Navigating Tornado Insurance Claims: What You Need to Know

When the skies clear after a tornado tears through your neighborhood, the silence can feel overwhelming. Amid the debris and damage, you’re left wondering: “What now?”

Tornado insurance claims are typically covered under standard homeowners insurance policies, tucked within your windstorm protection. But understanding exactly what’s covered—and what isn’t—makes all the difference in rebuilding your life.

Most homeowners are surprised to learn their policies actually do cover wind damage to their home’s structure, personal belongings inside, and even debris removal. However, the devil’s in the details. If you live in tornado-prone regions of Texas like Dallas, Houston, or San Antonio, you might have a percentage-based windstorm deductible instead of a flat dollar amount. These typically range from 1-5% of your home’s insured value, which can be significantly higher than your standard deductible.

Time matters tremendously after a tornado. Once you’ve ensured everyone’s safety, filing your claim promptly starts the recovery clock ticking. Many Texas insurers have strict deadlines, and delays could affect your settlement.

Before touching anything, document everything. Those photos and videos of twisted metal, shattered windows, and exposed interiors become your evidence. They tell the story your insurance company needs to hear.

If your home becomes uninhabitable, don’t forget to ask about Additional Living Expenses (ALE) coverage. This valuable protection can cover your hotel stays, restaurant meals, and other costs while you’re displaced. Many policyholders leave this money on the table simply because they didn’t know to ask.

My name is Scott Friedson, and I’ve walked alongside hundreds of families through their darkest days after tornado disasters. As a multi-state licensed public adjuster, I’ve settled over 500 large loss claims exceeding $250 million in total—many of them tornado insurance claims for both homeowners and businesses across the country.

The difference between getting by and truly recovering often comes down to understanding your policy before disaster strikes. Tornadoes can transform your home from safe haven to hazard zone in minutes. Whether you’re facing minor roof damage or complete structural failure, knowing how to steer your claim is the first step toward rebuilding.

Tornado insurance claims vocabulary:

– filing a tornado insurance claim

– tornado insurance claim denial

Tornado Insurance Claims 101: What’s Covered & What’s Not

When a tornado turns your world upside down, understanding what your insurance actually covers can feel like navigating a maze. Most standard homeowners policies include tornado damage under windstorm coverage, but the devil’s in the details.

Your policy typically has your back for wind damage to your home’s structure—from shingles torn off your roof to walls damaged by flying debris. If rain pours through that hole the tornado punched in your roof, the resulting water intrusion damage is usually covered too.

Got a yard full of debris after the storm? Most policies include debris haul-off coverage, though it’s often limited (typically around $3,000). That massive oak tree that fell on your garage? Tree removal costs are generally covered when they damage insured structures, though you won’t be reimbursed for the tree itself.

Perhaps most importantly when your home becomes uninhabitable, your loss of use/additional living expenses coverage kicks in, helping with hotel bills and other temporary living costs while repairs happen.

“Insurers act as the nation’s financial first responders in quickly helping their policyholders,” notes Mark Friedlander from the Insurance Information Institute. But how they calculate your payment makes a world of difference.

A key factor affecting your payout is whether your policy provides Replacement Cost Value (RCV) or Actual Cash Value (ACV) coverage:

| Coverage Type | Definition | Example Payout | Best For |

|---|---|---|---|

| Replacement Cost Value (RCV) | Pays to replace damaged items with new ones of similar quality | $1,500 for a 5-year-old laptop | Maximizing claim value |

| Actual Cash Value (ACV) | Pays replacement cost minus depreciation | $400 for a 5-year-old laptop | Lower premium costs |

What might surprise you is what’s typically NOT covered after a tornado:

Flood damage isn’t included, even if the flooding happened during the tornado (you’ll need separate flood insurance for that). Earth movement including sinkholes triggered by the storm typically falls outside standard coverage. That rotting fence that finally collapsed during the wind? Damage due to neglected maintenance often gets denied. And remember, your insurer won’t pay for costs exceeding your policy limits, which is why having adequate coverage from the start is crucial.

