Why Property Damage Case Evaluation Can Make or Break Your Recovery

Property damage case evaluation is the critical process of analyzing your insurance claim to determine its true value and the best path to recovery. When disaster strikes your commercial building, apartment complex, or religious institution, understanding this evaluation process is essential to securing a fair settlement.

Quick Answer: What You Need to Know About Property Damage Case Evaluation

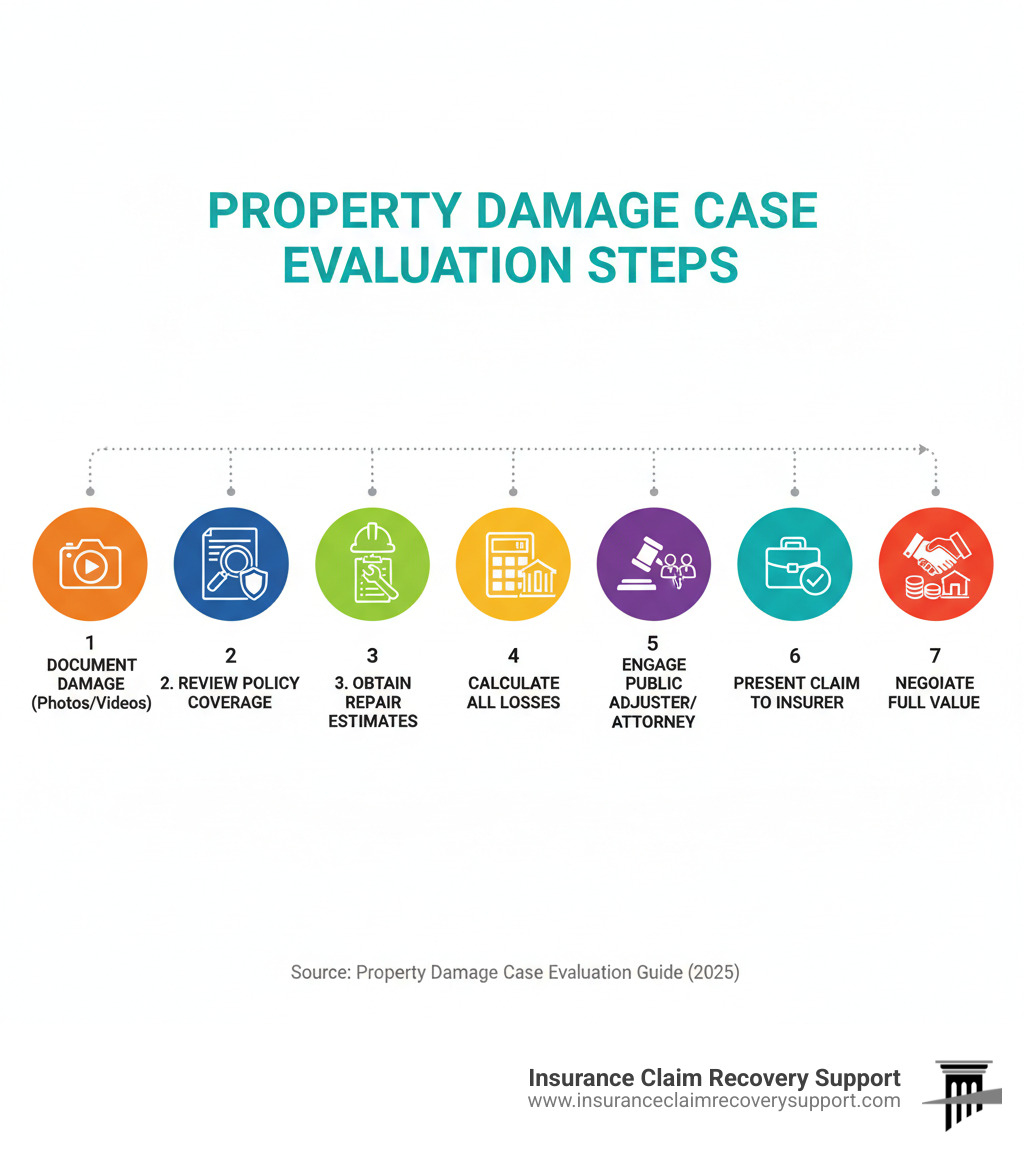

A strong property damage case evaluation involves a comprehensive approach. It starts with clear documentation like photos, videos, and repair estimates. It requires a deep policy analysis to understand your coverage, whether it’s Replacement Cost Value (RCV) or Actual Cash Value (ACV). You’ll need professional assessments from independent experts to measure the full scope of damage and proof of causation linking the loss to a covered event like a fire, hurricane, or freeze. Finally, timely reporting and a full quantification of all losses—including business interruption—are non-negotiable.

