The Reality of Severe Weather for Texas Property Owners

San Angelo storm damage is a critical concern for commercial property owners, multifamily investors, and institutional facilities across West-Central Texas. The state consistently leads the nation in weather-related property damage, and San Angelo’s position in the Concho Valley makes it vulnerable to severe thunderstorms, flash floods, hail, and high winds.

Recent events underscore this risk, particularly the catastrophic July 4th flood where 14 inches of rain affected over 12,000 structures. For commercial and multifamily properties, the impact goes beyond visible destruction to include business interruption, hidden moisture damage, and compromised roofing systems. The financial toll can take years to fully manifest, a fact insurance companies may leverage to their advantage.

Navigating the insurance claim process is often as challenging as the disaster itself. Insurers may delay, underpay, or wrongfully deny claims, leaving property owners with inadequate settlements. The choice between accepting a low offer, engaging in costly litigation, or hiring a professional advocate can determine your property’s future.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support (ICRS) LLC. As a Multi-State Licensed Public Adjuster with over 15 years of experience, I specialize in helping commercial and multifamily property owners secure fair settlements for San Angelo storm damage and other losses. My firm excels at overturning wrongful denials and negotiating settlements 30% to over 3,800% above initial offers, helping clients avoid litigation and achieve a full recovery.

Navigating the Aftermath of San Angelo Storm Damage and Other Texas Disasters

When a major storm hits your commercial or multifamily property, understanding the event, the available resources, and the insurance process is key to your recovery. The San Angelo storm damage from recent events provides a clear example of the challenges owners face.

Recent Catastrophic Events: The San Angelo Storm Damage of July 4th

On July 4th, 2024, a record-breaking 14 inches of rain caused a catastrophic flash flood in San Angelo. The floodwaters, reaching up to 15 feet deep, devastated north and northeast San Angelo, impacting 12,102 structures. The event prompted over 100 water rescues and led Tom Green County to declare a natural disaster. For commercial and multifamily owners, this meant flooded first floors, compromised foundations, and the start of a long recovery process involving significant business interruption. You can learn more about local challenges on our San Angelo page and broader issues on our Texas Flood resource.

