The Deadliest Texas Flood in Nearly 50 Years

Texas Flood 2025 devastated Central Texas over the July 4th weekend, becoming the deadliest inland flooding event in the United States since 1976. The catastrophic flash floods claimed at least 135 lives and caused over $1.1 billion in damage across the Texas Hill Country.

Key Facts About Texas Flood 2025:

- Date: July 4-6, 2025

- Location: Central Texas Hill Country, primarily Kerr County

- Fatalities: 135+ deaths (117 in Kerr County alone)

- Rainfall: Up to 20.33 inches in some areas

- River Rise: Guadalupe River surged 26 feet in 45 minutes

- Damage: $1.1 billion estimated property damage

- Cause: Mesoscale convective vortex amplified by tropical moisture

The disaster struck when a stalled storm system, fed by remnants of Tropical Storm Barry, dumped four months’ worth of rain in just hours. The Guadalupe River system experienced unprecedented rises, with water levels jumping 26 feet in less than an hour near Hunt, Texas. Camp Mystic became a tragic symbol of the disaster, where 27 children and staff lost their lives as floodwaters overwhelmed the facility. The event highlighted critical failures in warning systems, as Kerr County lacked dedicated flood alert infrastructure despite its location in “Flash Flood Alley.”

For commercial property owners, multifamily complexes, and other large facilities affected by the floods, the path to recovery is complex. Many survivors face inadequate FEMA assistance and complicated insurance claims. As Scott Friedson, a multi-state licensed public adjuster who has settled over $250 million in property damage claims, I’ve seen how disasters like Texas Flood 2025 can overwhelm property owners. My experience helping policyholders steer flood damage claims and maximize settlements is crucial when communities face such destruction.

Key Texas Flood 2025 vocabulary:

Anatomy of a Superstorm: What Caused the Catastrophic Floods?

