Public adjuster Houston: A crucial ally when facing the maze of insurance claims. Many property owners, from commercial complexes to hospitals, find themselves overwhelmed. What seems like an endless process can sometimes turn into a waiting game with insurance companies. Here’s why you might need a public adjuster in Houston:

- Expert Representation: They work for you, not for the insurance company.

- Maximized Settlements: Aim to secure the maximum compensation.

- Peace of Mind: Handle the paperwork, negotiations, and evidence gathering.

In Houston, claims can become particularly complex due to the frequent natural disasters like hurricanes and floods. Don’t settle for less; know when and why you should seek expert support.

I’m Scott Friedson, CEO of a leading public adjusting firm, specialized in handling large loss claims. With experience settling claims worth over $250 million, I’ve seen the difference a good public adjuster makes in Houston.

Understanding Public Adjusters

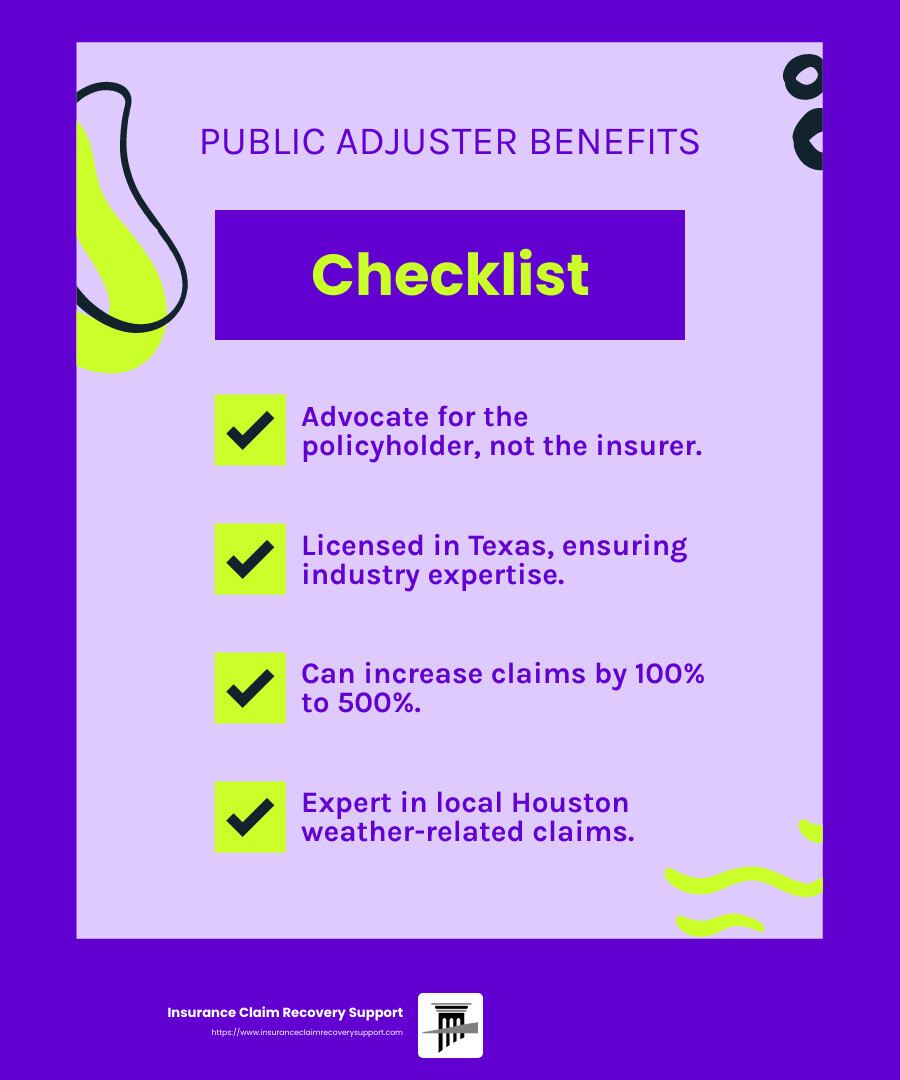

A public adjuster is a licensed professional who stands by your side, helping you steer the tricky world of insurance claims. Unlike insurance company adjusters, who aim to protect the insurer’s bottom line, public adjusters advocate for you, the policyholder.

Licensed Professionals

Public adjusters in Texas must pass the Texas All Lines Insurance Adjuster exam. This ensures they know the ins and outs of the insurance industry. Once licensed, they are regulated by the Texas Department of Insurance, which means they must follow strict ethical guidelines.

