Why Personal Property Damage Lawyers Are Key to Your Claim

Personal property damage lawyers are essential if you’ve experienced unexpected harm to your valuable items. They help you get the compensation you deserve.

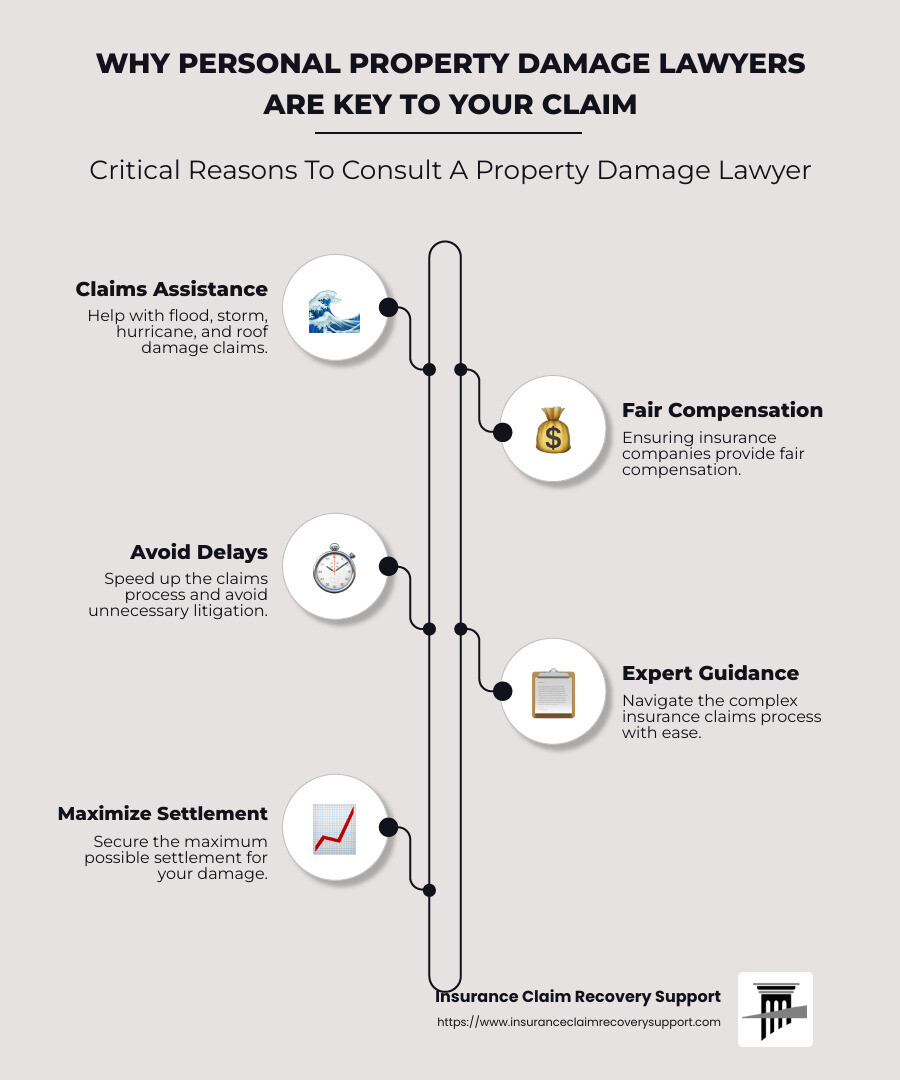

Here are the main reasons you might need a personal property damage lawyer:

- Claims : Assist with flood damage, storm and hurricane damage, roof damage

- Negotiation: Ensure fair compensation from insurance companies

- Avoiding Delays: Speed up the claims process and prevent unnecessary litigation

Property damage can turn your world upside down. Unexpected harm to your home, prized possessions, or business assets can be stressful and costly. This is where a personal property damage lawyer steps in. They help you through the intricate insurance claims process, ensuring that you receive the compensation you’re rightfully owed.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support LLC. With over 500 large loss claims and $250 million in settlements, I specialize in helping policyholders secure fair compensation.

Personal property damage lawyer terms explained:

– property damage claim attorney

– property insurance attorney

– commercial property damage claims

What is Personal Property Damage?

