Navigating the Insurance Maze: Understanding the Public Adjuster Claim Process

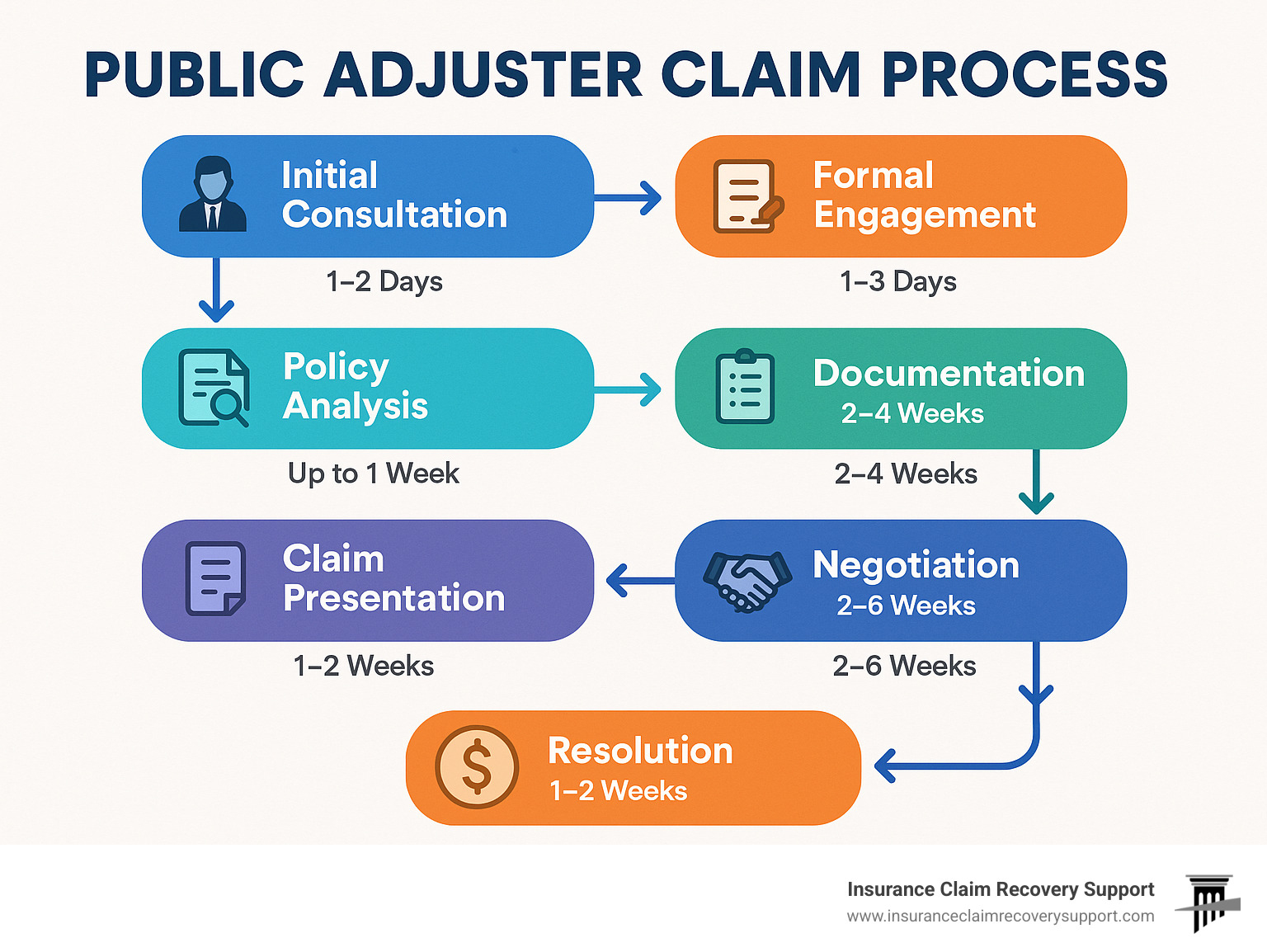

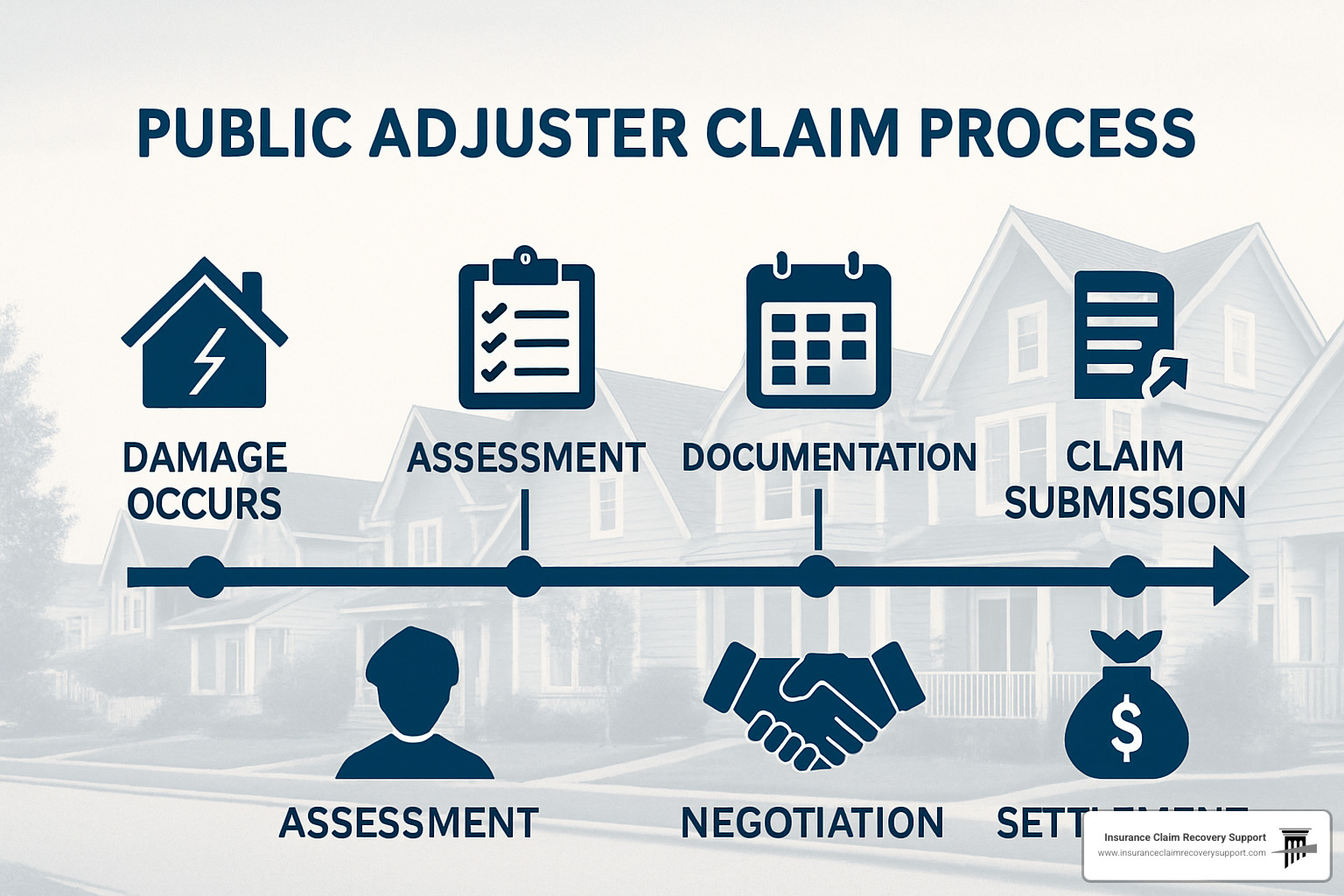

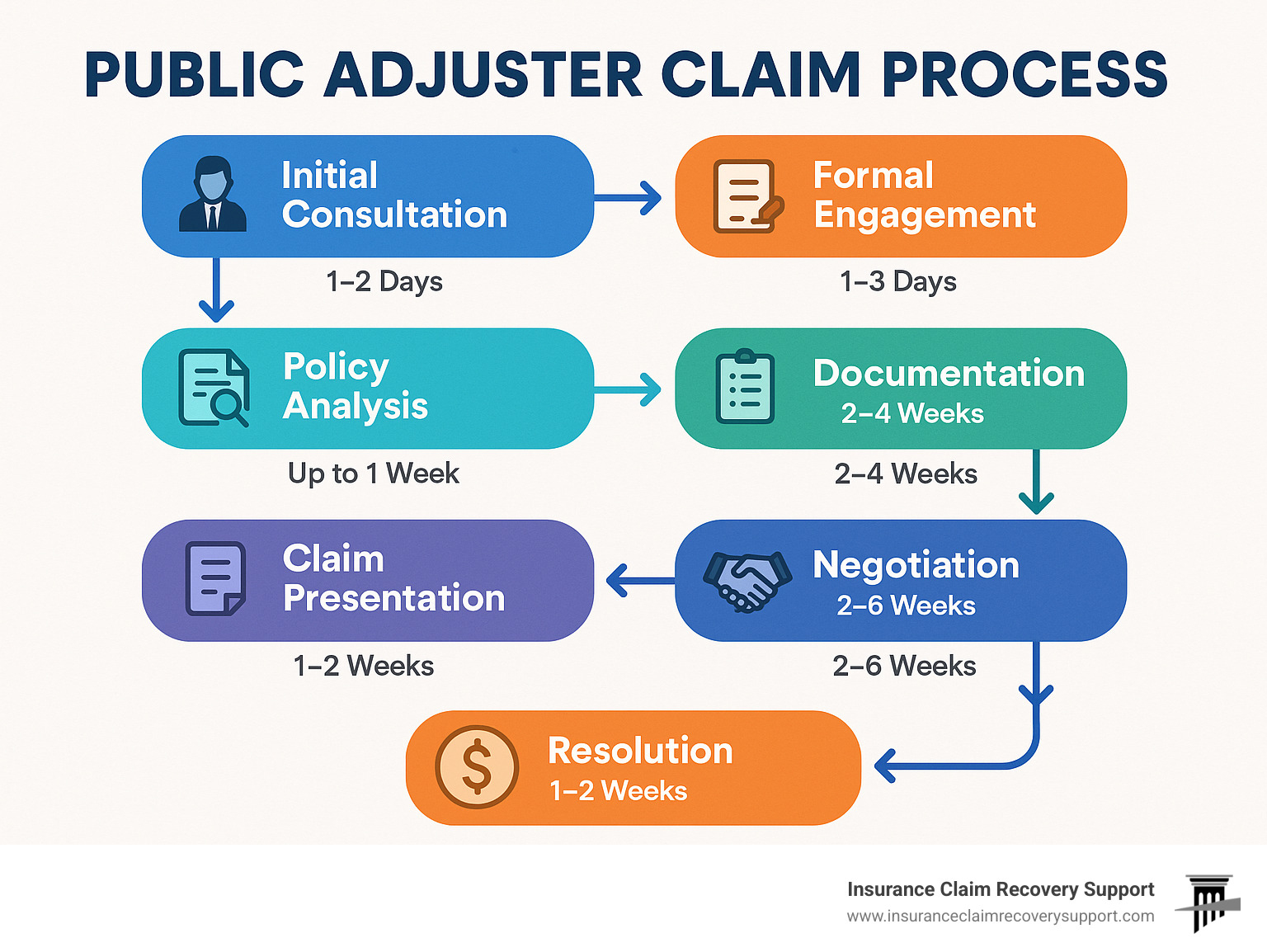

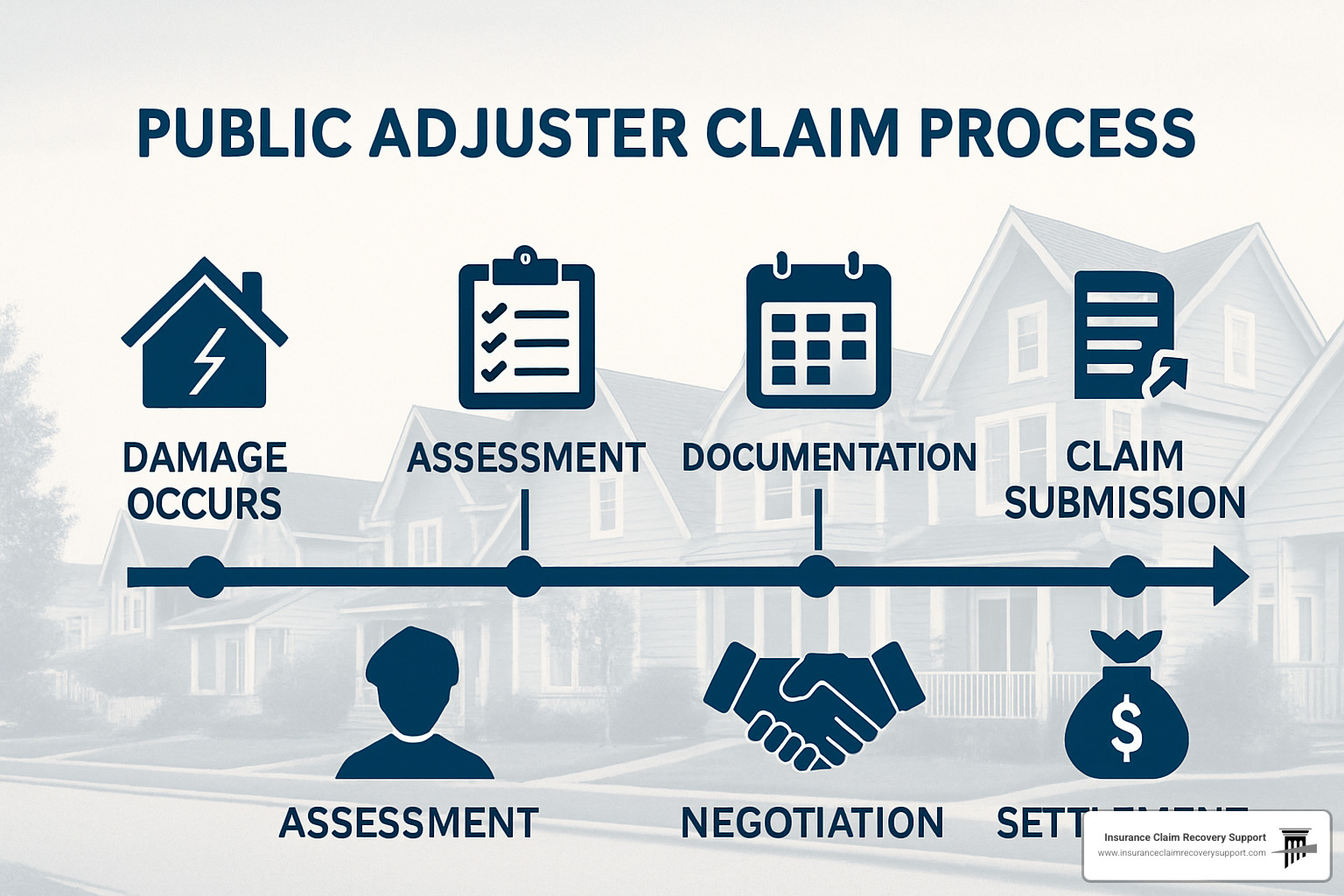

The public adjuster claim process typically follows these key steps:

- Initial consultation – Assessment of your claim situation

- Formal engagement – Signing representation agreement

- Policy analysis – Reviewing coverage details and exclusions

- Documentation – Gathering evidence and preparing estimates

- Claim presentation – Submitting formalized documentation to insurer

- Negotiation – Advocating for maximum settlement

- Resolution – Finalizing settlement and disbursement

When disaster strikes your property, navigating the insurance claims landscape can feel overwhelming. Insurance policies are written in