Denied hurricane damage insurance claim is a phrase that no policyholder wants to encounter, especially amidst the chaos of post-storm recovery. Sadly, it’s a reality for many, due to reasons ranging from policy exclusions to missed deadlines. If you’ve recently faced this roadblock, here’s what you need to know right off the bat:

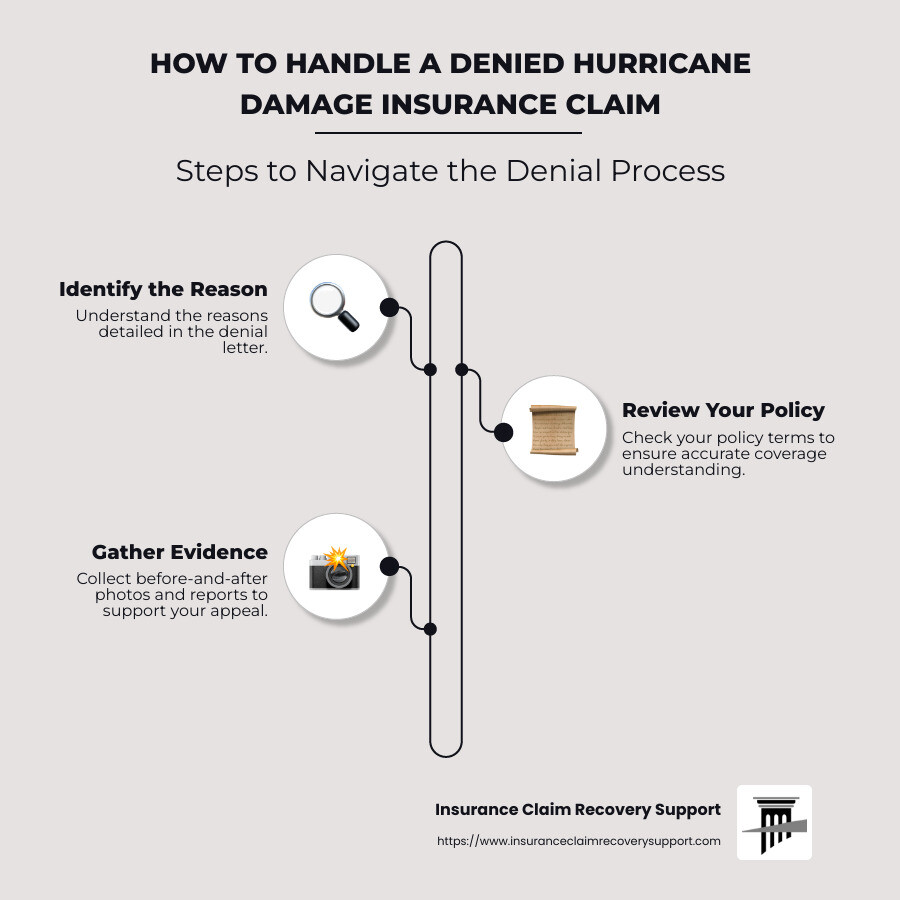

- Identify the Reason for Denial: Always start by understanding why the claim was rejected. The explanation should be detailed in the denial letter.

- Review Your Policy Thoroughly: Ensure that you weren’t denied coverage you believe you had.

- Gather Detailed Evidence: Include before-and-after photos, estimates, and any reports.

- Consider Professional Help: Consulting with a public adjuster or attorney can turn the tide in negotiations.

Navigating these denials can be overwhelming, but they aren’t necessarily the end of your claim. Understanding and addressing the reasons for denial promptly is pivotal in overturning these decisions.

As Scott Friedson, the CEO of Insurance Claim Recovery Support LLC, I bring my extensive experience and success in handling denied hurricane damage insurance claims to support and guide you through this process. Our expertise has proven invaluable for many, and we’re here to ensure you’re not facing this daunting task alone. Let’s take that frustration and turn it into action.

Denied hurricane damage insurance claim word guide:

– commercial hurricane damage insurance claim

– how to file a hurricane damage insurance claim

Common Reasons for Denied Hurricane Damage Insurance Claims

After a hurricane, dealing with a denied hurricane damage insurance claim can be incredibly frustrating. Understanding the common reasons for denial can help you avoid these pitfalls and strengthen your case.