Common Misconceptions About Tornado Insurance Claims

The aftermath of a tornado is no time to find gaps in your understanding. Here are reality checks on common tornado claim misconceptions:

Many homeowners believe all water damage is covered, but that’s simply not true. The source matters enormously—water entering through wind-created openings (typically covered) versus rising floodwaters (not covered) represent completely different claim scenarios.

That fixed dollar deductible you’re thinking of? In tornado-prone regions, you might actually have a percentage deductible for windstorm damage. A 2% windstorm deductible on a $300,000 home means you’re responsible for the first $6,000 before your coverage kicks in—a potentially shocking findy after disaster strikes.

Don’t assume your tornado damage is automatically covered. Some policies in high-risk areas explicitly exclude or limit windstorm coverage without additional endorsements. And perhaps most importantly, never assume your insurer’s adjuster will identify all damage—they’re often handling dozens of claims simultaneously after widespread disasters.

Key Policy Sections Governing Tornado Insurance Claims

Your homeowners policy is organized into sections that determine how tornado insurance claims get paid:

Coverage A (Dwelling) protects your home’s main structure and anything attached to it, like your garage. When tornado winds damage your roof or exterior walls, this is where your claim begins.

Coverage B (Other Structures) covers those detached buildings and features—garden sheds, fences, detached garages—that often suffer significant damage during tornados.

Coverage C (Personal Property) steps in for your belongings inside the home. From furniture to clothing to electronics, this coverage helps replace what the tornado destroyed.

Coverage D (Loss of Use/Additional Living Expenses) becomes your lifeline if your home is temporarily uninhabitable. This covers hotel stays, restaurant meals above your normal food budget, and other additional expenses while you’re displaced.