complex language, and company adjusters work for the insurer—not you. This creates an inherent conflict of interest that often leaves policyholders undercompensated.

A public adjuster serves as your advocate, handling every aspect of the claim process while you focus on recovery. Unlike company or independent adjusters who represent insurance carriers, public adjusters work exclusively for policyholders, typically charging a percentage fee (usually 5-20%) of the final settlement.

“You’re just traumatized when you have these losses. At some point, you’re just glad you’re alive. And then you have to turn to the business side of this. It’s tough.” — Don Hornstein, University of North Carolina insurance law expert

Studies show the difference can be substantial—homeowners who hired public adjusters received average settlements of $22,266 compared to $18,659 for those handling claims themselves. This 19% increase often more than covers the adjuster’s fee.

I’m Scott Friedson, a multi-state licensed public adjuster who has settled hundreds of millions in commercial and multifamily property damage claims throughout my career working through the public adjuster claim process for over 500 large losses valued at more than $250 million.

Public adjuster claim process

Public adjuster claim process definitions:

–

Hail storm insurance claim

–

assistance with insurance claims

–

insurance claims dispute assistance

Adjuster 101: Company vs Independent vs Public

When your property suffers damage and you file an insurance claim, you’ll soon meet an insurance adjuster – but did you know there are three distinctly different types? Understanding these differences is crucial before diving into the

public adjuster claim process.