Incorrect Filing

One of the most common reasons for claim denial is incorrect filing. This could mean errors in the paperwork or missing crucial deadlines. Insurance companies have strict timelines for filing claims, and missing these can lead to immediate denial. Always double-check your documents for accuracy and ensure you meet all deadlines.

Unpaid Premiums

Another frequent issue is unpaid premiums. If your insurance coverage has lapsed due to late payments, your claim might be denied outright. Keeping up with your premium payments is essential to maintain your coverage. A lapse in coverage can leave you without any financial support when you need it most.

Lack of Evidence

Insufficient documentation is a major reason claims get denied. Insurance companies require detailed evidence to process a claim. This includes photographs of the damage, repair estimates, and receipts for damaged items. Without this documentation, proving the extent of damage can be challenging. Make sure you have comprehensive records to support your claim.

Policy Exclusions

Every insurance policy has exclusions, and understanding these is crucial. Common exclusions in hurricane-prone areas include flood damage, which generally requires separate flood insurance. Claims for damages not covered by your policy will be denied. Review your policy carefully to know what is included and what is not.

Failure to Prevent Further Damage

After a storm, it’s your responsibility to take reasonable steps to prevent further damage. This might involve temporary repairs, like covering a damaged roof with a tarp. Failure to do so can result in a claim denial. Document any mitigation efforts you make and keep receipts for any expenses incurred.

Understanding these common reasons for denial can help you prepare a stronger claim and reduce the risk of rejection. If your claim has been denied, knowing these factors can also guide you in addressing the issues and potentially overturning the decision.

Steps to Take After Your Hurricane Damage Claim is Denied

Facing a denied hurricane damage insurance claim can feel overwhelming, but it’s not the end of the road. Here’s a clear roadmap to help you steer this challenging situation.

Understand the Reason for Denial

Start by thoroughly reviewing the denial letter from your insurance company. This document should outline the specific reasons your claim was denied. Insurance companies are required to provide clear explanations, often citing particular clauses from your policy. Understanding these reasons is crucial for determining your next steps.

Review Your Insurance Policy

Next, revisit your insurance policy. Pay close attention to the terms and conditions, coverage limits, and any exclusions. This will help you assess whether the denial was justified or if there might have been a misunderstanding. Knowing your policy inside and out can also reveal if there are any ambiguities that could work in your favor.

Collect Evidence

Strengthen your case by gathering additional evidence. This includes taking new photographs of the damage, obtaining repair invoices, and securing expert testimony if necessary. For example, if your roof was damaged, a contractor’s detailed report can be invaluable. Make sure all evidence directly addresses any deficiencies noted in the denial letter.

File an Appeal

Once you’ve gathered all necessary documentation, you can file an appeal with your insurance company. This involves submitting additional evidence and a detailed explanation of why you believe the denial was incorrect. Follow the internal appeal process outlined by your insurer, and be sure to adhere to any deadlines.

Consult a Lawyer

If your appeal is unsuccessful or if you suspect bad faith practices by the insurance company, consulting a lawyer can be beneficial. A legal expert can provide advice on navigating the appeals process and help you understand your rights. They can also identify any bad faith practices, such as unjust denial or unreasonable delays, and advise on potential legal actions.

By taking these steps, you can improve your chances of overturning a denial and securing the settlement you deserve. Persistence and a thorough understanding of your policy and rights are your best allies in this process.

How to Spot Bad Faith Practices by Insurance Companies

Dealing with a denied hurricane damage insurance claim can be frustrating, especially if you suspect your insurer is acting in bad faith. Here’s how to identify some common bad faith practices.

Unjust Denial

An insurance company might deny your claim without a valid reason. This kind of arbitrary decision is a red flag. Insurers are required to provide a clear, written explanation for any denial. If the reason seems flimsy or unsupported by your policy, it may be time to question their motives.

Unreasonable Delays

Insurance companies are obligated to handle claims promptly. If you’re experiencing investigation delays or long waits for payment without a good reason, your insurer might be using delay tactics. These tactics can pressure you into giving up or accepting a lower settlement.

