Why Understanding Your Roof Claim Adjuster Matters When Thousands Are at Stake

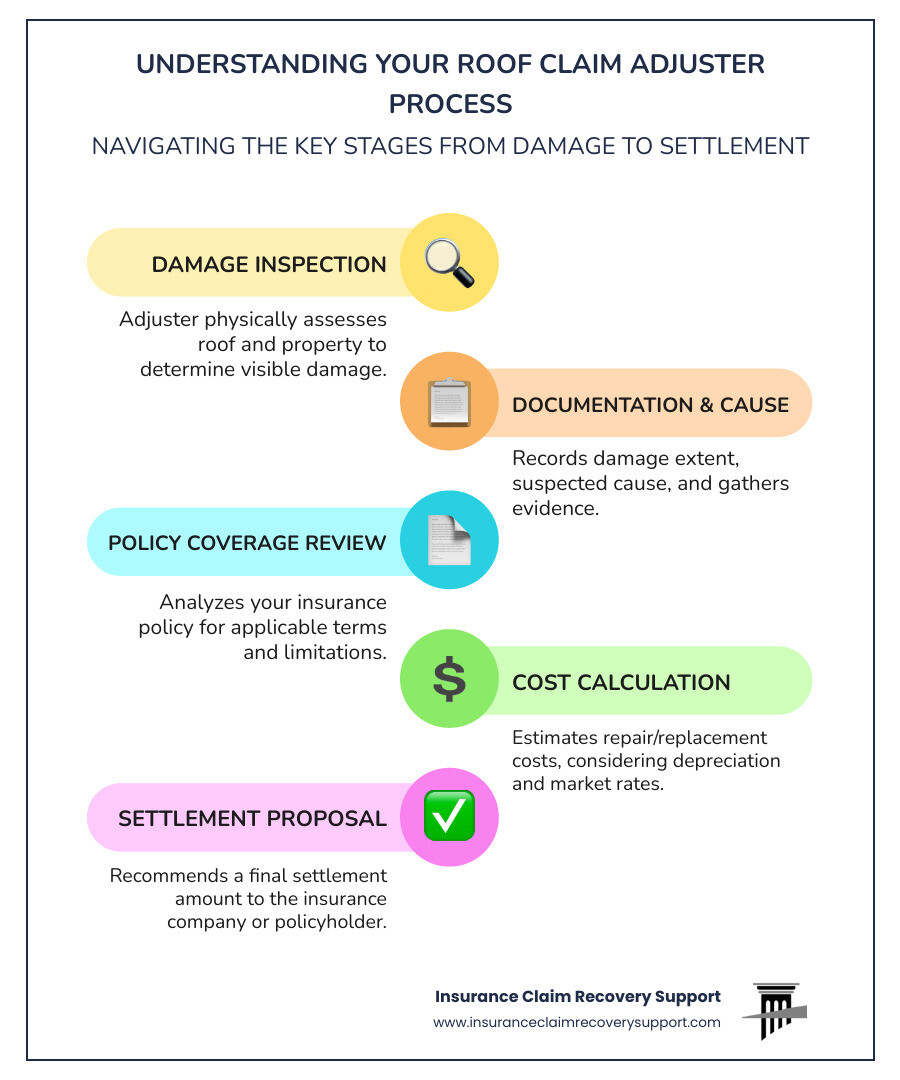

A roof claim adjuster is an insurance professional who investigates roof damage, determines coverage, and calculates the settlement amount your insurance company will pay. Here’s what you need to know:

What a Roof Claim Adjuster Does:

- Inspects the damaged roof and surrounding property

- Documents the extent and cause of damage

- Reviews your insurance policy to determine coverage

- Calculates repair or replacement costs

- Recommends a settlement amount to the insurance carrier

Two Types of Adjusters:

- Company Adjuster (works for your insurance company)

- Public Adjuster (works exclusively for you, the policyholder)

When a storm damages your commercial property’s roof, the insurance adjuster who arrives on-site becomes a pivotal figure in your financial recovery. Yet, many property owners don’t understand their role, who they represent, or how their assessment can mean the difference between a $50,000 and a $500,000 settlement for the same damage.

