Insurance settlement negotiation can be a daunting process, especially when dealing with complex claims from property damage due to events like hurricanes or floods. To steer this challenge effectively as a commercial group policyholder, there are key tactics to understand:

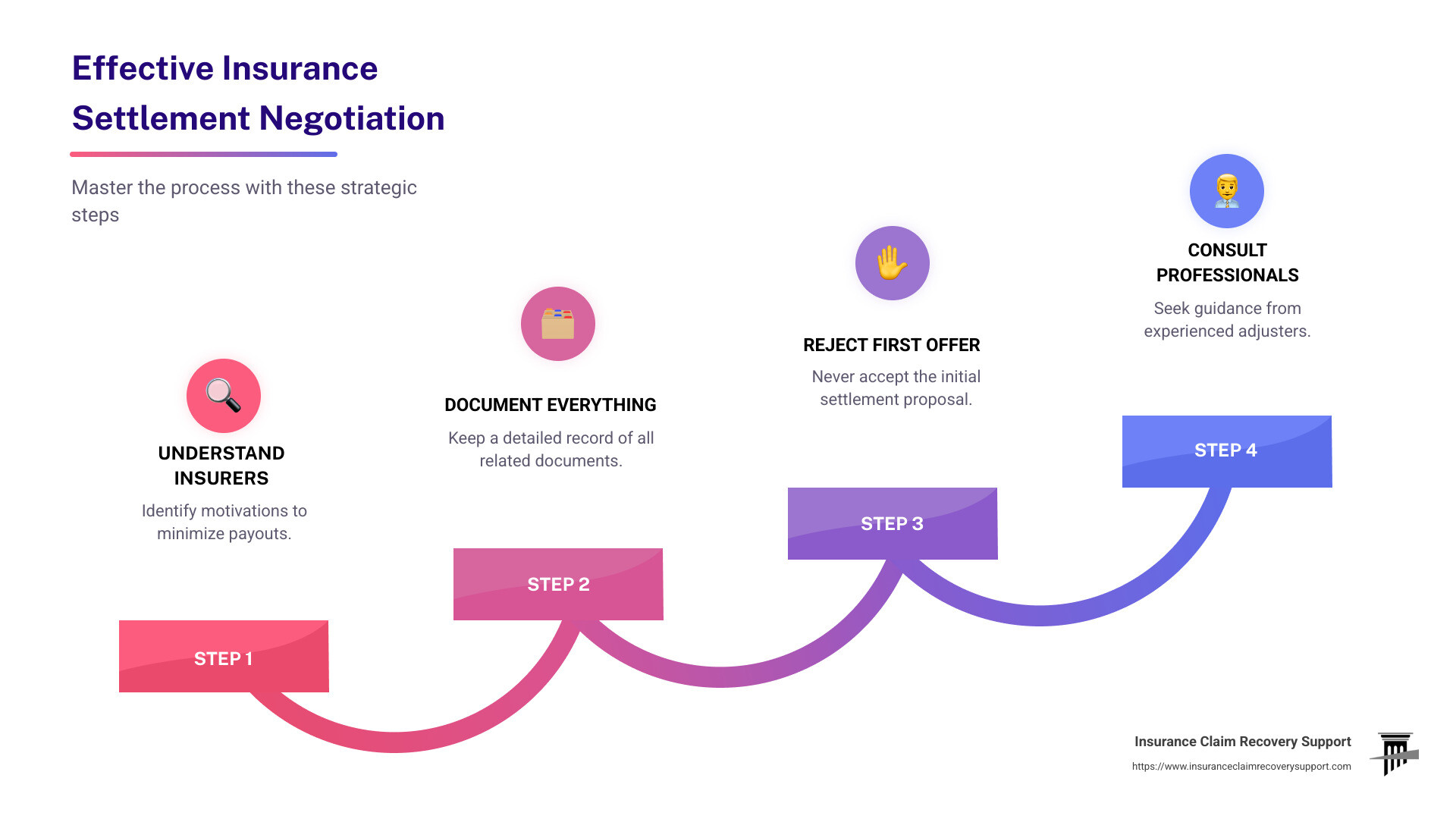

- Never accept the insurer’s first offer.

- Know the full value of your policy coverage.

- Stay organized and document everything related to your claim.

- Consult professionals for guidance.

Insurance companies are primarily driven by their bottom line, often leading them to minimize payouts. Understanding their motivations and methods allows you to counter lowball offers wisely and leverage negotiation tactics to reach a fair settlement.

