Why Insurance Brokers Choose Strategic Referrals for Complex Claims

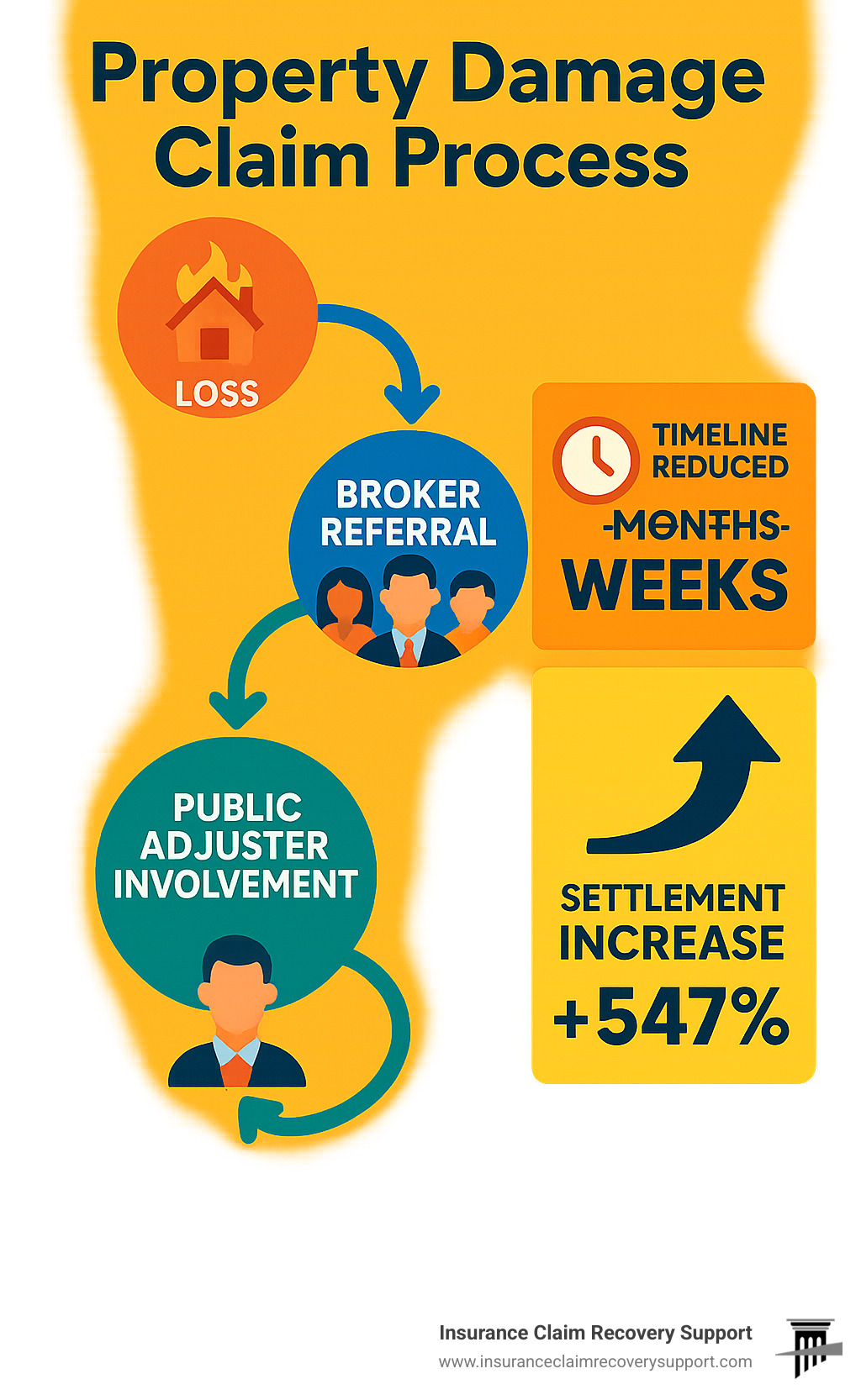

Why insurance brokers refer Insurance Claim Recovery Support Public Adjusters is a question that reveals the smart business strategy many brokers use to protect their client relationships while ensuring maximum claim recoveries. Here are the key reasons:

