Austin public insurance adjuster services are vital for policyholders seeking to steer the often complex world of insurance claims. Whether you’re a commercial property owner or managing a multifamily complex, working with a public adjuster can improve your claim outcome. Here’s what you need to know at a glance:

- Representation: Public adjusters work exclusively for you, helping ensure you receive a fair settlement.

- Expertise: They possess the skills to manage claims efficiently, addressing challenges like underpayment and wrongful denial.

- Value: By maximizing claim settlements, public adjusters often secure higher payouts than what insurance companies initially offer.

Navigating an insurance claim without an expert can lead to unnecessary delays and underpayment. By leveraging the expertise of a professional, you stand a better chance of achieving a favorable outcome.

I’m Scott Friedson. As a multi-state licensed public adjuster, I’ve successfully managed over $250 million in claims, including extensive work as an Austin public insurance adjuster. My goal is to ensure policyholders, like you, steer clear of undervalued settlements and achieve the full compensation deserved.

Essential Austin public insurance adjuster terms:

Understanding Public Insurance Adjusters

A public insurance adjuster is a licensed professional who represents policyholders during the insurance claim process. Unlike the adjusters employed by insurance companies, public adjusters work exclusively for you, the policyholder. They are your advocate, ensuring that your claim is handled fairly and that you receive the maximum settlement possible.

These professionals are experts in interpreting complex insurance policies and navigating the often intricate claims process. They take the burden off your shoulders by managing every aspect of the claim, from documenting damages to negotiating with the insurance company.

Why Hire a Public Insurance Adjuster?

Hiring a public insurance adjuster can be a game-changer for policyholders. Here are a few key reasons why:

-

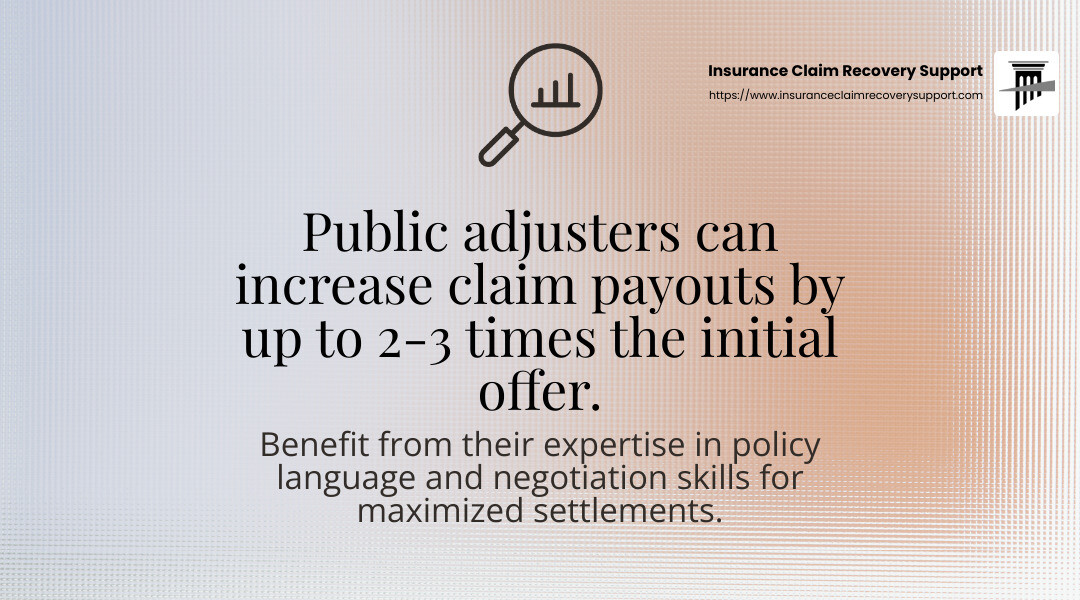

Maximized Settlements: Public adjusters often secure significantly higher payouts than what the insurance company initially offers. Their expertise in policy language and negotiation skills can boost your claim amount, sometimes even doubling or tripling the initial offer.

-

Stress Reduction: Dealing with insurance claims can be overwhelming. A public adjuster handles all the details, allowing you to focus on getting your life back to normal. They document damage, prepare estimates, and communicate directly with the insurance company on your behalf.

-

Expertise: Public adjusters have a deep understanding of insurance policies and claims procedures. This expertise is invaluable, especially when navigating complex claims involving extensive property damage. They ensure that you don’t leave money on the table by identifying every aspect of damage covered by your policy.

