Why Understanding Supplemental Claims is Critical for Property Owners

A supplement claim (also called a supplemental insurance claim) is a request for additional funds after an initial property damage claim settlement. It’s not a new claim, but an extension of your original one, covering items or damages that were missed, hidden, or underestimated in the original estimate.

If you’re a commercial property owner, multifamily operator, or facility manager, you’ve likely experienced the frustration of an insufficient initial settlement. The insurance adjuster inspects visible damage, issues a check, and moves on—only for you or your contractor to find the repair costs far exceed what was paid. This is where the supplement claim process becomes essential.

Key Points About Supplement Claims:

- What it is: A request for additional funds to cover the full cost of repairs from a single covered event.

- When it’s needed: When the initial estimate misses hidden damage, code upgrades, material price increases, or other legitimate costs.

- Common triggers: Water damage behind walls, structural issues found during repairs, matching materials, and compliance with building codes.

- Your rights: The initial offer is not final. Policyholders have the right to negotiate and present evidence for additional coverage.

The term “supplemental claim” became common with the rise of computerized estimating software, which often produces incomplete initial scopes of work. Today, restoration contractors supplement a high percentage of their jobs, with specialists averaging significant revenue increases on claims.

Unfortunately, some insurers use the term to delay payments or treat legitimate disputes as “new” claims. This creates confusion for policyholders who are simply trying to get paid what they’re owed.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. For over 15 years, I’ve successfully negotiated hundreds of millions of dollars in supplement claims for commercial and multifamily property owners, often increasing recoveries by 30% to more than 3,800%. My firm specializes in leveraging expert damage assessment and direct negotiation to achieve fair settlements without unnecessary litigation.

Supplement claim terms to know:

- Commercial Insurance Claims – Commercial Property Claims What You Need To Know About The Commercial Property Damage Insurance Claims Process We adjust property claims for churches, schools, warehouses, retail buildings. We can help. We handle all the negotiations with your insurance company so you don’t have to.

- public adjusters

- should i hire a public adjuster

What is a Supplemental Claim in Property Insurance?

A supplement claim in property insurance is an extension of your original loss claim. It’s a request for additional funds to cover damages or costs that were part of the original incident—whether a hurricane in Houston or fire damage in Austin—but were not included in the initial insurance settlement.

While the term originated as industry slang among contractors, a supplement claim is now understood to mean: “Additional funds requested from the insurance company to cover items needed to complete repairs on a property that were not included in the initial insurance estimate.” This includes costs arising from hidden or mistakenly overlooked damage, emphasizing that it’s all part of the original loss.

Commercial Property, Multifamily Properties, and Hidden Damage

For owners of large, complex properties in Texas, supplement claims are often a necessity. An initial adjuster’s inspection after a major freeze in Lubbock or tornado in Fort Worth can easily miss hidden issues. For example, a roof that appears repairable may hide extensive structural damage or water intrusion that only becomes apparent when repairs begin.

The rise of computerized estimating software has also contributed to the need for supplements. These systems use standardized pricing that may not account for the unique complexities of a commercial building or fluctuating material costs in a post-disaster market. This can result in an initial estimate that is a fraction of the true repair cost.

Initial Claim vs. Supplement

It’s crucial to distinguish between an initial claim and a supplement claim. An initial claim is your first report of loss. A supplement claim is filed after an initial payment has been made but you’ve finded the funds are insufficient to complete repairs. It’s not a new claim for a new event; it’s a request to fully fund the repairs for the original event. Our goal at Insurance Claim Recovery Support is to ensure the initial claim accurately reflects the entire loss, minimizing the need for prolonged supplemental negotiations.

The Anatomy of a Commercial Property Supplement Claim

Why Are Supplemental Claims Necessary?

Initial insurance assessments rarely capture the full scope of a loss. An adjuster visiting your commercial property after a storm in Austin or a fire in Dallas is often pressed for time and may only document the most obvious damage. A supplement claim becomes necessary to cover what they missed.

Common reasons for a supplement include:

- Hidden Damage: Water from a hurricane can seep into walls, causing mold or rot that isn’t found until demolition begins. Similarly, the heat from a fire can warp structural elements in ways that aren’t immediately visible.

- Code Upgrades: When repairing significant damage, local ordinances in places like Round Rock or San Antonio often require you to bring the affected area up to current building standards. These mandatory upgrades, often based on standards from organizations like the International Code Council (ICC), are frequently omitted from initial estimates.

