Why Choosing the Right Public Claim Adjuster Firm in Texas Can Make or Break Your Settlement

Public claim adjuster firm texas searches spike after every major storm – and for good reason. When your property suffers damage from fire, wind, or flooding, you’re facing a complex insurance maze where one wrong move can cost you thousands.

Top-rated public claim adjuster firms in Texas offer:

- Licensed advocacy exclusively for policyholders (not insurers)

- Contingency-based fees capped at 10% by Texas law

- Specialized expertise in fire, storm, water, and business interruption claims

- Document preparation and policy analysis

- Settlement negotiation with insurance companies

- Claims reopening for denied or underpaid settlements

The stakes are high. Research shows using a public adjuster increases insurance claim payouts by 747% on average compared to handling claims alone. But not all adjusters are created equal.

Your insurance company has an adjuster who represents their interests. You need a licensed professional in your corner who fights exclusively for your maximum settlement.

I’m Scott Friedson, a multi-state licensed public adjuster and CEO of Insurance Claim Recovery Support LLC, headquartered in Austin, Texas. Over my career, I’ve settled hundreds of millions in property damage claims and helped policyholders increase settlements from 30% to 3,800% while avoiding unnecessary litigation.

Why This Guide Matters

Every year, Texas faces severe weather that leaves property owners dealing with claim delays, underpaid offers, and insurance company tactics designed to minimize payouts. From hurricanes along the Gulf Coast to tornado damage in Dallas-Fort Worth, from freeze damage in Austin to wildfire losses in West Texas, property owners need expert advocacy to steer the complex claims process.

What a Public Claim Adjuster Really Does (and Why Insurer Adjusters Aren’t on Your Side)

When disaster strikes your Texas property, you’ll quickly find that navigating an insurance claim feels like learning a foreign language while blindfolded. That’s where a public claim adjuster firm texas becomes your advocate and translator.

A public insurance adjuster is a state-licensed professional who works exclusively for you – the policyholder – to prepare, present, and negotiate your property damage claim. Think of us as your personal advocate in what can feel like an unfair fight against insurance companies.

Here’s the key difference: we handle the burden of proof your insurance policy requires. Your policy demands extensive documentation, detailed estimates, and proof of loss statements that most property owners simply can’t manage effectively while dealing with property damage chaos.

Insurance companies know this. They’re counting on you being overwhelmed by paperwork, confused by policy language, and frustrated enough to accept whatever they offer.

Public adjusters level the playing field. We know insurance law inside and out. We understand policy language written by lawyers. We know current construction costs and can spot when insurance company estimates lowball your actual repair needs.

Company vs. Independent vs. Public Adjusters

Not all adjusters are on your side. Understanding who works for whom can save you thousands of dollars and months of frustration.

| Adjuster Type | Who They Work For | How They’re Paid | Whose Interests They Serve |

|---|---|---|---|

| Company Adjuster | Insurance Company (Staff) | Salary from insurer | Insurance company |

| Independent Adjuster | Insurance Company (Contract) | Fee from insurer | Insurance company |

| Public Adjuster | Policyholder | Percentage of settlement | Policyholder exclusively |

Company adjusters are direct employees of your insurance company. They might be perfectly nice people, but their paycheck comes from the same company you’re asking to pay your claim.

Independent adjusters work as contractors for insurance companies. While they’re not direct employees, they depend on insurance companies for their livelihood. If they consistently recommend high payouts, they won’t get hired again.

Public adjusters work exclusively for policyholders like you. We only get paid when you get paid, and our fee is a percentage of your settlement. This means we’re motivated to get you the highest possible settlement.

Licensing & Regulation in Texas

Texas takes public adjuster licensing seriously, and that’s good news for property owners seeking professional representation. Every public adjuster must be licensed by the Texas Department of Insurance (TDI) and follow strict regulations under the Texas Insurance Code.

To earn a Texas public adjuster license, professionals must pass the Texas All Lines Insurance Adjuster exam, be at least 18 years old, and undergo thorough background checks including fingerprinting. Once licensed, we must complete 24 hours of continuing education annually to stay current on insurance law and industry changes.

