Public insurance adjuster for flood damage: When disaster strikes, navigating flood damage insurance claims can be daunting. Here’s a quick breakdown for those in a hurry:

-

Understanding Coverage: First, know that standard homeowners insurance typically doesn’t cover flood damage. A separate flood insurance policy is necessary.

-

Document Everything: Capture photos, make lists of all damaged items, and check for any consultation reports to support your claim.

-

Hire Experts: A public insurance adjuster for flood damage can guide you through the complexities, ensuring a fair settlement. They advocate for you, unlike the adjuster from your insurance company who represents their interests.

Living through a flood is challenging, but getting back on your feet shouldn’t add stress. By hiring a public insurance adjuster for flood damage, you get a professional ally who ensures you’re compensated fairly for your losses.

I’m Scott Friedson, a seasoned expert in public insurance adjuster for flood damage. Having settled over $250 million in large-loss claims, I understand the intricacies of flood insurance claims and the importance of advocating for policyholders. Let’s steer this journey together for a successful recovery.

Understanding Flood Damage and Insurance

Flood damage can be overwhelming, and understanding how insurance works in these situations is crucial. Let’s break it down simply.

Flood Insurance vs. Water Damage

First things first: flood damage and water damage are not the same in the eyes of insurance companies. Water damage is typically covered by homeowners insurance and includes things like burst pipes or roof leaks. However, flood damage, caused by natural events like heavy rains or storm surges, is not covered by standard policies. For that, you need a separate flood insurance policy.

The Role of the NFIP

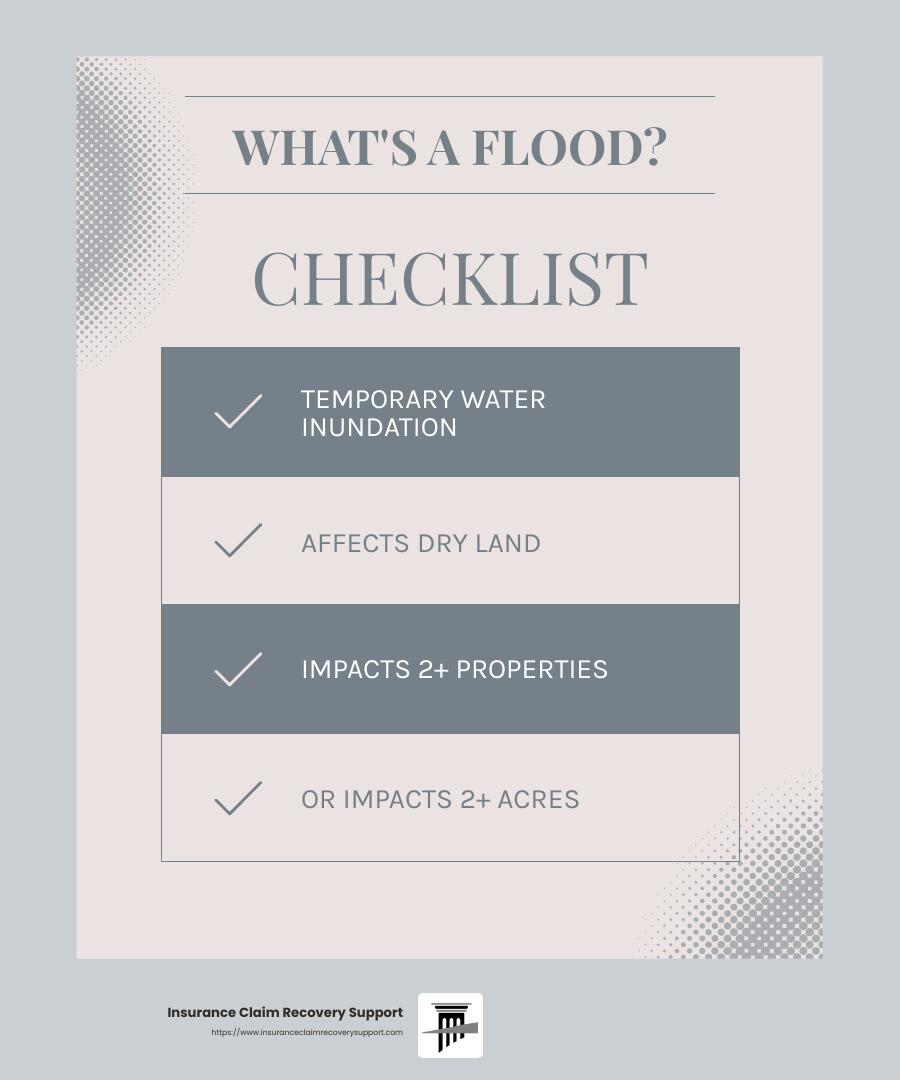

The National Flood Insurance Program (NFIP) is a government initiative created to provide flood insurance to property owners in participating communities. This program is crucial because the private market often avoids flood insurance due to the high risk involved. The NFIP defines a “flood” as a temporary condition where water inundates normally dry land, affecting two or more properties or two or more acres of land.