- Client Retention: Referring a public adjuster demonstrates the broker’s commitment to their client’s best interests

- Reduced Liability: Minimizes the broker’s exposure to errors and omissions claims

- Specialized Expertise: Public adjusters handle complex claim negotiations that brokers aren’t equipped for

- Higher Settlements: Studies show public adjusters achieve 547% higher payments than policyholders handling claims alone

- Time Management: Allows brokers to focus on their core business of selling insurance rather than managing claims

- Professional Reputation: Successful claim outcomes improve the broker’s standing with clients

When a catastrophic event strikes a commercial property, multifamily complex, or religious institution, the aftermath creates enormous pressure on everyone involved. The property owner faces overwhelming documentation requirements, complex policy language, and insurance company adjusters whose primary goal is to minimize payouts. Meanwhile, insurance brokers find themselves caught between frustrated clients and the insurance companies they represent.

This tension creates what industry professionals call “the broker’s dilemma” – how to serve clients’ best interests during claims while maintaining relationships with carriers. Smart brokers have found that referring qualified public adjusters like Insurance Claim Recovery Support solves this challenge neatly.

As Scott Friedson, CEO of Insurance Claim Recovery Support, I’ve spent 15+ years helping brokers steer this exact situation by settling over $200 million in large-loss claims. My experience shows that brokers who understand why insurance brokers refer Insurance Claim Recovery Support Public Adjusters consistently maintain stronger client relationships and build more successful practices.

The Broker’s Dilemma: Navigating the Aftermath of Large-Scale Property Damage

Imagine a multi-family apartment complex in Houston or a commercial building in Dallas that has just been devastated by fire or a severe storm. The property owner is reeling, facing immense stress and financial uncertainty. Their first call is often to their trusted insurance broker, seeking guidance and reassurance. While brokers are experts in policy placement and coverage, the intricacies of a large-loss property damage claim can quickly become a quagmire.

The burden of proving the loss falls squarely on the policyholder, not the insurance company. This means gathering extensive documentation, from detailed building restoration estimates to comprehensive property inventories. We’ve seen how an improperly prepared or submitted claim can lead to underpayment, significant delays, or even outright denial. It’s a daunting task for anyone, let alone someone navigating the emotional and logistical chaos post-disaster.

Adding to the complexity is the intricate policy language. Insurance policies are often written in legal and technical terms, packed with provisions, stipulations, and endorsements that can change annually. Most policyholders, and even many brokers, aren’t equipped to fully decipher these nuances. This is where the insurance company’s adjuster, whose primary goal is to minimize payouts and protect their employer’s bottom line, gains a significant advantage. This inherent conflict of interest can leave policyholders feeling vulnerable and shortchanged. We understand that brokers want to know How to Settle Property Damage Insurance Claims effectively for their clients.

Common Challenges Policyholders Face

When a large commercial property, such as an apartment complex or a religious institution, suffers significant damage, the challenges are monumental. Consider a Fire Property Damage Claims that destroys a processing plant, or extensive Water Damage Insurance Claim throughout an office building, or even catastrophic damage from a Hurricane Damage Claims ripping through a commercial complex in Galveston. These aren’t simple claims.

Policyholders often face:

- Overwhelming Documentation: We’ve seen cases where the sheer volume and intricate detail of required documentation are staggering. As one commercial client shared, managing their explosion damage claim personally was a “mistake” due to their “insufficient expertise and time.”

- Emotional Stress: Recovering from such events is traumatic. Expecting a property owner to carefully document damages and negotiate with an insurance giant while simultaneously trying to rebuild their life or business is simply unrealistic.

- Negotiation Disadvantage: Insurance company adjusters are highly trained negotiators. They know the policy inside and out and are incentivized to keep costs down. Policyholders, often inexperienced in claims, are at a clear disadvantage. This often results in “unreasonable and pale” settlement offers compared to the true loss suffered.

- Claim Delays: Insurers may exploit policyholder inexperience by demanding excessive evidence, leading to frustrating delays. As the saying goes, “justice delayed is justice denied.” This is why we often advise clients that the WSJ Says to Expect Claim Delays: Hire a Public Adjuster Instead.

