Understanding the Flood Insurance Claim Process: First Steps After Disaster

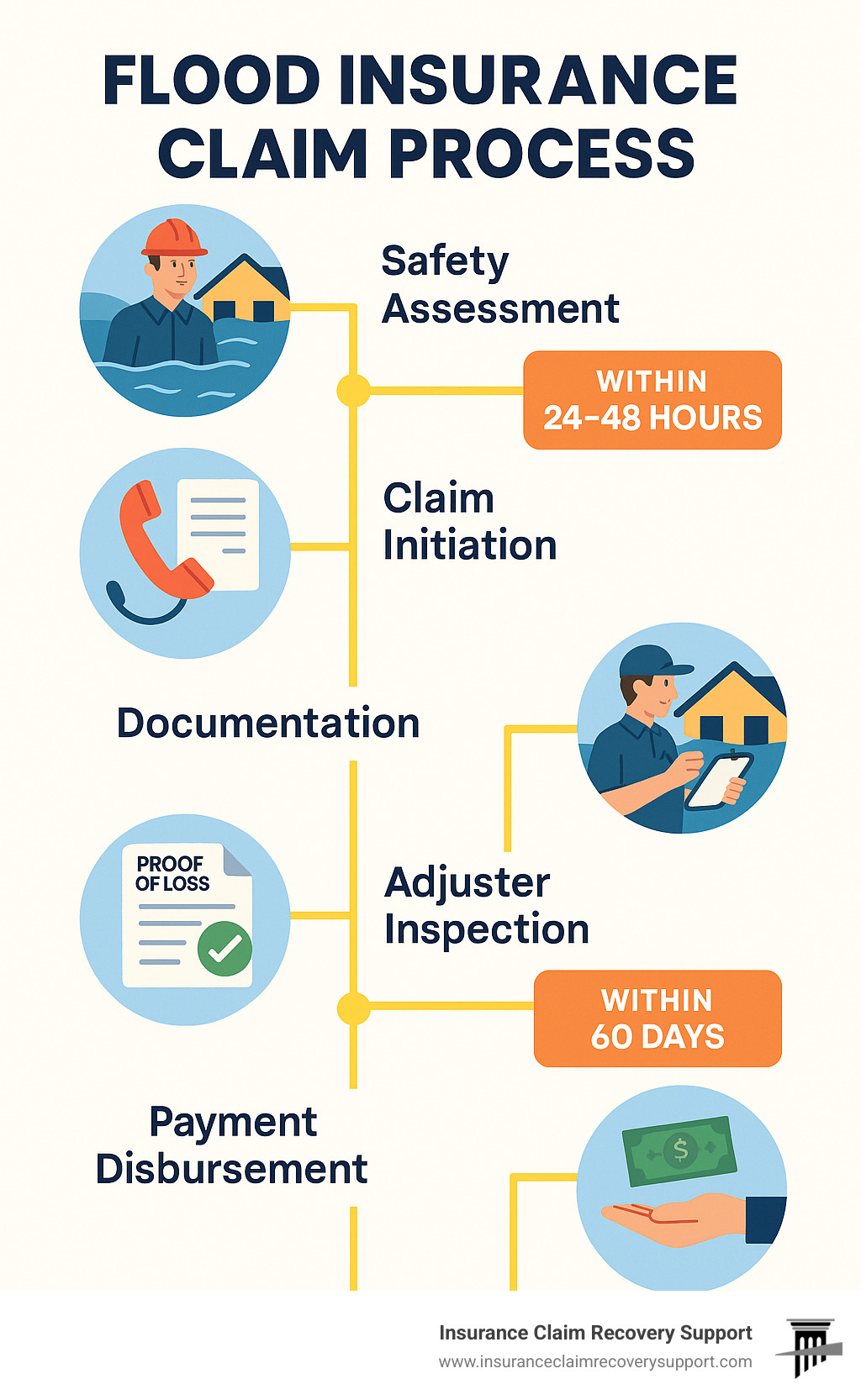

The flood insurance claim process involves several key steps to ensure you receive proper compensation for your damages:

- Safety First – Wait until authorities confirm it’s safe to return to your property

- Contact Your Insurer – Notify your insurance agent or company within 24-48 hours

- Document Everything – Take photos and videos of all damage before cleanup

- Meet with the Adjuster – Verify their credentials and review damage together

- Submit Proof of Loss – File this formal document within 60 days of the flood

- Receive Payment – Standard claims typically take 4-8 weeks to process

When floodwaters recede, they leave behind more than just physical damage—they create a complex insurance claim process that can feel overwhelming. Floods can happen anywhere, and even just one inch of floodwater can cause up to $25,000 in damage to your property. The National Flood Insurance Program (NFIP) provides nearly $1.3 trillion in coverage nationwide, but navigating the claims process requires careful attention to detail and timing.

As a policyholder, understanding each step of the flood insurance claim process is crucial to maximizing your recovery. From the moment you first report your loss to the final settlement check, every action you take can impact your claim outcome.

My name is Scott Friedson, a multi-state licensed Public Adjuster and CEO of Insurance Claim Recovery Support LLC, who has personally handled hundreds of flood insurance claim process cases resulting in over $250 million in settlements for policyholders across Texas and beyond.

Step 1: Safety First & Start Your Flood Insurance Claim Process

Before anything else, your safety is paramount. Never enter a flooded property until authorities have confirmed it’s safe to do so. Floodwaters can contain dangerous contaminants, and structural damage may not be immediately visible.

When you’re given the all-clear to return home, approach with caution. Shut off electricity and gas if it’s safe to do so—this simple step can prevent electrical fires or gas leaks. Wear protective gear including boots, gloves, and masks—floodwater is rarely just water; it often contains sewage, chemicals, and debris. Check for structural damage before fully entering your home, as floods can undermine foundations and weaken walls. And keep an eye out for unwelcome visitors—displaced wildlife like snakes and insects often seek shelter in flooded homes.

The flood insurance claim process officially begins when you notify your insurer, which should be done within that critical 24-48 hour window after the flood. This isn’t just a formality—it starts the official clock on your claim and demonstrates your commitment to the process.

“I’ve seen too many folks delay reporting because they’re overwhelmed by the devastation,” says Scott Friedson of Insurance Claim Recovery Support. “But those first two days are crucial for getting the help you need quickly.”

When you’re ready to make that call, have these contacts handy:

Emergency Contact Information:

– Your insurance agent or company (check your policy documents)

– FEMA Mapping and Insurance eXchange (FMIX): 877-336-2627

– Your local emergency management office

– Utility companies to report outages or damage

Don’t forget to notify your mortgage lender as well—they have a financial interest in your property and will need to endorse any settlement checks for structural repairs.

How to Initiate the Flood Insurance Claim Process

Grab your declarations page if you can find it—this document contains your policy number and coverage details. If it’s been swept away in the flood, don’t panic. The NFIP Call Center can help identify your insurance carrier with some basic information.

When you make that first call, you’ll need to provide some essential details: your full name and contact information, policy number, the date and cause of loss, your property address, your current location if you’ve been displaced, and your mortgage company information.

Take note of your claim number and the name of any representatives you speak with. This information will be your golden ticket throughout the flood insurance claim process. Most flood insurance payments for building damage come as dual-payee checks made out to both you and your mortgage lender, which is why keeping your lender in the loop is so important.

Requesting Advance Payments

Here’s some good news: you don’t have to wait for the entire claim to be processed before getting some financial relief. When you first report your claim, ask about advance payments:

You can receive up to $5,000 without an adjuster visit or documentation. For more substantial immediate help, up to $20,000 may be available with proper photo/video documentation and FEMA authorization. These amounts will be deducted from your final settlement, but they can provide crucial funds when you need them most.

These advance payments can be lifesavers when you need to begin essential cleanup right away. Mold can begin developing within 24-48 hours after flooding, so quick action is essential. According to CDC research, exposure to damp and moldy environments can trigger respiratory issues and other health problems, especially for those with pre-existing conditions or compromised immune systems.