Texas law protects consumers by capping public adjuster fees at 10% of the total claim settlement. This fee structure aligns our interests with yours – we only succeed when you get a fair settlement.

You can verify any adjuster’s license and check for complaint history through the Texas Public Adjuster License Lookup or by calling TDI directly at 800-252-3439. Never work with an unlicensed adjuster – it’s illegal and could void your claim.

For complete details on licensing requirements and consumer protections, visit More about licensing requirements on the TDI website.

Key Services Offered by a Public Claim Adjuster Firm Texas

When disaster strikes your Texas property, a public claim adjuster firm texas becomes your professional advocate in what can feel like an overwhelming battle with your insurance company. We handle every aspect of your claim from start to finish, so you can focus on getting your life back together.

Think of us as your personal insurance claim quarterback. We assess the damage, analyze your policy coverage, prepare all the paperwork, and negotiate with your insurance company to get you the settlement you deserve.

Our comprehensive services start with a thorough property inspection where we document every bit of damage, including hidden problems that insurance company adjusters often overlook. We take detailed photographs, measurements, and notes that create an ironclad case for your claim.

Next comes policy analysis – where our expertise really shines. Insurance policies are written in legal language that can confuse even the smartest people. We decode your policy to identify every coverage that applies to your situation, from additional living expenses to business interruption benefits.

The claim preparation and presentation is where the magic happens. We prepare professional proof of loss documents, detailed repair estimates using current Texas construction costs, and compile all supporting documentation. Then we submit everything to your insurance company in a way that demands attention and respect.

We specialize in all types of property damage claims that Texas weather loves to throw at us: fire damage, wind and storm damage, water damage from burst pipes or flooding, lightning strikes, and freeze damage. Our Public Insurance Adjuster services cover both residential and commercial properties throughout the Lone Star State.

Residential vs. Commercial Claim Support

Residential claims are personal – they’re about your home, your family’s safety, and your peace of mind. Whether you’re a homeowner in Austin dealing with storm damage, a Dallas resident facing fire damage, or a San Antonio family dealing with freeze damage, we understand that your home is more than just a building.

We handle everything from homeowner policy interpretation to additional living expenses while your home is being repaired. We also assess personal property damage, steer code upgrade requirements, and don’t forget about damage to your landscaping and detached structures.

Commercial claims are more complex, involve higher dollar amounts, and can shut down your business if not handled properly. We represent office buildings, retail centers, restaurants, churches, schools, and industrial facilities across Texas.

Commercial property owners face unique challenges like business interruption losses when they can’t operate normally, extra expense coverage for temporary locations, and loss of rental income for property owners.

Specialized Large-Loss & Denied Claim Advocacy

When your claim involves serious money – typically over $100,000 – insurance companies bring out their big guns. That’s when you need our specialized expertise in large-loss claims where every detail matters and every dollar counts.

Fire damage is particularly tricky because there’s often more damage than meets the eye. Our Fire Insurance Public Adjuster Texas USA services include smoke damage assessment, structural damage evaluation, and content loss documentation.

Texas storms can be brutal, and we know exactly how to document storm damage properly. Our Hail Storm Damage Insurance Claim expertise covers roof damage, siding damage, window damage, and interior damage from wind-driven rain.

Sometimes insurance companies just say “no” to legitimate claims. When that happens, we don’t back down. Our Denied Storm Damage Insurance Claim services help you reopen denied claims, challenge improper denials, and pursue appeals through the proper legal channels.

When & Why to Hire a Public Claim Adjuster Firm Texas

Knowing when to call a public claim adjuster firm texas can be the difference between a fair settlement and leaving money on the table. Statistics show policyholders who hire public adjusters receive settlements 747 % higher on average than those who go it alone.

Call a licensed adjuster when:

- The insurer’s first offer seems low.

- Damage involves multiple systems (fire, wind-driven water, or business interruption).

- Your claim has been denied or stalled.

- Losses are roughly $25,000 or more.

Texas public adjusters work on contingency—no upfront cost and fees capped at 10 % of the final settlement—so our interests stay aligned with yours.

Early Engagement = Stronger Evidence

The first hours after a loss are critical. Once cleanup starts, evidence disappears. A qualified adjuster secures photographs, measurements, and documentation before it’s lost, then manages all communication with the carrier.

