Top Public Adjusters Austin Texas for Your Property Damage Claim

Looking for reputable

public adjusters Austin Texas to manage your property damage insurance claim? Here’s a quick list of Austin’s top-rated professionals to jumpstart your search:

| Rank |

Public Adjuster Firm |

Specialty |

Location |

| 1 |

Insurance Claim Recovery Support (ICRS) |

Commercial & Multifamily |

Austin, TX |

Austin property owners who’ve suffered losses due to fire, hail, wind, or other disasters often find navigating the insurance claims process frustrating and exhausting. As insurance companies employ their own experts to minimize payouts, hiring a dedicated, knowledgeable public adjuster has become essential for securing fair settlements.

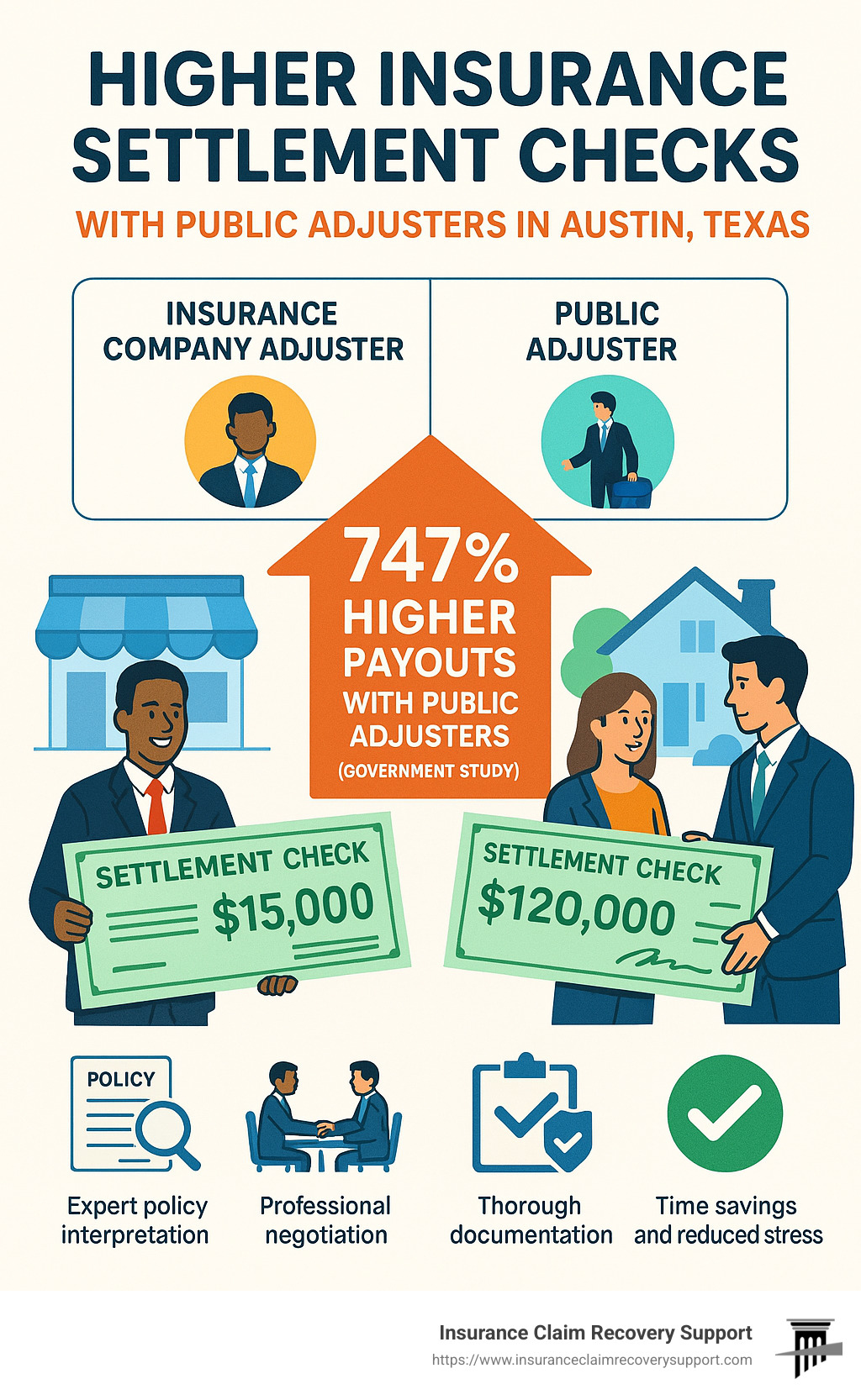

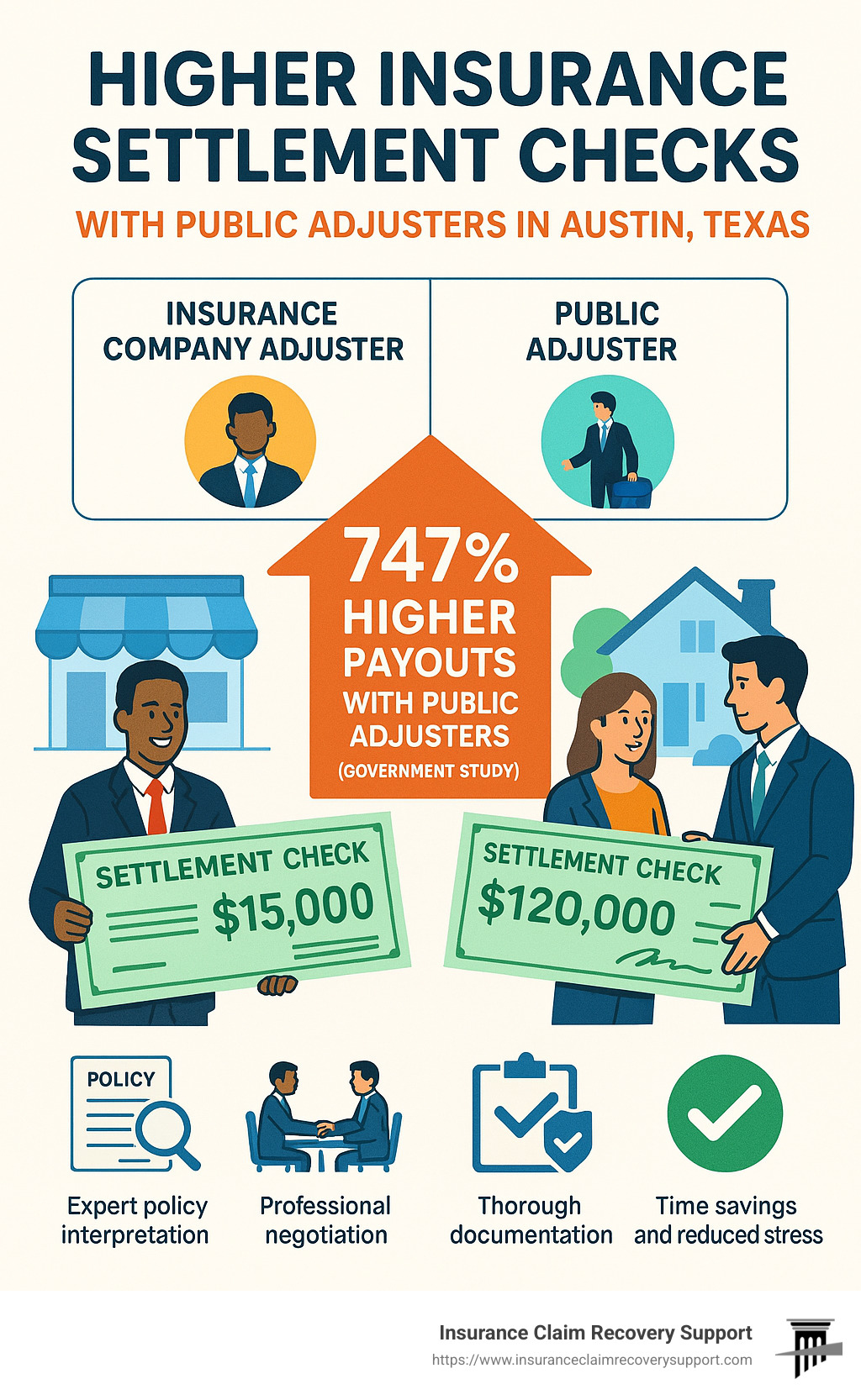

In fact, a government

study shows public adjusters typically raise claim payouts by 747%. That’s because unlike insurance company adjusters, public adjusters represent your interests exclusively.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support (ICRS), a multi-state licensed public adjuster headquartered in Austin, TX. Having settled over $250 million across 500+ large-loss property claims, I’ve overturned wrongly denied cases, significantly boosted settlement amounts, and helped numerous Austin property owners successfully steer complex insurance claims with trusted

public adjusters Austin Texas.

Understanding Public Adjusters in Austin, Texas

When disaster strikes your property in Austin, the aftermath can be overwhelming. Between assessing the damage, finding temporary accommodations, and trying to maintain your daily routine, the last thing you need is to battle with your insurance company for a fair settlement. This is where