Personal property damage occurs when your belongings are harmed, reducing their value or functionality. This can be due to natural causes like floods and hurricanes or man-made actions such as vandalism and negligence.

Legal Definition

Legally, personal property damage refers to the destruction or impairment of movable items. Unlike real property (land and buildings), personal property includes things you can take with you when you move.

Examples

Personal property damage can affect a wide range of items. Here are some common examples:

- Electronics: TVs, computers, and smartphones

- Furniture: Sofas, beds, and tables

- Vehicles: Cars, motorcycles, and boats

- Jewelry: Rings, necklaces, and watches

- Appliances: Refrigerators, ovens, and washing machines

Monetary Value

The monetary value of personal property is critical in damage claims. Insurance companies often try to minimize payouts, so know the worth of your belongings. Detailed inventories, including photos and receipts, can help prove value.

Functionality Loss

When property loses its functionality, it can no longer serve its intended purpose. For example, a water-damaged laptop might not work, or a vandalized car may be undriveable. Functionality loss often leads to higher compensation claims because the item is either unusable or needs expensive repairs.

Case Study: Water Damage

Consider a case where a burst pipe floods a home, damaging furniture and electronics. The homeowner’s insurance policy covers water damage, but the insurance company offers a low settlement. The homeowner hires a personal property damage lawyer who negotiates a fair payout by proving the true value and functionality loss of the damaged items.

Understanding what constitutes personal property damage and its implications can help you steer the claims process more effectively. This knowledge is crucial when dealing with insurance companies to ensure you get the compensation you deserve.

Next, we’ll explore When to Hire a Personal Property Damage Lawyer.

When to Hire a Personal Property Damage Lawyer

Navigating property damage claims can be tough. Knowing when to hire a personal property damage lawyer can make a huge difference in getting the compensation you deserve. Here are some key scenarios where hiring a lawyer is essential:

Home Insurance Claims

Filing a home insurance claim might seem straightforward, but it can quickly become complicated. Insurance companies often use complex language and procedures that can confuse policyholders. A personal property damage lawyer can simplify the process, ensuring you meet all deadlines and provide the necessary documentation.

Denied Claims

Insurance companies sometimes deny claims, even when they are valid. Common reasons for denial include:

- Late filing: Missing deadlines can void your claim.

- Lack of evidence: Insufficient proof of damage can lead to denial.

- Policy exclusions: Certain types of damage might not be covered.

In these cases, a lawyer can help you appeal the denial and present a stronger case.

Under-Compensated Claims

Even if your claim is approved, the payout might not cover your losses. Insurance companies often undervalue claims to save money. For example, they might offer less than the replacement cost of damaged items. A personal property damage lawyer can negotiate with the insurer to ensure you receive a fair settlement.

Insurance Company Disputes

Disputes with insurance companies are common. They might argue over the extent of the damage or the value of your belongings. A lawyer can act as your advocate, handling communications and negotiations to resolve the dispute.

Case Study: Hurricane Damage

Imagine your home is hit by a hurricane, causing extensive damage to your roof and personal belongings. You file a claim, but the insurance company offers a low settlement, citing exclusions and depreciation. Frustrated, you hire a personal property damage lawyer who reviews your policy, gathers evidence, and negotiates a higher payout. The lawyer’s expertise ensures you get the compensation needed to repair your home and replace your belongings.

Understanding these scenarios can help you decide when to seek legal assistance. Next, we’ll dig into the Types of Personal Property Damage Claims you might encounter.

Types of Personal Property Damage Claims

When it comes to personal property damage, several scenarios might necessitate filing a claim. Each type of damage has its own unique challenges and requirements. Here’s a breakdown of the most common types of personal property damage claims:

Fire Damage

Fire can cause devastating damage to homes and businesses. Beyond the immediate destruction from flames, smoke and water used to extinguish the fire can also cause significant harm.

Common Causes:

– Unattended cooking

– Electrical faults

– Heating equipment malfunctions

– Arson

Water Damage

Water damage claims are among the most frequently filed. This type of damage can result from various sources, including burst pipes, plumbing failures, and natural disasters.

Examples:

– Flooding from storms (requires separate flood insurance)

– Leaky or burst pipes

– Overflow from appliances like washing machines

Vandalism

Vandalism involves intentional damage to property. This can range from graffiti on walls to more severe acts like breaking windows or damaging vehicles.