When you suffer property damage, the path to compensation is challenging. Insurance companies may offer settlements based on Actual Cash Value that leave you thousands—or even millions—short of what’s needed to fully restore your property. The insurer’s adjuster works for them, and their goal is often to minimize payouts.

The question isn’t whether your claim has value—it’s whether you’re capturing its full value. Many property owners in Texas accept settlements that don’t account for code upgrades, business interruption, or the true replacement cost of damaged property.

I’m Scott Friedson, a Multi-State Licensed Public Adjuster with over 15 years of experience conducting **property damage case evaluations for commercial and multifamily property owners. I’ve successfully settled over 500 large-loss claims valued at more than $250 million. My experience shows that a thorough evaluation can increase claim recoveries by 30% to more than 3,800%, turning initial offers into settlements that truly restore properties and businesses.

First Steps: Gauging the Strength of Your Property Damage Claim

When disaster strikes your commercial property in Austin, Dallas, or Houston, your path to recovery begins the moment you start assessing the damage. A proper property damage case evaluation is your opening argument in a negotiation where the other side is already looking for reasons to pay less. This guide will walk you through the essential first steps.

What Are the Primary Indicators of a Strong Claim?

A solid claim has elements that insurance companies can’t easily dispute. For owners of commercial buildings, apartment complexes, and religious institutions, these indicators are key:

- Clear Causation: You must prove the damage directly resulted from a specific event, like a tornado in Fort Worth or a fire in Dallas. The clearer the link, the stronger your case.

- Covered Peril: Your policy must explicitly cover the cause of damage, whether it’s a hurricane, freeze, or fire. Always check for exclusions, especially for events like freeze damage in San Antonio, where specific preventative measures might be required.

- Prompt Reporting: Most policies require you to report damage as soon as possible. Delaying can weaken your position, as insurers may argue it caused further damage.

- Substantial Damage: While all damage matters, claims involving tens or hundreds of thousands of dollars in repairs demand a thorough evaluation. The stakes are too high to go it alone.

- Documented Evidence: This is the bedrock of your claim. Photos, videos, professional assessments, and repair estimates transform your request into a demand backed by proof.

Decoding Your Policy: Replacement Cost vs. Actual Cash Value

Understanding your insurance policy is critical. For commercial property owners, one distinction can make or break your recovery: Actual Cash Value (ACV) versus Replacement Cost Value (RCV).

Actual Cash Value (ACV) is the replacement cost of your property minus depreciation. Insurers prefer this method because it saves them money by accounting for wear and tear. For a 20-year-old roof on a Lubbock apartment complex, an ACV payout will be a fraction of what you need for a new one.

Replacement Cost Value (RCV) covers the cost to repair or replace damaged property with new materials of like kind and quality, without deducting for depreciation. This is what you need to be made whole. However, many RCV policies require you to complete repairs before they release the full amount.

| Feature | Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

|---|---|---|

| Definition | Replacement Cost minus Depreciation | Cost to replace with new, no depreciation |

| Payout | Lower, accounts for wear and tear | Higher, covers full cost of new replacement |

| Impact on You | Leaves a gap between payout and repair cost | Aims to fully cover repair/replacement |

Beyond ACV vs. RCV, we scrutinize your declarations page, endorsements (which add or remove coverage), and deductibles. We also watch for the coinsurance penalty, a trap that reduces your payout if you’ve insured your property for less than a required percentage of its value (typically 80-90%). The Insurance Information Institute provides helpful guidance on understanding coverage requirements.

The Critical Role of Documentation in Your Property Damage Case Evaluation

Documentation is the ammunition in your property damage case evaluation. It substantiates your losses and counters attempts by insurers to undervalue your claim.

