Understanding the Association Master Policy: Your Community’s Financial Safety Net

An association master policy is the insurance purchased by an HOA or condominium association to protect shared property and common areas like roofs, exterior walls, hallways, and pools. It acts as the community’s financial safety net, covering large-scale property damage and liability claims that fall outside individual unit owner policies (HO-6).

Quick Answer: What Does an Association Master Policy Cover?

- Property Damage: Common areas, shared structures, and (depending on policy type) some interior elements of individual units

- General Liability: Legal protection when someone is injured in a common area

- Association Protection: Directors & Officers coverage for board decisions

- What It Doesn’t Cover: Your personal belongings, interior unit upgrades (in most cases), and individual liability inside your unit—that’s where your HO-6 policy comes in

However, many homeowners and even board members don’t understand their policy’s details until a disaster—like a hurricane, fire, or burst pipe—causes widespread damage. Inadequate coverage can lead to massive shortfalls, often passed to homeowners as special assessments costing tens of thousands of dollars per household.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. For over 15 years, I’ve helped HOA boards steer complex master policy claims. Understanding your policy isn’t just about compliance; it’s about protecting your community’s financial future.

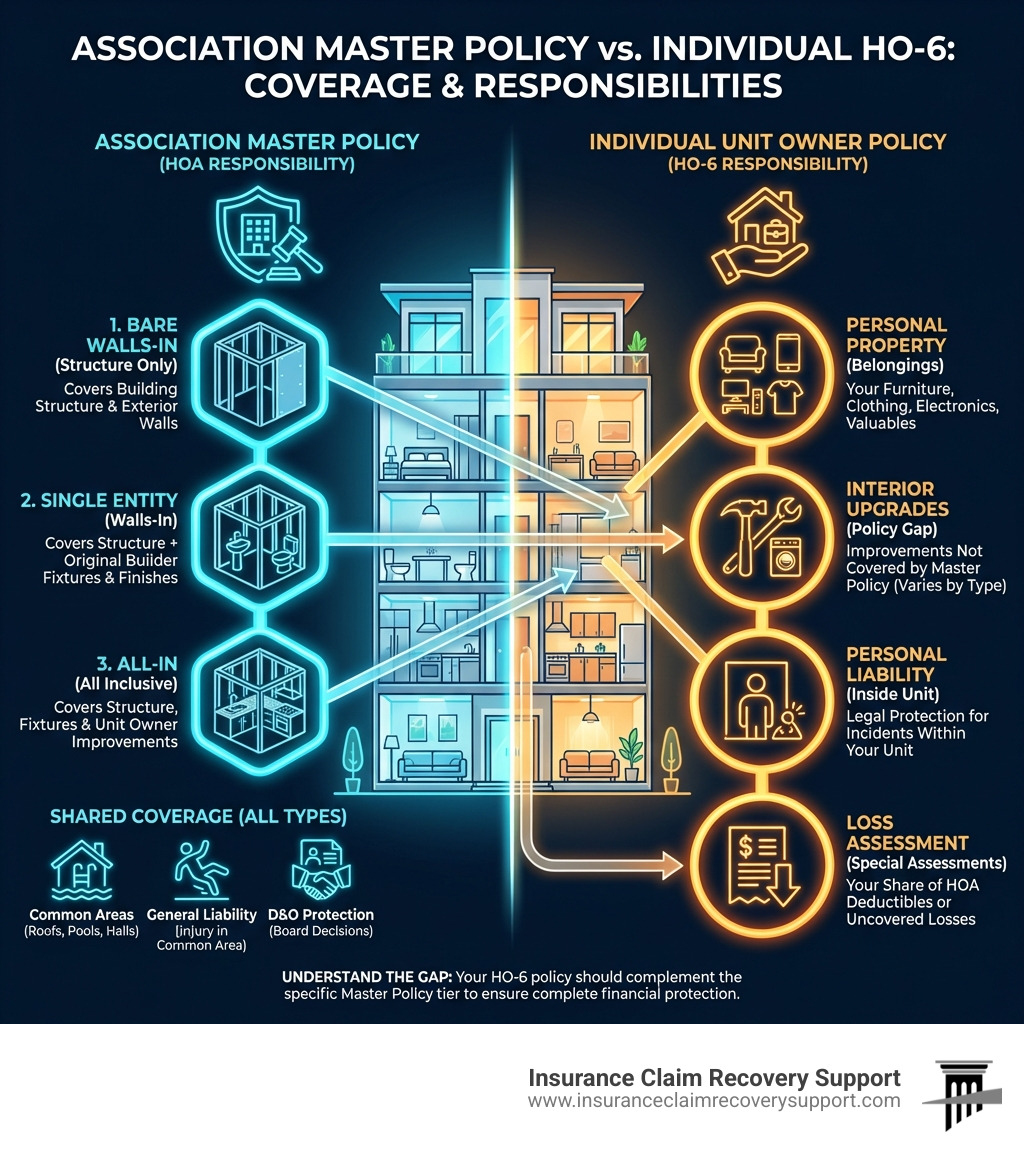

The Three Tiers of Master Policies: ‘Bare Walls’ to ‘All-In’

