School public adjuster services are invaluable for educational institutions facing the daunting process of navigating insurance claims after events such as fires, natural disasters, or water damage. Schools often encounter complex insurance policies, and handling claims without professional expertise may lead to unfair settlements or lengthy delays. A public adjuster works on behalf of the school to ensure a fair and prompt settlement while alleviating the burden on school administrators.

In the field of insurance claims, schools face unique challenges due to their complex structures and large properties. This is where a public adjuster steps in, bridging the gap between schools and insurance companies to handle everything from policy details to claim negotiations. By enlisting these professionals, schools can better focus on education and recovery, without getting lost in paperwork or low settlement offers.

Scott Friedson, a seasoned multi-state licensed public adjuster, has a proven track record in assisting schools and other institutions with significant property claims. From a wealth of experience in guiding schools through the challenging claims process, Friedson ensures institutions receive the best possible outcomes, helping them to quickly resume normal operations.

Understanding the Role of a School Public Adjuster

A school public adjuster plays a crucial role in managing the insurance claims process for educational institutions. Their primary responsibility is to advocate for schools, ensuring they receive fair settlement after events like fires, floods, or other disasters. Here’s a closer look at what these professionals do:

Job Duties and Responsibilities

Damage Assessment: The first step involves inspecting and documenting the extent of damage to school property. This ensures no detail is missed and the claim reflects the true extent of the loss.

Policy Review: Schools often have complex insurance policies with specific coverage and exclusions. Public adjusters review these policies to determine what is covered and help schools understand their entitlements.

Claim Preparation: Preparing a claim involves compiling necessary documents, including estimates, photos, and reports. This comprehensive documentation supports the claim and aims to maximize the settlement.

Negotiation: Public adjusters negotiate with insurance companies on behalf of the school. Their goal is to secure a settlement that accurately reflects the school’s losses and needs.

Settlement Guidance: Once an offer is made, the adjuster helps the school understand and evaluate it, ensuring the settlement is fair and meets the institution’s requirements.

Navigating Insurance Policies and Claims Process

Insurance policies can be daunting, filled with legal jargon that can confuse even the most seasoned administrators. Public adjusters are fluent in this language, offering clarity and guidance. They ensure that schools are not shortchanged due to misunderstood policy terms or overlooked coverage.

The claims process itself can be time-consuming and complex. It involves multiple steps, from initial filing to final settlement, and requires meticulous attention to detail. Public adjusters streamline this process, handling communications and paperwork, so school officials can concentrate on their primary mission: education.

Case in Point

Consider a scenario where a school suffers extensive damage from a storm. A public adjuster would step in to assess the damage, review the school’s insurance policy, and prepare a detailed claim. They would then negotiate with the insurance company to secure a settlement that allows the school to repair and reopen quickly, minimizing disruption to students and staff.

By taking on these responsibilities, school public adjusters relieve educational institutions of the burden of managing complex insurance claims, enabling them to focus on recovery and continued operation. This specialized support is invaluable in ensuring schools receive the settlement they deserve, allowing them to rebuild and move forward confidently.

Steps to Becoming a Public Adjuster for Schools

Becoming a school public adjuster involves a series of steps, primarily focusing on obtaining the necessary licenses and education. Each state has its own requirements, and we’ll look at Michigan and Florida as examples.