Reopening Denied or Underpaid Claims

A denial is not the last word. We routinely reopen files—sometimes months later—by providing new evidence, correcting policy misinterpretations, or filing supplements. Zero-dollar denials often end in five- or six-figure settlements once handled properly.

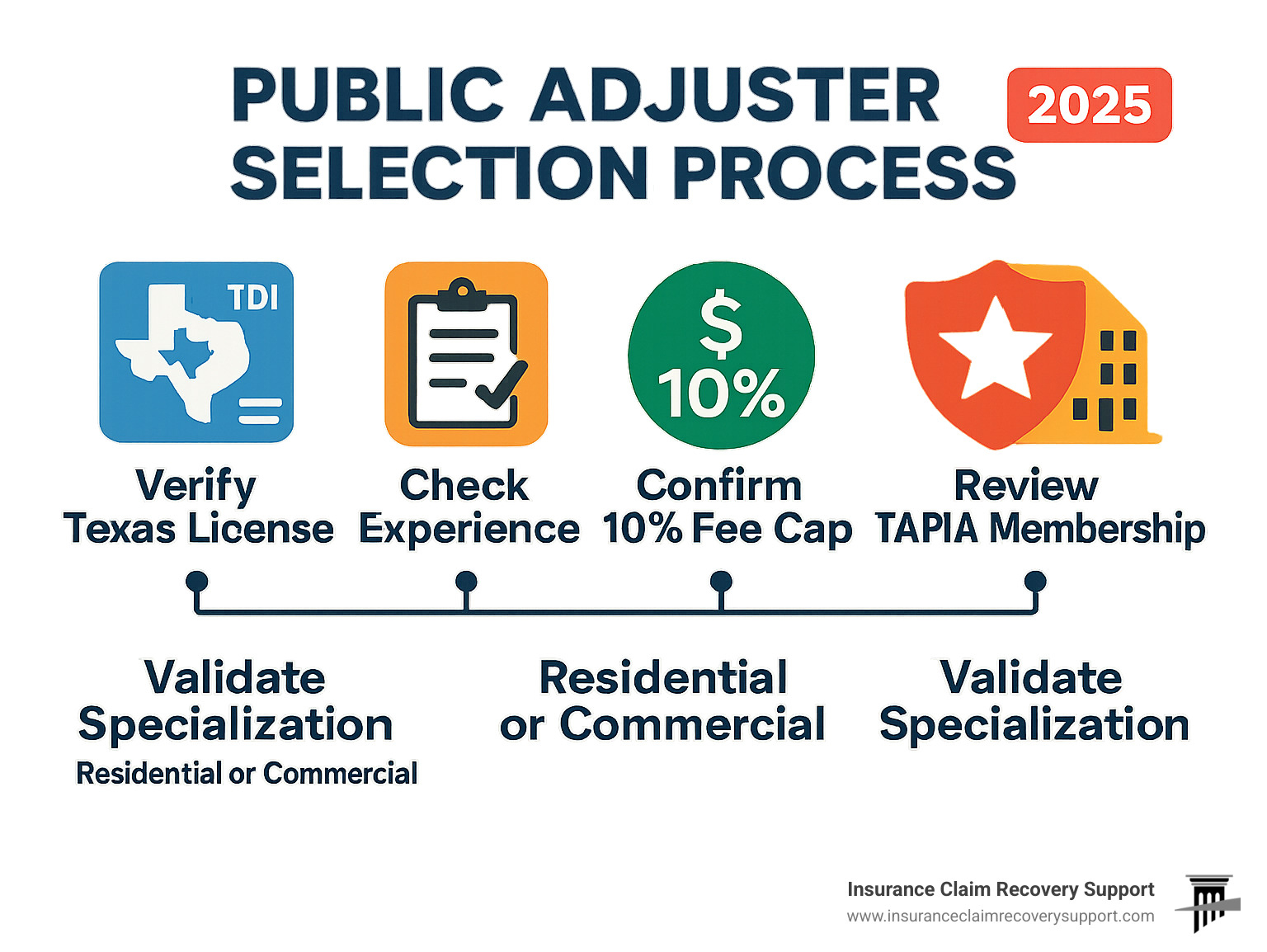

How to Choose the Right Public Claim Adjuster Firm in Texas

Finding the right public claim adjuster firm texas can mean the difference between settling for pennies on the dollar and receiving the full compensation you deserve. After handling hundreds of millions in claims across Texas, I’ve seen how the wrong choice can cost property owners thousands in lost settlements.

