Finding a public adjuster Texas expert for your property damage claim can make all the difference in ensuring you receive a fair and prompt settlement.

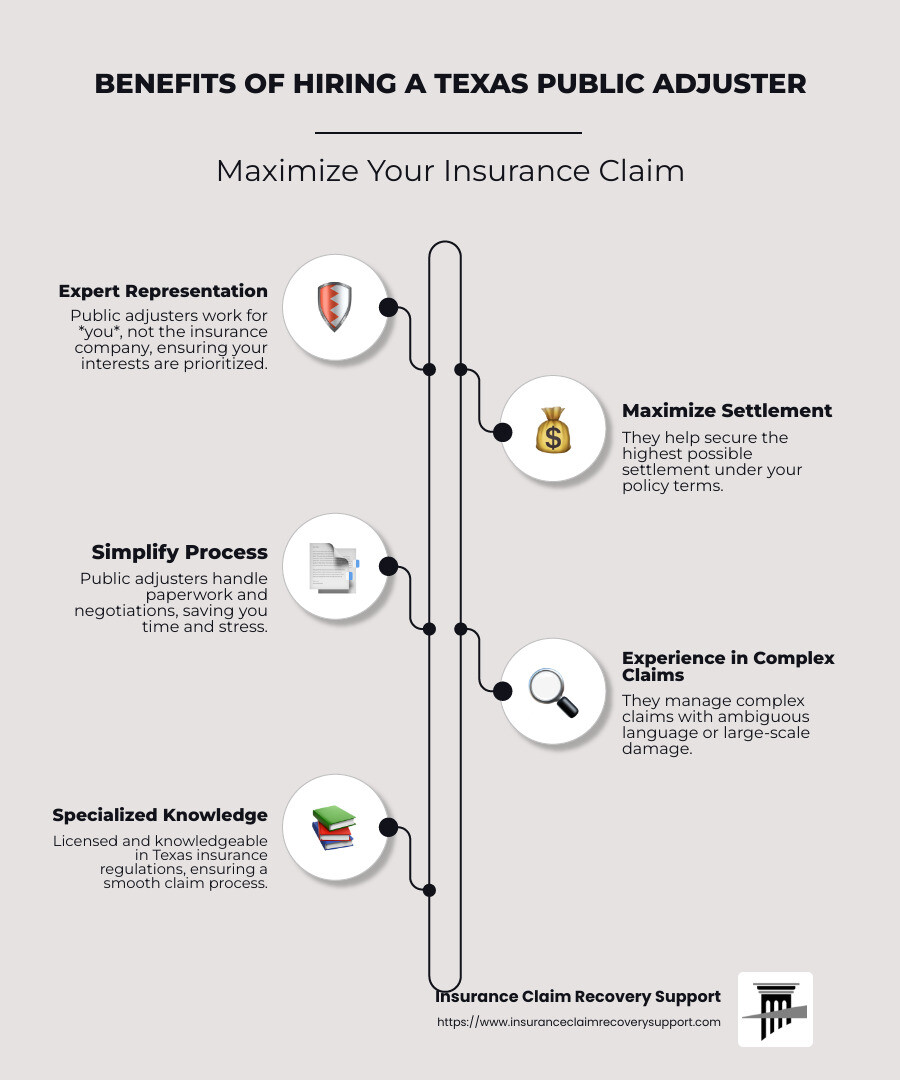

Here’s why hiring a public adjuster Texas is beneficial:

- They represent you and not the insurance company.

- Public adjusters help secure the maximum settlement allowed under your policy.

- They handle complex claims, easing your stress and saving you time.

Navigating insurance claims in Texas can be a daunting task, especially when you’re facing property damage from events like fires, hurricanes, or floods. Insurance companies often have their interests in mind, which may not align with yours. In this landscape, a public adjuster becomes crucial. They are licensed professionals who advocate for policyholders, ensuring that claims are processed efficiently and settlements are equitable.

I’m Scott Friedson, a multi-state licensed public adjuster with vast experience settling claims valued over $250 million, including overturning wrongfully denied claims. Don’t let insurance jargon and delays overwhelm you—trust a seasoned public adjuster Texas to advocate for your rightful claim.