Challenges in Filing a Flood Claim

Filing a flood insurance claim can be complex. The NFIP has specific criteria for what constitutes a flood and what damages are covered. For instance, damage to basements is often limited to essential items like heaters and not personal belongings. This was a harsh reality for many during events like Superstorm Sandy, where policyholders realized too late that their coverage was inadequate.

Why You Need a Public Insurance Adjuster for Flood Damage

Navigating these complexities can be daunting. A public insurance adjuster for flood damage can be your best ally. They specialize in understanding policy details, documenting damages accurately, and negotiating with insurance companies to ensure you get a fair settlement. Unlike the adjusters sent by your insurer, public adjusters work for you, not the insurance company.

By having a clear understanding of flood insurance and utilizing the expertise of a public insurance adjuster, you can better protect yourself and your property from the financial aftermath of a flood.

Next, we will discuss the role of a public insurance adjuster in the claims process, including documentation and settlement negotiation.

The Role of a Public Insurance Adjuster for Flood Damage

Dealing with flood damage is stressful. The claims process can add to that stress. That’s where a public insurance adjuster for flood damage steps in. Their role is to make this process smoother and ensure you get what you’re owed.

Claims Process

The first step is understanding the claims process. After a flood, you need to file a claim with your insurance company. This involves a lot of paperwork and understanding what your policy covers. A public adjuster knows the ins and outs of this process. They guide you through each step, making sure nothing is missed.

Documentation

Documentation is key in any insurance claim. You need to prove the extent of the damage to your property. A public adjuster helps you document everything. They take photos, videos, and detailed notes. They also gather repair estimates and any other evidence needed. This thorough documentation supports your claim and can lead to a higher settlement.

Settlement Negotiation

Once the damage is documented, it’s time for settlement negotiation. This is where a public adjuster really shines. They negotiate with the insurance company on your behalf. Their goal is to get you the best possible settlement. They understand the tactics insurance companies use and can counter them effectively.

Public adjusters work for you, not the insurance company. Their expertise can often result in a higher payout than you might achieve on your own. As one homeowner shared, “Hiring a public adjuster meant I didn’t have to fight the insurance company alone. They handled everything and got me a fair settlement.”

In summary, a public insurance adjuster for flood damage is your advocate. They handle the claims process, ensure thorough documentation, and fight for a fair settlement. This support can make a significant difference in recovering from a flood.

Next, we’ll explore how to choose the best public adjuster for your needs.

How to Choose the Best Public Adjuster

Choosing the right public insurance adjuster for flood damage can make a huge difference in your claim’s success. Here’s what you should focus on:

Experience

Look for adjusters with a strong track record in flood damage claims. Experience matters because it means the adjuster has dealt with similar situations before. They know what works and what doesn’t. An experienced adjuster will understand the nuances of flood damage and the best strategies to maximize your claim. As seen in the case of Jane, who chose an adjuster with extensive local knowledge, experience often leads to better outcomes.

Expertise

Expertise is about understanding the specific challenges of flood damage. An adjuster with specialized knowledge will be familiar with the National Flood Insurance Program (NFIP) and other relevant regulations. They’ll know how to document damage effectively and negotiate with insurance companies. Certifications like NFIP Certified Flood Adjuster are indicators of this expertise. Such credentials show that the adjuster has undergone specialized training in flood claims.

Client Reviews

Client reviews offer insights into an adjuster’s performance. Look for reviews that mention the adjuster’s communication skills, professionalism, and success rate. Patterns in feedback can reveal how well the adjuster handles claims and interacts with clients. For example, adjusters with positive reviews about their negotiation skills and client support are often more reliable. Checking reviews on trusted platforms can help you make an informed decision.

