Beyond Bricks and Mortar: Why Your Business Needs More Than Traditional Coverage

Non damage business interruption insurance protects your business from financial losses when operations are halted by events that don’t physically damage your property—like cyber attacks, supply chain failures, government shutdowns, or civil unrest.

Quick Answer: What is Non-Damage Business Interruption?

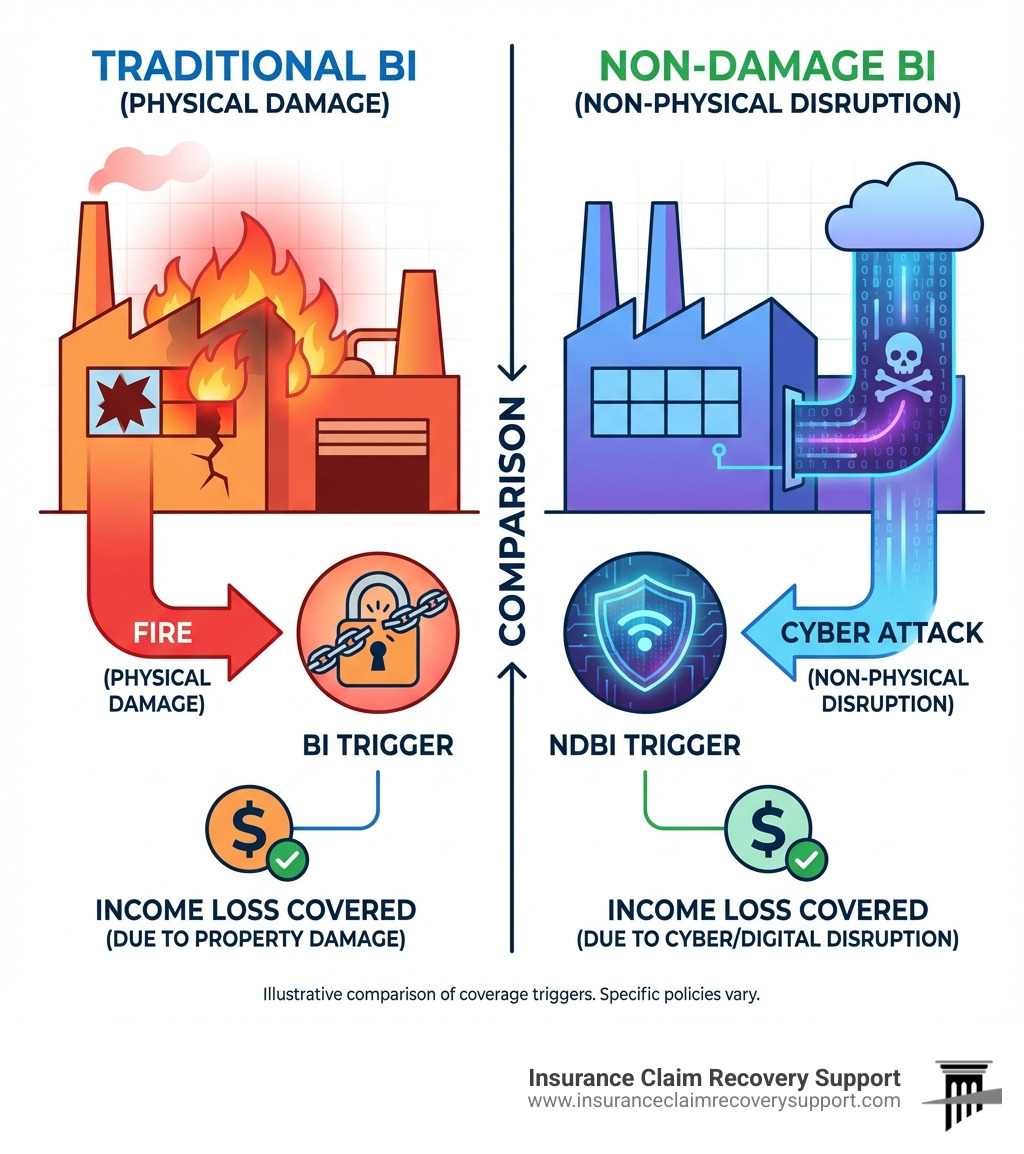

Traditional Business Interruption (BI) requires physical damage to your property (fire, storm, etc.) to trigger coverage.