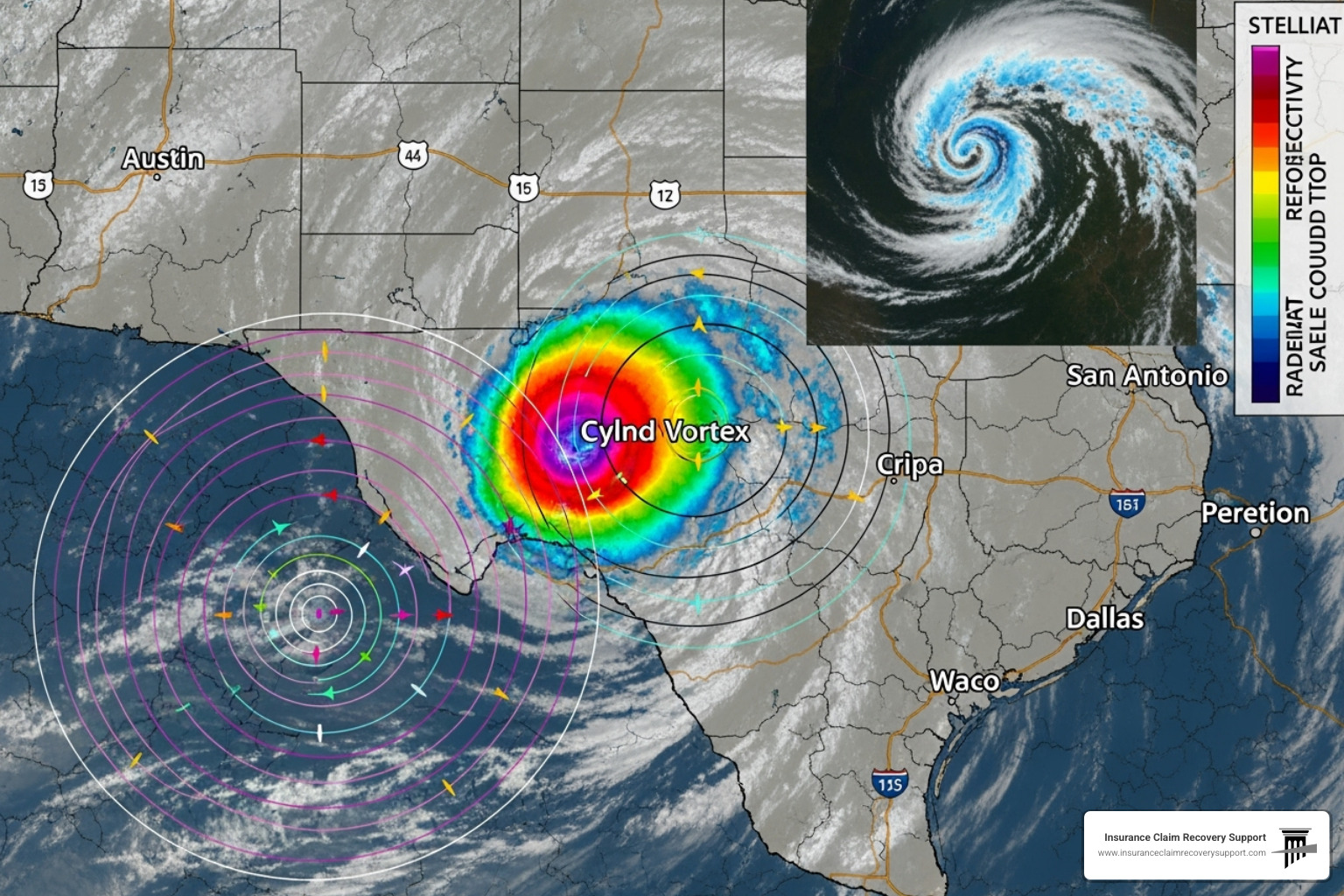

Understanding what made Texas Flood 2025 so devastating requires looking at the perfect storm of meteorological factors. This was a rare event that caught even experienced forecasters off guard.

The main culprit was a mesoscale convective vortex—a swirling storm system that stalled over the region, pulling in immense moisture from the remnants of Tropical Storm Barry and the tropical East Pacific. This created an atmospheric river of unprecedented proportions. Compounding the issue, record-breaking temperatures meant the atmosphere could hold far more moisture than usual, setting the stage for a catastrophic release of water.

How Climate Change Fueled the Disaster

We cannot ignore the influence of climate change on Texas Flood 2025. A warming planet makes extreme weather events more intense and frequent. During the disaster, atmospheric water vapor was 35 to 50% higher than normal because warmer oceans evaporate more moisture and warmer air holds more water. At the same time, a weakening jet stream allowed the storm system to stall over Central Texas, dumping rain in one location for an extended period. These factors, fueled by unusually warm ocean temperatures, led to a dramatic increase in rainfall intensity. The Intergovernmental Panel on Climate Change confirms that every weather event now carries the fingerprint of our changing climate, a critical fact for future flood protection planning.

A “Rain Bomb” Over the Hill Country

The term “rain bomb” is no exaggeration. In just a few hours, Texas Flood 2025 dropped the equivalent of four months of normal rainfall, with a recorded high of 20.33 inches. The Guadalupe River’s response was terrifying: near Hunt, Texas, it rose 26 feet in just 45 minutes.

This extreme response is a product of the region’s geography, known as “Flash Flood Alley.” Steep slopes and shallow soils over porous karst terrain (limestone) mean rainwater runs off quickly once the ground is saturated. The “time of concentration”—the time it takes for rain to reach the river—is incredibly short, often just one to two hours. This geography turns heavy rain into deadly walls of water, posing unique risks for commercial properties that may seem safe under normal conditions.

The Unprecedented Impact on Texas Communities and Properties

The Texas Flood 2025 left a devastating mark across Central Texas. When the floodwaters receded, the scope of destruction was immense. At least 135 lives were lost, making this the deadliest inland flooding event in the U.S. in nearly five decades, with 117 fatalities in Kerr County alone.

The financial toll was equally staggering, with preliminary damage estimates reaching $1.1 billion. This figure includes severe damage to commercial buildings, multifamily properties, apartment complexes, and religious institutions across Kerrville, Hunt, and surrounding communities. The tragedy at Camp Mystic, where twenty-seven children and staff members lost their lives, became a heartbreaking symbol of the disaster’s speed and ferocity.

The Human Cost: Trauma and Financial Hardship for Survivors

Behind the statistics, survivors of the Texas Flood 2025 face overwhelming and persistent psychological trauma, including PTSD, anxiety, and panic attacks. This emotional toll is compounded by severe financial hardship, as homes, businesses, and possessions were destroyed in hours. Entire families were displaced, forced to steer complex insurance claims and government aid while grieving. While community support and GoFundMe campaigns provided initial relief, the long, grinding process of rebuilding falls heavily on survivors, especially commercial property owners tasked with restoring operations vital to their communities.