Understanding the Role of a Public Adjuster in Texas

When disaster strikes, dealing with insurance claims can be overwhelming. This is where a public adjuster Texas expert steps in to make a real difference. They are your ally in navigating the complex insurance landscape to ensure you get a fair settlement.

Claims Process

The claims process can be intricate and time-consuming. A public adjuster takes on the heavy lifting for you. They document the damage, estimate repair costs, and prepare all necessary paperwork. Their main goal? To secure a fair settlement from your insurance company.

Imagine you’ve just experienced significant property damage. The stress of the situation can make it hard to think clearly, let alone negotiate with an insurance company. A public adjuster handles all this, so you can focus on rebuilding.

TDI Licensing

In Texas, public adjusters must be licensed by the Texas Department of Insurance (TDI). This licensing ensures they meet high standards of knowledge and ethics. To become licensed, adjusters must pass the rigorous Texas All Lines Insurance Adjuster exam. This means when you hire a licensed public adjuster, you’re assured of their expertise and integrity.

Negotiation Skills

One of the most valuable assets a public adjuster brings is their negotiation skills. Insurance policies are often filled with complex language and loopholes. A skilled adjuster knows how to interpret these policies and argue for a settlement that covers your losses adequately.

For instance, after Hurricanes Harvey and Irma, insurers struggled to find qualified inspectors. This led to delays and underpaid claims. A public adjuster can help avoid such pitfalls by advocating for a timely and fair settlement.

In summary, a public adjuster in Texas is more than just a middleman. They are your advocate, guide, and expert negotiator. With their help, you can steer the often confusing claims process with confidence.

Next, we’ll explore when hiring a public adjuster is the right choice for your situation.

When to Consider Hiring a Public Adjuster

Navigating the aftermath of property damage can feel like a maze. At times, bringing in a public adjuster Texas expert can be the key to open uping a fair insurance settlement. But how do you know when it’s the right move?

Large Claims

When your property has suffered extensive damage, the stakes are high. Large claims aren’t just about fixing what’s broken. They’re about securing your financial future. A public adjuster has the expertise to manage these substantial claims. They ensure you’re not left out of pocket by your insurance company.

Consider this: After major disasters like Hurricanes Harvey and Irma, many policyholders faced delays and underpayments due to a shortage of qualified adjusters. Having a dedicated public adjuster can help you avoid these challenges by ensuring a comprehensive and timely claim settlement.

Complex Situations

Property damage isn’t always straightforward. You might be dealing with a tangled web of issues—water, fire, and mold damage all from one incident. Or perhaps the damage reveals pre-existing problems that complicate your claim. In these cases, a public adjuster is invaluable. They have the experience to solve these complexities and make sure every aspect of your claim is addressed.

Ambiguous Policy Language

Insurance policies are infamous for their dense and confusing language. What’s covered? What’s not? These questions can become contentious. A public adjuster is skilled in deciphering policy jargon. They can clarify ambiguities and push for a broader interpretation of your coverage. This means they might identify benefits you didn’t even know you had.

Hiring a public adjuster is about having an expert advocate on your side. They work for you, not the insurance company. Their goal is to ensure you receive the maximum settlement you’re entitled to under your policy. Whether it’s negotiating for a higher payout, clarifying complex policy language, or managing a large claim, their expertise can make all the difference.

Up next, we’ll dive into the costs and benefits of hiring a public adjuster, helping you weigh your options effectively.

Evaluating the Cost and Benefits

Hiring a public adjuster Texas professional can be a game-changer in your insurance claim process. But, like any important decision, it’s crucial to weigh the costs against the benefits.

The 10% Fee

One of the main considerations is the fee. In Texas, public adjusters typically charge up to 10% of your claim settlement. At first, this might seem like a hefty price. However, it’s important to look beyond the number and consider the value they bring.

Public adjusters are skilled negotiators. They understand the ins and outs of insurance policies and have the expertise to maximize your settlement. For many, the fee is a worthwhile investment because the final payout, even after paying the adjuster, can be significantly higher than what you might achieve on your own.

Higher Settlement

A key advantage of hiring a public adjuster is their ability to secure a higher settlement. These professionals know how to assess damage accurately and advocate for a fair payout from insurance companies. They’re not just guessing; they use their experience and knowledge to ensure you get what you deserve.

