Tornado damage claims are a crucial step for property owners looking to recover losses after a tornado strikes. Whether you’re dealing with residential or commercial property damage, understanding the process can help ensure you receive the compensation you deserve.

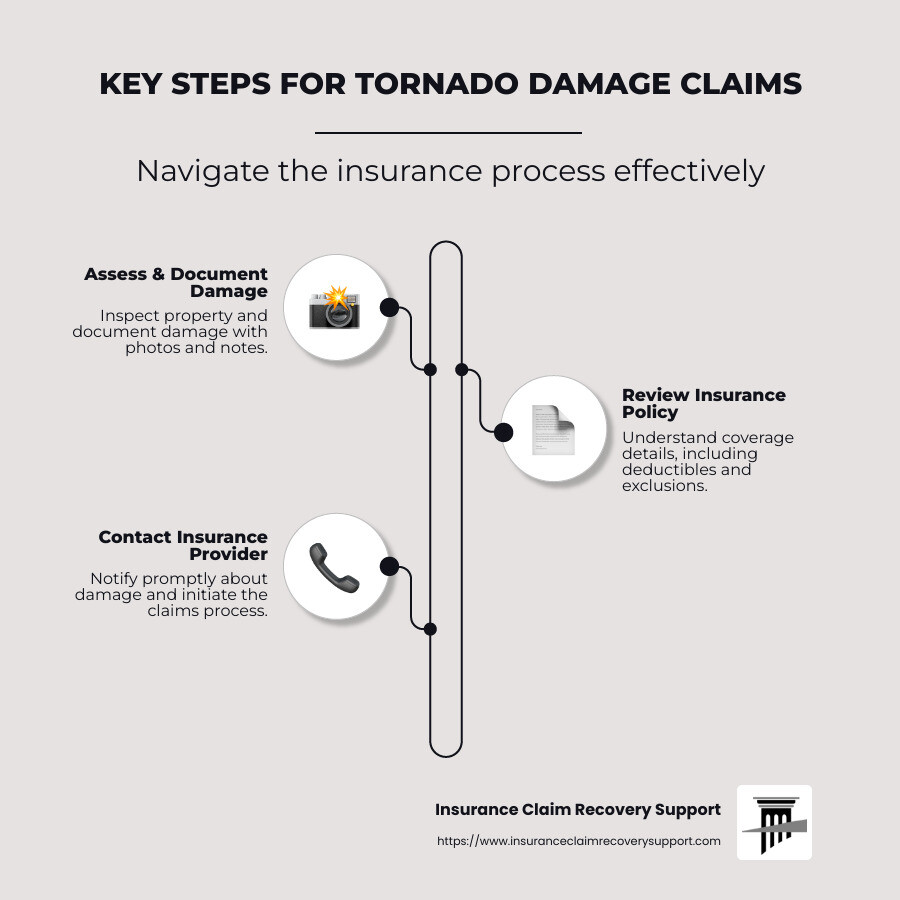

Key steps for a smooth tornado damage claims process:

- Assess and Document Damage: Start by inspecting your property for damage, and document everything with photos and notes.

- Review Your Insurance Policy: Understand the coverage details, including deductibles and exclusions.

- Contact Your Insurance Provider: Notify them promptly about the damage and initiate the claims process.

- Engage Professional Help: Consider hiring a public adjuster to assist with complex claims and negotiations.

Tornadoes can turn lives upside down in minutes, leaving behind a path of destruction. This guide will help you steer insurance claims and minimize stress.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. I’ve settled over 500 large-loss claims and can help you steer tornado damage claims efficiently from start to settlement.

Understanding Tornado Damage Claims

When a tornado hits, understanding your homeowners insurance policy is essential to ensure you get the coverage you need. Let’s break down what’s typically covered and how to file a claim effectively.

What is Covered?

Dwelling Coverage (Coverage A): This part of your policy covers damage to the structure of your home. It includes the roof, walls, and any attached structures. If a tornado damages your house, this coverage helps pay for repairs or rebuilding up to the policy’s limit.