By focusing on experience, expertise, and client reviews, you can choose a public adjuster who will effectively advocate for your flood damage claim. This ensures you have a skilled partner by your side, working to get you the best possible settlement.

Next, we’ll dive into top tips for filing a flood damage claim.

Top Tips for Filing a Flood Damage Claim

Filing a flood damage claim can be daunting, but with the right steps, you can smooth out the process. Here’s how to make sure your claim is strong and effective:

Documentation

Capture Everything: Take clear photos and videos of all damaged areas. This visual evidence is crucial. Use your phone or camera to document every detail.

Keep Records: Save all receipts related to temporary repairs, lodging, and other expenses. These can be reimbursed as part of your claim. Also, maintain a detailed inventory list of all damaged or destroyed items, including descriptions, purchase dates, and estimated values.

Email Evidence: Send photos, videos, and receipts to your insurance agent and claims adjuster immediately. CC yourself to ensure you have a copy for your records.

Emergency Mitigation

Act Fast: Begin emergency mitigation as soon as possible. This means starting the cleanup and drying process to prevent further damage, like mold growth.

Hire Professionals: Consider using a reputable water extraction company to handle the dry-out process. Avoid signing any work authorization forms without insurance approval to prevent unexpected charges.

Ensure Safety: Address safety concerns like standing water and electrical hazards promptly. If needed, shut off power during daylight for safety.

Policy Understanding

Know Your Coverage: Review your insurance policy thoroughly. Understand what is covered under flood damage and any exclusions or limitations. This knowledge will help manage your expectations and streamline the claim process.

Ask Questions: Don’t hesitate to ask your insurance adjuster for a copy of your policy and an explanation of your coverage. This clarity can prevent misunderstandings later.

Be Mindful of Terminology: Use the correct terms when communicating with your insurance company. Water damage and flood damage are not the same, and using the wrong terminology could affect your claim.

By focusing on detailed documentation, swift emergency mitigation, and thorough policy understanding, you can strengthen your flood damage claim. These steps will help ensure you get the compensation needed to restore your property effectively.

Next, we’ll address frequently asked questions about working with public insurance adjusters for flood damage.

Frequently Asked Questions about Public Insurance Adjusters for Flood Damage

What not to say to a flood insurance adjuster?

When speaking with a flood insurance adjuster, be cautious about your words. Avoid admitting fault or suggesting that you might be responsible for the damage. Statements like “I should have done more to prevent this” can be used against you. Also, steer clear of discussing any liability issues unless you have clear guidance from a professional. It’s best to focus on providing factual information and letting the evidence speak for itself.

How to deal with an insurance adjuster after water damage?

Navigating the claims process can be tricky, but clear communication is key. Start by organizing all your documentation. This includes photos, videos, and receipts from the damage and any temporary repairs. When you meet with the adjuster, present this information clearly and concisely. Document every interaction you have with them, including phone calls and emails, to ensure there’s a record of your communications.

What are the negatives of using a public adjuster?

While hiring a public insurance adjuster for flood damage can be beneficial, there are some potential drawbacks to consider. One is the cost. Public adjusters typically charge a percentage of your claim settlement, which can range from 10% to 20%. It’s important to weigh this cost against the potential for a higher settlement. Additionally, the claims process duration might be longer. While a public adjuster works to maximize your settlement, this can sometimes extend the timeline as they negotiate on your behalf. Consider these factors carefully to decide if a public adjuster is right for your situation.

Conclusion

Navigating the aftermath of flood damage can be overwhelming, but with the right support, you can make the process much smoother. Insurance Claim Recovery Support is dedicated to advocating for policyholders, ensuring you receive the compensation you deserve. We understand the complexities of flood damage claims and are committed to guiding you through every step.

Our team of expert public insurance adjusters specializes in flood damage claims. We work exclusively for policyholders, not insurance companies, which means our focus is solely on maximizing your settlement. With locations in major Texas cities like Austin, Dallas-Fort Worth, San Antonio, Houston, Lubbock, and more, we are well-equipped to serve clients across the state and beyond.

Our commitment to policyholder advocacy sets us apart. We handle the intricate details of your claim, from documentation to negotiation, so you can focus on rebuilding your life. With our extensive experience and local expertise, we ensure that your claim is handled with the utmost professionalism and care.

If you’re facing flood damage, don’t steer the claims process alone. Reach out to Insurance Claim Recovery Support today and let us help you secure the settlement you deserve. Together, we can turn high water into high recovery.