Why Finding the Right Smoke Damage Adjuster Can Save Your Property and Your Wallet

When fire strikes your property, a smoke damage adjuster becomes your most important ally in recovering what you’ve lost. Here’s what you need to know:

What is a Smoke Damage Adjuster?

– A licensed professional who specializes in evaluating smoke and soot damage for insurance claims

– Works to document hidden damage that insurance companies often overlook

– Negotiates with insurers to secure maximum compensation for your losses

Types of Smoke Damage Adjusters:

– Public Adjusters – Work exclusively for you, the policyholder

– Insurance Company Adjusters – Work for your insurance company

– Independent Adjusters – Hired by insurance companies but work as contractors

When You Need One:

– Claims over $10,000 in estimated damages

– Complex multi-building properties

– Denied or underpaid claims

– Hidden smoke damage in HVAC systems or structural areas

Research shows that smoke damage can add $10,000 or more to your insurance claim, as smoke travels through HVAC systems to reach every corner of your building. One homeowner found their initial insurance estimate of $42,000 fell drastically short when an independent assessment revealed actual remediation costs closer to $300,000.

The hidden truth about smoke damage: It’s often more expensive and widespread than the fire itself. According to the Environmental Protection Agency, smoke carries acidic particles that corrode metal fixtures, contaminate electronics, and penetrate deep into building materials where it continues causing damage long after the flames are out.

I’m Scott Friedson, a multi-state licensed public adjuster who has settled over 500 large loss claims valued at more than $250 million, including complex smoke damage adjuster cases across Texas. Through my experience as CEO of ICRS LLC, I’ve helped property owners increase their smoke damage settlements from 30% to 3,800% by uncovering hidden damage that insurance companies routinely miss.

Common smoke damage adjuster vocab:

– fire claims public adjuster

– homeowners insurance claims adjuster

– public adjuster definition

What Does a Smoke Damage Adjuster Do?

Think of a smoke damage adjuster as your personal detective and advocate rolled into one. When smoke invades your property, it doesn’t just leave behind what you can see – it travels through air ducts, seeps into walls, and settles in places you’d never think to look.

As your smoke damage adjuster, we’re not just documenting the obvious damage. We’re uncovering the hidden story of how smoke moved through your property and what it contaminated along the way. While the insurance company’s adjuster works to minimize their payout, we work exclusively for you to maximize your recovery.

Our job starts with understanding the science behind smoke behavior. We use thermal imaging cameras to detect temperature variations that reveal hidden soot deposits, and moisture meters to identify areas where firefighting water created secondary damage. We also coordinate with certified industrial hygienists who provide scientific analysis of air quality and contamination levels.

We handle all negotiations with your insurance company. This means you don’t have to face their team of professionals alone. We speak their language, understand their tactics, and know exactly how to present your claim for maximum impact.

Key Responsibilities of a Smoke Damage Adjuster

When we take on your smoke damage case, we become forensic investigators. Smoke mapping is one of our most critical responsibilities – we create detailed documentation showing how smoke traveled through your property, identifying entry points like HVAC systems, roof vents, and failed window seals.

Soot sampling is another crucial part of our work. Using the “sponge test” method, we wipe horizontal and colder surfaces to differentiate between actual soot deposits and ordinary household dust. This simple technique can mean the difference between a $5,000 cleaning estimate and a $50,000 replacement claim.

We prepare all cost estimates using Xactimate software, the industry standard that insurance companies use. Our estimates include specialized treatments like thermal fogging ($550-$1,550) and ozone treatments ($400-$1,800), plus comprehensive content cleaning or replacement.

Qualifications to Look For in Your Smoke Damage Adjuster

Not every adjuster understands the complexities of smoke damage. When you’re looking for representation, state licensing should be your first checkpoint. In Texas, this means your adjuster has passed comprehensive examinations and maintains continuing education requirements.

IICRC certifications are equally important. The Institute of Inspection, Cleaning and Restoration Certification sets the gold standard for smoke and fire damage restoration protocols.

Large loss experience matters more than you might think. Smoke damage claims often exceed $100,000 once all hidden damage is uncovered. Your adjuster should have specific experience handling complex claims.

Finally, ask for references from recent smoke damage clients. A qualified adjuster should be able to demonstrate a track record of significantly increasing settlement amounts compared to initial insurance company offers.