Personal Property (Coverage C): Tornadoes can scatter or destroy your belongings. This coverage helps replace items like furniture, clothing, and electronics. Some items have sublimits, meaning there’s a max payout for specific types of belongings.

Loss of Use (Coverage E): If your home becomes unlivable due to tornado damage, this coverage helps with additional living expenses. It might cover hotel bills, meals, and other costs incurred while your home is being repaired.

Filing a Claim

Contact Your Insurer: As soon as it’s safe, contact your insurance company to report the damage. Quick notification is crucial to start the claims process.

Document the Damage: Take clear photos and videos of all the damage. Capture every angle and detail, from broken windows to roof damage. This documentation supports your claim and helps your insurer understand the extent of the damage.

Understand the Claim Process: Filing a claim involves several steps. After notifying your insurer, they will assign an adjuster to assess the damage. Be prepared to provide all your documentation, including photos and receipts for any temporary repairs.

Coverage Limits and Deductibles: Be aware of your policy’s coverage limits and deductibles. Coverage limits are the maximum amount your insurer will pay for a covered loss. If the tornado damage exceeds these limits, you’ll be responsible for the additional costs. Deductibles are the amount you pay out-of-pocket before insurance kicks in.

By understanding these aspects of your homeowners insurance policy, you can steer the tornado damage claims process more smoothly. Next, we’ll discuss how to take immediate steps after a tornado to protect your property and safety.

Steps to Take After a Tornado

Documenting the Damage

When a tornado strikes, it’s crucial to document the damage thoroughly. This step is essential for filing a successful insurance claim.

Safety First: Before you do anything, ensure it’s safe to enter your property. Watch out for hazards like downed power lines or unstable structures.

Initial Inspection: Once it’s safe, perform a quick inspection of your home. Look for visible damage to the roof, walls, and windows. This will give you a sense of the extent of the damage.

Emergency Contacts: Keep a list of emergency contacts handy, including local authorities and your insurance provider. This ensures you can reach out quickly if needed.

Photos and Videos: Take clear photos and videos of all the damage. Capture every angle, from the roof to the foundation. Don’t forget to include close-ups of specific issues like cracks in walls or missing shingles. Videos can provide a comprehensive view that photos alone might miss.

Inventory List: Create a detailed inventory list of damaged items inside your home. Include descriptions, purchase dates, and estimated values. This list will help your insurance adjuster understand the full extent of your loss.

Preventing Further Damage

After documenting the damage, it’s important to take steps to prevent further damage to your property.

Temporary Repairs: Make temporary repairs to protect your home from more harm. For example, cover broken windows with plastic or board them up to prevent rain from entering. Use tarps to cover any holes in the roof.

Securing Property: Secure your property by removing debris that could cause additional damage. This includes fallen branches or loose items that might be blown around by the wind.

Receipts: Save all receipts for materials used in temporary repairs. These expenses might be reimbursable by your insurance company. For instance, if you buy a tarp to cover a damaged roof, keep that receipt.

By documenting the damage and taking steps to prevent further harm, you can ensure a smoother claims process. This meticulous approach not only helps with your insurance claim but also protects your home from additional damage.

Next, we’ll explore how to steer the insurance process and ensure you get the compensation you deserve.

Navigating the Insurance Process

Hiring a Public Adjuster

When dealing with tornado damage claims, hiring a public adjuster can be a game-changer. These professionals work for you, not the insurance company, to ensure you get the best settlement possible.

Advocacy is a key benefit of hiring a public adjuster. They fight on your behalf to make sure all damages, even hidden ones, are accounted for. Their goal is to maximize your settlement, ensuring you receive what you deserve.

Expertise is another advantage. Public adjusters bring specialized knowledge of the insurance industry. They collaborate with experts like forensic accountants and building estimators to create a comprehensive claim. This ensures that nothing is overlooked.

In a recent Texas tornado case, a business owner received a settlement increase of 40% after hiring a public adjuster. This adjustment covered all repair costs and business interruption losses, showcasing the value of professional help.

