Introduction

Are you overwhelmed by the intricate process of filing a multifamily fire insurance claim after experiencing property damage?

Dealing with fire damage on your multifamily property is a nightmare no property owner wants to live through. In addition to the immediate concern of dealing with the aftermath of the fire, you’re left grappling with the complexity of filing insurance claims. It can be a puzzle of responsibilities between you as a landlord, your tenants and the insurance companies.

This is where we, at Insurance Claim Recovery Support, aim to ease your burden. Owning multifamily properties, be it condominiums or apartment complexes, throw up unique challenges, especially when it comes to insurance claims. To make matters worse, fire incidents tend to be more complicated, often involving multiple variables and stakeholders. The multifamily fire insurance claim process is akin to a multi-layered business negotiation that demands meticulous attention to detail.

Nevertheless, the good news is that the tornado of confusion doesn’t have to be yours to navigate alone.

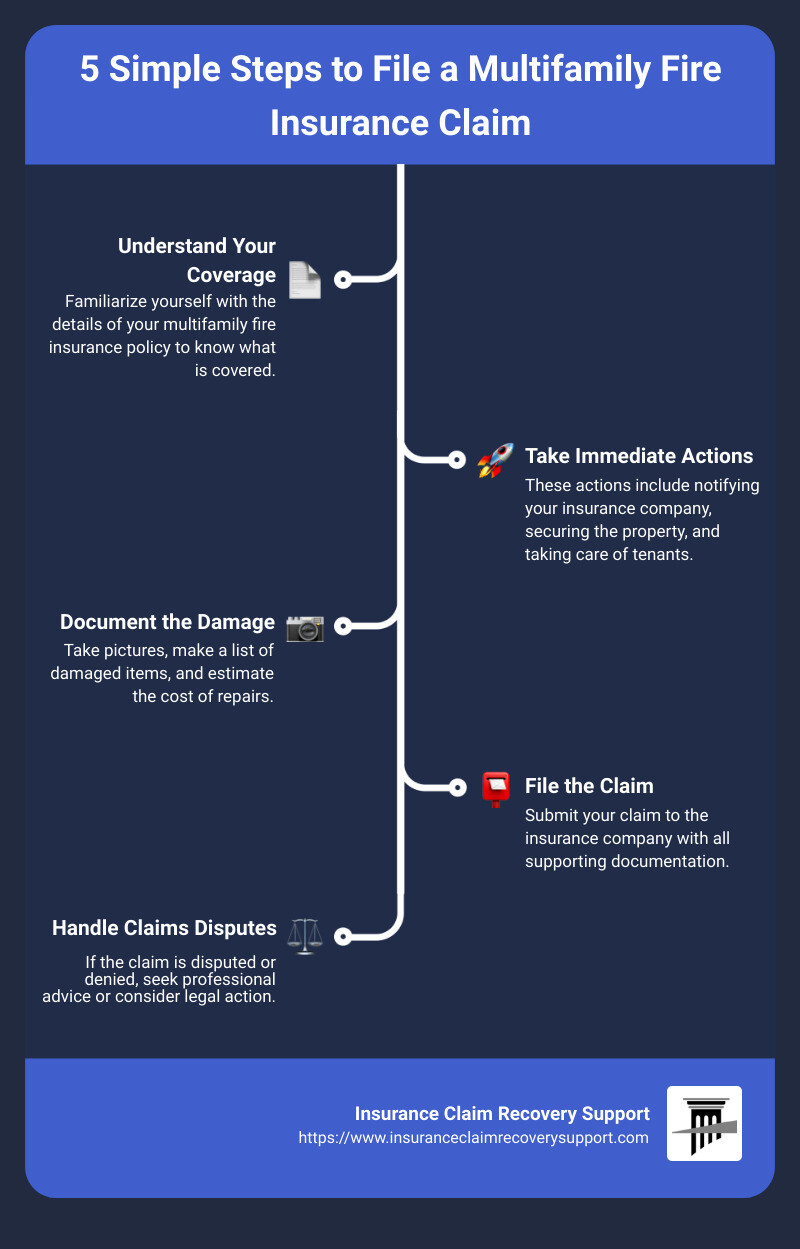

Here’s a snapshot of how you can file a multifamily fire insurance claim in 5 simple steps:

- Understand Your Multifamily Fire Insurance Coverage

- Take Immediate Actions Post-Fire

- Document the Damage Diligently

- File the Claim with Precision

- Handle Claims Disputes or Denials

Dive in with us as we guide you through these steps, making sure you’re well-equipped to navigate this intricate process confidently and efficiently.

Understanding Your Multifamily Fire Insurance Coverage

Before we delve into how to file a multifamily fire insurance claim, it’s crucial to understand what your multifamily fire insurance coverage entails. This knowledge is essential not only in the aftermath of a fire but also in helping you make informed decisions before such an incident occurs.