The Strain on the Broker-Client Relationship

For insurance brokers, these complex claims can be a double-edged sword. On one hand, they want to be their clients’ trusted advisors. On the other, they are often overwhelmed by the sheer volume of questions and the emotional intensity of their clients. Brokers are specialists in insurance placement, not claims adjusting. They lack the specialized expertise in damage assessment, policy interpretation for complex scenarios, and aggressive negotiation tactics that large-loss claims demand.

This leads to a real strain:

- Answering Complex Claim Questions: Brokers find themselves fielding intricate questions about coverage, estimates, and timelines that are beyond their scope of expertise.

- Managing Client Expectations: Clients naturally expect their broker to solve their problems, but brokers often lack the tools or authority to influence the claim outcome directly.

- Perceived Conflicts of Interest: Brokers work with insurance carriers, which can create a perceived conflict of interest in the client’s eyes, especially if the claim is underpaid or denied.

- Risk of Losing Clients: If a client feels their claim wasn’t handled fairly, they may blame their broker, leading to dissatisfaction and, ultimately, client churn. We often hear from clients who regret not seeking professional help sooner, like a civil engineering director who lamented a suboptimal recovery on a previous claim.

- Protecting Professional Reputation: A broker’s reputation is built on trust and reliability. Unresolved or poorly handled claims can severely damage that reputation.

- Focusing on Insurance Placement vs. Claim Adjustment: Brokers’ core business is selling and servicing insurance policies. Getting bogged down in protracted claim disputes diverts valuable time and resources from their primary revenue-generating activities.

This is precisely why insurance brokers refer Insurance Claim Recovery Support Public Adjusters – to offload this immense burden and ensure their clients receive the expert advocacy they desperately need.

Leveling the Playing Field: How a Public Adjuster Becomes the Policyholder’s Advocate

When a policyholder faces a significant property loss, they are often up against an insurance company with vast resources, legal teams, and adjusters whose allegiance lies with the insurer’s bottom line. This is where a public adjuster steps in as the policyholder’s dedicated advocate, fundamentally leveling the playing field.

A public adjuster is a licensed professional whose sole purpose is to represent the policyholder’s interests. We inspect the damage, analyze the policy, prepare meticulous estimates and inventories, and negotiate with the insurance company on behalf of our client. Our allegiance is exclusively to the policyholder, ensuring they receive the maximum settlement they deserve. Organizations like the National Association of Public Insurance Adjusters (NAPIA) provide valuable resources and a code of ethics for public adjusters, further ensuring professionalism and client advocacy.

The impact of this advocacy is profound. Studies have shown that public adjuster representation typically results in 547% higher payments for claims compared to those handled by policyholders alone. This isn’t just a number; it represents the difference between rebuilding a commercial property fully or having to cut corners, between a business thriving post-disaster or struggling to recover.

The Critical Difference: Public Adjuster vs. Company Adjuster

It’s crucial to understand the fundamental difference between a public adjuster and an insurance company adjuster (or even an independent adjuster hired by the insurance company).

- Allegiance: A public adjuster’s allegiance is solely to the policyholder. We work for you. A company adjuster, however, is employed by the insurance company, and their primary duty is to protect the company’s financial interests. An independent adjuster is also hired by the insurance company and works for them. This distinction is paramount. As we like to say, “Insurance companies have experts working for them, you should too!”

- No Conflict of Interest: Because we are paid by the policyholder (on a contingency basis, meaning we only get paid if you get paid), there is no inherent conflict of interest. Our success is directly tied to your success.

- Maximizing Settlement: Our goal is always to maximize your settlement. Company adjusters, conversely, are trained to minimize the insurance company’s financial liability.

- In-depth Policy Analysis: We possess the expertise to decipher complex insurance policies, understanding every nuance, clause, and endorsement to ensure all entitled coverages are identified and pursued. This includes often-overlooked aspects like business interruption or temporary living expenses for multifamily properties.

- Independent Loss Assessment: We conduct an independent, thorough assessment of the damage, often identifying hidden damages or aspects of the loss that a company adjuster might overlook or undervalue. This forms the basis of a comprehensive claim package that substantiates your full loss. This is why we are truly an Independent Loss Assessor.

