Introduction: Your First Step After a Lowball Offer or Denial

Damage to your commercial property is stressful enough without a dispute with your insurance company. A denied claim or a lowball offer can feel overwhelming, but you have options.

Here are 7 key changes to help you with disputing damage claims effectively:

- Understand the “Why”: Know the specific reasons your claim was denied or underpaid.

- Document Thoroughly: Gather all possible evidence of damage, costs, and communication.

- Communicate Strategically: Keep clear, concise, and professional records of every interaction.

- Negotiate Effectively: Learn techniques to advocate for a fair settlement.

- Explore ADR: Consider mediation, appraisal, or arbitration.

- File a Complaint: Contact your state’s insurance regulatory agency if needed.

- Seek Professional Help: Partner with a public adjuster or attorney for expert guidance.

Denied or underpaid claims are common, and customer satisfaction with property claims has dropped significantly. Your insurance policy is a contract, and you deserve a fair settlement for covered losses. This guide provides proven strategies to challenge your insurer’s decision, take control of the process, and work towards the compensation you’re owed.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support (ICRS). My team and I have settled hundreds of millions in commercial and multifamily property damage claims, often overturning wrongful denials and significantly increasing settlements by disputing damage claims on behalf of policyholders.

Basic disputing damage claims vocab:

Change #1: Understand Why Your Claim Was Disputed

If your insurance claim is denied or underpaid, you must ask: Why? Understanding the insurer’s specific reasons is the first step in disputing damage claims. Insurance companies aim to minimize payouts, which often leads to disagreements over coverage, damage scope, or repair costs.

Common scenarios that trigger a dispute include:

- Claim Denial: Your claim is rejected outright.

- Underpayment of Claim: The settlement offer is significantly lower than the actual cost of repairs or replacement.

- Delays in Processing the Claim: Your insurer takes an unusually long time to process your claim or make a payment.

- Disagreements Over Coverage: Your insurer claims certain damages are not covered under your policy.

- Disputes Over the Cause of Damage: The insurer attributes the damage to a cause not covered by your policy, such as wear and tear or pre-existing conditions.

For commercial and multifamily property owners, these disputes are costly, impacting operations and tenants. We see these issues frequently after major events like a freeze in Houston, a tornado in Dallas, or other widespread Texas storms.

For a deeper dive into these issues, you can explore our resources on Underpaid and Delayed Insurance Claims and What You Need to Know About Insurance Claims.

Common Reasons for Claim Denial or Underpayment

Let’s break down the typical justifications insurers use:

- Policy Exclusions: Your policy may exclude certain damages, like floods or some types of mold. Understanding these exclusions before a loss is vital.

- Missed Deadlines: Insurers have specific timeframes for reporting claims. If you miss these, your claim could be denied.

- Disputed Cause of Loss: A major point of contention. An insurer might claim roof damage is from wear and tear, not a windstorm, or that water damage is from a slow leak, not a sudden pipe burst. Expert opinion on causation is critical here.

- Wear and Tear Arguments: Insurance covers sudden and accidental damage, not deterioration from age. Insurers may try to categorize covered damage as wear and tear to avoid payment.

- Low Damage Estimates: The insurer’s estimate may be far below the actual repair cost. Adjusters often miss hidden damage, use cheaper materials in calculations, or undervalue labor. For a large commercial property, this can mean a shortfall of hundreds of thousands of dollars.

- Improper Depreciation: The initial payment is often for Actual Cash Value (ACV), which includes depreciation. If you have a Replacement Cost Value (RCV) policy, you’re owed the full replacement cost after repairs are done. Insurers may fail to explain this or delay the final RCV payment.

- Lack of Documentation: If you don’t provide sufficient evidence of the damage, its cause, or its cost, the insurer may deny or underpay your claim.

These issues are particularly prevalent in complex scenarios involving large-scale commercial property damage. Learn more about navigating these challenges in our guide on Commercial Property Damage Claims.

