Introduction: The Unseen First Responders of Property Claims

A catastrophe inside property adjuster is a specialized insurance professional who works remotely from a desktypically at the insurance company’s officeto assess, evaluate, and settle large-scale property damage claims after disasters like hurricanes, tornadoes, fires, floods, and hailstorms. Unlike field adjusters who physically visit damaged properties, inside adjusters review documentation, analyze virtual inspections, interpret policies, prepare estimates using software like Xactimate, and negotiate settlementsall without leaving their office.

Key Responsibilities of a Catastrophe Inside Property Adjuster:

- Review and interpret insurance policies to determine coverage for property damage claims

- Analyze photos, videos, and virtual inspections submitted by field adjusters or policyholders

- Prepare damage estimates using industry-standard software (primarily Xactimate)

- Communicate with policyholders, field adjusters, and contractors to clarify claim details

- Negotiate and authorize settlements based on policy terms and damage assessments

- Document all claim activities and maintain detailed file records for compliance

- Handle high claim volumes during catastrophe deployments (often 50-100+ claims at once)

What Owners and Managers of Commercial and Multifamily Properties Need to Know:

Fact: Inside adjusters work for the insurance company, not for youtheir goal is to settle claims efficiently within policy limits, which may not align with your recovery needs.

Fact: Their initial estimate is a starting point for negotiation, not a final offer you must accept.

Fact: During catastrophes, inside adjusters manage overwhelming caseloads that can lead to rushed evaluations, missed damage, or underpayment.

Myth: The inside adjuster’s assessment is always thorough and accuratein reality, desk-based reviews of photos and virtual inspections often miss hidden damage that only on-site expertise can identify.

FAQ: Public Adjuster or Lawsuit?

- Do I need to file a lawsuit to get a fair settlement? Usually no. A licensed public adjuster can build a complete, defensible claim file, scope the full damage, and negotiate a fair settlement pre-litigation, often faster and at lower overall cost.

- When should I involve an attorney? When there is a clear coverage denial, statutory/bad-faith issues, or when negotiations have fully broken down. A public adjuster can help avoid unnecessary litigation by resolving scope and pricing disputes first, and can coordinate with counsel if litigation becomes necessary.

- Quick comparison:

- Public Adjuster path: weeks to a few months; contingent fee on recovered amounts; detailed documentation, negotiated supplements, faster cash flow, preserves options.

- Lawsuit path: 12 6+ months; attorney and expert fees/costs; discovery, depositions, potential trial; disrupts operations and delays recovery.

