Why Disputing Your Insurance Claim is Worth the Fight

An insurance claim dispute arises when a commercial property owner receives a denied, delayed, or underpaid settlement that fails to cover the actual damage. If you’re facing this situation, you don’t have to accept the insurer’s decision.

Key Steps to Resolve an Insurance Claim Dispute:

- Review Your Policy & Denial Letter: Understand the insurer’s reasoning by referencing specific policy language.

- Document Everything: Gather photos, videos, repair estimates, and all correspondence.

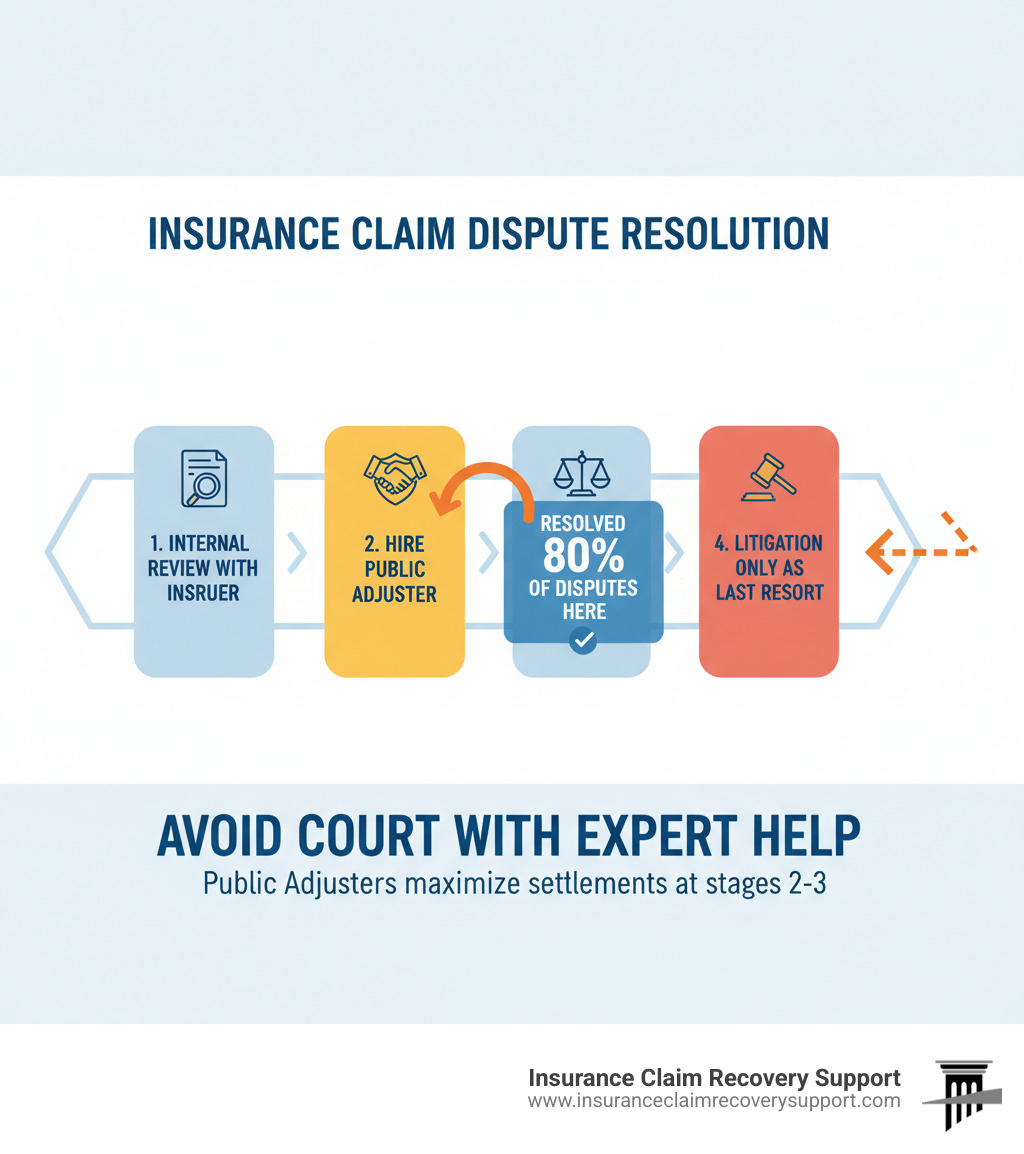

- Request an Internal Review: Formally ask the insurer’s claims department to reconsider their decision.

- Hire a Public Adjuster: Engage a licensed professional who represents your interests to negotiate a fair settlement and help you avoid litigation.

- Explore Alternative Dispute Resolution (ADR): Use appraisal or mediation as outlined in your policy before resorting to a lawsuit.

Many property owners believe they must accept their insurer’s initial offer, but industry data shows public adjusters can increase settlements by 200% to 300%. Disputes often stem from misunderstandings or an insurer’s “deny first” approach, especially for large commercial claims involving fire, tornado, or freeze damage.

