Finding the Right Public Adjuster Can Make or Break Your Property Damage Claim

When your commercial property, apartment complex, or religious institution is hit by a disaster, the search for a public adjuster near me becomes an urgent necessity. Whether you’re facing the aftermath of a hurricane in Houston, a fire in a Dallas high-rise, or widespread freeze damage in Austin, you’re not just dealing with physical repairs; you’re facing a complex insurance claim process designed to protect the insurer’s financial interests, not yours. You need an experienced advocate to fight for your rights and secure the maximum possible settlement.

Here’s what you need to know immediately when vetting a public adjuster:

Quick Answer for Finding a Public Adjuster:

- Verify State Licensing: Always confirm that the adjuster is licensed in your state. For Texas-based claims, you can verify their credentials through the Texas Department of Insurance (TDI).

- Confirm Commercial Experience: Ensure they have specific expertise with your property type, whether it’s a commercial building, multifamily HOA, or apartment complex. Ask for case studies or examples of similar claims they’ve handled.

- Demand Local Knowledge: A local adjuster will be intimately familiar with regional building codes, labor costs, and weather patterns (like Gulf Coast hurricanes or North Texas hail storms) that are critical for an accurate claim.

- Check Professional Standing: Reputable adjusters are often members of professional organizations like the National Association of Public Insurance Adjusters (NAPIA), which upholds a strict code of ethics.

- No Upfront Fees: A credible public adjuster works on a contingency fee basis. This means they only get paid a percentage of the money they recover for you. If they ask for money upfront, walk away.

- Ask for a Proven Track Record: Request references from other commercial property owners and check online reviews to verify their reputation and results.

- Clarify Scope and Team: Ask who will actually work your file day-to-day, what specialists they bring in-house or through their network, and how often you will receive progress updates.

- Understand the Contract: Review the contingency fee agreement, termination terms, and how supplemental claims are handled. Make sure you understand what is included and what is not.

- Confirm Independence: In Texas, only licensed public adjusters can negotiate claims for policyholders. Be cautious of contractors offering to handle your claim negotiations, as that is not permitted.

- Discuss Strategy for Disputes: Ask how they approach appraisal or other alternative dispute resolution methods to avoid unnecessary litigation.

Property damage from fire, hurricanes, tornadoes, or floods can devastate your investment. While your insurance company has a team of adjusters working to minimize their payout, public adjusters work exclusively for you—the policyholder. This distinction is critical.

Independent research has shown that policyholders who hire a public adjuster often receive significantly higher settlements, with some studies indicating an average increase of 40% or more. In our experience, we frequently encounter claims that were initially undervalued by 50% to 500% below their actual worth. This gap represents the difference between a full recovery and a significant financial loss for your business or organization.

The stakes are incredibly high. The National Association of Insurance Commissioners (NAIC) consistently reports that unsatisfactory settlement offers and wrongful claim denials are the most common complaints filed against insurance carriers. Without a professional advocate on your side, you could face months of delays, a lowball offer that doesn’t cover your damages, or an outright denial that forces you into expensive and time-consuming litigation.

When should you call a public adjuster near me?

- Immediately after major events like windstorms, lightning strikes, fires, freeze events, or plumbing failures that affect multiple units or large portions of your property.

- When you suspect hidden damage behind walls, roofs, or mechanical systems that may not be obvious during a quick inspection.

- If you receive an initial offer that does not reflect the true scope of restoration, code upgrades, or business interruption losses.

- When a claim is dragging on without clear milestones, or the insurer keeps requesting repetitive documentation without resolution.

- If your claim has been partially paid, denied, or closed prematurely and you need a supplemental claim or a second opinion.

As Scott Friedson, CEO of Insurance Claim Recovery Support LLC, I’ve dedicated my career to helping commercial and multifamily property owners steer these complex insurance claims. For over 15 years, my team has served as the public adjuster near me for clients across Texas and the nation, successfully settling hundreds of millions of dollars in property damage claims. We consistently achieve results that help policyholders maximize their recovery and avoid the courtroom.

We serve property owners and managers throughout Texas, including Austin, Dallas-Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, Lakeway, Amarillo, and surrounding communities. Our national reach allows us to assist portfolio owners with properties across multiple states while keeping a strong Texas base for on-site inspections and local code insight.

What to do in the first 72 hours after a loss

- Prioritize safety and secure the site. Coordinate emergency mitigation and keep all invoices and photos.

- Notify your insurer promptly and document every communication. Save adjuster names, dates, and summaries of calls.

- Photograph and video all damages before demolition begins. Keep samples when appropriate.

- Document operational impacts. Track unit downtime, lost rents, extra expenses, and vendor lead times.

- Centralize communication through a single point of contact on your team to avoid confusion and missed messages.

- Be cautious about signing any documents that assign or transfer your policy rights without legal review.

Common pitfalls to avoid

- Relying solely on the insurer’s scope and missing hidden or code-related damages that can greatly affect cost.