In summary, a public insurance adjuster is your ally in the claims process, working diligently to secure the compensation you deserve. By hiring one, you gain an expert advocate who can turn a potentially stressful situation into a manageable one, ensuring you receive a fair and prompt settlement.

The Role of Austin Public Insurance Adjusters

Types of Claims Handled

An Austin public insurance adjuster is your go-to expert when dealing with various types of insurance claims. Whether you’re facing fire damage, storm damage, or business interruption, these professionals are equipped to manage it all.

-

Fire Damage: Fires can devastate homes and businesses, leaving behind complex claims. Public adjusters in Austin specialize in evaluating fire-related losses to ensure every detail is documented and claimed.

-

Storm Damage: Austin is no stranger to severe weather. Storms can cause significant damage, and navigating these claims can be tricky. Public adjusters are skilled at handling storm damage claims, ensuring that all aspects, from wind to water damage, are covered.

-

Business Interruption: When a disaster halts your business operations, the financial impact can be severe. Public adjusters help quantify these losses and work to maximize your business interruption claim, so you can focus on getting back to business.

How They Work for You

Austin public insurance adjusters play a critical role in the insurance claim process. Here’s how they work to maximize your settlement:

-

Claim Preparation: They carefully prepare your claim by documenting all damages, gathering evidence, and compiling detailed reports. This preparation is crucial for a strong claim submission.

-

Negotiation: Public adjusters are expert negotiators. They engage directly with the insurance company to advocate for a fair and comprehensive settlement. Their goal is to secure a payout that fully covers your losses.

-

Settlement Maximization: By leveraging their expertise, public adjusters often achieve settlements that are significantly higher than initial offers. They ensure no stone is left unturned, identifying all potential areas for compensation.

An Austin public insurance adjuster is your advocate, working tirelessly to ensure that you receive the maximum compensation for your property damage. Their expertise in handling diverse claims allows you to rest easy, knowing that a professional is managing the complexities of your insurance claim.