Smoke vs. Fire Damage: Why Your Claim Needs Special Handling

Smoke damage is often more expensive to fix than fire damage itself. While fire damage is dramatic and obvious, smoke damage is sneaky. It hides in places you’d never think to look, and it keeps causing problems long after the flames are out.

Fire destroys what it touches, but smoke travels everywhere. It slips through your HVAC system, creeps into electrical outlets, and finds its way into rooms that were nowhere near the actual fire.

Smoke particles are positively charged, which means they stick to metal and synthetic materials like magnets. Your insurance company’s adjuster might walk through and focus on the obvious fire damage, but a qualified smoke damage adjuster knows to look deeper.

Coverage differences between smoke and fire damage can be significant. Insurance companies love to offer quick cleaning solutions for smoke damage – usually around $4 per square foot. But real smoke damage requires specialized treatments like thermal fogging ($550-$1,550) and ozone treatments ($400-$1,800) to truly eliminate odors and contamination.

The corrosive nature of soot makes this even more complicated. Soot from burning plastics contains acids that literally eat away at your metal fixtures, electronics, and appliances.

HVAC contamination is another area where insurance companies try to cut corners. When smoke travels through your heating and cooling system, it deposits particles throughout the entire network of ducts.

Common Types of Smoke, Soot & Ash Damage Adjusters Flag

Dry smoke comes from high-temperature fires that burn fast and hot. The residue looks like fine powder but penetrates deep into porous materials like drywall and fabric.

Wet smoke comes from low-heat, smoldering fires. It creates thick, sticky residues that smear when you try to wipe them away. Plastic fires and rubber burning typically produce wet smoke, and it’s extremely difficult to remove.

Protein residue is particularly tricky because you can barely see it. Kitchen fires often create protein smoke that leaves almost invisible deposits, but the smell is unmistakable and persistent.

Fuel oil soot results from furnace problems or heating oil fires. This type of damage is often a total loss situation because fuel oil can permanently stain porous materials.

Chemical vapors from burning synthetic materials create some of the most dangerous and expensive damage. These vapors can destroy electronics throughout your property and create serious health hazards.

Hidden Health Risks Linked to Smoke Residue

The health risks from smoke damage give you powerful leverage in your insurance claim. When we document health hazards, it strengthens the argument for complete remediation rather than surface-level cleaning.

Respiratory issues are the most immediate concern. Smoke particles are microscopic and can stay airborne for months after a fire.

The carcinogen exposure from smoke is serious business. Many components of smoke are known cancer-causing agents, and prolonged exposure increases health risks.

Indoor air quality continues to deteriorate because smoke residues keep releasing toxic chemicals for months or even years after a fire. Professional monitoring can document these ongoing emissions, which supports claims for complete remediation.

Step-by-Step Roadmap to Filing & Winning a Smoke Claim

Think of your smoke damage claim as a chess game where the insurance company has already planned their moves. They’re counting on you to make predictable mistakes that save them thousands of dollars. But when you understand their playbook, you can turn the tables and secure the full settlement you deserve.

The moment you find smoke damage, the clock starts ticking. Insurance companies have trained their adjusters to look for any reason to reduce your payout.

Documentation becomes your best friend in smoke damage claims. Insurance companies love to deny claims due to “insufficient evidence” or “failure to prove causation.” By following our proven roadmap, you’ll build a case so solid that your insurer has no choice but to pay what you’re owed.

How to File an Insurance Claim for Fire Damage covers the broader fire claim process, but smoke damage requires its own specialized game plan.

Before You Call the Smoke Damage Adjuster

Safety always comes first. Smoke damage often tags along with structural problems or water damage from firefighting efforts. Have a professional check your utilities and make sure the building is structurally sound before you step inside with a camera.

Securing the scene means protecting your property from further damage while keeping all the evidence intact. You might need to cover broken windows, tarp damaged sections of roof, or shut off utilities. Take photos of everything you do and keep every receipt.

Initial photography should capture the big picture and the details. Take wide shots of every room, then zoom in on obvious damage. Don’t clean anything before photographing it. Those soot patterns tell the story of how smoke traveled through your property.

Additional Living Expenses start adding up immediately if your property becomes unlivable. Begin tracking hotel costs, restaurant meals, laundry expenses, and anything else above your normal living costs right away.

During the Adjuster’s Inspection

The adjuster’s inspection determines the scope of your entire claim, so this walkthrough needs to be thorough and systematic.