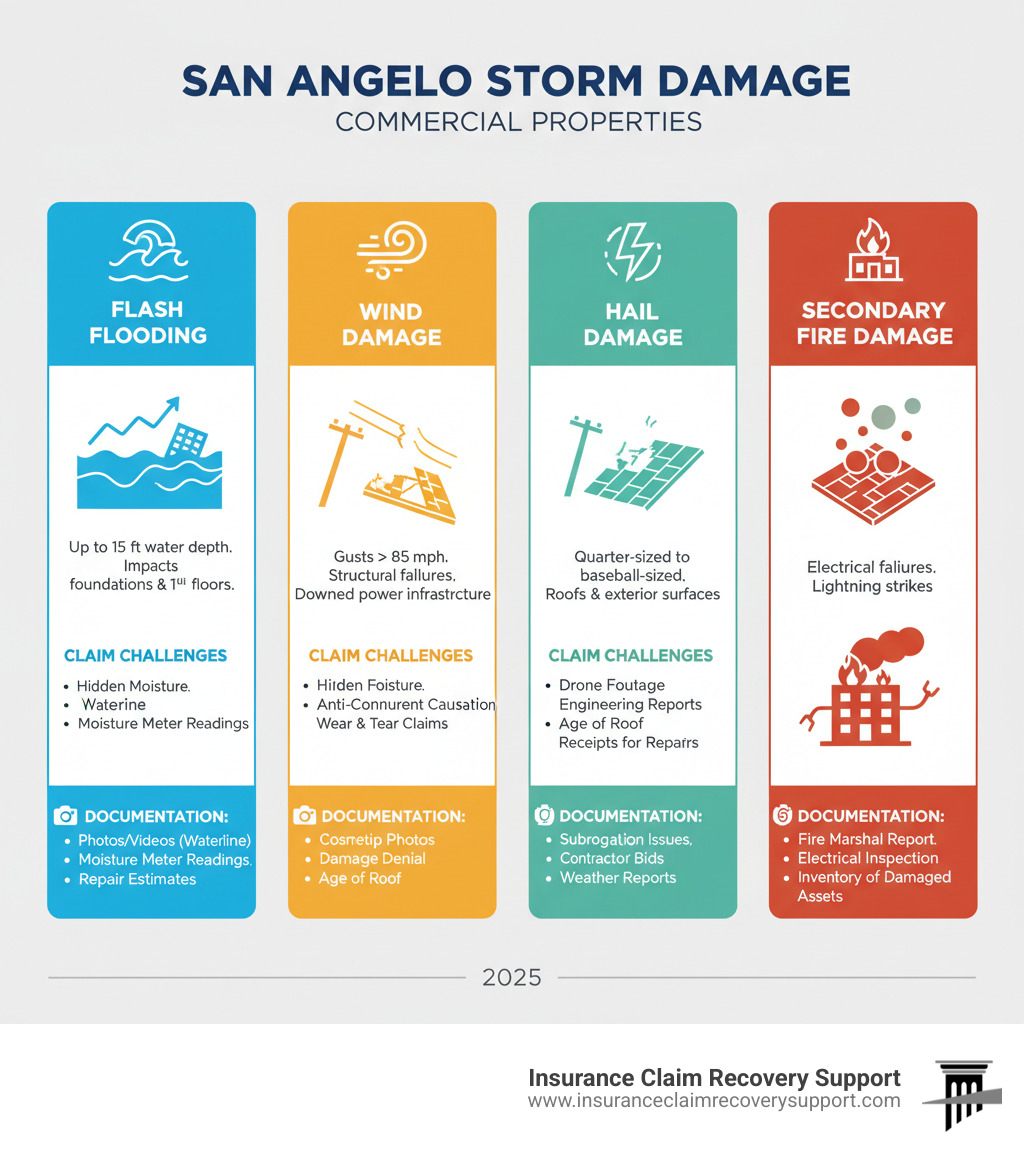

Understanding the Full Scope of Property Damage

The visible damage after a storm is often just the tip of the iceberg. The San Angelo storm damage created multiple layers of destruction, many of which are hidden.

- Flooding and Water Damage: Beyond immediate destruction, floodwaters saturate insulation, compromise foundations, ruin electrical systems, and lead to mold growth within 24-48 hours.

- Wind and Hail Damage: Wind gusts exceeding 85 mph and large hail can tear off roofing, damage rooftop HVAC units, and allow wind-driven rain to penetrate the building, causing hidden moisture damage. Proper documentation is crucial, as explained in our Hail Damage Roof Repair guide.

- Fire and Lightning Damage: Storms can cause secondary fire damage from electrical failures or lightning strikes. The catastrophic fire at the Grande Motel is a recent example. Lightning can also fry electrical panels and systems throughout a building. Learn more from our Fire Damage Claim Help and Damage Caused by Lightning resources.

Insurance company adjusters may perform quick inspections that miss these hidden issues. Comprehensive assessments using thermal imaging and engineering reports are often necessary to document the full extent of the loss, but insurers rarely volunteer for these unless pressed by a professional.

Official Response and Community Resources

Following the July 4th flood, a disaster declaration by the City of San Angelo and Tom Green County opened the door for state and federal aid. The most critical step for property owners is to complete the Individual State of Texas Assessment Tool (iSTAT) survey. This survey is the primary tool FEMA uses to determine the level of federal disaster assistance. Access the iSTAT damage survey at the Texas Division of Emergency Management portal: iSTAT survey.

While community organizations like the San Angelo Area Foundation provide vital immediate relief, this aid is meant to supplement, not replace, your insurance settlement. Utility crews continue power restoration, and the National Weather Service (NWS) San Angelo office issues ongoing advisories. This official documentation is valuable for your claim, but professional advocacy is often needed to ensure your insurer pays what you are owed. Our Assistance with Insurance Claims page explains how public adjusters coordinate with all available resources to secure your full compensation.

From Damage Assessment to Fair Settlement: The Property Claim Process

Recovering from San Angelo storm damage requires navigating a complex insurance claim process where the right strategy can mean the difference between a fair settlement and financial struggle. For commercial and multifamily property owners, understanding your options is the first step.

