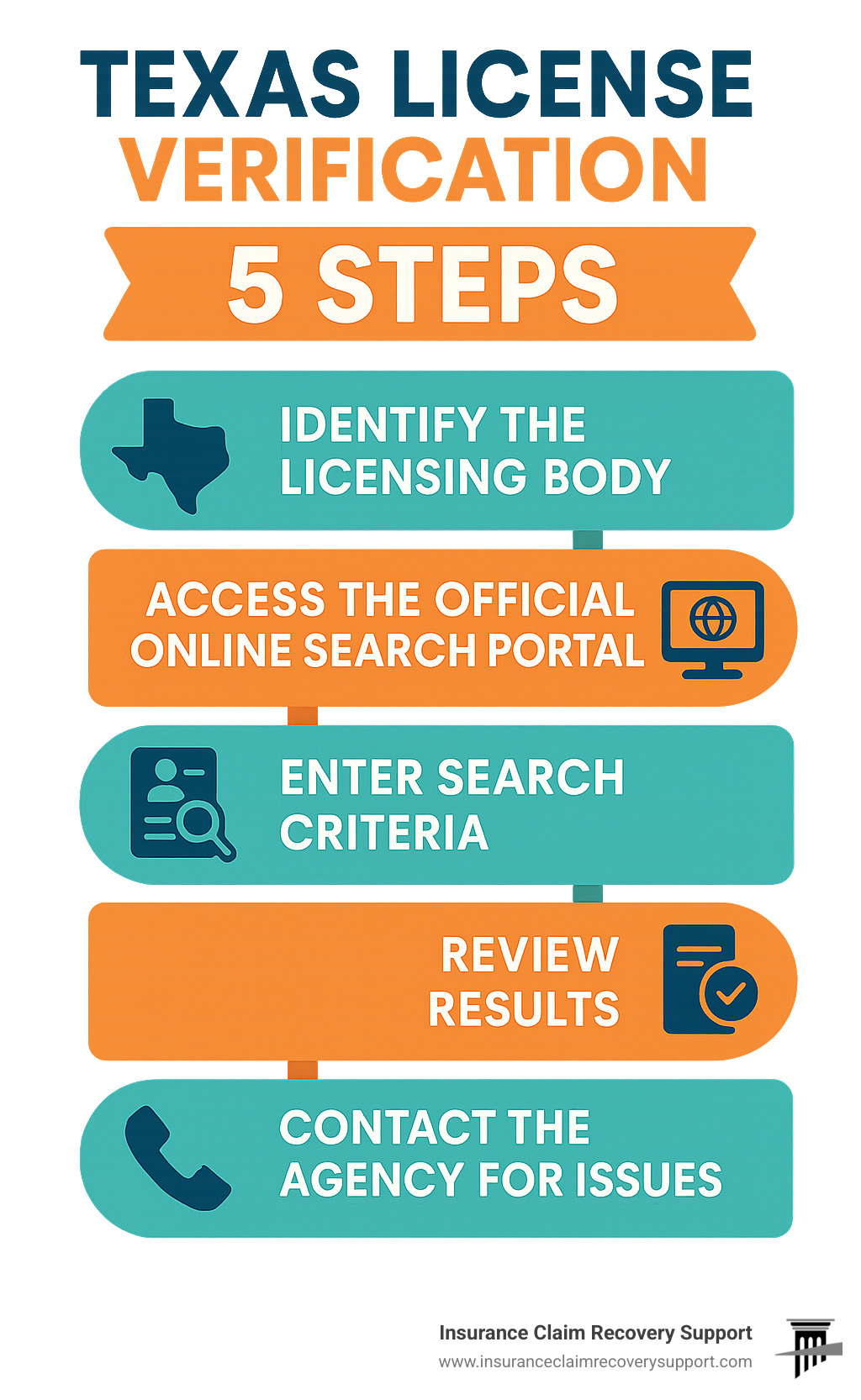

Here’s a quick guide on how to verify a professional license in Texas:

- Identify the Licensing Body: Determine which state agency regulates the specific profession (e.g., Texas Department of Licensing and Regulation for contractors, Texas Department of Insurance for public adjusters).

