When Disaster Strikes: Finding the Right Property Damage Lawyer in Texas

If you’re searching for help with a property damage claim, here’s what you need to know about hiring a property damage lawyer Texas:

- When to hire: After claim denial, lowball offer, or significant damage (over $100,000)

- Cost structure: Most work on contingency (no fee unless you win)

- Potential benefit: The Texas Department of Insurance found legal representation increases claim payments by an average of 308%

- Statute of limitations: You have two years from the date of damage to file a lawsuit

- Services provided: Policy review, damage documentation, negotiation with adjusters, bad faith claims, and litigation

When storms rage across the Texas landscape or fire consumes your property, the aftermath can be overwhelming. Property damage lawyer Texas professionals specialize in helping property owners steer the complex insurance claim process when disaster strikes. From hail-battered roofs in Dallas to hurricane destruction along the Gulf Coast, these legal experts understand the unique challenges Texas property owners face when seeking fair compensation.

The insurance claims process is rarely straightforward. Insurance companies often use tactics like sending their own engineers to dispute damage, offering unreasonably low settlements, or outright denying valid claims. When faced with these obstacles, having an experienced property damage attorney can make the difference between a denied claim and fair compensation.

I’m Scott Friedson, a multi-state licensed Public Adjuster and CEO of Insurance Claim Recovery Support, who has settled hundreds of millions in property damage claims throughout Texas, including overturning wrongfully denied claims and increasing payouts by up to 3,800% without unnecessary litigation.

Quick look at Property damage lawyer Texas:

Understanding Texas Property Damage Law

When disaster strikes your home or business in Texas, understanding the legal framework that governs property damage claims can make all the difference in your recovery. Let’s break down these laws in simple terms so you can better steer your claim.

In Texas, property damage falls into two main categories:

Real property damage – This includes your home, attached garage, fencing, and other structures permanently fixed to your land.

Personal property damage – These are your movable belongings like furniture, electronics, clothing, and family heirlooms.

This distinction matters because Texas courts use different methods to determine how much compensation you deserve depending on what was damaged. Here’s how it works:

| Valuation Method | When It Applies | How It’s Calculated |

|---|---|---|

| Repair Cost | For repairable damage | Cost of necessary repairs + Loss of use during repairs |

| Diminished Value | For permanent damage | Difference in market value before and after damage |

Statutory Deadlines & Valuation Rules

The clock starts ticking the moment your property is damaged. Under Texas Civil Practice and Remedies Code §16.003, you have two years from the date of damage to file a lawsuit. Miss this deadline, and you could permanently lose your right to compensation – regardless of how valid your claim might be.

When it comes to valuing your damage, Texas follows these principles:

For permanent damage that can’t be fully restored, you’re typically entitled to the decrease in your property’s market value from immediately before to after the damage occurred.

With temporary damage that can be repaired, you deserve the reasonable cost of those repairs plus compensation for being unable to use your property during repairs.

Good news for property owners: Texas law allows you to choose repair costs as your measure of damages, even without proving diminished market value. The key requirement is that these repairs must be reasonable and necessary.

Property Damage Lawyer Texas & the Law

A skilled property damage lawyer Texas professional understands the nuances that can make or break your claim. They’ll help you steer legal principles that might affect your case, such as:

The Property Owner Rule – This allows you, as a property owner, to testify about your property’s market value without being qualified as an expert witness. However, you can’t testify about technical repair costs without proper expertise.

Mental anguish limitations – Texas generally restricts recovery for emotional distress related to property damage unless there was intentional misconduct, serious bodily injury, or a special relationship duty was violated.

As established in the landmark case City of Tyler v. Likes, “The flooding of a home, however traumatic, does not automatically imply compensable mental anguish under Texas common law.” A knowledgeable property damage lawyer Texas can help determine if your situation might qualify for one of the rare exceptions.

Understanding these legal frameworks isn’t just academic – it directly impacts how much compensation you might receive and whether your claim will succeed. When faced with significant property damage, having someone who knows these laws inside and out can be your greatest asset in achieving a fair recovery.