Consider this: After major disasters, such as Hurricanes Harvey and Irma, many policyholders found themselves battling for fair compensation. Public adjusters can help steer these challenging situations, ensuring you receive the maximum possible settlement.

The Deductible

It’s important to remember that hiring a public adjuster doesn’t eliminate the need to pay your deductible. This is a fixed cost that comes out of your pocket. However, a skilled adjuster can help maximize your claim in such a way that the impact of the deductible feels less burdensome.

By potentially increasing the overall settlement, the cost of the deductible becomes a smaller percentage of your total recovery, making it more manageable.

In summary, hiring a public adjuster is about investing in expertise and peace of mind. Their goal is to advocate for your best interests, ensuring you receive the compensation you’re entitled to. Up next, we’ll explore the process of becoming a public adjuster in Texas, shedding light on what makes these professionals well-equipped to handle your claim.

The Process of Becoming a Public Adjuster in Texas

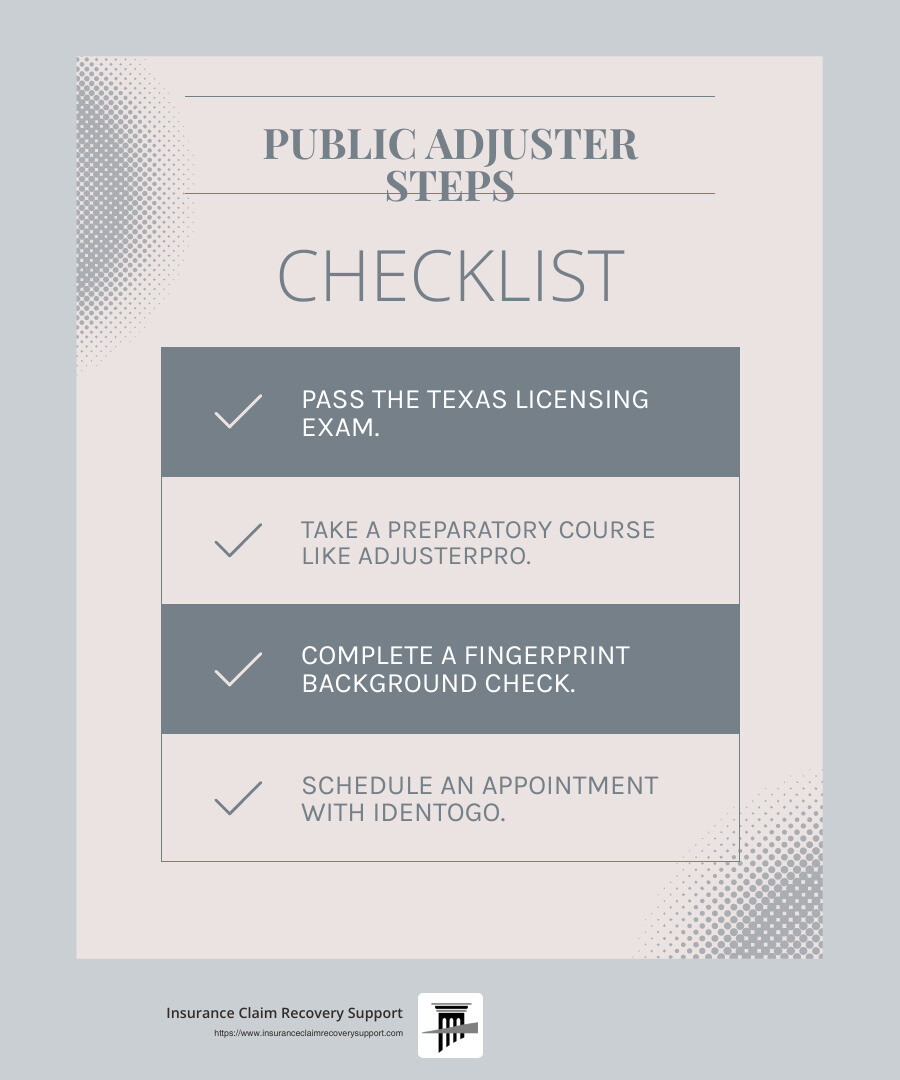

Becoming a public adjuster Texas professional involves several key steps. Let’s break down this journey into simple steps.