Before cleanup begins, document everything with photos and videos. These will be invaluable for your claim and for securing those advance payments. Be sure to capture the water line on walls and the damage to both the structure and your personal belongings.

Want to learn more about how long your claim might take? Check out our detailed guide on Flood Damage Insurance Claim Settlement Time or explore resources for Flood Damage Recovery.

The flood insurance claim process may seem daunting, but taking it one step at a time—starting with safety—will help ensure you receive the compensation you deserve.

Step 2: Document Everything Before Cleanup

Documentation is your strongest ally in the flood insurance claim process. Before you start cleaning up or moving damaged items, you need to create a thorough record of everything affected by the flood.

“I can’t stress this enough—the single most important action you can take to strengthen your claim is thorough documentation,” explains Scott Friedson. “After helping hundreds of flood victims across Houston, Dallas, and Austin, we’ve seen how carefully documented claims consistently result in more comprehensive settlements.”

Your documentation should be methodical and detailed. Take photographs and videos of every room, including areas that appear undamaged for comparison purposes. Capture close-up images of damaged furniture, electronics, and personal belongings. Don’t forget to document water lines on walls—these tell the story of how high the water reached.

For valuable items like appliances and electronics, record make, model, and serial numbers. This information proves invaluable when calculating replacement costs. As you document, create an itemized list describing each damaged item, when you purchased it, and its estimated value. If you have receipts, set them aside in a dry place. Even credit card statements can help verify purchases if original receipts are lost.

Before discarding anything, save samples of damaged materials like carpet swatches, pieces of drywall, or fabric from furniture. These physical examples help adjusters assess the quality and value of what needs replacement.

Understanding what’s typically covered versus excluded can help focus your documentation efforts:

| Typically Covered | Typically Not Covered |

|---|---|

| Building structure | Damage from moisture/mold that could have been avoided |

| Foundation | Currency, precious metals, stock certificates |

| Electrical and plumbing systems | Property outside the building (landscaping, decks) |

| Major appliances | Temporary housing/Additional Living Expenses |

| Permanently installed carpeting | Vehicles (covered by auto insurance) |

| Personal belongings | Basement improvements (limited coverage) |

For more detailed information about working with public adjusters versus insurance companies, visit our guide on Public Adjuster vs Insurance Company for Property Damage Claim.

Cleanup & Mold Mitigation Responsibilities

As a policyholder, you have a duty to prevent additional damage after a flood. The NFIP recognizes this responsibility and offers up to $1,000 in reimbursement for loss-avoidance measures you take, including costs for sandbags, water pumps, plastic sheeting, and even your own labor at federal minimum wage.

Once flooding occurs, quick action is essential. Remove standing water as soon as safely possible, then remove wet materials like carpet, padding, and insulation that can harbor mold. Clean and disinfect everything that got wet, and use fans and dehumidifiers to dry the space thoroughly.

Keep a drying log with daily moisture readings—this documentation proves you took reasonable steps to prevent mold damage. According to EPA research, mold can begin growing within 24-48 hours in damp environments, potentially leading to serious health issues. For scientific guidance on proper mold remediation techniques, the EPA’s mold resources provide valuable information.

Remember to discard perishable food items that may have been exposed to floodwaters or lost refrigeration during power outages. Taking these proactive steps not only protects your health but also strengthens your position in the flood insurance claim process.

Preparing for the Adjuster’s Inspection

Within days of reporting your loss, an insurance adjuster should contact you to schedule an inspection. This is a crucial meeting that will significantly impact your settlement amount.

When the adjuster arrives, verify their credentials by asking to see both their driver’s license and Flood Control Number (FCN) card. Legitimate adjusters never charge fees or collect deductibles directly from policyholders.

Have your documentation organized and accessible for the inspection. Walk through the property together, pointing out all areas of damage. The more prepared you are, the more efficiently the adjuster can assess your loss.

“Having contractor estimates ready can be helpful,” advises Scott Friedson, “but consult with your adjuster before signing any repair contracts. This ensures the work will be covered and prevents potential disputes later in the flood insurance claim process.”

During major flooding events, adjusters may offer remote adjusting via video calls instead of in-person visits. If this happens, ensure you have good lighting, a reliable internet connection, and a device with a quality camera to clearly show all damage.