- Access the Official Online Search Portal: Steer to the official website of the identified licensing body.

- Enter Search Criteria: Use the professional’s name, business name, or license number in the search tool.

- Review Results: Check the license status (active, inactive, expired), issue date, expiration date, and any disciplinary actions.

- Contact the Agency for Issues: If you find discrepancies or cannot locate a license, contact the licensing agency directly.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. As a multi-state licensed public adjuster, I’ve settled hundreds of millions in commercial and multifamily property damage claims, seeing how essential license verification in Texas is for policyholders seeking legitimate professional assistance and avoiding unnecessary litigation. Understanding this process is vital for protecting your assets and ensuring a fair recovery.

Basic texas license verification glossary:

The purpose of license verification in Texas is multifaceted, but at its core, it’s about public safety and consumer protection. For us, as property owners and managers, it means ensuring that the individuals and businesses we entrust with our valuable assets are not only skilled but also legally authorized and accountable. This process helps us avoid potential pitfalls like working with unlicensed individuals who might perform substandard work, disappear with our money, or even expose us to legal liabilities.

Many professions in Texas require licensure, especially those involved in the construction, repair, and insurance claim processes that affect commercial and multifamily properties. These commonly include:

- Contractors: Electricians, A/C and refrigeration contractors, mold assessors and remediators, plumbers, and elevator contractors, among others, are licensed by the Texas Department of Licensing and Regulation (TDLR).

- Public Adjusters: These professionals, who advocate for policyholders in insurance claims, are licensed and regulated by the Texas Department of Insurance (TDI).

- Other Trades: Depending on the specific damage or repair needed, you might encounter other licensed professionals like architects, engineers, or even certain environmental specialists.

By verifying licenses, we gain peace of mind knowing we’re partnering with professionals who have met state-mandated qualifications and are subject to regulatory oversight. This is especially critical when dealing with significant property damage in cities like Houston, Dallas, Fort Worth, San Antonio, or Austin, where the stakes are high.

What is Primary Source Verification?

When we talk about license verification in Texas, the gold standard is “primary source verification.” This means that the information we obtain about a professional’s license comes directly from the official licensing authority – the state board or agency that issued the license. Why is this important?

Search results from official online verification systems are considered primary source verification because they are accurate and based upon the agency’s direct records. This ensures the data is reliable, current, and holds legal standing, helping us avoid disputes later on. Unlike self-reported data, which might appear on a professional’s website or business card and may not be verified by the licensing body, primary source verification is the most authoritative way to confirm a license’s legitimacy. While some professional profiling systems might include self-reported data, such as a physician’s primary practice address or hospital privileges on the Texas Medical Board’s system, the core license status and disciplinary actions are always verified directly by the board.

Information You Can Uncover

Through these verifications, we can access a wealth of crucial information about a professional:

- License Number: The unique identifier for their license.

- Issue Date: When the license was first granted.

- Expiration Date: When the license needs to be renewed.

- License Status: This is vital. It tells us if the license is active, inactive (meaning they cannot practice), expired (meaning it’s no longer valid), or suspended/revoked (indicating disciplinary action).

- Disciplinary History: Any formal actions taken against the licensee by the board, such as fines, reprimands, suspensions, or revocations. This information is publicly available through the verification systems.

- Public Complaints: While current complaint or investigation statuses may not always be publicly available, past disciplinary actions stemming from complaints will be.

- Board Orders/Sanctions: Specific directives or penalties imposed by the licensing board.

This comprehensive overview allows us to make informed decisions and choose professionals who are not only qualified but also have a clean record, which is paramount when dealing with sensitive and costly property damage claims.

Your Guide to Texas License Verification Portals

When your commercial property needs repairs after storm damage, knowing where to verify licenses can feel overwhelming. The good news? Texas has streamlined the process with user-friendly online portals. These official state systems make verification straightforward and accessible, helping you quickly vet potential service providers before signing any contracts.

The key is knowing which agency oversees which profession. Think of it like a filing system – each type of professional has their own designated drawer in the state’s regulatory cabinet.