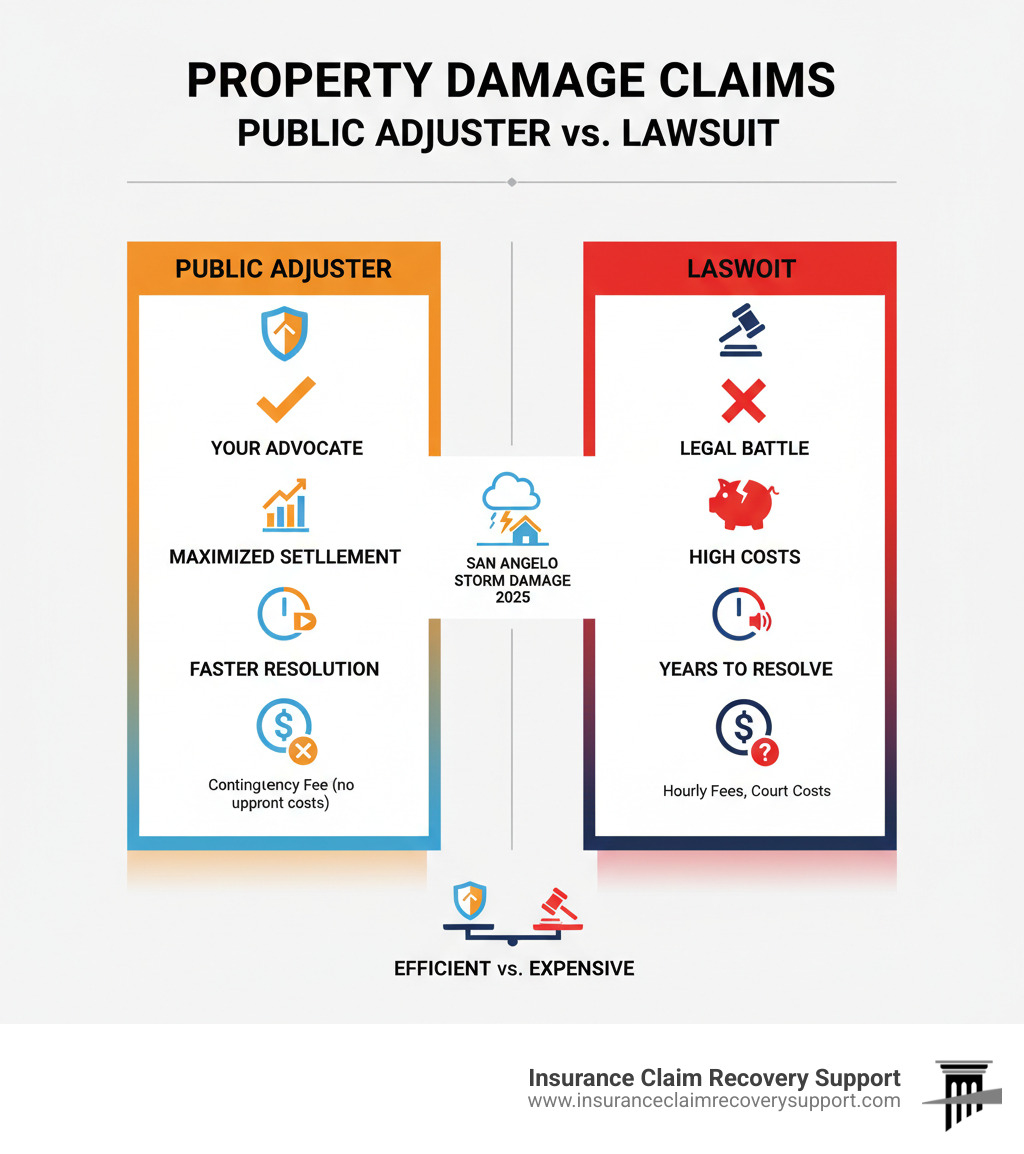

The Insurance Claim Journey: Public Adjuster vs. Lawsuit

After a major loss, you have three paths: manage the claim yourself, hire a public adjuster, or file a lawsuit. The insurance company’s adjuster works to protect their employer’s bottom line, and their initial offer often falls far short of true restoration costs. This is where a public adjuster becomes your essential advocate.

