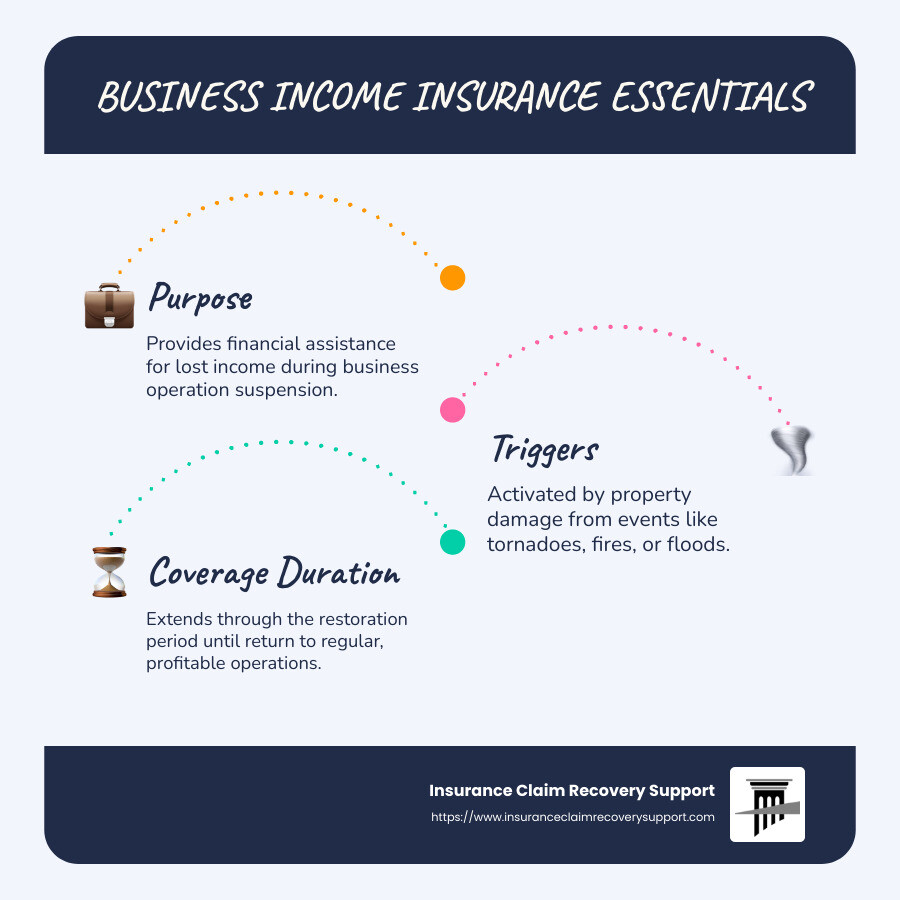

Business income insurance is the safety net businesses need when disaster strikes. This type of insurance covers your business’s lost income when unexpected property damage disrupts your operations. Here’s a quick snapshot:

- Purpose: Provides financial assistance for lost income during the suspension of operations.

- Triggers: Activated by property damage from events like tornadoes, fires, or floods.

- Coverage Period: Extends through the “restoration period,” which is the time needed to repair or rebuild similar quality property—or relocate, if necessary.

When severe weather or other mishaps impact your business operations, business income insurance steps in to cover what your business would have earned. The coverage applies until your business can return to regular, profitable operations. This often includes several critical expenses like employee wages, lease or mortgage payments, and other ongoing operating expenses that don’t pause just because your business does.

I’m Scott Friedson, and I’ve settled hundreds of millions in business income insurance claims. I specialize in ensuring businesses, like yours, steer the claims process smoothly and receive fair compensation.

Understanding Business Income Insurance

When your business faces unexpected disruptions, business income insurance is your financial lifeline. It covers the income you lose when your operations are halted due to property damage. This insurance ensures that your business can survive financially until you can reopen.

What Does It Cover?