Verifying Contractors and Trades with TDLR

The Texas Department of Licensing and Regulation (TDLR) is your go-to resource for most construction and repair professionals. Whether you need an electrician after fire damage, an A/C contractor following hurricane repairs, or a mold remediator after flood damage, TDLR has you covered.

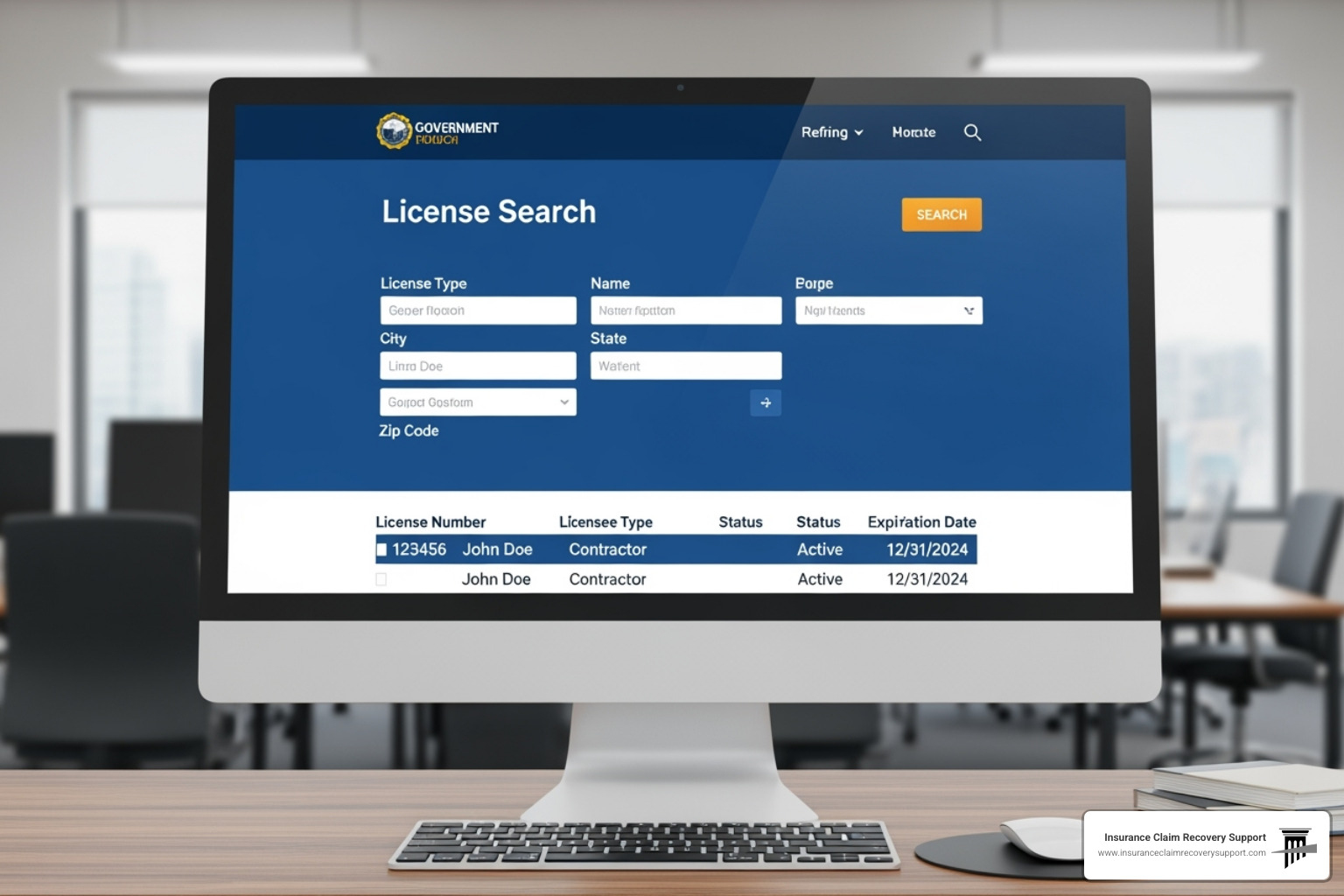

Getting started is simple. Head to the Search the TDLR License Database and you’ll find several search options that make finding information easy. You can search by name if you know the contractor’s full name or business name. If you have their license number handy, that’s often the fastest route. For property managers overseeing multiple locations, you can even search by city – perfect when you need contractors in Austin, Dallas, or Fort Worth.

