Understanding the Impact of Severe Weather on Texas Panhandle Properties

Amarillo storm damage from severe weather poses significant challenges for commercial and multifamily property owners. When high winds, large hail, and flooding strike, the path to recovery can be overwhelming, especially when facing a complex insurance claim. To steer this, you must document all damage immediately, contact your insurer promptly, and understand that some damage, like to roofs, may be hidden and cause leaks years later.

Recent storms have battered the region, creating urgent operational challenges and triggering a difficult insurance process. Unlike residential claims, commercial claims involve complex policy language and adjusters who represent the insurer’s interests. Many owners are caught off guard by exclusions and limitations that drastically reduce their settlements or lead to wrongful denials.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. For over 15 years, I’ve specialized in Amarillo storm damage cases, settling hundreds of millions of dollars for commercial and multifamily property owners. My firm overturns wrongful denials and increases claim recoveries by 30% to over 3,800%, ensuring property owners get the benefits they deserve without unnecessary litigation.

Assessing the Scope of Recent Amarillo Storm Damage

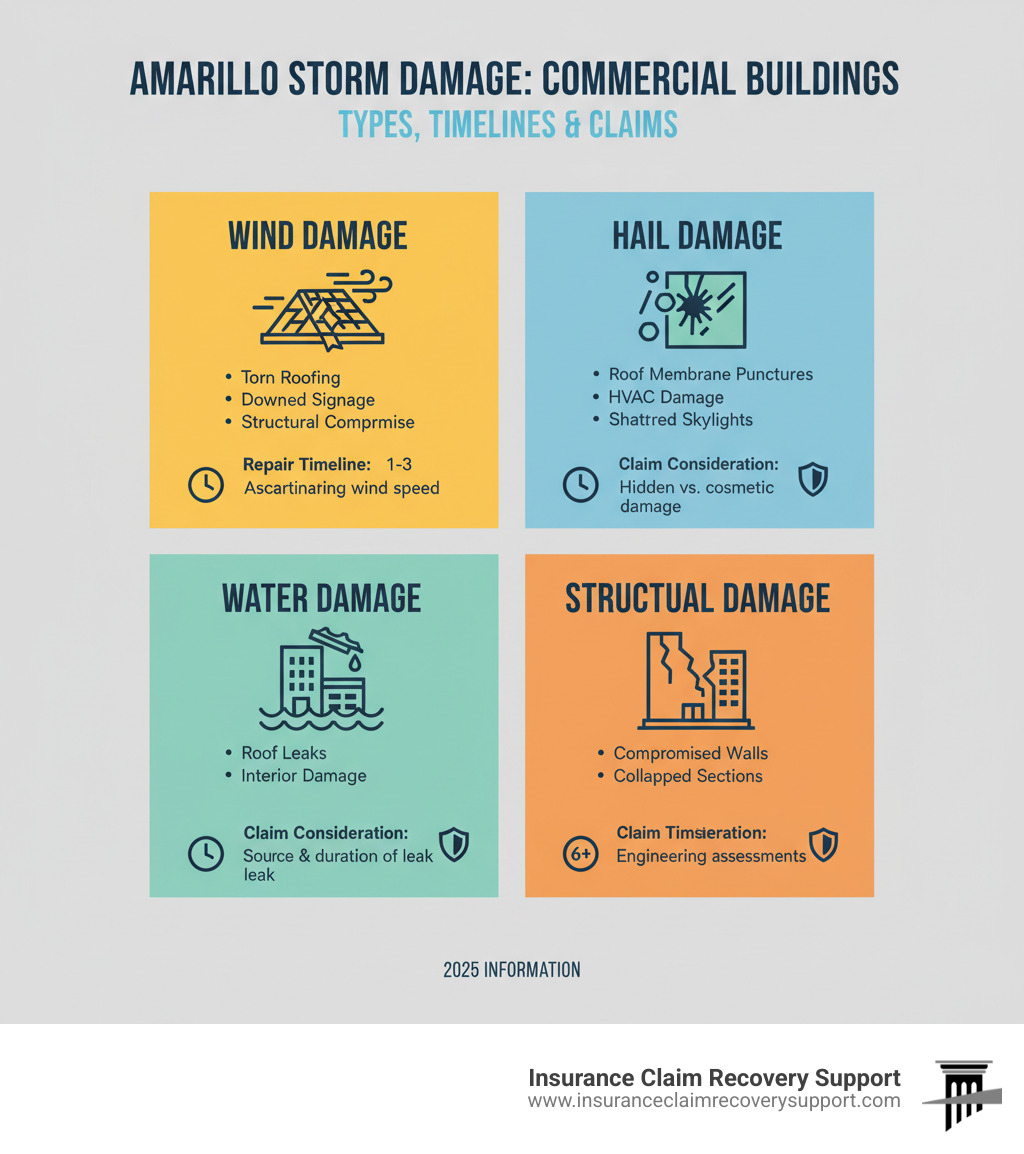

The Texas Panhandle has been hit hard by recent storms, leaving extensive Amarillo storm damage that affects businesses and multifamily properties. Recent events delivered a punishing combination of destructive forces across Potter and Randall Counties. Wind gusts reached up to 80 mph, and hailstones measured 2.5 inches in diameter, particularly in the City of Canyon, which declared two disasters in six weeks.

The damage is widespread, from torn roofing and shattered storefronts to flooding in Amarillo’s Tradewinds and Olsen neighborhoods. Power outages affected thousands. The hail damage is especially concerning; large hailstones can puncture roof membranes and damage HVAC units, creating vulnerabilities that may not cause interior leaks for months or even years. Understanding the full scope of these Hail Storm Texas events is crucial for protecting your investment. Roofs take the brunt of the punishment, and what seems like minor cosmetic damage can be a structural compromise threatening the entire building. For guidance on repairs, see our resources on Hail Damage Roof Repair.