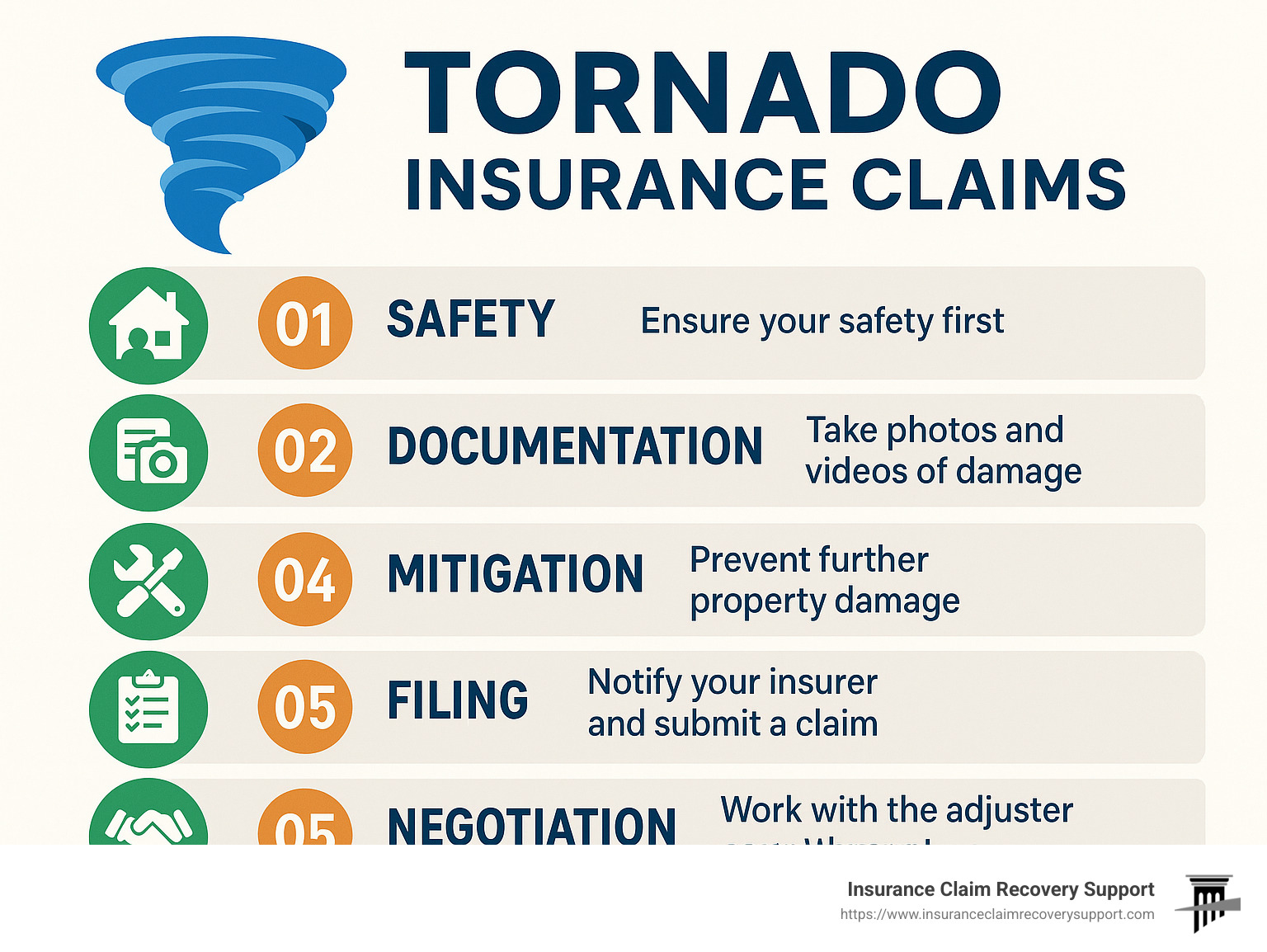

Now that you understand what your insurance should cover after a tornado, let’s walk through the five critical steps to filing a successful tornado insurance claim and getting your life back on track.

Step 1: Ensure Safety, Notify Authorities & Gather Key Documents

When the winds finally die down and you’re facing the aftermath of a tornado, your first instinct might be to rush back home and start the claims process. Please don’t. Your safety matters more than anything else.

“The house can be rebuilt, but you can’t be replaced,” as we often tell our clients at Insurance Claim Recovery Support. Tornadoes create a maze of hidden dangers that aren’t always obvious at first glance.

The Kentucky Department of Insurance puts it plainly: “Never try to re-enter your home or attempt any repairs unless it is safe to do so. Watch for broken power lines, shattered glass, splintered wood or sharp protruding objects and mud-slicked walkways.”

Before taking a single step toward filing your tornado insurance claim, make sure you’re not walking into danger. Wait for official clearance if authorities evacuated your area. When you do approach your property, check for structural stability – those walls might look fine but could collapse at any moment.

Be extremely cautious around downed power lines – they might still be live even if neighborhood power appears out. If you detect the rotten-egg smell of natural gas, shut off utilities immediately and get a safe distance away before calling the gas company.

Many tornado survivors in Dallas and Houston have told us horror stories about injuries from exposed nails, broken glass, and splintered wood – so wear protective gear including sturdy boots, thick gloves, and even a hard hat if you have one.

Once you’ve confirmed it’s safe to be on your property, gathering these essential documents becomes your next priority:

Your homeowners insurance policy is the roadmap for your entire claim process. Don’t have a physical copy? No problem. Your policy number will suffice to get things started. Make sure you have contact information for your insurance agent and the claims department.

You’ll also need personal identification documents and any proof of ownership for valuable items. If you previously created a home inventory, now’s when that preparation really pays off.

Here’s a tip that’s saved countless Texas homeowners headaches: Keep digital copies of all these documents in cloud storage. When tornadoes tear through communities in San Antonio, Lubbock, or Waco, those who can access their policy details regardless of physical damage have a significant head start on recovery.

Immediate Safety Checklist Before Starting Tornado Insurance Claims

Before diving into paperwork, make absolutely certain your situation is stable:

Confirm your home’s structural integrity. Those ceiling cracks might indicate serious structural damage that could lead to sudden collapse.

Check carefully for gas leaks – if you smell gas, don’t turn on lights or use phones inside. Leave immediately and call authorities from a safe distance.

Look for electrical hazards like wet appliances, exposed wiring, or damaged service lines.

Secure temporary shelter if your home isn’t safe. Your policy’s Additional Living Expenses coverage was designed precisely for this situation.

