Understanding Texas Public Adjusters: Your Property Claim Advocate

A public adjuster in Texas is a licensed professional who represents policyholders—not insurance companies—during property damage claims. If you’re dealing with property damage and considering professional help, here’s what you need to know:

Quick Guide: Texas Public Adjusters

- Licensed professionals who represent YOU (not your insurance company)

- Can increase claim settlements by up to 747% on average

- Maximum fee capped at 10% of the total claim settlement in Texas

- Handle property damage claims only (not health or injury claims)

- Must pass state licensing exam and background check

- You have a 72-hour cancellation window after signing a contract

When disaster strikes your property in Texas—whether it’s fire, flood, hail, hurricane, tornado or freeze damage—navigating insurance claims can be overwhelming. Insurance policies are deliberately complex, and insurance companies have teams of adjusters working to minimize payouts.

Think of it this way: insurance companies are for-profit businesses with a clear incentive to pay as little as possible on claims. Their adjusters work for them, not for you.

This is where a public adjuster enters the picture.

Unlike insurance company adjusters, public adjusters work exclusively for policyholders. They handle the entire claims process—from documenting damage to negotiating settlement—with your best interests in mind.

With only 944 licensed public adjusters in Texas (compared to over 117,000 insurance company adjusters), finding the right professional can make a significant difference in your claim outcome.

As Scott Friedson, a multi-state licensed public adjuster and CEO of Insurance Claim Recovery Support LLC, I’ve personally helped policyholders recover hundreds of millions in commercial and multifamily property damage claims throughout Texas, often increasing claim settlements by 30% to over 3,800% and helping overturn wrongfully denied claims.

Public Adjuster vs Company & Independent Adjusters: Texas Basics

When storm clouds gather over your Texas home and damage occurs, you’ll soon meet different types of insurance adjusters. Understanding who actually works for you can make all the difference in your claim outcome.

The Three Types of Insurance Adjusters in Texas

Imagine you’re sitting at your kitchen table after a severe storm has damaged your roof. The phone rings, and it’s an adjuster wanting to inspect your property. But who are they really working for?

Public Adjusters stand firmly in your corner. They work exclusively for you, the policyholder, with one clear mission: maximizing your settlement. You pay them directly, which means their success is tied to yours.

Company Adjusters are employees of your insurance company. While they may seem helpful, they have dual loyalties. Their paycheck comes from the insurer, and they follow company guidelines designed to control costs.

Independent Adjusters might seem neutral based on their name, but don’t be fooled. They’re contractors hired by insurance companies who still represent insurer interests, not yours.

As one experienced public adjuster in Texas often asks homeowners: “When an insurance company adjuster must choose between your interests and their employer’s bottom line, which side do you think they’ll take?”

Key Differences That Matter to Your Claim

| Aspect | Public Adjuster | Company/Independent Adjuster |

|---|---|---|

| Who they represent | You, the policyholder | The insurance company |

| Payment source | Percentage of your settlement (capped at 10% in Texas) | Salary or fee from insurance company |

| Primary goal | Maximize your settlement | Control costs for insurer |

| Policy expertise | Interprets policy in your favor | Applies restrictive interpretations |

| Claim documentation | Thorough documentation of all damages | May overlook or minimize certain damages |

| Negotiation stance | Advocates for maximum coverage | Works within company guidelines to limit payouts |

“One wrong answer to an insurance company can get your claim denied,” a veteran public adjuster in Texas often warns clients. This highlights why having someone who understands the nuances of policy language and claim procedures is so valuable.

The impartial negotiation provided by public adjusters often reveals damages that company adjusters miss – whether intentionally or not. Consider this real example: After severe weather hit Dallas, a homeowner received an initial offer of $22,000 for roof and water damage. After bringing in a public adjuster in Texas, the documented damages revealed significant structural issues the company adjuster had overlooked. The final settlement? $87,000 – nearly four times the original offer.

When dealing with insurance companies after property damage, company adjusters serve two masters – you and their employer. Public adjusters have just one loyalty: to you and your full recovery.

When & Why to Hire a Public Adjuster in Texas

Let’s face it – not every fender-bender needs a lawyer, and not every insurance claim needs a public adjuster. But when disaster strikes your Texas home or business, knowing when to call in professional help can make all the difference between a settlement that barely covers your damages and one that truly makes you whole again.