Know Your Policy and Your Rights

Your insurance policy is a legal contract. Understanding its terms and your rights is your first line of defense in disputing damage claims.

- Review Your Policy: Read your policy carefully, noting coverage limits, deductibles, exclusions, and your duties after a loss, including clauses on appraisal or mediation.

- Coverage Limits: Be aware of your coverage limits. You should receive the maximum allowed for a covered loss, but not more.

- Policyholder Duties: Your policy outlines your duties after a loss, such as mitigating further damage and cooperating with the investigation. Failure to do so can be a reason for denial.

- Fair Claims Handling: Insurers are legally obligated to handle claims in good faith. This includes a thorough investigation, a reasonable explanation for their decision, and no unreasonable delays or denials.

- Texas Department of Insurance (TDI): The TDI oversees insurers and protects policyholders in Texas. It sets regulations for claim processing and dispute handling. The TDI is a valuable resource if you suspect improper conduct by your insurer.

For more detailed information relevant to our policyholders in Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway, our resource on Property Damage Claims in Texas provides state-specific insights.

Change #2 & #3: Document Everything and Communicate with Purpose

Thorough documentation and strategic communication are the bedrock of successfully disputing damage claims. Without clear evidence and a record of interactions, challenging an insurer’s decision is difficult. We advise all our clients, from apartment complex owners in Houston to religious institutions in San Antonio, to treat every piece of information as critical.

Crucial Documentation for Disputing Damage Claims

Think of yourself as building a bulletproof case. Here’s a list of essential documents to gather:

- Before-and-After Photos/Videos: This is crucial. If possible, use photos to document your property’s condition before the damage. After the incident, take extensive, time-stamped photos and videos of all damaged areas, including wide shots and close-ups. For large commercial buildings, consider drone footage.

- Initial Notice of Loss: Keep a copy of your initial claim submission, including the date and time.

- Repair Estimates and Invoices: Obtain multiple, detailed estimates from reputable, independent contractors. If you’ve made temporary repairs, keep all receipts.

- All Correspondence: Keep a detailed log of all communications with your insurer, including dates, times, names of representatives, and summaries of conversations. Follow up critical conversations with an email.

- Weather Reports: For weather-related damage, obtain official weather reports for your location on the date of loss to corroborate the cause.

- Independent Adjuster Reports: A public adjuster’s detailed damage assessment report is invaluable.

- Receipts for Damaged Items: Provide receipts or other proof of ownership and value for damaged contents.

- Business Interruption Records: For commercial properties, gather financial records showing lost income and extra expenses from the business interruption.

Keeping detailed records is a best practice detailed in our guide on How to Settle Property Damage Insurance Claims. For specific insights into wind damage, see our guide on Wind Damage Insurance Claims.

Timelines and Statutes of Limitations in Texas

Time is of the essence when disputing damage claims. Understanding timelines and statutes of limitations is critical.

- Prompt Notice of Loss: Most policies require you to notify your insurer of a loss promptly. Undue delay can jeopardize your claim.

- Texas Prompt Payment of Claims Act: This act sets deadlines for insurers. Generally, they must acknowledge a claim within 15 business days, begin an investigation within 15 business days, decide on the claim within 15 business days of receiving all info, and pay accepted claims within 5 business days. Failure to meet these deadlines can result in penalties.

- Statute of Limitations for Property Damage: In Texas, you typically have two years from the date of loss or denial to file a lawsuit. Missing this deadline means you lose your right to sue.

- Bad Faith Claim Deadlines: There may be specific timelines for pursuing a bad faith claim, but acting swiftly is always advisable.

We advise policyholders in Texas to be acutely aware of these timelines. For comprehensive information on your state’s insurance statutes, you can use the National Association of Insurance Commissioners (NAIC) State Law Search tool.

Change #4, #5, & #6: Master Negotiation and Alternative Dispute Resolution

With your documentation in order, it’s time to engage your insurer strategically. This is where disputing damage claims moves from defense to offense as you work toward a fair resolution. Most disputes can be resolved without litigation, as insurers prefer to settle. Your job is to present a clear, professional case that makes paying your claim their easiest option.