Start with photographs and videos from every angle. Before-and-after images are invaluable. Next, obtain detailed, itemized repair estimates from independent contractors—don’t rely solely on the insurer’s preferred vendors. Keep a communication log of every interaction with your insurance company, noting dates, names, and discussion summaries.

For commercial properties, business interruption records are vital. Document lost income with past financial statements and projections. Finally, create detailed inventory lists for all damaged contents. For complex damage, like a compromised foundation, you may need expert reports from structural engineers or forensic accountants. This is where a public adjuster excels—we coordinate these professionals to build a compelling claim presentation that leaves no room for doubt.

For more information about how we help property owners maximize their settlements and avoid unnecessary lawsuits, visit our property damage claim services page.

The Professional Property Damage Case Evaluation: Public Adjuster vs. Insurance Claim Lawsuit

A professional property damage case evaluation is your most powerful tool against an insurer’s lowball offer. For managers of HOAs, religious institutions, and apartment complexes, the choice isn’t just about getting paid—it’s about getting back to business quickly. This often means choosing between hiring a public adjuster or engaging in a costly insurance claim lawsuit.

A skilled public adjuster often achieves better results through negotiation, resolving claims in a fraction of the time and at a fraction of the cost of litigation.

Assembling Your Team: When to Call in Professionals

For commercial properties, a property damage case evaluation almost always benefits from professional expertise. The warning signs that you need help are clear:

- Claim Delays: The insurer is dragging its feet, a common “delay, deny, defend” tactic.

- Lowball Offers: The initial offer won’t cover the full cost of repairs.

- Claim Denial: The insurer denies your claim on questionable grounds.

- Complex or High-Value Claims: The damage is extensive, involves multiple perils (like wind and water), or the financial stakes are high.

Your professional team should include contractors and structural engineers for technical assessments and a public adjuster to quarterback the entire claim. We work exclusively for you, the policyholder, to interpret your policy, document losses, and negotiate directly with the insurer to maximize your settlement.

Fact vs. Myth: Common Misconceptions About the Claims Process

Let’s clear up some dangerous misconceptions that could cost you thousands.

Myth: The insurance company’s adjuster works for me.

Fact: The insurer’s adjuster works for the insurance company. Their goal is to protect the company’s bottom line. A public adjuster is your exclusive advocate, motivated to maximize your settlement.Myth: Filing a claim will always cause my premiums to skyrocket.

Fact: For major losses from covered perils like fire or a hurricane, the benefit of a full settlement almost always outweighs any potential premium increase. You pay for insurance to use it when disaster strikes.Myth: I have to accept the first offer from my insurance company.

Fact: Absolutely not. Initial offers are often negotiation tactics. A skilled property damage case evaluation reveals the true value and empowers you to negotiate for what you deserve.Myth: Only lawyers can handle complex claim disputes.

Fact: While attorneys are essential for litigation, public adjusters are experts in policy, damage assessment, and negotiation—the skills needed to prevent a lawsuit. We can also identify bad faith conduct, where an insurer unreasonably denies or delays your claim, and advise on next steps.

For more information on the costs associated with disaster recovery, you can refer to FEMA’s Cost Estimating Format (CEF), which provides standardized guidelines for documenting and estimating disaster-related costs.

How a Public Adjuster Maximizes Your Settlement and Helps Avoid Unnecessary Litigation

The difference between hiring a public adjuster and pursuing an insurance claim lawsuit is stark. A lawsuit means attorneys, expert witnesses, depositions, and waiting years for a resolution. By contrast, a public adjuster streamlines the process to get you paid faster.

We start with expert policy interpretation, identifying all applicable coverages for your commercial building or apartment complex. We then build a detailed claim presentation with independent estimates and expert reports, preparing every claim as if it might go to trial. This proactive approach strengthens our position in negotiations.

Our negotiation skills level the playing field. We understand insurer tactics and advocate fiercely on your behalf, challenging lowball offers and disputing unfair denials. Our goal is to maximize your settlement by accounting for every detail, from direct damage and code upgrades to business interruption.

Most importantly, we help you avoid unnecessary lawsuits. By presenting a strong, expertly negotiated claim, we significantly increase the likelihood of a fair settlement without ever stepping into a courtroom. This allows you to focus on what matters most—restoring your property and operations.

For more information about how we can help you with your property damage claim, visit our property damage claim services page.