What kind of lawyer do I need for property damage? If your property, whether a business or residential, has suffered damage from events like fire, hail, or flood, and you’re questioning the insurance company’s settlement offer, a property damage claim attorney can be invaluable. Here’s a quick breakdown:

- Property Damage Lawyer: Specializes in negotiating claims and handling disputes related to damaged properties.

- Insurance Lawyer: Focuses on legal matters involving insurance companies, particularly useful for policy disputes.

- Personal Injury Lawyer: Often includes property damage in their scope when it’s related to accidents causing personal injuries.

When disaster strikes and causes property damage, understanding the legal landscape is crucial. Property owners often face challenges with insurance claims, from receiving low settlement offers to having claims outright denied. Navigating these issues requires not just any lawyer, but one who understands the nuances of property damage law and can advocate effectively to maximize your compensation. With your rights and significant financial recovery at stake, choosing the right legal representation is paramount.

I am Scott Friedson, a multi-state licensed Public Adjuster and CEO specializing in settling large loss property damage claims. My experience in turning underpaid claims into fair settlements underscores the importance of knowing what kind of lawyer do I need for property damage. Let’s explore further to ensure you get the compensation you deserve.

Important what kind of lawyer do i need for property damage terms:

– commercial property damage

– property damage claim attorney

– personal property damage lawyer

What is Property Damage?

Property damage refers to harm or destruction caused to real or personal property due to events like accidents, natural disasters, or intentional acts. Understanding the types of property involved and the role of insurance policies is crucial for anyone dealing with property damage claims.

Real Property vs. Personal Property

Real Property includes land and anything attached to it, such as buildings or structures. Think of your home, garage, or any permanent installations.

Personal Property, on the other hand, encompasses movable items not permanently affixed to land. Examples include your car, furniture, electronics, and jewelry.

Knowing the distinction is important because it affects how claims are processed and what kind of insurance coverage applies.

Tangible Property

Both real and personal properties are considered tangible property, meaning they are physical and can be touched. This differentiates them from intangible assets like stocks or patents, which require different handling in legal and insurance contexts.

Role of Insurance Policies

Insurance policies are designed to protect against financial losses from property damage. They can cover both real and personal property, but the specifics vary widely between policies.