Comparing the Texas Flood 2025 to Other Major Disasters

To understand its significance, the Texas Flood 2025 was the deadliest inland flood since the 1976 Big Thompson River flood in Colorado. While hurricanes like Katrina (1,392 deaths) and Maria (2,975 deaths) had higher death tolls, the speed of this flood made it particularly lethal. Unlike Hurricane Harvey in 2017, which spread its rainfall over days, this disaster was a concentrated punch that delivered devastating force in hours. The Guadalupe River’s 26-foot rise in 45 minutes left no time for evacuation. This event, happening without a named hurricane, serves as a sobering reminder that the most dangerous storms can develop quickly and locally, overwhelming even the best-laid plans.

Systemic Failures: Why Was the Texas Flood 2025 So Deadly?

The tragic loss of 135 lives in the Texas Flood 2025 was not just a result of extreme weather; it was compounded by systemic failures in warning systems, infrastructure, and planning. Many of these deaths were preventable, highlighting a troubling pattern of outdated systems and underfunded projects.

Inadequate Warnings and Outdated Infrastructure

Kerr County’s lack of a dedicated flood warning system, despite its location in “Flash Flood Alley,” was a critical failure. A proposed $1 million flood alert system—just 1.5% of the county’s annual budget—was rejected in 2017 due to cost concerns. Instead, the county relied on cell phone alerts and broadcast systems that proved inadequate when cell towers failed and power went out, leaving many residents with no warning.