Effective Negotiation and Internal Appeals

Successful negotiation starts with the right mindset. You’re seeking what’s rightfully yours under your policy.

- Stay professional in every interaction, even when frustrated. Calm professionalism will make you stand out.

- Present facts clearly using your organized documentation. Reference specific policy language, detailed repair estimates, and highlight where the insurer’s assessment fell short. For a large commercial building in Dallas, small oversights can mean hundreds of thousands in underpayment.

- Submit a counter-offer backed by evidence. Explain your valuation with photos, contractor bids, and expert opinions to help the adjuster justify a higher settlement.

- Request an internal review formally, stating your reasons for appealing and providing additional documentation.

- Escalate to a supervisor if your adjuster is unresponsive. Politely ask to speak with their manager, who may have more authority to approve a settlement.

Our resource on How to Negotiate with an Insurance Adjuster for Property Damage provides deeper strategies. If your property suffered lightning damage, check out Does Homeowners Insurance Cover Lightning Strike Damage? for specific insights.

Alternative Dispute Resolution (ADR) Methods

When direct negotiation stalls, ADR offers structured paths forward without the cost of litigation.

- Mediation uses a neutral third party to facilitate communication and help find common ground. It’s effective when communication has broken down and can help resolve technical disagreements in complex commercial claims.

- The appraisal clause, common in commercial policies, is a powerful tool for valuation disputes. It applies when the cost of damage is disputed, not coverage itself. Both sides hire an appraiser, and if they disagree, a neutral umpire makes a binding decision. The process is often faster and less expensive than litigation.

- Filing a complaint with your state insurance department can prompt action if you suspect bad faith or regulatory violations. While they don’t force payment, they investigate and can pressure insurers to reconsider. The Texas Department of Insurance takes these complaints seriously.

For cases involving unethical practices, our guide on Reporting Contractor and Roofer Fraud in Insurance Claims explains how to protect yourself.

These ADR methods often resolve disputes more efficiently than litigation. A skilled public adjuster can guide you through these processes and help avoid costly legal battles.

Change #7: Strategic Professional Support: Public Adjusters and When to Consider Legal Action

When disputing damage claims for a large commercial or multifamily property, the financial stakes are immense. A denied fire claim in Houston or a lowball tornado offer in Dallas can mean millions in losses. Navigating a major insurance dispute requires specialized expertise, much like surgery or a complex legal case. This is where strategic professional support is essential.

Public Adjusters: Your First Line of Professional Defense

A public adjuster is a licensed insurance professional who works exclusively for you, the policyholder—never the insurance company. We are your advocates, fighting to ensure you receive every dollar you’re entitled to under your policy.

When should you hire a public insurance adjuster? For any claim over $10,000, or when dealing with complex damage, denied claims, or inadequate settlement offers, a public adjuster can be invaluable. This is especially true for commercial properties, multifamily communities, and religious institutions across Texas cities like Austin, San Antonio, and Fort Worth.