public adjusters Austin Texas come into the picture.

Austin’s unique weather patterns create specific challenges for property owners. From those sudden spring thunderstorms that rattle our windows to the occasional flooding that turns Shoal Creek into a raging river, and even those severe winter freezes that can catch many of us off guard – these regional weather events create specific insurance claim scenarios. Local

public adjusters Austin Texas understand these challenges inside and out, and how they affect insurance claims in our corner of the Lone Star State.

What is a Public Adjuster?

A public adjuster is a licensed insurance professional who works exclusively for you, the policyholder – never for insurance companies. They’re your personal advocate who evaluates your property damage, carefully documents every loss, and negotiates with your insurance company to ensure you receive a fair and comprehensive settlement.

I recently spoke with an Austin restaurant owner who told me: “When the insurance company initially offered us a settlement that wouldn’t even cover half our damages, we felt helpless. Our public adjuster completely turned things around, securing a settlement three times higher than the original offer.”

Here in Texas, public adjusters must be licensed by the Texas Department of Insurance (TDI). This isn’t just a formality – it requires passing a rigorous exam, undergoing thorough background checks, and completing continuing education to stay current with insurance laws and practices. This licensing ensures you’re working with a qualified professional who understands the complexities of insurance policies and Texas-specific regulations.

How Do Public Adjusters Differ from Insurance Company Adjusters?

The distinction between public adjusters and insurance company adjusters is night and day – and understanding this difference explains why so many Austin property owners choose to hire their own representation.

Insurance company adjusters (sometimes called “staff adjusters”) work for the insurance company, not for you. While they might seem helpful and friendly during their visit, their primary loyalty belongs to their employer. Their job performance is often measured by how well they control costs and minimize payouts – which can put their interests directly at odds with yours.

An Austin commercial property owner shared this experience after suffering significant storm damage: “The insurance company’s adjuster spent less than 30 minutes at my property and missed more than half the damage. My public adjuster spent four hours documenting everything carefully. The difference in thoroughness was shocking.”

Here’s what really sets these two types of adjusters apart:

Insurance company adjusters work for the insurance company and aim to minimize company payouts. They’re paid a salary by the insurance company regardless of your settlement amount, often juggle dozens of claims simultaneously, and while they cost you nothing upfront, they may cost you thousands in unclaimed damages.

Public adjusters work exclusively for you, the policyholder, with the goal of maximizing your recovery. They’re paid a percentage of your settlement (typically capped at 10% in Texas), handle fewer claims with more personalized attention, and while they charge a fee, they typically help you recover significantly more than you would on your own.