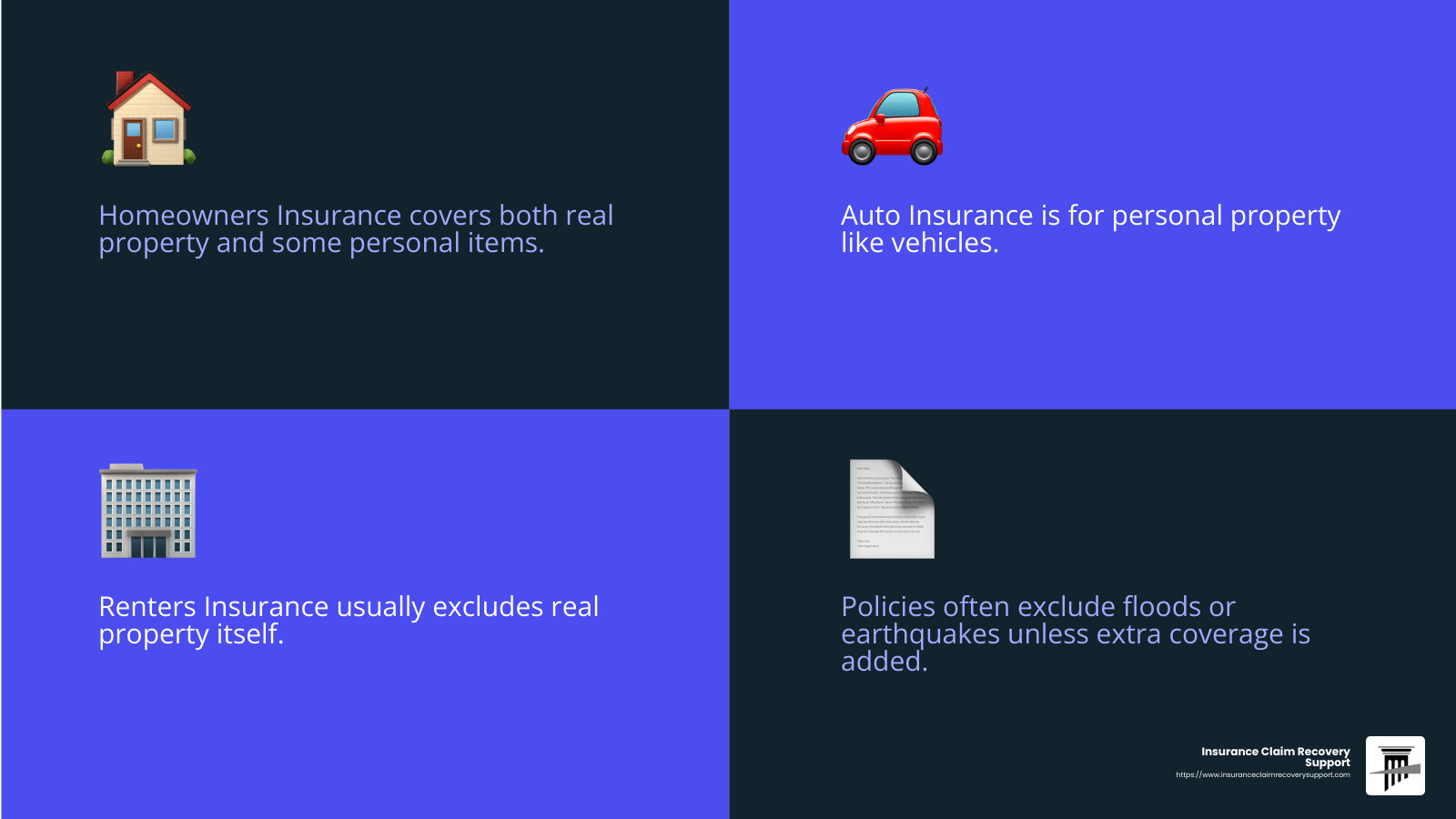

- Homeowners Insurance typically covers real property and some personal property within the home.

- Auto Insurance covers damage to vehicles, which are considered personal property.

- Renters Insurance usually covers personal property within a rented space, not the real property itself.

Understanding your policy is key. Each policy has its own terms, conditions, and exclusions. For instance, many standard policies exclude certain types of damage, like floods or earthquakes, unless additional coverage is purchased.

When property damage occurs, it is essential to review your insurance policy to determine what is covered. This will guide you in filing a claim and seeking compensation. If disputes arise, knowing what kind of lawyer do I need for property damage can ensure you have the right legal support to steer these complexities.

Next, we’ll explore common causes of property damage and how they impact your claims.

Common Causes of Property Damage

Property damage can happen for a variety of reasons, and understanding these can help you prepare and respond effectively. Let’s break down some of the most common causes:

Natural Disasters

Natural disasters are among the most common causes of property damage. Events like earthquakes, hurricanes, hail, and storms can wreak havoc on both real and personal property. For example, in New York, freezing weather during winter months often leads to burst pipes, causing significant water damage. These incidents are typically covered by specific insurance policies, but it’s crucial to check your coverage details.

Human Error

Sometimes, property damage results from simple human mistakes. This can include accidents like a contractor failing to correctly repair property issues or a neighbor accidentally damaging your fence while mowing their lawn. While these situations might seem minor, they can still result in costly repairs and insurance claims. One in 20 insured homes reports a claim each year, highlighting the frequency of such incidents.

Construction Defects

Faulty construction work can lead to severe property damage. Issues like foundation cracks, water leaks, or poor workmanship can cause immediate or future damage. If a contractor’s negligence is the cause, they may be held liable. For instance, if a construction company uses substandard materials that lead to a roof collapse, they could be responsible for the repairs.