- Material Price Increases: After a widespread disaster, such as a freeze event across Waco, the demand for materials like lumber and roofing spikes, making the initial estimate’s pricing obsolete.

- Inaccurate Scope: The adjuster may budget for a simple repair when a full replacement is needed, or they might overlook entire components of a damaged system, like underlying insulation or HVAC contamination from smoke.

In short, adjusters—whether due to inexperience, time constraints, or company protocols—often produce an insufficient settlement that requires a supplement claim to correct.

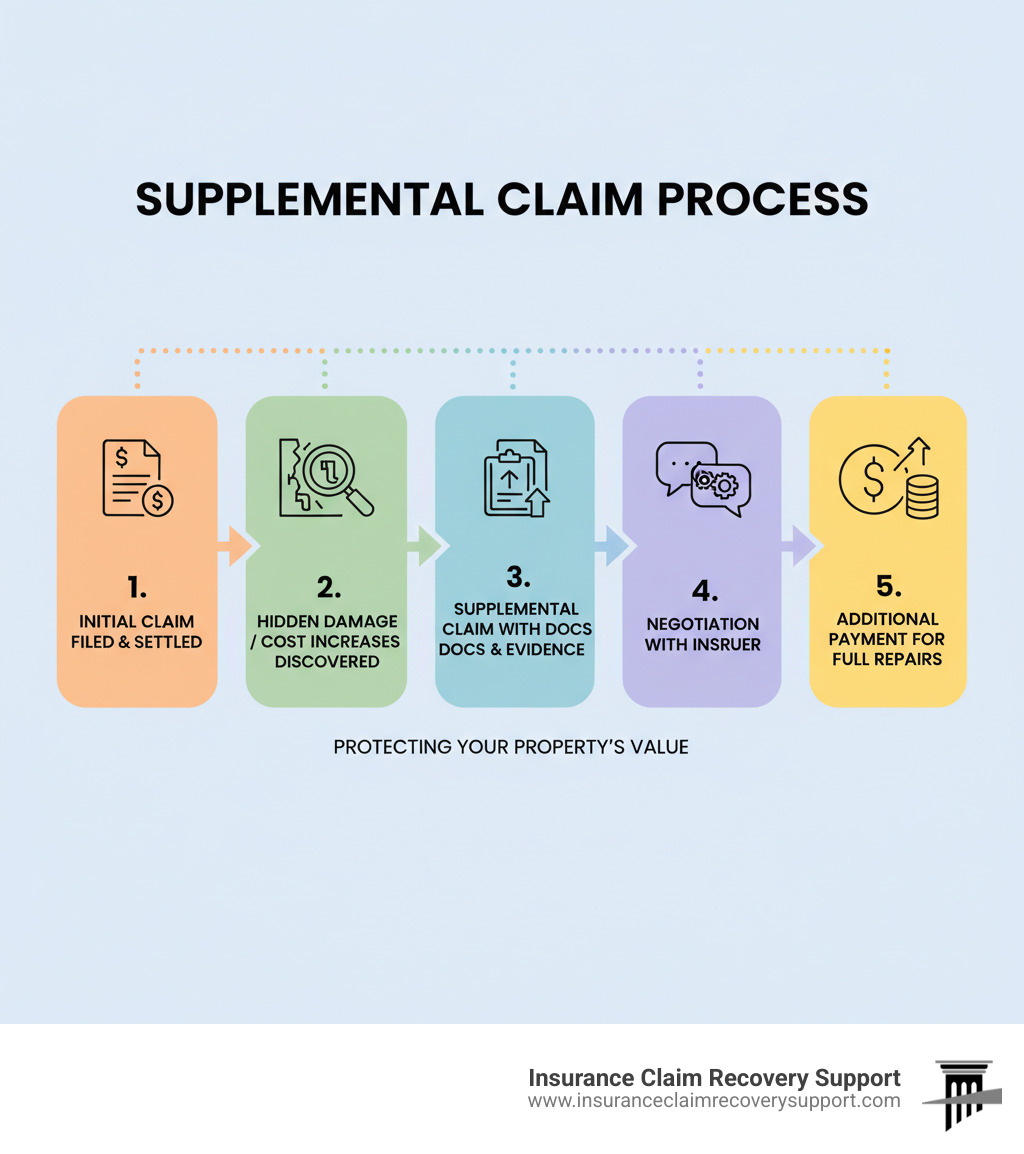

The Process: Filing a Supplemental Claim

Filing a successful supplement claim is about building an irrefutable case to prove what you’re owed. It requires a strategic, documented approach.