Common Targets:

– Residential homes

– Commercial properties

– Vehicles

Wind Damage

Wind damage typically results from high-powered winds during storms, hurricanes, or tornadoes. This can affect the structural integrity of buildings and cause significant property damage.

Common Wind Damage:

– Roof damage (lifting, missing shingles)

– Broken windows

– Damaged siding and gutters

Hurricane Claims

Hurricanes can cause widespread destruction, affecting both the exterior and interior of properties. Common types of hurricane damage include broken windows, roof damage, and water intrusion leading to mold.

Key Points:

– Florida law requires windstorm coverage in residential insurance policies.

– Damage can include structural and personal property loss.

Mold Claims

Mold can develop due to water damage or high humidity levels. It not only damages property but also poses health risks.

Signs of Mold:

– Musty odors

– Visible mold growth on walls or ceilings

– Health issues like allergies or respiratory problems

Roof Damage

Roof damage is a common issue, especially in areas prone to severe weather. It can result from high winds, falling tree branches, or hail.

Types of Roof Damage:

– Missing or damaged shingles

– Leaks and water damage

– Structural damage from fallen debris

Defective Construction

Defective construction claims arise when property damage results from poor workmanship or substandard materials used during construction.

Examples:

– Cracks in walls or foundations

– Faulty plumbing leading to water damage

– Improperly installed roofs or windows

Commercial Property Damage

Businesses can suffer from various types of property damage, affecting their operations and financial stability. Common claims include fire damage, theft, and weather-related damage.

Common Commercial Claims:

– Burglary and theft

– Fire and smoke damage

– Weather-related damage (wind, hail, flooding)

Residential Property Damage

Residential property damage encompasses a wide range of issues that can affect homeowners. This includes everything from minor repairs to major reconstruction after a disaster.

Examples:

– Roof damage from storms

– Water damage from burst pipes

– Fire and smoke damage

Understanding these types of personal property damage claims can help you be better prepared and know what to expect. Next, we will explore How Personal Property Damage Lawyers Can Help you steer these claims effectively.

How Personal Property Damage Lawyers Can Help

Navigating the maze of property damage claims can be overwhelming. A personal property damage lawyer can be your guide, ensuring you get the compensation you deserve. Here’s how they can help:

Filing Claims

The first step in any property damage case is filing a claim. This might sound straightforward, but it involves a lot of paperwork and specific details. A lawyer can:

- File your claim promptly: Timing is crucial, especially with statutes of limitations varying by state.

- Ensure all necessary documentation: Missing documents can delay or even void your claim.

Insurance Claims Process

Insurance companies often have complicated processes that can be hard to understand. A lawyer will:

- Handle communication: They’ll act as a buffer between you and the insurance company.

- Guide you through each step: From filing to final settlement, they ensure you don’t miss anything.

Documentation

Proper documentation is key to a successful claim. A lawyer can help you:

- Gather evidence: Photos, videos, and detailed inventories of damaged items.

- Obtain repair estimates: Multiple estimates to validate the amount you’re claiming.

- Compile witness statements: Statements from anyone who saw the damage occur.

Negotiation

Insurance companies often try to settle for less than you deserve. A lawyer can:

- Negotiate fair settlements: Using your evidence to counter lowball offers.

- Stand firm: They know the tactics insurers use and how to counter them effectively.

Dispute Resolution

If your claim is denied or underpaid, a lawyer can:

- Challenge the denial: They’ll review your policy and the reason for denial, then fight for your rights.

- Resolve disputes: Whether through negotiation or litigation, they aim to get you what you’re owed.

Maximizing Compensation

A lawyer’s goal is to maximize your compensation. They do this by:

- Identifying all recoverable losses: From structural damage to relocation costs.

- Ensuring policy compliance: Making sure the insurer sticks to their contractual obligations.

By leveraging their expertise, a personal property damage lawyer can make a complex and stressful process much more manageable. They help you focus on restoring your life and property while they handle the legal complexities.

Next, we will dig into Common Tactics Used by Insurance Companies to understand how they might try to minimize your claim and how you can be prepared.