The search results tell you everything you need to know at a glance. You’ll see the license status (active, inactive, or expired), issue and expiration dates, and any disciplinary actions on record. The system updates regularly, so you’re getting current information every time you search.

Interpreting the results is straightforward. An “active” status means you’re good to go. “Inactive” or “expired” means stop – this professional cannot legally work in Texas right now. Any disciplinary history deserves a closer look and perhaps a conversation with the contractor about what happened.

If you run into trouble or can’t find a license you’re expecting to see, TDLR’s customer service team at 800-803-9202 can help sort things out.

How to Verify a Public Insurance Adjuster’s License

Here’s where things get interesting for property owners and managers. Public insurance adjusters are licensed by a completely different agency – the Texas Department of Insurance (TDI) – because they’re insurance professionals, not contractors.

This distinction matters enormously for your property damage claim. A licensed public adjuster works exclusively for you, the policyholder, helping steer the complex insurance claim process and negotiate with your insurance company. They’re your advocate, not the insurance company’s.

Public adjuster requirements in Texas are strict, and for good reason. These professionals handle significant financial negotiations on your behalf. The TDI website search functions similarly to TDLR’s system, but you’ll be looking specifically for “Public Insurance Adjuster” as the license type.

When checking the license status, the same rules apply – active means authorized to represent you, while inactive or expired means they cannot legally handle your claim. This verification step is crucial whether your property is in San Antonio, Waco, Round Rock, or anywhere else in Texas.

Working with a properly licensed public adjuster can mean the difference between a fair settlement and leaving money on the table. It’s also your best protection against unnecessary litigation, as experienced adjusters know how to present claims effectively and negotiate successfully with insurance companies.

Navigating Common Verification Issues

Even with the best online tools, verifying licenses in Texas can sometimes feel a bit like a treasure hunt with a few unexpected detours. You might encounter common problems like discrepancies, licenses that seem to be missing, or questions about how often the data gets updated. Don’t worry, these issues are quite common, and thankfully, they’re usually easy to resolve.

Are There Fees for Texas License Verification?

Good news first! When you’re simply performing a basic online lookup for a license through official Texas state agency portals like the TDLR or TDI, there are generally no fees involved. Think of it as a free public service designed to keep everyone safe and transparent, especially for commercial and multifamily property owners.

However, there’s a small distinction. If you ever need an official written verification document, like a “Letter of Good Standing,” those sometimes come with a small administrative fee. For example, some boards might charge around $45.00 for such a letter. But for our everyday needs of checking a professional’s license online, the primary source data is usually free and completely sufficient for your needs.

What to Do with Discrepancies or Issues

So, what happens if you search for a license and it just doesn’t show up? Or maybe the information looks a little off? Don’t hit the panic button! Here’s a quick guide to help you sort things out:

First things first, let’s take a deep breath and double-check the information you entered. A tiny typo in a name or license number is often the culprit behind a missing result. It happens to the best of us!

If that doesn’t work, try different search criteria. If you’re searching by name, try using the business name instead, or vice versa. If you have a license number, that’s often the most direct route. Sometimes professionals might use a slightly different name for their license than the one they advertise.

If you still can’t find what you’re looking for, or if you spot information that seems incorrect, the next crucial step is to contact the relevant licensing board directly. They’re there to help! For the TDLR, you can simply call their customer service at 800-803-9202. For other boards, their contact information is usually easy to find on their official websites. They can often provide clarification or even help you conduct the search.

What if you find disciplinary actions listed? It’s important to know how to interpret disciplinary actions. Don’t let a “hit” on a record scare you off immediately. The board’s website often provides clear definitions of what different actions mean (like a simple reprimand versus a suspension or revocation). Understanding the severity and context of the action will help you make an informed decision for your commercial or multifamily property.

