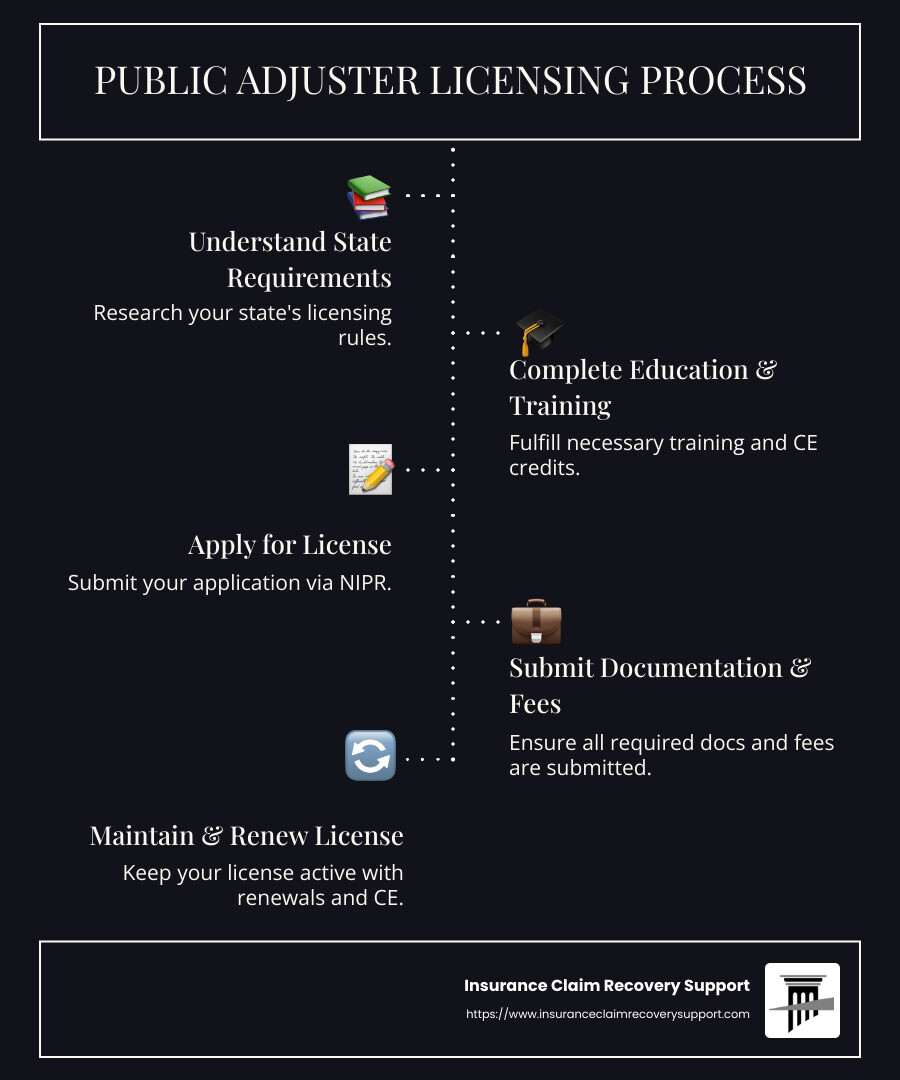

Public adjuster licensing is crucial for anyone looking to hire or become a public adjuster. Understanding the requirements involves several key steps. Here’s a quick overview:

- State-Specific Requirements: Each state has its own rules for licensing adjusters. It’s important to know your state’s specific needs.

- Educational Requirements: Most states require a licensing exam and continuing education (CE) credits to maintain the license.

- Application Process: Licenses can often be applied for or renewed through platforms like NIPR, which centralizes licensing services.

Navigating public adjuster licensing requirements can be complex, but this guide will simplify the process and ensure you are properly licensed to handle insurance claims.

My name is Scott Friedson, and I bring extensive expertise in managing large loss insurance claims as a multi-state licensed public adjuster. With over 500 claims totaling more than $250,000,000 settled, I assure you that understanding public adjuster licensing is your first step toward success in claim handling.