Vandalism

Vandalism is an intentional act that can cause extensive damage to property. This includes graffiti, broken windows, or deliberate destruction of property. Businesses and homeowners alike should take preventive measures, such as installing security systems, to deter vandals. Insurance policies often cover vandalism, but it’s wise to confirm the specifics with your provider.

Understanding these common causes of property damage is essential for both prevention and recovery. Knowing what type of coverage you have and what kind of lawyer do I need for property damage can make a significant difference when navigating insurance claims and legal responsibilities.

Next, we’ll dive into the types of lawyers who specialize in property damage and when you might need their expertise.

What Kind of Lawyer Do I Need for Property Damage?

When property damage strikes, navigating the aftermath can be complex. The type of lawyer you need depends on the nature of your claim and the challenges you face. Here’s a breakdown to help you decide.

When to Hire a Property Damage Lawyer

Insurance Disputes: If your insurance company denies your claim or offers less compensation than you believe is fair, a property damage lawyer can help. These lawyers specialize in dealing with insurance companies and can negotiate on your behalf.

Denied or Underpaid Claims: Sometimes, insurers reject claims without valid reasons or offer settlements that don’t cover your losses. A lawyer can challenge these decisions, ensuring you get the compensation you deserve.

Legal Deadlines: You typically have a limited time to file a property damage lawsuit. Missing this deadline can result in losing your right to sue. A lawyer can help you meet all necessary timelines and avoid legal pitfalls.

How a Property Damage Lawyer Can Help

Claim Evaluation: A lawyer will assess your situation to determine the strength of your case. They’ll help you understand your rights and the potential compensation you could receive.

Policy Review: Understanding insurance policies can be tricky. A property damage lawyer will review your policy to identify coverage options you might not be aware of. This ensures you’re claiming everything you’re entitled to.

Negotiation: Lawyers are seasoned negotiators. They know how to deal with insurance adjusters and can work to maximize your settlement. Their expertise can make a significant difference in the outcome of your claim.

Litigation: If negotiations fail, your lawyer can take your case to court. They’ll handle all the legal complexities, from filing the lawsuit to presenting your case before a judge. This is crucial, especially in cases where third-party liability or breach of contract is involved.

In some cases, a personal injury lawyer might also be involved, especially if the property damage is linked to an injury. This dual expertise can be beneficial in securing a comprehensive settlement.

Choosing the right lawyer is crucial in navigating these challenges. Their experience and knowledge can significantly impact your claim’s success. Next, we’ll explore the steps you should take immediately after finding property damage.

Steps to Take After Finding Property Damage

Dealing with property damage can be overwhelming, but taking the right steps early on can make a big difference. Here’s a simple guide on what to do when you find damage to your property.

Mitigate Damages

First, you need to prevent further damage. This is your responsibility as a property owner. For example, if a pipe bursts, turn off the water supply immediately. Doing nothing can worsen the situation and affect your claim.

Document Damage

Thorough documentation is key. Take clear photos and videos of all the damage from different angles. Keep detailed notes about what happened and when. This evidence will be crucial when filing your claim.

File a Report

If the damage involves criminal activity, like vandalism, or if it’s extensive, file a police report. This official document can support your insurance claim by providing a third-party account of the incident.

Contact Insurance

Notify your insurance company as soon as possible. Provide them with all the details and documentation you’ve gathered. This includes any photos, videos, and police reports. The quicker you act, the smoother the process will be.

Filing an Insurance Claim

After contacting your insurance company, you’ll deal with an insurance adjuster. They will evaluate the damage and the coverage of your policy. Be prepared for this step by having all your evidence and repair estimates ready.

-

Documentation: Submit all your gathered evidence to the adjuster. This includes photos, repair estimates, and any other relevant documents.