Insurance companies are legally required to act in good faith. When they fail, you can and should fight back. A structured approach, combined with professional representation from a public adjuster, can resolve disputes efficiently. Most policies contain a “Mandatory Appraisal Clause” that offers a path to resolution without expensive litigation.

As CEO of Insurance Claim Recovery Support, I’ve resolved hundreds of millions of dollars in insurance claim disputes, turning wrongfully denied claims into fair settlements. Over 15 years, I’ve seen how the right strategy can increase recoveries by 30% to more than 3,800%.

Why Was Your Property Damage Claim Denied or Underpaid?

You bought commercial property insurance for peace of mind. So when a disaster like a fire, hurricane, or tornado strikes your property and your insurer denies the claim or offers a fraction of the repair costs, the frustration is immense. It feels like a betrayal.

Insurance companies are for-profit businesses; their bottom line improves when they pay out less. This conflict of interest often leads to a “deny first” strategy, where they count on policyholders in Austin, Dallas, and Houston to accept the initial decision without a fight. This unfairly places the burden of proof on you to document your losses and prove your claim is valid.

Insurance claim disputes often arise when an insurer states the damage isn’t covered, falls under an exclusion, or offers an underpaid settlement that doesn’t reflect true restoration costs. They may also dispute the scope of work or the validity of the claim itself. Understanding the specific reason for the denial is your first step toward resolution.

Commercial Property Damage: What You Need to Know

Decoding Your Policy and the Insurer’s Decision

Your insurance policy is a complex legal contract. When a claim is denied, the decision should be based on this contract. Start with a thorough policy review, paying close attention to coverage limits, exclusions, and endorsements. You have the right to a clear, written explanation for the denial, citing specific policy language.

Demand specifics. If they cite an exclusion, have them point to the exact clause. One common dispute area is replacement cost value (RCV) versus actual cash value (ACV). If your policy promises RCV (the cost to replace with new items) but they only pay ACV (which deducts for depreciation), you have grounds to dispute. Insurers also frequently blame damage on poor maintenance instead of a covered event—an argument you can counter with evidence.

Glossary of Property Insurance Claim Terms

The Critical Importance of Documentation and Communication

In an insurance claim dispute, documentation is your most powerful weapon. A solid paper trail transforms your case from “he said, she said” into an irrefutable record of facts.

- Visual Evidence: Take extensive photos and videos of all damage from multiple angles. Capture wide shots for context and close-ups for detail.

- Repair Estimates: Obtain multiple independent repair estimates from reputable local contractors to establish fair market value and counter lowball offers.

- Inventory of Losses: Create a detailed list of all damaged property, including purchase dates and original costs, to support your proof of loss statement.

- Communication Log: Never rely on phone calls alone. Keep a log of every conversation and follow up with an email summarizing what was discussed. Save all written correspondence chronologically.

Thorough documentation provides the leverage needed to negotiate a fair settlement and is essential if you need to escalate your dispute. It demonstrates you are prepared and serious about proving claim validity.

9 Tips for Settling Disaster Insurance Claims

Your Strategic Guide to Winning an Insurance Claim Dispute

Navigating an insurance claim dispute is challenging, but with the right strategy and professional support, you can secure the settlement your property deserves.

The Professional Advantage: Public Adjusters, Appraisers, and Attorneys

When your claim is denied or underpaid, you have options. Understanding who can help is key.

The Role of a Public Adjuster:

The adjuster from your insurance company works for them. As public adjusters, we work exclusively for you, the policyholder. We are licensed professionals who level the playing field by evaluating damage, interpreting complex policies, and negotiating with your insurer to maximize your settlement. We handle the entire process, from documenting hidden damage to managing all communications, with the goal of helping you avoid unnecessary litigation.

A property damage lawsuit can drag on for years and cost tens of thousands in legal fees. Our goal is to secure a fair settlement efficiently through negotiation and appraisal. Studies show public adjusters can increase settlements by 200-300%. At Insurance Claim Recovery Support, we’ve increased recoveries by 30% to over 3,800% for our clients.

What is a Public Insurance Adjuster?

Insurance Appraisers and Attorneys:

When the dispute is only about the value of the damage, the policy’s appraisal clause allows both sides to hire independent insurance appraisers to resolve the disagreement. If an agreement can’t be reached, a neutral umpire makes the final decision. This process is highly effective at settling value disputes without going to court.

While we resolve most disputes without legal action, an attorney is crucial for cases involving suspected bad faith or complex legal issues. We often work alongside attorneys, providing the claims expertise and documentation they need for their legal arguments.