My name is Scott Friedson, and as a licensed public adjuster with experience in insurance settlement negotiation, I’ve helped numerous policyholders recover fair compensation from insurers. From this experience, I’ll guide you through mastering negotiations step by step.

Important insurance settlement negotiation terms:

– Texas insurance claims

– how do insurance companies settle personal injury claims

– how to negotiate a settlement with an insurance claims adjuster

Step 1: Understand the Insurance Company

When entering into insurance settlement negotiation, the first step is to understand the mindset of the insurance company. They are your opposing party. Their primary goal is to reduce the settlement offer as much as possible to protect their bottom line.

Commercial Motivations

Insurance companies are profit-driven entities. This means they will often use tactics to minimize the amount they pay out on claims. For instance, they might offer a low initial settlement, hoping you’ll accept it without question. It’s crucial to recognize this as a standard practice, not a reflection of your claim’s actual value.

Recognizing Tactics

Some common tactics include:

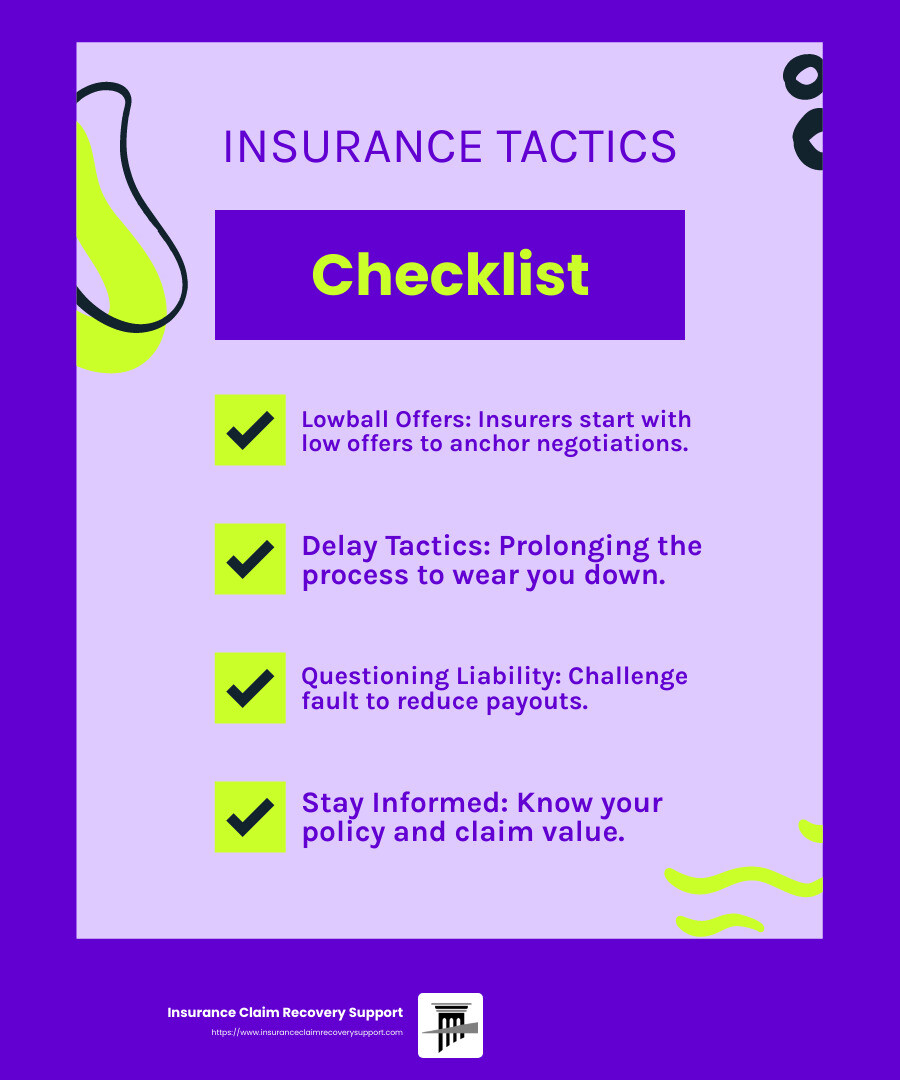

- Lowball Offers: Insurers may start negotiations with a much lower offer than what your claim is worth. This is a strategic move to anchor the negotiations in their favor.

