Understanding the Flood Claim Landscape: Policies, Players, and Pitfalls

When flood damage devastates your commercial or multifamily property, navigating the complex insurance claim process is often overwhelming. This is where an expert insurance adjuster for flood recovery becomes your most critical asset.

Why hire an expert? The benefits are clear:

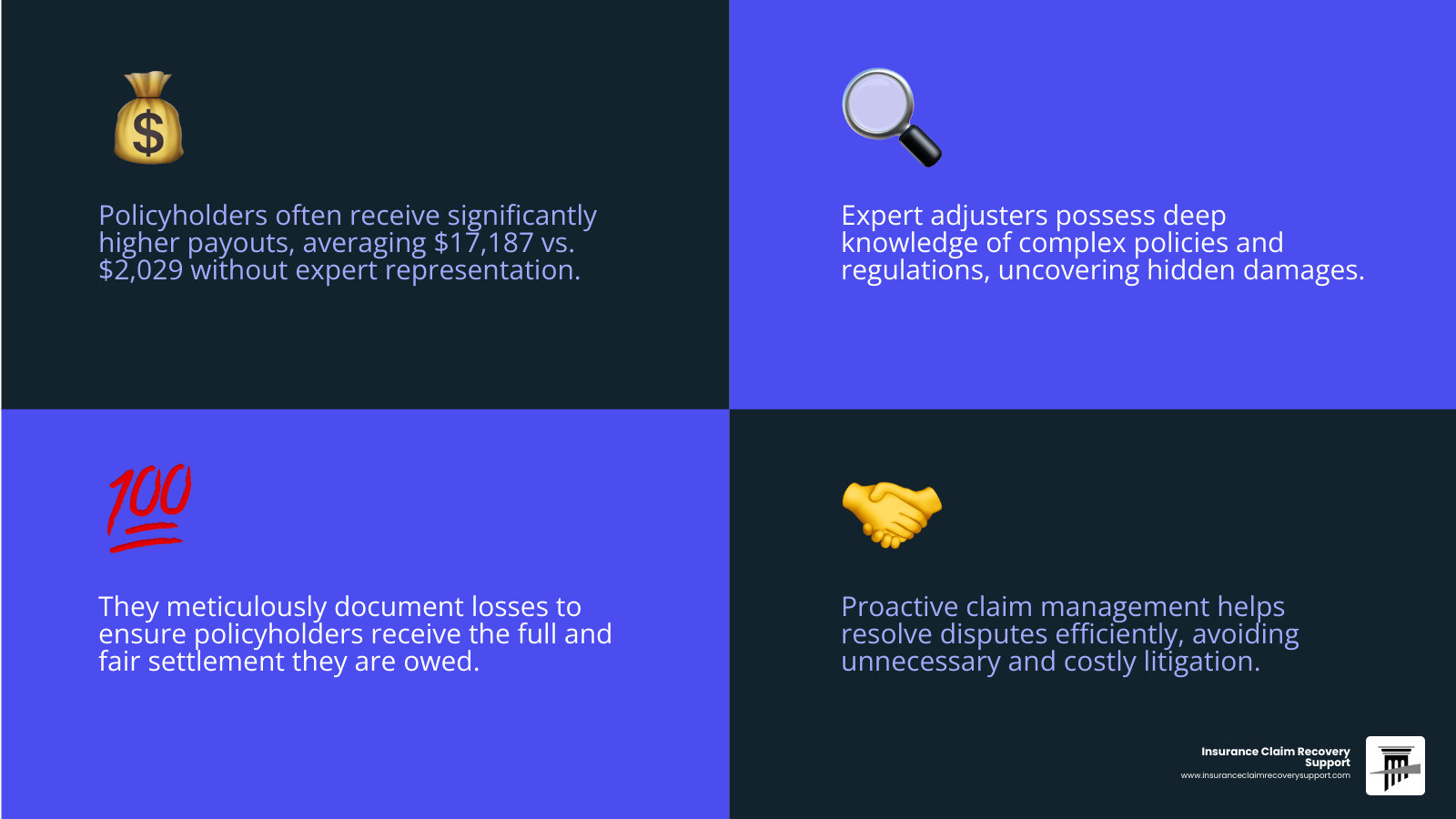

- Higher Payouts: Studies show policyholders with a public adjuster receive significantly higher settlements (e.g., 747% higher).

- Expert Navigation: They understand complex policies and regulations, like the NFIP, and identify hidden damages.

- Maximized Compensation: They fight to get you the full amount you’re owed, not just the insurer’s initial offer.

- Reduced Stress & Time: They manage the entire claim, freeing you to focus on your business.