Finally, for out-of-state professionals looking to work in Texas, our state has specific rules. While some may qualify for license reciprocity (meaning their license from another state is recognized here), many will need to meet Texas’s own licensing criteria or apply for an endorsement. If you’re considering someone from out of state, it’s always best to consult with the specific Texas licensing board for their requirements. Also, keep in mind how often the data is updated. Most official online verification systems, like TDLR’s, provide a “last updated” timestamp, assuring you that you’re looking at the most current information available.

By following these simple steps, you can steer most verification issues with ease. This ensures you have accurate information about the professionals you’re considering for your commercial or multifamily property needs, helping you make smart choices for your investment.

After Verification: The Path to a Successful Property Damage Claim

Once we’ve completed our Texas license checks and confirmed our professionals are legitimate, we’re ready to move forward with confidence. Whether it’s the contractor rebuilding our commercial property after tornado damage in Georgetown or the public adjuster handling our flood claim in Lakeway, we now have the peace of mind that comes with working with properly licensed experts.

Having a licensed team makes all the difference in the insurance claim process. When our licensed contractor provides detailed repair estimates and our licensed public adjuster presents our case to the insurance company, we’re working with professionals who are accountable to state regulatory boards. This accountability translates into better work quality and more professional representation.

At Insurance Claim Recovery Support, we’ve seen how working with licensed professionals helps commercial buildings, multifamily HOAs, apartment complexes, and religious institutions avoid unnecessary litigation. Our licensed public adjusters focus on thorough documentation, accurate damage assessment, and skilled negotiation with insurance companies. This approach often resolves claims without ever stepping foot in a courtroom.

The difference between filing an insurance lawsuit and working with a public adjuster is striking. When property damage occurs in San Angelo or Lubbock, property owners face a critical choice about how to pursue their claim.

| Feature | Insurance Lawsuit | Using a Public Adjuster |

|---|---|---|

| Timeline | Lengthy, often spanning years of legal proceedings. | Faster, typically weeks to months, depending on claim complexity. |

| Cost | High legal fees (hourly or contingency), court costs, expert witness fees. | Contingency fee (often 10-15% of settlement), paid only upon successful recovery. No upfront costs. |

| Outcome | Uncertain, stressful, public record. Can result in prolonged disputes and unpredictable results. | Often results in a higher settlement than initial offers, less stress, private negotiation. Focus on maximizing recovery. |

| Control | Policyholder often relinquishes significant control to legal counsel. | Policyholder maintains control, with the public adjuster acting as an advocate and guide. |

| Relationship | Adversarial, often leading to strained relationships with the insurer. | Collaborative negotiation, aiming for a fair settlement without resorting to court. |

| Focus | Legal strategy and evidence for court. | Detailed damage assessment, policy interpretation, and negotiation tactics. |

The litigation route often becomes a long, expensive journey with uncertain outcomes. Legal fees pile up, relationships with insurers become adversarial, and the stress of court proceedings can be overwhelming. Meanwhile, the damaged property sits unrepaired while legal battles drag on.

Working with a licensed public adjuster offers a completely different experience. We handle the complex insurance policy language, document every aspect of the damage, and negotiate directly with the insurance company. Our goal is always to achieve the maximum settlement possible while maintaining professional relationships that benefit our clients.

When fire or storm damage strikes a commercial property, time is money. Every day of delayed repairs means lost revenue and potential secondary damage. A public adjuster who works exclusively for the policyholder can often resolve claims much faster than traditional litigation, getting businesses back on their feet sooner.

The verification process we’ve outlined ensures that whether you’re dealing with property damage in Houston’s business district or a multifamily complex in Austin, you’re working with legitimate professionals who are held to state standards. This foundation of trust and accountability sets the stage for a smoother claim resolution and helps avoid the costly detours that litigation can create.

Frequently Asked Questions about Verifying Texas Licenses

It’s natural to have questions when you’re navigating professional licenses, especially when dealing with something as important as your commercial or multifamily property. We’ve put together some common questions to help clarify things even further.

How do I verify a contractor’s license in Texas?

When you’re looking to hire a contractor for repairs after fire, storm, or flood damage, knowing they’re legitimate is your first line of defense. The main way to check a contractor’s license in Texas is through the Texas Department of Licensing and Regulation (TDLR) online search tool. Think of it as your go-to detective kit!