Non-Damage Business Interruption (NDBI) covers income loss from events that don’t damage your property:

- ✅ Cyber attacks and ransomware shutting down your systems

- ✅ Supply chain disruptions when key suppliers can’t deliver

- ✅ Government orders closing access to your property

- ✅ Civil unrest or nearby incidents restricting operations

- ✅ Utility failures and power outages

- ✅ Regulatory actions suspending your operations

Why it matters: The potential worst-case loss for many businesses today isn’t a fire—it’s a major cyber event or extended supply chain breakdown. Traditional property insurance won’t cover these risks.

Today’s businesses operate in an interconnected world where a fire at your facility isn’t the only threat to your bottom line. A ransomware attack can shut down your operations without touching a single physical asset. A supplier’s facility closure halfway around the world can halt your production line. A government order can deny access to your premises even though your building stands intact.

Traditional business interruption insurance was designed for a different era—when most risks involved physical damage to property. But as risk managers increasingly recognize, the threats businesses face today are often non-physical in nature. According to industry data, 30-40% of small business owners carry business interruption insurance, yet many don’t realize their policies won’t respond to these modern, non-damage events.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support (ICRS), and over 15 years I’ve helped commercial property owners recover hundreds of millions in claims, including complex non damage business interruption losses where traditional coverage fell short. Understanding these gaps can mean the difference between recovering your losses and facing financial devastation when the unexpected strikes.

Understanding Non Damage Business Interruption Coverage

What is Non-Damage Business Interruption and How Does It Differ from Traditional BI?

Traditional business interruption (BI) insurance replaces lost income when your business must close due to direct physical damage from perils like fire or storms. The trigger is always physical damage, which leaves a critical gap for modern threats that don’t damage property.

Enter Non-Damage Business Interruption (NDBI) insurance. This coverage fills the gap by protecting your business from financial losses caused by events that do not involve physical damage to your property. NDBI policies are triggered by a range of pre-defined, non-physical events, providing profit protection even if your building is untouched.

The key difference is the trigger: Traditional BI requires physical damage, while NDBI covers the complex, non-physical risks of the 21st century, like a major cyber event. For a deeper dive into the foundational concepts, you can explore our complete guide on business interruption.

Here’s a quick comparison:

| Feature | Traditional Business Interruption (BI) | Non-Damage Business Interruption (NDBI) |

|---|---|---|

| Primary Trigger | Direct physical damage to insured property (e.g., fire, storm, flood) | Non-physical events (e.g., cyberattack, regulatory action, supply chain failure) |

| Coverage Scope | Lost income, continuing expenses, extra expenses due to physical damage | Lost income, continuing expenses, extra expenses due to non-physical events |

| Common Perils | Fire, windstorm, lightning, water damage, vandalism | Cyber attack, power outage, regulatory action, civil unrest, supply chain disruption |

| Modern Relevance | Still vital for physical risks | Increasingly crucial for modern, interconnected business risks |

Common Triggers and Real-World Examples

The world has become a complex web of interdependencies, and a disruption anywhere can have a ripple effect on your business. Non-Damage Business Interruption can be triggered by a diverse range of events, many of which are becoming increasingly common:

- Cyber Attacks: A ransomware attack like the 2017 NotPetya attack can encrypt your systems, shutting down operations and causing massive income loss even though your physical assets are unharmed.

- Supply Chain Failure: A key supplier experiences a shutdown at their facility, preventing them from delivering critical components. Your business, though undamaged, cannot produce or sell.

- Regulatory Actions: A government agency, like the FDA, might issue a manufacturing suspension due to compliance violations, halting production without any physical damage to your plant.

- Government Orders & Civil Authority: Mandated closures during the COVID-19 pandemic or restricted access due to civil unrest can cause revenue loss for businesses even if they weren’t directly targeted.

- Power Outages & Utility Failures: A widespread power grid failure (not caused by damage to your premises) can bring operations to a standstill.

- Denial of Access: Security threats or events like drone sightings near airports can prevent employees and customers from accessing your premises.

- Nearby Natural Disasters: A flood or wildfire in a nearby area can cause road closures or evacuations that deny access to your business, indirectly causing an interruption.

These real-world scenarios highlight a crucial truth: business interruption doesn’t always come with a physical footprint. It can arise from invisible threats that are just as devastating to your bottom line.

