Storm-related large loss claims can feel overwhelming, but understanding them is crucial for property owners. These claims arise from substantial damage caused by severe weather events like hurricanes, tornadoes, and floods. Knowing how to steer these claims can lead to efficient and fair insurance recovery.

Key Points:

1. What Are Storm-Related Large Loss Claims?

– They occur when property experiences significant damage from storms.

– Involves complex, high-value insurance claims.

- Why Are They Important?

- Ensures proper compensation for large-scale damage.

-

Helps avoid financial ruin by mitigating high repair costs.

-

How to Approach Them:

- Review your insurance policy to know what’s covered.

- Document damage carefully and promptly.

- Consult public adjusters for expert claim handling.

As a seasoned professional in large loss claims, I am Scott Friedson. With over a decade of experience, I specialize in advocating for policyholders in storm-related large loss claims, ensuring they receive fair settlements.

Relevant articles related to storm-related large loss claims:

– commercial large loss claim

– large loss claims handling

– what is a large loss claim

Understanding Storm-Related Large Loss Claims

Storm-related large loss claims can be daunting, but understanding them is essential for property owners facing significant damage. These claims often arise from severe weather events like hurricanes, tornadoes, and floods. Let’s break down the key elements involved:

Property Damage

When a storm hits, the damage can be extensive. It can affect everything from your roof to your foundation. Homeowners should be ready to document all visible damage, as this will be crucial when filing a claim.

Windstorm

Windstorms, especially those associated with hurricanes and tornadoes, are notorious for causing significant property damage. High winds can rip off shingles, break windows, and even topple trees onto homes.

Flood

Flooding is another major concern during storms. It can ruin interiors, damage electrical systems, and lead to mold growth. Flood damage is typically not covered under standard homeowners insurance policies. You’ll need separate flood insurance for that.

Fire

While less common, fires can occur during storms due to lightning strikes or electrical issues caused by water damage. Fires can lead to severe structural damage, increasing the complexity of a large loss claim.

Structural Damage

Storms can compromise the integrity of a building, affecting support beams and foundations. This type of damage requires thorough inspection and often extensive repairs, making it a significant component of large loss claims.

Understanding these elements is vital in navigating storm-related large loss claims. Proper preparation and documentation can ensure a smoother claims process and better insurance recovery.

Next, we’ll dive into the Steps to File a Storm-Related Large Loss Claim, where we’ll cover how to document damage, understand your insurance policy, and steer the claim process efficiently.

Steps to File a Storm-Related Large Loss Claim

Filing a storm-related large loss claim can feel overwhelming, but breaking it down into clear steps can make the process manageable. Here’s how to steer it effectively:

1. Documentation

First things first: document everything. After a storm, take photos and videos of all damage. Capture wide shots for context and close-ups for detail. Include both exterior and interior damage.

Create a list of damaged items. Note their estimated value and any receipts you might have. This documentation is crucial for a successful claim.

2. Review Your Insurance Policy

Before contacting your insurer, review your policy. Understand what is covered and what isn’t. Look for details about deductibles, coverage limits, and exclusions. Standard policies often don’t cover flood damage. You might need separate flood insurance for that.

3. The Claim Process

Once you’ve documented the damage and reviewed your policy, it’s time to start the claim process.

- Notify your insurer promptly. Many policies have specific time frames for reporting damage.

- Submit your documentation. This includes photos, videos, and your list of damaged items.

- Be clear and detailed. Provide a thorough account of the damage and any immediate repairs you’ve made.

4. Work with an Insurance Adjuster

An insurance adjuster will assess the damage to determine your compensation. Here’s how to make the most of this step:

- Prepare for the visit. Have all your documentation organized and ready.

- Walk through the damage. Show the adjuster all affected areas and discuss necessary repairs.

- Get repair estimates. Obtain quotes from reputable contractors and submit these to your insurer.

5. Keep Communication Open

Maintain a detailed record of all interactions with your insurance company and adjuster. Record dates, names, and conversation summaries. Keep copies of all correspondence and claim documents.

By following these steps, you’ll be better equipped to handle the complexities of filing a storm-related large loss claim. Next, we’ll explore the Common Types of Storm Damage Covered, providing insight into what you can expect your insurance to handle.

Common Types of Storm Damage Covered

When a storm hits, understanding what types of damage are typically covered by your insurance can help you manage the recovery process. Let’s break down the most common claims: wind damage, water damage, fallen trees, and structural repairs.

