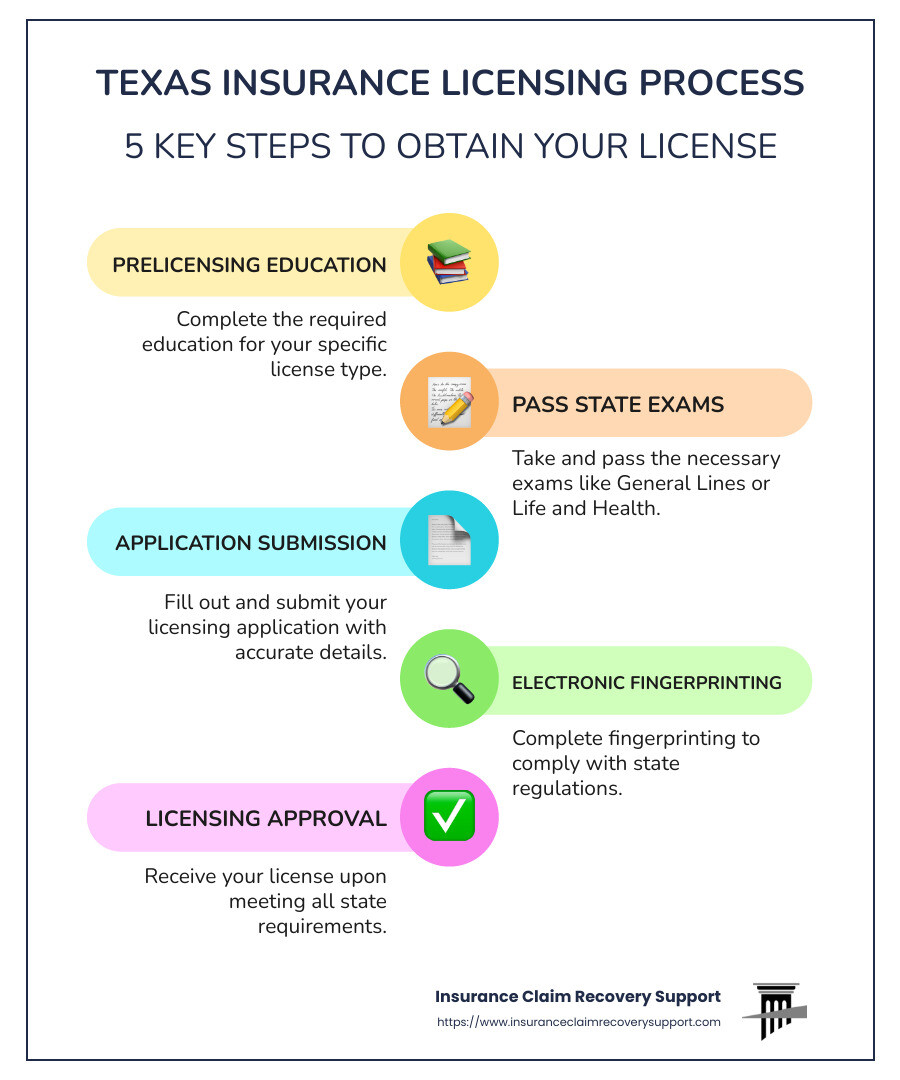

State of Texas insurance license is a crucial component of entering the insurance industry in the Lone Star State. Whether you’re aiming to become an insurance agent, broker, or adjuster, understanding the licensing requirements is the first step. Here are the key steps you need to know:

- Complete any required prelicensing education

-

This may vary by license type.

-

Pass the necessary state exams

-

Options include General Lines, Life and Health, or Property and Casualty.

-

Submit an application and fingerprinting

- Ensure accuracy to avoid delays.

The Texas Department of Insurance oversees these steps, ensuring all applicants meet the state standards for knowledge and professionalism.

I’m Scott Friedson, a multi-state licensed public adjuster and CEO of Insurance Claim Recovery Support, with experience in large property damage claims. Throughout my career, I’ve helped numerous clients steer the intricacies of the state of Texas insurance license requirements to successfully manage their claims. Moving forward, we’ll dig deeper into the details and requirements for obtaining your Texas insurance license.

Know your state of texas insurance license terms:

– bonding for public adjusters

– public adjuster Texas

Understanding the State of Texas Insurance License

Requirements

To get your state of Texas insurance license, you’ll need to meet specific requirements set by the Texas Department of Insurance. While Texas doesn’t mandate prelicensing education for most license types, it’s highly recommended to take a study course to prepare for the challenging exams. However, if you’re applying for a temporary 90-day license, you must complete 40 hours of prelicensing education within 14 days of your application. This is particularly crucial for those aiming for General Lines—Life, Accident & Health, and General Lines—Property & Casualty licenses.

Exam Details

Passing the state exam is a critical step in the licensing process. The exam varies depending on the type of license you’re pursuing. For example, the General Lines—Life, Accident & Health exam and the General Lines—Property & Casualty exam are common choices. Each exam tests your understanding of insurance principles and Texas regulations.

If you’re applying for an Adjuster license, you’ll need to complete a 40-hour prelicensing course, which includes a state certification exam. This exam must be monitored by a disinterested third party to ensure integrity. Applicants with certain professional designations like CLU® or CPCU® may be exempt from specific exams.

Continuing Education

Once licensed, maintaining your Texas insurance license requires ongoing education. Continuing education (CE) ensures you stay updated on industry changes and maintain your professional competency. The number of CE hours required can vary, so check with the Texas Department of Insurance for specifics related to your license type.

CE fines for non-compliance can be paid online, making it easy to manage your obligations. It’s crucial to complete your CE requirements before your license renewal to avoid late fees and potential penalties.

