Why Property Owners Need Insurance Claim Legal Advice After Denials

Insurance claim legal advice becomes critical when your property damage claim gets denied, delayed, or severely underpaid. Here’s when you need professional help:

Immediate Legal Advice Needed:

– Claim denied without proper investigation

– Settlement offer 50% below contractor estimates

– Bad faith tactics like unreasonable delays or intimidation

– Complex commercial losses over $100,000

– Statute of limitations approaching (varies by state)

– Multiple denials on the same loss event

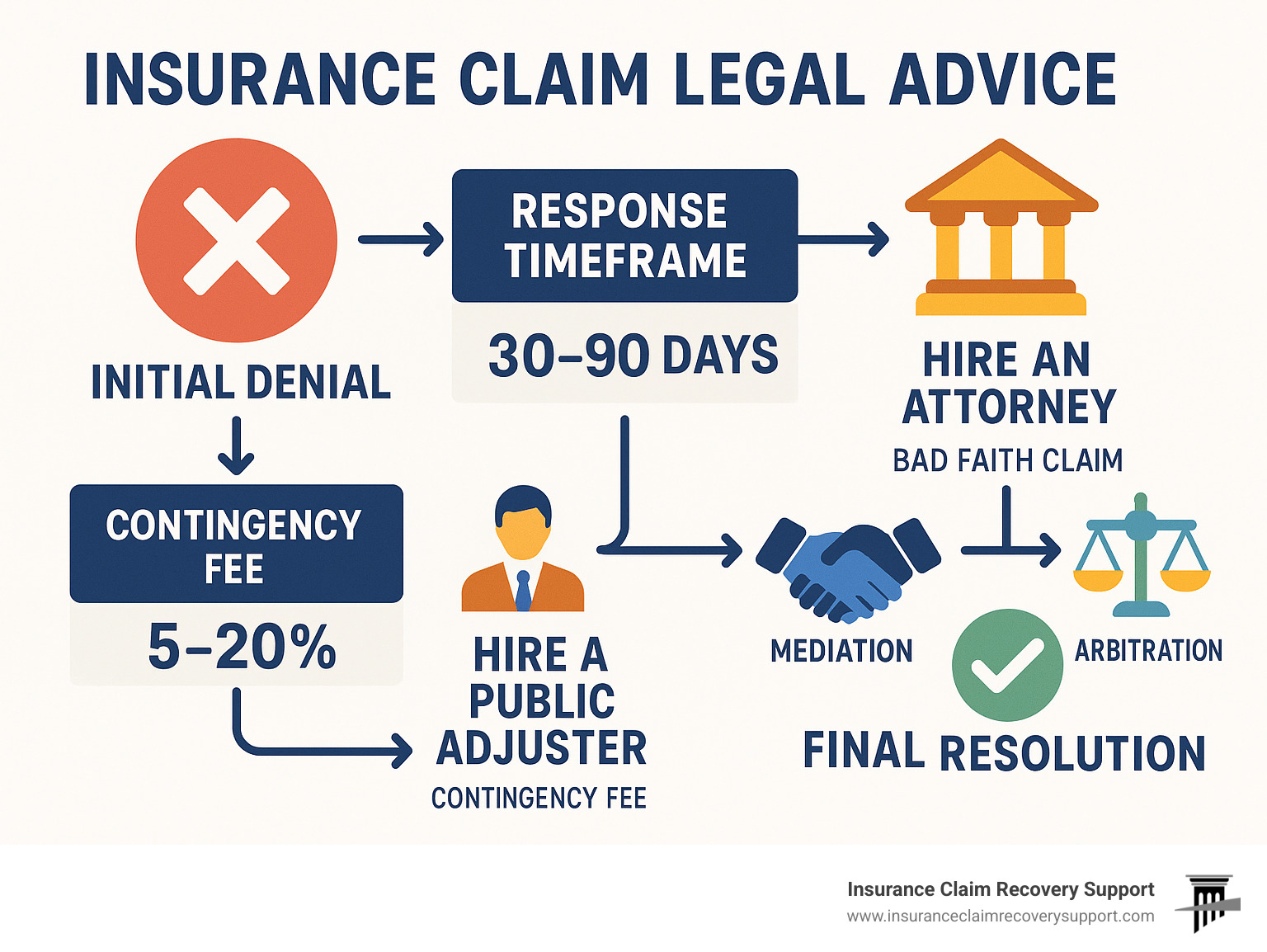

Your Legal Options:

1. Internal appeals with your insurer

2. State insurance commissioner complaints

3. Public adjuster representation (5-15% contingency fee)

4. Attorney consultation for bad faith claims

5. Alternative dispute resolution (mediation, arbitration)

The research shows that 62% of working adults face legal issues within three years, yet the average attorney costs $391 per hour. For property damage claims, most personal injury attorneys work on contingency, meaning no upfront costs.