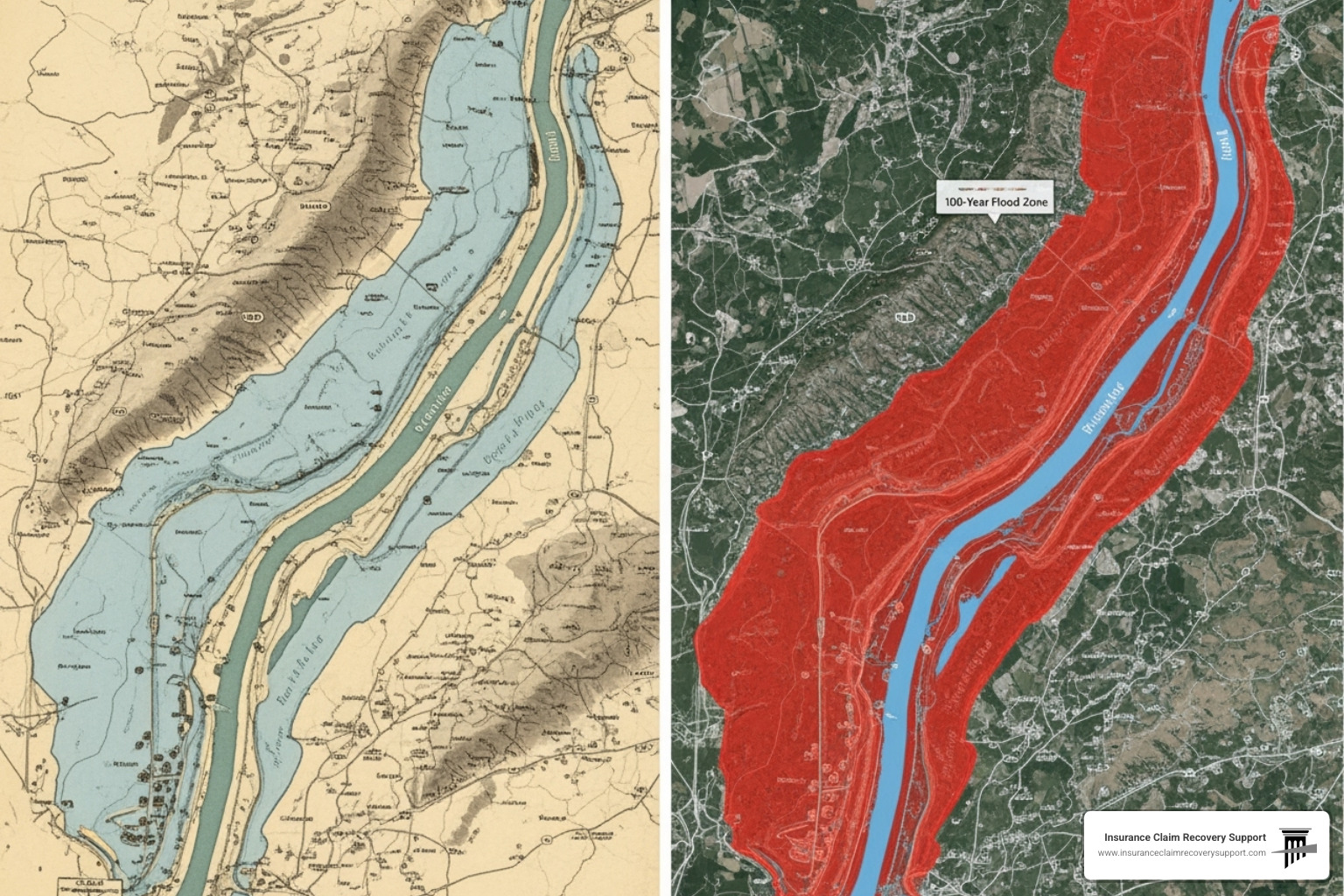

The problem runs deeper. More than 50% of FEMA’s floodplain maps are outdated, some by decades. These maps fail to account for climate change and current rainfall patterns. At Camp Mystic, modern mapping from the First Street Foundation showed 17 structures at high risk, compared to only eight on FEMA’s obsolete map. This discrepancy creates a false sense of security for property owners. Furthermore, a 2024 state report identified a $54.5 billion need for flood mitigation projects in Texas, a funding gap that leaves communities dangerously vulnerable.

Lessons Learned for Future Resilience

The Texas Flood 2025 taught a vital lesson: elevation is salvation. When floodwaters rise rapidly, getting to higher ground is the only sure path to safety. This principle must be integrated into future development.

- Update Building Codes: New construction, especially commercial and multifamily properties, must be liftd well above current flood level requirements.

- Invest in Modern Warning Systems: Communities need robust, multi-layered alert systems that function without relying solely on cellular networks.

- Proactive Planning: Flood risk management must be part of all community development, from zoning to infrastructure design.

For property owners, this disaster underscores the need to understand your true flood risk, not just what outdated maps suggest. When disaster strikes, having experienced professionals to steer complex commercial property damage claims is invaluable. For more insights, visit our Texas storm damage news page.

The Difficult Path to Recovery for Property Owners

After the Texas Flood 2025, property owners began the arduous journey of recovery. For those managing commercial buildings, multifamily complexes, and religious institutions, this path is a maze of bureaucracy, insufficient aid, and complex insurance claims.

Navigating FEMA and Financial Aid Problems

FEMA assistance, while helpful, rarely covers the true cost of recovery. The system caps total aid at $87,200, but the average FEMA payment for this disaster was only about $8,000—a fraction of what is needed to restore a flood-damaged commercial property. Many owners receive frustrating denial letters due to strict eligibility requirements regarding ownership, insurance coverage, and citizenship. For more substantial help, Small Business Administration (SBA) loans are an option, but they represent additional debt at a time of crisis. This system leaves property owners scrambling to bridge a significant financial gap.

The Complexities of Commercial Flood Insurance Claims

Commercial flood insurance claims are far more intricate than residential ones. The stakes are higher, policies are more complex, and the potential for business interruption losses is devastating.

- Coverage Types: National Flood Insurance Program (NFIP) policies and private flood insurance differ significantly. A crucial distinction is that NFIP policies do not cover loss of use, a catastrophic gap for businesses unable to operate during repairs. Private policies may offer this, but with their own complex terms.

- FEMA’s “50% Rule”: If repair costs exceed 50% of your property’s market value, you must upgrade the entire structure to meet current flood regulations. This often requires costly elevation work that far exceeds the $30,000 available through Increased Cost of Compliance (ICC) coverage.

- Documentation: Documenting large-scale commercial damage—from structural issues to lost inventory and business interruption—is a meticulous and overwhelming process.