What Does Multifamily Fire Insurance Typically Cover?

Multifamily fire insurance is a specialized type of coverage designed to protect multi-unit residential buildings against potential property damage or liability. This includes apartment complexes, condominiums, and townhouses. The coverage essentially protects property owners, landlords, and property managers from potential financial losses or legal disputes that may arise due to a fire incident.

However, bear in mind that different insurance companies—and differing policies—cover different loss events. It’s important to read the contract you signed with your insurance company to know precisely what your insurance policy will cover after a fire. The insurance could cover damages from small kitchen fires to large-scale structural fires that can devastate an entire building.

Importance of Understanding Your Policy’s Coverage Before a Fire Occurs

Understanding your policy’s coverage before a fire occurs is crucial to successfully handling the aftermath of a fire incident. It helps you eliminate assumptions and avoid unpleasant surprises when filing an insurance claim. Coverage limits are the maximum amounts your insurance company will pay for each type of covered loss, and your deductibles are the amounts you’ll need to pay out-of-pocket before your coverage kicks in.

Determining Responsibility Between Landlords and Tenants in Case of a Fire

When it comes to multifamily properties, determining responsibility in the event of a fire can be complex. This is because both the landlord and the tenant likely have responsibilities and insurance coverage. Depending on the details of the fire, the insurance company for one or the other may pay for the property damage. In some cases, each party’s coverage may cover different portions of the overall losses.

For instance, fires traced back to the kitchen, often caused by tenants leaving food on the stove or in the oven, can be particularly challenging for landlords. On the other hand, electrical fires due to faulty wiring, aging appliances, or overheated appliances fall under the landlord’s responsibility more often than not.

In summary, understanding your multifamily fire insurance coverage is the first crucial step in filing a multifamily fire insurance claim. At Insurance Claim Recovery Support, we are ready to help you navigate these complexities, ensuring that you understand your coverage and secure a fair and prompt settlement.

Preventing Fires in Multifamily Properties

As property owners, we know that safeguarding our properties from fire is not just crucial for our business but also for the safety and well-being of our tenants. Let’s delve into common causes of apartment fires and how to prevent them.

Common Causes of Apartment Fires and How to Prevent Them

Kitchen fires and cooking fires: These are by far the most common cause of apartment fires. While these fires are difficult to prevent due to their accidental nature, educating tenants on safe cooking practices can help in reducing these incidents.

Appliances and electrical fires: Faulty wiring, aging appliances, or overheated appliances are often the culprits behind these fires. Regular maintenance and inspection of your property’s electrical system and appliances can help prevent such fires.

Smoking and open flames: Open flames in an apartment run the risk of causing a fire. Encouraging tenants to smoke outside the building and educating them on the risks of unattended open flames can help mitigate this risk.

Arson: Fires started intentionally can be devastating. Installing security cameras and maintaining good security practices can deter potential arsonists.

Accidental fires: These are often started by children playing with matches, lighters, or fireworks. Educating children about fire dangers and keeping such objects out of their reach can prevent these accidents.

In all these scenarios, remember that as a landlord, you have a responsibility to ensure the safety of your property. Regular property maintenance, safety education for tenants, and good security practices are key.

Importance of Property Maintenance in Fire Prevention

Maintaining your property is not just about keeping it in good shape; it’s also about preventing fires. Regular inspections and maintenance of electrical systems, appliances, and fire safety equipment can go a long way in preventing fires.

At Insurance Claim Recovery Support, we understand the importance of prevention and encourage property owners to invest in regular maintenance to minimize the risk of fires.

The Role of Renters Insurance in Fire Prevention and Coverage

While renters insurance may not directly prevent fires, it plays a vital role in covering the personal belongings of your tenants in the event of a fire. Encouraging your tenants to get renters insurance can help them recover their losses faster and reduce any potential disputes or legal issues that might arise.

In conclusion, preventing fires in your multifamily property is just as important as understanding your insurance coverage. By being proactive and taking the necessary precautions, you can significantly reduce the risk of fires and ensure the safety of your property and tenants.

If a fire does occur, we’re here to help you navigate the complexities of a multifamily fire insurance claim. At Insurance Claim Recovery Support, we’re committed to helping you secure a fair and prompt settlement.

Filing Your Multifamily Fire Insurance Claim

When dealing with a multifamily fire insurance claim, the process may seem daunting. However, by taking a systematic and measured approach, you can efficiently navigate the claim process.

Step-by-Step Guide on How to File a Multifamily Fire Insurance Claim

Step 1: Document the Damage

The first step in filing a claim is to document the damage. Taking pictures of your property before any damage occurs is a great practice. If a fire does occur, take additional pictures and note down the extent of the damage. This will help make your insurance claim more compelling.