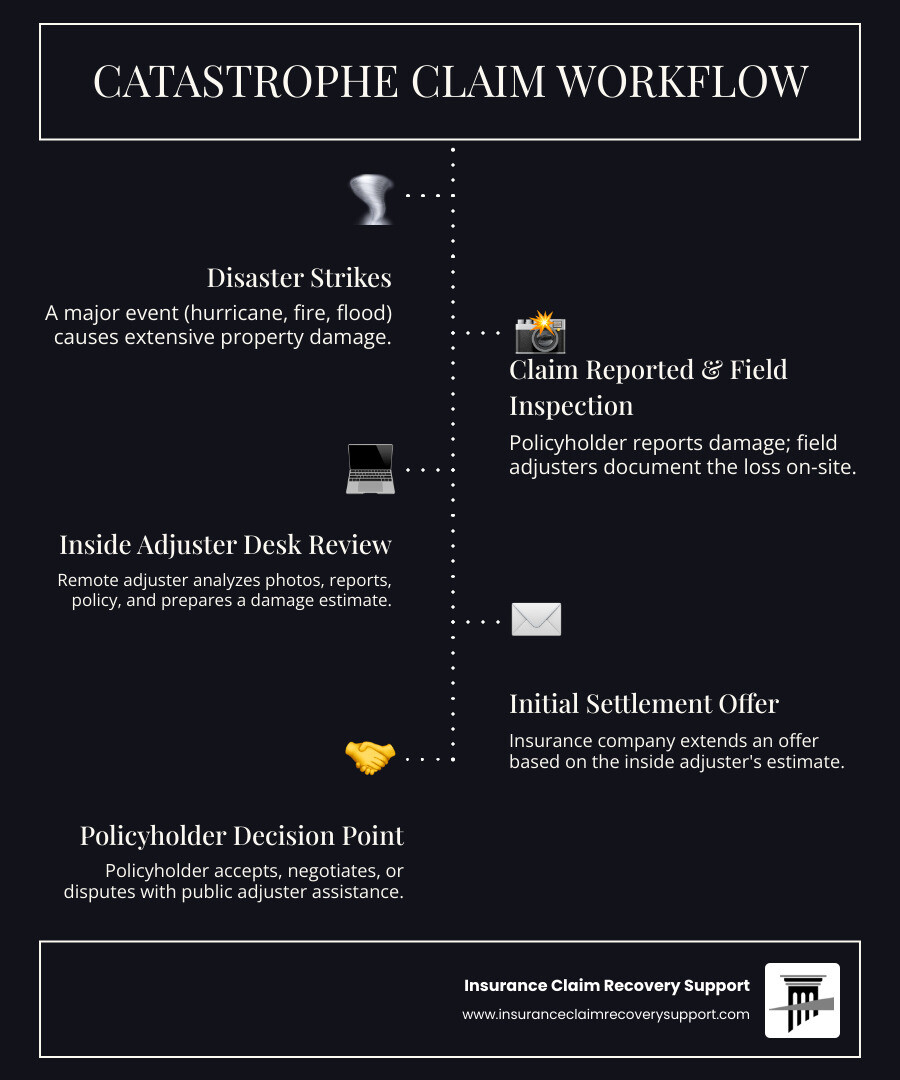

When a catastrophe strikes your commercial or multifamily property, the catastrophe inside property adjuster becomes the gatekeeper between your loss and your recovery. They work from a desk, often hundreds of miles away, reviewing photos and reports while you’re standing in the rubble. According to industry sources, these adjusters can receive over 100 assignments on the first day of a major hurricane deployment, working 15-hour days, seven days a week, to process claims. This overwhelming workloadcombined with the inherent limitation of not physically inspecting your propertycreates a perfect storm for underpayment, overlooked damage, and claim disputes that can derail your business recovery and lead to costly, time-consuming lawsuits.

As Scott Friedson, CEO of Insurance Claim Recovery Support with over 15 years of experience settling hundreds of millions in property damage claims, I’ve seen how the limitations of the catastrophe inside property adjuster role can impact commercial and multifamily policyholders’ recoveriesand how strategic public adjuster representation levels the playing field. Understanding what inside adjusters do, how they work, and where their process falls short is essential for any owner or manager seeking fair compensation after a disaster, often without having to resort to litigation.

The World of the Catastrophe Inside Property Adjuster

When a hurricane slams into the Gulf Coast or a tornado tears through Dallas-Fort Worth, the insurance industry shifts into emergency mode. While field adjusters grab their ladders and cameras to inspect damaged properties in person, there’s another army of professionals working behind the scenesoften hundreds of miles from the disaster zone. The catastrophe inside property adjuster becomes the analytical engine processing the massive wave of claims that floods in after every major disaster.

These desk-based professionals work from insurance company offices, reviewing photos and reports while owners and managers of commercial and multifamily properties stand amid the rubble of their buildings. Their role is absolutely central to how quickly you’ll receive your settlement and whether that settlement will actually cover what you need to rebuild. Understanding their worldand their limitationscan make the difference between a fair recovery and a financial disaster that compounds your physical one.

Primary Responsibilities of a Catastrophe Inside Property Adjuster

The catastrophe inside property adjuster operates as the remote claim manager and analytical backbone of the catastrophe response. Their desk becomes command central for decisions that directly impact your commercial property’s recovery timeline and settlement amount.

Policy interpretation and coverage analysis comes first. Before they can assess a single dollar of damage, inside adjusters must dig into your commercial property insurance policyevery page, every endorsement, every exclusion. They’re looking for what’s covered, what’s not, and how much you’re entitled to receive. This includes parsing through deductibles, coverage limits, and specific clauses related to hurricanes, tornadoes, fire, or flood damage claims. For properties in designated flood zones, this also involves navigating the complex rules of the National Flood Insurance Program (NFIP). For complex commercial and multifamily claims, this interpretation step becomes even more criticaland more prone to disagreement.

Damage analysis happens entirely from a distance. This is where the inside adjuster role fundamentally differs from traditional adjusting. They never set foot on your property. Instead, they piece together the damage puzzle using photos, videos, drone imagery, scope sheets, and reports submitted by field adjusters or sometimes directly by policyholders. They’re looking at your roof damage, your interior structural issues, your water-damaged commercial spacesall through a screen. Companies like Travelers have invested in training drone operators to capture 4K or 8K images specifically to help inside adjusters see more detail, but there’s no substitute for physically being there. This remote assessment method is efficient for insurance companies but creates significant risk for commercial property owners whose damage might be missed or minimized.

Estimate writing using Xactimate software represents the technical heart of their job. Inside adjusters spend hours in this industry-standard software, creating line-item estimates for repairs. They sketch your roof and interior spaces digitally, enter specific repair items, apply depreciation schedules, and calculate costs based on local pricing databases. Xactimate proficiency is considered the single most important technical skill for adjustersit’s their primary tool for translating physical damage into dollar amounts. The problem? Their estimate becomes the insurance company’s opening offer, and many commercial property owners mistakenly believe it’s a final, non-negotiable number. It’s not.