Common Tactics Used by Insurance Companies

Insurance companies often employ various tactics to minimize the amount they pay out on claims. Understanding these tactics can help you be better prepared and protect your interests. Here are some common strategies insurers use:

Claim Denial

One of the most straightforward tactics is to deny your claim outright. This can be for reasons such as:

- Late filing: If you miss the deadline for filing your claim, it may be denied.

- Lack of coverage: The insurer may argue that your policy doesn’t cover the type of damage you’ve claimed.

- Insufficient documentation: If you haven’t provided enough evidence, your claim can be denied.

Example: After a hurricane, a Florida homeowner’s claim was denied because the insurer argued that the damage was due to flooding, which wasn’t covered under the homeowner’s policy.

Underpayment

Even if your claim is approved, insurance companies may offer less than what you’re entitled to. They might:

- Lowball offers: Provide an initial offer that’s much lower than the actual cost of repairs.

- Omitting certain damages: Exclude parts of the damage from their assessment.

Statistic: About half of all restaurant owners report that weather damage has closed their business at some point, yet many receive lowball offers that don’t cover the full extent of the damage.

Delaying Claims

Delaying the processing of claims is another common tactic. This can frustrate policyholders and pressure them into accepting lower settlements. Delays can occur due to:

- Requesting additional documentation: Asking for more and more paperwork.

- Slow communication: Taking a long time to respond to your inquiries.

Quote: “Damage doesn’t get better with time,” says Tim Felks, head of property claims at Farmers Insurance. Reporting a claim as soon as possible can help get repairs going sooner.

Misrepresentation

Insurance companies might also misrepresent the details of your policy to minimize payouts. They could:

- Misinterpret policy terms: Twist the language of your policy to argue that certain damages aren’t covered.

- Downplay the extent of coverage: Claim that your policy limits are lower than they actually are.

Fact: Homeowners often aren’t aware of policy caveats and exclusions until they need to file a claim, making them vulnerable to misrepresentation.

Bad-Faith Tactics

When insurers don’t act in good faith, they can be held accountable. Bad-faith tactics include:

- Ignoring claims: Not acknowledging or acting on your claim within a reasonable timeframe.

- Providing unreasonable explanations: Giving vague or unjustified reasons for denying or underpaying your claim.

Case Study: A blog post by a defense law firm suggested that insurers benefit by delaying claim payments to pressure policyholders into settling for less. This unethical strategy was exposed and criticized by the Dallas Morning News.

By understanding these tactics, you can better steer the claims process and advocate for your rights. A personal property damage lawyer can help you counter these strategies and ensure you receive the compensation you deserve.

Next, we will explore the Recoverable Losses in Personal Property Damage Claims to understand what types of damages you can claim.

Recoverable Losses in Personal Property Damage Claims

When your property is damaged, understanding what you can claim is crucial. Here are some common types of recoverable losses in personal property damage claims:

Structural Damage

Structural damage refers to harm to the main parts of your property, like the walls, roof, and foundation. Imagine a hurricane ripping off your roof or a fire charring your walls. These damages can be extensive and expensive to repair.

Example: After a hurricane, a Florida homeowner’s roof was severely damaged by flying debris. The insurance covered the cost of roof replacement because it was included in the policy.

Valuables Damage

Damage to valuables within your property can also be claimed. This includes items like electronics, appliances, and furniture. If a fire destroys your home, it’s not just the walls and roof you need to worry about but also your TV, fridge, and sofa.

Fact: According to the United States Fire Administration, fires caused $25.6 billion in property loss in 2018, affecting both structures and contents.

Cleanup Costs

Cleanup costs can add up quickly, especially if you need to remove water, debris, or mold. These costs are often covered by your insurance policy.

Example: After a flood, a business owner had to pay for water removal and mold remediation. These cleanup costs were included in their insurance claim.

Relocation Costs

If your home or business is uninhabitable due to damage, you may need to relocate temporarily. Relocation costs can include hotel stays, meals, and even renting a temporary office space.

Quote: “Damage doesn’t get better with time,” says Tim Felks, head of property claims at Farmers Insurance. Swift action can help you get back to normal faster.

Business Interruption Expenses

For business owners, property damage can mean lost income. Business interruption insurance can cover these losses, helping you stay afloat while you rebuild.

