Why Florida Property Owners Turn to Professional Insurance Advocates

When searching for a public adjuster Florida, property owners need licensed professionals who represent their interests not the insurance company’s. A public adjuster is a state-licensed advocate for you, the policyholder. They work on a contingency fee (typically 20%, or 10% during declared emergencies), so they only get paid if you do.

Florida’s weather from hurricanes to floods causes thousands of property damage claims annually. For owners of commercial buildings, multifamily complexes, or religious institutions, dealing with insurers is an uphill battle. The insurance company’s adjuster works to minimize your payout. A public adjuster levels the playing field by thoroughly documenting damages, interpreting complex policy language, and negotiating aggressively on your behalf.

This professional advocacy is often the difference between a low settlement and the full compensation your policy provides. The alternative is often costly litigation, which can drag on for years. A skilled public adjuster presents such a well-documented claim that insurance companies are more likely to settle fairly without a court battle.

I’m Scott Friedson, a multi-state licensed public adjuster who has settled over $250 million in commercial property damage claims. My experience helping Florida property owners with complex claims has shown me how critical professional representation is in securing fair settlements while avoiding unnecessary litigation.

Easy public adjuster Florida glossary:

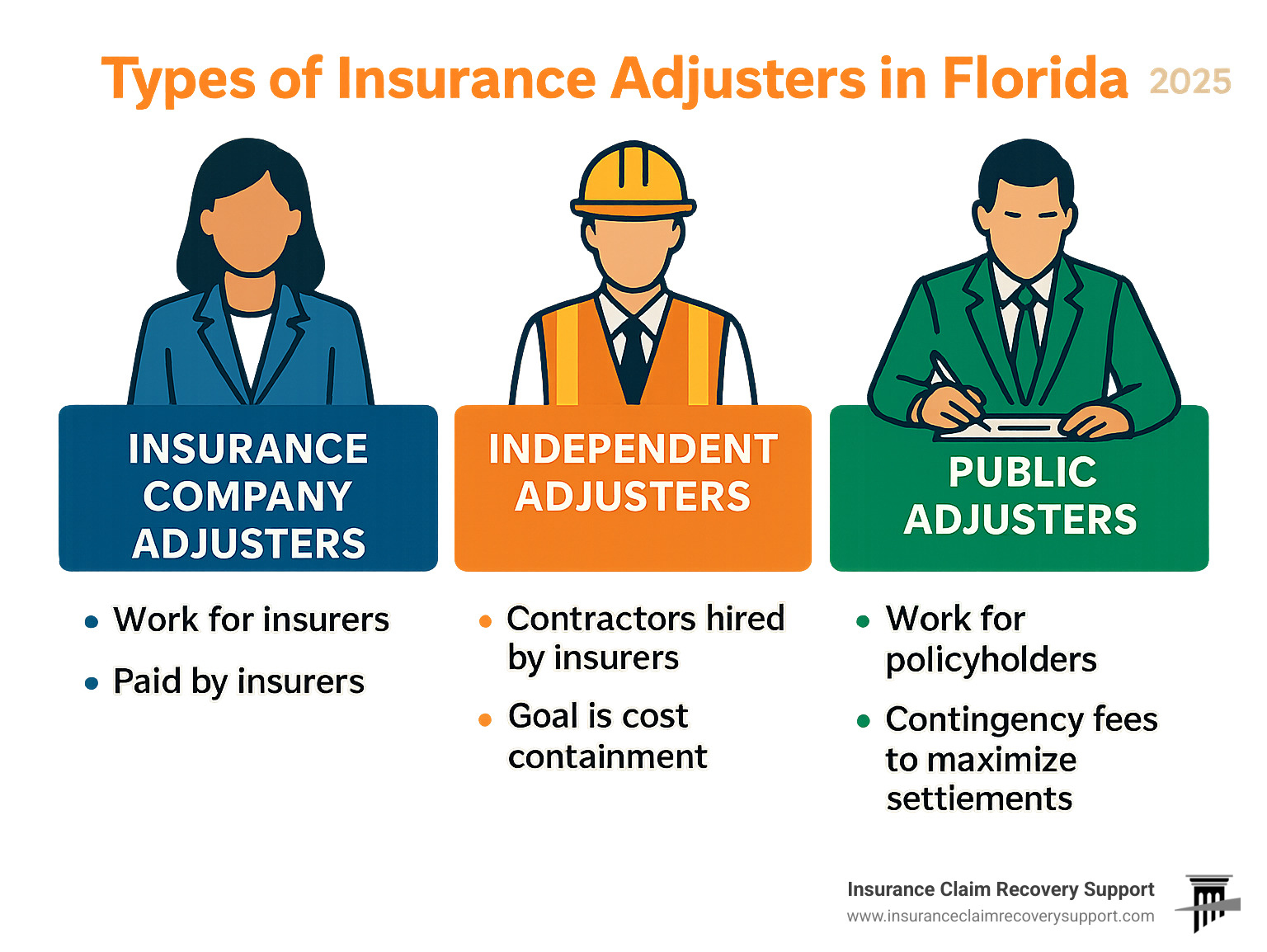

Understanding the Role of a Public Adjuster vs. an Insurance Company Adjuster

When your Florida commercial property is damaged, you’ll find that adjusters aren’t all the same. The adjuster your insurance company sends works for them, not you. Understanding this fundamental difference is key to a fair settlement.