High Water, High Stakes: Why Your First Call After a Flood Matters

Imagine your apartment complex or manufacturing facility after a flood. The water recedes, but the chaos remains. For property owners, this isn’t just a loss; it’s a monumental challenge. Many face an insurance process that seems designed to delay, deny, or underpay. This guide will show how an expert insurance adjuster for flood recovery can be your strongest ally.

My name is Scott Friedson, and as CEO of a large-loss public adjusting firm, I have settled hundreds of millions in property damage claims, including many related to floods, for commercial and multifamily policyholders. My experience has shown me the power of strong advocacy in securing fair compensation.

When your property is hit by floodwaters, understanding who does what in the insurance world is your first step toward recovery.

The Adjuster Triangle: Public vs. Company vs. Independent

After a flood, you’ll encounter different types of adjusters. It’s crucial to know their allegiances:

- Company (Staff) Adjuster: An employee of your insurance company whose loyalty is to their employer, aiming to minimize the payout.

- Independent Adjuster: A contractor hired by your insurance company. While seemingly independent, they work for and are paid by the insurer, aligning their interests with the company.

- Public Adjuster: The only adjuster who works exclusively for you, the policyholder. We are licensed advocates who negotiate on your behalf to maximize your settlement.

Here’s a quick comparison:

| Adjuster Type | Allegiance | Payment Structure | Primary Goal | Conflict of Interest |

|---|---|---|---|---|

| Company (Staff) | Insurance Company | Salary | Minimize Payout for Insurer | Yes |

| Independent | Insurance Company | Fee per Claim (paid by insurer) | Minimize Payout for Insurer | Yes |

| Public | Policyholder (YOU) | Contingency Fee (percentage of your settlement) | Maximize Payout for Policyholder | No |

Our job is to level the playing field. A Florida government study by OPPAGA found that policyholders who used a Public Adjuster received payouts that were 747% higher than those who didn’t. This is why having an expert insurance adjuster for flood recovery on your side is vital.

What Does a Claims Adjuster Do?

Why Standard Property Insurance Won’t Cover a Flood

One of the most painful findies for property owners is that standard commercial property insurance policies typically exclude flood damage. A flood is specifically defined as water inundating normally dry land from an outside source, affecting two or more properties. This is why a separate flood insurance policy is necessary. The National Flood Insurance Program (NFIP), a federal program, is the primary provider of this coverage. Understanding this distinction before a flood is crucial for businesses in Texas and nationwide.

Does Homeowners Insurance Cover Hurricane Damage?

What Your Flood Policy Actually Covers (and What It Doesn’t)

Even with a flood policy, understanding its nuances is critical. Generally, it covers direct physical damage to your building and its contents.

- Building Property Coverage: Includes the insured building, its foundation, electrical and plumbing systems, HVAC, and permanently installed items.

- Contents Coverage: Covers items within the building, such as furniture, electronics, and business inventory or machinery.

- Business Interruption: While not standard in all flood policies, this vital coverage for lost income can often be included through endorsements.

What’s often not covered or has limitations?

- Earth Movement: Damage from events like landslides is typically excluded.

- Basement Contents: Personal belongings in basements often have limited or no coverage under NFIP policies.

- Loss of Use/Additional Living Expenses: NFIP policies generally do not cover these.

- Property Outside the Building: Landscaping, wells, and pools are usually not covered.

Navigating these details is why an expert insurance adjuster for flood recovery is indispensable. We review your policy to ensure your claim accounts for every covered detail.

The Power of an Advocate: How an Expert Insurance Adjuster for Flood Recovery Maximizes Your Claim

Facing flood damage to your commercial property can feel like a lonely battle. An expert insurance adjuster for flood recovery acts as your personal champion, ensuring your voice is heard and your losses are fully recognized. We’re here to turn chaos into a clear path forward.

From Chaos to Compensation: The Public Adjuster’s Process

When we step in, we bring order to the chaos. Our methodical process is designed to leave no stone unturned.

First, we conduct a deep dive into your flood insurance policy to understand all coverages and exclusions. Then, we perform comprehensive damage documentation. We don’t just look at the obvious; we use tools like thermal imaging cameras to find hidden moisture behind walls and under floors. This is crucial, as unseen water can lead to mold and other long-term problems. We capture every angle with 360-degree photography, detailed notes, and videos, helping you create precise lists of all damaged property.

Next, we create our own independent, highly detailed estimates for all repairs and replacement costs, factoring in current labor and material prices. Finally, we compile all documentation and estimates into a robust claim package. For NFIP claims, this includes the crucial “Proof of Loss” document, which must be accurate and submitted on time.