Whether you’re dealing with fire damage, storm destruction, or flood claims, understanding your rights prevents insurers from taking advantage. Insurance companies hire experienced defense counsel – you need equally skilled representation.

As Scott Friedson, a multi-state licensed public adjuster and CEO of ICRS LLC, I’ve settled over $250 million in property damage claims and overturned wrongfully denied cases while providing essential insurance claim legal advice to policyholders. My experience shows that proper legal guidance can increase settlements from 30% to 3,800% while avoiding unnecessary litigation.

Insurance Claims 101: Filing Correctly the First Time

Getting your insurance claim right from the start can save you months of headaches and prevent the need for insurance claim legal advice down the road. After helping thousands of property owners across Austin, Dallas, Houston, and San Antonio, we’ve seen how simple mistakes during initial filing can turn straightforward claims into lengthy battles.

What Is an Insurance Claim & When to File

Think of an insurance claim as your formal way of saying, “Hey, something bad happened to my property, and I need you to keep your promise to help me fix it.” It’s essentially activating that insurance policy you’ve been paying for.

The clock starts ticking the moment damage occurs. Whether it’s fire damage, storm damage from Texas’s infamous weather events, or freeze damage from surprise cold snaps, you need to act fast. Most policies require notification “as soon as possible” – and insurance companies take this seriously.

We’ve seen claims denied simply because homeowners waited too long to report obvious damage. Lightning strikes, tornado damage, and flood damage (if you have flood insurance) all require immediate attention for both safety and claim protection.

Step-by-Step Claim Roadmap

Filing a successful claim requires following the right steps in the right order.

Start by calling your insurer’s 24/7 hotline immediately. Get that claim number and write it down – you’ll use it constantly. Ask about emergency repair authorization while you’re on the phone.

Documentation is your best friend. Take 150-200 photos for an average home. Walk through every room with your phone camera, even areas that look undamaged. Storm damage and fire damage often hide in unexpected places.

Your duty to mitigate further damage is a policy requirement. Tarp damaged roofs, turn off utilities if necessary, and remove standing water. Keep every receipt for emergency repairs.

During the adjuster inspection, be present and speak up. Point out every bit of damage you’ve found. Don’t assume they’ll catch everything. Pro tip: don’t sign anything during that first meeting.

Getting independent contractor estimates is crucial. Compare these with your insurer’s estimate and document significant differences. This is often where we see the biggest gaps.

| Home Claims | Commercial Claims |

|---|---|

| Homeowner calls hotline | Business owner notifies carrier |

| Standard adjuster assigned | Commercial specialist assigned |

| Repair estimates from contractors | Professional restoration quotes |

| Settlement typically within 30 days | Complex evaluation, 60-90 days |

Know Your Policyholder Rights & Duties

Your insurance company owes you good faith handling of your claim. This means they can’t drag their feet without reason, lowball you with ridiculous offers, or make you jump through unnecessary hoops.

The cooperation clause works both ways. Yes, you need to cooperate with their investigation, but they need to cooperate with you too – returning phone calls, explaining decisions, and treating you with basic respect.

When insurance companies violate these standards through unreasonable delays, inadequate investigations, or outright bad faith, that’s when you need insurance claim legal advice.

When You Need Insurance Claim Legal Advice: Denials, Delays & Bad Faith

Nobody expects their insurance company to fight them after a disaster. Yet that’s exactly what’s happening more often across Texas. Insurance companies are getting creative with denials, using engineer reports and technical fine print to avoid paying legitimate claims.

When your claim gets denied or severely underpaid, you’re facing a system designed to protect the insurer’s bottom line, not your family’s recovery. That’s when insurance claim legal advice becomes essential.

Top Signs You Need Insurance Claim Legal Advice

Repeat denials are a classic warning sign. First, they say it’s not covered. Then they claim you didn’t report it properly. Next, they argue the damage was pre-existing. Each excuse buys them time while you’re stuck with mounting repair bills.

Lowball settlement offers that fall far short of contractor estimates are another clear signal. When three roofers tell you storm damage will cost $50,000 to fix, but your insurer offers $20,000, they’re betting you’ll give up rather than fight.

Complex commercial losses over $100,000 almost always require professional representation. The stakes are too high, and the insurance company’s legal team is too experienced for property owners to handle alone.