Comparing Property Damage Insurance Lawsuit vs. Using a Public Adjuster

| Feature | Property Damage Insurance Lawsuit | Using a Public Adjuster |

|---|---|---|

| Primary Goal | Seek compensation for damages through formal legal action. | Maximize settlement through expert claim preparation and negotiation. |

| Process | Formal legal proceedings, findy, depositions, potential trial. | Claim investigation, documentation, negotiation with the insurance carrier. |

| Timeline | Can be lengthy, often taking months or years to resolve. | Generally faster; focused on efficient claim resolution. |

| Cost | Attorney fees (often 33-40% of settlement), court costs, expert fees. | Public adjuster fees (typically 10-15% of settlement, contingent). |

| Relationship | Adversarial; insurer is typically the defendant. | Collaborative with policyholder; public adjuster represents policyholder’s interests. |

| Risk | High risk of no recovery if lawsuit fails; high legal costs. | Lower risk; public adjusters are typically paid only if a settlement is reached. |

| Control | Limited control over legal strategy and court schedule. | Policyholder retains more control over claim decisions. |

| Expertise | Legal expertise; may require separate property damage experts. | Specialized expertise in insurance policies, damage assessment, and negotiation. |

| Litigation Avoidance | Initiates litigation. | Aims to resolve claim without litigation, often preventing the need for a lawsuit. |

Avoiding unnecessary litigation is often the smartest approach. A skilled public adjuster can level the playing field, carefully documenting losses and negotiating a fair settlement without the time, expense, and uncertainty of a lawsuit. Our firm exclusively represents policyholders in Austin, Dallas, Fort Worth, San Antonio, Houston, and throughout Texas, ensuring you receive maximum compensation. For more details, learn about the commercial property insurance claim process.

Frequently Asked Questions about the Texas Flood 2025

What made the Texas Flood 2025 so much more intense than previous events?

The flood’s intensity stemmed from a rare combination of factors: a stalled storm system (a mesoscale convective vortex) that acted like a firehose; extreme atmospheric moisture, amplified by climate change and remnants of a tropical storm; and the unique geology of “Flash Flood Alley,” which has steep slopes and shallow soil, causing rapid runoff. This convergence resulted in record rainfall (up to 20.33 inches) and a river that rose 26 feet in just 45 minutes.

My commercial property was damaged. What are the first steps in the insurance claim process?

If your commercial property, multifamily complex, or religious institution was damaged, act quickly and methodically.

- Ensure Safety: Secure the property to prevent further damage or injury.

- Document Everything: Take extensive photos and videos of all damage before any cleanup or repairs begin.

- Mitigate Further Loss: Make temporary repairs, like tarping the roof, and keep all receipts.

- Notify Your Insurer: Contact your insurance company immediately to start the claims process.

Most importantly, consider consulting a public adjuster early. Commercial flood claims are notoriously complex. An adjuster who works for you—not the insurance company—can manage the entire process, from documenting losses to negotiating a fair settlement. This helps you avoid common pitfalls and the stress of unnecessary litigation, ultimately maximizing your financial recovery.

How can Texas communities better prepare for future extreme weather events?

Building resilience after the Texas Flood 2025 requires a proactive, multi-faceted approach.

- Invest in Modern Warning Systems: Communities need reliable, multi-layered alert systems that don’t depend solely on cell service.

- Update Maps and Codes: Floodplain maps must be updated to reflect current climate risks, and building codes must mandate elevation and flood-resistant construction.

- Fund Mitigation Projects: The state’s $54.5 billion infrastructure need for flood mitigation is not optional; it’s a critical investment in survival.

- Plan Smarter: Local governments must integrate hazard mitigation into all land use planning to keep new development out of high-risk zones.

Educating property owners about their true flood risk and the importance of proper insurance coverage before a disaster is also essential for creating resilient communities.

Conclusion: Building a More Resilient Texas for the Future

The Texas Flood 2025 was a sobering wake-up call, exposing deep cracks in our preparedness and revealing how climate change is amplifying weather risks. The loss of 135 lives and over $1.1 billion in damages stemmed not just from rain, but from systemic failures like outdated flood maps and inadequate warning systems.

For owners of commercial buildings, multifamily complexes, and religious institutions, the path forward requires proactive mitigation and expert guidance. Traditional recovery aids like FEMA often fall short, and navigating complex commercial insurance claims alone can lead to financial hardship.

Communities across Texas, including Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway, must prioritize resilience. This means updating building codes, investing in modern infrastructure, and planning for the climate realities of today.

At Insurance Claim Recovery Support, we understand that recovering from a disaster requires more than just filing paperwork. Our public adjusters work exclusively for policyholders, not insurance companies. We have settled over $250 million in claims for flood, fire, hurricane, and tornado damage because our expert advocacy ensures you receive the maximum settlement without the stress of litigation.

The Texas Flood 2025 taught us that we must prepare for the worst. Having a trusted expert in your corner when disaster strikes makes all the difference.