Why Storm Damage Claims Require Expert Advocacy

A public adjuster for storm damage serves as your dedicated advocate when insurance companies fail to provide fair compensation after hurricanes, tornadoes, hail, or other severe weather events damage your commercial or multifamily property. When your property in Texasfrom Houston to Dallas-Fort Worth or Austin to San Antoniois hit, you need an expert on your side.

Many property owners are shocked to find that insurance company adjusters do not advocate for the policyholder and often offer inadequate settlements. This is where a public adjuster becomes essentialthey work exclusively for you, ensuring every aspect of your loss is properly documented and compensated.

Key Benefits of Hiring a Public Adjuster for Storm Damage:

- Maximize Your Settlement: A public adjuster’s primary goal is to secure the full and fair settlement you are entitled to under your policy. They achieve this by carefully documenting all damages, creating detailed cost estimates, and leveraging their deep knowledge of insurance policies. A landmark study by the Florida Legislature’s Office of Program Policy Analysis and Government Accountability (OPPAGA) found that policyholders who hired public adjusters for hurricane claims received settlements that were, on average, 747% higher than those who did not.

- Expert Damage Assessment: Insurance adjusters may perform a quick, superficial inspection. A public adjuster conducts a forensic-level investigation to identify all storm-related damage, including hidden issues like moisture behind walls, compromised structural supports, or subtle hail impacts that can lead to future leaks. They use specialized equipment and a trained eye to ensure nothing is missed.

- Handle Complex Negotiations: Large loss claims involve intricate negotiations over business interruption, loss of rental income, code compliance upgrades, and other complex coverages. A public adjuster acts as your professional negotiator, presenting a comprehensive claim package and arguing on your behalf to counter the insurer’s attempts to underpay.

- Save Time and Stress: Managing a large insurance claim is a full-time job. A public adjuster handles all communications with the insurance company, manages deadlines, and compiles all necessary documentation. This frees you and your property management team to focus on critical operational needs, such as tenant relations and business continuity.

- Avoid Unnecessary Litigation: By building a robust, evidence-based claim from the outset, a public adjuster can often prevent the disputes that lead to costly and time-consuming lawsuits. A well-documented claim is difficult for an insurer to dispute, paving the way for a settlement through negotiation rather than litigation.

- No Upfront Costs: Reputable public adjusters work on a contingency fee basis. This means they are paid a small percentage of the settlement they recover for you. If you don’t get paid, they don’t get paid, aligning their interests directly with yours.

When your commercial building, apartment complex, or multifamily property suffers storm damage, you’re not just dealing with repairsyou’re facing potential business interruption, displaced tenants, and mounting expenses. Meanwhile, insurance companies deploy their own adjusters whose primary goal is minimizing payouts, not maximizing your recovery.

The stakes are particularly high for commercial properties. Unlike residential claims, commercial storm damage involves complex policy language, business interruption coverage, loss of rent calculations, and compliance with local building codes in cities like Austin, Houston, or Dallas. For example, repairing a damaged roof might trigger a code requirement to upgrade the entire roofing system, an expense insurers often initially refuse to cover. Without expert representation, property owners frequently leave hundreds of thousandsor even millionsof dollars on the table.

As Scott Friedson, a Multi-State Licensed Public Adjuster and CEO of Insurance Claim Recovery Support, I’ve successfully settled over 500 large-loss claims valued at more than $250 million, specializing in public adjuster for storm damage cases across Texas and nationwide. My track record includes increasing claim recoveries by 30% to more than 3,800%, helping commercial and multifamily property owners steer these complex challenges and avoid unnecessary litigation while securing the maximum settlement they deserve.

Handy public adjuster for storm damage terms:

Understanding the Players: Public Adjuster vs. Insurance Company Adjuster

When storm damage hits your commercial or multifamily property, you’ll quickly find that the insurance claims process involves several different types of adjusters. Understanding who these people areand more importantly, who they work forcan make the difference between a fair settlement and leaving money on the table.

Here’s the reality: not all adjusters are on your side. In fact, most aren’t.

What is a Public Adjuster and How Do They Differ?

A public adjuster for storm damage is a licensed professional who works exclusively for you, the property owner. In Texas, public adjusters are licensed and regulated by the Texas Department of Insurance, ensuring they meet strict ethical and professional standards. Think of us as your personal advocate in the complex world of insurance claims. We have a fiduciary duty to act in your best interests, which is a legal obligation to put your financial needs first. This duty requires us to be completely transparent, to negotiate in good faith on your behalf, and to prioritize your maximum recovery above all else.

When you hire a public adjuster, you’re getting someone who understands the intricate details of commercial insurance policies, knows how to identify and document all types of storm damage, and has the negotiation skills to secure maximum settlements. We are essentially leveling the playing field between you and the insurance company’s vast resources.

