Property damage statute of limitations texas is a critical topic for anyone seeking compensation for damage to real or personal property. In Texas, the default time limit to file a property damage lawsuit is two years. This clock starts ticking from the date of the incident causing the damage, according to the Texas Civil Practice & Remedies Code § 16.003. However, there are exceptions, such as those involving minors, fraud, or delayed findy of damage.

Property damage can take many forms, from minor issues to major losses due to events like natural disasters or accidents. Knowing the statute of limitations is essential to ensure you protect your rights and pursue necessary legal actions within the required timeframe. Ignoring this deadline can lead to dismissals, forfeiting your chance for compensation.

I’m Scott Friedson, the CEO of Insurance Claim Recovery Support, and I’ve helped countless property owners like you steer the complexities of the claims process. With decades of experience in handling property damage claims, particularly in Texas, I’ve overturned countless wrongfully denied claims. Join me as we dig deeper into understanding the nuances of property damage statute of limitations texas and ensure you receive the fair settlement you deserve.

Property damage statute of limitations texas helpful reading:

– attorneys fees in property damages texas

– how to sue someone for property damage in texas

Understanding Property Damage in Texas

In Texas, property damage can affect both real property and personal property. Understanding the difference is crucial when dealing with insurance claims.

Real Property: This includes land and anything permanently attached to it, like homes or buildings. If a tornado rips off your roof or a flood damages your foundation, these are examples of damage to real property.

Personal Property: This covers movable items like cars, furniture, or electronics. For instance, if a hailstorm dents your car or a thief steals your laptop, these are instances of personal property damage.

Insurance Coverage plays a vital role in managing property damage. Texas homeowners often rely on insurance to cover repairs or replacements. However, the scope of coverage can vary based on the policy details. Some policies might cover damage from natural disasters, while others might not.

It’s essential to review your insurance policy closely. Look for details about what is covered and any exclusions that might apply. For example, some policies may not cover flood damage unless you have a specific flood insurance policy.

If you face damage, contact your insurance company immediately. They will guide you through the process of filing a claim. Be prepared to provide documentation, such as photos of the damage and repair estimates, to support your claim.

Navigating the Claims Process: Property damage claims can be complex. If you encounter issues like denied claims or undervaluation, consider seeking professional help. Public adjusters or legal counsel can assist in negotiating with insurance companies to ensure you receive a fair settlement.

Understanding the differences between real and personal property and knowing your insurance coverage can make a significant difference in how you handle property damage claims in Texas. Always stay informed and prepared to protect your rights and assets.

Property Damage Statute of Limitations Texas

In Texas, understanding the property damage statute of limitations is crucial for anyone dealing with property damage claims. The key rule to remember is the two-year deadline. This means you have two years from the date the damage occurs to file a lawsuit. This time limit is set by the Texas Civil Practice & Remedies Code and is vital for ensuring your claim is heard.

Why Two Years?

The two-year statute of limitations is designed to ensure that claims are made while evidence is still fresh and witnesses’ memories are clear. For instance, if your home is damaged by a flood, you need to file your lawsuit within two years from the date of the flood. Miss this deadline, and you might lose the chance to seek compensation.