Think of insurance adjusters as the people who determine how much money you’ll receive for your claim. But here’s the catch – they don’t all work for the same team.

| Type |

Who They Work For |

Who Pays Them |

Primary Goal |

| Company (Staff) Adjuster |

Insurance Company |

Insurance Company |

Minimize Claim Payout |

| Independent Adjuster |

Insurance Company |

Insurance Company |

Minimize Claim Payout |

| Public Adjuster |

Policyholder |

Policyholder |

Maximize Claim Recovery |

Company (Staff) & Independent Adjusters Explained

Company adjusters are direct employees of your insurance carrier. They receive regular paychecks, benefits, and often performance bonuses tied to how well the company performs financially. Their career advancement depends on keeping their employer – the insurance company – happy with their work.

“Wait, what about independent adjusters? Aren’t they… independent?”

Not exactly. Despite their somewhat misleading name, independent adjusters still work for insurance companies – just as contractors rather than employees. Insurance carriers typically bring them in during disasters when they need extra hands to process many claims quickly. As Charles Nyce, a risk management professor at FSU, points out, “About 90 percent of all insurance claims are settled without escalating into a court fight,” but that doesn’t mean these settlements are always fair or complete.

Both company and independent adjusters share a common focus: controlling costs for the insurer. While many are ethical professionals, their primary duty is to their employer – not to you. They’re looking at your claim through the lens of company policies, procedures, and bottom lines.

What Makes a Public Adjuster Different

Public adjusters stand alone as the only licensed insurance professionals who work exclusively for you, the policyholder. This fundamental difference creates a true fiduciary relationship – they’re legally obligated to put your financial interests first.

Amy Bach, executive director of United Policyholders, explains it perfectly: “The insurance companies have totally the upper hand and when there’s a public adjuster, it does level the playing field a lot for the consumer having someone who speaks insurance and speaks damage.”

Unlike the other types, public adjusters:

- Are licensed by state insurance departments

- Must pass rigorous professional exams

- Maintain ongoing continuing education

- Adhere to strict ethical standards

- Have a fiduciary duty to policyholders

In Texas specifically, public adjusters must be licensed by the Texas Department of Insurance and follow state regulations regarding contracts, fees, and professional conduct. This regulatory oversight ensures they maintain objectivity and serve only one master: you.

The difference is simple but profound – while company and independent adjusters work to control claim costs for insurers,

public adjusters work to maximize your recovery. When you’re dealing with a significant property loss, this distinction can mean thousands of dollars in your settlement.

Is Hiring a Public Adjuster Right for You?

Not every insurance claim requires a public adjuster, but certain situations strongly warrant professional representation. Understanding when to engage a public adjuster can significantly impact your claim outcome.

When your property has been damaged, you’re already dealing with enough stress. The last thing you need is to battle with your insurance company over fair compensation. That’s where a public adjuster can become your greatest ally.

You should consider hiring a public adjuster when facing

large or complex losses (typically over $10,000), dealing with

denied or significantly underpaid claims, navigating

complicated coverage issues, managing in the aftermath of a

widespread catastrophe, lacking the

time or expertise to handle the claim yourself, or encountering

resistance from your insurance company.

Texas property owners are no strangers to devastating weather events—from powerful hurricanes in Houston to flooding in Austin, wildfires across the state, and severe storms in Dallas-Fort Worth and San Antonio. These complex claims often benefit tremendously from professional guidance through the

public adjuster claim process.

Key Moments to Bring in a Public Adjuster

Timing is everything when it comes to insurance claims. Here are the critical moments when bringing in a public adjuster can make all the difference:

Day One: The ideal time to contact a public adjuster is immediately after finding damage, before you even file your initial claim. This ensures proper documentation from the start and helps you avoid costly mistakes that could haunt you later.

“I wish I’d called a public adjuster first thing,” shares Marcos, an Austin homeowner. “I inadvertently said some things to my insurance company that they used against me later. A public adjuster would have guided me through those initial conversations.”

After a Low Offer: If you’ve received a settlement offer that seems inadequate, don’t just accept it. A public adjuster can review the offer, identify where you’re being shortchanged, and negotiate for a fair amount.

Supplement Stage: Sometimes damage isn’t fully apparent until after the initial settlement. Public adjusters excel at identifying additional damage and filing supplemental claims that might otherwise go unnoticed.

Post-Catastrophe Window: In the chaotic aftermath of a major disaster, securing professional representation within the first 72 hours can be crucial for proper emergency mitigation and documentation when everyone is competing for attention.

Benefits vs Drawbacks Checklist

Before making your decision, it’s worth weighing the pros and cons of hiring a public adjuster:

On the positive side, studies consistently show

higher average settlements with professional representation. You’ll benefit from

expert policy interpretation,

professional documentation of damages,

skilled negotiation with insurance adjusters, significant

time savings, and the

peace of mind that comes from knowing a dedicated advocate is handling your claim.

As one Texas homeowner shared after Winter Storm Uri: “I initially thought the damage was minimal, but my public adjuster found hidden pipe damage throughout my walls that I would have never finded until it was too late. They literally saved my home.”

The main drawback is the

fee impact on your net settlement (typically 5-20% of recovery). There’s also the potential for delays if you don’t hire the right professional, and for very small claims, the service may not be cost-effective. Additionally, some adjusters may not specialize in your specific type of loss.

Public adjuster fees in Texas are negotiable, and many adjusters offer sliding scales based on claim size. While their fee reduces your net recovery, the overall settlement is often substantially higher than what you might secure on your own—frequently more than covering the cost of their services.

