Fire damage claims Austin typically arise when property owners face the devastating aftermath of a fire, losing valuable structures and belongings. Whether it’s a house fire or a wildfire, the process of claiming insurance in Austin can be overwhelming. Here’s what you need to know right away:

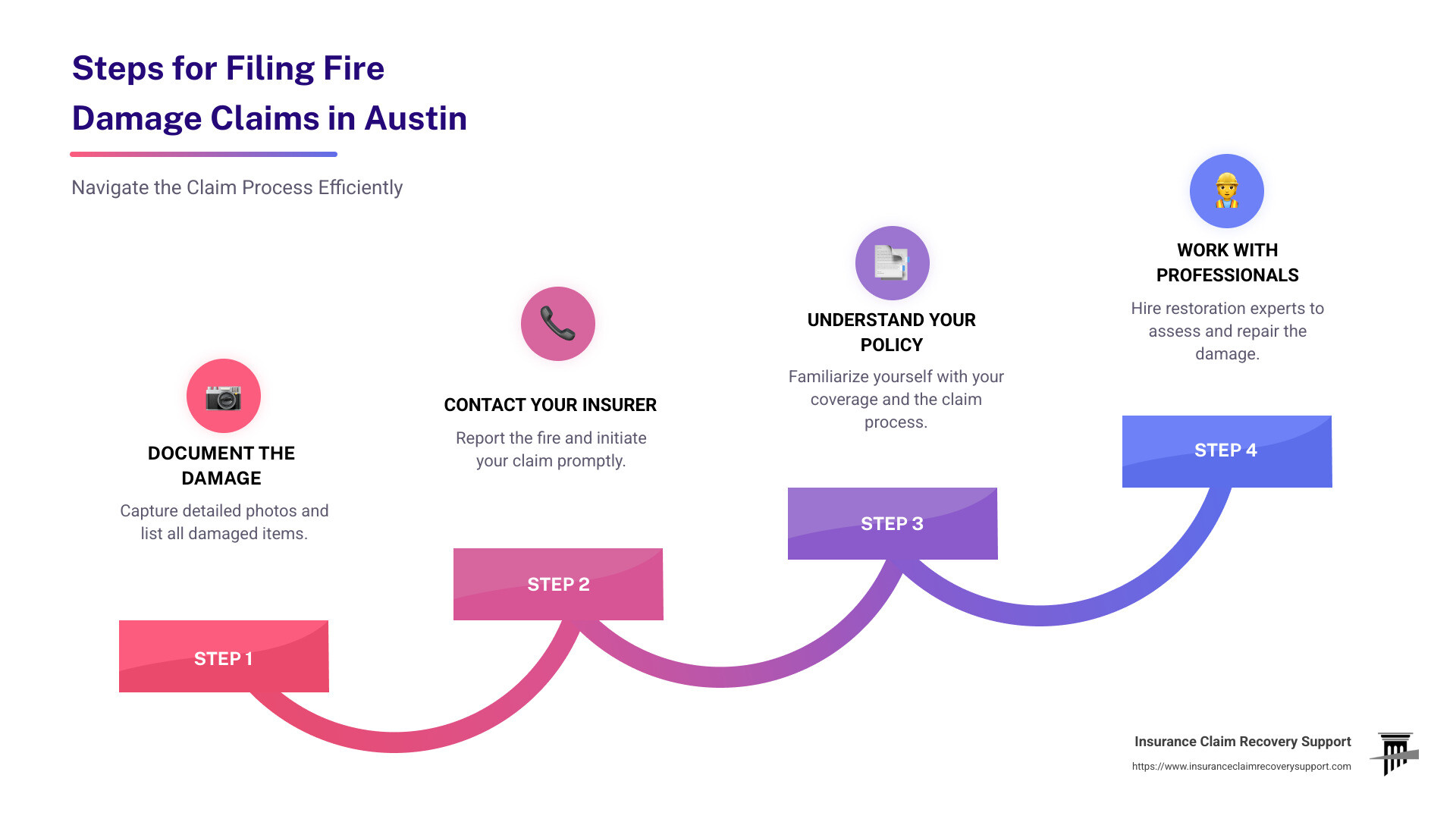

- Document the Damage: Take detailed photos and list all losses.

- Contact Your Insurer Promptly: Initiate your claim as soon as it’s safe.

- Stay Informed: Understand your policy and the claims process.