Documenting Damage to Your Commercial or Multifamily Property

After a storm, your most critical task is documenting the Amarillo storm damage. A thorough record is essential for your insurance claim.

- Safety First: Do not enter an unsafe property. Wait for clearance from emergency services.

- Photograph and Video Everything: Capture wide shots for context and close-ups of specific damage to roofs, windows, siding, HVAC units, and interiors.

- Create an Inventory: List all damaged equipment, furnishings, and stock with corresponding photos.

- Save All Receipts: Keep records of any emergency repairs, like tarping a roof or boarding windows.

- Log Communications: Note every conversation with your insurance company, including date, time, and who you spoke with.

This undeniable record is vital. For help verifying storm severity with official weather data, use a Hail Wind Report Verification service. Understanding the specifics of a Hail Damage Roof Insurance Claim will also prepare you for the process ahead.

Official Response and Community Recovery Efforts

While agencies like the Amarillo Fire Department, Xcel Energy, and the National Weather Service (NWS) Amarillo provide critical emergency services, power restoration, and official damage surveys, their role is focused on public safety and infrastructure. The Texas Division of Emergency Management (TDEM) encourages property owners to report damage via the iSTAT survey, which helps with community-wide recovery planning.

However, these efforts are not designed to help you steer your individual commercial insurance claim. That complex process begins where public assistance ends. When you need specialized guidance, Public Adjusters in Potter County, TX can provide the expertise required to secure a fair settlement.

The Path to Recovery: Managing Your Commercial Insurance Claim

Dealing with an insurance claim after experiencing Amarillo storm damage can feel like a second disaster. For commercial and multifamily property owners, securing a fair settlement is about protecting your investment and business continuity. You face a critical choice: negotiate with your insurer alone and risk litigation, or hire a public adjuster who works exclusively for you. With the right expertise, you can achieve a maximum settlement without a drawn-out legal battle.

Commercial claims are far more complex than residential ones, filled with exclusions and depreciation schedules that can reduce your payout. For context on how these claims work, review our resources on Texas Insurance Claims.

Filing Your Claim: Initial Steps for Amarillo Storm Damage

Once your property is secure and documented, you must formally notify your insurance company.

- Contact your provider promptly to report the loss.

- Request a full, certified copy of your insurance policy, including all endorsements. Don’t rely on a summary.

- Review your coverage for wind, hail, and water damage, deductibles, and depreciation rules.

- Complete the “Proof of Loss” form accurately. We strongly recommend having an expert review it before submission.

- Maintain meticulous communication logs of every interaction with your insurer.

For more guidance, our resources on Hail Damage Claims offer detailed insights.

Public Adjuster vs. Lawsuit: A Comparison for Property Owners

When your insurer’s offer is too low, you have a choice. Do you sue, or do you hire a public adjuster to negotiate a fair settlement without litigation? Here’s how the two paths compare:

| Feature | Hiring a Public Adjuster | Pursuing an Insurance Claim Lawsuit |

|---|---|---|

| Process | Your public adjuster inspects, documents, estimates, and negotiates on your behalf. | You file a lawsuit, which involves findy, depositions, expert witnesses, and a potential trial. |

| Timeline | Typically 60-180 days. | Often 1-3 years or more. |

| Cost Structure | A contingency fee (typically 10-15%) of the settlement. No upfront costs. | Attorney fees (30-40%+) plus court costs and expert fees, which can be substantial. |

| Stress Level | Lower. You have an advocate managing the process. | High. Litigation is adversarial and emotionally draining. |

| Typical Outcomes | Fair settlements reflecting actual repair costs. We see increases of 30% to over 3,800%. | Outcomes vary widely, and legal fees can significantly reduce your net recovery. |

The reality is that most insurance disputes can be resolved through expert negotiation. Litigation should be a last resort. A skilled public adjuster can often achieve better results in a fraction of the time, with far less stress.

Storm Claim Myths vs. Facts for Texas Businesses

Misconceptions about insurance can cost you thousands. Here are the facts.

- Myth: The insurance company’s adjuster is there to help me.

-

Fact: The insurer’s adjuster works for the insurance company. Their job is to protect the insurer’s bottom line. A public adjuster works for you.

-

Myth: If hail damage looks minor or “cosmetic,” it’s not worth claiming.

-

Fact: What looks cosmetic can compromise your roof and lead to major leaks years later. Insurers often use “cosmetic damage” exclusions to deny claims for what is actually functional damage. You need an expert to document the true impact.

-

Myth: Filing a claim is straightforward.

- Fact: Commercial claims are complex and adversarial. Insurers often produce estimates far below the actual cost of repairs. Without expert representation, you are at a significant disadvantage. Learn more about common tactics in a Hail Damage Claim Dispute.

Your Recovery Roadmap

Recovering from Amarillo storm damage requires prompt action, thorough documentation, and expert advocacy. After securing your property and notifying your insurer, recognize that you don’t have to face the insurance company alone.

Insurance Claim Recovery Support exclusively represents policyholders—never insurance companies. Our public adjusters advocate for you, ensuring all damage is properly documented and valued. We have a track record of increasing client recoveries by 30% to over 3,800% and work on a contingency basis, so you pay nothing unless we secure a settlement for you.

Whether you’re managing an office building, multifamily complex, or other commercial property in Amarillo, Austin, Dallas, Houston, or anywhere in Texas, we have the expertise to handle your claim. Don’t let the claim process become another disaster. Get professional help with your claim from licensed public adjusters and let us fight for your property’s full recovery.