Avoiding Litigation: The Proactive Path to Resolution

Many policyholders, frustrated with lowball offers or denied claims, might consider legal action. While litigation is sometimes necessary, it’s a costly, time-consuming, and emotionally draining process. One of the most significant advantages of engaging a public adjuster is our ability to resolve disputes with insurance carriers without the need for expensive and protracted lawsuits. We aim to Avoid Unnecessary Litigation.

Our approach is proactive:

- Proactive Documentation: We carefully document every aspect of the loss from day one, building an irrefutable case for your claim. This comprehensive package often pre-empts the need for legal battles.

- Expert Negotiation: With our deep understanding of insurance policies and claims processes, we engage in expert negotiations, leveraging facts and policy language to advocate for a fair settlement. We know the pressure points and how to effectively counter insurer tactics.

- Reduced Legal Fees: By achieving a fair settlement through negotiation, we help policyholders avoid the substantial legal fees associated with litigation.

- Faster Resolution: While a public adjuster ensures a complete settlement, not just a quick one, our process is typically far faster than going to court. Litigation can drag on for years, whereas a public adjuster can often secure a satisfactory resolution in months.

Why Insurance Brokers Refer Insurance Claim Recovery Support Public Adjusters

When disaster strikes a commercial property, multifamily complex, or religious institution, the aftermath creates enormous pressure on everyone involved. The property owner faces overwhelming documentation requirements, complex policy language, and insurance company adjusters whose primary goal is minimizing payouts. Meanwhile, insurance brokers find themselves caught between frustrated clients demanding answers and insurance companies they represent.

This tension creates what industry professionals call “the broker’s dilemma” – how to serve clients’ best interests during claims while maintaining relationships with carriers. Smart brokers have finded that referring qualified public adjusters like Insurance Claim Recovery Support solves this challenge perfectly.

The reasons why insurance brokers refer Insurance Claim Recovery Support Public Adjusters go far beyond simply passing off a difficult situation. It’s actually a strategic business decision that benefits everyone involved.

Client retention becomes much stronger when brokers demonstrate they truly have their clients’ best interests at heart. Instead of leaving property owners to steer complex claims alone, brokers who make strategic referrals show they’re willing to bring in specialists – even if it means sharing the spotlight.

Reduced liability is another major factor. When brokers attempt to guide clients through intricate claim negotiations, they risk exposure to errors and omissions claims if something goes wrong. By referring to qualified public adjusters, brokers protect themselves while ensuring clients get expert representation.

Specialized expertise makes all the difference in large-loss claims. Public adjusters understand the nuances of damage assessment, policy interpretation, and negotiation tactics that most brokers simply don’t encounter regularly enough to master.

The 547% higher payments that public adjusters typically achieve compared to policyholders handling claims alone speaks volumes. This isn’t just a statistic – it represents the difference between a property owner struggling to rebuild properly versus having the resources to restore their investment completely.

Time management becomes crucial during claim season. Brokers who get bogged down in protracted claim disputes find themselves unable to focus on their core business of selling and servicing insurance policies. Smart referrals free up valuable time for revenue-generating activities.

Professional reputation grows stronger when brokers are known for ensuring successful claim outcomes. Word travels fast in commercial real estate circles, and property owners remember brokers who helped them through their darkest hours.

As Scott Friedson, CEO of Insurance Claim Recovery Support, I’ve spent 15+ years helping brokers steer this exact situation by settling over $200 million in large-loss claims. My experience shows that brokers who understand why insurance brokers refer Insurance Claim Recovery Support Public Adjusters consistently maintain stronger client relationships and build more successful practices.

The beauty of this approach is that it creates a win-win situation. Clients get the expert advocacy they desperately need, while brokers demonstrate their commitment to superior service without overextending themselves into areas outside their expertise.

The Broker’s Dilemma: Navigating the Aftermath of Large-Scale Property Damage

Imagine a multi-family apartment complex in Houston or a commercial building in Dallas that has just been devastated by fire or a severe storm. The property owner is reeling, facing immense stress and financial uncertainty. Their first call is often to their trusted insurance broker, seeking guidance and reassurance. While brokers are experts in policy placement and coverage, the intricacies of a large-loss property damage claim can quickly become a quagmire.