The Right Time to Consider a Public Adjuster

When storm clouds roll across the Texas sky and leave destruction in their wake, the aftermath can be overwhelming. Large or complex losses often justify professional representation, especially when damages exceed $10,000. Why? Because the paperwork, documentation, and negotiation become exponentially more complicated.

If you’ve already filed a claim and received a disappointing response – either a flat denial or significantly underpaid offer – a public adjuster in Texas can be your greatest ally. They have the expertise to challenge these decisions effectively.

The numbers don’t lie. A government study revealed that policyholders who use public adjusters receive settlements averaging 747% higher than those who handle claims themselves. This staggering difference shows just how much money is often left on the table without professional representation.

After major disasters hit Texas cities like Austin, Dallas, Houston, or San Antonio, public adjusters become especially valuable. When thousands of claims flood insurance companies simultaneously, corners get cut, and details get missed. Your claim deserves thorough attention, not a rushed assessment.

Commercial property and multi-family building owners particularly benefit from professional claim representation. These complex properties often involve business interruption losses, tenant relocation costs, and complicated building systems that company adjusters may not fully understand or document.

Texas law provides a 72-hour cooling-off period after signing with a public adjuster. This gives you time to reconsider without penalty if you change your mind.

Signs You Need a Public Adjuster in Texas

You might need professional help if you’re feeling outmatched by your insurance company’s resources. Their teams of adjusters, engineers, and attorneys work together to minimize payouts – shouldn’t you have an expert in your corner too?

Policy language confusion is another red flag. When your insurance document reads like it’s written in a foreign language (which, let’s be honest, it practically is), a public adjuster can translate those complex exclusions and limitations into plain English.

As one TAPIA (Texas Association of Public Insurance Adjusters) member puts it: “Insurance policies are purposefully written in a confusing manner. You wouldn’t go to court without an attorney; nor should you handle a complex claim on your own.”

When your property suffers multiple types of damage – perhaps wind-driven rain along with structural issues after a tornado in Fort Worth or freeze damage combined with water losses in Lubbock – sorting out what’s covered becomes increasingly difficult without professional guidance.

Deadline pressure can also make professional help invaluable. Texas insurance claims have strict documentation timelines, and missing these can jeopardize your entire claim.

Finally, if your settlement offer seems suspiciously low, trust that instinct. A San Antonio business owner received an initial $42,000 offer for hail damage in 2022. After hiring a public adjuster in Texas, the documented settlement grew to $178,000 – a 323% increase that more than justified the adjuster’s fee.

The peace of mind that comes from knowing a professional is handling your claim allows you to focus on what matters most – getting your life back to normal after a disaster.

