Understanding the Power and Impact of Tornadoes

The effects on tornadoes are devastating consequences that extend far beyond immediate physical destruction, impacting communities, economies, and mental health for years.

Quick Answer: Key Effects of Tornadoes

Physical Effects:

- Wind speeds reaching up to 300 mph in the most violent tornadoes

- Structural damage ranging from minor roof damage (EF0) to complete building destruction (EF5)

- Debris transformed into lethal projectiles

- Damage paths ranging from a few yards to over 100 miles

Economic Effects:

- Billions of dollars in annual property damage across the United States

- In 2011 alone, tornado damage exceeded $28 billion

- Extended business interruption periods for commercial properties

- Complex insurance claim settlements

Human Effects:

- Post-traumatic stress disorder (PTSD), anxiety, and depression in survivors

- Approximately 5% of adolescents experiencing tornado events report suicidal thoughts

- Women, children, and adolescents show higher rates of mental health symptoms

- Community-wide psychological impacts lasting months to years

Climate-Related Trends:

- Increasing frequency of tornado outbreak days (30+ tornadoes)

- Geographic shifts toward the Southeast U.S.

- Growing intensity of cool-season tornado events

- Higher volatility and unpredictability in tornado patterns

For owners of commercial buildings, multifamily complexes, and other large properties, understanding these effects is critical for safety and navigating the complex insurance claim process. Damage can range from minor repairs to complete structural losses, and the insurance settlement often becomes a secondary disaster for unprepared policyholders.

As CEO of Insurance Claim Recovery Support, I’ve seen how a deep understanding of tornado effects helps policyholders secure the fair settlements they deserve. This guide explores the impacts of tornadoes and how expert claim management can lead to a faster, more complete recovery.

Similar topics to effects on tornadoes:

The Widespread Effects on Tornadoes: From Environment to Economy

The effects on tornadoes represent forces of nature that can reshape communities in minutes. For property owners across Texas—from Austin and Dallas-Fort Worth to San Antonio and Houston—these storms pose immediate danger and long-term financial challenges.