Wind Damage

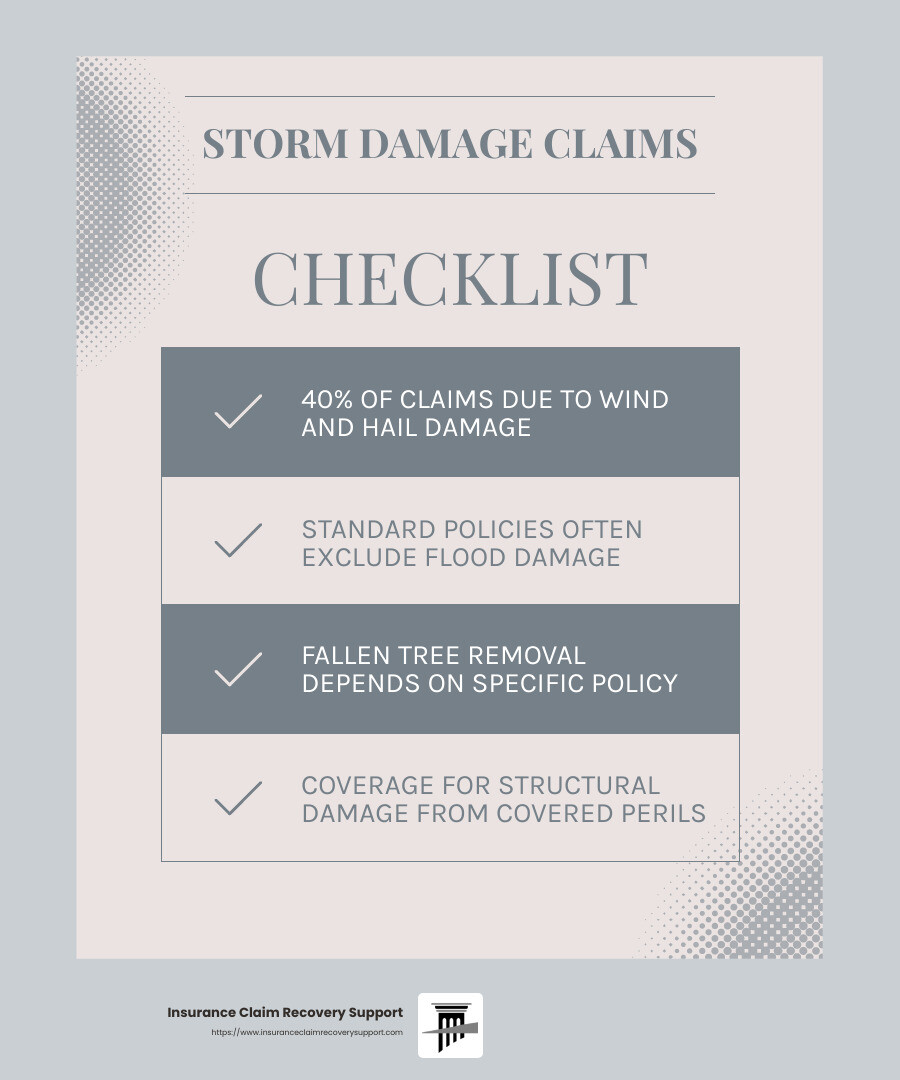

Wind damage is one of the most frequent causes of insurance claims. High winds can tear off shingles, damage siding, and break windows. In 2021, wind and hail damage accounted for nearly 40% of homeowners insurance claims, highlighting how common these issues are. Most policies cover the cost of repairs for wind-related damage, but be sure to check your specific coverage details.

Water Damage

Water damage from storms, like rain entering through a damaged roof, is usually covered. However, it’s important to note that standard homeowners policies often do not cover flood damage. Flooding requires separate flood insurance. If you’re in a flood-prone area, consider purchasing this additional coverage through programs like the National Flood Insurance Program (NFIP).

Fallen Trees

Fallen trees can cause significant damage. If a tree falls and damages your home or another insured structure, your policy will typically cover the repairs. However, if a tree falls without causing damage, coverage for removal might depend on your policy’s specifics. Some policies offer limited coverage for trees blocking driveways or access for people with disabilities.