- Lost Income:

-

Imagine a fire damages your retail store. During the downtime, business income insurance compensates for the revenue you would have earned. This is crucial for maintaining cash flow and keeping your business afloat.

-

Operating Expenses:

- Even if your business is closed, bills still need to be paid. This coverage helps with ongoing expenses like rent, utilities, and employee wages. This way, you can keep your team and infrastructure intact, ready to hit the ground running once repairs are complete.

The Restoration Period

The restoration period is the time it takes to repair or rebuild your business property. Coverage lasts until your operations can resume normally. If you can operate from a temporary location, the insurance may cover that time too.

For example, if a tornado damages your office, and it takes three months to repair, the business income insurance will cover your lost income and expenses during this period. If you decide to temporarily relocate, extra expense coverage may help with those costs.

Real-World Example

Consider Kate’s Bagel Shop, which suffered fire damage. Thanks to her business income insurance, she was able to cover lost profits and ongoing expenses during the restoration period. This allowed her to focus on rebuilding her shop without worrying about financial strain.

Understanding your policy is crucial. Check for specifics like the waiting period before coverage kicks in and any limits on the restoration period. This knowledge ensures you’re prepared when the unexpected happens.

Next, we’ll explore what exactly business income insurance covers, including mortgage payments, employee wages, and more.

What Does Business Income Insurance Cover?

Business income insurance is your safety net when unforeseen events disrupt your operations. It helps cover essential expenses, ensuring your business stays afloat during tough times. Here’s what it typically covers:

Mortgage Payments

Even when your business is temporarily closed, your mortgage obligations remain. Business income insurance steps in to cover these payments, preventing financial strain. This ensures that you don’t fall behind on your mortgage, keeping your business premises secure.

Employee Wages

Retaining your workforce is crucial. This insurance helps you pay your employees, even when revenue isn’t coming in. By covering wages, it ensures that your team is ready to jump back into action as soon as your business reopens.

Loan Payments

Businesses often rely on loans for growth and operations. During a disruption, loan payments can add pressure. Business income insurance covers these payments, helping you avoid default and maintain good credit standing.

Tax Payments

Taxes don’t wait for business disruptions to end. This coverage ensures you meet your tax obligations on time. It prevents penalties and keeps your business compliant with tax laws, even when you’re not generating income.

Business income insurance is designed to keep your business financially stable during the restoration period. By covering these critical expenses, it allows you to focus on getting back on track without the added stress of financial burdens.

Next, we’ll dig into the exclusions and limitations of business income insurance, so you know what not to expect from your policy.

