Protecting Your Ministry Through a Crisis

The church insurance claim process is the formal procedure by which a religious institution reports damage or loss to its insurance carrier and seeks financial compensation. While churches hope never to use this process, understanding it can mean the difference between a fair settlement and a financial crisis that impacts your ministry for years.

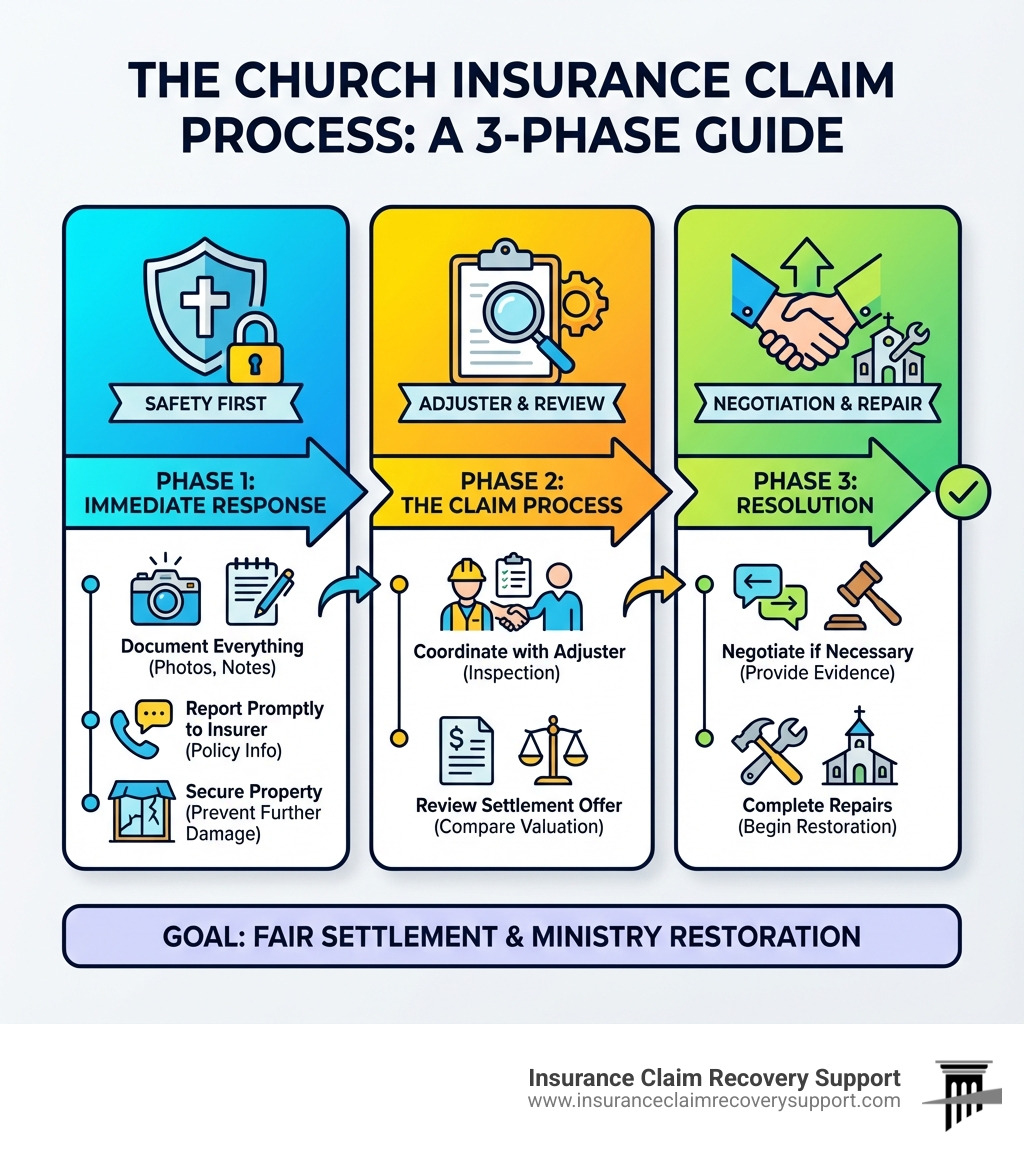

Here’s the church insurance claim process at a glance:

- Assess and secure the scene — Ensure safety and prevent further damage.

- Document everything — Take photos, videos, and written notes of all damage.