Step 1: Understand State Licensing Requirements

The first step in becoming a public adjuster is to understand the licensing requirements specific to your state. This is crucial because each state has its own set of rules and regulations for licensing.

State-Specific Requirements

Each state has unique requirements for public adjuster licensing. For instance, Florida requires a state-approved insurance course, a licensing exam, and a $50,000 surety bond. In contrast, Pennsylvania does not require pre-licensing education but mandates passing the Series 16-19 examination.

It’s essential to check your state’s insurance department website for the most accurate and current information. This ensures you meet all the necessary criteria before proceeding to the next steps.

Licensing Exam

Most states require you to pass a licensing exam. This exam typically covers important topics such as policy interpretation, claims processes, and state regulations. For example, in Florida, you must pass the Florida Adjuster Examination.

The exam ensures that you have the knowledge needed to handle insurance claims effectively. Be sure to prepare thoroughly, as passing this exam is a critical step in obtaining your license.

Training Hours

In addition to passing an exam, some states require a certain number of training hours. These hours can be part of a pre-licensing course that covers everything from insurance laws to ethical practices. For instance, California mandates a pre-license course, while states like Pennsylvania do not.

Check your state’s requirements to see if training hours are needed. Completing these hours will not only fulfill state requirements but also equip you with valuable skills and knowledge for your career as a public adjuster.

Understanding these state-specific requirements is crucial for successfully navigating the public adjuster licensing process. Once you’re clear on these, you’re ready to move on to the next step: completing your education and training.

Step 2: Complete Necessary Education and Training

Once you’re familiar with your state’s specific requirements, it’s time to focus on the education and training needed for public adjuster licensing. This step is vital for building the foundation of your career and ensuring you’re well-prepared for the challenges ahead.

Continuing Education (CE) Requirements

Continuing education is not just a one-time task; it’s an ongoing commitment. As a public adjuster, you’ll need to stay updated on the latest industry trends, laws, and best practices. CE courses are designed to keep you informed about changes in policies and regulations that affect your work.

Every state has its own CE requirements. For example, in Texas, public adjusters must complete 24 hours of continuing education every two years, including ethics training. Make sure to check your state’s specific CE requirements to maintain your license and stay compliant.

Training Programs

To meet these educational requirements, you’ll need to enroll in training programs. One highly recommended resource is AdjusterPro. They offer comprehensive courses custom to different state requirements, helping you prepare for licensing exams and meet CE obligations.

AdjusterPro provides a range of courses, from basic insurance principles to advanced claims handling techniques. This ensures you’re equipped with the necessary skills to serve your clients effectively. Their programs are designed to be flexible, allowing you to learn at your own pace and schedule.

The Importance of Certification

Certification acts as a badge of expertise and credibility. It signals to policyholders that you’re knowledgeable and trustworthy. Courses that offer certification can be invaluable in boosting your career prospects. They demonstrate your commitment to professional development and your dedication to serving clients with the highest standards.

By completing the necessary education and training, you’re not only fulfilling state requirements but also setting yourself up for a successful career as a public adjuster. Once you’ve completed this step, you’re ready to apply for your public adjuster license.

Step 3: Apply for Your Public Adjuster License

Now that you’ve completed your education and training, it’s time to take the next step: applying for your public adjuster license. This process is streamlined and straightforward, thanks to resources like NIPR’s Licensing Center.

Using NIPR’s Licensing Center

The National Insurance Producer Registry (NIPR) is your go-to resource for applying for and managing your public adjuster license. NIPR offers a centralized platform that simplifies the application process by providing a one-stop solution for all your licensing needs.

To start, visit NIPR’s Licensing Center and create an account. This will give you access to a variety of tools and resources, such as state requirement guides, application forms, and status checks. The platform is designed to be user-friendly, ensuring you can steer the process with ease.