Understanding Tornado Formation and Physical Destruction

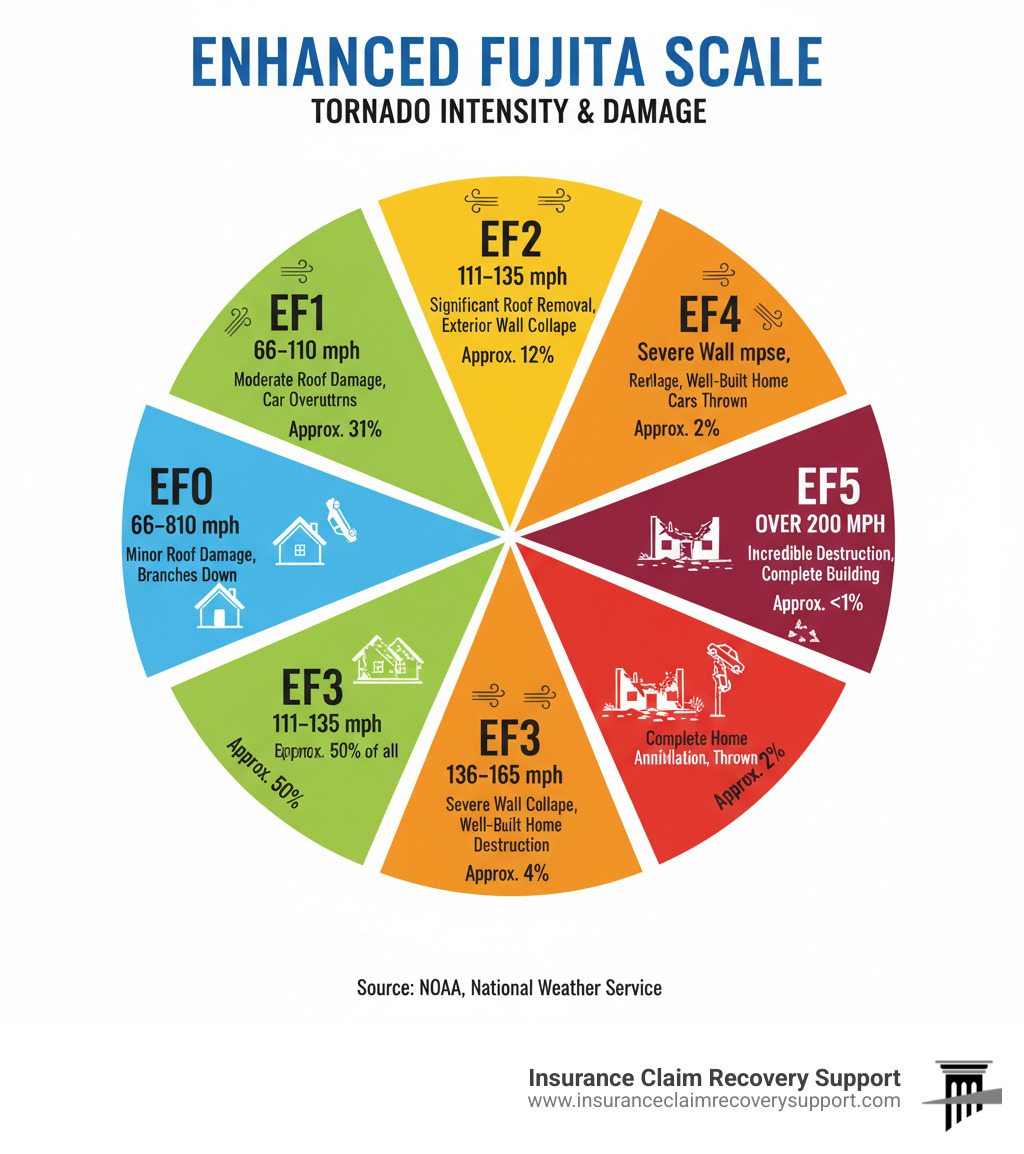

Tornadoes form in severe thunderstorms, creating rotating columns of air with winds from 65 to over 300 mph. The Improved Fujita (EF) Scale classifies them by the damage they cause, from an EF0 causing minor roof damage to an EF5 that can level a well-constructed building.

The primary threat is not just wind, but also the debris it carries. Trees and roofing materials become lethal projectiles capable of causing catastrophic structural damage. This is why robust construction and regular maintenance are critical, especially for commercial roofing systems. A well-maintained roof may survive a weaker tornado, while a neglected one could fail, leading to massive interior water damage and business interruption. For more on this, see our guide on Roofing Insurance Claims for Storm Damage.

Climate Change and Shifting Tornado Patterns

While the link between climate change and tornadoes is still being studied, significant shifts in tornado patterns are impacting Texas property owners. Key trends include:

- More “Tornado Outbreak Days”: Days with 30 or more tornadoes are becoming more frequent.

- Geographic Shifts: Tornado activity is moving eastward from the Great Plains, increasing risks in the Southeast U.S.

- Increased Volatility: While Texas has seen fewer warm-season tornado days, the overall unpredictability has increased dramatically.

- Intense Cool-Season Events: Tornadoes are becoming more common outside the traditional spring season, catching communities off guard.

These shifting patterns make year-round preparedness essential. Our resource on Texas Storm Damage explores how these changes affect properties across the state.

The Economic and Insurance Aftermath of a Tornado

Beyond the physical destruction, the economic impact of tornadoes is staggering, causing billions in damage annually. For commercial property owners, this means shuttered businesses, displaced tenants, and complex insurance battles.

Navigating a commercial claim involves understanding key coverages that are often disputed or underpaid:

- Business Interruption: Covers lost profits and ongoing expenses, but the period of recovery is often debated.

- Code or Ordinance: Pays for required upgrades to meet current building codes, a massive expense often excluded from standard policies.

- Debris Removal: Policies cover removal, but disputes arise over the scope and cost.

- High Deductibles: Windstorm deductibles are often a percentage (2-5%) of the total policy value, meaning a $20 million policy could have a $1 million deductible.

Understanding your policy is the first step. Our guide on How to File an Insurance Claim for Storm Damage can help.

When facing a major loss, you have options. Many property owners assume their only choices are to accept the insurer’s offer or file a lawsuit. However, hiring a public adjuster from the start is a more efficient, less adversarial path to a fair settlement.

| Feature | Public Adjuster Process | Insurance Lawsuit Process |

|---|---|---|

| When It Happens | From the moment damage occurs, we document, evaluate, and advocate for your full claim. | Typically begins after a claim has been denied or severely underpaid. |

| Who’s On Your Side | We work exclusively for you, the policyholder, to maximize your settlement. | Your attorney represents you in an adversarial process against the insurer. |

| How Long It Takes | Comprehensive, upfront claims often lead to settlements in weeks or months. | Litigation can drag on for months or even years, delaying your recovery. |

| What It Costs | We work on a contingency fee, and our expertise often nets you more money despite our fee. | Attorney fees, court costs, and expert witness expenses can significantly reduce your net recovery. |

| The Approach | Proactive and collaborative, focused on negotiating a fair settlement based on facts. | Adversarial by nature, focused on winning a legal battle. |

| The Outcome | Our expertise helps resolve disputes before they escalate, avoiding litigation in most cases. | The focus shifts from rebuilding to winning a case, which is emotionally and financially draining. |

Myth vs. Fact: Tornado Damage Claims

Myth: My insurance company will automatically pay for all tornado damage.