Acting as the communication hub means inside adjusters juggle constant interactions with policyholders, contractors, and field adjusters. They’re fielding your questions about coverage, requesting additional documentation, clarifying discrepancies in damage reports, and explaining (or defending) their coverage decisions. For owners and managers in Houston dealing with hurricane damage or Austin businesses recovering from tornado insurance claims, this adjuster becomes your primary point of contact with the insurance companyeven though they’ve never seen your property in person.

Settlement negotiation and authorization is where their true loyalty becomes clear. Based on their remote assessment and policy interpretation, inside adjusters prepare and authorize settlement offers. They’re working within company guidelines to settle claims efficiently and within policy terms. “Efficiently” often means quickly and for as little as the policy allowsnot necessarily what you actually need to fully restore your commercial property. This is why understanding that their initial offer is a negotiable starting point becomes absolutely critical for owners and managers.

File documentation and compliance requires meticulous record-keeping of every phone call, every coverage decision, every line item in the estimate, and every justification for their settlement offer. This documentation trail serves the insurance company’s interestsprotecting them in audits and potential disputesbut it also creates the paper trail you’ll need if you disagree with their assessment and decide to bring in a public adjuster.

Managing crushing claim volumes during major catastrophes fundamentally changes how inside adjusters work. When a hurricane hits the Texas coast, these adjusters can receive 100+ new assignments on day one. They’re working 15-hour days, seven days a week, trying to process an overwhelming flood of claims. This intense workload creates a perfect storm for rushed evaluations, overlooked damage, and underpaymentespecially for complex commercial losses that require more careful analysis. Your multifamily property claim might get 30 minutes of review time when it really needs three hours.

For owners and managers of commercial and multifamily properties dealing with wind, fire, or extensive flood losses in Dallas, Fort Worth, San Antonio, or Houston, the inside adjuster’s decisions directly determine whether you can fully rebuild or face a significant funding gap.

Inside vs. Field Adjuster: A Tale of Two Roles

The insurance industry uses two very different types of adjusters to handle catastrophe claims, and understanding which one is working on your claimand what they can and cannot domatters significantly for commercial property owners.

| Feature | Catastrophe Inside Property Adjuster | Field Adjuster |

|---|---|---|

| Location | Office-based (often hundreds of miles from disaster) | On-site at damaged properties |

| Travel Requirements | Minimal (work from desk) | Extensive (70%+ travel typical during catastrophes) |

| Inspection Method | Virtual assessment using photos, videos, reports | Physical inspection with ladder, camera, moisture meters |

| Primary Tools | Xactimate software, video calls, document review systems | Ladder, camera, measuring tools, moisture detection equipment |

The inside adjuster works from a desk, typically at an insurance company office that might be in another state entirely. When your commercial building in Round Rock suffers tornado damage, your inside adjuster might be reviewing photos from a cubicle in Atlanta or Chicago. They rely entirely on technology and documentationanalyzing images, reviewing reports, and making coverage decisions without ever experiencing the smell of smoke damage, the feel of compromised structural elements, or the visual context that comes from walking through damaged spaces.

Field adjusters, by contrast, physically visit your property. They climb onto roofs, inspect HVAC systems up close, use moisture meters to detect hidden water damage, and document conditions with their own cameras. During catastrophe deployments, they might travel 70% or more of their time, moving from property to property to conduct hands-on inspections. Their physical presence allows them to catch damage that doesn’t photograph well or find issues hidden behind walls or above ceilings.

The inspection method difference creates the most significant impact on claim outcomes. Virtual assessments using photos and videosthe inside adjuster’s primary toolfrequently miss damage that’s not immediately visible or that requires physical testing to detect. Water infiltration behind walls, compromised structural connections, hidden fire damage in crawl spaces, or the full extent of impact damage to commercial roofing systems often don’t show up clearly in photographs. Field adjusters can physically verify these issues; inside adjusters must rely on what’s documented for them.

Primary tool differences reflect these distinct approaches. Inside adjusters are software expertsthey live in Xactimate, use video conferencing platforms, and manage digital file systems. Field adjusters are equipment expertsthey know how to safely steer damaged structures, use diagnostic tools, and capture documentation that accurately represents conditions. Both skill sets matter, but for complex commercial property damage in Georgetown, Lakeway, Waco, or Lubbock, the hands-on field inspection usually provides more accurate damage assessment.

Here’s what this means for you as an owner or manager: If your claim is being handled primarily by an inside adjuster reviewing photos, there’s significant risk that damage will be missed or minimized. This desk-based analysis, combined with the overwhelming workload these adjusters face during catastrophes, creates the perfect conditions for underpayment. This is precisely where an experienced public adjuster who physically inspects your property and prepares their own detailed estimates can level the playing fieldoften identifying tens or hundreds of thousands of dollars in damage that the inside adjuster’s remote review missed entirely.