Exclusions and Limitations

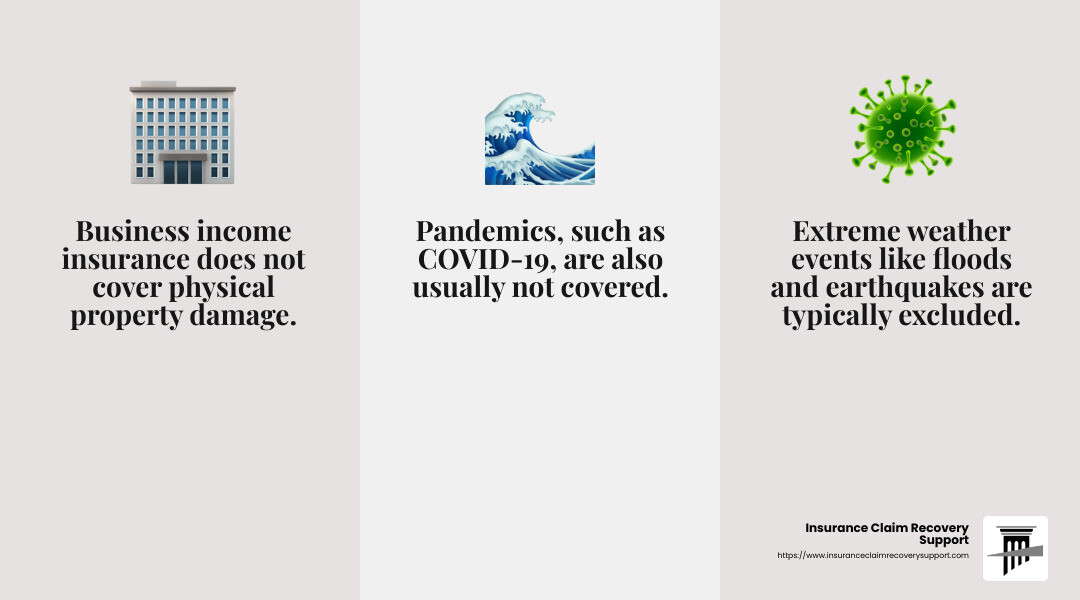

While business income insurance provides vital financial protection, know what it doesn’t cover. Understanding these exclusions will help you avoid surprises when you need to rely on your policy.

Property Coverage

Business income insurance doesn’t cover physical damage to your property. For that, you’ll need separate property insurance. This policy is specifically designed to cover income loss, not the cost of repairs or rebuilding.

Extreme Weather

Certain extreme weather events, like earthquakes and floods, are usually not covered. If your business is in a high-risk area, consider additional policies for these specific perils. For instance, flood insurance is a separate policy that businesses in flood-prone areas should consider.

Pandemics

Pandemics, such as COVID-19, are typically excluded from business income insurance. After the SARS outbreak, many insurers added exclusions for viral infections. This means losses due to pandemics are generally not covered, leaving businesses to seek alternative solutions during such crises.

In summary, while business income insurance is a valuable tool for protecting your business’s financial health, it has its limitations. Knowing these exclusions will help you make informed decisions about additional coverage you might need.

Next, we’ll explore who needs business income insurance and why it might be essential for your business.

Who Needs Business Income Insurance?

Business income insurance is crucial for businesses that rely on a physical location, specialized equipment, or both to generate income. Let’s break down why this coverage is essential for different types of businesses:

Physical Location

If your business operates from a specific location, like a retail store or a service-based business, business income insurance can be your safety net. Imagine a scenario where a fire damages your premises, forcing you to close temporarily. This insurance helps cover the loss of income during the restoration period. Without it, you might struggle to pay rent, employee wages, and other fixed expenses.

Equipment-Dependent Businesses

For companies that rely heavily on equipment, such as manufacturing plants or tech firms, any damage can halt operations. Business income insurance ensures that you can cover your ongoing expenses while your equipment is being repaired or replaced. For example, a software company might need this coverage to protect against income loss if their servers are damaged and they can’t operate.

Retail Stores

Retail businesses, whether online or brick-and-mortar, often face unique risks. If a storm damages your storefront or disrupts your supply chain, business income insurance can help you maintain financial stability. This coverage is particularly important during peak sales periods when any interruption could significantly impact your revenue.

Service Businesses

Service-oriented businesses, like hair salons or accounting firms, depend on their ability to serve clients in person. If an unexpected event forces you to close your doors temporarily, business income insurance can help cover your financial obligations until you can resume normal operations.

Any business that relies on a specific location, equipment, or both should consider business income insurance. It provides a financial cushion during unexpected disruptions, allowing you to focus on getting back on your feet without the added stress of financial strain.

Next, we’ll dive into how business income insurance works and the different types of coverage options available to protect your business.

How Business Income Insurance Works

Business income insurance is designed to protect your business’s financial health when unexpected events disrupt your operations. Let’s explore how it provides income protection, civil authority coverage, and support for dependent properties.

Income Protection

At its core, business income insurance acts as a financial safety net. It helps replace lost income if your business can’t operate due to covered property damage, like fire or theft. This means you can continue paying important expenses—like employee wages, rent, and loan payments—while your business is being restored.

