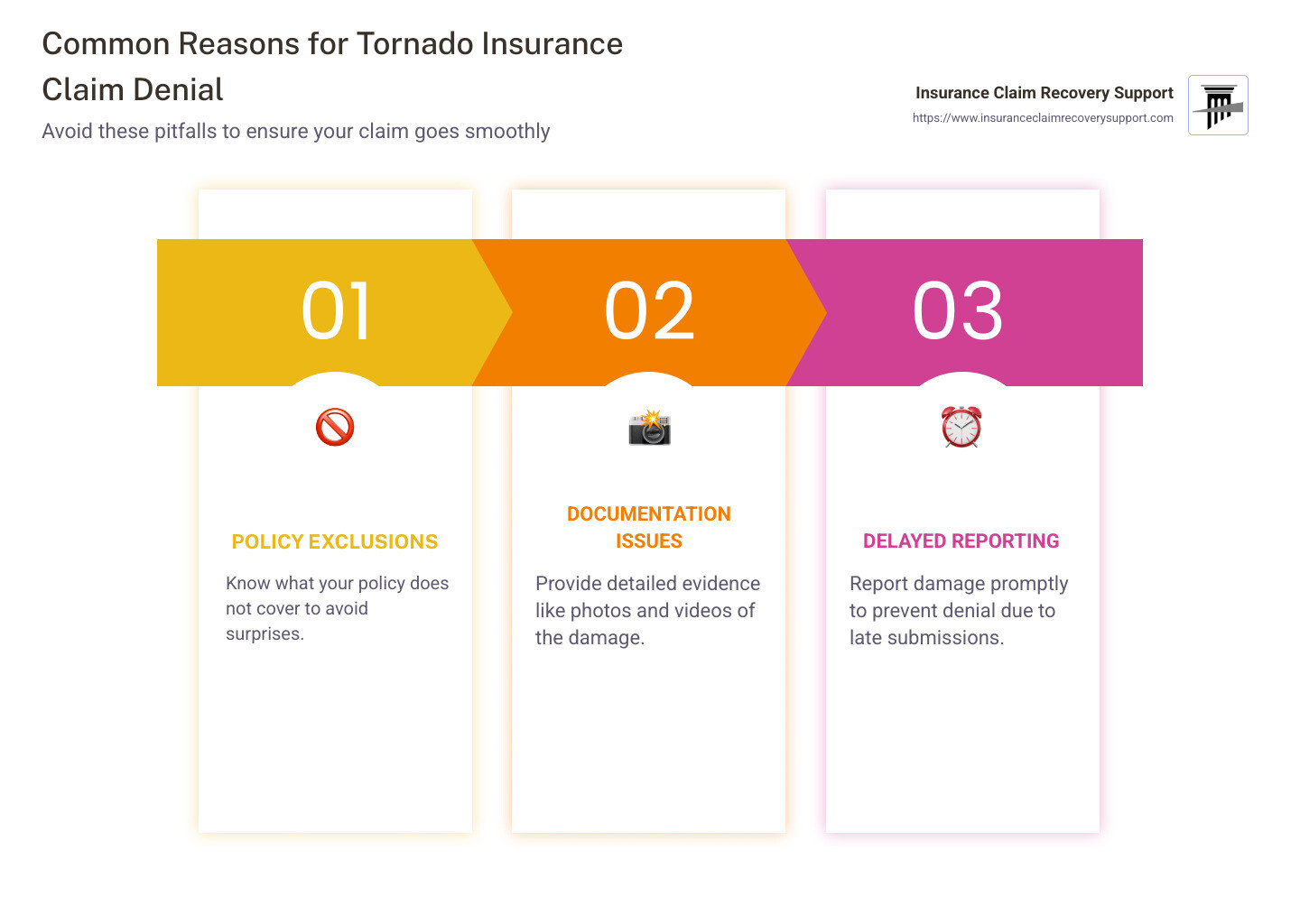

Tornado insurance claim denial can be a perplexing and frustrating experience for property owners. If you’re facing this, here are the most common reasons why claims might be denied:

-

Policy exclusions and limitations: Understand what your policy does not cover, such as certain types of storm damage.