Common Causes & Types of Claims Across Texas

Texas is a state of extremes – from scorching summers to unexpected freezes, gentle rain to raging hurricanes. Living here means accepting that Mother Nature might occasionally test the strength of your property. And trust me, she doesn’t play favorites across our vast state.

When it comes to property damage in Texas, we see distinct patterns across different regions. In Dallas-Fort Worth, homeowners frequently battle with wind and hail that can transform a perfectly good roof into a pockmarked mess overnight. Meanwhile, Houston residents know all too well the devastating impact of hurricane-driven water surging through neighborhoods.

Hail damage has become practically a Texas tradition, with our state ranking second nationally for hail claims. Cities like San Antonio and Fort Worth regularly see golf ball-sized ice chunks pummeling homes, vehicles, and businesses. The aftermath often reveals damaged shingles, dented siding, and cracked windows that can lead to bigger problems if not addressed.

Hurricane damage remains a constant threat along our Gulf Coast. Houston and Galveston residents have weathered some truly catastrophic storms that leave behind a mix of wind destruction, flooding, and structural failures that can take years to fully recover from.

When it comes to tornado damage, the Dallas-Fort Worth metroplex sits squarely in what meteorologists call “Tornado Alley.” These powerful twisters can level entire neighborhoods in minutes, leaving families to pick up the pieces – sometimes literally.

Fire damage affects both urban apartments and rural ranches across Texas. With climate change intensifying our drought seasons, wildfire risks continue to grow, especially in the western parts of our state.

The 2021 winter storm taught Texans a harsh lesson about freeze damage. From Austin to Houston, countless homes suffered burst pipes and the resulting water damage when temperatures plunged to record lows.

Everyday water damage from plumbing failures, appliance malfunctions, and roof leaks represents one of the most common claims we see. What makes these particularly challenging is the potential for mold growth in our humid climate if not properly remediated.

In urban areas, vandalism can create property damage requiring specialized claim handling that many homeowners aren’t prepared to steer alone.

Residential vs Commercial Losses

The path to recovery looks quite different depending on whether your damaged property is a home or a business.

For residential claims, the focus typically centers on making your home livable again. This includes repairing structural elements like roofs and walls, replacing personal belongings, and sometimes covering temporary housing costs through Additional Living Expenses coverage while repairs take place. The policies tend to use more standardized language, though that doesn’t necessarily make them easier to understand!

Commercial claims bring additional layers of complexity. Beyond physical repairs to office buildings, warehouses, or apartment complexes, these claims often involve business interruption losses that can far exceed the cost of physical repairs. Many commercial properties must also comply with updated building codes during repairs (requiring ordinance or law coverage). With multiple stakeholders potentially involved – property owners, business tenants, and lenders – these claims require specialized expertise.

In cities like Austin, Round Rock, Georgetown, and Lakeway, we frequently see homeowners struggling with roof damage claims after intense storms. Meanwhile, in Houston, Dallas, and San Antonio, business owners often face the double challenge of repairing physical damage while calculating complex business interruption losses.

High-Risk Texas Disasters

The data doesn’t lie – according to NOAA research, Texas experiences more billion-dollar weather disasters than any other state in the nation. Climate scientists predict this trend will only intensify in coming years.

Recent weather patterns have created distinct high-risk zones across our state:

The Gulf Coast (including Houston) faces increasingly powerful hurricanes that test even the most well-built structures. Central Texas communities like Austin, San Antonio, and Waco have seen historic flooding become more common. North Texas around Dallas-Fort Worth experiences some of the most severe hailstorms and tornadoes in the country. And West Texas cities like Lubbock and San Angelo face growing wildfire threats as drought conditions intensify.

These regional risks underscore why having appropriate insurance coverage is just the first step. Knowing when to engage a property damage lawyer Texas professional becomes equally important when insurance companies dispute or deny valid claims – which happens far more often than most policyholders expect.