A roof claim adjuster’s role is complex. These professionals evaluate visible damage, policy language, building codes, and market conditions—all factors that dramatically impact your settlement. According to the U.S. Bureau of Labor Statistics, claims adjusters are trained professionals, but they are often overworked, especially after major weather events. Since company adjusters work for the insurance carrier, their assessments may overlook critical damage or apply unfavorable pricing, leading to underpayment.

For commercial and multifamily properties, the stakes are immense. An underpaid roof claim can lead to revenue loss, tenant issues, and even business closures. Research shows a significant percentage of underpaid claims are never challenged, and insurers may pay 20-50% less than what policyholders are owed without professional advocacy. Understanding the adjuster’s process is vital to protecting your investment.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. For over 15 years, I’ve helped commercial property owners overturn denied claims and secure fair settlements, often increasing recoveries by 30% to over 3,800%. This guide explains the adjuster’s role and the steps you can take to ensure a successful outcome.

What an Adjuster Looks For: Key Assessment Factors

When a roof claim adjuster arrives, they conduct a systematic evaluation to determine the cause, coverage, and value of the damage. Here are the key factors they consider:

- Roof Age: Insurers may argue an older roof (20+ years) failed due to “wear and tear” or only pay Actual Cash Value (ACV), not full Replacement Cost Value (RCV).

- Maintenance History and Proper Installation: Adjusters look for signs of neglect (e.g., rot, loose nails) to argue damage was pre-existing, potentially reducing your payout.

- Type of Roof: The material—asphalt, tile, metal, or flat TPO/EPDM—affects the assessment, as each has unique vulnerabilities and repair costs.

- Cause of Damage: The adjuster must confirm a covered peril (wind, fire, hail) caused the damage. They look for specific evidence, like patterns of wind uplift, to verify the claim’s source. In Texas, for example, wind and hail damage claims are frequent and require precise cause determination. https://insuranceclaimrecoverysupport.com/texas-tops-list-of-states-with-most-wind-and-hail-damage-insurance-claims/

- Scope of Damage: They determine if you need a simple repair or a full replacement, looking for both obvious and subtle signs like granule loss, uplifted membranes, or hidden moisture.

- Building Codes and Ordinances: This is critical. For example, in Florida, if over 25% of a roof is damaged, the entire system must be replaced to meet current code. “Ordinance and Law” coverage in your policy can cover these increased costs.

- Actual Cash Value (ACV) vs. Replacement Cost Value (RCV):

- ACV: The replacement cost minus depreciation (for age and wear). This payout will not cover the full cost of a new roof.

- RCV: The cost to replace the roof with new materials of similar quality, without deducting for depreciation. This is the goal for most commercial policies.

Common Tactics of a Company Roof Claim Adjuster and How to Respond

Be aware of common tactics used to minimize payouts. Here’s how to recognize and counter them:

- Lowball Offers: The adjuster offers a settlement far below the true repair cost.

- Our Response: We counter with detailed, independent estimates that document the true cost of replacement, including code upgrades and local market pricing.

- Delaying Tactics: The process is dragged out, pressuring you to accept a low offer out of frustration.

- Our Response: We manage all communication, enforce deadlines, and keep the claim moving forward according to required timelines.

- Downplaying Damage: The adjuster dismisses damage like granule loss or small dents as “cosmetic” or misses hidden issues.

- Our Response: We use drones and thermal imaging to provide irrefutable proof of all damage, validated by our team of roofing experts.

- Arguing “Wear and Tear”: The adjuster blames the roof’s age or pre-existing conditions for the damage, not the covered event.

- Our Response: We prove the new damage was caused by the covered peril, separating it from any normal aging and ensuring your claim is covered.