The walkthrough checklist should cover every square inch of your property, including areas that look perfectly fine. Smoke has a sneaky way of traveling through HVAC systems, electrical outlets, and tiny gaps in construction.

Sponge tests separate the professionals from the amateurs. A qualified smoke damage adjuster uses clean sponges to wipe surfaces in suspected contamination areas. This simple test tells the difference between soot deposits and ordinary dust or dirt.

Third-party industrial hygienists provide scientific backup for significant smoke damage claims. These certified professionals collect air samples and surface samples for laboratory analysis.

HVAC system inspection often reveals the most expensive hidden damage. Smoke travels through heating and cooling systems like a highway, contaminating ductwork, filters, and mechanical components throughout your entire building.

After the Smoke Damage Adjuster Issues the Estimate

Getting that initial damage estimate feels like progress, but it’s really just the opening move in your negotiation. Insurance companies typically provide conservative estimates that focus on obvious damage while downplaying hidden contamination.

Scope review means going through the adjuster’s estimate with a fine-tooth comb. Look for missing items, inadequate quantities, and cleaning specifications that don’t meet industry standards.

Supplemental claims are the norm rather than the exception in smoke damage cases. Most claims require additional estimates as hidden damage becomes apparent during the restoration process.

| Comparison | Company Adjuster | Public Adjuster |

|---|---|---|

| Works For | Insurance Company | Policyholder |

| Goal | Minimize Payout | Maximize Settlement |

| Fee Structure | Paid by Insurer | Contingency Fee |

| Expertise | General Claims | Specialized Damage |

Maximizing Your Payout & Avoiding Costly Mistakes

The harsh reality about smoke damage claims is that most property owners unknowingly sabotage their own settlements. After helping families across Texas recover millions in smoke damage claims, I’ve seen the same devastating mistakes repeated over and over.

Under-valuation happens when insurance companies focus on quick surface fixes instead of proper restoration. They’ll offer you $4 per square foot for “cleaning” when complete smoke remediation actually requires specialized thermal fogging treatments that cost $550-$1,550, ozone treatments ranging from $400-$1,800, and sometimes complete replacement of contaminated materials.

Quick-cleaning traps are another insurance company favorite. They’ll pressure you to use their “preferred” restoration contractors who work under volume agreements that prioritize speed over thoroughness.

The most heartbreaking mistake I see is discarding evidence before your claim settles. Families throw away smoke-damaged belongings thinking they’re worthless, not realizing that replacement costs for electronics, clothing, and household items often reach $50,000 or more.

Missed deadlines can destroy your claim entirely. Most Texas insurance policies require notification within 10-30 days of finding damage. Miss this deadline, and your insurance company has legal grounds to deny your entire claim.

How to Settle Property Damage Insurance Claims provides comprehensive guidance on the settlement process, but smoke damage claims have unique challenges that require specialized expertise.

Top 10 Errors Homeowners Make After Smoke Damage

Late reporting tops the list because it can void your coverage completely. Even if you’re not sure about the extent of damage, contact your insurer immediately.

DIY cleanup attempts might seem responsible, but they often make things worse. Household cleaning products can set smoke stains permanently and create chemical reactions that increase the damage.

Accepting lowball offers without getting a second opinion is like selling your car to the first person who makes an offer. Insurance companies often present initial settlements that seem generous but fall thousands short of actual restoration costs.

Inadequate documentation gives insurance companies excuses to minimize your claim. Poor photos, missing receipts, and incomplete damage inventories all work against you.

Premature repairs can void coverage for restoration work. While emergency mitigation is necessary and covered, major restoration should wait until your claim is approved.