Choosing the Right Public Insurance Adjuster in Austin

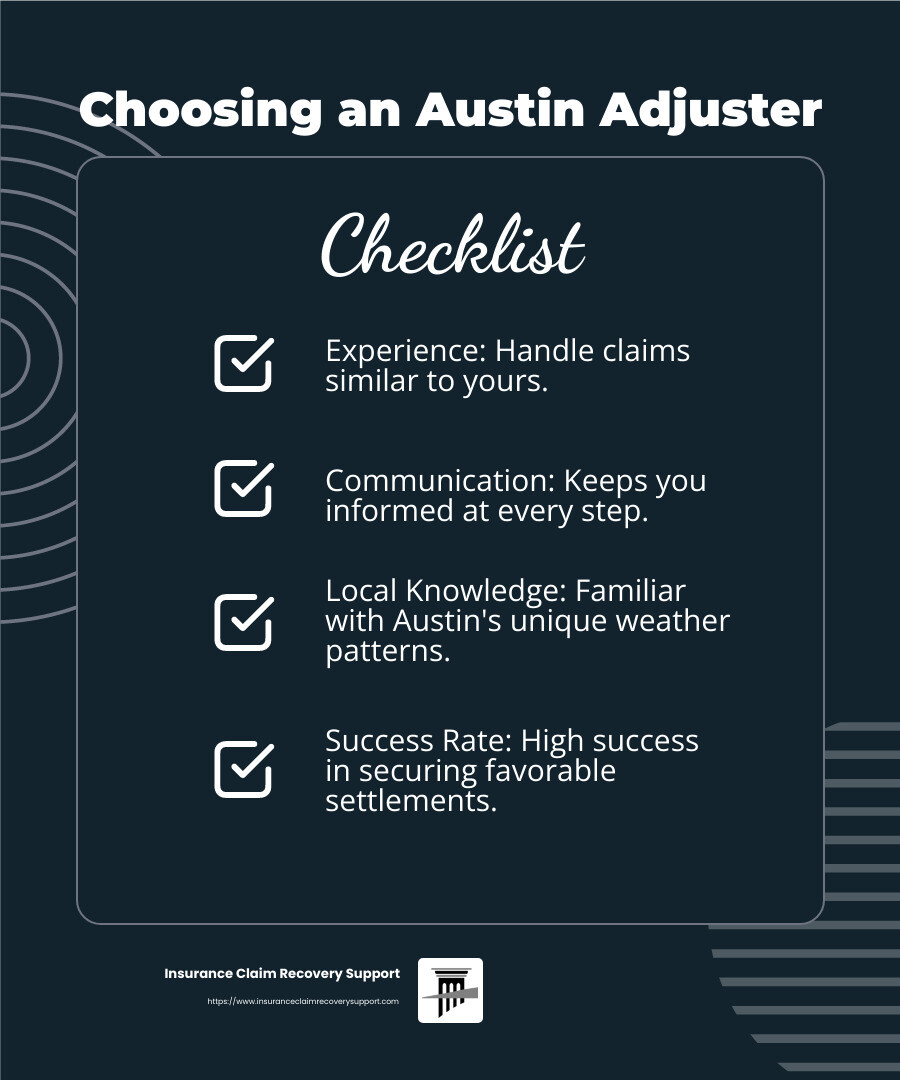

Choosing the right Austin public insurance adjuster can make a big difference in your insurance claim experience. Here are some key qualities and questions to consider:

Key Qualities to Look For

-

Experience: Look for adjusters with a track record of handling claims similar to yours. Experienced adjusters understand the nuances of different types of claims, whether it’s fire, storm, or business interruption.

-

Communication Skills: Good communication is crucial. You want an adjuster who keeps you informed at every step and explains complex terms in a way that’s easy to understand.

-

Local Knowledge: An adjuster familiar with Austin’s unique weather patterns and local regulations can better steer your claim. They know the common issues and how to address them effectively.

Questions to Ask Potential Adjusters

-

Fee Structure: Understand how they charge. Most public adjusters in Texas charge a percentage of your claim payout. Ensure you know this percentage and that it’s clearly outlined in your agreement.

-

Past Successes: Ask for examples of past claims they’ve successfully handled. A high success rate can indicate their ability to secure favorable settlements.

-

Claim Process: Inquire about their approach to managing claims. Knowing how they plan to prepare, negotiate, and settle your claim gives you insight into their expertise and strategy.

By focusing on these qualities and asking the right questions, you can confidently choose the best public insurance adjuster to handle your claim in Austin. This will ensure a smoother process and a better chance of maximizing your settlement.

Frequently Asked Questions about Public Insurance Adjusters

How much do public adjusters charge in Texas?

In Texas, public adjusters typically charge a percentage of the total claim payout. This fee structure means their payment is directly linked to the settlement amount they secure for you. By law, this fee cannot exceed 10% of the claim’s total value.

It’s important to have a clear understanding of this percentage before hiring an adjuster. Make sure it’s detailed in your contract, so there are no surprises later. This fee structure often motivates adjusters to work harder to maximize your settlement.

Are public adjusters worth the money?

Absolutely. Hiring a public adjuster can be a wise investment, especially for complex or large claims. They bring expertise in navigating the claims process, which can lead to higher settlements and faster resolutions.

Public adjusters handle the stressful parts of the claim, giving you peace of mind. They understand the fine print of insurance policies and know how to present your claim to get the best possible outcome. Many policyholders find that the increased settlement amount more than covers the adjuster’s fee.

Can you negotiate with a public adjuster?

Yes, negotiation is part of the process. A skilled public adjuster has strong negotiation skills, which they use to improve your settlement. They know how to argue for a fair payout by presenting clear evidence and leveraging their expertise.

When working with a public adjuster, you’re not just hiring someone to fill out paperwork. You’re getting an advocate who fights for your rights and ensures you receive the maximum benefits you’re entitled to. This can make a significant difference in the outcome of your claim.

Conclusion

At Insurance Claim Recovery Support, we pride ourselves on being dedicated advocates for policyholders. Our mission is simple: to ensure you receive the maximum settlement you deserve. We understand that navigating the insurance claim process can be daunting, especially when dealing with property damage from fire, storm, or other disasters.

Our team of Austin public insurance adjusters is committed to working tirelessly on your behalf. We bring a wealth of experience and local expertise to the table, ensuring that every aspect of your claim is carefully documented and presented. This attention to detail often results in significantly higher settlements compared to initial offers from insurance companies.

We believe in clear communication and transparency throughout the claims process. Our adjusters are not just experts in insurance policies; they are skilled negotiators who know how to maximize your benefits. By partnering with us, you gain a trusted ally who is focused on your best interests.

If you’re facing a complex claim or simply want peace of mind, consider reaching out to us. Let us handle the stress and intricacies of the insurance world while you focus on recovery and rebuilding. Learn more about how we support policyholders with multi-family insurance claims.

With Insurance Claim Recovery Support, you’re not just a policyholder—you’re our priority.