The burden of proving the loss falls squarely on the policyholder, not the insurance company. This means gathering extensive documentation, from detailed building restoration estimates to comprehensive property inventories. We’ve seen how an improperly prepared or submitted claim can lead to underpayment, significant delays, or even outright denial. It’s a daunting task for anyone, let alone someone navigating the emotional and logistical chaos post-disaster.

Adding to the complexity is the intricate policy language. Insurance policies are often written in legal and technical terms, packed with provisions, stipulations, and endorsements that can change annually. Most policyholders, and even many brokers, aren’t equipped to fully decipher these nuances. This is where the insurance company’s adjuster, whose primary goal is to minimize payouts and protect their employer’s bottom line, gains a significant advantage. This inherent conflict of interest can leave policyholders feeling vulnerable and shortchanged. We understand that brokers want to know How to Settle Property Damage Insurance Claims effectively for their clients.

Common Challenges Policyholders Face

When a large commercial property, such as an apartment complex or a religious institution, suffers significant damage, the challenges are monumental. Consider a Fire Property Damage Claims that destroys a processing plant, or extensive Water Damage Insurance Claim throughout an office building, or even catastrophic damage from a Hurricane Damage Claims ripping through a commercial complex in Galveston. These aren’t simple claims.

Policyholders often face:

- Overwhelming Documentation: We’ve seen cases where the sheer volume and intricate detail of required documentation are staggering. As one commercial client shared, managing their explosion damage claim personally was a “mistake” due to their “insufficient expertise and time.” For instance, a processing plant completely destroyed by fire will require extensive documentation, far beyond what most business owners are prepared for.

- Emotional Stress: Recovering from such events is traumatic. Expecting a property owner to carefully document damages and negotiate with an insurance giant while simultaneously trying to rebuild their life or business is simply unrealistic. As one client put it, “an insured property loss is devastating and stressful.”

- Negotiation Disadvantage: Insurance company adjusters are highly trained negotiators. They know the policy inside and out and are incentivized to keep costs down. Policyholders, often inexperienced in claims, are at a clear disadvantage. This often results in “unreasonable and pale” settlement offers compared to the true loss suffered.

- Claim Delays: Insurers may exploit policyholder inexperience by demanding excessive evidence, leading to frustrating delays. As the saying goes, “justice delayed is justice denied.” This is why we often advise clients that the WSJ Says to Expect Claim Delays: Hire a Public Adjuster Instead.

The Strain on the Broker-Client Relationship

For insurance brokers, these complex claims can be a double-edged sword. On one hand, they want to be their clients’ trusted advisors. On the other, they are often overwhelmed by the sheer volume of questions and the emotional intensity of their clients. Brokers are specialists in insurance placement, not claims adjusting. They lack the specialized expertise in damage assessment, policy interpretation for complex scenarios, and aggressive negotiation tactics that large-loss claims demand.

This leads to a real strain:

- Answering Complex Claim Questions: Brokers find themselves fielding intricate questions about coverage, estimates, and timelines that are beyond their scope of expertise. After a major natural disaster, an independent agent will be the first person many clients call, but interpreting policies in cases of underinsurance or complex damage can be overwhelming.

- Managing Client Expectations: Clients naturally expect their broker to solve their problems, but brokers often lack the tools or authority to influence the claim outcome directly.

- Perceived Conflicts of Interest: Brokers work with insurance carriers, which can create a perceived conflict of interest in the client’s eyes, especially if the claim is underpaid or denied. This puts the broker in a difficult position, feeling “conflicted between client expectations and insurance company positions.”

- Risk of Losing Clients: If a client feels their claim wasn’t handled fairly, they may blame their broker, leading to dissatisfaction and, ultimately, client churn. A civil engineering director once reflected on a past claim where the recovery was suboptimal due to the absence of professional guidance from the outset, a regret we often hear.

- Protecting Professional Reputation: A broker’s reputation is built on trust and reliability. Unresolved or poorly handled claims can severely damage that reputation.

- Focusing on Insurance Placement vs. Claim Adjustment: Brokers’ core business is selling and servicing insurance policies. Getting bogged down in protracted claim disputes diverts valuable time and resources from their primary revenue-generating activities. Most independent insurance producers play a minimal role in the actual claims process, as their expertise lies in selling policies, not adjusting claims.