Remember what Lawrence White, an NYU Stern School of Business economics professor advises: “Try not to come across as angry. Try to come across as reasonable.” A good public adjuster helps maintain this professional approach throughout negotiations, turning potentially contentious situations into productive discussions.

For more information about what makes a quality public adjuster, visit our guide on

what is a good public adjuster.

Public Adjuster Claim Process: Step-By-Step Guide

The

public adjuster claim process isn’t just a series of steps—it’s a carefully orchestrated journey designed to maximize your recovery while keeping your stress to a minimum. At Insurance Claim Recovery Support, we’ve refined this approach through years of helping property owners across Texas get back on their feet after disaster strikes.

Let’s walk through our comprehensive five-stage approach that has helped hundreds of clients steer the complex insurance landscape:

Stage 1 – Intake & Authority: Launching the Public Adjuster Claim Process

Everything begins with establishing our relationship and gathering essential information about your situation.

When you first reach out to us—whether by phone, email, or through our website—we conduct a free, no-obligation consultation to understand your damage situation. This initial conversation helps us determine if we’re the right fit for your needs.

If we decide to move forward together, you’ll sign a representation agreement that clearly outlines our services and fee structure. We believe in complete transparency from day one, with no hidden costs or surprise charges down the road.

We’ll then obtain a complete copy of your insurance policy, including all endorsements and declarations pages. This critical document serves as our roadmap throughout the claim process.

Finally, we send a formal Letter of Representation to your insurance company, officially notifying them that we’re now handling your claim. This letter establishes our authority to communicate directly with the insurer on your behalf.

“We make understanding your ‘Duties After Loss’ a priority,” explains our team. “Missing these policy-required steps can jeopardize coverage, so we guide you through each obligation to ensure full compliance.”

Stage 2 – Inspection & Evidence: Core of the Public Adjuster Claim Process

Thorough documentation forms the foundation of every successful claim. This stage is where our expertise really shines.

We begin with a comprehensive on-site assessment, often employing specialized equipment like thermal imaging cameras that can reveal hidden damage invisible to the naked eye. This technology has saved countless clients from finding mold or structural issues months after their claim closed.

Our team captures detailed photos and videos of all visible damage, creating a visual record that’s difficult for insurance companies to dispute. For water-related claims, we create detailed moisture maps showing the full extent of affected areas—a crucial tool for preventing future mold problems.

When your personal belongings are damaged, we help develop detailed inventories documenting each item’s condition, age, and replacement value. This meticulous approach ensures nothing falls through the cracks.

For complex situations, we bring in specialized experts—engineers, roofers, industrial hygienists—who provide professional opinions that strengthen your claim. As Don Hornstein, a University of North Carolina insurance law expert, notes: “If the house was simultaneously destroyed by flood and, concurrently by wind, it’s not covered by private insurance.” Our expertise helps identify these critical distinctions that can determine coverage.

Throughout this stage, we also oversee any emergency mitigation work to prevent secondary damage, ensuring these efforts help rather than hinder your overall claim.

Stage 3 – Valuation & Schedule of Loss

Accurately valuing your damage is perhaps the most technical aspect of the

public adjuster claim process—and it’s where many policyholders leave money on the table when handling claims themselves.

Using industry-standard estimating software like Xactimate (the same platform most insurance companies use), we calculate the full cost to repair or replace damaged property. This creates a level playing field when negotiating with your insurer.

For personal property, we carefully determine both actual cash value and replacement cost value, accounting for depreciation where applicable. Commercial claims require additional analysis of financial records to determine business income losses and extra expenses.

All these valuations come together in a comprehensive Schedule of Loss—a detailed document itemizing all damages and their associated costs. This professional presentation makes it difficult for insurance companies to minimize or overlook legitimate damages.

When structural issues are involved, we incorporate engineering findings into our valuation, adding technical credibility to our assessment. We analyze building plans, pre-loss photos, maintenance records, financial statements, receipts, and contractor estimates to build the strongest possible case for your recovery.

Stage 4 – Presentation & Negotiation

With thorough documentation in hand, we move to formal presentation and negotiation with your insurance company.

We prepare and submit a formal Proof of Loss with supporting documentation that meets all policy requirements and deadlines. Then we present our findings directly to the insurance company’s representatives, often in face-to-face meetings with their adjusters to review damages and discuss our valuation.

When insurance companies respond with desk reviews or lowball estimates—a common tactic—we challenge these assessments with technical evidence and policy language. Our negotiation strategy is built on solid documentation and deep knowledge of insurance regulations.

“The printed policy forms may contradict current local adjusting practices due to evolving court rulings and regulator guidance,” notes our experience. We leverage this knowledge to counter insurance company tactics that might shortchange policyholders unfamiliar with these nuances.

If direct negotiation reaches an impasse, we can pursue alternative dispute resolution mechanisms like appraisal or mediation—often resolving claims without costly litigation.

For more insights on effective negotiation approaches, visit our guide on

how to negotiate a settlement with an insurance claims adjuster.

Stage 5 – Settlement, Payment & Close-Out

The final stage involves securing and properly handling your settlement—a process that can be surprisingly complex.

We carefully review all settlement documents to ensure they’re fair, complete, and don’t contain hidden waivers that might limit your rights. Then we help steer the payment process, which often involves two-party checks requiring multiple endorsements.

For property owners with mortgages, we coordinate with mortgage holders to ensure prompt endorsement of settlement checks—a frequent bottleneck that can delay your recovery. If additional damage is finded later, we handle supplemental claims to address these issues.

Throughout the entire

public adjuster claim process, we maintain transparent communication about progress, challenges, and expected timelines. Our goal isn’t just to maximize your settlement—it’s to provide peace of mind during a difficult time in your life.

When your claim concludes, we ensure all aspects are properly closed out and documented, giving you a clear record of the resolution and protecting your rights for the future.