A downtown Austin business owner put it perfectly: “After our office suffered fire damage, the insurance company’s adjuster seemed friendly but kept finding reasons to deny portions of our claim. Our public adjuster knew exactly how to counter each denial with policy language and documentation. It was like having a translator who spoke fluent ‘insurance’ on our side.”

When disaster strikes your Austin property, having a knowledgeable, local advocate can make all the difference between a settlement that leaves you struggling and one that truly makes you whole again. That’s the value that

public adjusters Austin Texas bring to the table – and why more property owners are turning to these professionals when they need to file a claim.

Why Hire a Public Adjuster in Austin, Texas

Austin’s real estate market continues to thrive in 2025—property values remain strong, and for many owners, their homes or businesses represent their life’s biggest investment. Unfortunately, when disaster strikes, getting the fair insurance settlement you deserve isn’t always easy. This is exactly why many savvy Austin property owners turn to experienced

public adjusters Austin Texas to protect their financial interests.

When you’ve suffered property damage due to fire, flood, storms, or other unexpected events, the insurance claim process can quickly become frustrating and overwhelming. Insurance policies are notorious for complicated wording, tricky exclusions, and vague conditions. A skilled public adjuster can cut through the confusion with

expert policy interpretation, helping you understand exactly what’s covered and how to maximize your settlement.

Public adjusters also bring valuable local knowledge to the table. Austin’s unique weather—from flash floods and severe thunderstorms to occasional winter freezes—often leads to claims that involve very specific considerations. Public adjusters familiar with Austin’s climate and property conditions make sure nothing is overlooked in documenting your damage.

Speaking of documentation, having comprehensive, accurate records is often the difference between a frustrating denial or a generous settlement. Your public adjuster knows precisely what evidence insurance companies require, collecting

thorough documentation of damages, repair estimates, photographs, and more. They organize this information clearly and professionally, strengthening your claim significantly.

Negotiating with insurance companies can feel impossible when you’re already stressed and trying to recover from a loss. Here’s where public adjusters truly shine. Their daily experience in

professional negotiation means they understand the tactics insurers use to minimize payouts and know exactly how to counteract them. With a trusted advocate handling these negotiations, you’re far more likely to get the settlement you deserve.

Let’s face it: managing an insurance claim can take over your life, especially if you’re also trying to run a business or simply keep your family afloat. One of the biggest advantages of hiring a public adjuster is

time savings. They manage every aspect of your claim—from initial documentation to final negotiations—freeing you to focus on recovery and getting your life back to normal.

Hiring a public adjuster greatly reduces the stress that comes with property damage claims. Instead of losing sleep over paperwork, deadlines, and tense interactions with insurance agents, you have a licensed professional advocating for you.

Stress reduction alone is worth the choice to have an expert in your corner.

“Using a Public Adjuster raises insurance claim payouts by 747% typically, according to a government study,” says Scott Friedson of Insurance Claim Recovery Support. “That’s because your adjuster works exclusively for you—not the insurance company. Our only goal is to get you the highest settlement possible.”

One Georgetown homeowner found this out after a devastating winter freeze: “Our insurance company initially offered us $28,000 to repair extensive water damage. Our public adjuster stepped in, highlighting overlooked policy coverages and additional damage, and in the end, secured a settlement for $112,000. Hiring a public adjuster truly saved us.”

Handling Denied or Underpaid Claims

Have you received a denial or lowball offer from your insurer? Unfortunately, this is more common than many Austin property owners realize. But experienced

public adjusters Austin Texas know how to turn denied or underpaid claims around.

Insurance companies typically deny claims for reasons like missed deadlines, inadequate documentation, unclear cause of damage, or policy exclusions. Often, these denials are questionable at best. Public adjusters carefully review these decisions, identify weak reasoning, and gather additional evidence to successfully challenge the denial. They reach out to expert contractors, engineers, or even meteorologists to back up your claim and use relevant policy provisions to strengthen your case.