Latest research on claim payout increases

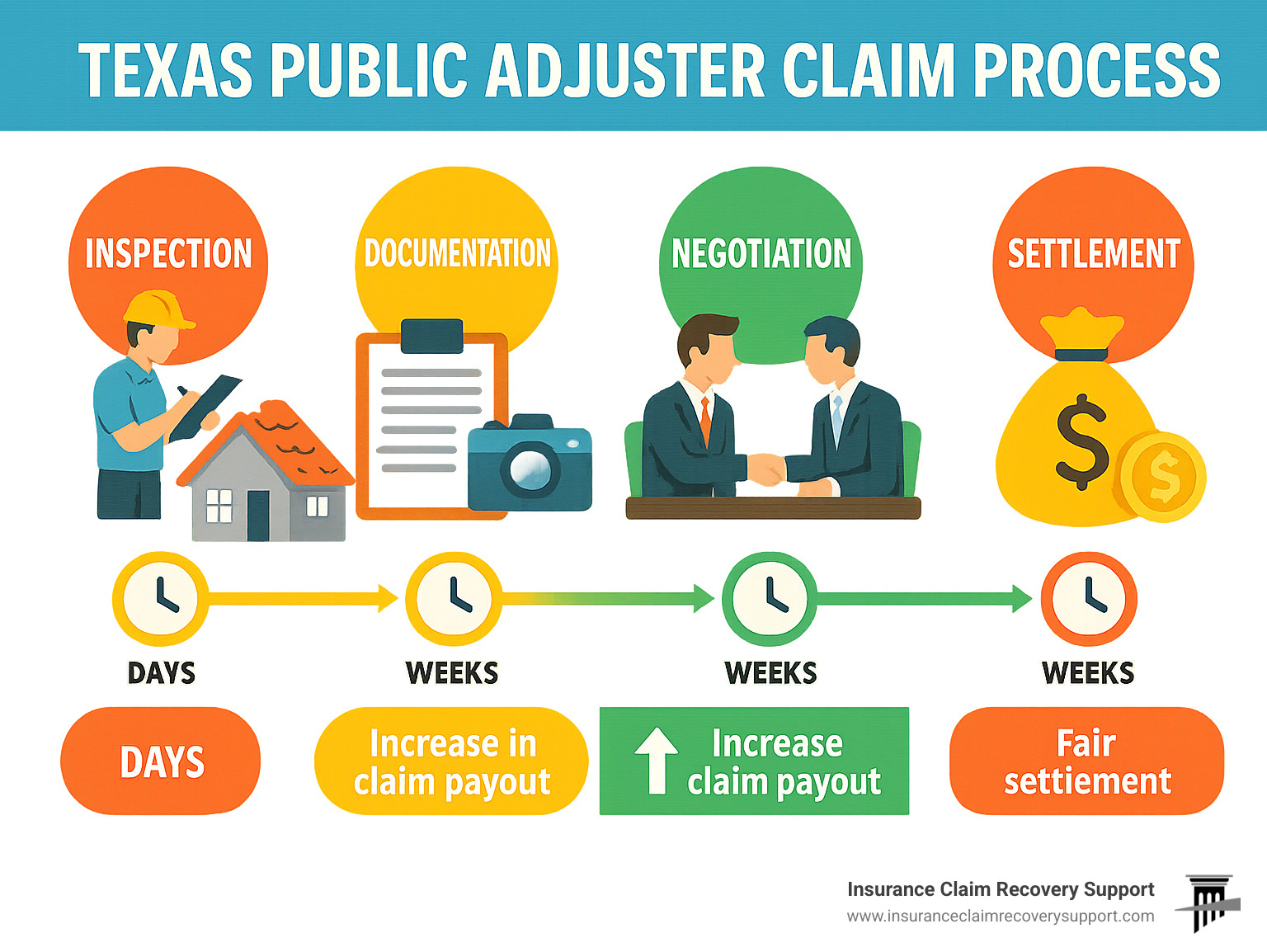

From Damage to Settlement: The Texas Claim Process (Step-by-Step)

When disaster strikes your Texas home or business, knowing what happens next can make all the difference. Let me walk you through what the journey looks like when you work with a public adjuster in Texas – from those first shocking moments of damage to the relief of a fair settlement.

1. Initial Contact & Property Assessment

After you’ve ensured everyone’s safety, you’ll need to notify your insurance company about the damage. But here’s where many Texans miss an opportunity: you can simultaneously reach out to a public adjuster for a free evaluation.

At Insurance Claim Recovery Support, we start with a thorough walk-through of your property. We’ll look for visible damage, but more importantly, we search for hidden issues insurance company adjusters often miss. This preliminary review helps us determine if we can significantly increase your settlement – and if we can’t help, we’ll tell you straight up.

2. Contract & Documentation

If we believe we can help maximize your claim, we’ll provide a clear contract outlining our partnership. Texas law has specific requirements for these agreements:

The contract must clearly state our fee (never more than the legal maximum of 10%), include your right to cancel within 72 hours without penalty, and detail exactly what services we’ll provide.

Once you’re comfortable moving forward, we begin the critical documentation phase. This is where our expertise truly shines – we capture comprehensive evidence including detailed photographs, videos, structural assessments, and complete inventories of damaged contents. This meticulous approach creates an indisputable record of your loss.

3. Working With Your Public Adjuster in Texas

Now the real work begins. Your public adjuster becomes your voice, handling all those stressful insurance company communications while you focus on getting your life back to normal.

During this phase, we develop what’s called a Scope of Loss – a detailed document that leaves no damage unaccounted for. We create professional estimates using industry-standard Xactimate software, ensuring repair costs reflect actual market rates in your specific Texas location.

When needed, we bring in specialized engineers, contractors, and other experts to strengthen your claim. As one seasoned adjuster puts it: “A skilled public adjuster in Texas will prepare forensic-grade, 20–200+ page reports with photos, videos, and engineering analysis.” These comprehensive files make it extremely difficult for insurers to dispute legitimate damages.

We also maintain meticulous communication logs, documenting every interaction with your insurance company – a practice that often proves invaluable if disputes arise.