This is precisely why insurance brokers refer Insurance Claim Recovery Support Public Adjusters – to offload this immense burden and ensure their clients receive the expert advocacy they desperately need.

Leveling the Playing Field: How a Public Adjuster Becomes the Policyholder’s Advocate

When a policyholder faces a significant property loss, they are often up against an insurance company with vast resources, legal teams, and adjusters whose allegiance lies with the insurer’s bottom line. This is where a public adjuster steps in as the policyholder’s dedicated advocate, fundamentally leveling the playing field.

A public adjuster is a licensed professional whose sole purpose is to represent the policyholder’s interests. We inspect the damage, analyze the policy, prepare meticulous estimates and inventories, and negotiate with the insurance company on behalf of our client. Our allegiance is exclusively to the policyholder, ensuring they receive the maximum settlement they deserve. As we often tell our clients, “no one provides peace of mind like ICRS public adjusters.”

The impact of this advocacy is profound. Studies have shown that public adjuster representation typically results in 547% higher payments for claims compared to those handled by policyholders alone. This isn’t just a number; it represents the difference between rebuilding a commercial property fully or having to cut corners, between a business thriving post-disaster or struggling to recover. For a deeper dive into our role, you can read What is a Public Insurance Adjuster?.

The Critical Difference: Public Adjuster vs. Company Adjuster

It’s crucial to understand the fundamental difference between a public adjuster and an insurance company adjuster (or even an independent adjuster hired by the insurance company).

- Allegiance: A public adjuster’s allegiance is solely to the policyholder. We work for you. A company adjuster, however, is employed by the insurance company, and their primary duty is to protect the company’s financial interests. An independent adjuster is also hired by the insurance company and works for them.

- No Conflict of Interest: Because we are paid by the policyholder (on a contingency basis, meaning we only get paid if you get paid), there is no inherent conflict of interest. Our success is directly tied to your success.

- Maximizing Settlement: Our goal is always to maximize your settlement. Company adjusters, conversely, are trained to minimize the insurance company’s financial liability.

- In-depth Policy Analysis: We decipher complex insurance policies, understanding every nuance, clause, and endorsement to ensure all entitled coverages are identified and pursued, including often-overlooked items like business interruption.

- Independent Loss Assessment: We perform an independent, thorough assessment of the damage, often identifying hidden issues or costs that a company adjuster might overlook or undervalue.

Avoiding Litigation: The Proactive Path to Resolution

Many policyholders, frustrated with low offers or denied claims, consider legal action. While litigation is sometimes necessary, it is costly, time-consuming, and emotionally draining. One of the greatest advantages of engaging a public adjuster is our ability to resolve disputes without the need for expensive lawsuits. We aim to Avoid Unnecessary Litigation.

Our approach is proactive:

- Proactive Documentation: We document every aspect of the loss from day one, building an irrefutable claim package that often pre-empts legal battles.

- Expert Negotiation: With deep knowledge of policies and claim procedures, we negotiate from a position of strength, countering insurer tactics effectively.

- Reduced Legal Fees: By reaching fair settlements through negotiation, clients avoid the substantial legal fees associated with courtroom battles.

- Faster Resolution: A public adjuster pursues a complete settlement in months, whereas litigation can drag on for years.

Here is a concise comparison that highlights why a public adjuster is often the preferred route for property damage claims over a lawsuit:

| Factor | Public Adjuster (ICRS) | Property Damage Lawsuit |

|---|---|---|

| Up-front cost | $0 – contingency fee only if recovery is made | Retainer plus court, expert, and filing fees |

| Typical duration | 3–9 months for most large losses | 1–3 years (or longer) through the courts |

| Decision maker | Negotiated settlement backed by policy facts | Judge or jury decides outcome |

| Net recovery to client | Settlement minus PA fee (generally 10–20 %) | Settlement/award minus 30–40 % attorney fee + expenses |

| Relationship with insurer | Cooperative, preserves future carrier relations | Adversarial, can strain future relations |

| Stress level | Adjuster handles documentation & negotiation | Depositions, findy, and court appearances increase stress |

In short, partnering with a public adjuster like Insurance Claim Recovery Support offers a faster, less adversarial, and more cost-effective path to a fair settlement—allowing owners and managers of commercial and multifamily properties to focus on rebuilding rather than battling in court.