Exceptions to the Rule

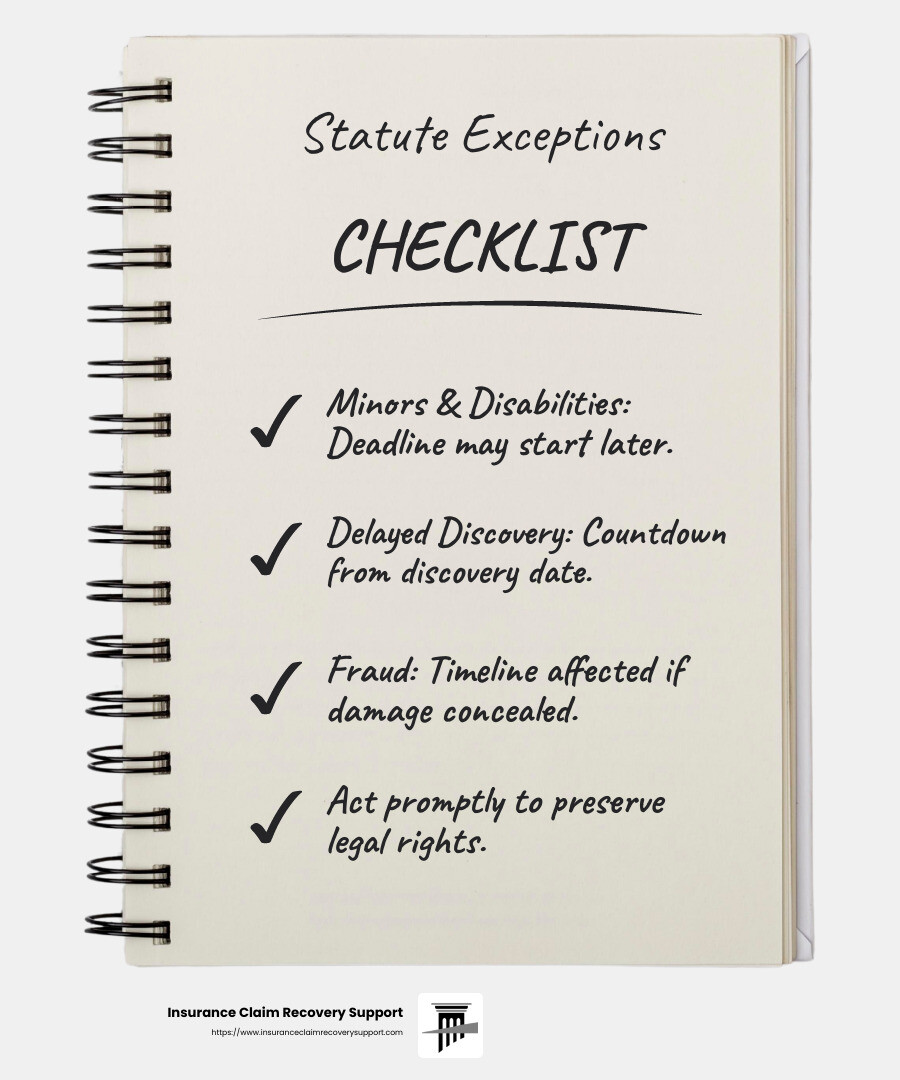

There are situations where this two-year deadline might not apply. These exceptions can extend or alter the time limit:

-

Minors and Disabilities: If the property owner is a minor or legally incapacitated, the clock might start ticking later.

-

Delayed Findy: Sometimes, damage isn’t immediately visible. If you find damage later, the deadline might extend from the findy date.

-

Fraud: If the damage was hidden due to fraud by another party, this could also affect the timeline.

Why It Matters

Failing to act within the statute of limitations can lead to your case being dismissed. This means no compensation for the damage, leaving you to cover costs out of pocket. It’s crucial to act promptly and gather all necessary documentation to support your claim.

If you’re unsure about the timeline or face any complications, seeking legal counsel can be a smart move. An attorney can provide guidance, ensuring you meet all deadlines and maximize your chances of a successful claim.

Stay informed about the property damage statute of limitations in Texas to protect your rights and ensure fair compensation for your losses.

Exceptions to the Statute of Limitations

Sometimes, the two-year deadline for filing a property damage claim in Texas might not apply. There are certain exceptions that can extend or change this timeline. Let’s look at them:

Minors

When the person impacted by the property damage is a minor (under 18), the statute of limitations can be paused. In Texas, the clock starts ticking once they turn 18. So, they have until their 20th birthday to file a lawsuit. This rule is crucial because it ensures young individuals have the opportunity to seek justice once they reach adulthood.

Disabilities

For individuals with disabilities or mental incapacity, the statute of limitations can be “tolled” or paused. This means the clock doesn’t start until they are deemed competent to handle legal matters. This exception is important to ensure that everyone has a fair chance to file a claim when they are ready and able to do so.

Delayed Findy

Sometimes, property damage isn’t obvious right away. For example, hidden water damage might not be finded until it causes significant issues. In such cases, the statute of limitations may start from the date the damage is finded, not when it actually occurred. This is known as the “findy rule” and can be a lifesaver in ensuring you don’t miss the deadline for filing a claim.