Example: Imagine a bakery that suffers fire damage, forcing it to close for repairs. With business income insurance, the bakery can cover ongoing expenses and keep its employees paid during the downtime.

Civil Authority Coverage

Sometimes, your business might be affected by events outside your immediate control. Civil authority coverage kicks in when access to your business is restricted by government order due to nearby damages.

Example: A tornado hits your town and local authorities block access to your area for safety reasons. Even if your business isn’t directly damaged, business income insurance can help cover your losses because you can’t operate.

Dependent Properties

Businesses often rely on suppliers, vendors, or other partners to function smoothly. If one of these dependent properties suffers damage, it could disrupt your operations. Contingent business interruption coverage, an extension of business income insurance, can help mitigate these risks.

Example: A clothing retailer depends on a single supplier for inventory. If a fire at the supplier’s warehouse delays shipments, the retailer might face a loss of income. With the right coverage, they can recover some of these losses.

In summary, business income insurance offers comprehensive protection against income loss due to property damage, restricted access, or supply chain disruptions. This ensures your business can weather the storm and emerge resiliently.

Next, we’ll address frequently asked questions about business income insurance, including the differences between business income and business interruption insurance.

Frequently Asked Questions about Business Income Insurance

What is the difference between Business Income and Business Interruption Insurance?

Business income insurance and business interruption insurance are often used interchangeably. They both refer to the same type of coverage that helps replace lost income when your business operations are halted due to direct physical damage, like a fire or storm. This coverage is crucial to keep your business afloat during the restoration period when repairs are underway.

How do you calculate Business Income Coverage?

Calculating business income coverage involves assessing your business’s yearly income, expenses, and expected revenue. The goal is to estimate the financial impact of potential disruptions. Here’s a simplified approach:

- Determine Expected Sales: Estimate the revenue you would have earned if no interruption occurred.

- Subtract Actual Sales: Deduct the revenue you managed to earn during the disruption.

- Consider Additional Expenses: Add any extra costs incurred, like renting temporary premises.

- Account for Cost Savings: Deduct savings from expenses that didn’t occur, like utilities for a closed location.

This calculation helps tailor the coverage to your specific needs, ensuring you have enough protection to cover lost income and necessary expenses.

What is the waiting period for Business Income Coverage?

Most business income insurance policies have a waiting period before coverage kicks in. This period, often ranging from 48 to 72 hours, is the time you need to wait after the damage occurs before the insurance starts compensating for lost income. However, some policies offer a zero-hour waiting period for an additional cost, allowing coverage activation immediately after a covered event. This can be particularly beneficial for businesses that can’t afford any downtime.

In the next section, we’ll explore the exclusions and limitations of business income insurance, so you know what to expect and plan accordingly.

Conclusion

At Insurance Claim Recovery Support, we are committed to helping policyholders steer the complex world of business income insurance. Our mission is to ensure that you receive the maximum settlement you deserve when your business faces unexpected interruptions.

Why Choose Us?

We specialize in representing policyholders, not insurers. This means our focus is solely on advocating for your best interests. Whether you’re dealing with fire, tornado, or flood damage, our experienced team is here to guide you through the claims process. We serve clients across Texas, including Austin, Dallas, Fort Worth, San Antonio, and Houston, to name a few.

Our Approach

We believe in a transparent and straightforward claims process. Our experts will work closely with you to document and negotiate your claim, saving you time and helping you avoid unnecessary litigation. We understand the importance of getting your business back on track quickly, and our goal is to secure a fair and prompt settlement.

Your Next Steps

Understanding your insurance policy and knowing your rights as a policyholder is crucial. If you’re facing a business interruption, don’t steer this journey alone. Reach out to us for a complimentary consultation. We’ll help you understand your coverage and ensure you’re fully prepared to maximize your claim.

For more information on how we can assist with your business interruption claims, visit our service page. Let us help you get the settlement you deserve.