Why Winter Storm Fern Property Damage Insurance Claims Demand Immediate Action

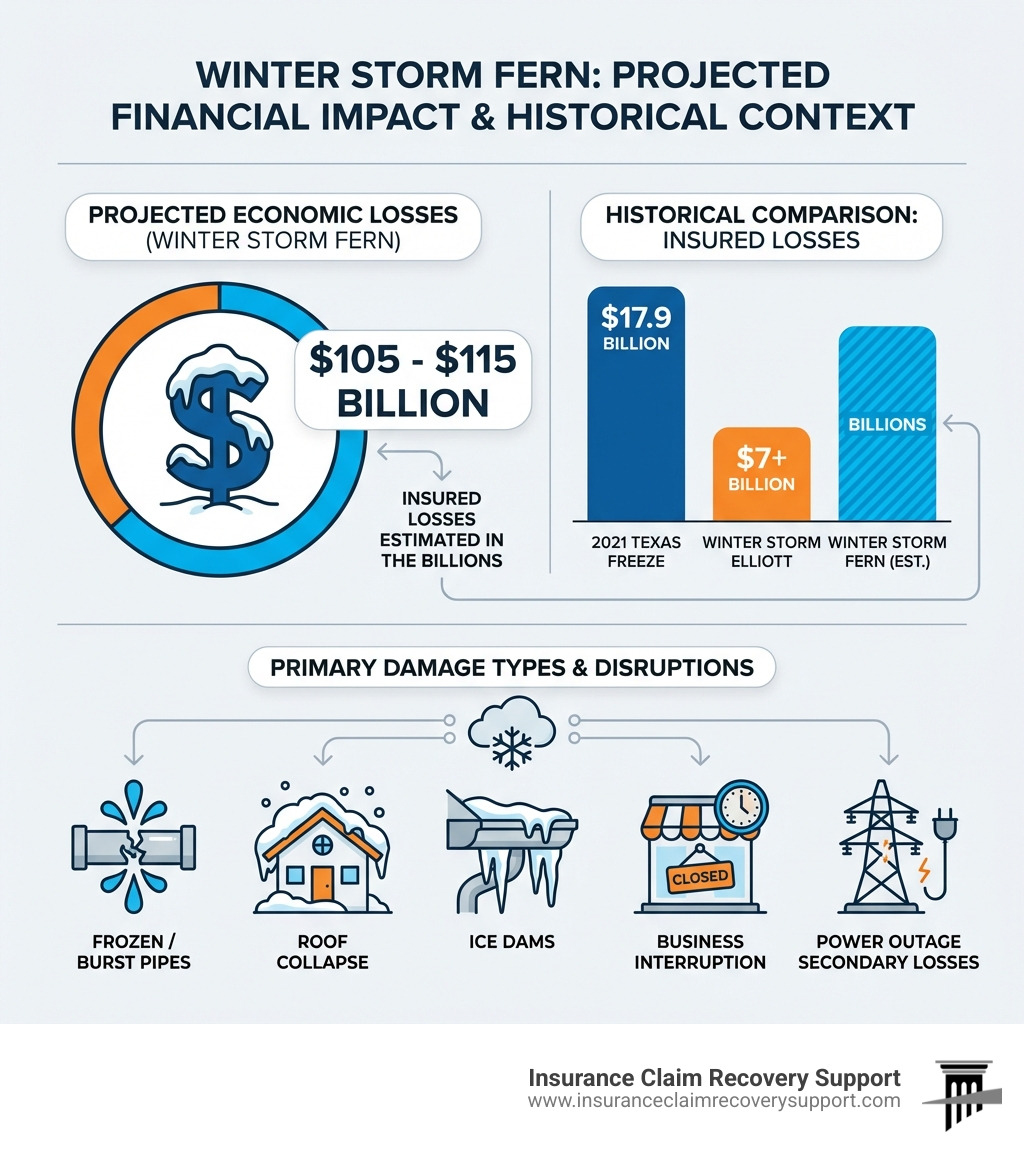

Winter storm fern property damage insurance claim filings are surging as property owners face billions in losses. Experts predict total economic losses from Storm Fern could reach $105-$115 billion, with insured losses potentially rivaling the catastrophic 2021 Texas Freeze.

Quick Answer: What You Need to Know About Filing a Winter Storm Fern Claim

- Document Immediately: Photograph all damage, including burst pipes, roof damage, and water intrusion.