4. Claim Submission & Negotiation

With our thorough documentation in hand, we submit your complete claim package and begin negotiations. This is where experience and expertise truly matter.

We present clear evidence of all damages, challenge lowball offers with supporting documentation, address coverage disputes by referencing specific policy language, and negotiate persistently until a fair settlement is reached.

The reality is that insurance companies often count on policyholders giving up after initial lowball offers. Having a professional who knows when to push back – and how – makes all the difference.

5. Resolution & Settlement

Once we’ve secured a fair settlement, we don’t just disappear. We ensure proper payment distribution and can even provide guidance on selecting reputable contractors for repairs.

If negotiations reach an impasse, we have several strategies available:

– We can help you invoke the appraisal clause in your policy

– We might suggest mediation as a less adversarial approach

– When necessary, we can connect you with specialized attorneys for possible litigation

Your claim experience will vary depending on both complexity and your Texas location. For instance, Austin and Round Rock property owners often face spring storm damage, while Houston and Galveston claims frequently involve complex hurricane issues. Dallas-Fort Worth residents deal with tornado aftermath, San Antonio and Waco see significant fire claims, and since Winter Storm Uri, Lubbock and San Angelo have experienced a surge in freeze damage claims.

One thing remains consistent across Texas: “The sooner we’re involved, the more thoroughly we can document the damage,” as one TAPIA member wisely notes. Early involvement of a public adjuster in Texas not only improves your claim outcome but provides invaluable peace of mind during a stressful time.

More info about adjuster claim support

Costs, Licensing & Legal Rules for Texas Public Adjusters

Let’s talk money, credentials, and rules of the road when it comes to hiring a public adjuster in Texas. Understanding these practical matters helps you avoid surprises and make confident decisions during an already stressful time.

Fee Structure & Costs

Good news – Texas law has your back when it comes to public adjuster fees:

The state caps public adjuster fees at 10% of your total claim settlement. This means if your claim settles for $100,000, your adjuster’s maximum fee would be $10,000.

Here’s a real-world example that shows why this can still be a fantastic deal:

Imagine your Houston business suffers $200,000 in hurricane damage. Your insurer initially offers just $120,000. Your public adjuster in Texas fights for you and secures the full $200,000. Their 10% fee comes to $20,000, but you still walk away with $180,000 – a full $60,000 more than the insurer’s first offer. That’s three times what you paid in fees!

Most Texas public adjusters work on contingency – meaning if they don’t increase your settlement, you pay nothing. Some offer alternative arrangements like flat fees for smaller claims or reduced percentages for very large losses. Don’t be shy about discussing fee options before signing anything.

Licensing Requirements

The Texas Department of Insurance doesn’t mess around when it comes to who can represent you. To earn a license, public adjusters in Texas must:

- Pass the challenging Texas All-Lines Insurance Adjuster exam

- Complete a fingerprint background check (typically through IdentoGO)

- Submit a formal application with a $50 fee

- Provide proof of a $10,000 surety bond

- Submit their client contract for TDI review and approval

“These requirements aren’t just bureaucratic hoops,” explains a veteran adjuster. “They ensure anyone representing Texas policyholders has proven their knowledge and committed to ethical standards.”

You can (and absolutely should) verify your adjuster’s license status through the TDI website before signing anything.

Legal Limitations & Ethical Rules

Texas law creates clear boundaries around what public adjusters in Texas can and cannot do:

They cannot practice law or provide legal advice, act as contractors on claims they adjust, pay or accept referral fees, or charge fees exceeding that 10% cap.

There are also strict rules about how they can seek clients. Public adjusters can’t knock on doors during natural disasters, solicit business after 9:00 PM, or wear anything suggesting they’re government officials.

Your contract with a public adjuster must include a 72-hour “cooling off” period, clearly state all services and fees, and be on file with TDI. This 72-hour window gives you time to reconsider without penalty if you have second thoughts.

“Many people worry about the line between adjusting and practicing law,” notes a claims specialist. “But Texas law makes this boundary very clear. Reputable adjusters know exactly where that line is and respect it.”

Understanding these regulations helps you spot genuine professionals and avoid those operating in gray areas. At Insurance Claim Recovery Support, we take pride in maintaining full compliance with Texas regulations while still delivering maximum value to our clients.