In recent years, wildfires have dramatically affected areas from California to Florida, and Austin is no exception. With rising temperatures and frequent droughts, Central Texas experiences increased wildfire risks. Having a solid plan for filing fire damage claims in Austin is essential to protect your property and your peace of mind.

As Scott Friedson, CEO of Insurance Claim Recovery Support LLC and an expert in handling property damage claims, I’ve settled hundreds of millions in claims, including fire damage in Austin. My background in advocating for property owners ensures your claim processing will be thorough and efficient.

Quick look at Fire damage claims Austin:

– Flood damage claims Houston

– Public adjuster Houston

Understanding Fire Damage Claims

Navigating fire damage claims in Austin can be challenging, especially when you’re dealing with the aftermath of a destructive fire. Understanding the types of damage and common causes can prepare you for the claims process.

Types of Fire Damage

Fire damage isn’t just about charred walls and burnt furniture. It’s a multi-faceted problem, involving:

-

Structural Damage: Fires can weaken the very bones of a building. The heat can warp beams, and flames can consume entire sections of a home. This type of damage is often the most visible and costly.

-

Smoke Damage: Smoke can seep into walls, carpets, and furniture, leaving a persistent odor and potential health hazards. Smoke damage is tricky because it might not be immediately visible but can have long-lasting effects.

-

Water Damage: Ironically, water used to extinguish fires can cause significant damage. It can lead to mold growth and further structural issues if not addressed quickly.

Common Causes of Fires

Understanding what causes fires can help prevent them. Here are the most common culprits:

-

Faulty Wiring: Electrical fires are often caused by outdated or damaged wiring. Regular inspections can help prevent these.

-

Unattended Cooking: The kitchen is a common starting point for house fires. Never leave cooking food unattended, especially when using oils or high heat.

-

Candles: While they create ambiance, candles are a fire hazard if left burning unattended or placed too close to flammable materials.

-

Smoking: Cigarettes can ignite furniture or bedding if not properly extinguished, making smoking a significant fire risk.

Knowing these causes and types of damage can help you better document and report any incidents, ensuring a smoother claims process with your insurance company. Being proactive and informed is key to handling fire damage claims in Austin effectively.

Next, we will dig into the steps you need to take to file a fire damage claim in Austin, ensuring that your property and peace of mind are protected.

Steps to File a Fire Damage Claim in Austin

When a fire strikes, the aftermath can be overwhelming. Here’s how to steer the fire damage claims in Austin efficiently.

Reporting the Fire

First things first: report the fire immediately. Once everyone is safe and the fire department has been notified, contact your insurance company as soon as possible. Quick action is crucial.

Your insurance company needs to know about the fire to start the claims process. Have your policy number ready and be prepared to provide details about the incident. This includes the date, time, and any known causes of the fire.

Documenting the Damage

Next, document everything. This is a critical step in supporting your claim. Start by taking clear photos and videos of the damage. Capture as much detail as possible, including:

-

Structural Damage: Photograph any charred or collapsed areas.

-

Smoke Damage: Look for soot and discoloration on walls and ceilings.

-

Water Damage: Note any areas where water has pooled or soaked into materials.

Create a detailed list of damaged items, including their value and condition before the fire. Keep receipts for any expenses related to temporary housing, clothing, or food, as these may be reimbursable.

Working with Fire Damage Restoration Professionals

After documenting the damage, it’s time to bring in the pros. Fire damage restoration experts can help clean and repair your property. They have the tools and expertise to handle:

-

Restoration: Repairing structural damage and making your home safe again.

-

Cleaning: Removing soot, smoke, and odors from surfaces and belongings.

-

Mold Remediation: Addressing any water damage to prevent mold growth.

Working with professionals not only ensures quality repairs but also helps strengthen your insurance claim. They can provide detailed reports and assessments that support the extent of the damage and the necessary repairs.

Taking these steps will help you steer the claims process more smoothly and ensure that your property is restored to its former state. Up next, we’ll discuss the challenges you might face and how to overcome them.

Challenges in Fire Damage Claims

Filing fire damage claims in Austin can be a daunting process, often filled with unexpected problems. Let’s unpack some of these challenges and how you can tackle them.

Bad Faith Insurance Practices

Unfortunately, not all insurance companies play fair. Some may engage in bad faith practices, which can make the claims process frustrating and stressful.

Here’s what to watch out for:

-

Claim Denial: Insurance companies may deny valid claims without a solid reason. This can leave you feeling stuck and unsure of what to do next.