Then, our advocacy shines through negotiation. We handle all communication with the insurer, presenting our findings and pushing back on lowball offers. Our goal is simple: ensure you’re fully compensated so you can focus on getting your property back to normal.

Find the Difference a Public Adjuster Can Make

The Financial Impact: Opening up Your Full and Fair Settlement

The numbers don’t lie. Statistics consistently show that policyholders who hire public adjusters receive significantly higher payments—in some cases, over 700% higher. Why such a dramatic difference? It comes down to several key factors.

We are experts at identifying hidden damage. Floods often leave behind unseen moisture that can lead to mold and structural problems. Our expertise and technology help us uncover issues a company adjuster might miss. We also bring expert negotiation to the table. We know how to build a strong case that covers every aspect of your loss, including business income losses and the true cost of replacing damaged inventory.

Our deep knowledge of navigating complex NFIP regulations helps us interpret your policy correctly, challenge unfair denials, and ensure you meet all requirements, like strict appeal deadlines. We are prepared to overcome the lowball offers that insurers often make, pushing for the full compensation you deserve.

For owners of commercial buildings, multifamily HOAs, and apartment complexes, maximizing compensation is about financial stability. An expert insurance adjuster for flood recovery is an investment that consistently pays off.

Apartment and Multifamily Claims

Avoiding the Courtroom: Public Adjusters vs. Litigation

One of the most significant benefits of hiring a public adjuster is avoiding the costly, time-consuming stress of litigation. For property owners, an insurance lawsuit can be a nightmare, pulling resources away from your core operations.

We help you steer clear of litigation by being proactive. By thoroughly documenting damages and presenting a well-supported claim from the start, we reduce the chances of disputes. We understand the common reasons for claim denials and help you avoid these pitfalls, making it much harder for the insurer to reject your claim.

Our expert negotiation skills often lead to a fair settlement without court intervention. We can even reopen underpaid or denied claims, securing additional funds that might otherwise require legal action. We have successfully recovered over $30 million in supplemental claims that insurers had previously closed.

Let’s compare the two paths:

| Feature | Insurance Claim Lawsuit for Property Damage | Public Adjuster Process |

|---|---|---|

| Timeframe | Can take years to resolve. | Typically much faster, aiming for settlement within months. |

| Cost | Significant legal fees, court costs, and expert witness fees. | Contingency fee (a percentage of the settlement); no upfront costs. |

| Stress | Extremely high; involves depositions and court appearances. | Significantly lower; we handle the bulk of the work. |

| Expertise | Requires hiring legal counsel and multiple expert witnesses. | We provide comprehensive expertise in claims adjustment and negotiation. |

Our goal is to achieve the maximum settlement through negotiation, avoiding the stress and expense of litigation. For property owners in Texas cities like Austin, Dallas, or Houston, this means getting back to business faster.

Denied Storm Damage Insurance Claim

Your Flood Recovery Playbook: A Step-by-Step Guide

When floodwaters recede, the real work begins. The path forward can feel overwhelming, but with a clear roadmap and an expert insurance adjuster for flood recovery guiding you, recovery is manageable. This is your playbook for moving from chaos to restoration.

Immediate Steps After a Flood

The hours and days after a flood are critical for both your safety and your insurance claim.

Safety first. Before anything else, ensure the property is safe. Avoid electrical hazards from standing water and look for structural damage like sagging ceilings. Stay out until a professional clears the area.

Once it’s safe, your next priority is to mitigate further damage. This could mean pumping out water, setting up fans, or tarping a damaged roof. Keep every receipt for these expenses, as they are often reimbursable.

Contact your insurance company promptly to report the damage and start the claims process. However, be careful what you say.

When speaking with insurance representatives, stick to the facts. Avoid admitting fault or speculating on the cause of the flood. Never sign anything without having your public adjuster review it first. The insurance company’s adjuster works for them, not you. Be polite but cautious.

How to File an Insurance Claim for Storm Damage

Mastering Damage Documentation to Strengthen Your Claim

Your claim’s success depends on your documentation. If it’s not documented, it didn’t happen in the eyes of the insurer.

Start with comprehensive photos and videos before any major cleanup. Capture wide shots for scope and close-ups of specific damage. Document water lines on walls, ruined inventory, and warped flooring.

Create a detailed inventory of every damaged item. For your office equipment or apartment lobby furniture, record the description, quantity, age, and original cost. An expert insurance adjuster for flood recovery can help determine proper replacement values.

Keep every single receipt related to your flood response, from water extraction services to temporary office space. For commercial properties, business interruption documentation is crucial. Gather financial statements, sales records, and payroll data to calculate lost income and ongoing expenses.