-

Documentation issues: Lack of photos, videos, or written proof of the damage can lead to denial.

-

Delayed reporting: Failing to report damages in a timely fashion can be detrimental.

-

Suspicion of fraud: Ensure honesty in all claims to avoid denial based on suspected fraud.

Insurance companies sometimes view claims through a profit lens, meaning they might undervalue or deny valid claims. Understanding your rights as a policyholder can help you steer these challenges.

As someone who has spent years in the field of insurance recovery, I’ve seen countless cases where valid tornado insurance claims have been wrongfully denied. I’m Scott Friedson, CEO of ICRS LLC, and throughout my career, I’ve overturned countless denied claims and dramatically increased payout amounts for clients. I am here to help you understand the complexities of tornado insurance claim denial and how to steer the process effectively.

Understanding Tornado Insurance Claim Denial

Navigating a tornado insurance claim denial can feel like trying to solve a puzzle with missing pieces. Let’s break down the key reasons why your claim might be denied, so you can understand the situation better and take necessary action.

Bad Faith

Sometimes, an insurance company might deny a claim without a valid reason. This is known as acting in “bad faith.” For instance, imagine a family whose home was shifted off its foundation by a tornado. Despite clear storm-related damage, their insurance carrier denied their claim, asserting it wasn’t storm-related. This is a classic example of bad faith, where the insurer fails to investigate claims fairly or promptly. If you suspect bad faith, consider seeking legal assistance to hold the insurer accountable.

Policy Exclusions

Insurance policies are full of exclusions—specific situations that are not covered. These exclusions can be tricky. For example, while wind damage might be covered, water damage from rain entering through a damaged roof might not be. It’s vital to understand these exclusions to avoid surprises. If you’re unsure, reach out to a professional who can help you interpret your policy.

Insufficient Evidence

Insurance companies need proof to process and approve claims. This means providing clear documentation of the damage. Lack of photos, videos, or detailed notes can lead to a claim denial. Think of it like showing your homework; if you don’t have it, you might not get credit. Always document everything thoroughly right after the storm to build a strong case for your claim.

Protecting Your Rights

Knowing your rights as a policyholder is crucial. If you believe your claim was wrongfully denied, you have options. Consider filing an appeal, gathering more evidence, or even seeking legal advice. Insurance companies are businesses, and they sometimes prioritize profits over payouts. Stay informed and proactive to ensure you get the coverage you deserve.

Steps to Take After a Tornado Insurance Claim Denial

Facing a tornado insurance claim denial can be disheartening, but it’s not the end of the road. Here’s a straightforward guide to help you steer the next steps.

Gather Evidence

Start by collecting as much evidence as possible. This is your foundation for a strong appeal.

- Photographs and Videos: Capture clear images and videos of all the damage. Include multiple angles and close-ups to provide a comprehensive view.

- Damage Documentation: Create a detailed list of all damaged items, noting their condition before and after the tornado.

- Repair Estimates: Obtain estimates from licensed contractors. These should outline the cost of repairs or replacements.

- Professional Reports: Consider getting a professional inspection. Reports from roofers or structural engineers can be persuasive.

- Weather Records: Document the date and time of the tornado. Use weather reports or news articles as additional proof.

File an Appeal

Once you’ve gathered your evidence, it’s time to file an appeal with your insurance company.

- Review the Denial Letter: Understand the specific reasons for the denial. This helps you address the issues directly.

- Write a Formal Appeal Letter: Clearly state why you believe the claim should be approved. Attach all your evidence.

- Request a Re-Inspection: Ask for another visit from an adjuster. Be present during this inspection, and if possible, have your contractor there too.

- Set a Resolution Date: Request a specific date for resolution. This keeps the process moving and provides a timeline for follow-up.

- Follow-Up: If you don’t hear back by the deadline, contact your insurer. Persistence is crucial.

Legal Assistance

If the appeal doesn’t resolve the issue, legal options are available.