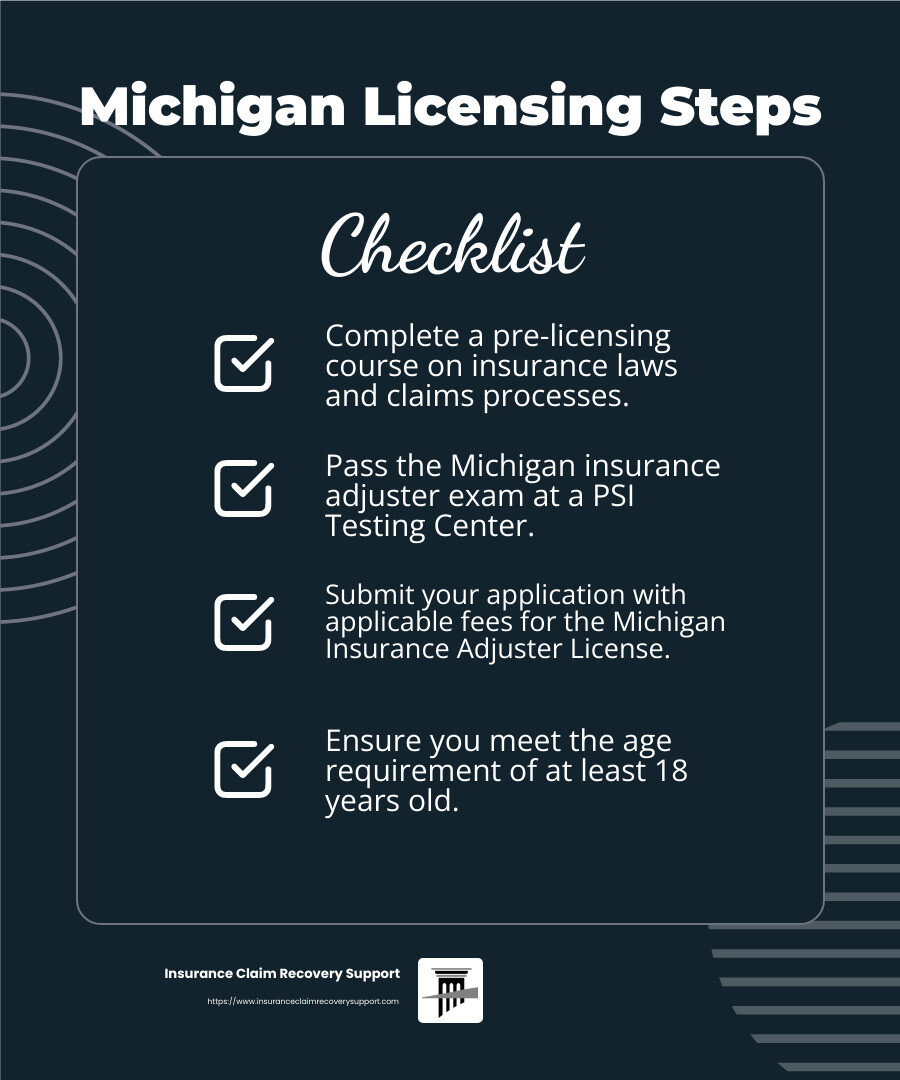

Licensing Requirements in Michigan

In Michigan, aspiring public adjusters must meet several key requirements:

Pre-Licensing Course: Before taking the state exam, you must complete an approved pre-licensing course. This course covers essential topics like insurance laws, policy details, and claims processes.

State Exam: After completing the course, you’ll need to pass the Michigan insurance adjuster exam. This exam tests your knowledge of state-specific regulations and general insurance principles. It’s administered by PSI Testing Centers.

Application Process: Once you pass the exam, submit your application for the Michigan Insurance Adjuster License. Along with the application, you must pay the applicable fees.

Age Requirement: You must be at least 18 years old to apply for a license in Michigan.

Licensing Requirements in Florida

Florida has a slightly different path for public adjusters:

Public Adjuster Apprentice: Begin as a public adjuster apprentice. This role allows you to gain practical experience under the supervision of a licensed public adjuster.

Pre-Licensing Education: Like Michigan, Florida requires you to complete a pre-licensing course, which prepares you for the state exam.

State Exam: The next step is passing the Florida state exam for public adjusters. This exam is conducted by Pearson Vue and covers policy interpretation, claims negotiation, and ethical practices.

Application Process: After passing the exam, you can apply for your license. Florida also requires you to obtain a $50,000 surety bond as part of the licensing process.

Continuing Education: Once licensed, you must complete 24 hours of continuing education every two years to maintain your license.

Both states emphasize a thorough understanding of insurance laws and policies. Continuous learning is crucial, as the field of insurance is always evolving. Whether you’re in Michigan or Florida, becoming a school public adjuster requires dedication to learning and a commitment to advocating for educational institutions.

Essential Skills and Knowledge for School Public Adjusters

Being a school public adjuster requires a unique set of skills and knowledge. Let’s break down the essentials you’ll need to succeed in this role.

Negotiation Skills

Negotiation is key in ensuring schools receive fair settlements. As a public adjuster, you’ll advocate for schools by negotiating with insurance companies. This involves presenting evidence, making persuasive arguments, and sometimes even standing firm against initial offers. Strong negotiation skills can lead to higher settlement amounts, ensuring schools have the funds needed for repairs and recovery.

Understanding Insurance Laws

Knowledge of insurance laws is crucial. Each state has specific regulations that govern insurance claims. Understanding these laws helps you steer the claims process effectively and ensures that schools comply with all legal requirements. This knowledge also empowers you to protect the rights of your clients and challenge any unfair practices by insurers.

