When it comes to Texas insurance claims, the process can seem daunting and complex, especially in the wake of property damage caused by fires, hurricanes, tornadoes, or other disasters. For property owners like multifamily complexes, apartment real estate investors, and homeowners associations, understanding this process is crucial to securing fair compensation. Whether you’re dealing with hail, freeze, or flood damage, this guide will help you steer your insurance claim efficiently.

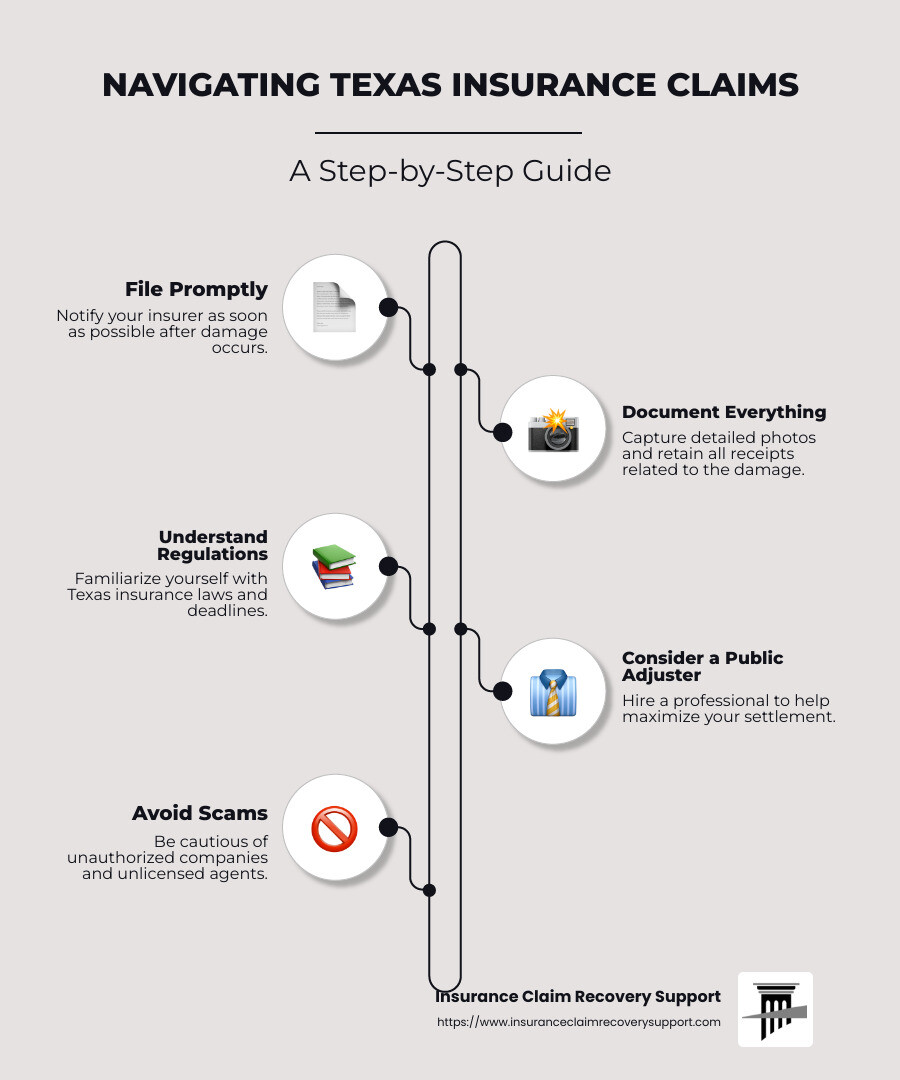

- File your claim promptly – The sooner you notify your insurer about the damage, the better.

- Document everything – Take detailed photos and keep receipts.

- Understand state regulations – Be aware of Texas-specific insurance laws.

- Consider hiring a public adjuster – They can help maximize your settlement.