Low Settlement Offers

Receiving a minimal offer that doesn’t cover your losses could indicate bad faith. Sometimes, insurers fail to conduct a thorough investigation and offer less money than your claim is worth. They might hope you’ll accept the lowball offer for quick relief.

Refusal to Provide Documentation

If your insurer denies your claim, they must provide a written explanation detailing the denial basis. Refusing to supply this documentation is a bad faith practice. Always ensure you receive and understand these explanations.

Failure to Investigate

A prompt investigation is crucial for a fair assessment of your claim. If your insurer neglects this duty, they may be acting in bad faith. A lack of investigation can result in inaccurate assessments of financial loss, leading to unjust denials or inadequate settlements.

Recognizing these practices can help you take the necessary steps to protect your rights. If you suspect bad faith, consider consulting a lawyer to explore your options.

Frequently Asked Questions about Denied Hurricane Damage Insurance Claims

Facing a denied hurricane damage insurance claim can be overwhelming. Let’s address some common questions about why claims get denied and what steps you can take next.

Why do insurance companies deny hurricane claims?

Insurance companies might deny your hurricane claim for several reasons:

Incorrect Filing: Mistakes in paperwork or missing deadlines can lead to denial. Always double-check your forms and submit them on time.

Unpaid Premiums: If your premiums aren’t current, your policy might lapse, leading to denial. Keep track of payment schedules to avoid this issue.

Lack of Evidence: Insufficient documentation is a frequent cause of denial. Make sure you have photos, repair invoices, and expert testimony to support your claim.

Policy Exclusions: Some damages might not be covered under your policy. For instance, flood damage often requires separate insurance.

Pre-existing Damage: If the damage existed before the hurricane, insurers might deny the claim. Document property conditions regularly to avoid this problem.

Failure to Prevent Further Damage: Policies often require you to mitigate damage. Not taking steps to prevent further harm can result in denial.

What happens when an insurance claim is denied?

When your claim is denied, don’t panic. Here’s what typically unfolds:

Appeal Process: Start by appealing the decision. Gather additional evidence and submit it for an internal review.

Internal Review: The insurance company will reassess your claim. Provide any new information to support your case.

External Review: If the internal appeal fails, you can request an external review by an independent third party.

Legal Action: If all else fails, consider legal action. A lawyer can help steer this complex process.

Do you need a lawyer to fight an insurance claim denial?

While not always necessary, a lawyer can be invaluable in certain situations:

Legal Representation: A lawyer can guide you through the appeal process and ensure your rights are protected.

Bad Faith Litigation: If your insurer is acting in bad faith—such as unjustly denying claims or delaying payments—legal action might be warranted.

Insurance Claim Process: Navigating the claims process can be tricky. A lawyer can help clarify policy terms and improve your chances of a favorable outcome.

In short, while you can handle some disputes on your own, having legal support can significantly boost your chances of success. If you’re unsure, consulting a lawyer for advice is a wise step.

Conclusion

Navigating the aftermath of a hurricane is challenging enough without the added stress of a denied hurricane damage insurance claim. It’s crucial to understand the importance of fighting a claim denial. Not only does this ensure that you receive the settlement you’re entitled to, but it also holds insurance companies accountable to their policyholders.

At Insurance Claim Recovery Support LLC, we are dedicated to advocating for homeowners and businesses facing denied claims. Our expertise lies in maximizing settlements for our clients, ensuring they can rebuild and recover after a disaster. We serve communities across Texas, from Austin to Houston, and we are committed to helping you understand your legal and contractual rights.

Fighting a denial is not just about recovering costs; it’s about securing your future. By understanding your rights and the intricacies of your insurance policy, you can better prepare for any challenges that may arise. The sooner you act, the better your chances of a successful outcome.

If you’re facing a denied claim, don’t go it alone. Let us help you steer the complex claims process and work towards a fair settlement. Visit our Texas Public Adjuster Hurricane Damage page to learn more about how we can assist you in maximizing your settlement. Together, we can turn a daunting situation into a manageable recovery journey.