- Beginning permanent repairs before a thorough, agreed scope is established, risking out-of-pocket costs later.

- Letting claim deadlines slip. If you need more time for a proof of loss or documentation, request extensions in writing.

Simple public adjuster near me glossary:

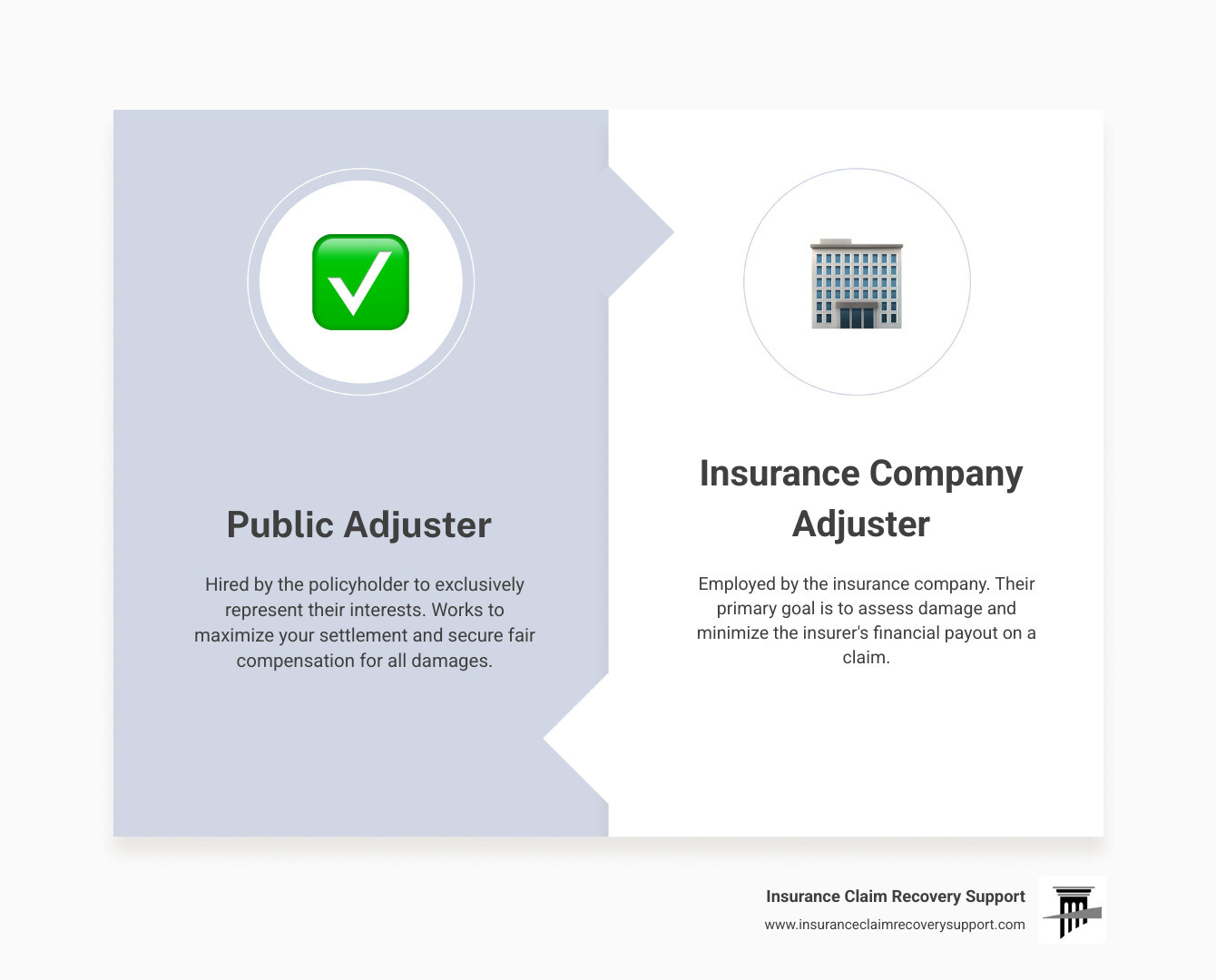

What is a Public Adjuster vs. an Insurance Company Adjuster?

The difference between a public adjuster and an insurance company adjuster isn’t just technical jargon—it’s the fundamental difference between having an expert in your corner versus negotiating against one. When you’re in a legal dispute, you wouldn’t ask the opposing side’s lawyer to represent your interests. The same principle applies to a large-loss property damage claim.

There are three main types of adjusters, and it’s crucial to understand who each one works for:

- Company Adjusters: These are employees of your insurance company. Their salary is paid by the insurer, and their primary responsibility is to protect the company’s financial interests. Their goal is to assess the damage and close the claim for the lowest amount possible under the policy.

- Independent Adjusters: These are third-party contractors hired by the insurance company, typically during major disasters like a hurricane in Houston or widespread tornado damage in the Dallas-Fort Worth area when the insurer’s staff is overwhelmed. Although they are not direct employees, they are paid by and work for the insurance company. Their allegiance is to the insurer, not to you.