For more information about working with claim adjustment specialists, visit our detailed guide on Claim Adjustment Specialists to better understand the process and maximize your claim potential.

Step 3: Working with Your Adjuster & Submitting Proof of Loss

The adjuster’s inspection is a critical phase in the flood insurance claim process. This meeting is your opportunity to showcase all the damage and ensure nothing gets overlooked.

When your adjuster arrives, they’ll thoroughly examine your property using specialized tools like moisture meters to detect water damage that might not be visible to the naked eye. They’ll take measurements, snap photos, and review your documentation while explaining what’s covered under your policy. Think of this visit as a collaborative process rather than an interrogation – you’re both working toward documenting the full extent of your loss.

After the inspection, you’ll receive a damage estimate that details the adjuster’s findings. Take time to review this document with a critical eye. Does it include everything you documented? Are there damaged items missing from the list? This estimate forms the foundation of your Proof of Loss form.

The Proof of Loss is essentially your formal claim statement – and it’s absolutely crucial to the flood insurance claim process. This sworn document outlines exactly how much you’re claiming for your damages.

“Many homeowners don’t realize they can sign the Proof of Loss even if they disagree with the amount,” explains Scott Friedson of Insurance Claim Recovery Support. “Signing doesn’t lock you in – you can still request additional payment later if you find more damage.”

FEMA requires this document to be filed within 60 days of the flood event. Without it, your payment simply cannot be processed. During major disasters, extensions may be granted, but don’t count on this – aim to submit on time.

Your claim might include different types of payments depending on your situation:

Replacement Cost Value (RCV) covers the cost of replacing damaged building elements with new ones of similar quality – but only for primary residences.

Actual Cash Value (ACV) factors in depreciation and applies to personal property and non-primary residences. This is why that five-year-old couch might be valued less than what you paid for it.

Increased Cost of Compliance (ICC) provides up to $30,000 to help bring substantially damaged buildings into compliance with current floodplain requirements – a significant help if your home needs major structural changes.

Key Deadlines in the Flood Insurance Claim Process

The clock starts ticking the moment flooding occurs, and missing deadlines can seriously impact your recovery. Here are the critical timeframes to keep in mind:

24-48 hours: Report your loss to your insurer – the sooner, the better.

72 hours: Complete initial drying to prevent mold growth. Mold can begin developing surprisingly quickly after flooding.

60 days: Submit your signed, complete Proof of Loss. This is perhaps the most critical deadline in the entire process.

4-8 weeks: The average processing time for standard flood claims once all documentation is received.

60 days: Your window to appeal a denial or disputed amount if you disagree with the outcome.

1 year: The deadline to file a lawsuit if other resolution methods fail.

6 years: The timeframe allowed to complete ICC work after approval.

“We always recommend creating calendar reminders for these important dates,” says Scott Friedson. “In our experience handling flood claims in San Antonio, Houston, and across Texas, missed deadlines are one of the most common reasons claims are denied or delayed.”

What to Do if You Disagree with the Adjuster

It’s not unusual to have differences of opinion during the flood insurance claim process. If you believe your damage assessment falls short, there’s a clear path forward.

Start by having a conversation with your adjuster – sometimes a simple discussion can resolve misunderstandings. If that doesn’t work, escalate to your insurer’s claims department and ask to speak with a claims examiner who can review the file.

When you find additional damage after the initial assessment, submit a supplemental claim with new documentation supporting your position. Photos, contractor estimates, and detailed descriptions will strengthen your case.

Your policy likely contains an appraisal clause that allows for third-party review if disagreements persist. This can be a helpful middle ground before taking more drastic steps.

If you receive a written denial, you have 60 days to file an appeal with FEMA. This formal process requires detailed documentation and clear explanations of why you believe the decision was incorrect. Many homeowners find that consulting with a public adjuster who specializes in flood claims provides valuable expertise during this stage. You can find more information about how to negotiate with insurance adjusters for property damage on our website.

As a last resort, you can file a lawsuit – but be aware that you must do so within one year of receiving your claim denial.