Fraud

If the responsible party engaged in fraud or deliberately concealed the damage, the timeline for filing a claim could be affected. In these cases, the clock starts ticking when the fraud or concealment is finded. This exception is crucial to prevent wrongdoers from escaping liability through deceit.

Each of these exceptions is designed to ensure fairness and justice in the legal process. If you believe any of these apply to your situation, consulting with a legal expert can help you better understand your rights and the specific timelines you need to follow. This can be vital for securing the compensation you deserve.

Steps to Take After Finding Property Damage

Once you find property damage, it’s crucial to act quickly and methodically. Here’s a simple guide to help you steer the process and ensure you’re on the right track.

Document the Damage

First, grab your smartphone or a camera and start documenting everything. Take clear photos or videos of all the affected areas and items. This visual evidence is essential for your insurance claim. The more detailed your documentation, the better. Photos of structural damage, broken items, or even receipts for damaged goods can be invaluable.

Contact Your Insurance Provider

Next, reach out to your insurance company as soon as possible. Quick communication is key. Report the damage and provide them with an initial overview. They will guide you on the next steps and inform you about the claim process. Make sure to follow their instructions closely to avoid any hiccups in your claim.

Seek Legal Counsel

Consider contacting an experienced property damage attorney. They can provide reliable guidance, ensure you meet all deadlines, and advocate for your rights. Legal counsel can also help you understand the nuances of your insurance policy and any potential exceptions to the property damage statute of limitations in Texas. This step can be crucial, especially if your claim involves large sums or complex issues.

Taking these steps promptly can significantly impact the smoothness of your claim process and the speed of your recovery after property damage. As you move forward, keep detailed records and stay in close communication with your insurance provider to ensure you understand each step of the process.

Frequently Asked Questions about Property Damage Claims

How long do you have to file a property damage claim in Texas?

In Texas, the clock is ticking the moment your property gets damaged. You have two years from the date of the damage to file a claim. This deadline is set by the Texas Civil Practice & Remedies Code, specifically in Section 16.003. Missing this two-year window could mean losing your chance to seek compensation.

What happens if I miss the deadline?

Missing the filing deadline for a property damage claim in Texas can have serious consequences. Once the two-year deadline passes, your legal rights to pursue a claim are generally forfeited. The court will likely dismiss your case, leaving you without any legal recourse to recover damages. This is why understanding and adhering to the property damage statute of limitations Texas is critical.

Are there exceptions to the statute of limitations?

Yes, there are a few exceptions that might extend the time you have to file a claim:

-

Minors: If the property owner is a minor, the two-year clock starts when they turn 18.

-

Disabilities: If the property owner has a disability that prevents them from filing a claim, the statute of limitations may be paused until they are able to proceed.

-

Fraud: If the responsible party engaged in fraud or concealed information about the damage, the statute of limitations might be extended. The clock starts ticking when the fraud is finded.

These exceptions are not always straightforward. Consulting with a knowledgeable attorney can help clarify how these might apply to your specific situation.

Conclusion

In the complex world of property damage claims, time is of the essence. The two-year statute of limitations in Texas is a critical deadline that can determine whether you can pursue compensation for your losses. Missing this deadline can mean losing your chance to recover damages, making it crucial to act promptly and seek professional help.

This is where Insurance Claim Recovery Support steps in. We are dedicated to guiding you through the maze of property damage claims. Our team specializes in ensuring that policyholders receive the maximum settlement they deserve. Whether it’s fire, flood, or storm damage, we have the expertise to handle your claim effectively.

Legal guidance is invaluable when navigating property damage claims. Our experienced public adjusters work exclusively for you, the policyholder, not the insurance company. We advocate for your rights, helping you understand your policy, gather necessary documentation, and meet all legal deadlines.

Don’t let the complexities of the property damage statute of limitations Texas overwhelm you. Protect your rights and ensure you receive the compensation you’re entitled to. For more information on how we can assist you with your property damage claims, visit our Texas Flood Property Damage Insurance Claim Tips for Policyholders page. Let us help you steer the process and secure the settlement you deserve.