As the CEO of Insurance Claim Recovery Support, I’ve spent years guiding policyholders through the complexities of Texas insurance claims. With my experience in settling over $250 million in large loss claims, I’m here to ensure you avoid unnecessary appraisal, denial, or delays in your claims journey.

Texas insurance claims further reading:

– how do insurance companies settle personal injury claims

– how to negotiate a settlement with an insurance claims adjuster

Understanding Texas Insurance Claims

In Texas, understanding the nuances of insurance claims is essential for navigating the process effectively. Texas operates as an at-fault state when it comes to auto insurance. This means that the driver who caused the accident is responsible for covering the damages. If you’re involved in an accident, you’ll file a claim with the at-fault driver’s insurance company. This is crucial to know, as it impacts how claims are handled and who pays for damages.

Claim Deadlines

Timing is everything when it comes to filing Texas insurance claims. The Texas Insurance Code outlines specific deadlines that insurance companies must follow. For instance, once you file a claim, the insurance company has 15 business days to acknowledge it. After receiving all necessary information, they have another 15 business days to decide whether they will accept or reject the claim. If they agree to pay, they must do so within five business days. Knowing these timelines can help you hold your insurer accountable and ensure a smoother claims process.

Understanding Your Insurance Policy

Your insurance policy is your roadmap through the claims process. It details what is covered, the limits of your coverage, and any exclusions. Before disaster strikes, take time to read and understand your policy. This will help you know what to expect and ensure you’re not caught off guard by any surprises. If you’re unsure about any part of your policy, don’t hesitate to ask your insurance agent for clarification.

Understanding these key aspects of Texas insurance claims will empower you to steer the claims process with confidence. Up next, we’ll dive into filing your insurance claim and the steps you need to take to get started.

Filing Your Insurance Claim

When dealing with Texas insurance claims, the first step is to file a First Notice of Loss (FNOL). This is your initial report to the insurance company about the incident or damage. It’s crucial to do this as soon as possible. The FNOL sets the claims process in motion and alerts the insurer to your situation.

Documentation

Gathering documentation is key to a successful claim. Start by taking clear photos and videos of the damage. Whether it’s a car accident or property damage, visual evidence is powerful. Capture every angle and detail. This includes any damage to belongings, structural issues, or even smoke stains if applicable.

Next, create a detailed inventory of losses. List each damaged item, its age, and its estimated value. This inventory helps substantiate your claim and ensures nothing is overlooked.

Keep all receipts for temporary repairs and expenses related to the incident. These might be reimbursed by your policy. However, avoid making permanent repairs until an adjuster evaluates the damage. Doing so could jeopardize your claim.

The Claim Process

Once your FNOL is filed and documentation is ready, the insurance company will guide you through the next steps. An adjuster will likely be assigned to your case. They will assess the damage to determine the repair costs. Be present during the adjuster’s visit to point out all damages and answer any questions they might have.

It’s wise to get repair estimates from multiple contractors or body shops. Compare these with the adjuster’s report. If there are discrepancies, discuss them with your insurance company to ensure a fair settlement.

After the adjuster completes their evaluation, the insurance company has a timeline to follow. They must decide on your claim within 15 business days of receiving all necessary information. If approved, payment must be made within five business days.

Filing a claim can feel overwhelming, but understanding these steps simplifies the process. Being organized and proactive helps ensure you receive the compensation you’re entitled to.

In the next section, we’ll explore how to steer the claims process, including what to expect from the adjuster’s visit and how to handle repair estimates.

Navigating the Claims Process

Navigating the Texas insurance claims process can be a bit like solving a puzzle. It involves several steps, each crucial to getting the compensation you deserve. Let’s break it down into manageable parts.

Adjuster Visit

Once you’ve filed your claim and gathered all necessary documentation, the next key step is the adjuster’s visit. This is when the insurance company sends a professional to assess the damage firsthand. Think of the adjuster as your claim’s detective.

Tips for the Visit:

- Be Present: Make sure you’re available during the visit. You can point out all the damages and provide any additional information the adjuster might need.

- Documentation Ready: Have all your photos, videos, and lists of damages handy. This helps the adjuster see the full picture.