Contact local emergency management for immediate assistance with basics like water, food and shelter.

Let family members know you’re safe using text messages rather than calls (which can overwhelm networks during disasters).

Throughout Texas, the Department of Emergency Management maintains disaster hotlines that can connect you with immediate resources. These services can help bridge the gap while you begin navigating the insurance claim process.

The road to recovery starts with safety. Once you’ve secured yourself and your family, then you can turn your attention to documenting the damage and starting your tornado insurance claim with confidence.

Step 2: Document Every Inch of Damage Like a Pro

When it comes to tornado insurance claims, the photos and videos you take might be worth thousands of dollars. As one seasoned insurance expert told me, “A single photo or video could literally change the outcome of your claim.”

Before you start cleaning up or moving anything, grab your phone and document everything. Start with wide-angle shots of each damaged area to show the overall impact, then move in for detailed close-ups that capture specific damage. Make sure you photograph all sides of your home, including the roof (if you can do so safely).

Your personal belongings matter too! Document every damaged item before you move or discard anything. That favorite couch that got soaked when the roof opened up? That needs a photo. The TV that got smashed by falling debris? Snap a picture. Create a detailed inventory as you go, noting estimated values and purchase dates if you can remember them.

“Document damages to your property before you begin any cleanup,” advises Carl Gross, Chief Operating Officer of a public adjustment firm. “If possible, don’t discard damaged items until the insurance adjuster has had a chance to inspect them.”

For truly impressive documentation that can strengthen your claim, consider these advanced methods:

360° imaging provides a comprehensive view that leaves nothing to the imagination. Many newer smartphones have this feature built right in.

Drone flyovers can safely capture roof damage without putting yourself at risk. If you don’t own a drone, check if any neighbors or local contractors might help.

Professional inspections from contractors or engineers can identify hidden damage that might not be visible to the untrained eye.

Don’t forget to document those easily overlooked items. The power outage that spoiled all your groceries? Take photos of that too. The damaged patio furniture? The torn window screens? The water-stained family photos? Document it all!

For more detailed guidance on creating documentation that speeds up your claim, check out our guide on How to Expedite Property Damage Insurance Claim Settlement.

Best Tools & Apps for Documenting Tornado Insurance Claims

Your smartphone is your most powerful ally when documenting tornado damage. Many insurance companies now offer their own apps specifically designed for claims documentation. These apps often include helpful features like guided photo capture and direct upload to your claim file.

Cloud storage services like Google Photos, iCloud, or Dropbox ensure your documentation stays safe even if your phone gets damaged. Upload your photos and videos as soon as possible after taking them.

When taking photos or videos, try narrating what you’re seeing: “This is the east-facing wall of the living room where the window was broken by debris, allowing rain to soak the hardwood floors and baseboards.” This verbal description creates a more complete record that can jog your memory later.

Digital timestamp tools add another layer of credibility to your documentation. Many camera apps automatically include this information, but double-check that the feature is enabled before you start shooting.

Thorough documentation isn’t just about quantity—it’s about quality too. Make sure your photos are well-lit, in focus, and clearly show the damage. If you’re in a Texas tornado zone like Dallas, Fort Worth, or San Antonio, you might deal with rapidly changing weather after a storm, so try to document damage during daylight hours when visibility is best.

The effort you put into documentation now will pay dividends when it’s time to negotiate your tornado insurance claim. Think of each photo as evidence that supports your case for fair compensation.

Step 3: Mitigate Further Loss & Track Out-of-Pocket Expenses

Once you’ve documented everything, it’s time to prevent further damage to your home. This isn’t just good common sense—it’s actually your legal responsibility under your insurance policy. Insurance companies call this your “duty to mitigate,” and taking reasonable steps now can protect both your property and your claim.

“Think of mitigation as first aid for your home,” explains Scott Friedson, licensed public adjuster. “Just like you’d apply pressure to stop bleeding before reaching the hospital, your home needs immediate attention to prevent small problems from becoming catastrophic.”

Cover any roof openings with sturdy tarps to keep rain out. Those blue tarps you see dotting neighborhoods after a tornado aren’t just for show—they’re essential protection against secondary water damage. Board up broken windows and doors not only to prevent further weather damage but also to secure your property against trespassers.