Step 2: Understand Your Coverage

Before filing your claim, it’s important to understand what’s covered under your insurance policy. Most fire insurance policies cover not only the actual building but also other structures on your property such as sheds or detached garages. If you’re unsure about your coverage, consider seeking help from a professional like a public adjuster.

Step 3: Report the Claim

Once you’ve documented the damage and understood your coverage, it’s time to report the claim to your insurance company. Here, it’s crucial to present all facts and evidence accurately to avoid any misunderstanding or disputes down the line.

Step 4: Negotiate with the Insurance Company

After filing the claim, you’ll need to negotiate with your insurance company. This is perhaps the most critical step because it’s where the settlement amount is finalized.

Step 5: Review the Final Settlement

Carefully review the settlement offer from your insurance company. If it doesn’t adequately cover your damages, consider negotiating for a fair resolution.

Importance of Accurate and Timely Reporting in the Claim Process

Accuracy and timeliness are key when reporting a claim. A delay in reporting or inaccuracies in the information provided can lead to claim delays or even denials. Therefore, it’s important to gather all necessary information and report the claim as soon as possible after the event.

How to Deal with Insurance Companies During the Claim Process

Insurance companies can sometimes offer lowball estimates or delay the claim process. Having a professional, like a public adjuster from Insurance Claim Recovery Support, can help keep everything on track and ensure that you receive a fair and accurate payment.

Filing a multifamily fire insurance claim doesn’t have to be overwhelming. By following these steps and seeking professional assistance, you can navigate the claim process successfully and ensure the best possible outcome.

Ensuring Fair Settlement from Your Multifamily Fire Insurance Claim

After you’ve filed your multifamily fire insurance claim, it’s essential to ensure that you receive a fair settlement. Here is how to avoid being underpaid by the insurance company and when to seek legal advice in case of a denied claim.

How to Ensure You Are Not Underpaid by the Insurance Company

As a property owner, you’re entitled to a fair settlement that fully covers your losses. Unfortunately, insurance companies may sometimes offer lowball estimates or delay claims, creating challenges for policyholders.

To ensure you’re not underpaid:

- Understand your policy: Review your insurance policy thoroughly to understand what is covered. This will help you know what to expect from your insurer.

- Document everything: Keep a detailed record of all the damage, including photographs and measurements. This documentation will serve as evidence when negotiating your claim.

- Be patient but persistent: The claim process can be tedious and time-consuming. However, being patient and persistent in your pursuit of a fair settlement is key.

The Role of a Public Adjuster in the Claim Process

A public adjuster can be a valuable ally during the claim process. They represent your interests, not the insurance company’s, and can help you navigate the complexities of the insurance claim process.

Public adjusters are experts in interpreting insurance policies and can assist in identifying covered damages and estimating appropriate repair or replacement costs. They can also help speed up the claim process by ensuring you provide all the required documentation in a timely manner.

If your claim is denied or you feel the settlement offered is inadequate, a public adjuster can help you seek a second inspection or independent appraisal.

When to Seek Legal Advice in Case of a Denied Claim

If your insurance company denies your claim or you believe they are not acting in good faith, it may be necessary to seek legal counsel. A lawyer can help you understand your rights and options, and can represent you in any legal proceedings.

At Insurance Claim Recovery Support, we can help you navigate this process, ensuring that you receive the fair and accurate payment you deserve. Our team of professional public adjusters is ready to assist you in making sure your multifamily fire insurance claim is handled promptly and fairly.

It’s your property, and you have the right to a fair settlement. Don’t settle for less than you deserve.

Conclusion

In conclusion, filing a Multifamily fire insurance claim involves understanding your insurance coverage thoroughly, preventing fires through proper property maintenance, filing your claim accurately and promptly, and ensuring fair settlement. Each step in the process holds equal importance in securing a fair and prompt settlement for the damage incurred.

Fire insurance for multifamily properties is more than a safety net – it is a crucial part of risk management that can safeguard your valuable assets from devastating losses. However, the complexities involved in the insurance claim process can be overwhelming, especially in the stressful aftermath of fire damage.

At Insurance Claim Recovery Support, we firmly believe that professional help can make a significant difference in your insurance claim process. Our team of experienced public adjusters is equipped to assist you in navigating the complexities of the claim process, ensuring you get the fair settlement you deserve and in a timely manner.

As you embark on this journey, remember to arm yourself with knowledge and seek help when needed. After all, your property isn’t just a structure; it’s an investment, a source of income, and an essential part of your livelihood.

For further insights and professional assistance, explore our Multi-Family Claims and Fire Property Damage pages. You can also reach out to us for a free claim review. We are here to help you ensure that your insurance claim recovery journey is as smooth and efficient as possible.