The statute of limitations clock creates urgent need for legal guidance. In Texas, you typically have two years from the date of loss to file a lawsuit, but some policies have shorter deadlines. Missing these can destroy an otherwise valid claim.

Bad Faith Red Flags Requiring Insurance Claim Legal Advice

Insurance bad faith isn’t just poor customer service – it’s a legal violation that can cost insurers big money.

Unreasonable investigation practices are surprisingly common. We’ve seen insurers refuse to inspect obvious damage, ignore expert reports from qualified contractors, and fail to explain denial decisions. When an adjuster spends five minutes looking at extensive storm damage, that’s not proper investigation.

Intimidation tactics designed to pressure you into accepting inadequate settlements include demands for excessive documentation, threats to cancel your policy, or high-pressure tactics to sign settlement agreements quickly.

Disputing Decisions & Settlement Offers

Internal appeals with your insurer should be your first step. Most companies have formal dispute processes, though they don’t always advertise them clearly.

The appraisal clause in most policies provides a way to resolve valuation disputes without going to court. Each side picks an appraiser, and if they can’t agree, they choose an umpire to make the final decision.

State regulator review through your insurance commissioner can put pressure on uncooperative insurers. File a Complaint Against Your Insurance Company with the Texas Department of Insurance when dealing with clear violations.

Civil litigation becomes necessary when other methods fail and you’re facing significant financial losses. Most attorneys who handle insurance disputes work on contingency, meaning you don’t pay unless you win.

Choosing Your Allies: Public Adjusters, Loss Assessors & Attorneys

When your insurance claim gets complicated, you don’t have to face the insurance company alone. Insurance companies have teams of experienced professionals working to minimize what they pay you. Shouldn’t you have someone equally skilled fighting for your interests?

Loss Adjuster vs. Loss Assessor vs. Public Adjuster

Loss Adjusters work for the insurance company. They show up at your Austin, Dallas, or Houston property after storm damage, taking photos and writing reports. Here’s the catch – they’re paid by your insurer, not you. Their job is to find reasons to pay less, not more.

Loss Assessors are common in the UK and Australia, where they work exclusively for policyholders. They’re certified by the Chartered Insurance Institute and regulated by the Financial Conduct Authority.

Public Adjusters are the US equivalent – your secret weapon against unfair claim handling. We’re licensed professionals who work only for property owners, never insurance companies. When you hire a public adjuster, you get someone who knows the insurance game inside and out.

The key difference? Loyalty. While company adjusters answer to corporate shareholders, public adjusters answer only to you.

When to Hire a Public Adjuster

Large losses almost always benefit from professional representation. If your fire damage, storm damage, or freeze damage claim exceeds $10,000, the complexity typically justifies expert help.

Complex policies create another challenge. Commercial properties, older homes with unique features, or properties with multiple types of coverage need someone who speaks “insurance” fluently.

Time constraints matter more than most people realize. Managing a proper claim takes 40-60 hours of focused work. Most busy professionals simply can’t invest the necessary time.