- Using Standardized Pricing (Xactimate): Estimates are generated with software that may not reflect local labor and material costs or may omit contractor overhead and profit (O&P).

- Our Response: We audit every line item of the insurer’s estimate, correcting errors and ensuring all costs, including O&P (typically 20%), are included.

- Requesting Recorded Statements: The insurer asks for a recorded statement that can be used to undermine your claim.

- Our Response: We advise against giving recorded statements without counsel and can handle communications on your behalf to protect your interests.

Disagreements and Disputes: What to Do Next

If you disagree with the adjuster’s assessment, you have options:

- Request a Second Inspection: You have the right to ask for another evaluation, preferably with your own roofing contractor present.

- Escalate to a Claims Manager: If the adjuster is unresponsive, ask to speak with their manager for a higher-level review.

- Invoke the Appraisal Clause: Many policies include this clause to resolve disputes over the loss amount. Each side hires an appraiser, and a neutral umpire makes a binding decision if they disagree.

- File a State DOI Complaint: If you believe the insurer is acting in bad faith, file a complaint with your state’s Department of Insurance.

- Seek Professional Assistance: If your claim is denied, underpaid, or stalled, it’s time to get expert help. We specialize in Insurance Claims Dispute Assistance and can help with a Help With Denied Claim. Our team has a 90% success rate in settling claims without lawsuits.

The Core of the Claim: How a Roof Claim Adjuster Assesses Damage

The adjuster’s primary role is to investigate the claim for the insurance company. This involves four key steps:

- Site Inspection: Physically inspecting the roof, taking photos and measurements, and assessing its condition.

- Damage Verification: Matching the observed damage to a covered peril in your policy, while considering the roof’s age and maintenance history.

- Policy Interpretation: Reviewing your policy to determine coverage, limits, and exclusions.

- Settlement Calculation: Estimating the repair cost, often using standardized software like Xactimate, which forms the basis of the initial settlement offer.

Preparing for the Inspection: A Property Manager’s Checklist

Being prepared for the adjuster’s visit is crucial. Here’s a checklist:

- Document Everything: Take date-stamped photos and videos of all damage before any repairs.

- Gather Records: Collect all roof maintenance records to counter claims of neglect.

- Get an Independent Estimate: Have a trusted contractor provide a detailed repair estimate. Note: In states like Florida, contractors cannot legally negotiate claims for you.

- Compile Key Documents: Have your policy, contractor’s estimate, photos, and receipts for temporary repairs ready.

- Document Temporary Repairs: Keep receipts and photos of any mitigation efforts, like tarping.

- Be Present: Attend the inspection to point out all areas of concern. A thorough inspection can take several hours.

- Assess Complex Damage: For events like tornadoes, a specialized Tornado Damage Assessment is vital to uncover hidden structural issues.

Company Adjuster vs. Public Roof Claim Adjuster: Fact vs. Myth

Understanding who works for whom is critical. Let’s separate fact from fiction.

| Feature | Company Adjuster (Staff/Independent) | Public Adjuster (like ICRS) |

|---|---|---|

| Who They Work For | The insurance company that issued your policy. | Exclusively for YOU, the policyholder. |

| Their Goal | To assess damage and determine the insurer’s liability and payout based on policy terms, often within parameters set by the insurer. | To maximize your settlement and ensure you receive everything you’re entitled to under your policy. |

| Allegiance | To the insurance company. | To the property owner. |

| Expertise | Trained in claims assessment, but often limited by insurer guidelines and heavy caseloads. | Licensed experts in policy language, damage assessment, construction costs, and negotiation; they know the insurer’s tactics. |

| Negotiation Power | Represents the insurer’s offer. | Negotiates against the insurer on your behalf, leveraging their expertise to advocate for a higher settlement. |

| Fees | Paid by the insurance company; no direct cost to you. | Typically works on a contingency fee (a percentage of the settlement); if you don’t get paid, we don’t get paid. |

| Impact on Settlement | May result in lower initial offers due to insurer-driven parameters or overlooked details. | Statistically leads to significantly higher settlements for policyholders. |

Myth vs. Fact: Who Should You Trust?