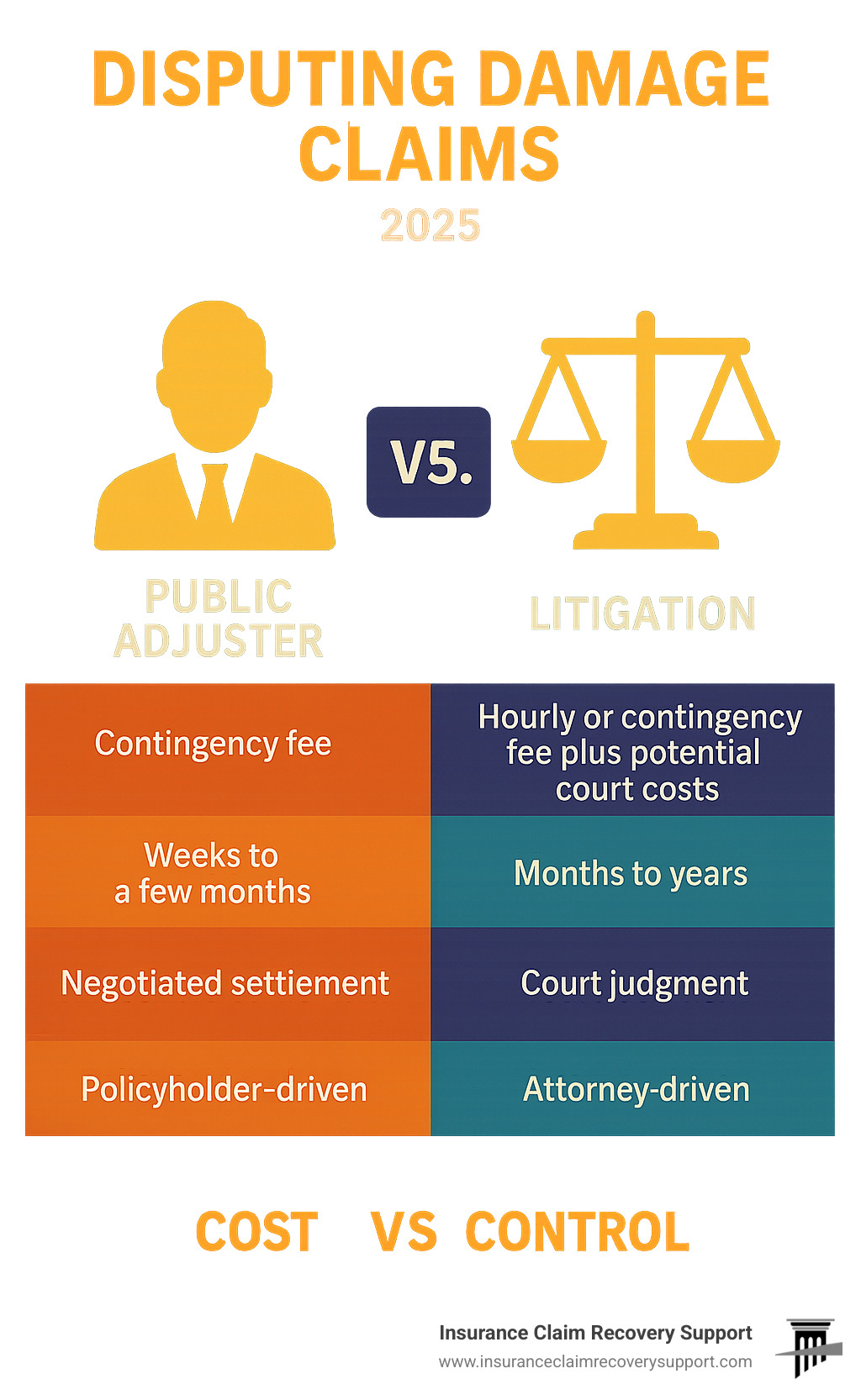

Our fees align with your success. Public adjusters work on a contingency basis, typically 10% to 15% of the settlement. We only get paid from the additional money we recover for you. If we don’t improve your settlement, you owe us nothing.

The results speak for themselves. Our clients often see settlements 200% to 300% higher than the insurer’s initial offer. We achieve this by thoroughly documenting all damage, interpreting complex policy language to your advantage, and negotiating from a position of strength.

We help you avoid costly litigation. A key advantage of hiring a public adjuster is that we often resolve disputes without going to court. Insurers know we can build an ironclad case, making them more willing to negotiate fairly and avoid a legal battle.

When Litigation Becomes Necessary: Understanding Bad Faith and Legal Recourse

While we work to avoid litigation, sometimes an insurer’s bad faith practices leave no choice. Bad faith can include unreasonable delays, failure to conduct a proper investigation, misrepresenting policy terms, or an unjustified denial.