Understanding where the association’s insurance responsibility ends and the individual unit owner’s begins is critical. This is defined by the three main types of association master policies:

- Bare Walls-In: The most basic policy, covering only the building’s structure (studs, drywall, exterior walls) and common areas. It excludes everything inside the unit, making the homeowner responsible for insuring flooring, fixtures, cabinets, and appliances.

- Single Entity (‘Walls-In’): A middle-ground option covering the structure plus original fixtures and finishes installed by the builder (e.g., standard cabinets, flooring). It does not cover homeowner upgrades or personal belongings.

- All-In (‘All Inclusive’): The most comprehensive policy, covering the structure, common areas, and all fixtures, finishes, and improvements made by unit owners. Personal property (furniture, electronics) is still excluded and requires an individual HO-6 policy.

The required policy type is usually defined in the association’s governing documents (Declaration or CC&Rs). Boards must ensure their policy aligns with these documents, and homeowners need to know the policy type to secure the right HO-6 coverage for their own unit.

What’s Covered vs. What’s Not

An association master policy primarily covers two areas:

- Property Damage: Protects physical assets owned by the association, including the building’s exterior, roof, foundation, and common areas like lobbies, pools, and clubhouses. If a fire or storm damages these shared spaces, this coverage pays for repairs.

- General Liability: Protects the association if someone is injured in a common area and the HOA is found liable. This covers legal fees and settlements from incidents like a slip-and-fall by the community pool.

However, understanding the common exclusions is critical:

- Personal Property: Your furniture, electronics, and clothing are never covered.

- Interior Finishes: Depending on the policy type (especially “bare walls-in”), your flooring, cabinets, and paint may not be covered.

- Personal Liability: Injuries occurring inside your private unit are your responsibility, covered by your HO-6 policy.

- Specific Perils: Disasters like floods and earthquakes typically require separate, specialized insurance policies.

To ensure comprehensive protection, HOAs should also consider these crucial add-ons:

- Directors & Officers (D&O) Insurance: Protects board members from personal liability for decisions made while serving the association.

- Crime/Fidelity Insurance: Safeguards the association’s funds from theft or fraud by board members or employees.

- Workers’ Compensation: Covers injuries to employees or hired contractors, which is often a legal requirement.

- Equipment Breakdown: Pays for failures of essential equipment like HVAC systems, elevators, or pool pumps.

- Ordinance or Law Coverage: Covers the extra cost to rebuild a damaged property to meet current, stricter building codes.

- Flood Insurance: A separate policy required for flood damage, which is excluded from standard policies.

- Umbrella Liability: Provides extra liability protection beyond the general policy’s limits for catastrophic claims.

Decoding Your Association Master Policy Coverage

Understanding the nuances of your association master policy is akin to deciphering a complex blueprint for your community’s financial resilience. It’s not just about having a policy; it’s about knowing what truly protects you when disaster strikes. Factors like premiums, deductibles, and loss assessments directly impact homeowners, while the property’s value and claim history heavily influence the policy’s cost and scope.

The Financial Impact: Premiums, Deductibles, and Loss Assessments

The cost of an association master policy, funded by homeowner dues, is a major part of an HOA’s budget. Premiums are influenced by property value, location (e.g., hurricane-prone areas in Texas), and claim history. The true financial test, however, comes with deductibles and loss assessments.

- Deductibles: This is the out-of-pocket amount the association pays before insurance kicks in. For perils like wind or hail, carriers increasingly use percentage deductibles (1-10% of the total insured value). On a multi-million dollar property, this can result in a deductible of hundreds of thousands of dollars.

- Loss Assessments: If a claim’s cost exceeds coverage limits or the deductible is too large for reserves to cover, the HOA can levy a “loss assessment.” This divides the shortfall among all unit owners, creating a sudden and significant financial burden. While an individual HO-6 policy can offer loss assessment coverage, relying on it to cover a massive master policy deductible is a logistical challenge for the board.