Working for Policyholders

When disaster strikes, such as a hurricane or flood in Houston, you want someone who has your best interests at heart. A public adjuster evaluates your damage, files your claim, and negotiates with the insurance company to ensure you get the settlement you deserve. They are your voice in the claims process.

Claim Negotiation

Negotiating a claim isn’t easy. Insurance companies often provide lower initial estimates. Public adjusters, however, have the expertise to identify all damages and argue for a higher payout. They ensure every detail is accounted for, so you receive a fair settlement.

In Houston, where weather-related claims are common, having a public adjuster can make a big difference. They understand local challenges and know how to tackle them effectively.

In the next section, we’ll dig into the benefits of hiring a public adjuster in Houston and how they can help you maximize your settlement and reduce stress.

Benefits of Hiring a Public Adjuster Houston

Navigating an insurance claim after a natural disaster can feel like an uphill battle. This is where a Public Adjuster Houston comes into play, offering you invaluable support and expertise. Let’s break down the benefits.

Maximize Your Settlement

One of the most significant advantages of hiring a public adjuster is their ability to maximize your settlement. Did you know that many clients have seen their claims increase by 100% to 500% after hiring a public adjuster? These professionals are skilled at identifying all covered damages and ensuring no detail is missed. They use advanced tools like Xactimate to provide accurate repair estimates, often uncovering mistakes in initial assessments.

Consider a real-world example: A Houston homeowner initially received a low settlement offer after hurricane damage. After hiring a public adjuster, the claim was reassessed, resulting in a payout several times higher than the original offer.

Reduce Stress

Dealing with the aftermath of property damage is stressful enough without the added burden of managing an insurance claim. A public adjuster takes on this responsibility, handling everything from documenting the damage to negotiating with the insurance company. This means you can focus on getting your life back to normal while they work to ensure a smoother and faster claims process.

Imagine not having to worry about the intricate details of filing proofs of loss or mitigating further damage. With a public adjuster, you can rest easy knowing an expert is on your side.

Expert Negotiation

Insurance companies have their own adjusters who aim to minimize payouts. Without a public adjuster, you’re at a disadvantage. Public adjusters are expert negotiators who understand the complexities of insurance policies. They work exclusively for you, eliminating any conflict of interest and ensuring your best interests are prioritized.

Their negotiation skills can significantly impact the outcome of your claim, ensuring you receive a fair and just settlement. In a city like Houston, where property damage from hurricanes and floods is common, having a skilled negotiator is invaluable.

Hiring a public adjuster in Houston not only helps you secure a higher payout but also ensures every bit of damage is accounted for in your claim. This expertise can make a huge difference in your recovery process.

In the next section, we’ll explore how to choose the best public adjuster in Houston, focusing on credentials, experience, and reviews.

How to Choose the Best Public Adjuster in Houston

Selecting the right Public Adjuster Houston can be the key to navigating a successful insurance claim. Here’s how to ensure you make the best choice.

Credentials

First, confirm the adjuster’s credentials. In Texas, public adjusters must have a license from the Texas Department of Insurance. This ensures they meet state requirements and have the necessary skills to handle your claim effectively. You can check their license status online.

Experience

Experience is another crucial factor. Look for adjusters who have handled claims similar to yours. For example, those with extensive experience managing claims from hurricanes and floods are preferable in Houston. Such adjusters have helped thousands of policyholders, showcasing their expertise and reliability. A seasoned adjuster will know the ins and outs of the insurance process, increasing your chances of a favorable settlement.

Reviews

Client feedback can provide valuable insights into an adjuster’s performance. Check reviews on platforms like Google and the Better Business Bureau (BBB). Look for patterns in feedback about the adjuster’s communication, professionalism, and success in handling claims. Positive reviews and testimonials can give you confidence in your choice.

“ICRS helped us steer the overwhelming process of filing a hurricane claim. Their expertise and persistence resulted in a settlement that was far beyond what we initially expected.”

— Satisfied Client, Google Review

Fees

Understanding the fee structure is essential before hiring a public adjuster. In Texas, public adjusters typically charge a percentage of the claim amount, with fees capped at 10% of the settlement. This fee should be clearly outlined in the contract. A reputable adjuster will only get paid if they recover more for you, ensuring their incentives align with your interests.

By focusing on these key aspects—credentials, experience, reviews, and fees—you can confidently choose the best licensed public adjuster in Houston. This ensures you get the maximum settlement possible and your property is restored to its best condition.

In the next section, we’ll dig into the insurance claim process in Houston, covering essential steps like claim filing and negotiation.

The Insurance Claim Process in Houston

Navigating the insurance claim process in Houston can feel overwhelming, but breaking it down into clear steps can make it manageable. Here’s how to handle the process effectively:

Claim Filing

The first step is to file your claim as soon as damage occurs. In Texas, timing is crucial due to strict deadlines. Notify your insurance company immediately to avoid complications. The sooner you report, the smoother the process will be.