Standing water removal should be a top priority. Water extraction equipment can be rented from hardware stores if professional services aren’t immediately available. The longer water sits, the greater the risk of mold growth, which could lead to additional claims complications.

Don’t forget to relocate any salvageable items to dry, protected areas of your home or to temporary storage. That family photo album or heirloom furniture might be saved with quick action.

For larger mitigation needs like removing a tree that’s fallen on your roof, don’t hesitate to call professionals. The cost may seem high in the moment, but preventing thousands in additional damage makes it worthwhile—and these emergency services are typically reimbursable under your policy.

Which Expenses Are Reimbursable Under Tornado Insurance Claims?

The aftermath of a tornado often involves significant out-of-pocket expenses, but many of these costs can be recovered through your insurance claim if you track them properly.

“Save every receipt—even for small purchases,” advises a Texas homeowner who weathered the 2019 Dallas tornado. “I kept receipts for everything from tarps to takeout meals, and was surprised how quickly those expenses added up to thousands of dollars.”

Your hotel bills while displaced are typically covered under Additional Living Expenses (ALE) coverage. Most policies provide ALE coverage of 20-30% of your dwelling coverage—meaning if your home is insured for $300,000, you could have up to $60,000-$90,000 available for temporary living arrangements.

Meals above your normal food costs are reimbursable too. While insurance won’t pay for all your food, they will cover the difference between your normal grocery budget and your increased costs while eating out or buying prepared foods.

Other commonly reimbursable expenses include:

Generator fuel costs keep the lights on when power is out, especially important for families with medical needs or during extreme weather. Security services might be necessary if your home is significantly damaged and exposed. Pet boarding fees are often covered when temporary housing doesn’t accept animals. Storage unit rental for protecting undamaged belongings is typically reimbursable as well.

One Fort Worth family shared their experience: “After the tornado took half our roof, we had to move out for three months during repairs. Our insurance covered not just our apartment rent, but also the storage unit for our furniture and even the increased commuting costs to work from our temporary home.”

Mitigation expenses like tarps, plywood, and emergency tree removal are typically covered separately from your ALE limits, so don’t skimp on protecting your property thinking it will eat into your living expense budget.

According to research from FEMA, every $1 spent on mitigation saves an average of $6 in recovery costs. Those temporary repairs truly pay for themselves by preventing more extensive damage.

Document all these expenses with dated receipts, and whenever possible, get approval from your insurance company before incurring major costs. A quick call to your adjuster can confirm coverage and give you peace of mind during an already stressful time.

Step 4: File Your Tornado Insurance Claim & Keep the Paper Trail

The moment of truth has arrived – it’s time to officially file your tornado insurance claim. Don’t delay this crucial step! Most policies require “prompt” reporting, and unnecessary delays could put your entire claim at risk.

When you’re ready to file, here’s how to approach it:

Call your insurance company’s claims department directly. Have your policy number handy and be prepared to explain what happened. The representative will guide you through their specific process and assign you a claim number – write this down immediately as you’ll need it for all future communications.

“The claim number is your golden ticket,” explains one claims professional. “Without it, your documents and calls might get lost in the shuffle, especially after a widespread disaster when insurers are handling thousands of claims simultaneously.”

Submit a formal written notice of loss as well, even if you’ve already called. Many insurance companies now offer convenient online portals or mobile apps for this purpose. This creates an official paper trail with a timestamp that can protect you later if disputes arise.

In Texas, insurance companies must follow strict prompt-payment rules. They’re required to acknowledge your claim within 15 days and make a decision within 15 days after receiving all necessary information. Knowing these timelines helps you hold your insurer accountable if they drag their feet.

Understanding your windstorm deductible is critical at this stage. If you have a percentage-based deductible (very common in tornado-prone areas), your out-of-pocket cost is calculated based on your dwelling coverage amount, not the damage total. For example:

If your home is insured for $400,000 with a 2% windstorm deductible, you’ll be responsible for the first $8,000 of tornado damage before your coverage kicks in. This applies regardless of whether your damage is $10,000 or $100,000.