Finally, maintain a communication log of every conversation with your insurance company. Send all documentation via email to create a timestamped record.

Public Adjusters for Commercial Property Tornado and Windstorm Claims

Choosing the Right Expert Insurance Adjuster for Flood Recovery

Selecting the right public adjuster may be the most important decision in your recovery. This person will be your advocate and guide.

- Verify Licensing: Check with your state’s Department of Insurance to confirm they are licensed and bonded. Unlicensed adjusters cannot legally represent you.

- Seek Flood Claim Expertise: Your adjuster should have a proven track record with flood claims and NFIP certification. Flood claims have unique rules and deadlines.

- Look for Commercial Experience: An adjuster who handles large-loss commercial claims will understand the unique challenges of your multifamily HOA or commercial building.

- Check References and Reviews: A reputable public adjuster will provide references from clients with similar claims. Ask for specific examples of flood claims they’ve handled.

- Understand the Fee Structure: Most public adjusters work on a contingency fee, taking a percentage of your final settlement. Be wary of anyone asking for upfront fees.

- Value Local Knowledge: An adjuster familiar with local building codes and construction costs in Texas cities like Austin, Dallas, or San Antonio can significantly benefit your claim.

The right public adjuster becomes your partner, handling complex negotiations while you focus on your business.

How to Choose a Public Adjuster for Hurricane Damage

Frequently Asked Questions about Flood Claims and Public Adjusters

After a flood, you’re left with urgent questions. As an expert insurance adjuster for flood recovery, I hear the same concerns from property owners and managers again and again. Here are the answers to the most common ones.

How much does a public adjuster cost for a flood claim?

This is often the first concern, but working with us won’t add to your immediate financial burden. We work exclusively on a contingency fee basis, meaning you pay nothing upfront. Our fee is a small percentage of the settlement we recover for you.

Most importantly, we only get paid when you get paid. If we don’t secure a better outcome for your claim, you owe us nothing. This structure creates a powerful partnership where our success is tied directly to yours. Considering that policyholders with a public adjuster often receive significantly higher settlements, our fee is a small investment for a much larger return. You’re typically far ahead financially, even after our fee.

How long does a flood insurance claim take with a public adjuster?

The timeline depends on the complexity of the damage and your insurer’s responsiveness. However, having an expert on your team typically makes the process more efficient.

Generally, our initial assessment and documentation phase takes a few weeks. The insurer’s review period may last 4-6 weeks. The negotiation phase can range from 2-12 months, as we work to maximize your settlement, not just close the file quickly. While this may seem long, it’s a proactive process that is typically much faster and less stressful than litigation, which can drag on for years.

When should I hire an expert insurance adjuster for flood recovery?

The simple answer is: as soon as possible. Ideally, you should contact us before you even notify your insurance company. This allows us to guide you from day one.

However, it’s never too late. You should definitely hire an expert if your commercial building or apartment complex has suffered significant damage. If your claim feels overwhelming, or if you’re drowning in paperwork, that’s when our advocacy is most valuable.

Absolutely reach out if your insurance company is delaying, offering a low settlement, or has denied your claim. We have successfully reopened and negotiated denied claims, recovering millions for policyholders who thought their claim was lost.

Bringing us in early prevents disputes from escalating. Our goal is to achieve maximum compensation through skilled negotiation, keeping you out of court and focused on your recovery.

When to Hire a Public Insurance Adjuster

Conclusion: Take Control of Your Flood Recovery Journey

Recovering from flood damage to your commercial building, multifamily HOA, apartment complex, or religious institution is a monumental task. The insurance claim process, designed to be complex, can add significant stress and financial burden. However, you don’t have to face it alone.

An expert insurance adjuster for flood recovery is your indispensable advocate. We bring specialized knowledge of flood policies, meticulous documentation techniques, and seasoned negotiation skills to the table, ensuring you receive the maximum settlement you deserve. By hiring us, you not only increase your potential payout significantly but also reduce your stress, save valuable time, and proactively avoid the costly and protracted process of litigation.

We, at Insurance Claim Recovery Support, are dedicated to advocating for policyholders like you. Specializing in commercial and multifamily property damage claims, including those from fire, hurricane, tornado, lightning, freeze, and flood, we serve clients nationwide from our base in Texas, with local expertise in cities like Austin, Dallas, Fort Worth, San Antonio, and Houston. Our commitment is to ensure you regain control of your flood recovery journey and achieve the full compensation necessary to rebuild and restore your valuable property.

Take the next step in your flood damage recovery. Don’t let the insurance company dictate your future. Secure the expert advocacy you need to adjust your expectations upward and achieve the recovery you’re entitled to.