One Austin-area apartment owner shared their experience after a severe hailstorm: “Our insurance company initially insisted our damage came from normal wear and tear, not the storm. We felt stuck—until our public adjuster stepped in, bringing expert opinions and clear documentation. After seeing the evidence, the insurance company reversed their decision, covering a full roof replacement.”

The bottom line is this: if your claim has been unfairly denied or undervalued, public adjusters have the expertise, resources, and determination to help you fight back and recover the settlement you deserve.

Choosing the Best Public Adjuster in Austin, Texas

Finding the right

public adjusters Austin Texas counts when you’re dealing with significant property damage. With so many adjusters out there, how do you pick the best one for your situation? Let’s make it simple and stress-free with some key pointers.

Licensing and Credentials

First things first: always make sure your public adjuster is properly licensed in Texas. It’s easy to check using the

Texas Public Adjuster License Lookup from the Texas Department of Insurance. This quick step helps protect you from scammers and ensures the professional you hire is authorized and accountable.

Beyond licensing, look for additional credentials or memberships in respected professional organizations, such as the National Association of Public Insurance Adjusters (NAPIA) or the Texas Association of Public Insurance Adjusters (TAPIA). These memberships show a commitment to ethical practices and ongoing learning.

At Insurance Claim Recovery Support, we take pride in staying ahead of the curve. We’re fully licensed, routinely attend continuing education, and proudly hold memberships in key industry organizations. Our goal? Making sure we know exactly how to get you the best possible settlement.

Experience with Property Damage Claims

Experience matters—a lot. Public adjusters with a proven track record handling property damage claims similar to yours can make a significant difference in your claim outcome.

In Austin, property damages can range from fires and floods to windstorms and ice storms. Each type of damage comes with unique challenges. For example,

fire and smoke damage claims often involve not just burned structures, but hidden smoke residue and water damage from firefighting efforts. One Round Rock business owner found this out firsthand: “Our public adjuster uncovered hidden smoke damage the insurance adjuster completely overlooked, saving us thousands in losses.”

For

windstorm and tornado damage, you’ll need a professional skilled at documenting roof, window, and structural damage that might initially go unnoticed. Or consider

flood and water damage—a seasoned adjuster understands how to carefully document water damage to flooring and walls, and advocate for mold prevention coverage.

Remember the historic Texas freeze of 2021? Many

ice storm damage claims from burst pipes and roof collapses posed complex issues. One Lakeway homeowner recounted how her public adjuster convinced the insurance company to fully replace water-damaged materials instead of patching them up—nearly tripling her settlement.

Building collapses due to structural damage also require experienced adjusters who can coordinate engineering reports and detailed documentation. Whatever your claim type, it helps to work with someone who’s steerd similar situations successfully.

At Insurance Claim Recovery Support, we’ve handled over $250 million in large-loss claims across Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, Lakeway, and beyond. We’ve seen just about every property damage scenario imaginable, and we know exactly how to protect your interests.

With the right experience and dedication, your public adjuster can transform a stressful insurance battle into a smooth, successful recovery.

Compensation and Fees for Public Adjusters

If you’re considering hiring

public adjusters Austin Texas, it’s natural to wonder how their fees and compensation work. Let’s break it down simply, so there are no surprises.

Most public adjusters work on what’s called a

contingency fee basis—this means they earn their fee as a percentage of your final settlement. In plain English:

they only get paid if you do. If they don’t secure a larger settlement for you, you owe them nothing. Pretty reassuring, right?

Here in Texas, the Texas Department of Insurance sets clear guidelines for public adjuster fees. Their fee is typically capped at

10% of the total claim settlement. However, the exact percentage can vary depending on a few key factors, like how complex your case is, whether your claim has already been denied, and how far along you are in the claims process.