-

Undervaluation: Sometimes, insurers offer settlements that don’t cover the full extent of your losses. This is a common tactic to minimize their payout.

-

Delayed Payment: Even when a claim is approved, insurers might delay payment, leaving you waiting for funds to start repairs.

-

Inadequate Investigation: Insurers might perform a quick or superficial investigation, missing crucial details that could impact your claim.

These practices are not only unfair but also against the law. Texas requires insurers to act in good faith, meaning they must handle claims promptly and fairly.

Legal Support for Fire Damage Claims

If you find yourself facing any of these issues, legal support can be a game-changer. Here’s how getting the right help can benefit you:

-

Legal Assistance: An experienced attorney can help you understand your rights and the insurance policy details. They know how to spot bad faith practices and can advise you on the best course of action.

-

Navigating Disputes: Lawyers can negotiate with your insurance company on your behalf. They can challenge unfair claims decisions and push for a fair settlement.

-

Claim Advocacy: With legal support, you have someone in your corner advocating for your best interests. They can help gather evidence, document your losses, and ensure your claim is properly valued.

In situations where an insurance company refuses to cooperate, having a legal professional can make all the difference. They can help you fight for the compensation you deserve, ensuring that you can rebuild and recover without unnecessary financial strain.

Next, we’ll tackle some frequently asked questions about fire damage claims in Austin to help you steer this complex process with confidence.

Frequently Asked Questions about Fire Damage Claims Austin

How do I get the most out of my fire insurance claim?

To maximize your fire insurance claim, take immediate action:

-

Report the Fire Promptly: Contact your insurance company as soon as possible. Quick reporting can help speed up the claims process.

-

Secure Your Property: Prevent further damage by securing your home. Cover broken windows or holes in the roof with tarps. This shows your insurer that you’re taking steps to mitigate losses.

-

Document Everything: Take photos and videos of all damage. Make lists of damaged items and keep receipts for any expenses related to the fire. This documentation is crucial for proving your losses.

How long does it take to settle a fire claim?

The time it takes to settle a fire claim can vary. Typically, it ranges from 30 to 120 days, but this can depend on the complexity of the claim and the state you’re in. In Texas, insurers are required to handle claims promptly, but delays can still occur. Staying organized and following up regularly with your insurer can help keep the process moving.

What if my fire damage claim is denied?

If your fire damage claim is denied, don’t panic. You have options:

-

Check for Bad Faith Insurance Practices: Sometimes, claims are denied without valid reasons. If you suspect bad faith practices, such as inadequate investigation or undervaluation, you may have grounds to challenge the denial.

-

Seek Legal Support: Consider hiring an attorney who specializes in insurance claims. They can help you understand your rights, gather evidence, and negotiate with your insurer. Legal support can be crucial in navigating disputes and advocating for a fair settlement.

By taking these steps, you can improve your chances of receiving the compensation you deserve, allowing you to rebuild and recover with less stress.

Conclusion

In the aftermath of a fire, navigating the claims process can be overwhelming. At Insurance Claim Recovery Support, our mission is to stand by you, ensuring you receive the maximum settlement you deserve. As a public adjustment firm, we exclusively advocate for policyholders, not insurance companies. Our expertise in fire damage claims in Austin and across Texas means we are well-versed in the challenges policyholders face, from claim denials to undervaluation.

The devastation of fires in Texas is undeniable. For instance, the Bastrop County fire was a stark reminder of how quickly flames can turn homes into ashes, affecting thousands of lives. In such trying times, having a dedicated ally can make all the difference. We understand the intricacies of Texas insurance laws and are committed to helping you steer the process smoothly.

Maximizing Settlements

Our role is to ensure you receive every penny you need to rebuild your life. We carefully document damages, negotiate with insurers, and challenge any bad faith practices. Our goal is to maximize your settlement so you can focus on recovery without financial strain.

Stay Informed on Texas Fire Damage News

Staying informed about fire risks and damage in Texas is crucial. Fires can occur without warning, and understanding the latest news and trends can help you prepare better. We encourage you to keep abreast of updates and take proactive steps to protect your property.

If you own or manage multi-family properties, our specialized services can support you in handling claims, ensuring your investments are protected and your tenants are safe.

In conclusion, you are not alone. With Insurance Claim Recovery Support by your side, you have a steadfast advocate ready to guide you from ashes to action. Reach out to us for a free consultation and let us help you secure the settlement you deserve.