Maximizing Your Settlement

To maximize your settlement, it’s crucial to approach the process methodically. Here’s how:

-

Policy Review: Start by thoroughly reviewing your insurance policy. Understand what is covered, any exclusions, and your deductible. This knowledge is essential to ensure you’re claiming everything you’re entitled to.

-

Adjuster Visit: Once your claim is filed, an insurance adjuster will visit your property. Be prepared with all your documentation, including photos, videos, and an inventory list. Walk the adjuster through the damage, pointing out all areas of concern. Don’t forget to ask for a copy of their report.

-

Detailed Assessment: Consider hiring a professional for a detailed assessment of the damage. This independent evaluation can provide a comprehensive view of your losses and ensure nothing is missed.

-

Accurate Estimates: Obtain accurate repair estimates from reputable contractors. These estimates will help you negotiate a fair settlement with your insurance company.

-

Claim Management: Managing your claim effectively is crucial. Keep track of all communications with your insurance company. Request written confirmation of any agreements or decisions made during the process. This documentation will be invaluable if any disputes arise.

By following these steps and leveraging professional help, you can steer the insurance process confidently and secure the compensation you deserve.

Next, we’ll address some frequently asked questions about tornado damage claims to further clarify this complex process.

Frequently Asked Questions about Tornado Damage Claims

Do insurance companies pay for tornado damage?

Yes, most insurance companies do pay for tornado damage. Tornadoes are typically covered under standard homeowners insurance policies. This includes damage from high winds, which is the primary cause of destruction during a tornado. Dwelling coverage helps pay for repairs to the structure of your home, like your roof and walls. Personal property coverage takes care of your belongings inside the home. However, every policy is different, so it’s important to review your specific coverage details. Some policies might have exclusions or require separate windstorm coverage, especially in tornado-prone areas.

How long after storm damage can I claim?

The time you have to file a claim after storm damage varies by insurance company and policy. It’s crucial to act quickly. Many policies have a specific claim deadline. Filing promptly is essential not only to meet these deadlines but also to prevent further damage that could complicate your claim. If you need to file supplementary claims for damage finded later, keep in mind that they might have different deadlines. Always check your policy or contact your insurer for the exact time limits.

What is the deductible for tornado insurance?

The deductible for tornado insurance can vary. Some policies have a windstorm deductible, which might be a percentage of your home’s insured value rather than a flat dollar amount. For example, if your home is insured for $200,000 and your windstorm deductible is 2%, you would pay $4,000 out-of-pocket before your insurance kicks in. Understanding your policy specifics is important to know how much you’ll need to cover if tornado damage occurs. Always review your policy and speak with your insurer to understand your financial responsibility in the event of a claim.

These FAQs provide a foundation for understanding how tornado damage claims work. Next, we’ll explore more about maximizing your settlement and ensuring you get the compensation you deserve.

Conclusion

Navigating the aftermath of a tornado can be daunting, but you don’t have to go through it alone. At Insurance Claim Recovery Support, we stand by policyholders, ensuring you get the compensation you deserve. Our commitment to policyholder advocacy means we work for you—not the insurance company.

Tornadoes in Texas can be particularly devastating, affecting cities like Austin, Dallas, and Houston. Our deep understanding of Texas storm patterns makes us the perfect ally in your recovery process. We’re here to help you steer the complex world of insurance claims, ensuring your claim is not undervalued or unfairly denied.

Our experienced public adjusters specialize in maximizing settlements. We carefully document every aspect of your loss, advocating for the fullest possible compensation. For instance, we helped a business owner in Houston secure a settlement that fully covered $100,000 in tornado damage, minus the deductible. This was possible through detailed documentation and skilled negotiation.

If you’re facing the challenges of tornado damage, Insurance Claim Recovery Support is here to help. We are dedicated to making your recovery process as smooth as possible, ensuring you receive a fair and prompt settlement. For more information on how we can assist with your insurance claim, visit our Tornado Damage Claim Service Page.

Let us help you rebuild and recover. Together, we can steer the path to recovery and ensure you get the compensation you deserve.