We work exclusively for you, the policyholder. We conduct our own comprehensive damage assessment, interpret your policy to maximize coverage, and negotiate aggressively with the insurer. Our goal is to secure a fair settlement efficiently, helping you avoid the time, cost, and stress of litigation. A lawsuit should be a last resort, as it can take years and incur substantial legal fees. By presenting a carefully documented claim, we resolve most cases without ever going to court.

Here’s how the approaches compare:

| Feature | Managing Claim Yourself | Hiring a Public Adjuster | Filing a Lawsuit |

|---|---|---|---|

| Advocacy | None—you represent yourself against insurance company | Exclusively represents your interests | Legal counsel represents your interests in court |

| Damage Assessment | Your own evaluation, often incomplete | Independent, comprehensive assessment including hidden damages | Court-appointed or expert witness assessment |

| Policy Interpretation | Your understanding, likely missing coverage opportunities | Expert interpretation to maximize all available coverage | Legal interpretation by attorneys and judges |

| Negotiation | Direct with insurer—you’re at a disadvantage | Professional, aggressive negotiation with insurer | Formal legal proceedings, findy, mediation, trial |

| Timeline | Varies widely, often stalled by insurer tactics | Generally resolves within months, aims for efficient settlement | Often 1-5+ years depending on complexity and court backlog |

| Cost | Your time plus potential massive underpayment | Contingency fee (percentage of settlement)—no upfront cost | Hourly legal fees, court costs, expert witness fees—often $50,000-$200,000+ |

| Outcome | Typically results in underpaid settlement or denial | Maximized settlement, avoids litigation risks and delays | Can result in significant award, but high risk, cost, and time investment |

| Stress Level | Very high, especially for complex commercial claims | Significantly reduced—professionals handle the burden | Extremely high, prolonged legal battle affecting business operations |

Our approach routinely helps clients recover 30% to over 3,800% above initial offers. Learn more in our Public Adjuster Claim Process guide and Commercial Property Damage Insurance Claim Guide.

Common Myths About Major San Angelo Storm Damage Claims

Misconceptions about insurance can cost you dearly. Let’s debunk the most common myths.

Myth: The insurer’s adjuster works for me.

Fact: The insurer’s adjuster is paid by the insurance company to protect its financial interests. Their goal is to minimize the payout. A public adjuster is the only adjuster who works exclusively for you. We’ve detailed these tactics in our guide on Why Insurance Companies Delay Deny and Dispute Claims on Purpose.

Myth: I must accept the first settlement offer.

Fact: The initial offer is a starting point for negotiation. Insurers often make lowball offers, hoping you’ll accept out of exhaustion. These offers are negotiable, and professional advocacy can lead to substantially higher settlements.

Myth: Cosmetic damage isn’t covered.

Fact: Coverage depends entirely on your policy. For a commercial property, what an insurer calls “cosmetic” (e.g., hail dents on a metal roof) can be a functional loss that voids warranties and reduces property value. An expert policy review is essential. If your claim has been unfairly denied, we can provide Help with Denied Claim.

Securing Your Recovery and Preparing for the Future

Achieving a full recovery means securing a settlement that covers not only physical repairs but also business interruption losses. Once a fair settlement is reached, you can restore your property to pre-loss condition with confidence. We ensure your claim accounts for lost rental income, ongoing expenses, and compliance with current building codes.

Looking ahead, consider using part of your settlement for mitigation upgrades to reduce future risk. We also recommend an annual policy review to ensure your coverage keeps pace with your property’s value. At Insurance Claim Recovery Support, we serve property owners throughout Texas, including San Angelo, Austin, Dallas-Fort Worth, and Houston, specializing in large loss claims for commercial and multifamily properties. If you’re dealing with San Angelo storm damage, you don’t have to face the insurance company alone. Explore our services for Public Adjusters in San Angelo, TX and learn about Hiring Best Public Insurance Adjuster. For a deeper dive, Learn how to navigate the complexities of a property damage claim. Let us ensure you receive every dollar you’re entitled to.