For more detailed guidance on handling storm-related claims, check out our comprehensive Storm Damage Insurance Claim resource.

How to Submit Strong Tornado Insurance Claims Packages

The difference between an average claim and an excellent one often comes down to organization and thoroughness. Insurance adjusters handle dozens of claims simultaneously, so making their job easier can work in your favor.

Create a comprehensive claims package that includes fully completed claim forms with accurate information. Organize your photos and videos logically – perhaps by room or area of damage – so the adjuster can easily follow along. Include a detailed inventory of damaged items that specifies each item’s description, approximate age, estimated replacement cost, and supporting photos when available.

“I’ve seen policyholders recover thousands more simply because they presented their claim professionally,” notes one claims expert. “When you submit contractor estimates alongside your personal documentation, you’re essentially building your case for proper compensation.”

Maintain your own claim diary documenting every conversation, email, and interaction related to your claim. Note the date, time, person you spoke with, and what was discussed. This simple habit can prevent misunderstandings and provide valuable evidence if disagreements arise later.

What to Expect From Adjusters Handling Tornado Insurance Claims

After filing your claim, your insurance company will assign an adjuster to assess the damage. Understanding the different types of adjusters can help you steer this process more effectively:

Company Adjusters work directly for your insurance company as employees. They handle claims according to company protocols and have authority to settle claims within certain limits.

Independent Adjusters are contractors hired by insurance companies during high-volume claim periods. While not direct employees, they represent the insurer’s interests, not yours.

Public Adjusters (like us at Insurance Claim Recovery Support) work exclusively for policyholders, never for insurance companies. We advocate solely for your interests to ensure you receive the maximum settlement you deserve.

After widespread tornado disasters, the adjustment process often changes. Many insurers now use virtual claims processes where you submit photos, videos and documentation electronically. This approach helps companies handle mass catastrophe events more efficiently, but it puts more responsibility on you to thoroughly document everything.

When an adjuster visits your property (whether virtually or in person), they’ll examine damaged areas, take photos and measurements, and ask questions about when and how the damage occurred. Be present during this inspection if possible – it’s your opportunity to point out all damage and answer questions directly. Your participation helps ensure nothing gets overlooked.

“The inspection isn’t just about the adjuster seeing the damage,” explains a veteran claims professional. “It’s about you showing them everything they need to see. Don’t assume they’ll notice all the problems without your guidance.”

The first settlement offer isn’t necessarily the final one. If you believe the adjuster has missed damage or undervalued repairs, you have the right to present additional evidence and request reconsideration.

Step 5: Negotiate, Repair & Rebuild Without Leaving Money on the Table

When the adjuster’s assessment lands in your inbox, remember one important thing: their first offer is rarely their final offer. Most tornado insurance claims involve some back-and-forth negotiation, and knowing how to steer this process can mean thousands of additional dollars for your recovery.

Take a deep breath and carefully review their settlement offer. Does it truly address all the damage you so carefully documented? Are the repair estimates realistic for contractors in your area? Many initial offers overlook important details like code upgrades that might be required during repairs or fail to properly account for all categories of coverage.

“The first offer is just the starting point,” explains Scott Friedson of Insurance Claim Recovery Support. “Insurance companies often test the waters with a conservative estimate, knowing most homeowners don’t understand they can push back.”

If you feel the offer falls short, don’t hesitate to request clarification on their calculations. Submit any additional documentation that supports higher costs, and get multiple repair estimates from licensed contractors to strengthen your position. Your policy likely includes an appraisal clause you can invoke if there’s a significant disagreement about the damage value.

A homeowner in Fort Worth shared her experience: “After a tornado tore through our neighborhood, the insurance company initially offered $22,000 for our damages. It seemed low, but I almost accepted it out of sheer exhaustion. Instead, we hired a public adjuster who found additional damage the first adjuster missed. Our final settlement was over $58,000—more than double the original offer.”

For more detailed guidance on these negotiations, check out our guide on How to Negotiate with Insurance Adjuster for Property Damage.