If something seems suspicious during your flood insurance claim process, don’t hesitate to contact the National Center for Disaster Fraud Hotline at 866-720-5721. According to FBI research, disaster fraud spikes significantly after major flooding events, with scammers specifically targeting vulnerable homeowners when they’re most desperate.

Step 4: Getting Paid, Appeals & Increased Cost of Compliance

Once your claim is approved, understanding how payments work becomes crucial in the final stage of the flood insurance claim process.

When that settlement check finally arrives, it might not be as straightforward as you’d hope. For building damage, your check will typically include both your name and your mortgage lender’s name. This means you’ll need their endorsement before cashing it – a detail that catches many Texas homeowners by surprise. On the brighter side, personal property payments usually come directly to you without the extra signature requirement.

Remember those advance payments you received early in the process? They’ll be subtracted from your final settlement amount. It’s like getting an advance on your paycheck – helpful in the moment, but accounted for in the end.

“Many of our clients in Houston are surprised to learn that their Replacement Cost coverage for building elements often comes in two separate payments,” explains Scott Friedson. “First, you’ll receive the Actual Cash Value amount. Then, after you’ve completed repairs, you submit receipts to receive the remaining portion. This staging helps ensure the repairs actually get done.”

Unlike your standard homeowners policy, flood insurance doesn’t cover temporary housing or other Additional Living Expenses (ALE). This gap can create serious financial strain for families displaced by flooding. However, if your area receives a Presidential Disaster Declaration, you may qualify for FEMA assistance even if you have flood insurance – a potential lifeline worth exploring.

Appealing Your Flood Insurance Claim Process Outcome

Disagreements about claim outcomes happen more often than you might think. If your claim is denied or the payment seems inadequate, you have options.

The appeal process begins when you receive a written denial letter explaining why certain damages weren’t covered. You then have a 60-day window to file an appeal with FEMA – and this deadline is non-negotiable. Your appeal needs to include a detailed letter explaining exactly why you believe the decision was incorrect, supported by compelling evidence.

“Simply saying ‘I deserve more money’ won’t get you anywhere,” notes Scott Friedson. “The most successful appeals directly address the specific reasons for denial with new evidence or clarifications. In Dallas, we recently helped a homeowner win an appeal by providing structural engineering reports that contradicted the adjuster’s assessment of pre-existing damage.”

FEMA typically responds within 90 days, though major disasters can extend this timeline. During this waiting period, you might consider consulting a public adjuster who specializes in flood claims. At Insurance Claim Recovery Support, we help policyholders gather additional documentation, prepare professional estimates, and craft persuasive appeal letters that speak directly to the technical aspects of their denial.

Avoiding Fraud & Protecting Your Settlement

Unfortunately, the post-flood period attracts scammers looking to exploit vulnerable homeowners. Protecting your hard-won settlement requires vigilance.

Be immediately suspicious of contractors demanding large upfront payments or pressuring you to sign contracts on the spot. Legitimate professionals understand you need time to review documents and check references. If someone’s reluctance to provide credentials seems fishy, trust your instincts – it probably is.

“One of the most dangerous scams we’re seeing in Austin and San Antonio involves Assignment of Benefits forms,” warns Scott Friedson. “These documents can sign away your rights to your insurance settlement. Once signed, the contractor controls your money and can disappear after collecting payment but before completing repairs.”

When anyone visits your property during the recovery process, always verify their identity and credentials. Get multiple estimates for major repairs, check licenses and insurance, and never pay in full before work is completed satisfactorily. A little caution goes a long way in protecting your financial recovery.

The Increased Cost of Compliance (ICC) coverage represents a valuable but often overlooked benefit. This provides up to $30,000 above your regular coverage limits specifically for bringing your property into compliance with current floodplain regulations. This coverage kicks in when local officials declare your building “substantially damaged” – meaning repair costs exceed 50% of the building’s market value.

ICC funds can help cover elevation costs, relocation expenses, demolition work, or floodproofing measures for non-residential buildings. However, accessing these funds requires specific documentation from local floodplain management officials, and you generally have six years to complete the approved work after approval.