For example, let’s say your claim involves extensive commercial fire damage or a building collapse—that’s a complicated case that might justify a slightly higher fee within the allowed range. On the flip side, simpler cases might come in at a lower percentage.

It’s important to keep in mind that while you do pay a fee, partnering with a skilled public adjuster usually results in a much larger settlement overall. Government study we mentioned earlier? It found that settlements handled by public adjusters typically net

747% more than claims without professional help. Now that’s a serious difference!

Here’s a real-world example from one of our happy clients, a commercial property owner near San Antonio:

“Our public adjuster charged us 8% of our settlement amount, but the result was incredible—they boosted our recovery by over 300%. The math was easy. We took home much more money than we’d have gotten trying to handle the claim alone.”

At Insurance Claim Recovery Support, transparency is a big deal. We explain our fees clearly and upfront, so there are no surprises down the road. Plus, we operate under a simple, friendly rule: if we don’t increase your settlement, you don’t pay. Period.

Our goal isn’t just to handle your claim—it’s to ensure you feel secure, confident, and fully informed every step of the way.

Curious about public insurance adjusters and how we advocate for clients throughout Texas, from Austin and Dallas to Houston and Waco? Visit our dedicated

Public Insurance Adjuster page.

Legal and Ethical Guidelines for Public Adjusters in Texas

When you’re dealing with property damage, know you’re working with someone you can trust. In Texas,

public adjusters Austin Texas must follow strict legal and ethical guidelines set by the Texas Department of Insurance (TDI). These rules ensure adjusters uphold professionalism and protect your rights as a policyholder.

First and foremost, every public adjuster in Texas is required to hold a valid license. The Texas Department of Insurance mandates that public adjusters pass a comprehensive exam, complete background checks, and participate in ongoing education. These licensing requirements help ensure that the adjuster you work with is both qualified and knowledgeable about current insurance practices and regulations.

Another important regulation revolves around

fee limitations. In Texas, public adjusters charge contingency fees, meaning they’re paid a percentage of your claim settlement. Texas law caps these fees at a maximum of 10% of the total settlement amount. This limit safeguards policyholders from excessive charges and ensures adjusters remain focused on maximizing your claim fairly and ethically.

Transparency and clarity in agreements are also a big deal in Texas.

Public adjuster contracts must clearly define the services provided, the fee structure, and your right to cancel the agreement within a specified timeframe (usually 72 hours after you sign it). This ensures you fully understand the arrangement and can change your mind without hassle if needed.

Texas also outlines several

prohibited practices to further protect you during the claims process. For instance, public adjusters cannot act as contractors on claims they’re adjusting. They must refrain from providing legal advice unless they’re also licensed attorneys. They’re also prohibited from making unrealistic guarantees or false promises about how much money you’ll receive from your claim.

Additionally, Texas law prevents public adjusters from soliciting business during declared disasters outside specific hours. Adjusters are also not allowed to receive compensation or referral fees from contractors, attorneys, or other third parties involved in your claim. These guidelines help ensure your adjuster acts solely in your best interest throughout the entire insurance claims process.

At Insurance Claim Recovery Support, we take these ethical and legal standards very seriously. Our reputation is built on honest communication, transparency, and genuine advocacy for policyholders. One of our clients from Waco summed it up nicely: “What impressed me about our public adjuster was their ethical approach. They never made unrealistic promises, were transparent about what they could and couldn’t do, and always kept us informed about the process.”

By working within these clear guidelines, our goal is simple—to help you achieve the highest possible settlement ethically and confidently, knowing you’re in trustworthy hands.

Frequently Asked Questions about Public Adjusters Austin Texas

What Types of Property Damage Claims Can Public Adjusters Handle?

If you’ve experienced property damage in Austin, you’re probably wondering if a public adjuster can help with your specific claim. Good news—

public adjusters Austin Texas can manage virtually any type of property damage claim covered by your insurance policy.