- Public Adjusters: These are the only adjusters licensed by the state to work exclusively for you, the policyholder. A public adjuster is your advocate, hired to manage the entire claim process on your behalf. Our fiduciary duty is to you, and our goal is to document, negotiate, and secure the maximum, fair settlement you are entitled to under your policy.

This inherent conflict of interest is why the National Association of Insurance Commissioners consistently reports that dissatisfaction with claim amounts and wrongful denials are the top complaints from policyholders. When you’re dealing with significant commercial property damage, this adversarial relationship can cost you tens of thousands, if not millions, of dollars.

| Aspect | Public Adjuster | Company or Independent Adjuster |

|---|---|---|

| Works For | You (the policyholder) | The insurance company |

| Primary Goal | Maximize your fair settlement | Minimize the insurance company’s payout |

| Legal Obligation | Fiduciary duty to protect your interests | Duty to protect the insurer’s interests |

| Payment Source | Contingency fee from your settlement (No recovery, no fee) | Salary or fee from the insurance company |

| Expertise Focus | Comprehensive damage documentation and policy analysis | Conservative damage assessment and narrow policy interpretation |

| Claim Strategy | Proactively build a detailed claim to justify full value | Process the claim as quickly and inexpensively as possible |

The Public Adjuster Process vs. an Insurance Lawsuit

Hiring a public adjuster is a proactive strategy designed to prevent disputes and avoid litigation. A lawsuit, on the other hand, is a reactive, last-resort measure taken after the claim process has already failed.

-

The Public Adjuster Process: A public adjuster gets involved early to build an irrefutable claim from the ground up. We carefully document all damage, bring in engineers and specialists, use industry-standard software like Xactimate to create precise cost estimates, and account for everything from code-mandated upgrades to business interruption losses. This detailed, evidence-based package is presented to the insurer for negotiation. The process is collaborative and focused on policy compliance, leading to a faster resolution and avoiding the courtroom in the vast majority of cases.

-

The Lawsuit Process: A lawsuit begins when you and the insurer are at an impasse, usually after a denial or a lowball offer. It is an adversarial, lengthy, and expensive process. It involves a long findy phase, depositions, expert battles, and high legal fees, which are often charged hourly or on a contingency basis that may be higher than a public adjuster’s fee. The outcome is uncertain and can take years to resolve, leaving your property in disrepair and your business in limbo.

By engaging a public adjuster, you are investing in a strategy to get the claim settled correctly the first time. Our firm regularly handles claims that were initially undervalued by 50% to 500%. We achieve this not by fighting, but by building a claim so thoroughly documented that the insurer has a clear, data-driven path to pay what is rightfully owed. For owners of commercial properties, apartment complexes, and multifamily HOAs in Texas and beyond, this is the key to a successful recovery.

Step-by-step: How a public adjuster advances a large-loss commercial claim

- Intake and strategy: Review your policy, endorsements, deductibles, and duties after loss to map a compliant claim strategy.

- Forensic documentation: Capture photo and video evidence, moisture mapping, and invasive inspections where needed to reveal hidden damage.

- Expert coordination: Engage engineers, industrial hygienists, estimators, and code consultants as appropriate for the peril and property type.

- Detailed estimating: Prepare line-item repair and replacement scopes that reflect real local labor and material costs and current code requirements.

- Business interruption analysis: Quantify loss of rents, extra expenses, and operational impacts with supporting accounting records.

- Negotiation and supplements: Present a complete claim package, respond to insurer requests, and submit supplements as additional damage or code issues are finded.

- Resolution and closeout: Aim for a fair settlement that funds full, code-compliant repairs and restores operations without unnecessary litigation.

Avoiding unnecessary litigation with appraisal and ADR

When valuation disputes arise, many commercial policies include an appraisal clause. A public adjuster can help you prepare the strongest possible documentation for appraisal or other alternative dispute resolution paths. These options often resolve disagreements faster and at a lower total cost than a lawsuit, while keeping the focus on evidence rather than courtroom procedure.

What owners and managers can prepare now

- A current asset register, recent capital improvements, and maintenance logs.

- Lease abstracts and rent rolls to support loss of rents calculations for multifamily and mixed-use properties.

- Vendor contracts, emergency mitigation invoices, and temporary relocation costs.

- A communications log for all insurer interactions, site visits, and requests for information.

Texas-specific considerations

Texas properties face unique exposures, from coastal wind events to inland freeze-related failures. Local code cycles, permitting timelines, and market labor availability can materially impact costs and schedules. A Texas-based public adjuster understands these dynamics in Austin, Dallas-Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, Lakeway, Amarillo, and surrounding regions, and builds them into your claim from day one.

Choosing a qualified public adjuster aligns the process with your objectives: restoring your commercial or multifamily asset fully, documenting every legitimate cost, and reducing the risk that a complex insurance claim turns into a prolonged lawsuit.