The Application Process

Applying for your license involves several key steps. Here’s a simple breakdown of what you need to do:

-

Gather Your Documents: Ensure you have all necessary documents ready. This typically includes proof of completed education, training certificates, and any other state-specific requirements.

-

Fill Out the Application: Use the NIPR platform to fill out your application form. Be thorough and accurate to avoid any delays in processing.

-

Submit Required Fees: Pay the application fees as specified by your state. These fees can vary, so check your state’s guidelines through NIPR.

-

Schedule Your Prometric Exam: Most states require you to pass a licensing exam. The Prometric exam tests your knowledge of public adjusting principles and state regulations. Schedule your exam through the Prometric website, and make sure to prepare thoroughly.

Preparing for the Prometric Exam

The Prometric exam is a critical part of the licensing process. It’s designed to assess your understanding of insurance policies, claim processes, and relevant laws. To prepare, review your training materials, take practice exams, and focus on areas where you feel less confident.

Consider forming a study group with fellow aspiring adjusters or seeking additional resources from platforms like AdjusterPro. Their study guides and practice tests can be invaluable in helping you succeed.

By following these steps and utilizing NIPR’s resources, you’ll be well on your way to obtaining your public adjuster license. Once you’ve submitted your application and passed the Prometric exam, you’re ready to start on your career as a licensed public adjuster.

Next, let’s discuss how to submit the required documentation and fees to finalize your application.

Step 4: Submit Required Documentation and Fees

Congratulations on reaching this crucial step in the public adjuster licensing process! Now, it’s time to submit the necessary documentation and fees to finalize your application.

Bond Submission

Most states require public adjusters to post a bond as part of the licensing process. This bond acts as a financial guarantee that you will adhere to state regulations and ethical guidelines.

-

Why It’s Important: The bond protects clients from potential misconduct or financial loss due to your actions. It’s a critical part of building trust with clients.

-

How to Obtain a Bond: Contact a surety bond provider to get the bond. They will guide you through the process and help you understand the bond amount required in your state.

The bond must remain active throughout your licensing period, so keep track of renewal dates.

Licensing Cost and Application Fees

The cost of obtaining a public adjuster license can vary significantly by state. Here’s what you need to know:

-

Application Fees: These are the fees you pay when you submit your license application. They cover the cost of processing your application and are non-refundable.

-

License Fees: Once your application is approved, you may need to pay an additional fee to receive your license. This fee is also state-specific.

-

Additional Costs: Don’t forget to budget for your bond and any study materials or courses you may need for the Prometric exam.

To get a clear picture of the total cost, visit NIPR’s Licensing Center for state-specific fee information.

Submitting Fees

Paying your fees is a straightforward process:

-

Online Payment: Most states allow you to pay application fees directly through the NIPR platform using a credit or debit card. This method is quick and secure.

-

Mail Payment: If online payment isn’t an option, you may need to send a check or money order via mail. Be sure to include any required forms and documentation.

Finalizing Your Application

Once you’ve submitted your documentation and fees, your application will be reviewed by the state insurance department. Keep an eye on your email or NIPR account for updates on your application status.

If additional information is needed, respond promptly to avoid delays. Once approved, you’ll receive your public adjuster license, allowing you to start your career officially.

Up next, we’ll explore how to maintain and renew your license to ensure you remain in good standing.

Step 5: Maintain and Renew Your License

Congratulations, you’re now a licensed public adjuster! But the journey doesn’t stop here. To continue your career, you need to maintain and renew your license. Here’s how:

License Renewal

Every state requires public adjusters to renew their licenses periodically. This ensures that you stay current with industry standards and regulations.

-

Renewal Period: Typically, licenses need renewal every 1 to 2 years. Check your state’s specific timeline to avoid lapses.

-

Renewal Process: Renew through the NIPR’s Licensing Center for a streamlined experience. This platform offers all the tools you need to manage your licensing requirements.

Continuing Education (CE) Requirements

Continuing education is essential for staying up-to-date in the insurance industry. It helps you learn new skills and understand changes in laws and practices.