- File Promptly: Notify your insurance company within 24-72 hours.

- Understand Coverage: Review your policy for water damage, roof collapse, and business interruption.

- Mitigate Damage: Take temporary steps like shutting off water and tarping roofs to prevent further loss.

- Get Estimates: Obtain detailed repair quotes from licensed contractors.

- Hire a Public Adjuster: Maximize your settlement and avoid litigation with expert negotiation.

The storm impacted over 220 million people across 34 states, causing widespread power outages, frozen pipes, and roof collapses. For commercial property owners and multifamily operators, the financial stakes are enormous, and the claims process can be daunting.

Fact vs. Myth: A Quick Look

- Myth: FEMA will cover my losses. Fact: Your commercial policy is your primary recovery tool; FEMA offers limited aid.

- Myth: The carrier’s adjuster works for me. Fact: The insurance company’s adjuster represents them. A public adjuster works exclusively for you.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support, and over the past 15+ years I’ve successfully settled hundreds of millions of dollars in property damage claims, including extensive experience with winter storm fern property damage insurance claim scenarios and freeze-related losses across Texas and other states. My team has achieved a 90%+ success rate in maximizing settlements without resorting to litigation, often increasing recoveries by 30% to more than 3,800% over initial carrier offers.

Know your winter storm fern property damage insurance claim terms:

Navigating Your Winter Storm Fern Property Damage Insurance Claim

Winter Storm Fern has left a trail of devastation, and navigating the aftermath can feel overwhelming. This section provides a roadmap for commercial and multifamily property owners to achieve a smooth recovery.

Identifying and Documenting Covered Damage

Understanding what your insurance policy covers is the first step for commercial and multifamily property owners in Texas cities like Austin, Dallas, and Houston, or across states like Florida and Georgia. Meticulous documentation, including timestamped photos and videos, is paramount.

Common types of covered damage from winter storms include:

- Frozen and Burst Pipes: This is the most insidious damage, with average claims often exceeding $30,000. Burst pipes lead to extensive water damage, impacting walls, ceilings, and structural integrity, especially in regions not built for prolonged freezes.

- Roof Collapse: The weight of heavy snow and ice can exceed a roof’s structural capacity, causing it to collapse. Commercial buildings with flat roofs are especially vulnerable.

- Ice Dams: When melting snow refreezes at the roof’s edge, it can cause water to back up under shingles and leak into the property, causing significant interior damage.

- Structural Damage: Beyond roof collapse, the building’s integrity can be compromised by falling trees or extensive water intrusion.

- HVAC and Appliance Damage: Power outages and extreme cold can damage critical systems. An all-risk policy generally covers appliances damaged by an outage.

Properties in the Southern Plains and Southeast are often more vulnerable due to a lack of winterization. For more on this, see our insights on freeze damage in texas.

The Claims Process: Steps for a Smooth Recovery

Navigating a winter storm fern property damage insurance claim requires a strategic, organized approach. We guide our clients through these essential steps:

- Immediate Documentation: As soon as it’s safe, thoroughly document all damage with timestamped photos and videos, including hidden areas.

- Temporary Mitigation: Your policy requires you to prevent further damage. Shut off water mains, tarp roofs, and dry wet areas. Keep all receipts for these reimbursable costs.

- Prompt Claim Filing: File your claim within 24-72 hours. Prompt notice is a policy requirement and helps avoid disputes.

- Maintain a Claim Log: Keep a detailed log of all communications with your insurer, including dates, names, and discussion summaries.

- Get Professional Estimates: Obtain multiple written, itemized repair estimates from licensed, reputable contractors to form the basis of your claim.

- Meet the Adjuster: Be prepared for the insurer’s adjuster. They work for the insurance company, not you. Having your own advocate is a significant advantage.

- Quantify Business Interruption: If your property’s operations were halted, your business interruption coverage is vital. We help quantify these complex losses, including lost profits and ongoing expenses.

Understanding Your Commercial Policy for a Winter Storm Fern Property Damage Insurance Claim

Decoding your commercial policy is critical for a successful winter storm fern property damage insurance claim. Key coverages include:

- Building Coverage: Covers the physical structure against perils like wind, snow, and freezing rain.

- Business Interruption Coverage: A lifeline that covers lost income and operating expenses when damage halts your business. This is crucial given the widespread power outages from Storm Fern.