Understanding the specific risks in your region helps you prepare both before disaster strikes and during the recovery process that follows. The right expertise can make all the difference when navigating the complex world of property damage claims in the Lone Star State.

Step-by-Step Texas Property Damage Claim Process

When disaster strikes your Texas property, knowing exactly what to do next can feel overwhelming. Let me walk you through the journey from damage to settlement, with clear steps that can help maximize your recovery.

The clock starts ticking the moment damage occurs. Your first move should be contacting your insurance company—ideally within 24-48 hours of finding the damage. Texas insurers expect “prompt notification,” and delays could jeopardize your claim.

While waiting for the insurance process to begin, you have a responsibility to prevent further damage. This might mean placing a tarp over your damaged roof after a storm or extracting water after a pipe burst. Your insurance expects these reasonable protective steps, and failing to take them could reduce your settlement.

Documentation is your best friend in this process. Before touching anything, grab your phone and capture extensive photos and videos of all damage. Create a detailed inventory of affected items, and save every receipt for emergency repairs or temporary housing. These records become your evidence and will strengthen your position throughout the claim.

Soon after filing your claim, your insurance company will send an adjuster to inspect your property. Try to be present during this visit—it’s your opportunity to point out damage they might otherwise miss. Provide copies of your documentation and take notes about what the adjuster observes.

Most Texas policies require a formal “proof of loss” statement, typically within 60 days of the damage. This document details everything damaged and its value. Complete this carefully and thoroughly—it becomes the foundation of your claim.