Fact: Not likely. Policies are complex, and initial offers from insurance adjusters are often thousands of dollars short of actual repair costs, especially for commercial properties.

Myth: I should wait for my insurance company to tell me what to do.

Fact: Being proactive is crucial. Thoroughly document all damage and seek expert advice from a public adjuster to ensure your claim is handled fairly from the start.

Myth: All adjusters are the same.

Fact: An insurance company’s adjuster works for them. A public adjuster, like Insurance Claim Recovery Support, works exclusively for you, the policyholder. Our only goal is to secure the maximum settlement you are owed.

The Human Toll: Navigating Recovery and Building Resilience

Beyond the structural damage, the effects on tornadoes include deep psychological wounds that can outlast the rebuilding process. The emotional toll is intertwined with the financial and physical recovery.

Primary Mental Health Effects on Tornadoes and Vulnerable Populations

Tornadoes shatter a community’s sense of safety. Survivors often face significant mental health challenges, including Post-Traumatic Stress Disorder (PTSD), anxiety, and depression. Flashbacks, nightmares, and persistent worry can become daily struggles. The trauma can also lead to sleep disorders and substance use as individuals try to cope.

Tragically, research shows that about 5% of adolescents who experience a major tornado report suicidal thoughts. The mental health effects are not distributed equally; women, children, and adolescents often show higher rates of symptoms. Children may express distress through behavioral changes, while the elderly face anxiety from displacement and loss of independence. The community-wide disruption of schools, businesses, and services creates a ripple effect of stress that touches everyone. For those struggling, the Scientific research on disaster mental health offers crucial support resources.

Protective Factors and Community Resilience

While the mental health effects are severe, resilience is possible. Certain protective factors act as buffers, helping individuals and communities recover.

- Social Support: Connections with family, friends, and neighbors are the most powerful lifeline.

- Coping Mechanisms: Optimism, self-efficacy (a belief in your ability to handle challenges), and hope provide fuel for the long recovery journey.

- Community Preparedness: Effective warning systems and emergency plans reduce anxiety by creating a sense of control.

- Stronger Building Codes: Knowing a property was built to withstand severe weather provides significant peace of mind. Our Public Adjuster Storm Damage Complete Guide explains how robust construction contributes to resilience.

- Financial Stability: This is a critical foundation for mental health recovery. The stress of fighting an insurance company can compound trauma exponentially. A fair and timely settlement removes a massive burden, allowing property owners to focus on healing.

Navigating Your Property Claim for a Smoother Recovery

The insurance claim process should not become a secondary disaster. For commercial property owners in Fort Worth, San Angelo, or Lakeway, the financial stress of an underpaid claim can derail recovery, impacting your health, business, and future.

This is where Insurance Claim Recovery Support steps in. We manage the complex, time-consuming work of a commercial property claim so you can focus on recovery. A tornado claim for a large multifamily property or religious institution involves intricate policy language, specialized damage assessments, and business interruption calculations that require expert knowledge.

As public adjusters, we work exclusively for you, not the insurance company. Our sole loyalty is to maximize your settlement. We document all damage with forensic detail, review your policy to identify all applicable coverages, and negotiate aggressively on your behalf. This proactive approach is designed to secure a fair settlement without the years of stress and expense that come with litigation.

By having an expert advocate, property owners in Houston, Austin, and across Texas can transform their recovery experience. Instead of fighting adjusters, you can focus on supporting tenants, communicating with stakeholders, and rebuilding your business. The financial stability from a maximized settlement allows you to hire quality contractors and reopen on a solid foundation, reducing stress for you, your employees, and your community.

For more information, visit our page on tornado damage insurance claim services. The effects of tornadoes are profound, but with the right support, recovery is achievable.

Conclusion

The full picture of the effects on tornadoes goes far beyond twisted metal, reshaping lives, economies, and communities for years. We’ve seen how these storms release incredible physical force, how climate change is shifting their patterns, and how they inflict a staggering economic and human toll.

For commercial property owners, the path to recovery is fraught with challenges, especially when navigating a complex insurance claim. Financial stability through a fair insurance settlement isn’t just about rebuilding structures—it’s about restoring peace of mind and giving business owners the foundation they need to heal.

At Insurance Claim Recovery Support, we stand with policyholders in Texas and nationwide. We’ve spent over 15 years ensuring that a devastating storm is not followed by a devastating settlement. Our expertise in commercial claims for properties in Austin, Dallas, Houston, and San Antonio allows our clients to avoid lengthy litigation and focus on what matters: rebuilding their business and community.

The road to recovery doesn’t have to be walked alone. With expert claim management, you can secure the resources needed to come back stronger. If you’re facing tornado damage, we are ready to advocate for you every step of the way. Visit our dedicated tornado damage insurance claim services page or explore our full range of services to learn more.