Official Texas Department of Insurance adjuster licensing page

Picking the Right Public Adjuster: Checklist, Mistakes & Dispute Options

Finding the perfect public adjuster in Texas shouldn’t feel like searching for a needle in a haystack. Think of it as finding a trusted partner who’ll stand by your side during one of the most stressful experiences a property owner can face.

Selection Checklist

When you’re ready to hire a public adjuster, take a deep breath and focus on what truly matters. First and foremost, verify their license through the Texas Department of Insurance website—this isn’t just a good idea, it’s essential protection for you and your claim.

Look for someone with relevant experience in your specific type of damage. An adjuster who specializes in hurricane claims might not be your best choice for fire damage, even if they’re excellent at what they do.

“Ask for and check references to confirm experience relevant to your specific loss,” advises a TAPIA representative. “The right adjuster makes all the difference in your claim outcome.”

Professional credentials matter too. Membership in the Texas Association of Public Insurance Adjusters (TAPIA) signals a commitment to ethical standards and ongoing education. When you’re reviewing potential adjusters, don’t just glance at their online reviews—read them carefully to understand how they handle challenges.

I always recommend interviewing multiple adjusters before making your decision. Pay attention to how clearly they explain things and whether they listen to your concerns. A good adjuster should make you feel comfortable asking questions and never make you feel rushed.

Before signing anything, thoroughly review the contract. All terms, services, and fees should be crystal clear. If something seems vague or confusing, ask for clarification—a reputable adjuster will be happy to explain.

Common Mistakes to Avoid

I’ve seen too many property owners make the same costly mistakes when working with public adjusters. Perhaps the biggest is hiring too late—once you’ve accepted a settlement, there’s little an adjuster can do to help you.

Don’t make the mistake of choosing based on fee alone. I’ve seen cases where an adjuster charging 10% recovered three times what a “discount” adjuster charging 7% could secure. The math is clear: net recovery matters more than percentage.

Be wary of contractors offering to handle your insurance claim. This isn’t just a bad idea—it’s actually illegal in Texas for contractors to negotiate claims. This arrangement creates serious conflicts of interest that rarely work in your favor.

Another common pitfall is signing vague contracts without clear service descriptions or fee structures. Take the time to read and understand what you’re agreeing to—your future self will thank you.

Don’t forget to maintain regular communication with your adjuster throughout the process. The best outcomes happen when you’re actively involved and informed about what’s happening with your claim.

Dispute Resolution if Your Public Adjuster in Texas Falls Short

Even with careful selection, sometimes relationships don’t work out as expected. If you find yourself unhappy with your public adjuster’s performance, you have several options.

Start with direct communication—many issues can be resolved through an honest conversation about your concerns. If that doesn’t work, try escalating to management if your adjuster works with a larger firm.

For more serious issues, you can file a formal complaint with the Texas Department of Insurance. As a regulatory body, they take complaints against licensed professionals seriously.

“Public adjusters in Texas must conduct business fairly with clients, insurers, and the public in accordance with the Code of Ethics,” notes a TDI representative. This provides a standard against which to measure your adjuster’s performance.

In severe cases, you might need to consider legal remedies such as breach of contract claims or fee refund demands. While these situations are rare, it’s important to know your rights.

At Insurance Claim Recovery Support, we believe in transparency from day one. Our team maintains open communication channels with every client and welcomes questions throughout the claim process. We understand that trust is earned through actions, not just words.

Frequently Asked Questions about Public Adjusters in Texas

What types of claims can a Texas public adjuster handle?

When disaster strikes your property in the Lone Star State, a public adjuster in Texas can be your greatest ally—but only for certain types of claims.

These professionals specialize exclusively in property damage claims, including:

Weather events like hurricanes sweeping through Houston, tornadoes in Dallas-Fort Worth, and those notorious spring hailstorms that hammer Austin and Round Rock. They’re also experts with fire and smoke damage, water damage from burst pipes, and the devastating freeze damage we saw during Winter Storm Uri.

For business owners, public adjusters in Texas handle complex commercial claims including business interruption and lost income calculations. They’ll also help with additional living expenses when you’re displaced from your home.

“I tell my clients to remember one simple rule,” says a veteran Texas adjuster. “If it involves damage to your property or belongings, we can help. If it involves injuries or liability, you need someone else.”

What falls outside their scope? Health insurance disputes, auto claims, workers’ compensation issues, liability matters, and any bodily injury situations. For these, you’ll need other specialists.