Navigating the Dispute Resolution Pathways

We use a tiered approach to resolve insurance claim disputes, always starting with the most efficient and cost-effective methods like internal reviews and direct negotiation. When that fails, Alternative Dispute Resolution (ADR) offers powerful tools like mediation and appraisal to reach a settlement without the time and expense of a lawsuit. Litigation is always a last resort due to its high costs and lengthy timeframe.

| Feature | Internal Appeal | Appraisal | Litigation |

|---|---|---|---|

| Cost | Low/No direct cost | Moderate (appraiser fees) | High (attorney fees, court costs) |

| Timeframe | Weeks to months | 2-4 months typically | 1-3+ years |

| Decision Maker | Insurer’s staff | Appraisers & Umpire | Judge/Jury |

| Binding? | No | Yes (on value) | Yes |

| Focus | Coverage & Value | Value only | Coverage, Value, Bad Faith |

| Public Adjuster Role | Guides & negotiates | Represents you | Provides expert documentation |

| Avoids Court? | Yes | Yes | No |

Fact vs. Myth: Common Fears About Insurance Claim Disputes

Myth 1: “You must accept the insurer’s first offer.”

Fact: Absolutely false. The first offer is a starting point for negotiation. With professional advocacy, initial offers can be increased by 200-300% or more.

Myth 2: “Disputing a claim always means going to court.”

Fact: This is untrue. The vast majority of insurance claim disputes are resolved out of court through negotiation, mediation, or appraisal—pathways that are faster and far less expensive than litigation.

Myth 3: “Hiring a public adjuster is too expensive.”

Fact: We work on a contingency basis, meaning we only get paid a percentage of the settlement we secure. Even after our fee, our clients’ net recovery is almost always dramatically higher than the insurer’s initial offer.

Myth 4: “Documentation doesn’t matter after a denial.”

Fact: Documentation becomes more critical after a denial. It is the evidence used to challenge the insurer’s decision and build a case for the compensation you are owed.

Myth 5: “Only attorneys can help with denied claims.”

Fact: While attorneys handle legal issues, public adjusters are the experts in valuing and negotiating property damage claims. We resolve most disputes without any legal intervention, saving you time and money.

Understanding ‘Bad Faith’ and Your Right to Fair Dealing

You paid your premiums and have a right to expect your insurer to act in good faith. When they fail to uphold their contractual obligations by acting unreasonably, it may be considered “bad faith.”

Watch for these red flags:

- Unreasonable delays in processing your claim without a valid reason.

- Inadequate investigation of your property’s damage.

- Misrepresenting policy language to justify a denial.

- Offering a “lowball” settlement that is clearly unreasonable.

If you suspect bad faith, you can file a complaint with the Texas Department of Insurance (TDI). However, to recover what you’re owed, you need professional advocacy. We document bad faith practices and use them as leverage in negotiations to hold insurers accountable.

8 Sneaky Tricks Insurance Companies Use to Underpay and Delay Your Claim

Securing Your Maximum Settlement and Final Steps

You’ve steerd the complexities of your insurance claim dispute. Now it’s time to secure your maximum settlement and rebuild. With persistence and the right strategy, property owners across Texas—from Houston to San Angelo—can successfully resolve their disputes.

Answering Your Final Questions on Disputing a Claim

Here are answers to common questions from commercial and multifamily property owners.

What are the time limits for my claim dispute in Texas?

In Texas, you generally have two years from the date your claim is denied to file a lawsuit. However, the process takes time, and costs increase with delays. Acting quickly strengthens your position, so contact a professional immediately after receiving an unfavorable decision.

What’s unique about windstorm claims in Texas?

Many standard commercial policies in Texas exclude windstorm damage, requiring a separate policy. A common dispute is whether damage was caused by wind (often covered) or flooding (requires separate coverage). Thorough documentation, including engineering reports and timestamped photos, is critical to prove causation.

How do I turn an underpaid settlement into fair compensation?

First, identify why the offer is low—was it excessive depreciation or missed damage? Counter their reasoning with independent contractor estimates and documentation of all damage. A public adjuster can prepare a comprehensive claim package and negotiate from a position of authority. If the dispute is only about value, your policy’s appraisal clause is an efficient tool to resolve the issue without litigation.

How can I protect my rights throughout the process?

Know your policy, document everything from day one, and never settle for less than you deserve. For more information on initial steps, see the NAIC’s guide on what to do after a property loss. Most importantly, get professional representation. As public adjusters, we level the playing field, counter the insurer’s tactics, and significantly increase your chances of securing a maximum settlement.

At Insurance Claim Recovery Support, we’ve successfully resolved hundreds of millions in insurance claim disputes for commercial properties, HOAs, and religious institutions. We’ve seen how the right advocacy can transform a denial into a fair recovery, often increasing settlements by 30% to more than 3,800%.

If you’re facing a denied or underpaid claim, you don’t have to go it alone. Explore our Claim Results to see the outcomes we’ve achieved for property owners like you.

Ready to turn your claim into the maximum settlement? Contact us for a complimentary claim review. Let’s map out a strategy to secure the compensation your property deserves.