- Hire a Lawyer: Consider hiring an attorney who specializes in insurance claims. They can offer legal advice and represent you if necessary.

- Bad Faith Claims: If you suspect your insurer is acting in bad faith, a lawyer can help you file a lawsuit.

- Additional Evidence: Gather any extra proof that can support your case, like expert testimonies or additional repair estimates.

- Court Options: Sometimes, taking the insurer to court is the best way to secure a fair settlement. A lawyer will guide you through this process.

- State Insurance Department: You can also file a complaint with your state’s insurance department. They can investigate and mediate disputes.

By following these steps, you can improve your chances of getting your claim approved. Persistence and thorough documentation are your best allies.

Common Misunderstandings About Tornado Insurance Coverage

Navigating tornado insurance claims can feel like untangling a web of jargon and fine print. Many policyholders find themselves surprised by tornado insurance claim denial due to misunderstandings about their coverage. Let’s break down some key areas where confusion often arises: policy language, coverage limits, and exclusions.

Policy Language

Insurance policies are notorious for their complex language. Terms like “actual cash value” and “replacement cost” can have significant implications for your payout.

- Actual Cash Value: This means your payout will factor in depreciation. So, if your 10-year-old roof is damaged, you’ll get what it’s worth now, not what it would cost to replace it.

- Replacement Cost: This covers the cost to replace damaged items with new ones. Policies with this coverage tend to have higher premiums.

Understanding these terms is crucial. If you’re unsure, ask your insurer for clarification or consult a professional.

Coverage Limits

Every policy has a ceiling—known as the coverage limit—on how much it will pay out for a covered loss. These limits apply to both your dwelling and personal property.

- Dwelling Coverage: This is the maximum amount your insurer will pay to repair or rebuild your home. Make sure it’s enough to cover the current cost of rebuilding.

- Personal Property Coverage: This covers the replacement of items inside your home. Ensure this limit reflects the total value of your belongings.

Regularly review your coverage limits, especially if you’ve made significant home improvements or acquired valuable items.

Exclusions

Exclusions are specific conditions or types of damage that your policy does not cover. These can lead to unexpected tornado insurance claim denial.

- Flood Damage: Standard policies usually don’t cover flood damage, even if it’s a result of a tornado. Separate flood insurance is necessary.

- Building Code Changes: If rebuilding requires meeting new building codes, your policy might not cover these additional costs.

Exclusions can vary widely, so know what’s not covered. This knowledge helps you decide whether additional coverage is necessary.

By understanding your policy’s language, limits, and exclusions, you can avoid surprises and ensure you’re adequately protected. This knowledge is a powerful tool in preventing a tornado insurance claim denial and securing the coverage you need when disaster strikes.

Next, we’ll explore the legal options available if your claim is unfairly denied, including how to pursue a bad faith lawsuit and seek punitive damages.

Legal Remedies for Tornado Insurance Claim Denial

If you’ve faced a tornado insurance claim denial, don’t lose hope. There are legal avenues to explore that can help you get the compensation you deserve. Let’s explore some key strategies: bad faith lawsuits, punitive damages, and expert witnesses.

Bad Faith Lawsuits

Insurance companies have a duty to act in good faith. This means they should handle claims promptly and fairly. If they don’t, you might have a case for a bad faith lawsuit.

-

What Is Bad Faith? It’s when an insurer unreasonably denies a claim or drags out the process without justification. For instance, denying a claim by arguing that tornado damage is unrelated despite clear evidence is a classic bad faith example.

-

Why File a Lawsuit? A successful bad faith lawsuit can compel the insurer to pay not just the policy benefits but also additional damages for the trouble caused.

Punitive Damages

Punitive damages are meant to punish the insurer for their misconduct and deter similar behavior in the future.

-

When Are They Awarded? Courts award punitive damages when the insurer’s actions are especially egregious. This isn’t just about denying a claim; it’s about doing so with malicious intent or gross negligence.

-

How Much? The amount is often a factor of the insurance company’s net worth. This ensures the punishment is meaningful and impactful.