Structural Repairs

Storms can cause extensive structural damage, from roof issues to compromised walls. Insurance usually covers repairs if the damage is due to a covered peril like wind or hail. However, it’s crucial to differentiate between damage caused by the storm and pre-existing wear and tear. Insurance is designed to cover sudden and accidental damage, not ongoing maintenance issues.

Understanding these common types of storm damage and how they are covered can help you steer the claims process more effectively.

In the next section, we’ll discuss Tips for Maximizing Your Insurance Settlement, providing strategies to ensure you receive the compensation you deserve.

Tips for Maximizing Your Insurance Settlement

Navigating storm-related large loss claims can be challenging. However, with the right approach, you can maximize your insurance settlement. Here are some key tips to help you:

Understand Your Deductibles

Your deductible is the amount you pay out of pocket before your insurance kicks in. Knowing your deductible is crucial. If the damage is close to or less than this amount, filing a claim might not be worth it. For example, if your deductible is $1,000 and the storm damage is $1,200, consider paying out of pocket to avoid potential premium increases.

Make Temporary Repairs

After a storm, prevent further damage. Use temporary fixes like tarps to cover leaks or broken windows. Keep receipts for any materials used, as these costs can be reimbursed. Avoid making permanent repairs until your claim is approved.

Review Your Policy Thoroughly

Before filing a claim, review your insurance policy. Understand what is and isn’t covered, including any exclusions or specific conditions like hurricane deductibles. Policies can change, so it’s wise to review them annually to ensure you have the coverage you need.

Negotiate If Necessary

Once you receive a settlement offer, review it carefully. If it’s lower than expected, don’t hesitate to negotiate. You can request a reevaluation or provide additional documentation to support your claim. You have the right to a fair settlement.

By following these strategies, you can improve your chances of receiving the full compensation you deserve. In the next section, we’ll address some frequently asked questions about storm-related large loss claims, providing further clarity on this complex process.

Frequently Asked Questions about Storm-Related Large Loss Claims

What is considered a large loss claim?

A large loss claim typically involves significant property damage that is costly and complex to repair. This could include the complete destruction of a home by a storm, extensive flood damage, or severe structural damage from high winds. Large loss claims often exceed hundreds of thousands of dollars and can reach into the millions. These claims are not only about the financial impact but also the complexity of repairs needed, which can involve multiple contractors and extended timelines.

Are insurance proceeds from storm damage taxable?

Generally, insurance proceeds from storm damage are not taxable. They are considered a reimbursement for losses, not income. However, if you receive more money than the actual cost of repairs or replacement, the excess might be taxable. It’s important to keep thorough records of all expenses related to the storm damage and consult with a tax professional to understand any potential tax implications.

What is a hurricane deductible?

A hurricane deductible is a specific amount you must pay out of pocket before your insurance covers damage caused by hurricanes. This deductible is usually higher than the standard deductible for other types of damage. It can be a flat amount or a percentage of the insured value of your home. Understanding this part of your insurance policy is crucial, especially if you live in a hurricane-prone area. Review your policy to know exactly how much you’ll need to cover in the event of a hurricane.

Conclusion

Navigating storm-related large loss claims can be overwhelming, especially when you’re dealing with the aftermath of severe weather events like hurricanes, floods, or tornadoes. At Insurance Claim Recovery Support, we understand the complexities involved in these situations and are dedicated to advocating for policyholders across Texas and beyond.

Our mission is simple: to ensure you receive the maximum settlement you deserve. We specialize in handling claims for various types of property damage, including wind, hail, fire, and flood damage. Whether you’re in Austin, Dallas, Houston, or any other city we serve, our team is ready to stand by your side.

Why choose us?

-

Expertise in Texas Storm Damage: We know the unique challenges posed by Texas weather. Our deep understanding of local conditions helps us provide unparalleled support to those affected by storm damage.

-

Advocacy for Policyholders: We are not just public insurance adjusters; we are your advocates. We work tirelessly to ensure that your claim is given the attention it deserves.

-

Comprehensive Support: From filing your claim to negotiating settlements, we guide you through every step, making the process less stressful.

For more information on how we can assist with your large loss claims, visit our large loss claims service page. Let us be your trusted partner in securing the settlement you need to move forward with confidence.

In the wake of a disaster, you are not alone. With Insurance Claim Recovery Support by your side, you have a committed team ready to help you rebuild and recover. Your peace of mind is our priority.