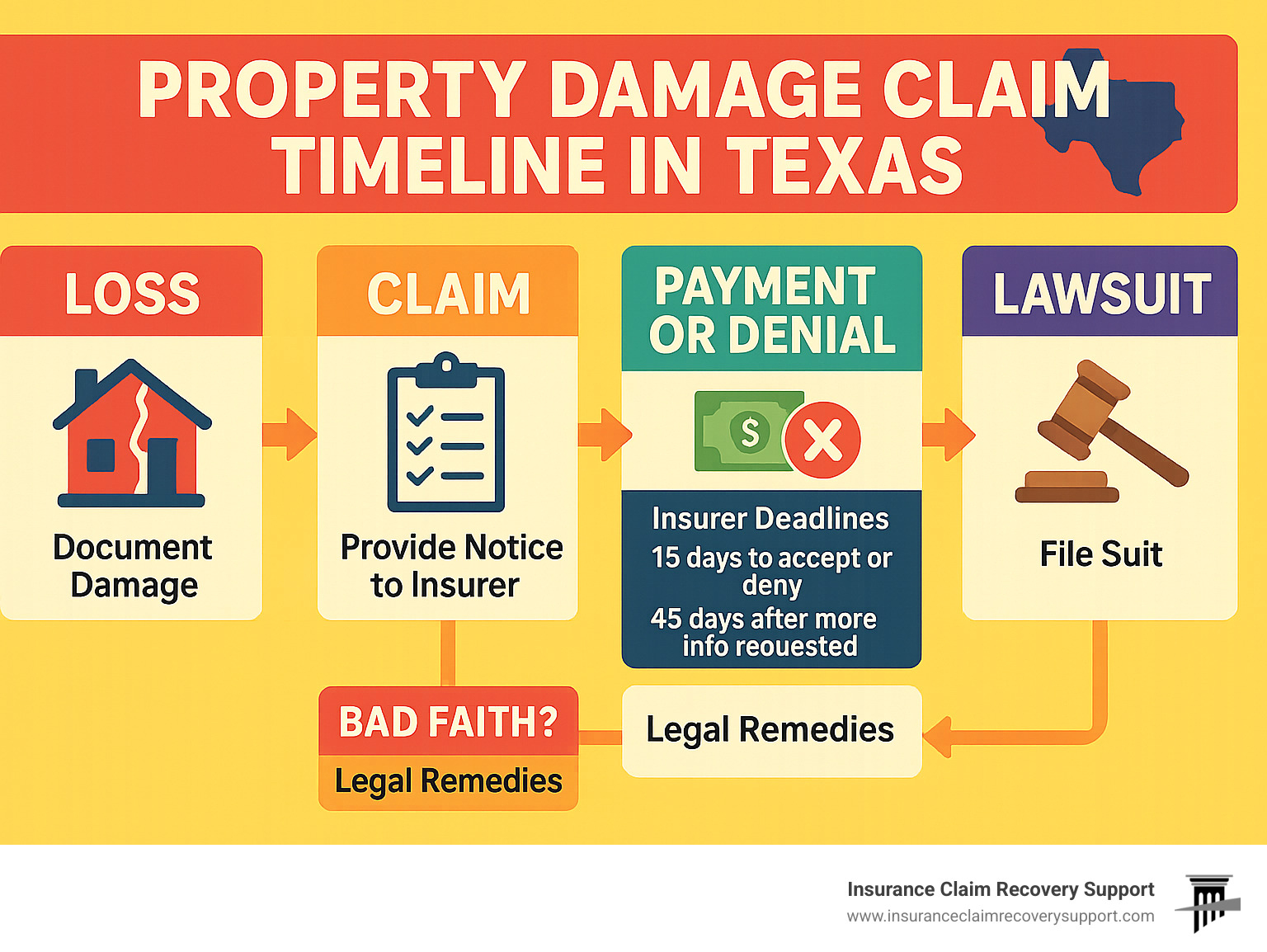

Under Texas Insurance Code, your insurer must acknowledge your claim within 15 days and make a decision within 15 days after receiving all necessary information. If their response disappoints you, don’t simply accept it. You have options, including requesting another inspection, invoking your policy’s appraisal clause, seeking mediation, or consulting with a property damage lawyer Texas professional.

You have a two-year window from the date of damage to file a lawsuit if necessary. This statutory deadline is firm, so keep it in mind as negotiations progress.

Essential Evidence & Documentation

The strength of your claim rests heavily on your evidence. Beyond basic photos, consider creating a narrated video walkthrough of your property, pointing out specific damage as you go. If you have “before” pictures showing your property’s prior condition, these can be invaluable in demonstrating the damage’s impact.

Maintenance records become particularly important when insurers try to blame damage on “wear and tear” rather than a covered event. Regular service records for your roof, plumbing, or HVAC systems can counter these arguments effectively.

Don’t rely solely on the insurance company’s repair estimates. Obtain at least two independent quotes from licensed Texas contractors. For significant or complex damage, consider hiring specialized experts like structural engineers or roofing specialists who can provide professional reports on causation and necessary repairs.

Texas law recognizes the “Property Owner Rule,” which allows you to testify about your property’s market value without being qualified as an expert. However, for technical assessments of repair methods and costs, expert testimony typically carries more weight.

Negotiating With Adjusters

Insurance adjusters are skilled negotiators trained to minimize payouts. Understanding their playbook helps level the field. First, know your policy inside and out—request a complete copy with all endorsements and declarations pages so you can speak confidently about your coverage.

When reviewing the adjuster’s damage assessment, look carefully for overlooked items or underestimated repair costs. Scope disputes are common, with adjusters often missing damaged areas or proposing inadequate repair methods. This is where your independent contractor estimates become crucial evidence.

Never accept the first settlement offer—it’s rarely the insurer’s best. Respond to lowball offers with detailed documentation supporting your claim value. Keep all communications professional but persistent, and always get key statements in writing.

If negotiations stall or the adjuster seems unreasonable, it might be time to bring in professional help. Public adjusters work exclusively for policyholders, not insurance companies, and can dramatically improve your settlement odds. For claims involving bad faith practices or approaching the statute of limitations, a property damage lawyer Texas specialist might be your best advocate.

More info about Public Adjusting Services

More info about Tips for Filing Claims

More info about How to Negotiate a Settlement with an Insurance Claims Adjuster

The property damage claim process isn’t a sprint—it’s a marathon that rewards preparation, documentation, and persistence. With the right approach, you can steer this challenging time and secure the recovery you deserve.