Expert Witnesses

Expert witnesses can be pivotal in building a strong case against an insurer. These professionals provide credible, third-party evaluations that can counter the insurer’s claims.

-

Who Are They? Experts might include structural engineers, meteorologists, or independent claims adjusters. They can assess the damage and testify about its cause and extent.

-

Why Use Them? Their testimony can challenge the insurer’s denial and support your case by providing objective, specialized insights.

By understanding these legal remedies, you can take informed steps towards challenging a tornado insurance claim denial. Whether through a bad faith lawsuit, seeking punitive damages, or leveraging expert witnesses, you have options to fight for your rights and secure the compensation you deserve.

Next, let’s address some frequently asked questions about what to do if your tornado insurance claim is denied, and how to prevent future denials.

Frequently Asked Questions about Tornado Insurance Claim Denial

What do I do if my tornado insurance claim is denied?

First, don’t panic. There are steps you can take to challenge the decision.

-

Review the Denial Letter: Carefully read the denial letter from your insurance company. Understand the reasons they provided for denying your claim.

-

Gather Evidence: Collect more evidence to support your claim. This might include photos of the damage, repair estimates, and expert opinions.

-

File an Appeal: Contact your insurance company to start the appeal process. Provide any new evidence and explain why you believe the denial was incorrect.

-

Contact the State Insurance Department: If you’re not successful with the appeal, the state insurance department can offer assistance. They may review your case and help mediate a resolution.

-

Consider Legal Assistance: If you still face issues, consulting an attorney specializing in insurance claims can provide guidance and help you fight for fair compensation.

How can I prevent future tornado insurance claim denials?

Preventing claim denials starts with preparation and understanding your policy.

-

Regular Maintenance: Keep your property well-maintained. Insurance companies often deny claims if they think damage resulted from neglect. Regularly inspect and repair your home, especially before storm season.

-

Policy Review: Know your policy inside out. Understand what is covered, any exclusions, and your deductible. This helps you avoid surprises when filing a claim.

-

Timely Filing: File claims as soon as possible after a tornado. Missing deadlines is a common reason for denials.

What are common reasons for tornado insurance claim denial?

Understanding why claims are denied can help you avoid pitfalls.

-

Missed Deadlines: Insurance policies have specific timeframes for filing claims. Missing these deadlines can result in denial.

-

Lack of Maintenance: Claims can be denied if the insurer believes the damage was due to poor upkeep. Regular inspections and repairs are crucial.

-

Insufficient Evidence: Not providing enough proof of damage or its cause may lead to denial. Always document thoroughly with photos and expert assessments.

By addressing these areas, you can reduce the chances of facing a tornado insurance claim denial in the future. Up next, we’ll explore more about the complexities of tornado insurance coverage and how to ensure you’re adequately protected.

Conclusion

Facing a tornado insurance claim denial can feel overwhelming, but you don’t have to tackle it alone. At Insurance Claim Recovery Support, we’re committed to advocating for policyholders and ensuring you receive the maximum settlement you deserve. Our team specializes in navigating the complexities of insurance claims, particularly those involving tornado damage.

Why Choose Us?

-

Advocacy for Policyholders: We work exclusively for you, not the insurance company. Our experienced public adjusters are dedicated to ensuring your claim is not undervalued or unfairly denied. We handle the intricate details so you can focus on recovery.

-

Maximum Settlement: Our goal is to secure the highest possible settlement for your claim. We carefully document every aspect of the damage and negotiate aggressively with insurers. This approach consistently results in higher settlements for our clients.

-

Nationwide Service with Local Expertise: While we serve policyholders across the country, our deep understanding of Texas-specific challenges—like those faced in Austin, Dallas, Houston, and beyond—makes us uniquely equipped to handle your claim.

Navigating the insurance claim process after a tornado can be daunting, but you don’t have to do it alone. Let us be your trusted partner in recovery. Visit our Tornado Damage Assessment page to learn more about how we can assist you in turning a denial into the compensation you deserve.