Some common scenarios include fire and smoke damage, whether from a small kitchen fire or a significant structural blaze. These claims often involve hidden issues such as smoke residue and water damage from firefighting efforts. Similarly, water damage from burst pipes, roof leaks, flooding, or severe weather events can create complex situations that public adjusters routinely handle with ease.

Austin is known for unpredictable weather, and public adjusters are experts in wind and storm damage claims. From hurricane-force winds to tornadoes and severe thunderstorms, they know exactly what to document and how to negotiate effectively with insurers. And if your property has experienced building collapse or structural damage from ice storms or other extreme weather, rest assured that an experienced public adjuster has likely seen—and successfully dealt with—it before.

Business owners often face unique challenges with property damage claims. Damage to your property can create a ripple effect, leading to business interruptions and extra expenses like temporary relocation costs and lost revenue. As one Austin business owner found after a tornado struck his manufacturing plant, the business interruption claim was even trickier than the physical damage. Fortunately, a skilled public adjuster stepped in to expertly calculate lost income and additional expenses, ensuring the business recovered fully.

The bottom line? If your commercial or residential property has sustained insured damage—whether it’s from fire, flooding, windstorms, ice storms, building collapse, or even business interruption—you can trust your public adjuster to guide you every step of the way.

How Do I Verify a Public Adjuster’s License in Texas?

Ensuring your public adjuster is properly licensed in Texas is an essential step before hiring one. Luckily, it’s easy to verify their credentials through the Texas Department of Insurance (TDI).

You can start by using the convenient

Texas Public Adjuster License Lookup online tool provided by TDI. Simply enter the adjuster’s details to quickly confirm their licensing status. You can also call TDI directly at 800-252-3439 and speak to a representative if you prefer to verify over the phone.

Don’t forget to check if there are any complaints or disciplinary actions listed, as this information could impact your decision. Reputable public adjusters are proud of their professional license and compliance record, so never hesitate to ask for proof if you’d like additional peace of mind.

What Should I Look for When Choosing a Public Adjuster?

Choosing the right public adjuster can make a huge difference in your insurance claim settlement. So, how do you know who to pick?

First, look for someone with plenty of hands-on experience handling property damage claims—especially claims similar to yours. Whether your property has sustained fire damage, a significant flood, or storm-related damage, an experienced adjuster will quickly pinpoint key issues and help maximize your claim payout.

It’s also helpful to find a public adjuster who specializes in your type of property. Some adjusters focus mainly on residential claims, while others are experts in complex commercial and multifamily property damage scenarios. Selecting someone with expertise aligned to your situation can greatly improve your results.

Local knowledge really matters too. Public adjusters familiar with Austin’s unique weather patterns, building codes, and construction costs are naturally better equipped to negotiate an optimal settlement. Don’t underestimate the advantage of having someone who knows the local landscape inside and out.

It’s always wise to ask for references or read online reviews. Real client testimonials from Austin-area property owners can offer valuable insight into how the adjuster communicates and performs. Communication style matters a lot—choose someone who clearly explains things, promptly answers your questions, and keeps you updated throughout the entire process.

Don’t overlook the adjuster’s resources either. A larger, reputable firm like Insurance Claim Recovery Support has access to a network of specialized experts, engineers, and contractors who can provide extra support if needed.

Finally, be sure you fully understand the fee structure upfront. Public adjusters in Texas typically operate on a contingency basis, charging a percentage of your total settlement. Fees are capped by Texas regulations at a maximum of 10%, so always clarify exactly what’s included and how fees are calculated.

One Georgetown homeowner said it best: “Interview a few different adjusters before you decide. Talking face-to-face made it clear who had the right experience, communication style, and local insight we needed. Once we found the right fit, the entire claims process was smooth sailing.”

At Insurance Claim Recovery Support, we invite you to contact us for a friendly conversation about your property damage claim. We’re always happy to explain our approach, answer questions, and help you feel confident and supported throughout your claim recovery journey.