Costs, Contracts & Compliance

Let’s talk money – after all, it’s probably one of your first questions about hiring a public adjuster. How much will this cost me?

Public adjusters typically work on a contingency fee basis, meaning they only get paid when you do. Their fee comes as a percentage of your settlement amount, which creates a natural alignment with your interests – the more you recover, the more they earn too.

In Texas and most states,

public adjuster claim process fees typically range from 5% to 20% of your settlement. This percentage can vary based on several factors:

- The size of your claim (larger claims often qualify for lower percentage rates)

- How complex your situation is

- When in the process you bring the adjuster on board

- Local market competition

Some states have legal caps on these fees. Florida, for instance, limits public adjuster fees to 10% for claims following a declared disaster. While Texas doesn’t have a specific statutory cap, the Texas Department of Insurance maintains oversight to ensure fees remain reasonable and fair.

Negotiating Fees & Understanding Caps

Here’s some good news – public adjuster fees are generally negotiable. At Insurance Claim Recovery Support, we believe in transparent pricing that’s custom to your specific situation. When discussing fees, keep these points in mind:

Sliding scales are common, with many adjusters offering reduced percentages for larger claims. After all, the work required for a $500,000 claim isn’t necessarily five times that of a $100,000 claim.

Prior payments matter too. If you’ve already received some money from your insurance company before bringing us on board, we may structure our fee differently for those funds.

Fee exclusions might apply to certain portions of your claim. For example, some adjusters reduce or waive fees on Additional Living Expenses components.

Value-added services should factor into your decision. Consider the full range of expertise and support you’re receiving when evaluating proposals.

The National Association of Insurance Commissioners (NAIC) reports that unsatisfactory claim amounts and claim denials consistently rank as top consumer complaints in the insurance industry. This underscores why professional representation often proves valuable – even after accounting for the fee. According to

research from the Insurance Information Institute, consumer satisfaction with claims handling varies significantly across insurance providers, highlighting the importance of expert representation.

Licensing, Bonding & Standards of Conduct

Public adjusters aren’t just people who decided one day to help with insurance claims. We’re highly regulated professionals who must meet strict requirements.

In Texas, public adjusters must:

Maintain proper licensing by passing a rigorous exam and background check through the Texas Department of Insurance.

Carry a surety bond that protects consumer interests in case of professional misconduct.

Adhere to ethical standards including specific codes of conduct. For example, in Texas, we can’t solicit business between 7:00 p.m. and 8:00 a.m., can’t solicit during active disasters in certain ways, must provide written contracts with specific disclosures, and have fiduciary obligations to serve you with objectivity and loyalty.

Complete continuing education to stay current with industry developments and regulations.

Before hiring any public adjuster, I recommend verifying their license status using the

Texas public adjuster license lookup tool. It takes just a minute and provides valuable peace of mind.

The NAIC’s Public Adjuster Licensing Model Act has helped standardize these requirements across many states, though specific regulations do vary by location. This oversight helps ensure that when you hire a public adjuster, you’re working with a qualified professional who’s accountable to regulatory authorities.

Choosing & Collaborating With Your Adjuster

Selecting the right public adjuster is perhaps the most crucial decision in the

public adjuster claim process. The quality of your representation directly impacts your claim outcome.

When evaluating potential adjusters, consider these key factors:

- Experience & Specialization: Look for adjusters with specific experience handling your type of loss (fire, water, storm, etc.) and property type (commercial, residential, multifamily).

- Local Knowledge: Adjusters familiar with your area (Austin, Dallas, Houston, San Antonio, etc.) understand local building codes, weather patterns, and construction costs.

- Credentials & Licensing: Verify proper licensing and check for additional credentials like NAPIA membership or specialized certifications.

- References & Reviews: Ask for client references and check online reviews and Better Business Bureau ratings.

- Communication Style: Ensure their communication approach matches your preferences.

- Resources & Team: For large losses, confirm they have adequate staff and resources to handle your claim thoroughly.

Rhoda Moehring, an 86-year-old rental homeowner, expressed a common sentiment: “I usually get zip with these things. ‘Was I insured for that?’ ‘No, sorry, you weren’t.’ And it goes on and on. So I don’t put a whole lot of confidence in it.” A good public adjuster helps cut through this confusion.

To find qualified adjusters in your area, visit our

Public Adjusters Near Me directory.

Due-Diligence Checklist Before Signing

Before hiring a public adjuster, complete this essential due diligence:

- License Verification: Confirm active licensing through the Texas Department of Insurance.

- BBB Check: Review their Better Business Bureau profile for complaints.

- NAPIA Directory: Check if they’re listed in the National Association of Public Insurance Adjusters directory.

- Interview Questions:

- How many claims like mine have you handled?

- Will you personally handle my claim or assign it to someone else?

- What is your communication process and frequency?

- How do you document and track claim progress?

- What resources do you have for my specific type of loss?

- Can you provide references from similar claims?

- Contract Review: Carefully read the contract, paying special attention to:

- Fee structure and calculation method

- Services included and excluded

- Cancellation provisions

- Timeline commitments

Be wary of adjusters who:

– Solicit door-to-door immediately after disasters

– Pressure you for immediate decisions

– Cannot provide verifiable references

– Request upfront payments

– Make guarantees about settlement amounts

Working Together During the Claim

Once you’ve selected a public adjuster, establish clear expectations for collaboration:

- Document Handoff: Provide all relevant policy documents, pre-loss photos, maintenance records, and correspondence.

- Communication Protocol: Establish preferred communication methods and frequency.

- Meeting Schedule: Set regular check-ins to review progress.

- Approval Checkpoints: Identify which decisions require your input and approval.

- Record Maintenance: Keep your own copies of all claim documentation.