How a Smoke Damage Adjuster Boosts Your Settlement

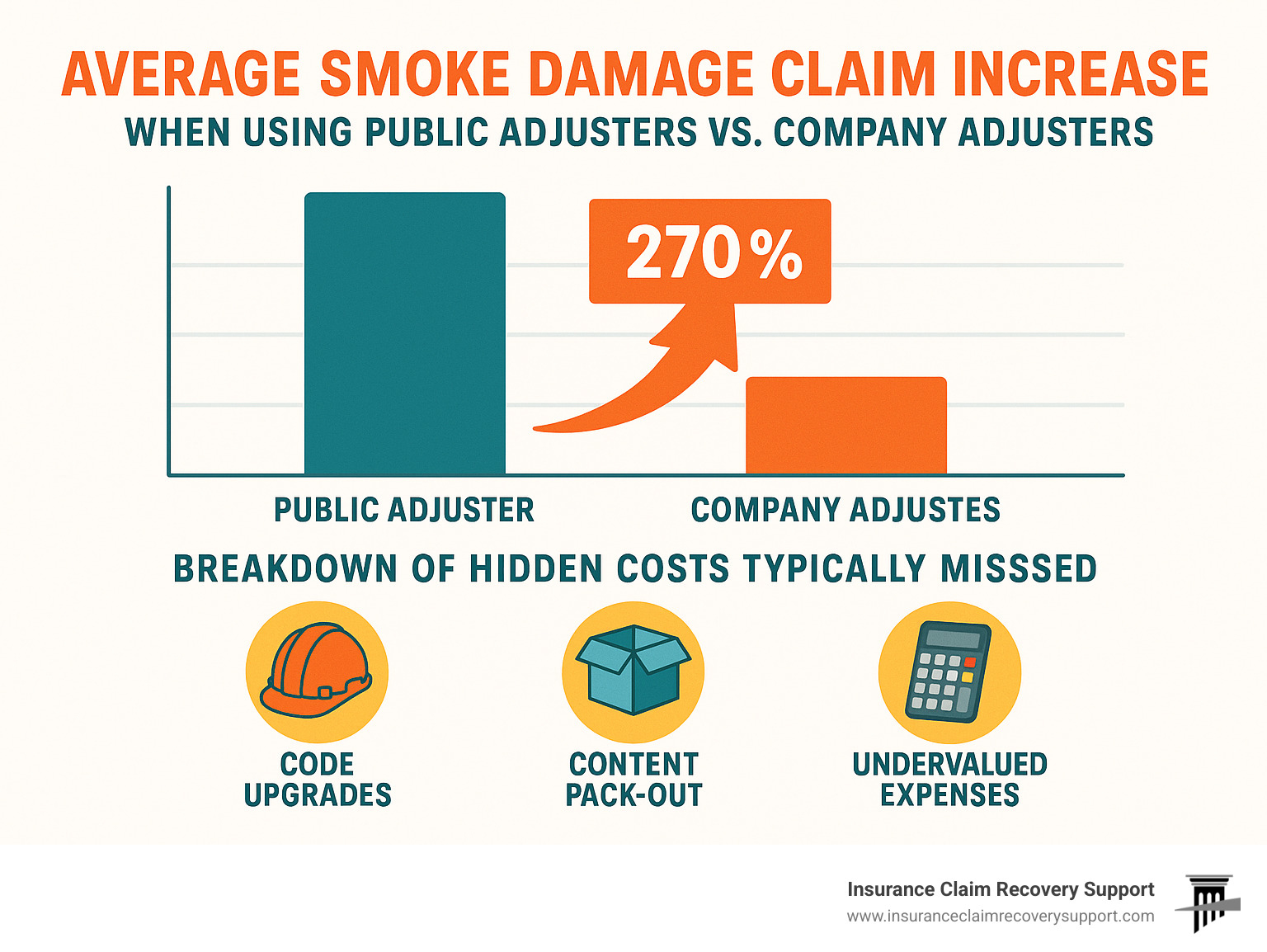

Working with an experienced smoke damage adjuster typically increases settlements by 30% to 300% compared to handling the claim yourself. Here’s how we make that happen:

Accurate pricing means using current market rates instead of the outdated pricing databases that insurance companies prefer. When they estimate thermal fogging at $400, we know the actual cost ranges from $550-$1,550 depending on your property size and contamination severity.

Code upgrades represent hidden value that insurance companies rarely mention. When smoke damage requires replacing building components, current building codes may mandate upgrades from your original construction. These upgrades can add $10,000-$50,000 to your claim.

Content pack-out services are frequently overlooked by company adjusters. Smoke-damaged contents often require off-site cleaning or storage during property restoration. Professional pack-out, content cleaning, and temporary storage can add $20,000-$100,000 to your claim.

Expert negotiation makes the biggest difference. Our experience handling hundreds of smoke damage claims across Austin, Dallas, Houston, and San Antonio gives us insight into insurance company tactics and settlement patterns.

Fire Claims Adjuster services extend beyond obvious fire damage to include the complex smoke contamination issues that often represent the majority of your actual loss.