Why NDBI is Crucial and What Financial Losses It Covers

In today’s interconnected economy, Non-Damage Business Interruption insurance is a necessity. Businesses dependent on technology, complex supply chains, or public access are especially vulnerable to non-physical disruptions. When an NDBI event halts revenue, fixed costs continue, creating a cash flow crisis. NDBI coverage acts as a financial lifeline by covering:

- Lost Profits/Net Income: The profits your business would have earned if the interruption hadn’t occurred.

- Continuing Operating Expenses: Ongoing costs like payroll, rent, mortgage payments, and loan payments.

- Extra Expenses: Additional costs incurred to mitigate the interruption, such as renting temporary equipment or outsourcing services.

- Remediation Costs: Costs to fix the issue that caused the interruption, like system cleanup after a cyberattack.

Without NDBI, a non-physical event could force a business to close permanently. For resources on navigating financial challenges, especially for small businesses, you can refer to our small business owner guide covid-19 resources and relief options.

Advanced Concepts: Parametric Solutions, Industry Risks, and Policy Exclusions

The NDBI landscape is evolving with innovative solutions and specific policy limitations to be aware of.

Parametric Solutions:

Unlike traditional insurance that pays based on proven losses, parametric policies pay a pre-agreed, fixed sum when a specific trigger occurs (e.g., a power outage lasting over 24 hours). This allows for transparent triggers and fast payouts, though the payment may not perfectly match the actual loss (a drawback known as “basis risk”).

Industry-Specific Risks:

Some industries, like life sciences, face unique NDBI exposures from regulatory actions (e.g., an FDA-enforced manufacturing suspension) that halt production without physical damage.

Policy Limitations and Exclusions:

NDBI policies are not all-encompassing. It’s crucial to read the fine print. Common exclusions can include certain cyber events or market fluctuations. Notably, most standard policies exclude losses from pandemics unless specifically endorsed, a gap many businesses finded during COVID-19. Understanding terms like “period of restoration” and “covered peril” is vital, as insurers often deny claims based on specific policy wording. For more on this, see our article: has covid-19 caused your business to close.

Navigating the NDBI Claim and Risk Assessment Process

Assessing Your Exposure to Non-Damage Business Interruption

Protecting your business starts with understanding your specific vulnerabilities to Non-Damage Business Interruption. It’s not enough to simply purchase a policy; you need to tailor it to your specific risks.

- Risk Analysis: Conduct a thorough risk analysis by mapping your entire value chain. Identify critical suppliers, key customers, and external factors that could interrupt your operations without causing physical damage.

- Quantify Losses: Estimate the potential financial impact of each scenario. How much revenue would be lost if a key supplier shut down for a month? Forensic accountants can help quantify these potential losses.

- Tailor Coverage: Use this analysis to work with insurance professionals and tailor your NDBI policy. This ensures your coverage aligns with your unique risks, providing robust protection where you need it most.

The Claims Process for Non-Damage Business Interruption

When a Non-Damage Business Interruption event occurs, the claims process can be complex due to the lack of physical evidence. Meticulous documentation and expert guidance are essential.

- Notify and Document: Immediately notify your insurer in writing and begin documenting everything. Preserve all evidence linking the non-physical event to your operational shutdown and financial losses.

- Prove and Quantify the Loss: You must clearly prove the non-physical event caused your financial losses. Forensic accountants are critical for this step, as they can analyze financial records to accurately calculate lost profits and extra expenses to substantiate your claim.

-

Engage a Public Adjuster: This is where a licensed public adjusting firm like Insurance Claim Recovery Support (ICRS) becomes your most valuable asset. We work exclusively for policyholders, never for insurance companies.

- Myth vs. Fact: A common myth is that hiring a public adjuster leads to litigation. Fact: Our expertise in policy language and claims presentation helps avoid disputes. With a 90% settlement success rate without unnecessary lawsuits, we streamline the process, reducing delays and preventing the need for costly litigation.

- Maximize Your Settlement: We handle all communication with the insurer, presenting a robust, well-documented claim to secure the maximum settlement you are entitled to under your policy. This allows you to focus on recovering your business operations.

Navigating an NDBI claim is daunting, but with expert support, you can ensure your business recovers. We assist property managers, commercial building owners, apartment investors, HOAs, and more in Texas cities like Austin, Dallas, and Houston, and across many other licensed states. For specialized help with your business income claim, get help with your business income insurance claim.