While your public adjuster leads the

public adjuster claim process, you remain an essential partner. Your timely responses to information requests and availability for inspections help maintain momentum.

As one Insurance Claim Recovery Support client from Round Rock noted: “The regular updates from my adjuster gave me peace of mind during a stressful time. I always knew where things stood and what was happening next.”

Outcomes, Timelines & FAQs

When you partner with a public adjuster, having realistic expectations about what comes next can make all the difference in your peace of mind. Let’s talk about what you can truly expect during your claim journey.

The numbers tell a compelling story. A study by the Florida Association of Public Insurance Adjusters found that homeowners working with public adjusters received settlements averaging $22,266, compared to just $18,659 for those going it alone. That’s a 19% difference that typically more than covers the adjuster’s fee.

But what about timing? While every claim has its own rhythm, here’s what we typically see:

For

simple claims, you’re looking at about 30-60 days from start to finish.

More complex situations often take 90-180 days to resolve properly. After a

major catastrophe, timelines frequently stretch longer due to the sheer volume of claims and shortage of adjusters. And if your claim becomes

disputed, well, the process can extend significantly if formal resolution methods become necessary.

The good news? About 90% of insurance claims settle without ever seeing the inside of a courtroom. The not-so-good news? The quality of those settlements varies dramatically—which is exactly where the

public adjuster claim process makes all the difference.

FAQ 1 – Will hiring a public adjuster delay my claim?

I hear this concern often, and it’s a fair question. The truth is, a good public adjuster typically won’t cause significant delays—quite the opposite.

Experienced public adjusters actually tend to speed things up by:

Providing complete documentation upfront instead of the piecemeal approach many policyholders take. When your insurance company receives a thoroughly documented claim package, they can process it more efficiently.

Anticipating insurer questions before they’re asked, saving those back-and-forth exchanges that eat up weeks of time.

Following up persistently on claim status, keeping things moving when they might otherwise stall in an adjuster’s overloaded inbox.

Knowing exactly when and how to escalate delays when necessary, using their knowledge of the industry and regulations.

That said, certain factors remain beyond anyone’s control: catastrophe situations that overwhelm insurance companies, complex claims requiring specialized testing, or simply an insurer that’s dragging their feet. At Insurance Claim Recovery Support, we focus on proactive management of what we can control while setting realistic expectations about what we can’t.

FAQ 2 – Are public adjuster fees covered by insurance?

No, your insurance policy won’t cover the cost of hiring a public adjuster. These fees come directly from your settlement as a percentage.

Here’s how it works in practice: If your settlement reaches $100,000 with a 10% public adjuster fee, you’ll receive $90,000 while your adjuster receives $10,000.

While this does reduce your immediate recovery, the math often still works strongly in your favor. When settlements average 19% higher with professional representation, that typically outweighs the fee percentage. Many of our clients find this arrangement more than worthwhile, especially for complex or large claims where the stakes are higher.

A few important notes about fees:

– You pay nothing unless you receive a settlement

– Percentages are typically negotiable

– Many adjusters use sliding scales for larger claims

– For business owners, these fees may be tax-deductible (though you should always consult your tax advisor)

FAQ 3 – What if I disagree with my public adjuster?

Even the best relationships can hit rough patches. If you find yourself at odds with your public adjuster, you have several options:

Start with direct conversation. Most issues stem from simple miscommunications or misaligned expectations. A frank discussion can often clear the air quickly.

Review your contract carefully. Understanding the rights and obligations on both sides can provide clarity about next steps.

Consider contract cancellation if necessary. Most agreements include a window of 3-5 business days for cancellation without cause. Beyond this period, terms vary by contract.

Explore mediation for more serious disagreements. A neutral third party can often help find middle ground.

File a regulatory complaint if warranted. The Texas Department of Insurance oversees public adjusters and can intervene in cases of misconduct.

Consult legal counsel for serious disputes. An attorney specializing in insurance matters can advise on your best course of action.

At Insurance Claim Recovery Support, we believe the best approach is preventing disagreements before they happen. We prioritize clear communication and transparency throughout the

public adjuster claim process, always keeping your satisfaction and maximum recovery as our north star.

Conclusion

When disaster strikes your property, the last thing you need is to battle your insurance company alone. The

public adjuster claim process offers a lifeline, providing expert guidance through what can feel like an insurance maze designed to minimize payouts rather than help you recover.

Throughout Texas—from the hailstorms of Dallas-Fort Worth to the hurricane risks in Houston, the wildfire threats in Austin, and the tornado dangers in San Antonio—property owners face unique challenges with their insurance claims. That’s where we come in.

At Insurance Claim Recovery Support, we’ve seen how professional representation transforms the claim experience. The numbers tell a compelling story: policyholders working with public adjusters receive settlements averaging $22,266 compared to just $18,659 for those going it alone. That 19% difference often exceeds our fee, making professional representation not just a service but a smart financial decision.

Timing matters enormously in the claims process. While engaging us early yields the best results, we can still make a significant difference even if you’ve already filed a claim or received a disappointing offer. The key is having someone who understands both the technical language of insurance policies and the practical realities of property damage.

As Amy Bach from United Policyholders so perfectly puts it: “The insurance companies have totally the upper hand and when there’s a public adjuster, it does level the playing field a lot for the consumer having someone who speaks insurance and speaks damage.”

Think of us as your personal translator and advocate in a world where the other side has all the resources and expertise. We balance those scales, giving you peace of mind during what’s already a stressful recovery period.

From Waco to Lubbock, from Georgetown to Round Rock, our team understands the specific challenges Texas property owners face. We know the local building codes, the regional weather patterns, and the typical insurance company responses to claims in your area.

The

public adjuster claim process isn’t just about getting more money (though that certainly helps). It’s about having a trusted partner who ensures nothing falls through the cracks—no damage goes undocumented, no coverage is overlooked, and no settlement option remains unexplored.