When & How a Property Damage Lawyer Texas Can Help

Let’s face it—sometimes insurance claims go sideways, and that’s when legal expertise becomes invaluable. While many property claims resolve smoothly, others hit roadblocks that only a property damage lawyer Texas can help steer. And it’s not just about peace of mind—according to Texas Department of Insurance data, having legal representation increases claim payments by an average of 308%. That’s a difference worth considering!

Think of a property damage lawyer Texas as your advocate when the insurance company isn’t playing fair. They become particularly valuable when your claim has been denied despite valid coverage, or when the insurer offers significantly less than what’s needed for proper repairs. They’re also essential when facing bad faith practices like unreasonable delays or misrepresentation of policy terms.

Many property owners don’t realize that most property damage lawyer Texas professionals work on a contingency basis—meaning they only get paid if you recover compensation. Typical fees range from 25-40% of the recovery amount, depending on case complexity and whether litigation becomes necessary. This arrangement makes quality legal help accessible when you need it most.

Signs You Need a Property Damage Lawyer Texas

The insurance claim process can be confusing, but certain red flags should have you reaching for the phone to call a property damage lawyer Texas:

Excessive delays are a common warning sign. If weeks pass with little communication or progress, something’s not right. Insurance companies in Texas have specific deadlines they must meet—when they don’t, it’s often a strategy to wear you down.

Lowball offers that don’t come close to covering your documented repair costs are another clear indicator. I recently worked with a family in Round Rock whose insurer offered just $8,000 for extensive roof and interior water damage that legitimate contractors estimated at over $45,000.

When your insurer sends engineers who contradict obvious damage by claiming it was pre-existing or caused by non-covered perils, that’s when legal expertise becomes crucial. These hired experts often produce reports designed to minimize the insurer’s liability rather than accurately assess your damage.

Complex commercial losses involving business interruption or code compliance upgrades require specialized knowledge. The valuation methods become much more complicated, and without proper representation, business owners often leave significant money on the table.

The clock is always ticking on property damage claims. With a two-year statute of limitations in Texas, an unresolved claim approaching this deadline needs immediate legal attention.

A remarkable example of the difference legal help can make: a commercial property owner in Texas was initially offered just $15,000 for hurricane damage but ultimately recovered $4.2 million with legal representation—becoming the largest verdict against an insurer in Texas for 2020.

Fee Structures & Selecting Counsel

Choosing the right property damage lawyer Texas is a crucial decision that can significantly impact your claim’s outcome. Here’s what to consider:

Fee structure should be transparent from the start. While most property damage attorneys work on contingency, confirm the exact percentage and whether it increases if your case proceeds to trial. Some attorneys may charge hourly rates for certain services, so get all fee arrangements in writing.

Experience matters tremendously in property damage cases. Look for attorneys with specific experience handling claims similar to yours—whether residential, commercial, or relating to specific disaster types like hurricane or fire damage. An attorney who specializes in Texas property claims will understand the nuances of local building codes and insurance regulations.

Resources become important for larger claims that might require multiple expert witnesses or substantial litigation costs. Ask potential attorneys about their capacity to take on insurance giants if necessary.

When reviewing candidates, pay attention to client testimonials and past results, particularly for cases similar to yours. A proven track record of success with similar property damage claims is the best predictor of future performance.

Finally, trust your instincts about communication style. Choose an attorney who explains complex legal concepts clearly and responds promptly to your questions. The property damage claim process can be stressful—you want someone who makes you feel confident and informed every step of the way.

Most reputable property damage attorneys offer free initial consultations to evaluate your claim. Use this opportunity to ask about their approach to your specific situation and how they plan to maximize your recovery.

More info about What Kind of Lawyer Do I Need for Property Damage?

More info about Property Insurance Attorney

Protecting Your Rights Against Bad Faith & Disputes

When your insurance company isn’t playing fair, Texas law has your back. The Texas Insurance Code §§ 541-542 offers robust protections against insurers who try to dodge their responsibilities. These laws aren’t just suggestions—they’re requirements with real teeth.