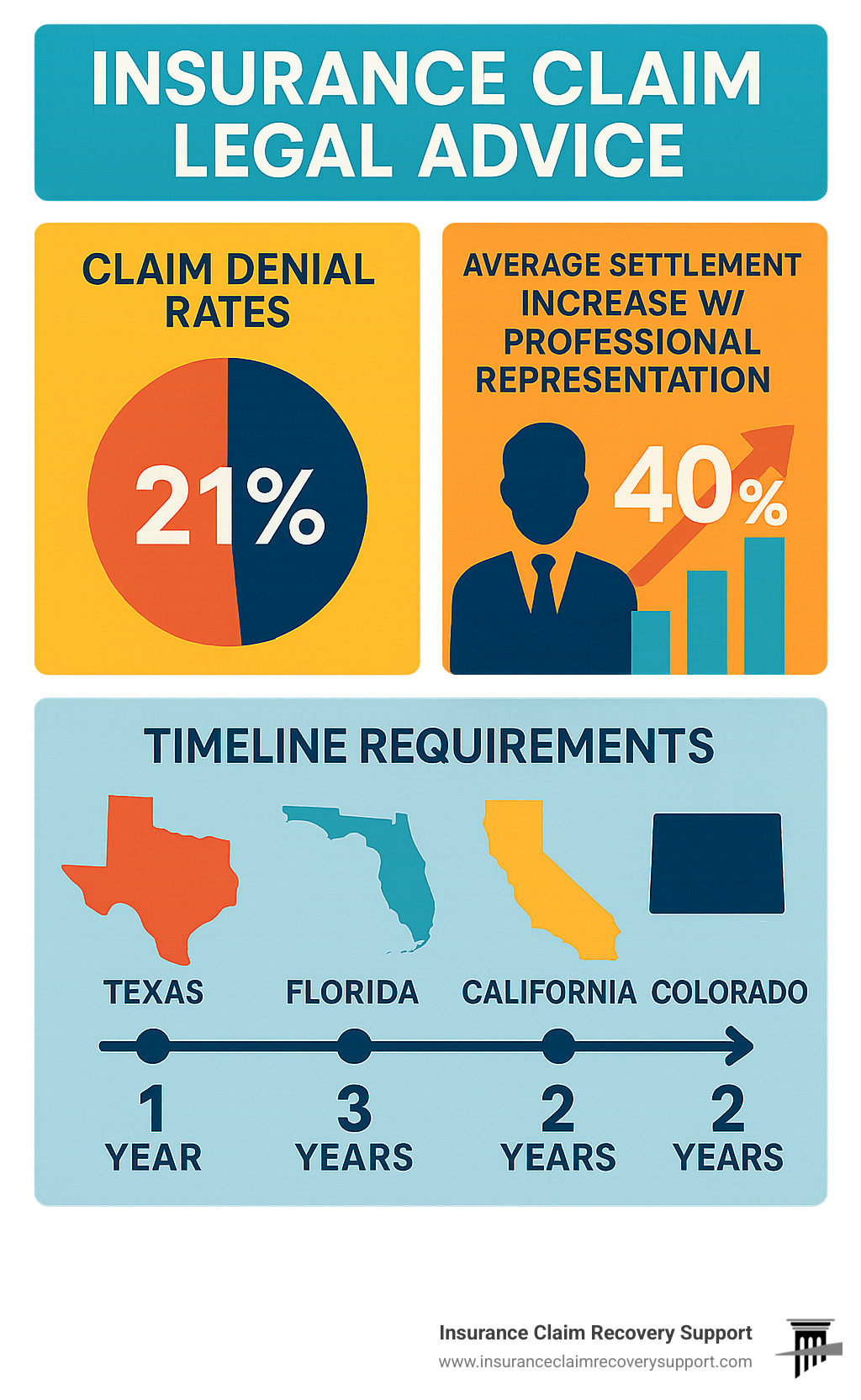

Research consistently shows that Should I Hire a Public Adjuster? often comes down to simple math. Public adjusters typically increase settlements by 40-70%. Even after paying our contingency fee (usually 5-15%), you still come out significantly ahead.

When to Lawyer Up

Bad faith lawsuits open up possibilities beyond your policy limits. When insurers act unreasonably, you may recover punitive damages and attorney fees on top of your actual claim.

Injury claims require specialized legal expertise that public adjusters can’t provide. If someone got hurt during the incident that damaged your property, you need an attorney.

Looming deadlines create urgency. When the statute of limitations approaches and other remedies have failed, attorneys can file protective lawsuits while continuing negotiations.

Free & Low-Cost Legal Help Options

Legal aid organizations receive federal funding to help low-income individuals steer legal challenges, including insurance disputes. Search by zip code through the Legal Services Corporation website.

Pro bono programs connect you with volunteer lawyers through state bar associations. Many attorneys donate time to help property owners fight unfair claim denials.

Prepaid legal plans work like insurance for legal services. Annual fees around $200-264 provide comprehensive coverage for over 100 legal matters, including insurance claims.

Evidence, Documentation & Deadlines: Building a Winning Case

The difference between a successful claim and a denial often comes down to documentation. After helping thousands of property owners across Texas recover millions in settlements, I’ve seen how proper evidence can transform even the most challenging cases.

The Ultimate Claim Document Checklist

The moment damage occurs, your documentation process begins. Start with photos – lots of them. For a typical home, take at least 150-200 photos showing damage from multiple angles. Don’t just photograph obvious damage – capture overview shots, close-ups, and everything in between.

Video walkthrough provides context that photos can’t. Record yourself walking through damaged areas while narrating what you’re seeing.

Weather documentation proves the cause of loss. Download official weather reports from the National Weather Service showing storm conditions on the date of loss. For recent Texas storms, this documentation has been crucial in proving wind damage claims.

Financial records tell the monetary story of your loss. Keep receipts for every emergency repair, from tarping your roof to removing standing water. Create a detailed inventory spreadsheet listing every damaged item with descriptions, ages, and replacement costs.

Contractor estimates provide professional validation of repair costs. Get multiple bids from licensed contractors – this gives you negotiating power when the insurance company’s estimate comes in low.