Options If Your Tornado Insurance Claim Is Denied or Underpaid

Claim denials happen more often than you might think, but they’re not the end of the road. If your tornado insurance claim is denied or significantly underpaid, you have several paths forward.

First, request a re-inspection with a different adjuster—sometimes a fresh set of eyes makes all the difference. You can also invoke your policy’s appraisal clause, which triggers a formal process where both you and the insurance company select appraisers to reassess the damage.

If these approaches don’t resolve the issue, consider filing a complaint with your state’s Department of Insurance. In Texas, the Texas Department of Insurance can often help mediate disputes between policyholders and insurers.

“Insurance companies know most people give up after the first ‘no,'” says a public adjuster with over 20 years of experience. “But persistence often pays off, especially when you know your rights under the policy.”

For more detailed information on resolving these disputes, visit our Claims Dispute resource.

Choosing Reputable Contractors After a Tornado

When the dust settles and you’re ready to rebuild, choosing the right contractor becomes your next critical decision. Unfortunately, tornado-ravaged communities often attract what industry professionals call “storm chasers”—opportunistic contractors who follow disasters, promising quick repairs but frequently delivering headaches instead.

These operators might demand large upfront payments, perform substandard work, or simply disappear after collecting your deposit. Some lack proper licensing or insurance, leaving you vulnerable if something goes wrong during repairs.

“The days after a tornado are emotional and stressful,” warns the Better Business Bureau. “That’s exactly when predatory contractors strike, pressuring homeowners to make quick decisions they later regret.”

To protect yourself, start by getting at least three written estimates with detailed scopes of work. Verify each contractor’s license, insurance, and bonding status before signing anything. Check references from previous customers, especially those with similar tornado damage repairs.

Never pay more than one-third of the total cost upfront, regardless of what the contractor claims is “standard practice.” Get everything in writing, including clear timelines and payment schedules tied to completion milestones.

A San Antonio homeowner learned this lesson the hard way: “After a tornado damaged our roof, we hired the first contractor who showed up. He took a $5,000 deposit and we never saw him again. The second contractor we hired found numerous problems with the partial work that had been done. We ended up paying twice for the same repairs.”

For Texas residents looking for more specific guidance on tornado recovery, our Texas Tornado resource provides valuable regional information.

The repair and rebuilding phase is just as important as the claim itself. Taking your time to find reputable professionals will ensure your home is restored properly, safely, and according to code—giving you true peace of mind after the storm.

Additional Help Beyond Insurance

Even with insurance coverage, tornado victims often need additional assistance. Several government and nonprofit programs can help:

-

FEMA Assistance: If a federal disaster is declared, FEMA may provide grants for uninsured losses. Visit DisasterAssistance.gov to apply.

-

SBA Disaster Loans: The Small Business Administration offers low-interest loans to homeowners, renters, and businesses to repair or replace disaster-damaged property.

-

Critical Needs Assistance: FEMA offers a one-time $500 payment per eligible household for immediate needs after a federally declared disaster.

-

Tax Relief: The IRS may allow casualty loss deductions and filing extensions for disaster victims.

-

Community Organizations: Local nonprofits, religious organizations, and community foundations often provide immediate assistance with food, clothing, and temporary shelter.

One Texas resident shared: “After insurance only covered part of our tornado losses, we received a $5,000 FEMA grant that helped us replace essential appliances and furniture. The application process was straightforward through DisasterAssistance.gov.”

FEMA and other government assistance typically doesn’t duplicate insurance coverage. As FEMA explains: “By law, FEMA cannot pay for costs covered by insurance. FEMA may provide some help, but it will be limited to what insurance doesn’t cover.”

Frequently Asked Questions About Tornado Insurance Claims

Does homeowners insurance cover all tornado damage?

Most standard homeowners insurance policies do cover wind damage from tornadoes, including damage to your home’s structure and personal belongings. However, there are some important exceptions you should be aware of.

Flood damage isn’t covered, even when it happens during a tornado. This surprises many homeowners who find too late that they needed separate flood insurance. Similarly, earth movement issues like sinkholes that might form during severe storms are typically excluded from standard policies.