Frequently Asked Questions about Smoke Damage Adjusters

When dealing with smoke damage, property owners naturally have questions about the claims process and what to expect. Having handled hundreds of smoke damage claims across Texas, I’ve heard these same concerns from homeowners in Austin, Dallas, Houston, and San Antonio countless times.

How long does a smoke damage adjuster claim take?

The timeline for smoke damage claims varies significantly based on the complexity of your situation, but most cases take 60 to 180 days from start to finish.

The initial assessment phase typically takes 7 to 14 days. This is when your smoke damage adjuster conducts a thorough inspection, documents all damage, and begins mapping how smoke traveled through your property.

Estimate preparation usually requires another 14 to 30 days. During this time, we prepare detailed restoration estimates using current market pricing and negotiate with your insurance company.

Your insurer’s response time can range from 30 to 60 days, though state regulations typically require them to acknowledge claims within 15 days and make settlement decisions within 30 days of receiving complete documentation.

Supplemental claim windows can extend the timeline by another 30 to 90 days. It’s common to find additional damage during the restoration process, especially with smoke contamination that isn’t immediately visible.

What if my smoke damage claim is denied or underpaid?

A denied or underpaid claim doesn’t mean the end of the road – you have several powerful options for fighting back.

The appraisal process is often your best first step. Most insurance policies include appraisal clauses that allow disputes to be resolved by neutral third parties. Each side selects an appraiser, and if they can’t agree on the damage amount, an umpire makes the final decision.

Mediation services are available through many state insurance departments, often at no cost to you. A neutral mediator helps both sides reach a fair resolution without the expense and stress of court proceedings.

Your litigation rights remain if other options fail. Many states, including Texas, have “bad faith” laws that allow you to recover attorney fees and punitive damages if insurers unreasonably deny valid claims.

When should I hire a public smoke damage adjuster?

Large loss situations are almost always worth professional representation. If your estimated damages exceed $10,000, the potential increase in your settlement typically far exceeds the adjuster’s fee.

Complex coverage scenarios definitely require expert help. Multi-building properties, commercial losses, or policies with unusual provisions can be nearly impossible to steer without specialized knowledge.

Claim stalemates are another clear signal that you need professional help. If negotiations with your insurance company have stalled, if they’re not returning your calls, or if you’re unsatisfied with their settlement offer, a smoke damage adjuster can often break through the deadlock.

Time constraints make professional representation invaluable. Properly documenting and negotiating a smoke damage claim is essentially a full-time job.

Previous denials or underpayments are obvious situations where you need expert help. If your claim has been denied or you believe the settlement offer is grossly inadequate, don’t accept defeat.

Conclusion & Next Steps

When smoke damage strikes your property, you’re facing one of the most challenging types of insurance claims – but also one with the greatest potential for recovery when handled correctly. The invisible nature of smoke contamination means insurance companies routinely miss thousands of dollars in legitimate damages.

That’s where Insurance Claim Recovery Support LLC steps in to level the playing field. We’ve spent years mastering the complexities of smoke damage claims, and we’ve gotten pretty good at turning insurance company lowball offers into fair settlements that actually cover your losses.

Our team of licensed public adjusters brings genuine expertise in the science behind smoke behavior, deep knowledge of health risks from contamination, and proven negotiation skills that consistently force insurance companies to pay what they actually owe.

Whether you’re dealing with smoke damage in Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, or Lakeway, we bring the same level of dedicated service to every corner of Texas. Our statewide coverage means you get big-city expertise with the personal attention you deserve.

The financial difference between going it alone and having professional representation is often staggering. We’ve helped clients transform initial insurance offers of $42,000 into final settlements exceeding $300,000 by uncovering hidden damage that company adjusters either missed or chose to ignore.

Don’t let your smoke damage claim go up in smoke. Contact Insurance Claim Recovery Support LLC today for a free consultation where we’ll give you an honest assessment of what your claim is really worth. Our contingency fee structure means you pay nothing unless we increase your settlement, making professional representation accessible when you need it most.

Insurance companies are counting on you not knowing your rights or the true scope of your damage. With our expertise backing you up, you’ll have the documentation, knowledge, and negotiation power needed to secure the maximum settlement you deserve.

The path forward is simple: let us handle the insurance company while you focus on getting your life back to normal. Contact us today and find out how we can turn your smoke damage disaster into a complete recovery story.

Best Public Adjuster services are just a phone call away, and we’re ready to put our experience to work for you.