I’ve seen countless Texans struggle with insurance companies that seem more interested in protecting their bottom line than honoring their promises. Your insurer has specific legal obligations: they must acknowledge your claim within 15 days, make a decision within 15 days after receiving all your information, pay accepted claims within 5 business days, and provide clear explanations if they deny your claim.

When insurance companies break these rules, the consequences can be significant. They may be on the hook for the full claim amount, plus 18% annual interest, your attorney’s fees, and even additional damages if their violation was “knowing.” These prompt-payment penalties often motivate insurers to resolve claims fairly once legal pressure is applied.

One powerful tool in your arsenal is the appraisal process. Most Texas property insurance policies include an appraisal clause that can resolve disputes about damage amounts without going to court. Think of it as a structured way to get a binding second opinion when you and your insurer can’t agree on the value of your loss.

Here’s how the appraisal process typically works: either you or your insurer invokes appraisal in writing, each side selects and pays for their own appraiser, these two appraisers then choose a neutral umpire (or a court appoints one if they can’t agree), both appraisers evaluate the damage independently, and if they disagree, the umpire makes the final call.

Be cautious about engineer reports from insurer-hired experts. After major disasters like Hurricane Sandy, investigations revealed some engineering firms routinely produce reports that minimize damage or blame it on non-covered causes. A property damage lawyer Texas can help you challenge these biased findings with independent expert opinions.

Appealing Denials & Maximizing Compensation

Don’t take “no” for an answer when you know your claim is valid. If your insurer has denied or underpaid your claim, you have several paths forward.

First, submit a formal written request for reconsideration with additional supporting documentation. Sometimes, a second review with more evidence is all it takes to turn a denial into an approval.

As you find additional damage (which is common with water and storm damage), file supplemental claims promptly. Document everything with photos, videos, and contractor estimates to strengthen your position.

If your dispute centers on the amount of loss rather than coverage, invoking your policy’s appraisal clause can be a game-changer. This process often resolves valuation disputes more quickly and affordably than litigation.

The Texas Department of Insurance can also be an ally. Filing a complaint might prompt the department to intervene or offer mediation services to resolve your dispute.

When other methods fail, litigation becomes necessary. The process typically involves filing a complaint in the appropriate court, serving the insurer, engaging in findy (where both sides exchange documents and take depositions), participating in mediation or settlement talks, and going to trial if needed.

Repair costs are just the beginning of what you might recover. You may also be entitled to loss of use compensation, temporary housing expenses, business interruption losses for commercial properties, consequential damages from the claim denial, interest penalties for delayed payment, and attorney’s fees.

In rare cases involving intentional misconduct, you might even recover for mental anguish, though Texas courts typically limit these damages for property claims unless there’s serious bodily injury or intentional wrongdoing.

Working with a knowledgeable property damage lawyer Texas can make all the difference in identifying and pursuing these additional damages. At Insurance Claim Recovery Support, we’ve seen how proper representation can transform an unfair offer into full and fair compensation.

More info about Public Insurance Adjuster Texas USA can help you understand how professional claim assistance works alongside legal representation when dealing with complex or disputed claims.

Frequently Asked Questions about Texas Property Damage Claims

How long do I have to file my property damage lawsuit?

When disaster strikes your Texas property, time isn’t on your side. You have two years from the date the damage occurred to file a lawsuit – that’s Texas’ statute of limitations for property damage cases. While two years might sound like plenty of time, it passes quickly when you’re dealing with insurance adjusters and rebuilding your life.

It’s worth noting that this two-year countdown applies specifically to lawsuits, not your initial insurance claim. Your policy likely requires you to report damage within days – sometimes as few as 30-60 days after the incident. Many Texas homeowners are shocked to find their claim was denied simply because they waited too long to report it.

I’ve seen too many families lose their right to compensation because they waited until the last minute. If you’re facing resistance from your insurer, consulting with a property damage lawyer Texas early in the process can protect your rights before deadlines expire.