Documentation

Next, focus on documentation. This involves gathering thorough evidence of the damage. Take detailed photos and videos, and keep all relevant receipts and repair estimates. This documentation is vital for supporting your claim and ensuring a fair settlement.

Negotiation

After filing and documenting, the negotiation phase begins. Insurance companies may offer an initial settlement that doesn’t cover all your damages. It’s important not to accept this first offer blindly.

- Review the Initial Offer: Carefully evaluate the initial offer from your insurer.

- Counteroffer with Evidence: Use your documentation to negotiate a better settlement. Present photos, videos, and receipts to support your case.

- Consider Professional Help: If negotiations stall, hiring a licensed public adjuster in Houston can be beneficial. They can manage the negotiation process and aim to maximize your settlement.

Settlement

Once a fair agreement is reached, it’s time to finalize the settlement.

- Finalize the Agreement: Ensure all terms are clear and agreed upon in writing.

- Receive Payment: After finalizing, you should receive your payment. Use these funds to cover repairs and restore your property.

- Follow Up: If additional damages are finded later, follow up with your insurance company or public adjuster.

By understanding each step—claim filing, documentation, negotiation, and settlement—you can steer the insurance claim process in Houston more effectively. This structured approach ensures you secure the settlement you deserve.

Next, we’ll address some frequently asked questions about public adjusters in Houston.

Frequently Asked Questions about Public Adjuster Houston

Navigating insurance claims can be tricky, especially when it comes to understanding the role of a Public Adjuster Houston. Here are some common questions answered to help you make informed decisions.

How much can a public adjuster charge in Texas?

In Texas, public adjusters typically charge a fee that is a percentage of the claim payout. By law, this fee cannot exceed 10% of the total claim amount. This means that their payment is directly tied to the final settlement they secure for you. For example, if your claim is settled for $50,000, the maximum fee a public adjuster can charge is $5,000. It’s important to discuss and agree on the fee upfront, ensuring it is clearly outlined in your contract.

What is the difference between a public adjuster and an insurance adjuster?

The main difference lies in representation:

- Public Adjuster: Works for you, the policyholder. Their goal is to ensure you receive the maximum settlement possible. They handle everything from documentation to negotiation, representing your best interests throughout the process.

- Insurance Company Adjuster: Works for the insurance company. Their primary objective is to minimize the payout on claims to save the company money. As one expert puts it, “Do not be under the impression that the insurance adjuster is there for you! He works for the insurance company and that’s who pays him to minimize the claim.”

Are there public adjusters in Texas?

Yes, there are licensed public adjusters in Texas. These professionals are licensed by the Texas Department of Insurance, ensuring they meet specific requirements and have the necessary knowledge to handle your claim effectively. Companies like Insurance Claim Recovery Support offer experienced public adjusters who can help you steer the complex claims process. Always verify the adjuster’s credentials and ensure they are licensed before hiring them.

By understanding these key aspects—fees, representation, and licensing—you can make informed decisions when hiring a public adjuster in Houston. This ensures you have the right support to secure the best possible settlement for your claim.

Conclusion

At Insurance Claim Recovery Support, our mission is simple: to stand by policyholders, not insurers. We understand the complexities of the insurance claim process, especially in a busy city like Houston with its unique challenges. From hurricanes to fires, we know what it takes to steer these waters and secure the best possible outcome for you.

Advocacy is Our Priority

We are your advocates. Our team works tirelessly to ensure that your interests are front and center. Unlike insurance company adjusters who aim to minimize payouts, we focus on maximizing your settlement. We handle everything from documenting your claim to negotiating with the insurance company, so you don’t have to face this daunting task alone.

Achieving Maximum Settlement

Our success is directly tied to your recovery. The more we secure for you, the better. This incentivizes us to fight for every dollar you deserve. Texas law caps public adjusters’ fees at 10% of the claim amount, ensuring that our interests align with yours. When we succeed, you succeed.

Why Choose Us?

- Expertise: We specialize in property damage claims, including fire, hail, hurricane, tornado, and flood damage.

- Experience: Our team has a proven track record of maximizing settlements for policyholders across Texas, including Houston, Austin, Dallas, Fort Worth, and beyond.

- Commitment: We are dedicated to providing you with the best possible support. Our goal is to make the insurance claim process as stress-free as possible, ensuring you receive the settlement you deserve.

For more information on how we can assist with multi-family property claims and more, visit our Apartment and Multi-Family Claims page.

The right public adjuster can make all the difference. Choose wisely, and let us be your trusted partner in recovery.