Legal Requirements and Board Responsibilities for an Association Master Policy

HOA boards carry a heavy, often legally mandated, responsibility to secure an adequate association master policy. In Texas, for example, the Texas Uniform Condominium Act (TUCA), Texas Property Code §82.111, requires condo associations to insure common elements and units for at least 80% of their replacement cost, though 100% is the standard best practice.

To fulfill their duties, HOA boards should take these key steps:

- Review Governing Documents & State Law: The board must ensure the master policy aligns with the association’s Declaration, Bylaws, and state laws like the Texas Property Code §82.111, which dictates minimum coverage requirements.

- Conduct a Risk Assessment: Identify the community’s unique risks (e.g., hurricanes, hail, floods) to determine necessary coverage types and limits.

- Obtain and Compare Multiple Quotes: Solicit proposals from several reputable insurance providers to compare coverage, premiums, and deductibles, ensuring the best value.

- Partner with a Specialized Insurance Broker: Work with an agent who understands HOA master policies. They can identify coverage gaps and advocate for the association’s interests.

- Perform an Annual Policy Review: Insurance needs change. The board should review the policy annually to confirm adequate limits, especially after property values increase or upgrades are made.

Neglecting these duties can expose the community to significant financial hardship and leave board members vulnerable to liability claims from homeowners.

Navigating Claims and Ensuring Your Community is Protected

When a major event like a hurricane or fire strikes, even the best association master policy is put to the test. The claims process for a multifamily property is complex, and disputes with insurance carriers can lead to delays and underpaid settlements. This is where proactive policy review and the help of a public adjuster become critical for HOA boards.

Master Policy Claims FAQ: Fact vs. Myth

When disaster strikes, misinformation can spread quickly. Here are the facts on common association master policy claim questions.

Q: May an individual unit owner make a claim under the association’s master policy?

A: Myth. The right to make a claim rests solely with the association (the policyholder), not individual unit owners. Owners must file claims for their own units under their personal HO-6 policy.

Q: Can an HOA force a homeowner to pay a deductible or assessment after a claim?

A: Fact. Yes. Governing documents usually allow the board to levy “loss assessments” to cover the master policy deductible or other uninsured costs. This cost is divided among all unit owners.

Q: What happens if a large claim is submitted? Could our master policy be cancelled?

A: Fact. A large claim or multiple claims can lead to non-renewal or cancellation by the insurance carrier, along with steep premium increases, making it difficult and expensive to find new coverage.

Q: If a claim is denied or underpaid, is a lawsuit our only option?

A: Myth (mostly). Litigation is a costly last resort. A public adjuster is an advocate who works exclusively for the policyholder to resolve claims without lawsuits. Unlike the carrier’s adjuster, a public adjuster documents the loss, interprets the policy, and negotiates to maximize the settlement. Our firm, Insurance Claim Recovery Support, has a 90% success rate in settling claims without unnecessary litigation.

Q: Is the insurance company’s initial settlement offer the final word?

A: Myth. The initial offer is just a starting point. The insurer’s adjuster works to minimize the payout for their employer. A public adjuster works for you to independently assess the damage and negotiate for a full and fair settlement, which is especially vital for complex fire, storm, or water loss claims.

Aligning Policies and Avoiding Costly Gaps in Your Association Master Policy

The interplay between the association master policy and individual HO-6 policies is where communities are most vulnerable. Misalignment creates coverage gaps that leave both the association and homeowners exposed.

To ensure seamless protection:

- Align Policies with Governing Documents: The board must ensure the master policy (bare walls-in, single entity, or all-in) matches the requirements in the association’s Declaration.

- Educate Homeowners: Boards should clearly communicate the master policy’s coverage and deductibles, advising owners to secure robust HO-6 policies with adequate loss assessment coverage.

- Partner with Experts: Both boards and homeowners should work with insurance agents specializing in condo insurance. For large or complex claims, however, an independent advocate is essential.

When a major loss from a fire, hurricane, or widespread water damage occurs, the claim can become overwhelming. A public adjuster from Insurance Claim Recovery Support represents you, the policyholder—never the insurance company. We specialize in large-loss commercial and multifamily claims for HOAs across Texas and other states, navigating the complexities to maximize your settlement and avoid unnecessary litigation. Our goal is to ensure your community gets the full amount it’s owed to rebuild quickly and avoid crippling special assessments.

For more on how we help condominium associations, explore our services at More info about condominium association claim services.

Don’t wait for a disaster. Contact us for a free policy review to ensure your association master policy truly protects your investment.