Understanding these elements is essential for anyone looking to establish a career in the Texas insurance industry. With the right preparation and ongoing commitment to education, you can successfully steer the licensing process and maintain your credentials.

Next, we will explore the specific steps to obtain your Texas insurance license, including the application process, electronic fingerprinting, and exam scheduling.

Steps to Obtain Your Texas Insurance License

Now that you understand the requirements and exam details, let’s dive into the specific steps to obtain your state of Texas insurance license. This involves the application process, electronic fingerprinting, and exam scheduling.

Application Process

Start by submitting your application through the Texas Department of Insurance’s online portal. Make sure all your personal information matches your government-issued ID. This is crucial because any discrepancies can lead to delays or complications. After submitting your application, you’ll pay a non-refundable fee. This fee cannot be transferred to another application, so double-check everything before you hit submit.

Electronic Fingerprinting

Fingerprinting is a mandatory step in the licensing process. It ensures the integrity and security of the insurance industry. Schedule your electronic fingerprinting appointment with IdentoGO by IDEMIA. You can do this online or by calling them at 888-467-2080. Appointments are available Monday through Friday from 8 AM to 5 PM Central time. Be sure to bring a valid photo ID to your appointment. Your fingerprints will be sent directly to the Texas Department of Insurance.

Exam Scheduling

Once your application and fingerprints are submitted, it’s time to schedule your exam. You can book your exam online or by contacting Pearson VUE customer service. Make sure your exam appointment aligns with your study schedule, giving you enough time to prepare. Appointments can be made up to one day before the test, depending on availability. Double-check that your name on the exam registration matches your ID exactly to avoid any issues on test day.

By following these steps carefully, you’ll be well on your way to securing your Texas insurance license. Next, we’ll discuss how to maintain your license through renewals and continuing education.

Maintaining Your Texas Insurance License

Once you’ve secured your state of Texas insurance license, keeping it active is crucial. This involves understanding the renewal process, meeting continuing education (CE) requirements, and avoiding late fees. Let’s break it down.

Renewal Process

Your Texas insurance license is valid for two years. The Texas Department of Insurance will notify you about 90 days before it expires. To renew, you’ll need to complete the renewal application online and pay the required fee. If your license is expired, you can still renew it, but you’ll need to pay a late fee in addition to the standard renewal fee.

Continuing Education Requirements

To maintain your license, you must complete 24 hours of continuing education every renewal period. This includes 3 hours of ethics training. If you’re an escrow officer, you’re exempt from CE fines, but you still need to complete any overdue CE before renewing. Failing to meet your CE requirements can lead to fines of $50 per incomplete hour, capped at $500 per license. You can easily pay these fines online through Sircon’s State Invoice Payment service.

Avoiding Late Fees

Don’t let your license expire! If it does, you’ll incur a late fee for each license type or line of authority. The best way to avoid this is by staying on top of your renewal date and completing your CE hours on time. If you need an exemption or extension due to illness, military service, or other uncontrollable circumstances, you can request it online through Sircon.

By understanding these key aspects, you’ll ensure your Texas insurance license remains active and in good standing. Up next, we’ll tackle some frequently asked questions about the state of Texas insurance license, including requirements and exam details.

Frequently Asked Questions about the State of Texas Insurance License

What are the requirements to get an insurance license in Texas?

To get a state of Texas insurance license, you need to complete a few key steps. First, decide which type of insurance license you want. Texas offers various types, including General Lines—Life, Accident & Health, and General Lines—Property & Casualty.

If you’re applying for a temporary license, you must complete 40 hours of prelicensing education within 14 days of your application. However, for a permanent license, prelicensing education is not mandatory, but it’s highly recommended due to the challenging nature of the exam.

After you choose your license type, you’ll need to pass the certification exam. If you hold certain designations like CLU® or CPCU®, you might be exempt from taking the exam.

How much does it cost to get your insurance license in Texas?

The cost of getting your insurance license in Texas varies. For a temporary 90-day license, the fee is $50. This allows you to begin working while you prepare for the permanent license exam.

For a permanent license, the fees depend on the type of license you are applying for. There are additional costs for fingerprinting and background checks, which are essential parts of the application process.

How many questions is the Texas state insurance exam?

The Texas state insurance exam varies in length depending on the type of insurance license you are pursuing. For most licenses, expect to face around 100 to 150 multiple-choice questions.

Each exam is designed to test your knowledge of insurance laws and practices in Texas. It’s crucial to prepare thoroughly, as the exam is rigorous. Consider enrolling in a state-approved course to improve your chances of passing on the first try.

By understanding these requirements, costs, and exam details, you’re well on your way to navigating the Texas insurance licensing process with confidence.

Conclusion

Navigating the state of Texas insurance license process can seem daunting, but it is a vital step for anyone looking to work in the insurance industry. At Insurance Claim Recovery Support, we understand the complexities involved in this journey. Our mission is to advocate for policyholders, ensuring they receive the maximum settlement possible in their insurance claims.

Policyholder Advocacy

Our team is dedicated to standing by policyholders, especially after disasters like Texas fires and storms. With our expertise, we help you understand your policy and steer the claims process. We believe every policyholder deserves fair treatment and compensation.

Texas Insurance Claims

Texas is known for its unpredictable weather, leading to various property damage scenarios. From hail to hurricanes, we assist clients across major cities like Austin, Dallas, and Houston. Our deep understanding of Texas’s insurance landscape enables us to provide effective support, ensuring that claims are handled swiftly and satisfactorily.

In conclusion, obtaining a Texas insurance license is just the beginning. With the right support, you can become a successful advocate for policyholders, helping them through challenging times. Trust us to guide you through the complexities of insurance claims, ensuring you and your clients receive the best possible outcomes.