The good news? You don’t need to steer this decision blindly. There are clear markers that separate top-tier firms from the rest.

License verification should be your first step, not your last. Every legitimate public adjuster must hold a current Texas license through the Texas Department of Insurance. This isn’t just paperwork – licensed adjusters have passed rigorous exams, met education requirements, and maintain ongoing continuing education. A quick check through the Texas Public Adjuster License Lookup can save you from costly mistakes.

Experience with your specific damage type matters more than you might think. A fire damage expert understands smoke migration patterns and hidden structural damage that storm specialists might miss. When interviewing potential adjusters, ask about recent claims similar to yours and the outcomes they achieved.

Texas presents unique challenges that require local storm expertise. Our weather patterns – from Gulf Coast hurricanes to Panhandle tornadoes, from Hill Country flooding to West Texas wildfires – affect how damage occurs and how repairs must be approached. Your adjuster should understand local building codes, construction methods, and the specific weather patterns that impact your area.

Communication standards reveal a lot about how your claim will be handled. Professional adjusters return calls within 24 hours, provide regular updates without being asked, and explain complex insurance terms in plain English.

Fee structure compliance protects you from predatory practices. Texas law caps public adjuster fees at 10% of your total settlement, and legitimate adjusters work on contingency – meaning no upfront costs to you. If someone asks for money upfront or quotes fees above 10%, walk away immediately.

For property owners dealing with roof damage specifically, our Best Public Adjuster for Roof Leak Insurance Near Me services provide specialized expertise in roof damage assessment and claim advocacy.

We maintain offices throughout Texas to serve property owners statewide. Visit our Locations page to find the office nearest you.

Checklist: Credentials, Fees & Ethics

When evaluating any public adjuster, these non-negotiables should guide your decision:

Start with licensing and credentials. Verify their current Texas public adjuster license through TDI and check for any disciplinary actions. Look for TAPIA membership – the Texas Association of Public Insurance Adjusters maintains higher professional standards. Confirm they carry professional liability insurance and can provide verifiable references from recent clients.

Examine the fee structure carefully. Legitimate adjusters work on contingency-based fees only with no upfront costs. Fee percentages should be at or below the 10% legal limit, clearly stated in writing. Your contract should specify exactly what services are included, and the adjuster must explain your 72-hour rescission right – your legal right to cancel the contract within 72 hours.

Red Flags & Legal Limits

Texas law protects consumers by prohibiting certain practices that can harm your interests. Here’s what to watch for:

Door-knocking during disasters is illegal for public adjusters in Texas. If someone shows up at your door immediately after a storm offering adjuster services, they’re either breaking the law or they’re not actually a public adjuster.

Contractor relationships create dangerous conflicts of interest. Public adjusters cannot act as contractors or provide repair services. If someone offers to both adjust your claim and repair your property, they’re violating Texas law.

Excessive fees violate Texas law and exploit property owners during vulnerable times. Any fee exceeding 10% of your settlement is illegal, period. Be especially cautious of adjusters who demand upfront payments.

Your insurance company has professional adjusters working for them. You deserve the same level of professional representation working exclusively for you.

Working with Your Adjuster: Step-by-Step from First Call to Settlement

Here’s what happens after you reach out to a public claim adjuster firm texas:

- Free consultation – review photos, policy, and goals.

- Sign contingency agreement – no money upfront; you have 72-hour rescission rights.

- Detailed inspection – document every visible and hidden loss.

- Policy analysis – uncover every benefit you’re owed.

- Estimate & proof-of-loss – prepared with current Texas labor and material costs.

- Negotiation – we handle all discussions and rebut low offers.

- Settlement & payment – you approve, funds arrive, our fee comes from the proceeds.