- Report promptly to your insurer — Call your carrier immediately with your policy details.

- Coordinate with the adjuster — The insurer will send an adjuster to inspect the loss.

- Review the settlement offer — Compare the insurer’s valuation against your own documentation.

- Negotiate if necessary — Provide additional evidence or seek professional help if the offer is too low.

- Complete repairs — Once a settlement is agreed upon, authorized repairs can begin.

Churches face unique challenges, from valuing irreplaceable items like stained glass to managing the emotional toll on a congregation. Unfortunately, many claims are underpaid or wrongfully denied. Insurers may use depreciation, policy exclusions the church didn’t know existed, or claims of “lack of maintenance” to reduce payouts, turning a property damage event into a financial crisis.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. For over 15 years, I’ve helped religious institutions steer the church insurance claim process and recover what they are rightfully owed. My firm specializes in overturning wrongfully denied claims and negotiating fair settlements for large-loss property damage, so your ministry can focus on your community, not your insurance company.

Navigating the Church Insurance Claim Process: A Comprehensive Walkthrough

Proactive Preparation: Ensuring Your Church is Covered Before a Loss

The most effective way to steer the church insurance claim process is to prepare before a disaster. This involves understanding your policy’s coverages and exclusions, implementing risk management like regular property maintenance, and conducting annual policy reviews to adjust for inflation and new building codes.

Property Valuation: Getting It Right

Accurately valuing your church’s property is critical. Ensure your building coverage reflects the true cost to rebuild with current materials and labor, including permanently attached items like pews and sound systems.

- Replacement Cost Value (RCV) vs. Actual Cash Value (ACV): The valuation method in your policy dramatically impacts your payout.

| Feature | Replacement Cost Value (RCV) | Actual Cash Value (ACV) |

|---|---|---|

| Definition | Pays to replace or rebuild with new items of like kind and quality. | Pays replacement cost minus depreciation for age and wear. |

| Payout Process | Often paid in two parts: ACV first, then depreciation after repairs are complete. | A single payment of the depreciated value. |

| Benefit | Allows full restoration without out-of-pocket costs for depreciation. | Lower premiums, but you cover the depreciation gap. |

| Example | A 10-year-old roof with a 20-year lifespan is fully replaced. | A 10-year-old roof with a 20-year lifespan might only receive 50% of its replacement value, less the deductible. |

- Valuation Essentials: Be aware of coinsurance clauses that require you to insure to a certain percentage of your property’s value. Obtain professional appraisals for unique items like stained glass and religious artifacts. Maintain a detailed inventory of all contents, and choose an insurer with a high AMBest rating (A- or better) for financial stability. You can reduce premiums with a higher deductible, but ensure it doesn’t make smaller claims impractical.

For more information on ensuring your commercial property is adequately protected, explore our resources on commercial property loss claims and a guide to commercial claims in Texas.

The Essential Steps of the Church Insurance Claim Process

When disaster strikes, prompt action and meticulous documentation are crucial.

1. Immediate Safety and Mitigation:

Your first priority is safety. Then, take reasonable steps to prevent further damage, like boarding up windows or shutting off water. This is a policy requirement. For major incidents, notify law enforcement or the fire department.

2. Document Everything:

Documentation is your most powerful tool. Take extensive photos and videos of all damage before cleanup. Keep a detailed log of the incident and all related expenses. Obtain copies of any official police or fire reports.

3. Notifying Your Insurer:

Report the claim to your insurer promptly with your policy number, date of loss, and a clear description of the damage. For property claims, provide your documentation and inventory of damaged items. For liability claims (e.g., an injury), provide incident details and witness information, but never admit fault. Refer all discussions to the adjuster.

For comprehensive guidance on navigating property damage claims, refer to our guide on property damage insurance claims in the insurance industry.

Working with Adjusters and Understanding Your Settlement

Once you report a claim, the insurance company assigns an adjuster to evaluate the loss. This is a critical stage in the church insurance claim process.

- The Adjuster’s Role: The insurer’s adjuster investigates the claim to determine coverage and recommend a payout. They work for the insurance company, and their goal is to settle the claim for their employer.

- Cooperation and Review: Be present for the adjuster’s inspection, provide all your documentation, and point out all damages. The adjuster will provide a “Scope of Loss” report and settlement offer. Scrutinize it against your own documentation and contractor estimates. Look for overlooked damages, incorrect costs, and unfair depreciation calculations.