- Ask Questions: Don’t hesitate to ask questions about the process or the adjuster’s findings.

Repair Estimates

After the adjuster’s assessment, it’s time to gather repair estimates. This step ensures you get a fair settlement and that all damages are accounted for.

Steps for Getting Estimates:

- Multiple Estimates: Get quotes from more than one contractor or repair shop. This gives you a better idea of the actual repair costs.

- Compare with Adjuster’s Report: Check the estimates against the adjuster’s findings. If there are differences, discuss them with your insurance company.

- Negotiate: If necessary, use the estimates to negotiate a better settlement with your insurer.

Payment Timelines

Once everything is in place, it’s all about the waiting game for the payment. In Texas, insurance companies have specific timelines to follow.

Key Timelines:

- Claim Decision: The insurance company must decide on your claim within 15 business days after receiving all needed information.

- Payment Issuance: If they approve your claim, they must issue payment within five business days.

Understanding these timelines is crucial. It helps you know what to expect and when to follow up if things seem delayed.

Navigating the claims process can feel daunting, but breaking it down into these steps makes it more manageable. Stay organized, communicate clearly, and advocate for your rights to ensure a smooth journey through your Texas insurance claims process.

In the next section, we’ll discuss common challenges you might face, like scams and dealing with unauthorized companies.

Common Challenges in Texas Insurance Claims

When dealing with Texas insurance claims, there are several challenges that policyholders might face. Understanding these can help you protect yourself and your finances.

Insurance Scams

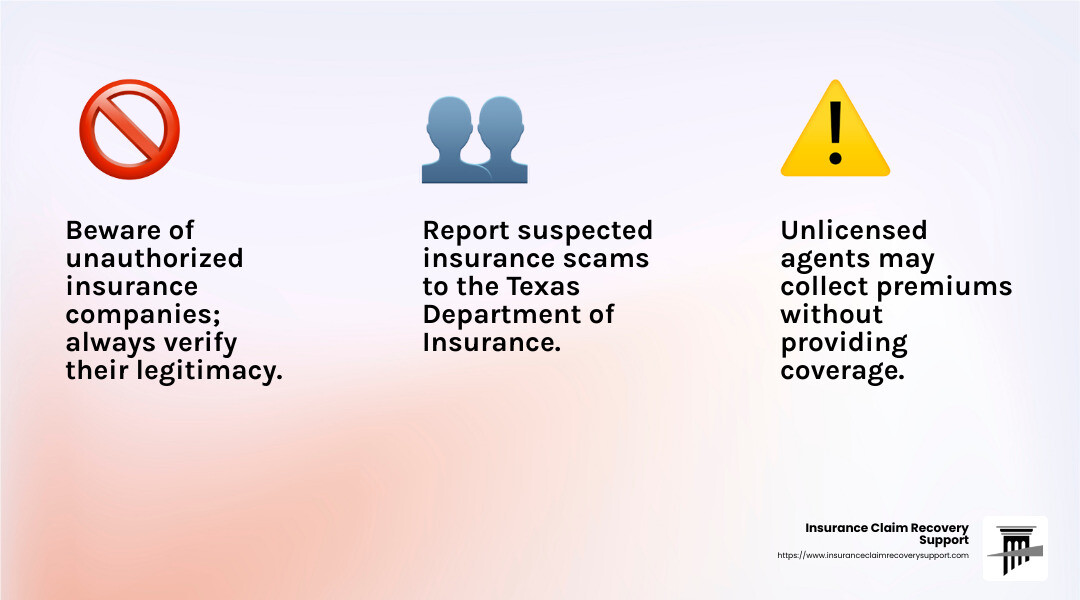

Insurance scams are a significant issue in Texas. Scammers often prey on unsuspecting policyholders, offering deals that seem too good to be true. For example, deceptive healthcare discount cards are a common scam. While some programs are legitimate, others are worthless and can leave you without coverage when you need it most.

If you suspect a scam, report it to the Texas Department of Insurance immediately. They can help verify the legitimacy of the program or company.