For more information about handling commercial property claims, visit our Commercial Property Damage resource page or learn about What Kind of Lawyer Do I Need for Property Damage? if your situation requires legal assistance.

Frequently Asked Questions about Flood Insurance Claims

Do I need to file FEMA disaster assistance if I already have flood insurance?

Even with flood insurance, registering for FEMA assistance is still a smart move. Your flood insurance claim process will cover many damages, but there are important gaps that FEMA might help with.

“I always tell my clients in Houston and Dallas to register with FEMA regardless of their insurance status,” explains Scott Friedson. “Flood insurance doesn’t cover temporary housing costs, which can be substantial when your home is uninhabitable.”

Beyond housing assistance, registering with FEMA opens doors to additional recovery resources like Small Business Administration (SBA) disaster loans and other federal programs that can complement your insurance settlement. Think of it as creating a safety net that catches what your policy doesn’t.

Is basement damage covered under a standard policy?

When it comes to basements, the flood insurance claim process has some significant limitations that often surprise homeowners.

Standard policies do cover certain essential basement elements. For the building itself, coverage typically includes foundation walls, electrical systems, central air conditioners, furnaces, water heaters, and permanently installed sump pumps connected to a power source.

For personal property in basements, coverage is much more restricted – limited to washers, dryers, food freezers, and the food inside them. What’s notably absent from coverage? All those finished basement improvements you’ve invested in – the beautiful paneling, plush carpeting, and comfortable furniture typically aren’t covered at all.

“Basement coverage limitations are one of the most common disappointments we see during the flood insurance claim process,” notes Scott Friedson. “Many Austin homeowners are shocked to learn their finished basement rec rooms have minimal protection.”

How long does it take to receive my claim payment?

Patience is unfortunately necessary during the flood insurance claim process. Under normal circumstances, you can expect your NFIP claim to take approximately four to eight weeks from filing to payment.

However, reality often differs from the ideal timeline. After major flooding events – like those we’ve seen across Texas in recent years – adjusters become overwhelmed with claims. When this happens, the process can stretch significantly longer as adjusters balance hundreds of cases simultaneously.

If you’re facing immediate financial pressure, remember to request an advance payment when you first report your claim. This can provide crucial relief while your full claim works through the system. An advance won’t speed up your final settlement, but it can help bridge the gap during those challenging first weeks after a flood.

For many of our clients in San Antonio and across Texas, understanding these realistic timelines helps set proper expectations and reduces stress during an already difficult situation.

Conclusion

Surviving a flood is challenging enough—the flood insurance claim process shouldn’t add to your burden. Yet the journey from finding water damage to receiving your final settlement check requires careful navigation and attention to detail at every turn.

Here in Texas, we’ve seen how flooding affects homeowners across Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, and Waco. The difference between merely getting by and truly recovering often comes down to how well you understand and manage your claim.

“After helping hundreds of Texans through the flood insurance claim process, I’ve found that knowledge truly is power,” says Scott Friedson, CEO of Insurance Claim Recovery Support. “The more you understand about your policy and the claims process, the better positioned you are to recover what you’re entitled to.”

While you can certainly handle your flood claim independently, you don’t have to face this challenge alone. As public adjusters, we work exclusively for policyholders—never for insurance companies. Our sole mission is maximizing your recovery after a flood disaster.

The most successful flood claims share common elements: thorough documentation, prompt reporting, careful adherence to deadlines, and persistent follow-through. When these elements come together, even complex claims can reach fair settlements.

For many homeowners, particularly those with substantial damage or complicated claims, professional guidance can be invaluable. A public adjuster brings experience with policy language, documentation requirements, and negotiation strategies that most homeowners encounter only once or twice in a lifetime.

If you’re facing water damage and feeling overwhelmed by the flood insurance claim process, help is available. Our team of licensed public adjusters specializes in advocating for Texas policyholders just like you.

Your home is more than just a building—it’s where your life happens. And getting you back home after a flood, with the full settlement you deserve, is what drives our work every day.

For more information about how we can assist with your flood insurance claim in Texas, contact us today. Your recovery is our priority.