Conclusion

Dealing with insurance claims after property damage can feel like adding insult to injury. You’re already stressed, overwhelmed, and likely wondering how to even begin navigating the confusing claim process. But here’s the good news: you don’t need to go it alone. That’s exactly where experienced

public adjusters Austin Texas step in—giving you peace of mind and making sure you get every penny you deserve.

The facts are clear. Policyholders who partner with public adjusters consistently receive significantly higher payouts compared to those who manage claims on their own. And really, it’s no wonder. Insurance companies have entire teams of professionals whose job it is to minimize payouts. Doesn’t it make sense to have a dedicated expert of your own to level the playing field?

As Austin continues its rapid growth in 2025 (and let’s be honest, those soaring property values too), the financial impact of property damage claims grows right along with it. With so much at stake, working with reputable public adjusters becomes not just beneficial—but essential. By choosing a trusted adjuster, you’re ensuring your investment is protected and that you’re getting the full settlement you’re entitled to.

At

Insurance Claim Recovery Support, we’re proud to advocate exclusively for property owners like you. From Austin to Dallas, Fort Worth to San Antonio, and Houston through Lubbock, San Angelo, Waco, Round Rock, Georgetown, Lakeway, and everywhere in between—we’ve helped countless Texans successfully steer their property insurance claims.

Our licensed adjusters bring decades of combined knowledge and a deep understanding of Texas weather events like fire, storms, hurricanes, tornadoes, lightning strikes, freezes, and floods. We know exactly how to document, negotiate, and settle your claim—securing maximum payouts, even on claims previously denied or underpaid by insurers.

Insurance companies have their teams of experts—so shouldn’t you have your own? Whether you’ve suffered damage from fire, wind, water, or another covered disaster, our team at Insurance Claim Recovery Support is here and ready to help. Reach out today for a free consultation and claim evaluation, and let our skilled

public adjusters Austin Texas handle the heavy lifting so you can focus on getting your life back on track.

For more information about insurance claims and recovery, check out the

National Association of Insurance Commissioners for helpful resources and consumer protection information.

Austin’s unique weather patterns create specific challenges for property owners. From those sudden spring thunderstorms that rattle our windows to the occasional flooding that turns Shoal Creek into a raging river, and even those severe winter freezes that can catch many of us off guard – these regional weather events create specific insurance claim scenarios. Local public adjusters Austin Texas understand these challenges inside and out, and how they affect insurance claims in our corner of the Lone Star State.

Austin’s unique weather patterns create specific challenges for property owners. From those sudden spring thunderstorms that rattle our windows to the occasional flooding that turns Shoal Creek into a raging river, and even those severe winter freezes that can catch many of us off guard – these regional weather events create specific insurance claim scenarios. Local public adjusters Austin Texas understand these challenges inside and out, and how they affect insurance claims in our corner of the Lone Star State.

“Using a Public Adjuster raises insurance claim payouts by 747% typically, according to a government study,” says Scott Friedson of Insurance Claim Recovery Support. “That’s because your adjuster works exclusively for you—not the insurance company. Our only goal is to get you the highest settlement possible.”

One Georgetown homeowner found this out after a devastating winter freeze: “Our insurance company initially offered us $28,000 to repair extensive water damage. Our public adjuster stepped in, highlighting overlooked policy coverages and additional damage, and in the end, secured a settlement for $112,000. Hiring a public adjuster truly saved us.”

“Using a Public Adjuster raises insurance claim payouts by 747% typically, according to a government study,” says Scott Friedson of Insurance Claim Recovery Support. “That’s because your adjuster works exclusively for you—not the insurance company. Our only goal is to get you the highest settlement possible.”

One Georgetown homeowner found this out after a devastating winter freeze: “Our insurance company initially offered us $28,000 to repair extensive water damage. Our public adjuster stepped in, highlighting overlooked policy coverages and additional damage, and in the end, secured a settlement for $112,000. Hiring a public adjuster truly saved us.”