A common myth is that all adjusters work for you. The fact is, their allegiances are fundamentally different. A company adjuster’s primary duty is to the insurance carrier, and their goal is to close the claim based on the insurer’s interpretation and financial interests. A public adjuster works exclusively for you, the policyholder, with the sole goal of maximizing your settlement.

Another myth is that hiring a public adjuster will anger the insurance company or delay your claim. In reality, insurers are legally required to work with your licensed representative. Our involvement often speeds up the process by providing the comprehensive documentation needed for a fair and prompt resolution. You don’t need to wait for a denial to seek help; hiring a public adjuster early ensures your claim is positioned for success from the start. Learn more about What is a Public Insurance Adjuster Hire and how we act as your advocate in any Public Adjuster Home Insurance Claim or commercial property claim.

Securing a Fair Settlement: Your Strategic Next Steps

Navigating a commercial roof claim requires a proactive strategy. Here are the key steps to empower yourself and improve your outcome:

- Know Your Policy: Understand your coverage limits, deductibles, and exclusions. This is your most powerful tool.

- Document Carefully: Take extensive photos and videos of all damage before cleanup. Keep a log of all communications with your insurer.

- Mitigate Further Damage: Make reasonable temporary repairs (like tarping) and keep all receipts.

- Get an Independent Estimate: A detailed estimate from your own contractor provides a crucial baseline for negotiations.

- Communicate Professionally: Be firm but professional in all interactions. Avoid giving recorded statements without counsel.

- Don’t Settle Prematurely: Never rush to accept an initial offer. It’s much harder to reopen a closed claim than to negotiate a fair settlement upfront. For large commercial claims, a complete Large Loss Claim Documentation Lists is essential.

When to Hire a Professional: Public Adjuster vs. Attorney

For complex commercial claims, professional help is not a luxury—it’s a necessity.

When to Hire a Public Adjuster (like ICRS):

- Complex or Large Losses: Your claim involves extensive damage from a hurricane, fire, or tornado, or is a significant Commercial Property Loss Claim.

- Underpaid or Denied Claims: The insurer’s offer is too low, or your claim has been wrongfully denied.

- You Lack Time or Expertise: You need an expert to manage the entire claims process while you focus on your business.

How a Public Adjuster Helps Avoid Litigation

A common fear is a long, expensive legal battle. Our primary goal is to prevent this. With a 90% settlement success rate without lawsuits, we achieve fair outcomes by:

- Presenting an Airtight Case: We use expert documentation, technology, and detailed estimates to leave no room for dispute.

- Negotiating from a Position of Strength: We are professional negotiators who speak the insurer’s language and relentlessly advocate for your best interests. This de-escalates conflict and leads to fair settlements, avoiding the need for an attorney.

FAQ: Public Adjuster vs. Lawsuit for Property Damage

Q: What’s the main difference between a public adjuster and an attorney?

A: A public adjuster works within the insurance policy to document, value, and negotiate your claim for the maximum settlement without going to court. An attorney provides legal representation, which may include filing a lawsuit if the insurer acts in bad faith or breaches the contract.

Q: Can a public adjuster prevent the need for a lawsuit?

A: Often, yes. By building a strong, evidence-based claim from the start, we resolve most disputes through negotiation, making litigation unnecessary.

Q: What are the costs?

A: Public adjusters typically work on a contingency fee—a percentage of the settlement we recover for you. We don’t get paid unless you do. Attorneys may use contingency fees, hourly rates, or a combination.

At Insurance Claim Recovery Support, we represent property managers, commercial owners, apartment investors, and HOAs across Texas, Florida, and other states. We are here to maximize your settlement and streamline your recovery, ensuring you get the full value you deserve without the stress of litigation.