- Documentation: The foundation is meticulous documentation. This includes high-resolution photos, videos, thermal imaging to find hidden moisture, and detailed notes. Our Large Loss Claim Documentation Lists ensure nothing is missed.

- Detailed Estimates: Secure line-by-line estimates from experienced commercial restoration contractors. These must reflect current market rates for materials and labor in your specific Texas location.

- Evidence and Negotiation: Compile all documentation and estimates into a clear, organized presentation for the insurer. As public adjusters with experience in Commercial Property Insurance Claims, we handle the negotiation, using our knowledge of construction costs and policy language to counter pushback and advocate for a full recovery.

- Manage Deadlines: A supplement is part of the original claim, but timeframes still apply. We manage all deadlines to protect your rights.

Common Problems and How to Overcome Them

Expect resistance. Insurers often delay, dispute the scope of work, or challenge costs. They may argue a repair is sufficient when replacement is needed or use outdated pricing. We overcome these tactics with persistent follow-up, detailed communication logs, and powerful counter-evidence from contractors, engineers, and market data. While we resolve most claims through negotiation, we also help you understand your rights regarding Bad Faith Insurance Claim Texas and other Insurance Dispute Resolution options if an insurer acts unreasonably.

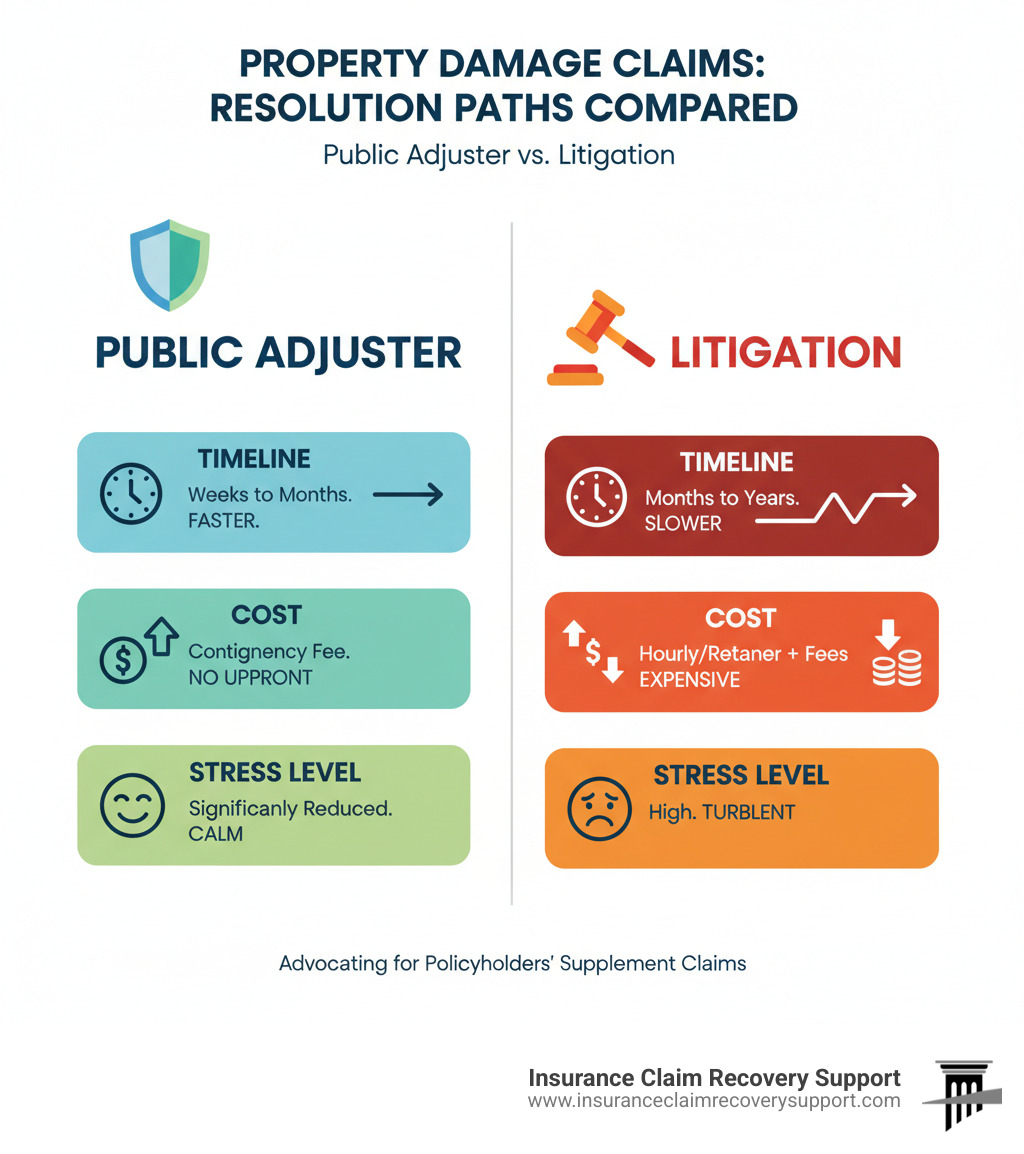

Maximizing Your Recovery: Public Adjusters vs. Litigation

When your supplement claim is disputed, you can try to negotiate alone, hire an attorney for a lawsuit, or engage a public adjuster. Our experience shows that partnering with a public adjuster is the most efficient path to maximizing recovery without the cost and stress of litigation.

The Public Adjuster’s Role in a Supplement Claim

As public adjusters, we work exclusively for you, the policyholder. For a supplement claim on your commercial or multifamily property, our role is to:

- Conduct an Expert Evaluation: We perform an independent, thorough inspection to find all damage, including issues the insurer’s adjuster missed.

- Quantify the Full Loss: We use specialized tools and collaborate with experts to create a detailed assessment covering all structural damage, code compliance needs, and true restoration costs.

- Interpret Your Policy: We analyze your policy to identify all applicable coverages and hold the insurer to the contract terms.

- Lead Negotiations: Our skilled negotiators in Public Adjuster Austin Texas and across the state handle all communications, taking the burden off you.

- Avoid Litigation: Our primary goal is to secure a fair settlement through expert negotiation, avoiding a costly and lengthy lawsuit. This is a key advantage a Big Claim Public Adjuster provides.