-

CE Credits: Most states require a certain number of CE credits for renewal. These courses cover various topics, from new insurance laws to advanced claims handling techniques.

-

Finding Courses: Platforms like AdjusterPro offer a range of courses custom for public adjusters. Choose courses that align with your interests and state requirements.

-

Tracking Your Progress: Use the NIPR services to keep track of your CE credits and ensure you meet all necessary requirements before your renewal date.

Utilizing NIPR Services

The National Insurance Producer Registry (NIPR) is a valuable resource for public adjusters. Here’s how it can help:

-

License Management: NIPR allows you to handle all aspects of your license, from initial application to renewal.

-

State Requirements: Easily access detailed information about your state’s specific licensing requirements and deadlines.

-

Alerts and Notifications: Set up alerts to remind you of upcoming renewal dates or CE deadlines.

By staying proactive and organized, you can ensure a smooth renewal process and continue helping clients with confidence.

Next, we’ll address some common questions about public adjuster licensing to further assist you on this journey.

Frequently Asked Questions about Public Adjuster Licensing

What are the licensing requirements for public adjusters?

To become a public adjuster, you must meet specific state requirements. Each state has its own set of rules, but most require you to pass a licensing exam. This exam tests your knowledge of insurance laws, policies, and claim handling.

-

State-Specific Rules: Always check with your state’s Department of Insurance for detailed requirements. Some states may require additional training or background checks.

-

Licensing Exam: The exam usually covers various insurance topics and regulations. Preparation courses are available to help you succeed.

How much does it cost to obtain a public adjuster license?

The cost of obtaining a public adjuster license can vary widely depending on your location. Here’s a breakdown of typical expenses:

-

Application Fees: These can range from $50 to $200, depending on the state.

-

Licensing Cost: This includes the cost of the exam, which might be an additional $50 to $100.

-

Additional Fees: Some states may require a bond or other fees related to the application process.

It’s important to budget for these costs and check your state’s specific fee structure.

Can I apply for a public adjuster license online?

Yes, you can apply for a public adjuster license online through the NIPR’s Licensing Center. This platform simplifies the process, allowing you to handle everything from initial applications to renewals.

-

Online Application: The NIPR’s Licensing Center offers a user-friendly interface to submit your application and track its status.

-

Streamlined Process: By using this online tool, you can ensure that you meet all requirements and deadlines without the hassle of paperwork.

Applying online not only saves time but also keeps your application organized and easily accessible. Make sure you have all necessary documentation ready before starting the process.

By understanding these FAQs, you’ll be better prepared to steer the public adjuster licensing process with confidence.

Conclusion

At Insurance Claim Recovery Support, we are committed to being your trusted partner in navigating the complexities of insurance claims. Our team of licensed public adjusters is dedicated to advocating for policyholders, ensuring you receive the maximum settlement you deserve. With our expertise, we handle the intricacies of property damage claims, including fire, hurricane, tornado, lightning, freeze, and flood damage.

Why Choose Us?

-

Expert Advocacy: We work exclusively for policyholders, not insurance companies. Our mission is to protect your interests and secure the best possible outcome for your claim.

-

Texas Presence: We proudly serve clients across Texas, including Austin, Dallas-Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway. Our local knowledge and experience are invaluable in understanding state-specific insurance regulations and requirements.

-

Nationwide Support: While we are based in Texas, our services extend nationwide, offering comprehensive support to policyholders across the country.

Navigating the insurance claim process can be overwhelming, but you don’t have to face it alone. With Insurance Claim Recovery Support, you’re not just hiring a public adjuster; you’re gaining a committed ally who will stand by your side every step of the way.

Whether you’re dealing with a complex claim, need assistance with ambiguous policy language, or simply want peace of mind, we’re here to help. Let us handle the burden of the claims process so you can focus on what matters most—your recovery.

For more information or to get started with our services, visit our service page. Together, we can achieve a swift and favorable resolution to your insurance claim.