For a deeper dive into the adjuster’s role, read what does a claims adjuster do.

Unique Challenges for Churches in the Claims Process

Churches face distinct problems in the claims process.

- Valuing Unique Property: Standard valuation methods fail for items like stained glass, pipe organs, and historical artifacts. These require professional appraisals to ensure they are covered for their true worth.

- Loss of Income: If damage makes your building unusable, business income coverage can replace lost revenue from tithes, event rentals, or other services.

- Lack of Maintenance and Exclusions: Insurers often deny claims by blaming a lack of maintenance (e.g., an old, leaky roof). Maintain your property and keep records. Also, be aware of policy exclusions, as claims are often denied for uncovered perils like flood or for lack of specific endorsements like abuse and molestation coverage.

For more insight into these issues, review our guides on denied insurance claim ultimate guide and why insurance companies delay, deny, and dispute claims on purpose.

Recognizing Bad Faith and When to Seek Professional Help

Sometimes, difficulties with an insurer cross the line into “bad faith.”

- Signs of Bad Faith: This occurs when an insurer fails to uphold their contract. Signs include unreasonable delays, offering a settlement far below the actual damage (lowballing), misrepresenting your policy, or denying a valid claim without a proper investigation.

- Public Adjusters vs. Lawsuits: When facing a disputed claim, a public adjuster is a powerful advocate who works exclusively for you. We aim to resolve disputes through expert negotiation, which is faster, less confrontational, and avoids the high costs of litigation. Our firm, for example, has a 90% success rate in settling claims without lawsuits. An insurance claim lawsuit is a last resort—a lengthy, expensive, and draining process that should only be considered when all other negotiation avenues have failed.

If you suspect your church’s claim is being handled in bad faith, it’s crucial to act. Learn more about bad faith insurance claim Texas and hiring the best public insurance adjuster.

FAQ: Common Questions About the Church Insurance Claim Process

The church insurance claim process can be confusing. Here are some common questions.

Q: How do property damage and liability claims differ?

A: Property claims focus on physical damage to your assets, requiring repair estimates. Liability claims involve injury to others, requiring investigation and potential compensation. For liability, always file a claim when someone is injured and asks the church to cover their bills.

Q: Will filing a claim raise my premium?

A: Myth: A single claim automatically leads to cancellation. Fact: Too many claims in a short period can lead to non-renewal or premium increases. For small property claims, weigh the payout against your deductible and potential loss of a “loss-free” discount. A public adjuster can help you assess if filing is financially beneficial. However, liability claims for injuries should almost always be filed.

Q: Can a church cancel an insurance claim after filing?

A: Yes, but the incident may still be recorded by the insurer and could affect future premiums or discounts. It’s better to assess the financial impact before filing.

Q: What information is needed for a claim?

A: For property damage, you’ll need your policy number, details of the loss (date, time, cause), photos/videos, and repair estimates. For legal liability, provide immediate notification of any incident, including details of what happened and any injured parties or witnesses. Prompt reporting is critical.

Q: Under what circumstances might a claim be denied?

A: Common reasons include damage from lack of maintenance, policy exclusions (the peril isn’t covered), late reporting, or failure to provide sufficient proof of loss.

When facing a denied claim, it’s important to understand your options. Explore our resources on claims dispute.

Conclusion: Rebuilding Your Church with Confidence and Support

Navigating the church insurance claim process is challenging, but proper preparation and advocacy ensure a fair recovery.

Key Takeaways for Your Church:

- Preparedness is Crucial: Understand your policy and value your assets accurately before a loss occurs.

- Documentation is Power: Carefully record all damage and communications with your insurer.

- You Are Not Alone: You have the right to expert representation when dealing with your insurer.

At Insurance Claim Recovery Support, we believe your ministry should focus on its mission, not on fighting insurance companies. As licensed public adjusters based in Texas and serving states nationwide, we represent only policyholders. Our expertise in large-loss claims for fire, storm, and water damage means we maximize your settlement and help you avoid unnecessary litigation. We have a 90% settlement success rate without resorting to lawsuits, allowing your church to rebuild and continue its vital work.

If your church has experienced property damage and needs assistance with the church insurance claim process, don’t hesitate to reach out. We are here to ensure your ministry receives the fair settlement it deserves. For specific guidance on fire-related claims, visit get help with your church fire claims.

For more insights into how community organizations rebuild after disasters, you can also refer to scientific research on disaster recovery for community organizations.