Statistic: About half of all restaurant owners report that weather damage has closed their business at some point, yet many receive lowball offers that don’t cover the full extent of the damage.

Understanding these types of recoverable losses can help you get the compensation you deserve. A personal property damage lawyer can guide you through the process, ensuring you claim everything you’re entitled to.

Next, let’s dive into some Frequently Asked Questions about Personal Property Damage Lawyers to clear up any lingering doubts.

Frequently Asked Questions about Personal Property Damage Lawyers

What should I do if my claim is denied?

If your claim is denied, don’t panic. There are steps you can take to challenge the decision:

- Review the Denial Letter: Understand why your claim was denied. Insurance companies often cite policy exclusions or lack of evidence.

- Gather Additional Evidence: Collect more documentation to support your claim. This might include photos, repair estimates, and expert opinions.

- Request an Internal Appeal: Ask your insurance company to reconsider their decision. Provide new evidence and a detailed explanation of why the denial is incorrect.

- Seek External Review: If the internal appeal doesn’t work, you can request an independent third party to review your case.

- Consult an Attorney: If you’re still facing issues, a personal property damage lawyer can help. They can guide you through the legal process and fight for fair compensation.

How long does the claims process take?

The length of the claims process can vary based on several factors:

- Complexity of the Claim: Simple claims like minor water damage might be resolved quickly, while more complex cases like extensive fire damage can take longer.

- Insurance Company Procedures: Each company has its own timeline for reviewing and processing claims. Generally, they are required to act promptly, but delays can happen.

- Documentation and Evidence: Providing complete and accurate documentation can speed up the process. Missing or incomplete information can cause delays.

- Disputes and Appeals: If your claim is denied or undervalued, the appeals process can add additional time. Legal actions like lawsuits can extend the timeline even further.

On average, straightforward claims might take a few weeks to a couple of months, while disputed claims can take several months or even years.

What are the costs associated with hiring a personal property damage lawyer?

Hiring a personal property damage lawyer can be an investment, but it often pays off in the long run. Here are some common costs associated:

- Contingency Fees: Many property damage lawyers work on a contingency fee basis. This means they only get paid if you win your case. The fee is usually a percentage of your settlement.

- Hourly Rates: Some lawyers charge by the hour. This can vary widely based on the lawyer’s experience and location.

- Flat Fees: For straightforward cases, some lawyers might offer a flat fee for their services.

- Additional Costs: There might be additional costs for things like expert witnesses, filing fees, and other legal expenses.

Fact: In Florida, insurance companies are required to pay attorney fees for policyholders who prevail in filing a claim against the insurance carrier for coverage as a result of a claims dispute.

Understanding these costs can help you make an informed decision about hiring a lawyer. Having a professional on your side can significantly improve your chances of a favorable outcome.

Next, let’s dive into some Common Tactics Used by Insurance Companies to better understand what you might be up against.

Conclusion

Navigating the complexities of property damage claims can be overwhelming. That’s where Insurance Claim Recovery Support LLC comes in. We specialize in advocating for policyholders, ensuring they receive the maximum settlement they deserve.

Advocating for Policyholders

Our mission is to stand up for you. Insurance companies often use tactics to delay, deny, or underpay claims. We know these tactics inside and out. Our team is dedicated to protecting your rights and fighting for the fair compensation you’re entitled to.

Ensuring Maximum Settlement

We carefully document your losses, handle the claims process, and negotiate with the insurance company on your behalf. Our goal is to secure the compensation your policy entitles you to. This includes covering structural damage, valuables, cleanup costs, and more. We make sure no detail is overlooked.

Texas Locations

Based in Texas, we serve policyholders across the state, including:

- Austin

- Dallas

- Fort Worth

- San Antonio

- Houston

- Lubbock

- San Angelo

- Waco

- Round Rock

- Georgetown

- Lakeway

We understand Texas’ unique weather patterns and the specific challenges they pose. Whether it’s fire, hail, hurricane, or flood damage, we have the expertise to handle your claim.

Nationwide Service

While we are Texas-based, our services extend nationwide. No matter where you are, our team is ready to assist you in navigating the claims process and fighting for the settlement you deserve.

Need help with your property damage claim? Don’t go through it alone. Contact Insurance Claim Recovery Support LLC today. Let us help you get the compensation you deserve.