What is a Public Adjuster in Florida?

A public adjuster Florida is a licensed professional who works exclusively for you, the policyholder. We are your advocate, fluent in the insurance company’s language and dedicated to fighting for your best interests. Our job is to maximize your settlement so you can fully restore your property.

As your policyholder advocate, we handle every aspect of your claim, from meticulous claim preparation and damage documentation to expert settlement negotiation. We have a fiduciary duty to you, meaning we are legally obligated to act in your best interests. Our exclusive representation ensures our only goal is maximizing your payout.

How Do They Differ from the Adjuster My Insurance Company Sends?

The difference comes down to one crucial question: Who signs their paycheck?

| Feature | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Who they work for | The policyholder (You) | The insurance company |

| Primary Goal | Maximize your claim payout | Minimize the claim payout |

| How they are paid | Contingency fee from your settlement | Salary or per-claim fee from insurer |

Your insurer’s adjuster, whether a company employee or an independent contractor, has an allegiance to the insurer. Their goal is to minimize your payout to protect the company’s bottom line, creating an inherent conflict of interest. They are trained to find reasons to reduce your settlement and are often incentivized to close claims quickly and cheaply.

This puts you at a disadvantage. A public adjuster Florida levels the playing field. We manage the complex damage assessment and claim negotiation, allowing you to focus on recovery. Our expertise in presenting well-documented, undeniable claims often helps you avoid costly litigation, as insurers are more likely to settle fairly when faced with professional representation.

The Legal Landscape for Public Adjusters in Florida

Florida’s vulnerability to natural disasters means property owners need protection. The Florida Department of Financial Services (DFS) oversees a strict regulatory framework for public adjusters, ensuring you receive honest, professional representation.

These state regulations and licensing requirements separate legitimate professionals from unscrupulous actors who may try to exploit property owners after a storm. When you hire a licensed public adjuster Florida for your commercial building or apartment complex, you can be confident they operate under a strict code of ethics.

Florida’s Regulations on Fees and Contracts

Florida law establishes clear, fair guidelines for public adjuster fees and contracts to protect consumers.

Public adjusters work on contingency fees, meaning we only get paid when you get paid. This aligns our success with yours. Florida law caps these fees to prevent overcharging:

- Standard Claims: Maximum fee of 20% of the settlement.

- Declared State Emergencies: Fee drops to 10% for one year after the disaster.

All agreements must be in a written contract that clearly outlines services and fees. This transparency ensures you know exactly what to expect.

Your Rights as a Policyholder When Hiring a public adjuster Florida

Florida law provides strong consumer protections when you hire a public adjuster Florida.

- Contract Cancellation: You have 10 business days to cancel a contract without penalty. During declared emergencies, this window extends to 30 days.

- No Upfront Fees: Legitimate public adjusters never ask for payment before securing your settlement. A request for an upfront fee is a major red flag.

- Professional Conduct: Adjusters can only solicit business from Monday to Saturday, 8 a.m. to 8 p.m. They cannot offer loans, gifts over $25, or control your choice of contractors.

If you encounter fraud or pressure tactics, report it to the Insurance Fraud Hotline at 1-800-378-0445. These protections, under Florida Statute 626.854, ensure you work with an ethical professional committed to maximizing your recovery.

The Claims Process: How a Public Adjuster Maximizes Your Settlement

When disaster strikes your commercial property, the insurance claim process is daunting. A public adjuster Florida acts as your dedicated project manager and advocate, handling every detail so you can focus on recovery.

Our process begins with a free consultation and a deep dive into your insurance policy to identify all available coverages, including often-overlooked ones like business interruption and loss of rents. We then carefully document all damage using photography, drones, and thermal imaging to find hidden issues. This prevents the insurer from downplaying your loss.

We create a comprehensive, line-by-line repair estimate using industry-standard software, ensuring our figures are accurate and defensible. Armed with this undeniable evidence, we negotiate aggressively with the insurance company on your behalf to secure the most accurate and complete settlement possible.

Types of Claims a Public Adjuster Handles for Commercial Properties

We specialize in large-scale losses for commercial buildings, multifamily complexes, apartment communities, and religious institutions across Florida. Our expertise covers a wide range of perils:

- Hurricane damage: We handle the complex effects of wind, wind-driven rain, and storm surge.