The litigation path is far different. A lawsuit means months or years of proceedings, high upfront costs, depositions, and a potential trial. Legal fees can be substantial, with the risk of losing and owing the insurer’s legal costs.

Compare this to the public adjuster process: We handle everything, typically resolving claims in months, not years. You pay nothing upfront; our fee comes only from the additional money we secure. Our goal is to get you maximum compensation without the stress and expense of litigation.

Legal action becomes necessary when bad faith is severe. If your insurer is clearly violating Texas insurance regulations, consulting with an attorney who specializes in insurance law may be your best option. In Texas, successful bad faith claims can result in the insurer paying your attorney fees, but this should always be a last resort.

The choice between a public adjuster versus litigation isn’t really a choice for most property owners. Public adjusters offer expertise with aligned incentives, faster resolution, and no upfront costs—making us your first and best line of defense when disputing damage claims.

Frequently Asked Questions about Disputing Damage Claims

We hear these concerns every day from commercial property owners across Texas, from Austin office buildings to Houston apartment complexes. Let’s tackle the most common ones.

What is the first step I should take if my property damage claim is denied?

First, request a detailed written explanation for the denial from your insurer. You need to know the specific policy provision they are citing and the evidence they used. Once you have this, review your insurance policy against their reasoning. This is a crucial first step for disputing damage claims, as you must understand their position to effectively challenge it.

Can I dispute the insurance company’s repair estimate if it’s too low?

Absolutely. Challenging a low estimate is a common and necessary step. Get independent repair estimates from trusted, reputable commercial contractors. These detailed bids are powerful evidence for negotiation or appraisal. Insurer estimates often miss hidden damage, use outdated pricing, or ignore code upgrades, potentially undervaluing a claim by hundreds of thousands. Their estimate is an opening offer, not the final word.

How is disputing a large commercial property claim different from a smaller one?

Disputes on large commercial or multifamily properties are far more complex. They involve issues like business interruption losses (lost income), code compliance (costly mandatory upgrades), and multiple layers of hidden damage (structural, electrical, HVAC). The financial stakes are much higher, where a small missed detail can cost tens of thousands. This is why a public adjuster is invaluable. We have the expertise to assess the full scope of complex losses, understand commercial construction and business interruption, and steer intricate policy language. Professional representation also helps avoid litigation, as insurers are more likely to negotiate fairly with an expert who understands the process.

Conclusion: Take Control of Your Claim Dispute

You now have a roadmap for successfully disputing damage claims. What seemed like an impossible battle can become a manageable process. By understanding the why behind a denial, building a case with documentation, communicating strategically, negotiating effectively, and using ADR, you can take control. Most importantly, you know when to seek professional support from a public adjuster.

These changes work together: Document everything, communicate with purpose, master negotiation, explore ADR, and seek professional support when the stakes are high.

For commercial and multifamily property owners across Texas, from Austin to Houston, an underpaid claim is devastating. A denied fire claim in San Antonio or an underpaid freeze claim in Dallas impacts your bottom line, tenants, and community.

This is where Insurance Claim Recovery Support makes the difference. We’ve recovered hundreds of millions for property owners from denied or underpaid claims. Our approach maximizes your settlement while avoiding the stress and expense of litigation. When you partner with a public adjuster, you get an expert who knows how insurance companies operate.

The contrast is striking: a lawsuit can take years and cost tens of thousands in legal fees. A public adjuster typically resolves disputes in months, with no upfront cost and fees paid only from your successful settlement.

Don’t let your insurance company’s initial offer be the final word. You have rights as a policyholder and deserve fair compensation for your covered losses. Whether you’re dealing with tornado damage in Waco, lightning strikes in Round Rock, or flood damage in Georgetown, the principles remain the same.

Take control of your claim dispute today. For expert help navigating a complex commercial or multifamily property claim dispute, request a complimentary claim consultation. We’re here to help you achieve the fair and just resolution you deserve.