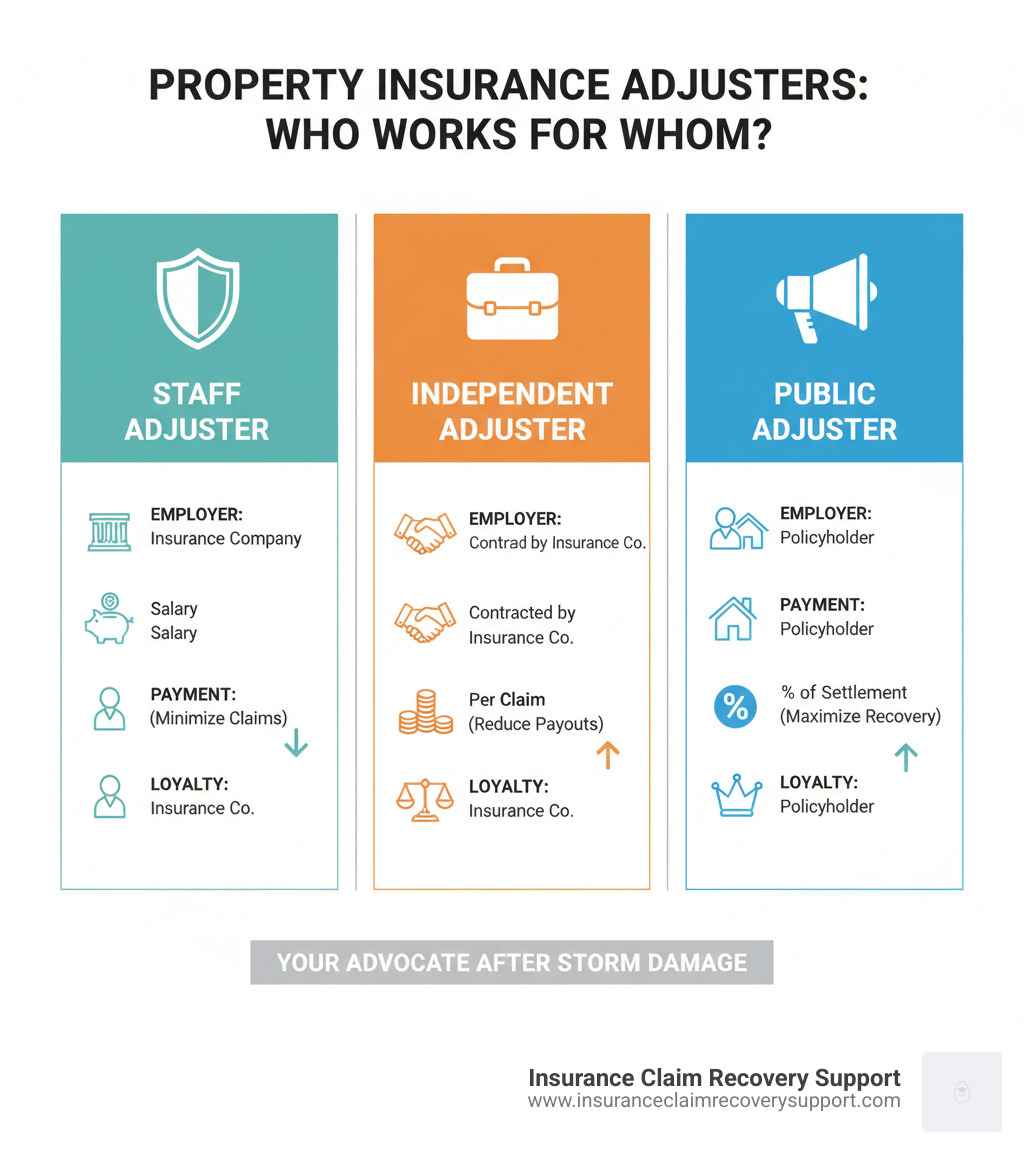

On the flip side, insurance company adjusterswhether they’re staff adjusters (direct employees of the insurance company) or independent adjusters (third-party contractors hired by the insurer for a specific claim)work for the insurance company, not for you. Their job is to assess your damage and determine how little the insurance company can legally pay while still closing the claim. Even an “independent” adjuster’s loyalty is to the insurer who provides them with a steady stream of work.

This creates an obvious conflict of interest. While they may seem friendly and helpful, their allegiance lies with minimizing the insurance company’s liability, not maximizing your recovery. They often use proprietary software with standardized, low-cost pricing, apply excessive depreciation to reduce the value of your property, and interpret your policy in the narrowest way possible to limit coverage.

| Feature | Public Adjuster | Company/Independent Adjuster |

|---|---|---|

| Who They Work For | You (the policyholder) | The insurance company |

| Primary Goal | Maximizing your settlement | Minimizing insurance company payouts |

| How They Are Paid | Percentage of your settlement | Salary or per-claim fee from insurer |

| Legal Duty | Fiduciary duty to you | Contractual duty to the insurer |

Why Your Commercial Property Needs an Advocate

Commercial and multifamily properties face unique challenges after storm damage. Your policy likely includes complex coverage for business interruption, loss of rent, and various endorsements that residential policies don’t have. These aren’t simple roof repair claimsthey’re intricate financial calculations that can involve months of lost income and extensive property restoration.

For example, after a tornado strikes a retail center near Fort Worth, the claim isn’t just for the physical building repairs. It involves calculating the lost revenue for every day the businesses are closed (business interruption), documenting ongoing expenses like salaries and loans, and potentially covering the costs for tenants to operate from temporary locations. An insurance company’s adjuster may offer a quick, lump-sum payment for this, but it often fails to account for the full, long-term financial impact. A public adjuster will bring in forensic accountants to build an irrefutable business interruption claim.

Insurance companies know that most property owners don’t fully understand these complexities. They’re counting on you to accept their initial assessment without question. But when you’re dealing with large loss claims that could reach hundreds of thousands or even millions of dollars, you need expert representation.

A public adjuster for storm damage brings that expertise to your corner. We understand how to properly calculate business interruption losses, document all related expenses, and identify damage that company adjusters often overlook. It’s truly a case of expert versus expert. The insurer has a team of adjusters, engineers, and lawyers working to protect their bottom line. You deserve to have your own team of experts working to protect yours.

Without this advocacy, you’re essentially negotiating with one hand tied behind your back. By engaging a public adjuster early, you are not starting a fight; you are preventing one. A professionally prepared and documented claim is far less likely to be unfairly denied or underpaid, which helps you avoid the costly, stressful, and time-consuming process of litigation. It’s the most effective way to secure a fair settlement and get back to business faster.