- Delay Tactics: By prolonging the process, insurers hope to wear you down, increasing the likelihood you’ll accept a lower offer just to resolve the matter quickly.

- Questioning Liability: They might challenge who was at fault or the extent of the damage to reduce their payout.

Countering Their Strategies

To effectively counter these tactics, you need to be prepared:

- Stay Informed: Know the details of your policy and the fair value of your claim.

- Document Everything: Keep meticulous records of all communications, damages, and expenses related to your claim.

- Be Patient: Don’t rush into accepting the first offer. Take your time to evaluate and respond appropriately.

By understanding the insurance company’s motivations and strategies, you can better position yourself in negotiations and work towards a fair settlement.

Next, we’ll dig into how to initiate the claim process effectively, ensuring you start on the right foot.

Step 2: Initiate the Claim Process

Starting your claim process on the right foot is crucial for a successful insurance settlement negotiation. Here are the key steps to take:

Gather Strong Evidence

The strength of your claim depends heavily on the evidence you provide. Collect as much documentation as possible to support your case. This includes:

- Photographs of the damage or injury

- Medical reports detailing any injuries sustained

- Receipts and invoices for any expenses related to the incident

- Witness statements if available

The more detailed your evidence, the harder it is for the insurance company to dispute your claim.

Start Your Claim Early

Timing is everything. Initiate your claim as soon as possible after the incident. This not only helps in gathering fresh evidence but also prevents critical information from being lost over time. Early filing can sometimes lead to a quicker resolution, as it shows the insurance company you are serious and proactive about your claim.

Never Admit Fault

When communicating with the insurance adjuster, never admit fault for the incident. It’s not your role to determine liability. Insurance companies might use any admission of fault to reduce your settlement offer. Stick to the facts and let your attorney handle discussions about fault.

By following these steps, you set a strong foundation for your claim and increase the likelihood of a favorable outcome. Next, let’s explore how to evaluate the value of your claim to ensure you’re negotiating from a position of knowledge.

Step 3: Evaluate Your Claim’s Value

Before diving into insurance settlement negotiation, it’s crucial to understand the true value of your claim. This helps you negotiate confidently and ensure you receive fair compensation.

Rough Value Calculation

Start by calculating a rough value of your claim. Consider all the costs you’ve incurred due to the incident. This includes not just direct expenses but also potential future costs. A clear understanding of these figures sets the baseline for your negotiations.

Medical Expenses

Medical expenses can quickly add up. Gather all your medical bills, including hospital stays, doctor visits, medications, and any ongoing treatments or therapies. These are tangible costs that the insurance company should cover.

Lost Wages

If the incident has affected your ability to work, calculate your lost wages. Provide documentation from your employer detailing your salary and the number of workdays missed. Remember to include any potential future earnings lost due to ongoing recovery.

Pain and Suffering

While harder to quantify, pain and suffering are significant components of a claim’s value. It covers physical discomfort and emotional distress caused by the incident. While there’s no exact formula, documenting how your life has been affected can strengthen your case.

“Even though there is no way to put a dollar value on emotional distress and ‘pain and suffering’, these components of an injured person’s losses can go a long way toward getting an insurance company to come to the table with a fair settlement offer.”

By evaluating these aspects, you create a comprehensive picture of your claim’s worth. This knowledge empowers you to negotiate effectively, ensuring you don’t settle for less than you deserve. Next, we’ll dig into engaging in effective negotiation to maximize your settlement.

Step 4: Engage in Effective Negotiation

Now that you have a clear understanding of your claim’s value, it’s time to engage in effective insurance settlement negotiation. This step involves navigating counteroffers, handling lowball offers, practicing patience, and securing written agreements.

Counteroffers

Insurance companies often start with a low offer. This is a common tactic to test your knowledge and resolve. Don’t be discouraged. Instead, respond with a counteroffer that reflects the true value of your claim. Be firm but reasonable, and back up your demands with the evidence you’ve gathered.

Handling Lowball Offers

Receiving a lowball offer can be frustrating, but it’s part of the negotiation process. Stay calm and ask the insurer to explain how they arrived at their offer. Use this information to highlight any discrepancies or overlooked details in your case. This not only shows that you’re informed but also opens the door for further discussion.

Patience is Key

Negotiation is often a waiting game. Insurance adjusters may delay responses to pressure you into accepting a lower offer. Resist the urge to settle quickly. Instead, remain patient and persistent. Keep the lines of communication open, and don’t hesitate to reiterate the strength of your case.