Unauthorized Insurance Companies

Some companies may present themselves as legitimate insurers, but they aren’t authorized to operate in Texas. These companies often offer policies at rates significantly lower than the market. While it might be tempting to go for the cheaper option, it could lead to problems down the road if the company can’t or won’t pay your claim.

To avoid this, always verify that an insurer is licensed in Texas. Use the Texas Department of Insurance’s Company Lookup tool or call them directly to confirm.

Unlicensed Insurance Agents

Just as there are unauthorized companies, there are unlicensed agents. These individuals pose as legitimate insurance agents to collect premiums without providing actual coverage. A good rule of thumb is never to pay insurance premiums in cash. It’s also wise to verify the agent’s credentials with the Texas Department of Insurance.

If you encounter an unlicensed agent or suspect fraud, report it to the authorities. The Consumer Protection Division can also assist in such cases.

Facing these challenges can be daunting, but being informed and vigilant can help you avoid common pitfalls in the Texas insurance claims process. Next, we’ll answer some frequently asked questions about Texas insurance to further guide you.

Frequently Asked Questions about Texas Insurance Claims

How long does an insurance company have to settle a claim in Texas?

In Texas, insurance companies have specific timelines they must follow when settling claims. Once an insurer agrees to pay a claim, they must issue payment within five business days. This timeline ensures that policyholders receive their compensation promptly. However, if the claim involves a condition that requires you to perform an act, such as providing additional documentation, the timeline may extend. In such cases, the insurer must pay within five business days after you complete the required action.

Understanding these deadlines is crucial to ensure your claim is processed efficiently. If you feel your claim is being delayed unfairly, you might need to take further action by contacting the Texas Department of Insurance.

Is Texas an at-fault state for insurance?

Yes, Texas operates as an at-fault state for auto insurance. This means that the driver responsible for an accident is also responsible for covering the damages. In practical terms, the at-fault driver’s insurance company pays for the other party’s medical expenses, property damage, and other losses.

This system emphasizes the importance of having adequate liability coverage. If you’re found to be at fault in an accident, your insurance will need to cover the costs up to your policy limits. Understanding your coverage and ensuring it’s adequate for potential liabilities is essential in managing your risk in Texas.

How do I report an insurance company in Texas?

If you encounter issues with an insurance company, such as unfair claim denials or delays, you can report them to the Texas Department of Insurance (TDI). The TDI provides a structured complaint process to address grievances against insurers.

To file a complaint, you can use their online Insurance Complaint Process or call them at 1-800-252-3439 for assistance. The TDI investigates complaints to ensure insurance companies comply with Texas laws. Additionally, the Consumer Protection Division can review insurance practices for possible violations under the Texas Deceptive Trade Practices Act.

Staying informed about your rights and the complaint process can empower you to take action if you face difficulties with your insurance provider. This proactive approach can help ensure that your Texas insurance claims are handled fairly and efficiently.

Conclusion

Navigating Texas insurance claims can be daunting, but you don’t have to do it alone. At Insurance Claim Recovery Support, we are committed to standing by policyholders every step of the way. Our focus is on advocacy—ensuring that your voice is heard and your claim receives the attention it deserves.

We understand the complexities involved in property damage claims, whether it’s from fire, storm, or other disasters. Our team specializes in securing the maximum settlement for our clients, ensuring that they can rebuild and recover without unnecessary financial burdens.

Our experience with Texas’s unique challenges, like its unpredictable weather, positions us as experts in the field. We serve clients across major Texas cities, including Austin, Dallas-Fort Worth, San Antonio, Houston, Lubbock, and beyond. Our goal is simple: to make the claims process as smooth and stress-free as possible for you.

If you’re facing a property damage claim and need a dedicated advocate on your side, don’t hesitate to reach out. Let us help you steer the complexities of your insurance claim and secure the settlement you deserve.

For more information on how we can assist with your insurance claim, visit our Public Adjusters page. We’re here to support you in achieving the best possible outcome for your claim.