For complex damage, expert reports become essential. Engineering reports can definitively establish structural damage, while restoration estimates provide detailed repair scopes.

Statute of Limitations & Notification Windows

Time is not your friend when it comes to insurance claims. Texas law requires you to notify your insurer immediately or “as soon as possible” after finding damage. While courts interpret this reasonably, don’t test these limits.

The proof of loss deadline typically gives you 60 days from when the insurer requests it. Missing this deadline can jeopardize your entire claim.

Texas’s two-year statute of limitations for property damage claims means you have two years from the date of loss to file a lawsuit if necessary. Other states vary significantly – Florida allows three years while California restricts fire damage claims to one year in some cases.

For insurance claim legal advice regarding deadlines, don’t wait until the last minute. When approaching these time limits with unresolved claims, professional representation becomes critical.

Frequently Asked Questions about Insurance Claim Legal Advice

What if my insurer demands an Examination Under Oath?

Don’t panic if your insurance company requests an Examination Under Oath (EUO). While this formal procedure sounds intimidating, it’s actually routine for many larger claims. Think of it as giving testimony under oath about your claim.

You have important rights during an EUO. You can bring an attorney with you, and we strongly recommend doing so. Your lawyer can object to improper questions and protect you from harassment. The questions must relate directly to your claim.

The key to a successful EUO is preparation. Review all your claim documents beforehand, including your policy, photos, and correspondence. Answer only what you know for certain – it’s perfectly acceptable to say “I don’t know” if that’s the truth.

How long can I wait before disputing a denial?

Time limits for disputing claim denials vary significantly, and missing these deadlines can permanently bar your recovery.

Your policy sets the first deadline. Most insurance policies give you between 60 to 365 days to dispute denials through internal appeals processes. Check your specific policy language.

State law provides the ultimate deadline. In Texas, you generally have two years from the date of loss to file a lawsuit against your insurer. However, some states have shorter periods – Florida gives you three years, while some California fire damage claims have just one year.

Can I reopen a settled claim if hidden damage appears?

Finding additional damage after settling your claim is more common than you might think, especially with water damage, foundation issues, or electrical problems that aren’t immediately visible. Most policies allow supplemental claims for newly finded damage.

The key is proving the damage was truly hidden. You need to demonstrate that the damage wasn’t visible during the original inspection and that you conducted a reasonable investigation initially.

Timing still matters for reopened claims. In Texas, you typically need to find and report additional damage within the original two-year statute of limitations period.

Conclusion

When your insurance claim gets denied or severely underpaid, you’re not powerless. Insurance companies have teams of experienced adjusters and attorneys working to minimize payouts – and you deserve equally skilled representation on your side.

The reality is simple: Most property owners don’t know their rights, and insurers count on that. Whether you’re dealing with storm damage in Austin, fire damage in Dallas-Fort Worth, or freeze damage in Houston, insurance claim legal advice can turn a denied claim into a full settlement.

Don’t wait until it’s too late. Every state has strict deadlines for filing lawsuits against insurers. In Texas, you typically have two years from the date of loss, but some situations require much faster action.

At Insurance Claim Recovery Support LLC, we’ve seen too many property owners accept unfair denials or lowball settlements simply because they didn’t know help was available. We serve clients throughout Texas – from Lubbock and San Angelo in the west to Houston and San Antonio in the south, including Round Rock, Georgetown, and Lakeway.

Our approach is straightforward: We only get paid when you do. No upfront fees, no hourly charges, no surprise bills. We work on contingency because we believe in the strength of your case.

What makes us different? We’re not just claim handlers – we’re your advocates. We understand the tactics insurers use to delay, deny, and underpay claims. We know how to document damage properly, when to bring in experts, and how to negotiate from a position of strength.

The process starts with a simple conversation. We’ll review your denial letter, examine your policy, and explain your options in plain English. No legal jargon, no pressure tactics – just honest advice about whether you have a case worth pursuing.

For property owners who thought their cases were hopeless, we’ve overturned wrongful denials and exposed bad faith practices. We’ve helped families rebuild after devastating losses and helped businesses get back on their feet.

Your next step is simple: Contact ICRS today for a free consultation. We’ll tell you honestly whether you have options and what we can do to help.

Don’t steer this alone. Insurance claim legal advice isn’t just about knowing the law – it’s about knowing how to use it to protect your family’s financial future.

For additional resources, check out our Glossary of Property Insurance Claim Terms and learn more about Public Adjuster vs Insurance Company for Property Damage Claim.

The insurance company had their chance to treat you fairly. Now it’s time to fight back.