-

Repair Estimates: Get multiple estimates for repairs. This will help you validate the amount you’re claiming and can be useful during negotiations.

Pursuing Legal Action

Sometimes, insurance claims don’t go as planned. If your claim is denied or underpaid, you might need to consider legal action.

-

Third-Party Liability: If someone else is responsible for the damage, you might need to pursue a claim against them. This could involve proving that their actions directly caused the damage.

-

Breach of Contract: If your insurance provider doesn’t honor the terms of your policy, this could be a breach of contract. Legal action might be necessary to get the compensation you’re owed.

-

Comparative Negligence: In some cases, the blame for the damage might be shared. Understanding how comparative negligence works is important, as it can affect the compensation you receive.

Taking these steps can help ensure that you’re on the right track to recovering from property damage. Proper documentation and knowing when to seek legal help are crucial. Up next, we’ll tackle some frequently asked questions about property damage lawyers.

Frequently Asked Questions about Property Damage Lawyers

Navigating property damage claims can be tricky. Here are some common questions and answers to help you understand the legal landscape.

How do I sue for property damage?

If you decide to sue for property damage, the first step is to file a notice of claim. This is a formal document that informs the responsible party of your intention to seek compensation. It’s crucial to provide detailed information about the damage and any negligence involved.

Once the notice is filed, you can proceed with a lawsuit filing. This involves submitting the necessary legal documents to the court. It’s essential to follow the correct procedures to avoid any delays or dismissals. Consulting a property damage lawyer can help ensure everything is done correctly.

How long do you have to file a property damage claim?

The statute of limitations for property damage claims is generally three years. This means you have three years from the date of the damage to file a lawsuit. Missing this deadline could lead to your case being dismissed.

However, there are exceptions. For instance, if the defendant is out of state or using a false name to conceal their identity, the clock on the three-year deadline may pause. Similarly, if the property owner is under 18 or declared legally incompetent, the timeframe might be extended.

What if my insurance carrier rejects my property damage claim?

Rejection of a property damage claim can be frustrating, but it’s not the end of the road. Dispute resolution is the first step. This involves negotiating with the insurance company to reach a fair settlement. Providing additional evidence or repair estimates can strengthen your case.

If negotiations fail, you might consider legal action. This could involve suing the insurance company for a breach of contract if they haven’t honored your policy’s terms. A property damage lawyer can help you steer the legal process and increase your chances of a successful outcome.

Understanding these aspects can empower you to take the right steps when dealing with property damage. Next, we’ll explore more about property damage lawyers and their role in helping you secure the compensation you deserve.

Conclusion

When it comes to securing the compensation you deserve for property damage, Insurance Claim Recovery Support is your dedicated partner. As a public adjustment firm, we specialize in advocating for policyholders to ensure they receive the maximum settlement possible. Our expertise spans various types of property damage, including fire, hail, hurricane, and flood damage.

Maximizing Settlement

At Insurance Claim Recovery Support, our mission is simple: to maximize your settlement. We understand the tactics insurance companies use to minimize payouts and are committed to countering those strategies with meticulous documentation and negotiation. Our deep knowledge of insurance policies and claims processes allows us to advocate effectively on your behalf, ensuring that no detail is overlooked.

Policyholder Advocacy

We stand firmly on the side of policyholders. Property damage can be overwhelming, both financially and emotionally. Our approach is centered on supporting you throughout the claims process, from filing to settlement. We help you understand your rights and options, providing the guidance you need to make informed decisions.

Nationwide Service

While based in Texas, we serve clients nationwide, including major cities like Austin, Dallas, and Houston. Our experience in handling property damage claims across different states ensures that we can steer the unique challenges each region presents. Whether you’re dealing with storm damage in Texas or another type of property damage elsewhere, we’re here to help.

Don’t let property damage claims overwhelm you. Trust Insurance Claim Recovery Support to be your advocate and guide. Learn more about how we can help you maximize your settlement and support you through the claims process.