You can easily search by the contractor’s name, their business name, or if you have it, their specific license number. This search will quickly show you their license status and if they have any disciplinary history. This is super important because the information comes straight from the TDLR, making it official and reliable. It’s what we call “primary source verification”—meaning the data is directly from the people who issued the license.

What is the difference between a public adjuster and a company adjuster?

This is a really important question for any property owner dealing with a claim. Imagine you’ve had a big storm, and your property needs major repairs. Who’s on your team?

A public adjuster is licensed by the state, just like us at Insurance Claim Recovery Support. Our job is to work exclusively for you, the policyholder. We help manage your claim from start to finish, aiming to get you the maximum settlement you deserve for your commercial building, apartment complex, or religious institution. We’re your advocate, looking out for your best interests.

On the flip side, a company adjuster works for the insurance company. Their role is to assess the damage from their employer’s point of view. While they’re assessing the damage, their primary responsibility is to the insurance company, not necessarily to you. This distinction is absolutely critical. Choosing a public adjuster ensures your interests are truly represented throughout the property damage claim process, helping you avoid unnecessary disputes.

Is an online license verification considered official?

Yes, absolutely! When you use the official online portals provided by a state licensing board, like the Texas Department of Licensing and Regulation (TDLR) or the Texas Department of Insurance (TDI), the results you see are considered official.

This is because these online tools provide what’s known as primary source verification. It means the information comes directly from the state agency that issued the license. So, you can trust that the data is accurate, up-to-date, and holds legal weight for verification purposes. It’s a quick and easy way to get the official word on a professional’s license status.

Your First Step Toward a Fair Recovery

When your commercial or multifamily property suffers damage, verifying Texas licenses becomes your shield against fraud, poor workmanship, and costly mistakes. It’s not just paperwork – it’s your first line of defense in protecting what might be your most valuable investment.

Think of license verification as the foundation of your entire recovery process. Just like you wouldn’t build on unstable ground, you shouldn’t trust your property’s restoration to unverified professionals. Whether you’re dealing with fire damage in Austin, storm damage in Houston, or flood damage in San Antonio, taking this crucial step can save you thousands of dollars and months of headaches.

At Insurance Claim Recovery Support, we’ve seen too many property owners learn this lesson the hard way. A seemingly legitimate contractor disappears with a deposit. An unlicensed “public adjuster” provides worthless representation. A fake electrician creates more problems than they solve. These situations are entirely preventable with proper verification.

Using licensed professionals isn’t just smart – it’s essential. When you work with properly licensed contractors and public adjusters, you’re not just getting qualified help. You’re getting professionals who are accountable to state regulatory boards, carry proper insurance, and follow industry standards. This accountability becomes especially important when dealing with complex property damage claims involving fire, hurricane, tornado, lightning, freeze, or flood damage.

Our team understands the overwhelming nature of property damage claims. That’s why we serve as your expert advocate throughout the entire process. We’re licensed public adjusters who work exclusively for property owners and managers, not insurance companies. Our job is ensuring you receive the maximum settlement you deserve while avoiding the stress and expense of unnecessary litigation.

The difference between working with licensed versus unlicensed professionals can make or break your claim. Licensed public adjusters like our team at Insurance Claim Recovery Support bring expertise in policy interpretation, damage assessment, and negotiation tactics that significantly improve your settlement outcomes. We handle everything from initial damage documentation to final settlement negotiation, allowing you to focus on running your business while we handle the insurance company.

From Georgetown to Lakeway, from Lubbock to San Angelo, and throughout Texas, commercial and multifamily property owners face unique challenges when disaster strikes. Weather doesn’t discriminate, but your choice of professionals can dramatically impact your recovery. By starting with proper license verification and partnering with experienced, licensed public adjusters, you’re setting yourself up for success rather than frustration.

Your fair recovery begins with informed decisions. Verify those licenses, choose licensed professionals, and let experienced advocates handle your claim. It’s the difference between a smooth recovery and a nightmare that drags on for months.

Find out how a public adjuster can help with your Texas property damage claim