Each region of Texas faces unique challenges. Houston battles hurricanes while San Antonio faces wildfire risks. Our team at Insurance Claim Recovery Support has handled claims in every corner of the state, from coastal storm surge to Panhandle wind damage.

How is the fee calculated and when is it paid?

The good news about hiring a public adjuster in Texas is that you typically don’t pay anything upfront. These professionals work on contingency, meaning they get paid only after successfully securing your settlement.

Texas public adjusters typically charge up to 10% of the total settlement amount—not just the increase they negotiate. This fee comes directly from your insurance payout after the claim is settled, never from your pocket beforehand.

Here’s what this looks like in practice:

A commercial property in Waco suffers $300,000 in fire damage. The insurance company initially offers $180,000. Your public adjuster documents additional damages and negotiates a final settlement of $300,000. At a 10% fee, they receive $30,000 from that settlement, leaving you with $270,000—still $90,000 more than the original offer.

“The best part of our fee structure,” explains a TAPIA member, “is that our success is directly tied to yours. If we don’t increase your settlement, you owe us nothing.”

Many firms adjust their rates based on claim size—perhaps 10% for smaller claims but dropping to 7% or less for major losses exceeding $500,000. These terms must be clearly spelled out in your written contract.

At Insurance Claim Recovery Support, we believe in transparent conversations about fees upfront, ensuring you understand exactly how our compensation works before we begin.

How do I verify a public adjuster’s license and complaint history?

Before trusting someone with your insurance claim, take time to verify they’re properly licensed and have a clean record. With only 944 licensed public adjusters in Texas (compared to over 117,000 insurance company adjusters), checking credentials is essential.

The simplest way to verify a license is through the Texas Department of Insurance website. Just enter the adjuster’s name or license number to confirm they’re currently authorized to practice. While there, check for any disciplinary actions or complaints.

“I always tell homeowners—never skip this step,” advises a consumer advocate. “It takes just two minutes online and could save you from a world of headaches.”

For a deeper dive into an adjuster’s background, you can contact TDI’s Consumer Help Line at 800-252-3439 or submit a public information request for their complaint history.

Professional associations provide another verification layer. Check if your potential adjuster belongs to TAPIA (Texas Association of Public Insurance Adjusters) or NAPIA (National Association of Public Insurance Adjusters). These memberships typically indicate a commitment to ethical standards and continuing education.

A reputable public adjuster in Texas will welcome your verification efforts. At Insurance Claim Recovery Support, we proudly maintain our licensing and professional certifications, and we’re always happy to provide references from satisfied clients with similar claims to yours.

Conclusion

When disaster strikes your Texas property, having a knowledgeable advocate by your side can transform your recovery experience. A public adjuster in Texas becomes your dedicated champion, working exclusively to maximize your insurance settlement while lifting the heavy burden of claim documentation and negotiation from your shoulders.

Throughout this guide, we’ve seen how the benefits of hiring a qualified public adjuster often deliver value far beyond their cost:

Professional documentation captures all damages—including those easily overlooked by untrained eyes. Your adjuster brings expert interpretation of those confusing policy clauses that most homeowners struggle to decipher. Their skilled negotiation with insurance companies levels the playing field, often resulting in significantly higher settlements (up to that eye-opening 747% average increase we mentioned). Perhaps most valuable of all: genuine peace of mind during what’s likely one of the most stressful times in your life.

The key to success? Choosing the right professional—someone properly licensed, experienced with your specific type of claim, and deeply committed to ethical practice.

At Insurance Claim Recovery Support, we’ve guided countless Texas property owners through the maze of insurance claims. From Austin to Dallas-Fort Worth, Houston to San Antonio, and Lubbock to Waco, our team understands the unique challenges posed by Texas weather events and the insurance policies designed to cover them.

Before you make your decision, remember these vital points:

Always verify licensing and credentials before signing any agreement. Take time to understand fee structures and get everything in writing. Try to engage a public adjuster in Texas early in your claim process for best results. Maintain open communication throughout your claim journey. And be extremely cautious of contractors offering to handle insurance negotiations—this is often illegal in Texas.

Whether you’re facing fire damage in Georgetown, hurricane destruction in Houston, or tornado devastation in Dallas, a qualified public adjuster can become your most valuable asset in securing a fair and comprehensive settlement.

Your property and financial recovery deserve expert attention. Don’t steer the complex insurance claim process alone when professional help is available right here in Texas.