If you live in a high-risk area, your policy might have limited windstorm coverage or exclude it altogether, requiring a separate endorsement for proper protection.

As I often explain to clients: “Homeowners insurance typically includes coverage for tornado insurance claims, especially damage caused by high winds. Wind is the primary cause of damage during a tornado, and most standard homeowners insurance policies cover wind-related damages.”

Are there separate windstorm deductibles for tornado insurance claims?

Yes, and this catches many homeowners by surprise. In tornado-prone regions, especially throughout Texas, many policies have separate windstorm deductibles that are significantly higher than your standard deductible.

Instead of the flat $500-$2,000 deductible you might be used to, windstorm deductibles are often calculated as a percentage of your home’s insured value. For example, if your beautiful Dallas home is insured for $300,000 and you have a 2% windstorm deductible, you’ll need to pay $6,000 out-of-pocket before your insurance coverage kicks in.

These percentage-based deductibles are particularly common in tornado-prone Texas cities like Dallas, Fort Worth, Houston, and San Antonio. When reviewing your policy, look specifically for terms like “wind/hail deductible” or “named storm deductible” to understand your financial responsibility when filing a tornado insurance claim.

What’s the difference between Actual Cash Value and Replacement Cost on tornado insurance claims?

This distinction can literally mean thousands of dollars in your pocket after a disaster. Here’s what you need to know:

Actual Cash Value (ACV) pays only the depreciated value of your damaged items. Think of it like this: Your 5-year-old laptop that originally cost $1,500 might only be valued at $400 after depreciation is calculated. That’s all you’ll receive to replace it.

Replacement Cost Value (RCV), on the other hand, pays the full cost to replace your damaged items with new ones of similar quality, without subtracting for depreciation. This means you’ll get enough money to actually replace what you lost.

I’ve seen families devastated twice – first by the tornado, then by finding they only had ACV coverage. One claim professional I work with noted: “The difference between ACV and RCV can easily amount to tens of thousands of dollars on a significant tornado insurance claim.”

While replacement cost coverage does come with higher premiums, most homeowners find the additional protection well worth it when disaster strikes. When reviewing your policy, this is one area where paying a bit more upfront can save you significant heartache later.

Conclusion

The journey through a tornado insurance claim isn’t just about paperwork—it’s about rebuilding your life after disaster strikes. By following the five-step roadmap we’ve outlined—prioritizing safety, carefully documenting damage, preventing further loss, filing a thorough claim, and standing firm during negotiations—you position yourself for the maximum settlement you deserve.

Tornadoes leave more than physical damage; they create emotional upheaval and uncertainty. That’s why having an advocate in your corner can make all the difference. At Insurance Claim Recovery Support LLC, we’ve walked alongside hundreds of homeowners through their darkest days, helping them steer the complex claims landscape when they feel most vulnerable.

Our team of licensed public adjusters serves property owners throughout Texas—from the busy streets of Austin and Dallas to the communities of Fort Worth, San Antonio, Houston, Lubbock, San Angelo, and Waco. We’ve helped families in Round Rock, Georgetown, and Lakeway transform devastating losses into opportunities to rebuild stronger than before.

What makes us different? Unlike insurance company adjusters, we work exclusively for you, the policyholder. We don’t answer to insurance companies, which means our only goal is maximizing your settlement. Our expertise helps identify damage that might otherwise go unnoticed, properly value what you’ve lost, and negotiate with the knowledge and confidence that comes from settling hundreds of large-loss claims.

Many of our clients come to us feeling overwhelmed by the process, only to find relief when they realize they don’t have to fight this battle alone. One homeowner from San Antonio told us: “Having a public adjuster felt like bringing reinforcements to an unfair fight. They spoke the insurance company’s language in a way I never could.”

The settlement you initially receive isn’t necessarily the final word. You have options, and you have rights as a policyholder.

For more specialized information on assessing tornado damage to your property, visit our detailed Tornado Damage Assessment resource.

When the winds have passed but the struggle continues, we’re here to help you rebuild. Don’t settle for less than you deserve—let us help you recover what was lost and move forward with confidence.

For a free consultation on your tornado insurance claim, reach out today. The road to recovery starts with a single call.