Ready to learn more about how we can help maximize your recovery? Visit our

public adjuster services page or reach out today for a free, no-obligation consultation.

Remember: when disaster strikes, you deserve an expert in your corner. Let us be that expert, guiding you to the settlement you truly deserve.

Public adjuster claim process definitions:

– Hail storm insurance claim

– assistance with insurance claims

– insurance claims dispute assistance

Public adjuster claim process definitions:

– Hail storm insurance claim

– assistance with insurance claims

– insurance claims dispute assistance

When your property has been damaged, you’re already dealing with enough stress. The last thing you need is to battle with your insurance company over fair compensation. That’s where a public adjuster can become your greatest ally.

You should consider hiring a public adjuster when facing large or complex losses (typically over $10,000), dealing with denied or significantly underpaid claims, navigating complicated coverage issues, managing in the aftermath of a widespread catastrophe, lacking the time or expertise to handle the claim yourself, or encountering resistance from your insurance company.

Texas property owners are no strangers to devastating weather events—from powerful hurricanes in Houston to flooding in Austin, wildfires across the state, and severe storms in Dallas-Fort Worth and San Antonio. These complex claims often benefit tremendously from professional guidance through the public adjuster claim process.

When your property has been damaged, you’re already dealing with enough stress. The last thing you need is to battle with your insurance company over fair compensation. That’s where a public adjuster can become your greatest ally.

You should consider hiring a public adjuster when facing large or complex losses (typically over $10,000), dealing with denied or significantly underpaid claims, navigating complicated coverage issues, managing in the aftermath of a widespread catastrophe, lacking the time or expertise to handle the claim yourself, or encountering resistance from your insurance company.

Texas property owners are no strangers to devastating weather events—from powerful hurricanes in Houston to flooding in Austin, wildfires across the state, and severe storms in Dallas-Fort Worth and San Antonio. These complex claims often benefit tremendously from professional guidance through the public adjuster claim process.

We begin with a comprehensive on-site assessment, often employing specialized equipment like thermal imaging cameras that can reveal hidden damage invisible to the naked eye. This technology has saved countless clients from finding mold or structural issues months after their claim closed.

Our team captures detailed photos and videos of all visible damage, creating a visual record that’s difficult for insurance companies to dispute. For water-related claims, we create detailed moisture maps showing the full extent of affected areas—a crucial tool for preventing future mold problems.

When your personal belongings are damaged, we help develop detailed inventories documenting each item’s condition, age, and replacement value. This meticulous approach ensures nothing falls through the cracks.

For complex situations, we bring in specialized experts—engineers, roofers, industrial hygienists—who provide professional opinions that strengthen your claim. As Don Hornstein, a University of North Carolina insurance law expert, notes: “If the house was simultaneously destroyed by flood and, concurrently by wind, it’s not covered by private insurance.” Our expertise helps identify these critical distinctions that can determine coverage.

Throughout this stage, we also oversee any emergency mitigation work to prevent secondary damage, ensuring these efforts help rather than hinder your overall claim.

We begin with a comprehensive on-site assessment, often employing specialized equipment like thermal imaging cameras that can reveal hidden damage invisible to the naked eye. This technology has saved countless clients from finding mold or structural issues months after their claim closed.

Our team captures detailed photos and videos of all visible damage, creating a visual record that’s difficult for insurance companies to dispute. For water-related claims, we create detailed moisture maps showing the full extent of affected areas—a crucial tool for preventing future mold problems.

When your personal belongings are damaged, we help develop detailed inventories documenting each item’s condition, age, and replacement value. This meticulous approach ensures nothing falls through the cracks.

For complex situations, we bring in specialized experts—engineers, roofers, industrial hygienists—who provide professional opinions that strengthen your claim. As Don Hornstein, a University of North Carolina insurance law expert, notes: “If the house was simultaneously destroyed by flood and, concurrently by wind, it’s not covered by private insurance.” Our expertise helps identify these critical distinctions that can determine coverage.

Throughout this stage, we also oversee any emergency mitigation work to prevent secondary damage, ensuring these efforts help rather than hinder your overall claim.

The numbers tell a compelling story. A study by the Florida Association of Public Insurance Adjusters found that homeowners working with public adjusters received settlements averaging $22,266, compared to just $18,659 for those going it alone. That’s a 19% difference that typically more than covers the adjuster’s fee.

But what about timing? While every claim has its own rhythm, here’s what we typically see:

For simple claims, you’re looking at about 30-60 days from start to finish. More complex situations often take 90-180 days to resolve properly. After a major catastrophe, timelines frequently stretch longer due to the sheer volume of claims and shortage of adjusters. And if your claim becomes disputed, well, the process can extend significantly if formal resolution methods become necessary.

The good news? About 90% of insurance claims settle without ever seeing the inside of a courtroom. The not-so-good news? The quality of those settlements varies dramatically—which is exactly where the public adjuster claim process makes all the difference.

The numbers tell a compelling story. A study by the Florida Association of Public Insurance Adjusters found that homeowners working with public adjusters received settlements averaging $22,266, compared to just $18,659 for those going it alone. That’s a 19% difference that typically more than covers the adjuster’s fee.

But what about timing? While every claim has its own rhythm, here’s what we typically see:

For simple claims, you’re looking at about 30-60 days from start to finish. More complex situations often take 90-180 days to resolve properly. After a major catastrophe, timelines frequently stretch longer due to the sheer volume of claims and shortage of adjusters. And if your claim becomes disputed, well, the process can extend significantly if formal resolution methods become necessary.

The good news? About 90% of insurance claims settle without ever seeing the inside of a courtroom. The not-so-good news? The quality of those settlements varies dramatically—which is exactly where the public adjuster claim process makes all the difference.