Fact vs. Myth: Common Questions About the Supplement Claim Process

Misconceptions about supplement claims can be costly. Here’s a comparison of your options.

| Feature | Using a Public Adjuster | Filing a Lawsuit (Attorney) |

|---|---|---|

| Timeline | Generally faster, focused on negotiation and settlement. Most claims resolved within weeks to months. | Significantly longer, often taking months to years, involving court proceedings, depositions, and potential trials. |

| Upfront Costs | No upfront fees; public adjusters work on a contingency basis (a percentage of the recovered settlement). | Often requires upfront retainers or significant hourly fees. Contingency fees for attorneys can be higher and may involve court costs. |

| Goal | Maximize settlement through expert claim preparation and negotiation, preserving business relationships where possible. | Compel payment through legal action, potentially involving significant legal fees and risking prolonged disputes. |

| Stress Level | Significantly reduced for the policyholder, as the public adjuster handles all claim-related tasks and communications. | High, due to direct involvement in legal proceedings, depositions, and the uncertainty of court outcomes. |

| Relationship | Collaborative, focusing on thorough documentation and expert advocacy to reach a fair agreement. | Adversarial, often escalating the dispute into a legal battle. |

Myth: A supplemental claim is a new claim.

Fact: It is part of your original loss. It simply seeks to fully cover the previously reported damage.

Myth: The insurer’s initial offer is final.

Fact: An initial offer is a starting point for negotiation. We understand How Do Insurance Companies Negotiate Settlements and use that knowledge to your advantage.

Myth: A lawsuit is my only option if the insurer won’t pay.

Fact: Public adjusters are experts at resolving disputes without litigation, saving you time, money, and stress.

Your Next Steps for a Fair Settlement

If you suspect your initial settlement is not enough, take these steps:

- Review Your Settlement: Compare the insurer’s offer against detailed bids from qualified commercial restoration contractors. Note any discrepancies or missed items.

- Get a Second Opinion: Don’t rely solely on the insurance company’s adjuster. An independent assessment is crucial.

- Seek Professional Help: If there’s a significant gap, it’s time to call us. Our public adjusters will conduct our own investigation, prepare a robust supplement claim, and negotiate directly with your insurer to secure the maximum settlement you deserve.

At Insurance Claim Recovery Support, we help owners of commercial buildings, multifamily properties, and religious institutions get fair settlements for fire, hail, hurricane, tornado, or flood damage across Texas. For expert Claim Help, contact us today. Don’t leave money on the table—let us fight for the full recovery you’re owed.