Licensing Exam

The first major step is passing the licensing exam. This exam is designed to test your knowledge of insurance concepts, Texas laws, and regulations related to claims adjusting. It’s not just a formality—it’s a crucial step to ensure you have the skills needed to serve clients effectively.

Tip: Many aspiring adjusters find it helpful to take preparatory courses. These courses can give you a solid foundation and increase your chances of passing the exam on your first try.

AdjusterPro

One popular resource for exam preparation is AdjusterPro. AdjusterPro offers comprehensive courses specifically custom for the Texas public adjuster exam. These courses cover everything you need to know, from basic insurance principles to detailed state-specific regulations.

AdjusterPro’s structured approach and in-depth material have helped many adjusters pass their exams with confidence. If you’re serious about becoming a public adjuster, consider leveraging this resource.

Fingerprint Background Check

After passing the exam, the next step is the fingerprint background check. This check ensures that all adjusters have a clean criminal record. It’s a part of maintaining trust and integrity in the profession.

You’ll need to schedule an appointment with an approved provider, like IdentoGO, to submit your fingerprints electronically. This process is straightforward but essential for obtaining your license.

Final Thoughts

Becoming a public adjuster in Texas requires dedication and preparation. From studying for the licensing exam to completing the fingerprint background check, each step is crucial in building a successful career. These professionals play a vital role in helping clients steer complex insurance claims, making their expertise invaluable.

With the right preparation and resources, you can join the ranks of skilled adjusters ready to advocate for policyholders across Texas. Up next, we’ll tackle some frequently asked questions about hiring a public adjuster in Texas.

Frequently Asked Questions about Public Adjuster Texas

How much does a public adjuster charge in Texas?

In Texas, a public adjuster typically charges a fee of up to 10% of the claim settlement. This fee is contingent upon the final amount they secure for you. It’s important to discuss and agree on this fee upfront. Make sure it’s clearly detailed in writing within your contract. Even though it might seem like a sizable chunk, a public adjuster often helps secure a much higher settlement than you might achieve on your own.

How long does it take to become a public adjuster in Texas?

Becoming a public adjuster in Texas involves a few important steps. First, you need to pass a licensing exam, which covers various insurance concepts and Texas-specific regulations. Many candidates choose to prepare using resources like AdjusterPro, which offers comprehensive courses custom for this exam.

After passing the exam, you must undergo a fingerprint background check. This ensures you have a clean criminal record, which is essential for maintaining trust in the profession. The entire process can take several months, depending on how quickly you complete each step.

Is using a public adjuster a good idea?

Absolutely. Hiring a public adjuster Texas expert can be incredibly beneficial, especially for large or complex claims. These professionals bring expertise in navigating the claims process and negotiating with insurance companies. Their skills often lead to higher settlements and faster claim resolutions.

A public adjuster works solely on your behalf, ensuring you get the maximum entitlement from your insurance policy. If you’re overwhelmed by the claims process or unsure about the settlement offered, a public adjuster can be a valuable ally. Their involvement can transform a daunting situation into a manageable one, providing peace of mind and potentially better financial outcomes.

Up next, we’ll dig into the conclusion, highlighting the advocacy and support offered by Insurance Claim Recovery Support in handling property damage claims.

Conclusion

At Insurance Claim Recovery Support, our mission is simple: advocate for you. We are dedicated to ensuring that you receive the maximum settlement possible for your property damage claims. Whether dealing with fire, hurricane, or flood damage, our team of experienced public adjusters in Texas is here to guide you every step of the way.

Our commitment to advocacy means we work exclusively for policyholders. We do not represent insurance companies. This independence allows us to focus entirely on your best interests, ensuring that every aspect of your claim is handled with precision and care.

Navigating property damage claims can be overwhelming. From understanding complex policy language to negotiating with insurance companies, it’s a process that requires expertise and diligence. That’s where we come in. Our team is well-versed in Texas-specific regulations and has a proven track record of securing higher settlements for our clients.

Choosing us means gaining a partner who is as invested in your recovery as you are. We handle the complexities, so you don’t have to. With our support, you can focus on rebuilding and moving forward, knowing that your claim is in capable hands.

In conclusion, if you’re facing a property damage claim in Texas, consider the benefits of having a dedicated advocate on your side. At Insurance Claim Recovery Support, we’re not just adjusters; we’re your ally in the claims process. Let us help you achieve the settlement you deserve.