Written Agreements

Once you’ve reached an agreement, ensure that everything is documented in writing. This includes the settlement amount and any other terms. A written agreement protects you and prevents misunderstandings later. It’s your proof of what was agreed upon, so review it carefully before signing.

By mastering these negotiation tactics, you increase your chances of reaching a settlement that truly reflects the value of your claim. In the next step, we’ll discuss the importance of consulting with a professional to further improve your negotiation strategy.

Step 5: Consult with a Professional

When navigating the complexities of insurance settlement negotiation, consulting with a professional can make all the difference. An insurance claims expert brings expertise and experience, ensuring you receive fair compensation for your claim.

Why Hire an Insurance Claims Expert?

Insurance companies have teams of professionals working to minimize payouts. To level the playing field, you need someone on your side who understands the claims process. An insurance claims expert can provide valuable advice, helping you understand your rights and the true value of your claim. They can also handle communication with the insurance company, preventing you from making statements that could harm your case.

Expert Advice for Fair Compensation

An expert can assess the full extent of your damages, including property damage, lost income, and additional expenses. This comprehensive evaluation ensures that your claim reflects all your losses. By presenting a well-documented case, an expert strengthens your position in negotiations, increasing the likelihood of a fair settlement.

Real-World Impact

Consider the case of R. Holland from Jacksonville, FL, who worked with a claims group to secure a substantial settlement for their association. This example illustrates how professional expertise can result in significant financial recovery, underscoring the importance of involving a skilled advocate in your negotiation process.

By engaging an insurance claims expert, you not only improve your negotiation strategy but also gain peace of mind. Knowing that a professional is advocating for your interests allows you to focus on recovery, while they work to secure the compensation you deserve.

Next, we’ll address some frequently asked questions about insurance settlement negotiation, providing further insights into this critical process.

Frequently Asked Questions about Insurance Settlement Negotiation

What is a reasonable settlement offer?

A reasonable settlement offer should cover medical expenses, lost wages, and property damage resulting from the incident. It should also account for non-economic damages like pain and suffering. To determine if an offer is reasonable, compare it to the estimated total value of your losses. It’s crucial to ensure that the settlement fully compensates for both current and future costs related to the accident.

How do I ask for more money in an insurance settlement?

If the initial offer doesn’t meet your needs, you can make a counteroffer. Start by clearly outlining why you believe the initial offer is insufficient. Highlight any overlooked damages, such as ongoing medical treatment or lost income. Provide supporting documents like medical bills or repair estimates. This approach shows the insurance company that you have a solid understanding of your claim’s value and are prepared to negotiate for a fair settlement.

Can you negotiate an insurance settlement offer?

Yes, you can absolutely negotiate an insurance settlement offer. The bargaining process is a standard part of insurance claims. Insurance companies often start with a low offer, hoping you’ll accept it without question. By understanding negotiation tactics and being patient, you can work towards a more favorable outcome. Always get any agreements in writing to ensure clarity and prevent misunderstandings.

Negotiating an insurance settlement can be challenging, but being informed and prepared greatly increases your chances of reaching a fair settlement.

Conclusion

Navigating the path to a fair insurance settlement negotiation can be daunting. But with the right approach, you can maximize your compensation and secure the support you deserve. That’s where we, at Insurance Claim Recovery Support, come in.

Our mission is simple: to ensure you receive the maximum settlement possible. We understand the tactics insurance companies use to minimize payouts. Armed with this knowledge, we advocate fiercely for policyholders, ensuring your rights are protected and your needs are met.

Based in Texas, we specialize in handling property damage claims from fire, hurricanes, tornadoes, and more. Whether you’re in Austin, Dallas, San Antonio, or any other city we serve, our team is committed to guiding you through the complex claims process with expertise and care.

Policyholder advocacy is at the heart of what we do. You’re not just another claim to us; you’re our priority. We work tirelessly to document your claim accurately, negotiate effectively, and stand by you every step of the way. This commitment ensures that you’re not left to face the aftermath of a disaster alone.

When you partner with us, you’re choosing a team dedicated to turning a stressful situation into a manageable one. Let us help you focus on what’s most important: rebuilding and moving forward with confidence.

You don’t have to steer this journey alone. Trust us to be your advocate and guide in achieving the settlement you deserve.