Most claims close within 30–90 days, depending on complexity. Begin with a Free Property Damage Insurance Claim Evaluation by a Public Adjuster.

Frequently Asked Questions about Texas Public Claim Adjusters

When you’re dealing with property damage and considering hiring a public claim adjuster firm texas, you probably have questions. These are the most common concerns we hear from Texas property owners.

How are fees capped and calculated in Texas?

Texas keeps things simple when it comes to public adjuster fees. State law caps our fees at 10% of your total settlement – period. No exceptions, no loopholes.

Here’s how it works: If we help you secure a $100,000 settlement, our maximum fee would be $10,000. If your settlement is $50,000, we can charge up to $5,000. The fee is calculated on your entire settlement amount, not just the increase we helped you achieve.

The best part? You pay nothing upfront and nothing if we don’t increase your settlement. This isn’t like hiring a lawyer where you might pay hourly fees whether you win or lose. We only get paid when you get paid, which means we’re highly motivated to maximize your settlement.

Can I hire a public adjuster after my claim is denied?

This might surprise you, but some of our biggest success stories start with denied claims. Insurance companies make mistakes, miss coverage opportunities, or misinterpret policy language. A fresh set of professional eyes often spots what went wrong.

You can hire a public adjuster at any stage – even months after your claim was denied or you accepted what seemed like a final settlement. We regularly reopen cases that were closed, denied, or severely underpaid.

I’ve seen claims that were initially denied for $0 end up settling for $50,000 or more once we got involved. Sometimes the insurance company’s adjuster simply missed hidden damage or didn’t understand a coverage provision.

What’s the fastest way to verify a public adjuster’s license?

Never skip this step – it’s too important. The fastest way to check is using the Texas Department of Insurance online license lookup system. You can also call them directly at 800-252-3439 if you prefer talking to a person.

The online system shows you everything you need to know: current license status, any disciplinary actions, and confirmation they’re authorized to practice in Texas. It takes about two minutes and could save you from a costly mistake.

Why does this matter so much? Unlicensed individuals cannot legally represent you in insurance claims. Using someone without proper licensing could actually jeopardize your entire claim. A legitimate adjuster will never hesitate to provide their license number or encourage you to verify their credentials independently.

Conclusion

When disaster strikes your Texas home or business, you’re facing more than just property damage – you’re entering a complex insurance maze where the wrong moves can cost you thousands. That’s exactly why choosing the right public claim adjuster firm texas becomes one of the most critical decisions you’ll make during recovery.

The numbers don’t lie. Property owners who work with professional public adjusters see their insurance claim payouts increase by an average of 747% compared to going it alone. That’s not a small difference – it’s often the gap between covering your actual losses and struggling to rebuild properly.

At Insurance Claim Recovery Support LLC, we’ve spent years building something different in the Texas public adjusting landscape. We don’t just process claims – we fight exclusively for Texas property owners who refuse to accept whatever their insurance company decides to offer. From our offices spanning Austin to Dallas-Fort Worth, San Antonio to Houston, and throughout Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway, we’ve seen how insurance companies treat policyholders when they don’t have professional representation.

Here’s what we’ve learned: insurance companies have teams of experts working to minimize your settlement. They have adjusters, attorneys, and entire departments dedicated to paying as little as possible on legitimate claims. Why would you face that machine alone?

Our mission goes deeper than just maximizing settlements. We believe in empowering Texas property owners with the knowledge and professional advocacy needed to level an inherently unbalanced playing field. When your roof gets torn off by a tornado, your business floods, or fire damages your home, you shouldn’t have to become an insurance expert overnight just to get fair treatment.

We handle the paperwork, the negotiations, the back-and-forth with adjusters who speak in policy language designed to confuse. You focus on what matters most – getting your life back to normal while we make sure you receive every dollar you’re entitled to under your policy.

Ready to find what your claim is actually worth? We’re offering a completely Free Property Damage Insurance Claim Evaluation by a Public Adjuster with no strings attached. No cost, no pressure, no obligation – just honest answers about your claim’s potential and clear guidance on your best path forward.

Your property damage is already stressful enough. Let us handle the insurance company while you focus on rebuilding and moving forward. That’s what we’re here for.