Policy Details

Insurance policies can be complex. A school public adjuster must be able to interpret policy details accurately. This includes understanding coverage limits, exclusions, and the specific terms that apply to educational institutions. By mastering policy details, you can identify all possible avenues for settlement and avoid potential pitfalls that could limit a school’s claim.

Investigation Techniques

Finally, strong investigation techniques are essential. Adjusters must thoroughly investigate claims to determine their validity and the extent of damage. This involves inspecting properties, reviewing records, and interviewing witnesses. Effective investigation ensures that all relevant information is considered, leading to a fair assessment of the claim.

In summary, becoming a successful school public adjuster involves honing your negotiation skills, understanding insurance laws, mastering policy details, and developing robust investigation techniques. These skills will enable you to advocate effectively for schools, ensuring they receive the support they need to recover from losses.

Next, we’ll explore the benefits of using a public adjuster for schools.

Benefits of Using a Public Adjuster for Schools

When schools face damage from events like storms or fires, navigating insurance claims can be overwhelming. This is where a school public adjuster can make a big difference.

Higher Settlement Offers

Public adjusters are experts in evaluating damage and ensuring no detail is missed. Statistics show that claims managed by public adjusters often result in higher settlements. For example, after Hurricane Michael, a public adjuster helped a homeowner uncover additional structural damage, leading to a much higher payout. Schools can benefit similarly by receiving the full settlement they deserve.

Expertise and Fair Negotiations

Insurance policies are often filled with complex terms. A public adjuster understands these complexities and can negotiate fairly with insurance companies. They know how to counter low settlement offers and ensure that schools get the funds they need for repairs. As one adjuster put it, “Insurance companies have experts working for them. You should, too!”

Policyholder Advocacy

A public adjuster acts as an advocate for the policyholder—in this case, the school. They handle all the intricate details of the insurance policy, ensuring that all damages are accounted for and that the school’s interests are protected. Their goal is to maximize the settlement and ensure a smooth claims process.

In summary, hiring a school public adjuster can lead to higher settlements, fair negotiations, and strong advocacy for schools. This expertise can be invaluable, especially when dealing with complex insurance claims.

Next, let’s dive into some frequently asked questions about becoming a school public adjuster.

Frequently Asked Questions about Becoming a School Public Adjuster

Is using a public adjuster a good idea?

Absolutely! Using a school public adjuster can be incredibly beneficial. They bring negotiation skills and policy expertise to the table, which are crucial when schools face complex insurance claims. Public adjusters are skilled at assessing the full extent of damages and ensuring that schools receive the highest possible settlements. They act as advocates for the policyholder, ensuring fair negotiations with insurance companies. This can make a significant difference in the outcome of a claim, often leading to much higher settlements than if the school handled the claim on its own.

How long does it take to become a public adjuster?

The path to becoming a public adjuster involves several steps and can vary by state. Generally, it includes completing an apprenticeship, preparing for the exam, and going through the licensing process. In states like Florida, you might start as a public adjuster apprentice, gaining hands-on experience. This period can last up to a year. Afterward, you’ll need to pass a state exam, which requires thorough preparation to understand insurance laws and policies. The entire process can take anywhere from several months to over a year, depending on the state’s specific requirements and your commitment to completing the necessary steps.

How much do public adjusters make?

Public adjusters have a wide salary range, influenced by experience, location, and the complexity of the claims they handle. On average, public adjusters in the U.S. earn around $61,465 per year, according to Indeed.com. However, top earners—especially those handling large or complex claims—can make significantly more, with some reports indicating earnings in the six-figure range. The potential for high earnings makes this career appealing, especially for those who excel in negotiation and have a keen understanding of insurance policies.

Conclusion

At Insurance Claim Recovery Support, we are committed to advocating for policyholders, especially schools, to ensure they receive the maximum settlement they deserve. As a dedicated school public adjuster, we work exclusively for policyholders, not insurance companies. This means our primary focus is on representing your best interests throughout the claims process.

With our expertise, we steer the complexities of insurance claims, ensuring that every detail is accounted for and that schools receive fair and just settlement. Our team is skilled in negotiation and has a deep understanding of insurance policies and regulations, which allows us to secure higher settlement offers for our clients.

We proudly serve policyholders across Texas, including major cities like Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway. Our local presence and knowledge of Texas-specific regulations give us an edge in handling claims related to fire and storm damage.

If you’re dealing with a property damage claim, don’t face it alone. Let us be your advocate and guide you through the process. Visit our Texas Fire and Storm Damage Public Adjuster page to learn more about how we can help your school steer the path to a successful claim settlement.

By partnering with us, you can rest assured that you have a dedicated team working tirelessly to secure the outcome you deserve.s