What documents will my insurer demand?

Be prepared for your insurance company to request a mountain of paperwork. They’re not trying to make your life difficult (though it often feels that way) – they need documentation to validate your claim.

Most Texas insurers will request a formal proof of loss statement detailing everything damaged and its value. You’ll also need ownership documentation like deeds or titles, along with before-and-after photos showing the damage. Keep all receipts for emergency repairs and temporary housing expenses.

Repair estimates from licensed contractors are essential, and for personal belongings, you’ll need to provide evidence of value through receipts or credit card statements. If you’re claiming business interruption losses, prepare to share financial records that demonstrate your typical income.

Insurance companies might also request recorded statements or examinations under oath. While you should cooperate with reasonable requests, some demands cross the line. A property damage lawyer Texas can help you determine which requests you must fulfill and which might be excessive fishing expeditions.

I’ve seen adjusters request tax returns from the past five years for a simple roof claim – that’s usually unnecessary and potentially invasive. Know your rights before handing over sensitive financial information.

What damages can I recover besides repairs?

Your claim shouldn’t just cover slapping a bandage on the problem – it should make you whole again. Beyond basic repair costs, Texas property owners can often recover several additional types of damages.

If you’ve been forced out of your home, you’re entitled to loss of use compensation and additional living expenses like hotel stays and restaurant meals. For businesses, interruption losses can be substantial, covering both lost income and ongoing expenses while you’re unable to operate.

Many Texas property owners don’t realize they can claim code upgrade costs when repairs require bringing older structures up to current building standards. Your settlement should also address any diminished property value that remains even after repairs are completed.

Personal property replacement, landscaping restoration, and exterior feature repairs should all be part of a comprehensive settlement. And if your insurer has acted in bad faith? You might be entitled to 18% interest penalties, attorney’s fees, and in some cases, triple damages for knowing violations.

Mental anguish compensation is limited in Texas property cases unless there’s intentional misconduct or bodily injury involved. However, a skilled property damage lawyer Texas can help identify all potential areas of recovery in your specific situation.

Insurance companies profit by paying as little as possible on claims. Without proper representation, you might leave thousands of dollars on the table without even realizing what you’re entitled to receive.

Conclusion

When storms rage, fires burn, or other disasters strike your Texas property, knowing your rights isn’t just helpful—it’s essential. The journey from documenting initial damage to receiving fair compensation requires both attention to detail and a solid grasp of Texas property laws.

Let’s be honest: insurance companies have entire teams—adjusters, engineers, and attorneys—all working with one goal in mind: minimizing what they pay you. Having someone in your corner levels that playing field considerably. It’s not just my opinion; the Texas Department of Insurance found that having professional representation increases claim payments by an average of 308%. Those numbers speak volumes about the value of expert help.

Time matters tremendously in these situations. While Texas gives you a two-year window to take legal action, your insurance policy likely demands much quicker reporting and documentation—sometimes within just days of the damage occurring. Waiting too long can jeopardize your entire claim.

At Insurance Claim Recovery Support LLC, we’ve seen how devastating property damage can be for both homeowners and businesses across Texas. Whether you’re facing hurricane destruction in Houston, fire losses in Austin, tornado damage in Dallas-Fort Worth, or severe hail impact in San Antonio, our public adjusters work exclusively for you—never for insurance companies.

Property damage lawyer Texas professionals can make all the difference when you’re facing:

- Disputed claims where the insurance company is digging in their heels

- Significant damage where the stakes are simply too high to steer alone

- Potential bad faith practices where insurers aren’t playing by the rules

- Complex commercial claims with business interruption considerations

Don’t try to handle this complicated process by yourself. The difference between a denied claim and fair compensation often comes down to having the right expertise on your side. When disaster strikes, you deserve an advocate who understands both the technical aspects of property damage and the emotional toll it takes.

For more information about how we can help with your Texas property damage claim, reach out to Insurance Claim Recovery Support today. We’re committed to one thing: making sure Texas property owners receive every dollar they deserve when disaster strikes.