- Debris Removal: Covers the substantial cost of removing storm debris from a covered loss.

- Actual Cash Value (ACV) vs. Replacement Cost (RC): It’s vital to know the difference. ACV pays the depreciated value, while RC pays to replace with new materials. Most commercial policies are RC, but you must confirm.

- Policy Exclusions: Be aware of potential exclusions. Insurers may deny a frozen pipe claim if the property was not properly heated. We review your policy to identify limitations and endorsements that expand coverage. For more on these issues, see our guide on the texas freeze.

The Financial Fallout: Winter Storm Fern’s Economic Impact

The financial impact of Winter Storm Fern is staggering, with total economic losses estimated between $105 billion and $115 billion. This dwarfs the $17.9 billion in insured losses from the 2021 Texas Freeze and the $7+ billion from Winter Storm Elliott. For commercial and multifamily property owners, these figures highlight the immense financial risk and the critical need for expert claim management to steer business interruption, supply chain disruptions, and direct property damage. For a deeper dive, read our report on winter storm related loss estimates in texas reaching to 100 million.

Public Adjuster vs. Insurance Claim Lawsuit: The Best Path to Recovery

When facing a lowball offer for your winter storm fern property damage insurance claim, a lawsuit is not your only option. Leveraging a public adjuster is a more efficient path to full recovery. Our firm, Insurance Claim Recovery Support (ICRS), specializes in maximizing settlements without costly and time-consuming litigation.

Here’s a comparison:

| Feature | Public Adjuster Process | Insurance Claim Lawsuit Process |

|---|---|---|

| Representation | Policyholder only (ICRS) | Attorney represents policyholder in court |

| Primary Goal | Maximize settlement, avoid litigation, expedite recovery | Force insurer to pay through legal means, often after denial |

| Process | Proactive claim building, documentation, negotiation | Formal legal filings, findy, depositions, court appearances |

| Timeline | Weeks to months (typically faster) | Months to years (often prolonged) |

| Cost | Contingency fee (percentage of settlement) | Hourly attorney fees, court costs, expert witness fees |

| Outcome | Negotiated settlement, often significantly increased | Court judgment or settlement after prolonged dispute |

As licensed public adjusters, we advocate exclusively for you. We proactively build your claim, negotiate from a position of strength, and avoid unnecessary litigation. Our 90%+ success rate in maximizing settlements without lawsuits saves you time, money, and stress, allowing you to focus on recovery.

Expert Advice and Resources for Storm Recovery

Recovering from Winter Storm Fern requires accurate information and expert guidance. Here, we address common questions to help you steer this challenging period successfully.

Fact vs. Myth: Winter Storm Fern Property Damage Claims

Let’s clear up some common misunderstandings about filing a winter storm fern property damage insurance claim:

- Myth: My small claim isn’t worth filing.

- Fact: What seems small can hide significant damage. With average claims for frozen pipes exceeding $30,000, it’s wise to have a professional assess the true extent of your loss before deciding not to file.

- Myth: FEMA will cover all my losses if my insurance doesn’t.

- Fact: FEMA is not a substitute for insurance. It provides limited disaster assistance, primarily for uninsured losses, and you must file with your insurer first. Learn more about federal disaster aid at FEMA’s official website.

- Myth: If my property was unoccupied, my claim will be denied.

- Fact: Coverage generally applies regardless of your presence, unless negligence is proven. However, policies often require unoccupied properties to be properly heated or winterized. We can help you steer these policy conditions.

- Myth: The first settlement offer from my insurer is final.

- Fact: Initial offers are almost always negotiable. Insurers often undervalue claims. We specialize in challenging low offers to ensure you receive the maximum settlement you are entitled to without resorting to a lawsuit.

At Insurance Claim Recovery Support, we act as your dedicated advocate for your winter storm fern property damage insurance claim. We ensure your claim is thoroughly documented, accurately valued, and aggressively negotiated. We help professional property managers, commercial building owners, and apartment investors steer these challenges. For more information, visit our guide on what you need to know about insurance claims.

We are licensed and serve clients across Texas (including Austin, Dallas-Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway) and other states like Florida, Georgia, Colorado, North Carolina, South Carolina, Oklahoma, and Pennsylvania. Our expertise in freeze and winter storm losses means we’re uniquely positioned to help you recover fully from Winter Storm Fern.