- Fire and smoke damage: These claims require forensic expertise to assess damage that spreads through HVAC systems and hidden spaces.

- Water damage: Whether from floods, burst pipes, or roof leaks, we identify hidden moisture that can lead to mold.

- Tornado and lightning damage: We document everything from structural collapse caused by tornadoes to hidden electrical damage from lightning strikes.

- Business interruption: We help you recover lost income and extra expenses, which is often the most critical part of a commercial claim.

How a public adjuster Florida Can Help You Avoid Litigation

No one wants a long, expensive court battle over an insurance claim. A skilled public adjuster Florida can almost always help you avoid litigation.

The key is preparation. Insurers often deny or underpay claims due to incomplete documentation. We eliminate this vulnerability by building an undeniable case from the start. We understand the tactics insurance companies use and counter them with factual evidence and expert policy interpretation, leaving no room for disputes.

By presenting a professionally prepared claim, we make it clear to the insurer that settling fairly is their best option. This process is significantly faster than a lawsuit, which can drag on for years while your property remains damaged. We act as a powerful deterrent to bad faith practices, motivating insurers to handle your claim fairly from the beginning and getting you back to business without the nightmare of a prolonged legal fight.

Choosing the Right Adjuster and Avoiding Pitfalls

Selecting the right public adjuster Florida for your commercial property claim is a critical decision. You need a licensed professional with extensive experience and a proven track record, especially with large, complex losses.

What to Look for in a Reputable Adjuster

When vetting adjusters for your commercial building or apartment complex, focus on these key qualities:

- Experience with large-scale losses: Commercial claims are complex. You need an adjuster who has handled multi-million dollar settlements.

- Specialization in commercial properties: Ensure they understand business interruption, loss of rents, and other commercial policy details.

- Strong testimonials and success stories: Look for documented proof of their results with properties similar to yours.

- Transparent communication: A professional adjuster explains their process clearly and keeps you informed.

- Clear, complete contracts: Never sign a blank contract. The fee structure and your cancellation rights should be clearly stated.

- Proper licensing: Always verify their license with the Florida Department of Financial Services before signing anything.

Red Flags and How to Report Misconduct

Disasters can attract scammers. Protect your investment by recognizing these warning signs:

- Unlicensed operators: Only licensed adjusters can legally represent you. Always verify their credentials.

- Unrealistic promises: No legitimate adjuster can guarantee a specific settlement amount upfront.

- Upfront fee demands: Public adjusters work on contingency. Any request for advance payment is illegal and a major red flag.

- High-pressure tactics: Professionals give you time to make an informed decision. Avoid anyone pushing for an immediate signature.

- Suggestions to inflate damages: This is insurance fraud and can expose you to serious legal trouble.

If you encounter any of these red flags, report them immediately to the Florida Insurance Fraud Hotline at 1-800-378-0445. Choosing wisely is your best defense and ensures your property’s future is in good hands.

Frequently Asked Questions about Florida Public Adjusters

Here are answers to common questions from commercial property owners about hiring a public adjuster Florida.

How much does a public adjuster cost in Florida?

A public adjuster Florida works on a contingency fee, so there are no upfront costs. We only get paid if you recover money from your insurer. Florida law caps these fees at 20% of your claim payment for standard claims. During a declared state of emergency, like a hurricane, the fee is limited to 10% for one year after the loss.

Can a public adjuster handle my denied or underpaid claim?

Yes. Reopening and renegotiating wrongfully denied or underpaid claims is a key service. Many policyholders don’t realize they can challenge an insurer’s decision. We submit supplemental claims with new evidence and expert documentation to fight for the settlement you deserve. In Florida, you generally have up to five years to reopen an old claim, making it a powerful alternative to costly litigation.

When should I contact a public adjuster?

The best time to contact a public adjuster Florida is immediately after property damage occurs. Early involvement allows us to manage the claim from the start, ensuring all damage is documented correctly and preventing costly mistakes. However, it’s never too late to seek help. We regularly assist with claims that are months or even years old. The sooner you call, the sooner we can work to maximize your recovery.

Conclusion: Securing Your Property’s Future

After a disaster strikes your Florida commercial property, you can either face your insurer alone or level the playing field with a professional advocate. Hiring a public adjuster Florida is a smart business decision to protect your investment and secure your property’s future.

Expert advocacy ensures you receive the full financial recovery your policy provides, while professional claim management provides significant stress reduction. We handle the complex process so you can focus on running your business. Our goal is to achieve a fair settlement through thorough documentation and skilled negotiation, which is a faster and more cost-effective path than litigation.

At Insurance Claim Recovery Support, we stand with policyholders. Our contingency fee structure means our interests are perfectly aligned with yours we only succeed when you do. Don’t let your insurance company dictate the terms of your recovery. Take control of your claim with professional representation.

Get professional help with your Florida property damage claim